Content

Plastic Additive Market Size, Share, Analysis and Forecast 2034

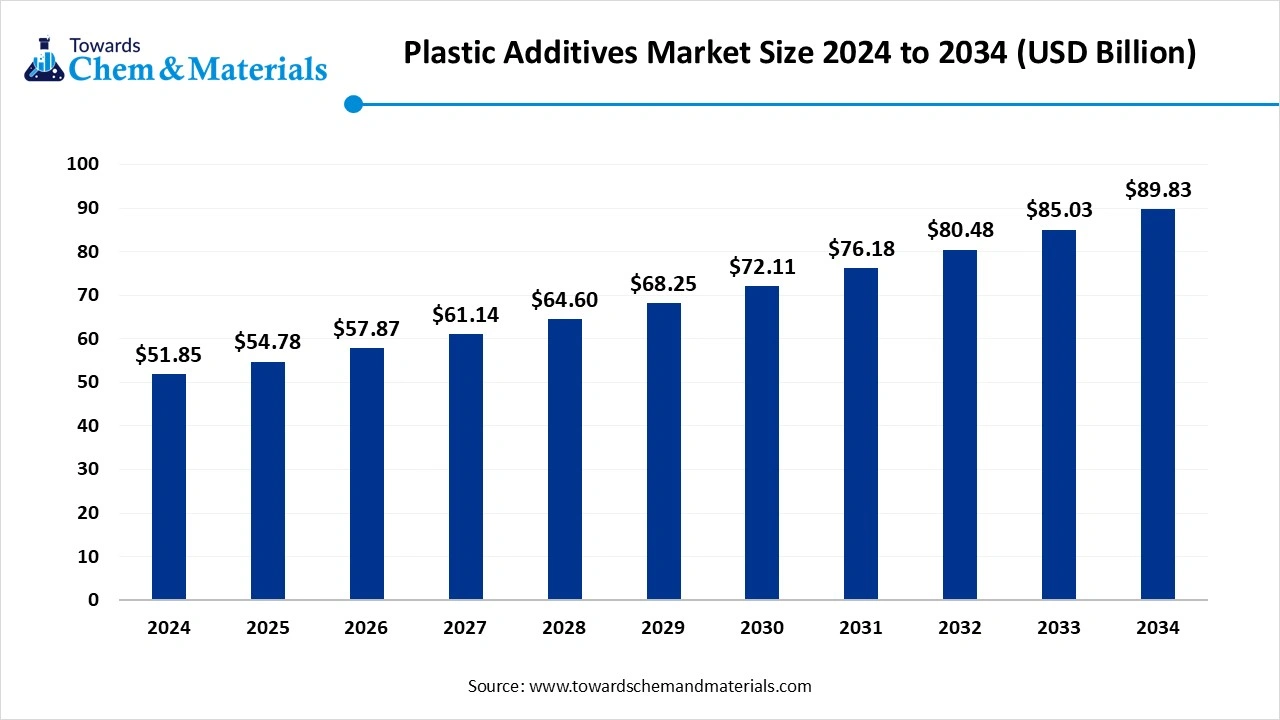

The global plastic additives market size was valued at USD 51.85 billion in 2024 and is expected to hit around USD 89.83 billion by 2034, growing at a CAGR of 5.65% from 2025 to 2034. The enlargement of the packaging industry and the ongoing implementation of sustainability standards have fueled the industry's potential in recent years.

Key Takeaways

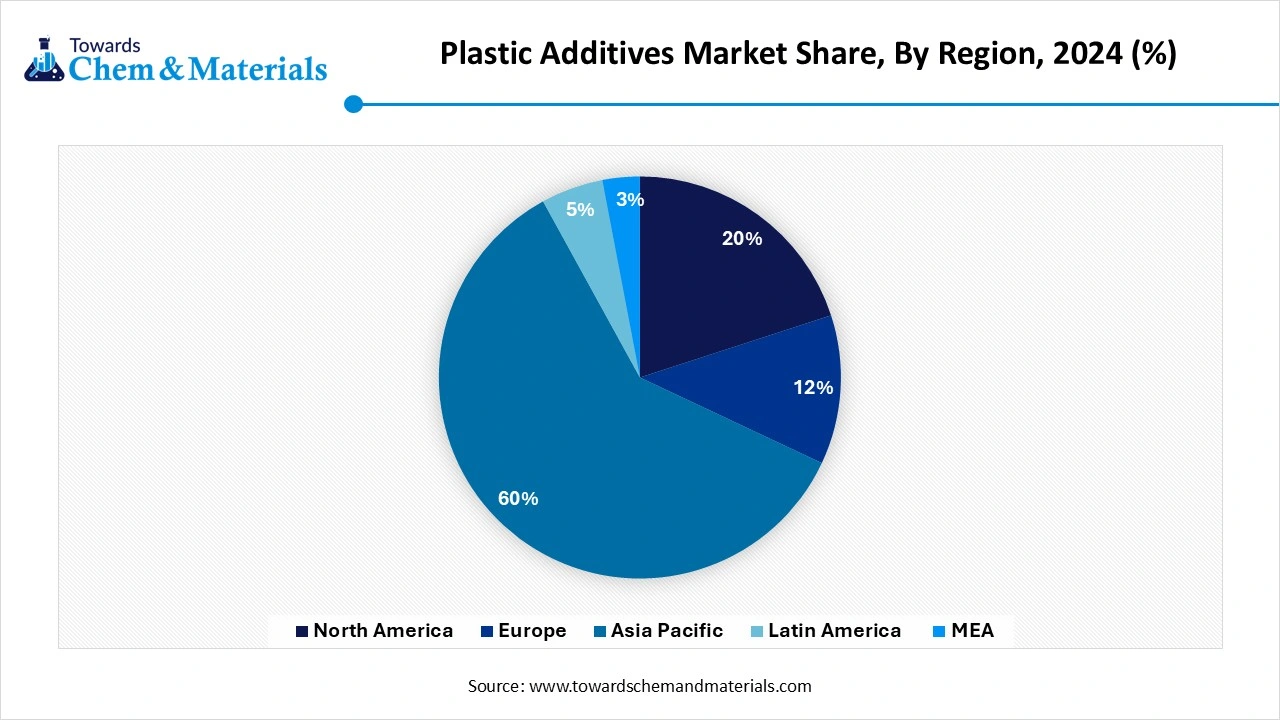

- By region, The Asia Pacific plastic additives market held the largest Share of 60% of the global market in 2024, owing to enlarged manufacturing infrastructure and ongoing technological advancements.

- By region, Middle East and Africa are expected to grow at a notable rate in the future, akin to the sudden increased investment in the petrochemical sectors and rapid industrialization

- By additive type, the plasticizers segment led the global plastic additives market in 2024. to increase demand for plasticizers, which have softness, flexibility, and durability in the current period.

- By additive type, the antimicrobial additives segment is expected to grow at the fastest rate in the market during the forecast period, owing to increased hygiene concerns in sectors such as healthcare, consumer products, and packaging.

- By polymer type, the polyvinyl chloride segment emerged as the top-performing segment in 2024 due to its versatility, low cost, and ability to blend easily with additives

- By polymer type, the bioplastics segment is expected to lead the market in the coming years, as sustainability and environmental regulations push industries away from traditional fossil-based plastics.

- By function, the durability segment led the market in 2024, as additives used for UV resistance, heat stability, and mechanical strength are critical for extending the life of plastic products.

- By function, the aesthetic improvement segment is likely to experience notable growth during the expected period, akin to the growing demand for visually appealing and customized plastic products

- By end-use industry, the packaging segment dominated the Global Plastic additives Market in 2024, owing to it being the largest user of plastics globally.

- By end use, the healthcare segment is expected to grow significantly over the forecast period, owing to rising health awareness and demand for safer, cleaner, and more durable plastic materials.

Market Overview

The Silent Strengtheners: Exploring the Rise of Plastic Additives Worldwide

The global plastic additives market includes chemical substances added to polymer matrices to enhance performance, processability, or lifespan. These additives tailor plastic properties for specific end-uses, ranging from UV resistance, flexibility, durability, thermal stability, to color and flame resistance. They are essential in extending the versatility of plastics across industries like packaging, automotive, construction, consumer goods, and electronics. Moreover, the demand for plastic grows in emerging countries, and plastic additives are likely to gain substantial advantage in the coming years, as per the future industry observation.

Which Factor Is Driving the Global Plastic Additives Market ?

The enlarged expansion of the plastics industry is spearheading the industry's growth in the current period. As plastic is considered the ideal material in the packaging industry in recent years, akin to its durability, strength, and cost effectiveness. Moreover, as the growing trend for e-commerce, food delivery, and others is leading industry growth in recent years, as the major manufacturers such as the automotive, construction, and food packaging is increasingly demanding the lightweight packaging options where plastic additives plays the major role in the making of this type of plastic which can gain major industry share in the coming period.

Market Trends:

- The sudden shift towards eco-friendly additives is driving the market growth in recent years, as several governments have implemented sustainability regulations for major manufacturers in the past few years.

- The increased demand for antimicrobial additives is contributing to the growth of the industry in the current period. Moreover, the sectors where safety and hygiene are the priority, such as healthcare and consumer products, are driving up market growth in recent years.

Market Opportunity

Chemistry Takes Centre Stage in Additives Market Evolution

The development of eco-friendly plastic additives is expected to create lucrative opportunities during the forecast period. Moreover, as several regional governments are actively involved in the heavy implementations of sustainability standards, where manufacturers can take the first mover advantage by developing innovative additives. Also, the manufacturers can take the help of modern technology, which can be a significant move towards innovative material development in the coming years.

Market Challenge

Compliance Pressure Slows Down Additive Innovation and Production

The stricter regulations from the government on harmful and toxic additives are expected to hamper the industry's growth in the coming period. These regulations are forcing manufacturers to reformulate their products, which is a time-consuming and expensive procedure that is likely to affect market growth in the coming years. Moreover, these barriers can create challenges like reduced production speed and profit margins during the projected time.

Market Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 54.78 Billion |

| Market Size by 2034 | USD 89.83 Billion |

| Growth rate from 2024 to 2025 | CAGR 5.65% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Additive Type , By Additive Type , By Function , By End-Use,By Regional |

| Key Companies Profiled | Adeka Corporation, Albemarle Corporation ,Arkema S.A. , BASF SE , Baerlocher GmbH , Clariant AG , Dow Inc. , Dupont de Nemours, Inc. , Evonik Industries AG, ExxonMobil Chemical , INEOS Group , Kaneka Corporation , Lanxess AG , LG Chem Ltd. , Milliken & Company , Mitsui Chemicals, Inc. , SABIC , Solvay S.A. , Songwon Industrial Co.,Ltd. ,Shandong Rike Chemical Co., Ltd |

Segmental Insights

Additive Type Insights

How the Plasticizers Segment Dominated the Global Plastic additives Market in 2024?

The plasticizers segment held the largest share of the market in 2024, due to increased demand for plasticizers, which have softness, flexibility, and durability in the current period. Plasticizers can give these unique characteristics to the plastic, which can be used in PVC applications such as flooring, hoses, and packaging, as per recent industry observations. Also, playing a major role in the development of low-cost with it performance plastic, the plasticizers gained immense industry attention as the ideal additive type in the market nowadays.

The antimicrobial additive segment is expected to grow at a notable rate during the predicted timeframe, owing to increased hygiene concerns in sectors such as healthcare, consumer products, and packaging. Moreover, the increased consumer awareness towards safety and hygiene is expected to provide a sophisticated consumer base to the segment in the coming years, as per industry expectations.

Polymer Type Insights

Why Do Polyvinyl Chloride Segments Dominated the Global Plastic additives Market by Raw Material Type?

The polyvinyl chloride segment held the largest share of the global plastic additives market in 2024, owing to its versatility, low cost, and ability to blend easily with additives. It is widely used in construction (pipes, doors, flooring), electrical (cables), and healthcare (blood bags). Additives enhance PVC's flexibility, fire resistance, and durability, making it ideal for both rigid and flexible applications. Its compatibility with plasticizers and stabilizers further strengthens its role in additive-heavy uses. PVC also offers excellent chemical resistance and mechanical strength. Because it requires significant additive support to meet performance needs, it has become the leading polymer type in the market over the years.

The bioplastic segment is expected to grow at a notable rate, as sustainability and environmental regulations push industries away from traditional fossil-based plastics. Made from renewable sources like corn starch or sugarcane, bioplastics are biodegradable and eco-friendly. Governments and industries are promoting green alternatives to reduce plastic waste, and consumers are increasingly demanding sustainable products. As bioplastics gain acceptance in packaging, agriculture, and consumer goods, the need for specialized, non-toxic additives will grow. The push for a circular economy, combined with innovation in biopolymer formulations, will drive significant growth in bioplastics and their additive needs in the coming years.

Function Type Insights

Why Did the Durability Segment Dominate the Global Plastic additives Market in 2024?

The durability segment dominated the market with the largest share in 2024. Additives used for UV resistance, heat stability, and mechanical strength are critical for extending the life of plastic products. In construction, automotive, and outdoor applications, plastics face weather, pressure, and wear and tear. Additives like stabilizers and antioxidants are used to prevent breakdowns from sunlight, heat, or chemicals. These durability-enhancing additives help maintain the physical integrity and safety of products over time. As plastics replace traditional materials in demanding environments, enhancing their lifespan is crucial. This strong demand across multiple industries explains why the durability function dominated the market.

The aesthetic improvement segment is expected to grow at a notable rate due to the growing demand for visually appealing and customized plastic products. Additives used to improve color, gloss, transparency, and texture are increasingly used in consumer electronics, packaging, automotive interiors, and household goods. As brands focus more on user experience and product appeal, aesthetic additives help create attractive finishes and enhance brand value. The rise of 3D printing and customized manufacturing also supports the demand for design-oriented additives. With end-users prioritizing style and visual quality, especially in consumer-facing sectors, aesthetic enhancement additives will play a bigger role in future markets.

End Use Insights

Why is the Packaging Sector Dominating Industry?

The packaging segment held the largest share of the market in 2024 because it is the largest user of plastics globally. Additives are critical in packaging to improve flexibility, shelf life, appearance, and resistance to moisture or chemicals. Food, beverages, personal care, and e-commerce all depend on high-performance plastic packaging. Plasticizers, stabilizers, colorants, and barrier additives are widely used to meet safety and functionality standards. The demand for lightweight, durable, and cost-effective packaging has kept this segment strong. With rapid growth in retail and consumer goods, especially in emerging markets, the packaging industry continues to be the largest consumer of plastic additives.

The healthcare and medical devices segment is observed to grow at the fastest rate during the forecast period, owing to rising health awareness and demand for safer, cleaner, and more durable plastic materials. Additives are used to enhance sterilization, antimicrobial resistance, flexibility, and strength in medical products like syringes, tubing, catheters, and packaging. Regulatory focus on patient safety and infection control is driving the use of specialized, medical-grade plastic additives. Aging populations and increasing healthcare access in developing countries are also boosting this sector. As healthcare innovations grow, so will the need for high-performance plastics enhanced with advanced additives.

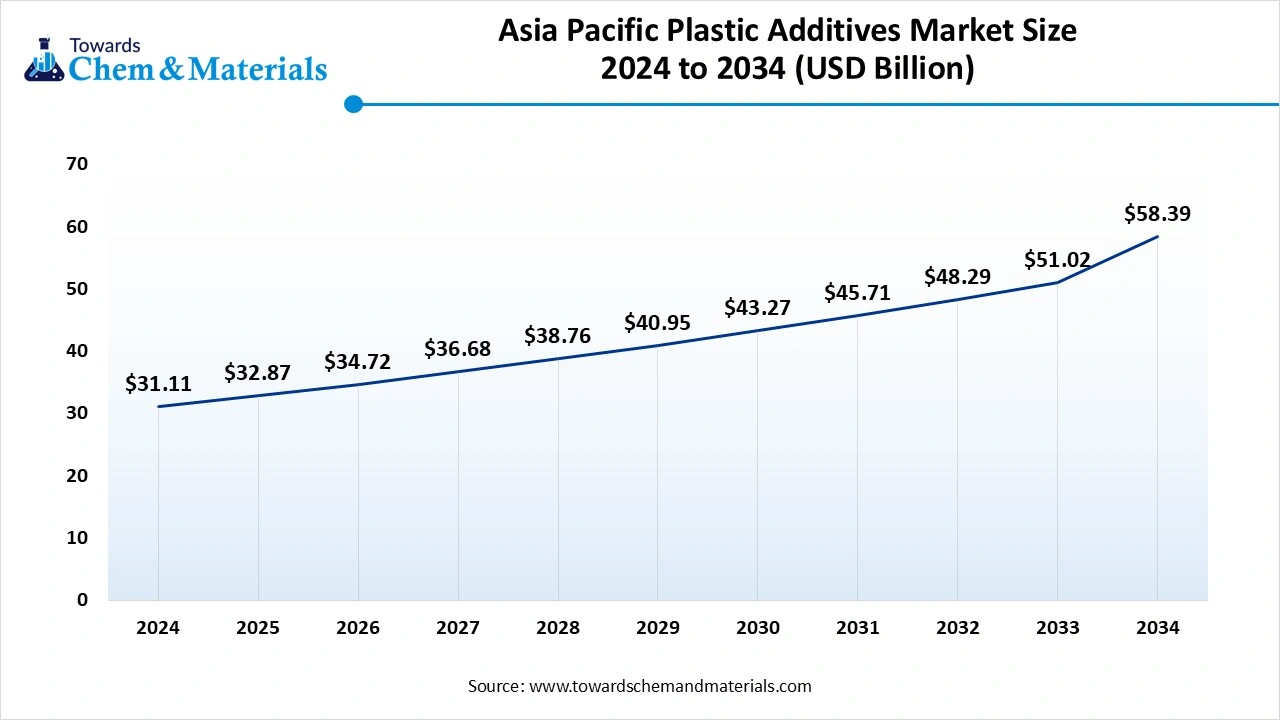

Regional Insights

The Asia Pacific plastic additives market size accounted for USD 32.87 billion in 2025 and is forecasted to hit around USD 58.39 billion by 2034, representing a CAGR of 6.50% from 2025 to 2034.

Asia Pacific accounted for the significant revenue in the current sector, akin to enlarged manufacturing infrastructure and ongoing technological advancements. Moreover, the countries in the region, such as China, India, and others, are seeing the heavy demand for plastic additives in their major sectors, like automotive, construction, and packaging, in recent years. Also, the increased urbanization and moderate infrastructure development have immensely contributed to the industry's growth in the past few years.

Is China’s Plastic Powerhouse Status Unshakable in the Current Period?

China maintained its dominance in the market, owing to the country's considered as the world's leading plastic producer with major domestic demand in the current period. Moreover, the country has strong governmental support with a sophisticated consumer base across the globe. Also, modern technology is playing a major role in industry development as the initiatives for bioplastics and renewable plastics are rising globally, as per the recent investigation.

Middle East and Africa

The Middle East and Africa are expected to capture a major share of the market, owing to the sudden increased investment in the petrochemical sectors and rapid industrialization. Moreover, having a huge raw material supply like oil and gas, which plays a major role in plastic production, has majorly contributed to the industry's growth in recent years. Furthermore, the sectors like construction and packaging are at their peak of development, which is extensively creating investment opportunities in the regions, as per the recent observation.

Could Investment and Infrastructure Fuel the Next Plastic Giants

Saudi Arabia and South Africa are expected to rise as dominant countries in the region in the coming years, owing to having huge raw material availability and huge infrastructure development investments. Moreover, the government in Saudi Arabia has increasingly supported plastic manufacturing by increasing the petrochemical supply as per the conservation. Also, South Africa has seen a huge infrastructure development, which can create a huge consumer base for the plastic additives manufacturer in the coming years.

Recent Developments

- In February 2025, Avient introduced its latest additive, which is called the oxygen scavenging additive. This newly launched additive can increase the shelf life of the PET bottles, as per the report published by the company recently. (Source: packagingeurope.com)

- In August 2024, the CAI introduced its new batch of additives. Also, the batch is called the VOC removal batch specifically, as per the company's claim. Moreover, these newly launched additives are specially designed for electric vehicles, which can be used in production. Furthermore, the additives are called LDV-8010TM. (Source:specialchem.com)

Top Companies list

- Adeka Corporation

- Albemarle Corporation

- Arkema S.A.

- BASF SE

- Baerlocher GmbH

- Clariant AG

- Dow Inc.

- Dupont de Nemours, Inc.

- Evonik Industries AG

- ExxonMobil Chemical

- INEOS Group

- Kaneka Corporation

- Lanxess AG

- LG Chem Ltd.

- Milliken & Company

- Mitsui Chemicals, Inc.

- SABIC

- Solvay S.A.

- Songwon Industrial Co., Ltd.

- Shandong Rike Chemical Co., Ltd

Segment Covered

By Additive Type

- Plasticizers (e.g., phthalates, adipates, trimellitates)

- Stabilizers

- Heat Stabilizers

- UV Stabilizers

- Antioxidants

- Flame Retardants

- Impact Modifiers

- Antimicrobial Additives

- Colorants / Pigments

- Lubricants

- Blowing Agents

- Antistatic Agents

- Nucleating & Clarifying Agents

- Foaming Agents

- Processing Aids

- Anti-blocking Agents

- Slip Agents

- Light Diffusers

- Anti-fogging Agents

By Polymer Type

- Polyethylene (PE)

- LDPE

- HDPE

- LLDPE

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Polystyrene (PS)

- Polyethylene Terephthalate (PET)

- Acrylonitrile Butadiene Styrene (ABS)

- Polycarbonate (PC)

- Polyamide (Nylon)

- Polyurethane (PU)

- Engineering Plastics

- Bioplastics / Biodegradable Polymers

By Function

- Property Enhancement

- Thermal, Electrical, Mechanical Strength

- Process Aid

- Flow modifiers, mold release

- Aesthetic Improvement

- Color, surface finish

- Durability/Protection

- UV, oxidation, microbial

- Safety/Compliance

- Flame retardancy, food contact regulations

By End-Use Industry

- Packaging

- Rigid Packaging

- Flexible Packaging

- Automotive & Transportation

- Building & Construction

- Consumer Goods

- Electronics

- Household items

- Electrical & Electronics

- Textiles & Fibers

- Healthcare / Medical Devices

- Agriculture

- Greenhouse Films, Mulch Films

- Industrial Applications

By Region

- North America

- U.S.

- Mexico

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Asia Pacific

- China

- India

- Japan

- South Korea

- Central & South America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- UAE