Content

Specialty Carbon Black Market Size and Growth 2025 to 2034

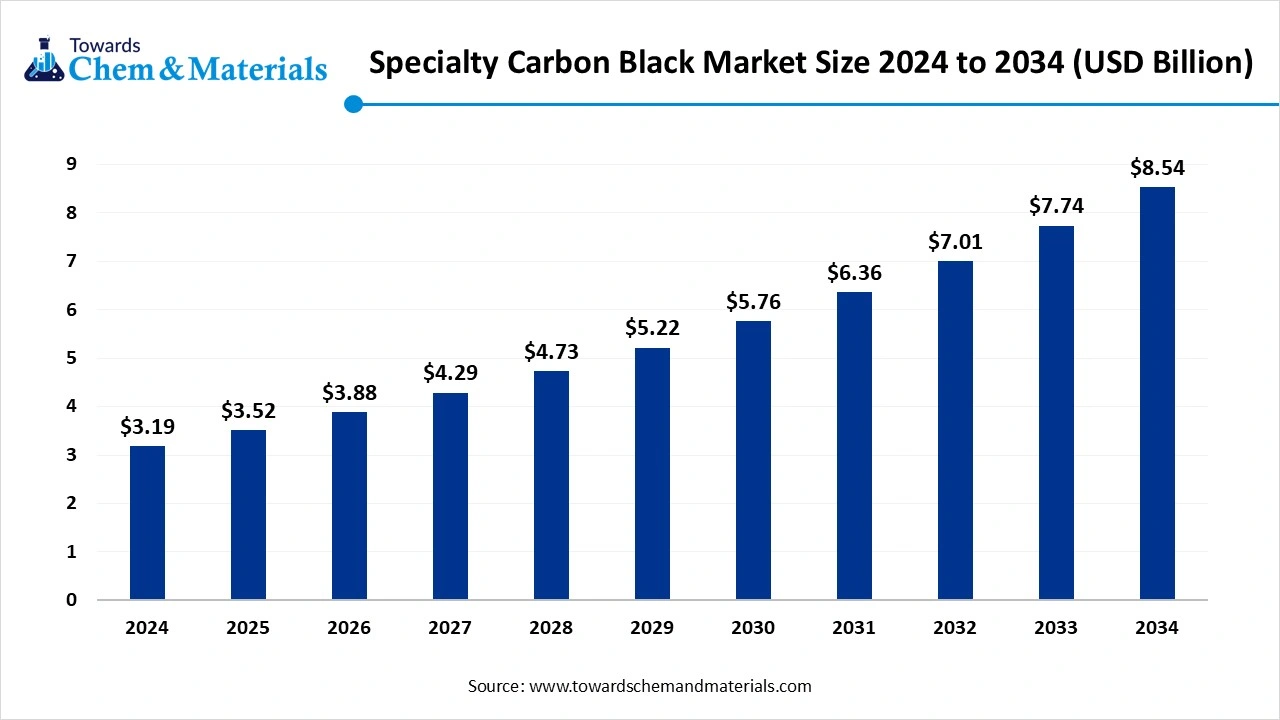

The global specialty carbon black market size accounted for USD 3.52 billion in 2025 and is forecasted to hit around USD 8.54 billion by 2034, representing a CAGR of 10.35% from 2025 to 2034. The growing demand across various industries like plastics, electronics, automotive, and paints & coatings drives the growth of the market.

Key Takeaways

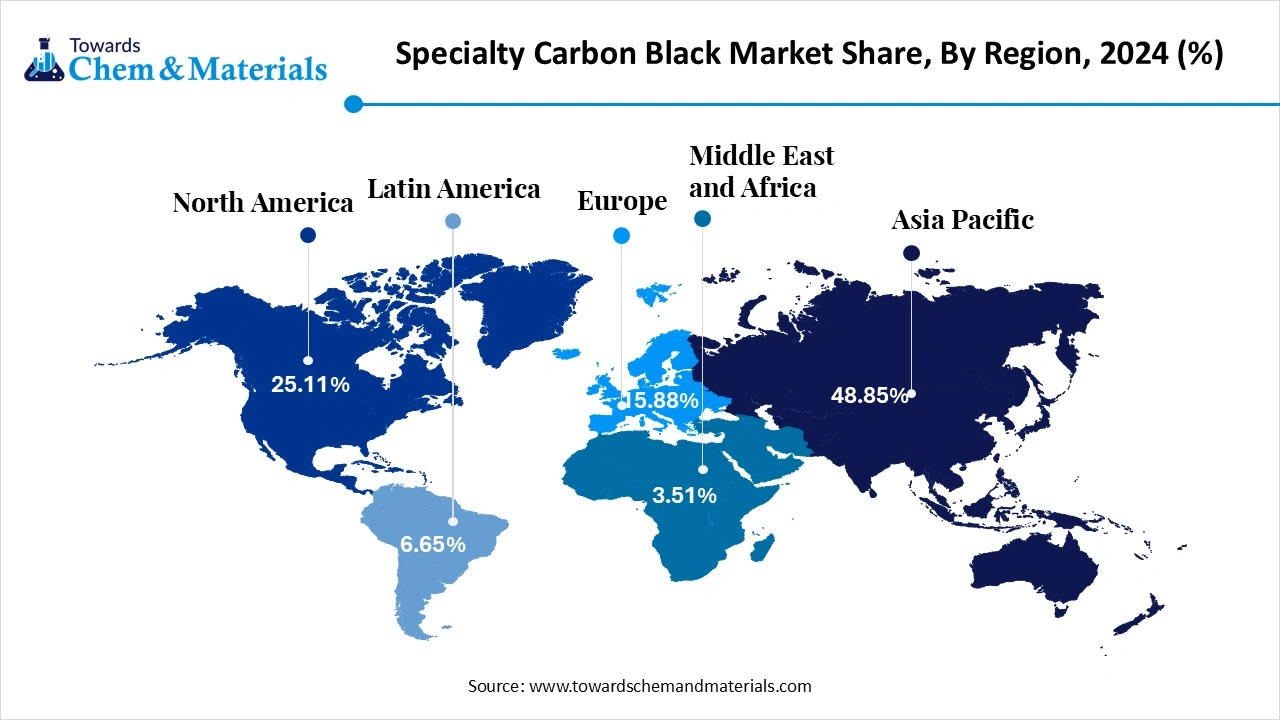

- The Asia Pacific dominated the specialty carbon black market with a revenue share of 48.85% in 2024.

- The China dominated the regional specialty carbon black market in 2024, owing to the expansion of key downstream sectors

- The Europe is growing at the fastest CAGR in the market during the forecast period due to the increasing production of commercial vehicles and passenger cars.

- By grade, the food contact segment led the market with the largest revenue share of 31.75% in 2024.

- By grade, the conductive segment is expected to grow at the fastest CAGR of 11.8% over the forecast period.

The Power of Specialty Carbon Black in Modern Applications

Specialty carbon black is a premium grade of carbon black that consists of outstanding conductivity, UV resistance, tinting strength, and dispersibility. It is specifically designed for non-rubber applications and consists of properties like high purity, electrical conductivity, deep black color, and UV protection. It is suitable for various applications like automotive parts, pressure pipes, and plastic film. It is widely used in electrostatic discharge protection in lithium-ion batteries and the electronics industry due to its electrical conductivity.

It is widely used in various end-use applications, like inks, coatings, sealants, paints, rubber products, adhesives, plastics, and food-related applications. The growing demand for electric vehicle batteries increases the adoption of specialty carbon black. The growing demand from various industries like polymer, inks & toners, and paints & coatings helps in the market growth. The growing demand for tyres in the automotive industry is fueling the adoption of specialty carbon black. Factors like growing demand from key industries like packaging, automotive, plastics, & electronics, increasing demand for printing inks & coatings, and adoption of eco-friendly carbon black formulations contribute to the overall growth of the market.

- The United States exported 35,143 shipments of carbon black. (Source: volza.com)

- According to Japan Export data, from October 2023 to September 2024, Japan exported 4850 shipments of carbon black with a growth rate of 28% compared to the previous twelve months. (Source: volza.com)

- Imerys Graphite Carbon Belgium NV is the leading supplier of conductive carbon black in the world.(Source: volza.com)

The Growing Automotive Industry Propels the Growth of the Market

The growing automotive industry in various regions increases demand for specialty carbon black for various applications. The growing vehicle production increases demand for tires is fueling the adoption of specialty carbon black for improving abrasion resistance, strength, and durability. The rising demand for lithium-ion batteries in hybrid & electric vehicles leads to higher demand for specialty carbon black.

The growing demand for various automotive components like seals, exterior & interior parts, rubber, gaskets, and hoses increases the adoption of specialty carbon black. The growing demand for rubber-based components and tyres in the automotive industry is fueling demand for specialty carbon black. Specialty carbon black enhances overall performance, battery capacity, and rate capability of vehicles. The growing demand for interior components, bumpers, and dashboards in the automotive industry increases demand for specialty carbon black for providing conductivity to plastic and UV protection. The rise in electric vehicles leads to higher demand for specialty carbon black. The growing automotive industry is a key driver for the specialty carbon black market.

Market Trends

- The Growing Demand for Advanced Plastics & Coatings: The growing demand for high-performance plastics & coatings in various industries, especially the automotive industry, increases demand for specialty carbon black for enhancing durability, mechanical properties, and UV protection.

- Growing Demand from the Construction Industry: The growing construction activities in various regions increase demand for specialty carbon black for enhancing durability & performance of building materials. It acts as a pigment for coloring concrete and a reinforcing agent in concrete. Specialty carbon black extends lifespan and prevents degradation of construction components. The growing demand for aesthetic customization of buildings increases the demand for specialty carbon black.

- Increasing Focus on Conductive Carbon Black: The growing shift towards conductive carbon black, especially in electronic & electrical applications, for protection of electrostatic discharge and semi-conductive cables.

- Growing Adoption of Electric Vehicles: The growing demand for electric vehicles in various regions increases demand for specialty carbon black for the production of lithium-ion batteries. It enhances the durability and electrode conductivity of electric vehicles. The growing investment in electric vehicles increases the adoption of specialty carbon black.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 3.52 Billion |

| Expected Size by 2034 | USD 8.54 Billion |

| Growth Rate from 2025 to 2034 | CAGR 10.35% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Grade, By Region |

| Key Companies Profiled | Tokai Carbon Co., Ltd. Continental Carbon Company, Cabot Corporation, Omsk Carbon Group, Atlas Organics Private Limited, Birla Carbon, Oak Investments Partners, Philips Carbon Black Limited, Ralson Carbon Black Limited, Himadri Specialty Chemical Ltd, Orion S.A. |

Market Opportunity

Growing Expansion of the Electronic Industry

The growing expansion of the electronics industry increases demand for specialty carbon black. The increasing adoption of various electronic devices, like wearable devices, smartphones, computers, and laptops, increases the adoption of specialty carbon black. The growing demand for semiconductors, cables, and connectors in electronic devices increases demand for specialty carbon black to create conductive pathways. The growing focus on the development of 5G infrastructure is fueling demand for specialty carbon black. The increasing demand for heat management in high-performance electronics is fueling the adoption of specialty carbon black for longevity and optimal functioning. The growing trend of miniaturization of electronic devices increases the adoption of specialty carbon black. The growing advancements in the electronics industry lead to a higher demand for specialty carbon black. The growing expansion of the electronics industry creates an opportunity for the growth of the specialty carbon black market.

- In 2024, India exported US$ 29.11 billion of electronic goods.(Source: ibef.org)

IMAGE: Electronics Market in India (US$ billion) 2016-2025

Market Challenge

High Production Cost Limits the Adoption of Specialty Carbon Black

Despite several advantages of specialty carbon black in various sectors, the high production cost restricts the growth of the market. Factors like stringent quality standards, complex manufacturing processes, higher raw material costs, and specialized applications are responsible for the higher cost.

A complex manufacturing process, like thermal decomposition, complex particulate structure, and partial combustion of hydrocarbons, increases the overall cost. The requirement of standard quality control measures throughout the manufacturing process increases the cost. The high cost of raw materials derived from natural gas and crude oil affects the market growth. The growing demand from various applications with enhanced quality, like specific particle size and higher purity, increases the production cost. The high production cost hampers the growth of the specialty carbon market.

Regional Insights

Which Region Dominated the Specialty Carbon Black Market in 2024?

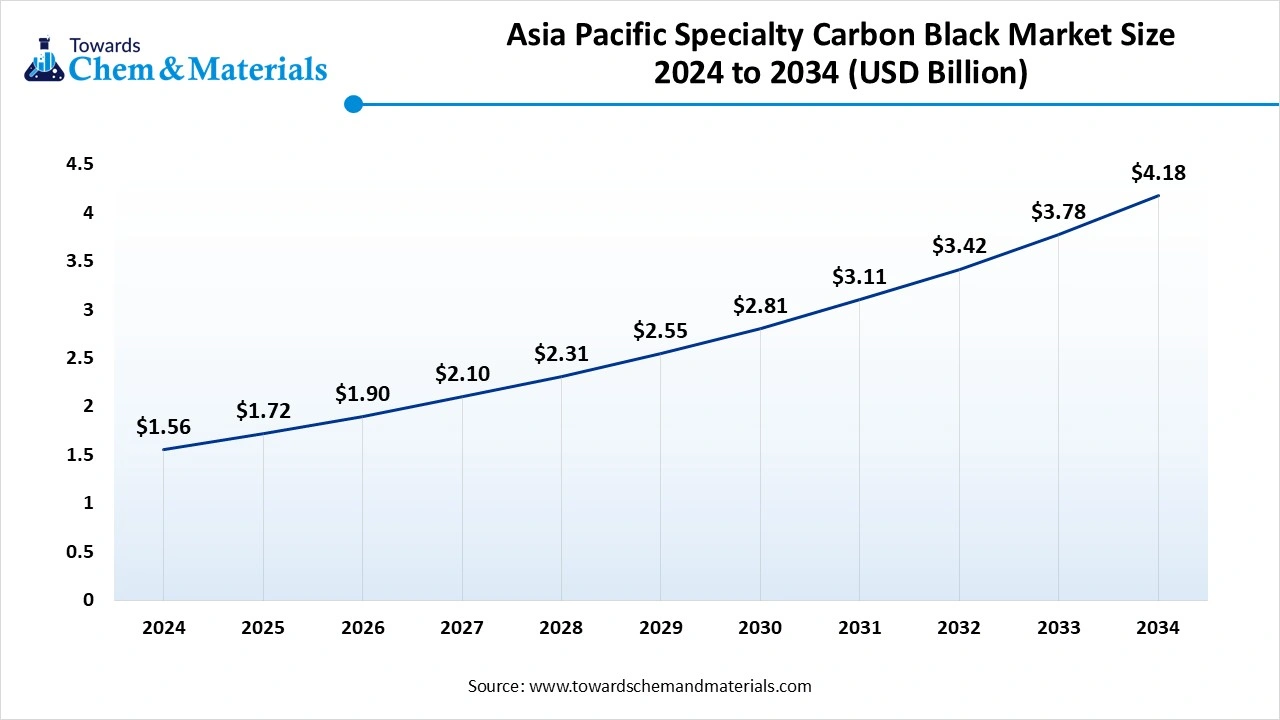

The Asia Pacific specialty carbon black market is expected to increase from USD 1.72 billion in 2025 to USD 4.18 billion by 2034, growing at a CAGR of 10.36% throughout the forecast period from 2025 to 2034. Asia Pacific dominated the specialty carbon black market in 2024.

The growing expansion of the automotive industry, rising advancements in vehicles, and increasing demand for high-performance tires increase the demand for specialty carbon black. The growing production of electronics like wearables, computers, laptops, TVs, and smartphones fuels demand for specialty carbon black to be used in lithium-ion batteries, conductive polymers, and others, which helps in the market growth. The growing development of infrastructure projects like buildings & roads increases demand for specialty carbon black. The well-established manufacturing hub for various sectors and growing industrial activity helps in the market growth. The strong presence of Birla Carbon Company drives the overall growth of the market.

China Specialty Carbon Black Market Trends

China led the specialty carbon black market in the Asia Pacific region. The growing production of tires in the country increases demand for specialty carbon black. The growing production of automobiles and automotive parts helps in the market growth. The booming electronic sector increases demand for specialty carbon black for various applications like pigmentation, electromagnetic shielding, and conductive materials. The strong government support for infrastructure development and industrial growth increases the adoption of specialty carbon black. The growing industrial expansion, including plastics, construction, and electronics, supports the overall growth of the market.

- China exported 45,279 shipments of carbon black.(Source: volza.com)

- China exported 427 shipments of conductive carbon black.(Source: volza.com)

Why is India Growing in the Specialty Carbon Black Market?

India is growing in the specialty carbon black market. The growing production of vehicles and tires increases demand for specialty carbon black. The growing expansion of specialty carbon black applications like construction, fireproofing, printing, and insulation helps in the market growth. The growing development of infrastructure projects like building & roads, and rapid urbanization, increases demand for specialty carbon black. The growing manufacturing sector, especially in electronics, plastics, and textiles, increases demand for specialty carbon black for diverse applications, contributing to the overall growth of the market.

- According to India Export data, from November 2023 to October 2024, India exported 12,211 shipments of carbon black with a growth rate of 22% compared to the previous 12 months.(Source: volza.com)

- According to India Export data, India exported 44,726 shipments of carbon black. (Source: volza.com )

Why is Europe Growing Fastest in the Specialty Carbon Black Market?

Europe experiences the fastest growth in the market during the forecast period. The thriving automotive industry in countries like France and Germany increases production of high-performance tires, fueling demand for specialty carbon black. The growing production of heavy-duty vehicles, passenger cars, and light commercial vehicles helps in the market growth. The growing expansion of the paints & coatings sector in industrial applications and construction increases demand for specialty carbon black. The growing adoption of sustainable practices fuels demand for specialty carbon black for various applications. The growing production of 5G technology and smart devices drives the overall growth of the market.

Germany Specialty Carbon Black Market Trends

Germany is significantly growing in the specialty carbon black market. The growing expansion of the infrastructure and construction sector increases demand for specialty carbon black for various applications. The strong focus on sustainability increases the adoption of specialty carbon black, which helps in the market growth. The growing expansion of the plastic industry and increasing demand for molded parts fuel demand for specialty carbon black. The growing adoption of electric vehicles and the strong presence of vehicle manufacturing support the overall growth of the market.

- According to Germany Carbon Black export data, Orion Engineered Carbons Co. Ltd. is the leading supplier of carbon black in Germany.(Source: volza.com)

Segmental Insights

Grade Insights

Why did the Food Contact Segment Dominate the Specialty Carbon Black Market?

The food contact segment led the specialty carbon black market in 2024. The growing demand for packaging in the food industry increases the demand for specialty carbon black. The regulatory bodies, like the European Plastic Regulation and the FDA, ensure the safety & quality of food-grade specialty carbon black. The growing consumption of packaged food & beverages helps in the market growth. The increasing demand for molded plastics, films, and sheets for food packaging is fueling the adoption of specialty carbon black. The changing lifestyle and growing consumption of convenience foods drive the overall growth of the market.

The conductive segment is the fastest growing in the market during the forecast period. The booming electronic sector increases the production of electronic components, batteries, and capacitors, fueling demand for conductive specialty carbon black. The growing development of advanced automotive components and the increasing adoption of electric vehicles help in the market growth. The growing demand for energy storage systems, including lithium-ion batteries, increases demand for conductive carbon. The rising demand for various plastic products like industrial bags, films, and pipes leads to higher demand for conductive carbon black. The increasing expansion of conductive polymers in wearable technology, sensors, and touchscreens supports the overall growth of the market.

Recent Developments

- In April 2024, Himadri Specialty Chemical announced an investment of Rs. 220 crores to expand specialty carbon black capacity. The facility is expanding by 70000 MTPA, and the total capacity is 130000 MTPA. The total increased capacity of specialty carbon black is 250000, and the facility is operational within 18 months.(Source: indianchemicalnews.com)

- In April 2024, Cabot launched MAJESTIC 710 specialty carbon black. It is used for water-based systems, and it improves color performance. It is diverse applications like colored coatings for composite surfaces & plastics, flexography, concrete coloration, tile grout, and gravure ink pigment. (Source: coatingsworld.com)

- In November 2023, Orion launched its second carbon black plant in eastern China. The carbon black is available for various applications like printing inks, polymers, fiber, rubber, and coatings. The total capacity of the two production lines is 70 kilotons. (Source: chemanalyst.com)

- In June 2025, Epsilon Carbon launched top-quality N134 grade hard carbon. The carbon black consists of superior durability and abrasion resistance. The N134 grade of hard carbon was launched to reduce import dependency, and a new production capacity produces 215000 tons of carbon black. The carbon black is available for high-performance passenger cars and heavy goods vehicles.(Source: indianchemicalnews.com)

Top Companies List

- Tokai Carbon Co., Ltd.

- Continental Carbon Company

- Cabot Corporation

- Omsk Carbon Group

- Atlas Organics Private Limited

- Birla Carbon

- Oak Investments Partners

- Philips Carbon Black Limited

- Ralson Carbon Black Limited

- Himadri Specialty Chemical Ltd

- Orion S.A.

Segments Covered

By Grade

- Food Contact Carbon Black

- Packaging

- Film & Sheet

- Consumer Molded Parts

- Others

- Conductive Carbon Black

- Conductive Polymers

- Paints & Coatings

- Battery Electrodes

- Printing Inks

- Others

- Fiber Carbon Black

- Polyester Fiber

- PP Masterbatches

- Nylon Textiles

- Other Synthetic Fibers

- Other Carbon Black

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait