Content

Magnesium Sulfate Market Size and Growth 2025 to 2034

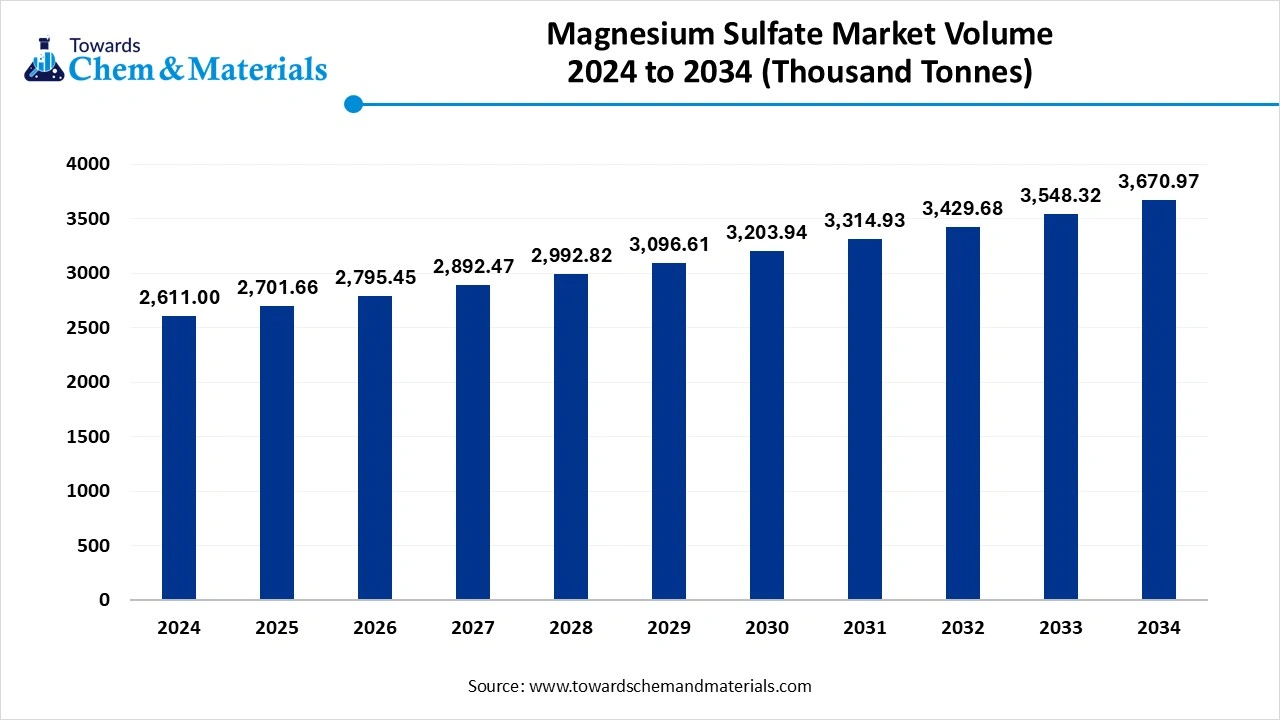

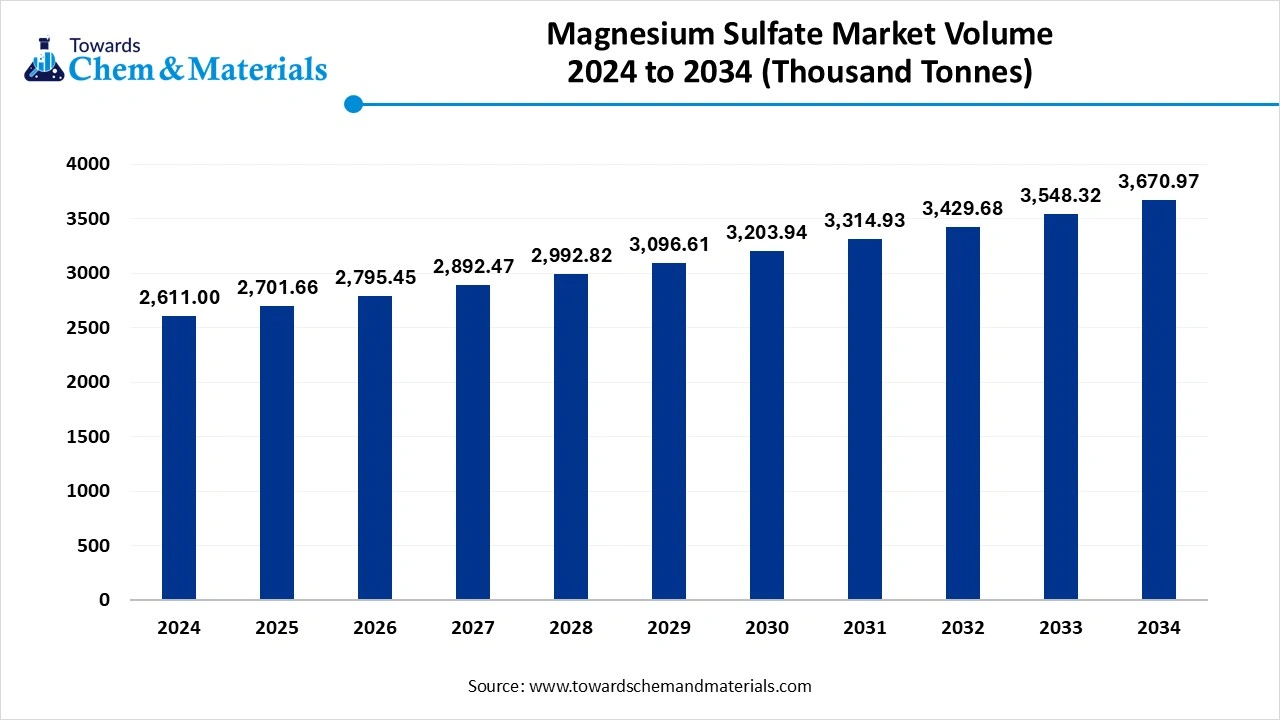

The global magnesium sulfate market volume is calculated at 2,611 thousand tones in 2024, grew to 2,701.66 thousand tones in 2025, and is projected to reach around 3,670.97 thousand tones by 2034. The market is expanding at a CAGR of 3.47% between 2025 and 2034. The ongoing increasing dependency on the agricultural sectors and expansion of the personal wellness sectors have accelerated the industry's potential in recent years.

Key Takeaways

- The Europe magnesium sulfate market held the largest revenue share of 46.33% in 2024, akin to enlarged demand from the personal wellness industry.

- The Asia Pacific is expected to grow at a notable rate in the future, owing to the heavy agriculture sector.

- By application type, the Agriculture grade magnesium held the largest revenue share of over 49.16% in 2024, owing to farmers across the world increasingly using it to improve crop quality and yield.

- By application type, the industrial grade segment is anticipated to expand at the highest rate in the coming years, owing to many industries such as textiles, construction, chemicals, and personal care that are increasingly using magnesium sulfate in various processes.

Market Overview

From Fields to Pharmacies: Magnesium Secures Market Relevance

The magnesium sulfate market is expected to see steady growth owing to its versatile applications in major areas such as personal care, agriculture, pharmaceutical, and industrial manufacturing in the current period. Several farmers are increasingly using magnesium sulfate on their farms, which is increasingly supporting better crop yields and other benefits. Also, magnesium sulfate has gained major attention in the pharmaceutical industry due to its ideal role in saline laxatives and anti-convulsants, as per the recent industry observations. Moreover, this sector is highly reliant on magnesium sulfates, leading the market potential in recent years, and is expected to drive growth in the future also.

Which Factor Is Driving the Growth of the Magnesium Sulfate Market?

The increasing prevalence of health and personal wellness is spearheading the industry growth during the forecast period. Also, having unique abilities such as magnesium sulfate can often be seen in using bath salts for muscle aches relief, and it can cut down stress levels while improving skin health. Magnesium sulfate gained immense popularity in the modern era. Moreover, in some regions like North America and Europe, individuals are increasingly demanding organic and therapeutic care personal care products, akin to sudden lifestyle changes and modern fast-paced lifestyles, which has immensely provided the greater consumer base in the past few years, as per the regional observations.

Market Trends

- The sudden shift towards organic farming is driving the industry growth in the current period. As the consumer becomes more aware of food safety and diseases from daily intake. Thus, the farmers are increasingly using magnesium sulfate in their organic farming projects due to its natural mineral composition, as per the recent data. Also, the magnesium sulfate I saw supports greater crop yield while not leading to any harmful residues, which gained local farmers' attention.

- The expansion and advancement of the pharmaceutical industry have led to the industry's growth in recent years, as magnesium sulfate has become essential in several treatments, like electrolyte replenishment and eclampsia in pregnant women in recent years. Moreover, magnesium sulfate gets recognition from the major healthcare associations, like the WHO and others, as a greater mineral source for the human body.

- The increased use of magnesium sulfate in industrial applications is contributing to the growth market. As the magnesium sulfate is used in different industries like the paper industry for the pulp processing chemicals and the construction industry for the production of fire-resistant panels, as per recent industry observations.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | Volume 2,701.66 Thousand Tonnes |

| Expected Size by 2034 | Volume 3,670.97 Thousand Tonnes |

| Growth Rate from 2025 to 2034 | CAGR 3.47% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Europe |

| Segment Covered | By Application, By Region |

| Key Companies Profiled | Mani Agro Chem, Weifang City Huakang Magnesium, Sulphate Factory, Zibo Jinxing Chemical Co., Ltd, Vinipul Inorganics Private Limited., China Nafine Group International Co., Ltd., ACURO ORGANICS LIMITED, Global Calcium, Richase Enterprise PTE. LTD, ICL, Rishi Chemical, GROWILL AGROTECH, Central Drug House, HiTech Minerals and Chemicals Group, TRIANGULUM CHEMICALS PRIVATE, LIMITED, ANISH CHEMICALS, |

Market Opportunity

Developing Regions Offer Rich Export Potential for Magnesium Sulfate

The increasing demand from the developing regions is expected to create lucrative opportunities for market in the coming years. Regions such as Southeast Asia, Latin America, and others are seen under the advancements of the sectors such as healthcare, agriculture, and wellness, which can create a beneficial environment for the manufacturers. Also, the manufacturers can gain the major market share by exporting magnesium sulfate to these types of countries, which can provide substantial profit margins in the coming years. Also, offering cost-effective and high-quality magnesium in these regions is likely to get immense trust and popularity during the projected period.

Formulations Flexibility Becomes a Key Competitive Advantage for Suppliers

The development of custom-grade and tailored magnesium sulfate is anticipated to create significant market opportunities for manufacturers in the coming years. The manufacturers can create tailored magnesium sulfate for specific industries, such as pharmaceuticals, where the purity and quality matter. Their manufacturers can create collaborations with the pharmaceutical companies, which gives them long-term agreement profit margins as per the industry expectations.

Market Challenge

Cost-Effective Alternatives Slow Down Magnesium Sulfate Adoption

The availability of the alternatives of magnesium sulfates is projected to hamper the industry's growth during the forecast period. In the agriculture field, farmers are also using magnesium nitrate and dolomite lime, which specifically provide the same results as the magnesium sulfates, which is limiting the market growth. Also, the presence of domestic substitutes plays a major role in the market as consumers prefer these types of local substitutes over the imported ones, owing to the cost-effective prices. However, if manufacturers can create domestic availability of the magnesium sulfates while giving cost-effective and high-quality material, the product can gain a substantial advantage in the coming years, as expected.

Regional Insights

The Europe magnesium sulfate market is expected to increase from USD 479.13 million in 2025 to USD 946.90 million by 2034, growing at a CAGR of 7.86% throughout the forecast period from 2025 to 2034. Europe dominated the market in 2024. Europe accounted for the heavy revenue in the current sector, akin to the presence of a strong personal wellness industry in the current period. Several individuals are seen demanding the magnesium sulfate for their personal wellness, which is used as the bath salts, and others for better skin health. Moreover, the ongoing implementation of the sustainability standards is increasingly supporting the magnesium sulfate market growth in recent years, while manufacturers are increasingly boosting the R&D activities for better product development, according to the recent regional survey.

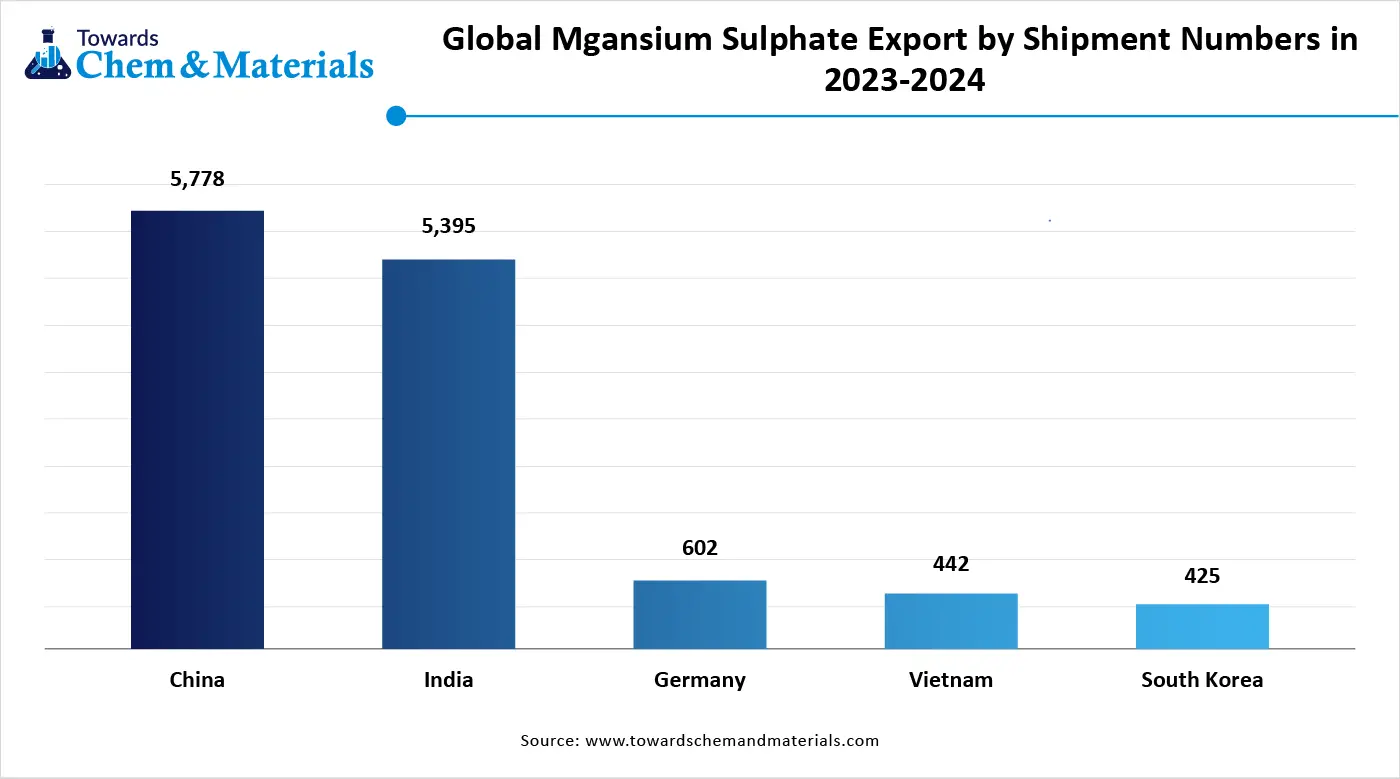

Can Germany’s Chemical Innovations Keep it Ahead in the Magnesium Sulphate Race?

Germany maintained its dominance in the magnesium sulfate market owing to its heavy and advanced industrial base and chemical innovations in recent years. The sectors such as the pharmaceutical and personal care have seen a heavy use of magnesium sulfate in the past few years, which is providing a huge consumer base to the industry. Also, Germany is considered a more technologically advanced farming country where modern farmers have been increasingly using magnesium sulfate for better crop yields in the past few years.

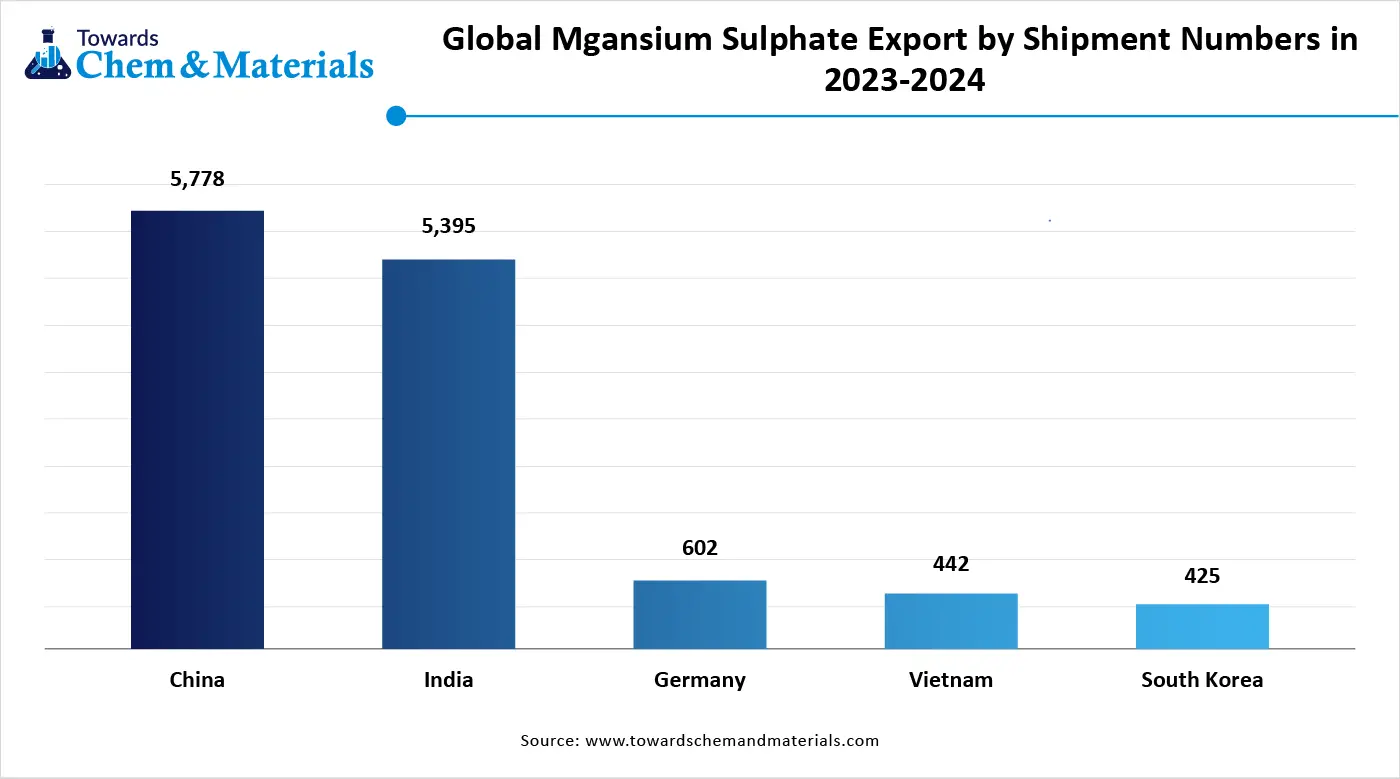

Asia Pacific is expected to capture the fastest share of the market during the forecast period, owing to the increasing need from the heavy sectors such as agriculture and healthcare. The countries in the region, such as India, China, and other Southeast Asian countries, are considered the farming hub and have greater farming exports. These initiatives need to improve the better crop yields, which is leading the magnesium sulfate industry growth, where farmers are using magnesium sulfate in their modern farming practices as per the recent regional observations. Also, the regional benefits like lower production cost and huge investment can lead the regional growth in the future.

Will China’s Production Power Shape the Future of the Magnesium Sulphate Market?

China is expected to rise as a dominant country in the Asian Pacific region in the coming years, owing to the country is considered a heavy producer and exporter globally. Also, China has a skilled labor force and advanced technology access, which can provide significant benefits to the magnesium sulfate manufacturers in the coming years, as per the recent industry observation. Furthermore, the governments in China are heavily supporting organic farming, which has led to the magnesium sulfate sales in the past few years.

Segmental Insights

Application Type Insights

How the Agricultural Grade Segment Dominated the Magnesium Sulfate Market in 2024?

The agricultural grade segment held the largest share of the market in 2024, due to farmers across the world increasingly using it to improve crop quality and yield. Magnesium is an essential nutrient for plant growth, and magnesium sulfate is a fast-acting solution to treat soil deficiencies. It is especially useful for crops like tomatoes, potatoes, and citrus fruits. As global food demand rises and farming practices become more modern, this grade continues to be widely adopted. Its easy availability and cost-effectiveness also make it a top choice for the agriculture sector.

The industrial grade segment is seen to grow at a notable rate during the predicted timeframe, owing to many industries such as textiles, construction, chemicals, and personal care that are increasingly using magnesium sulfate in various processes. It's used for dyeing fabrics, manufacturing fireproof materials, and producing cosmetic products like bath salts. With the global rise in industrial activity and product innovation, the demand for high-quality, consistent-grade materials is increasing. As industries look for affordable and eco-friendly raw materials, industrial-grade magnesium sulfate is likely to become more popular and drive future market growth.

Recent Developments

- In May 2024, Avenacy introduced magnesium sulfate in water for injection in the United States. Also, these initiatives are approved by the U.S. Food and Drug Administration as per the company's claim.(Source: businesswire.com )

- In April 2025, Camber unveiled their latest magnesium sulfate oral solution. Also, this solution is focused on the cleansing of the colon in preparation for colonoscopy, with an osmotic laxative indicated, as per the report published by the company recently. (Source: camberpharma.com)

Top Companies list

- Mani Agro Chem

- Weifang City Huakang Magnesium Sulphate Factory

- Zibo Jinxing Chemical Co., Ltd

- Vinipul Inorganics Private Limited.

- China Nafine Group International Co., Ltd.

- ACURO ORGANICS LIMITED

- Global Calcium

- Richase Enterprise PTE. LTD

- ICL

- Rishi Chemical

- GROWILL AGROTECH

- Central Drug House

- HiTech Minerals and Chemicals Group

- TRIANGULUM CHEMICALS PRIVATE LIMITED

- ANISH CHEMICALS

Segment Covered

By Application

- Agriculture Grade

- Medical Grade

- Food Grade

- Feed Grade

- Industrial Grade

- Detergents

- Pulp & Paper

- ABS Polymerization

- Sorel Cement

- Others

- Consumer Segment/Epsom Salt Grade

By Region

- North America

- U.S.

- Mexico

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Asia Pacific

- China

- India

- Japan

- South Korea

- Central & South America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- UAE