Content

What is the Current Polyphthalamide Market Size and Share?

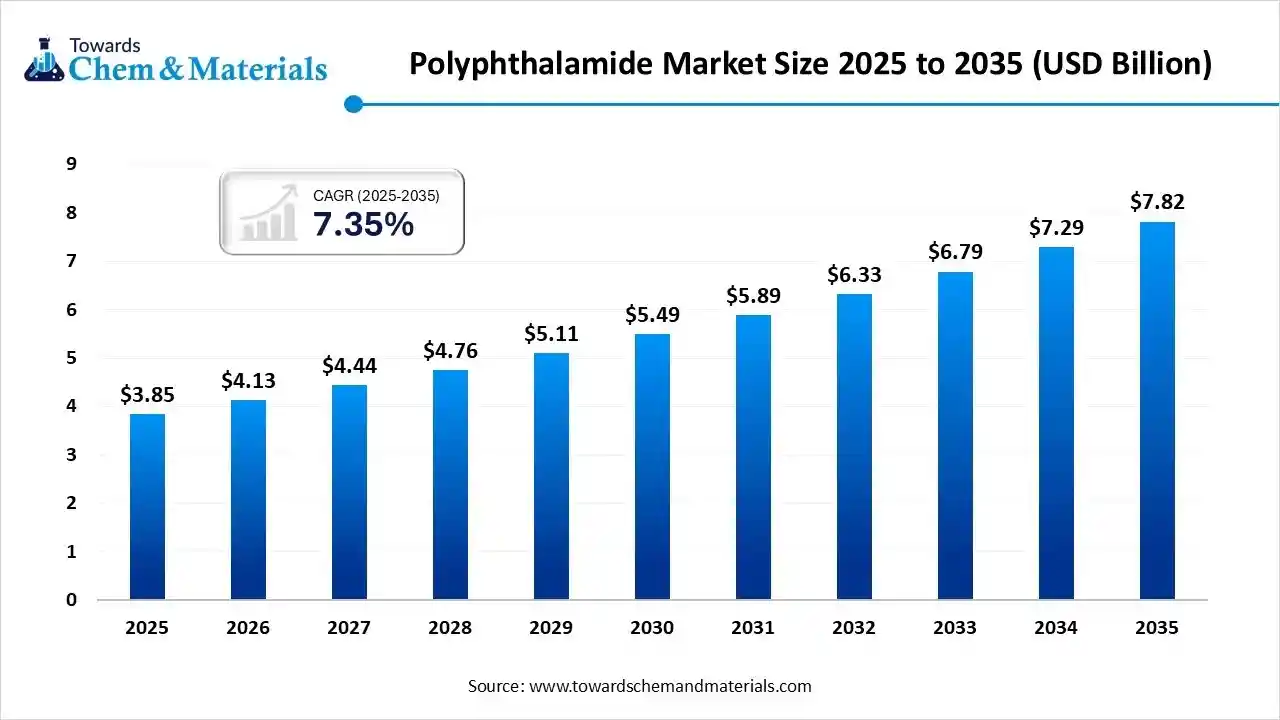

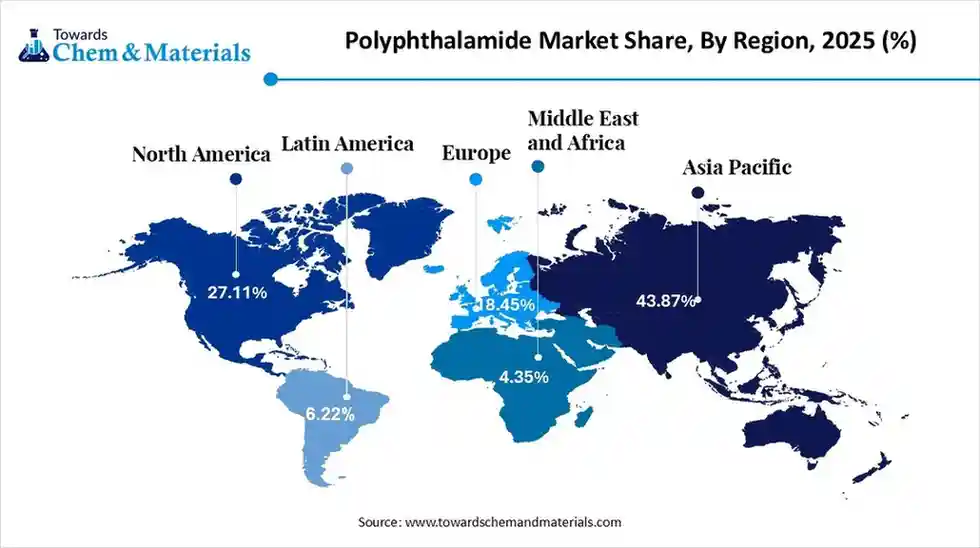

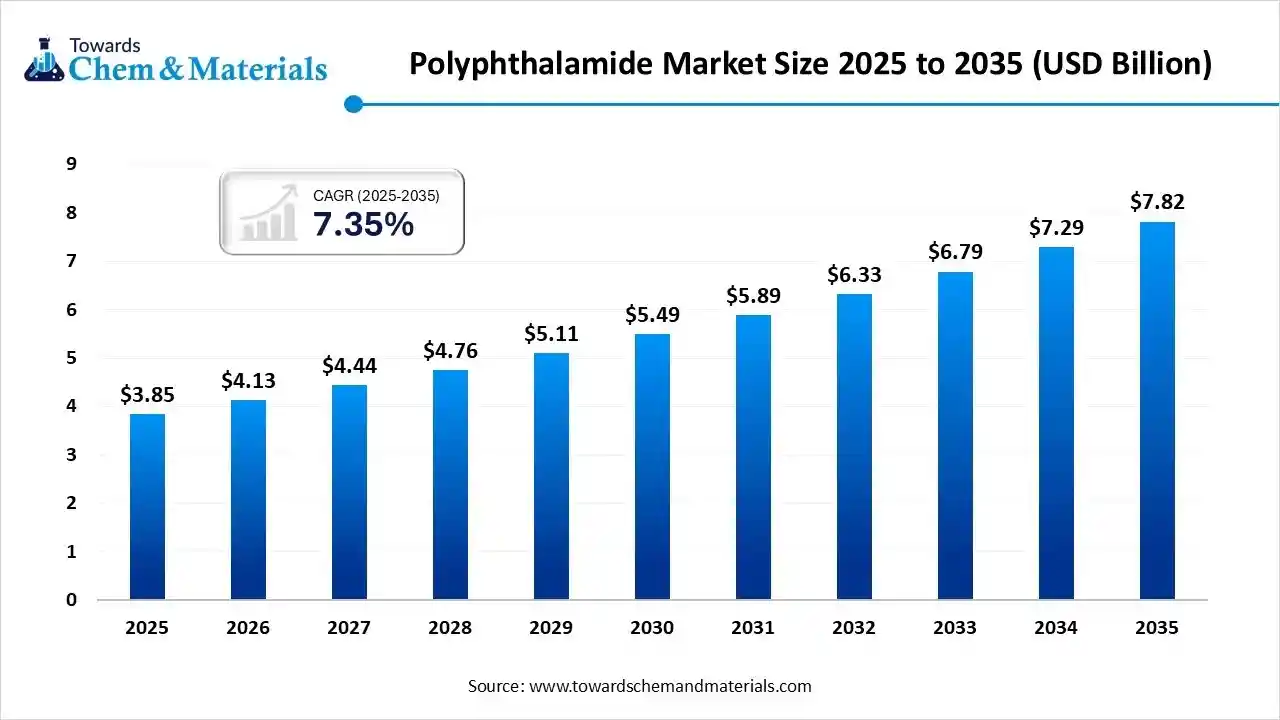

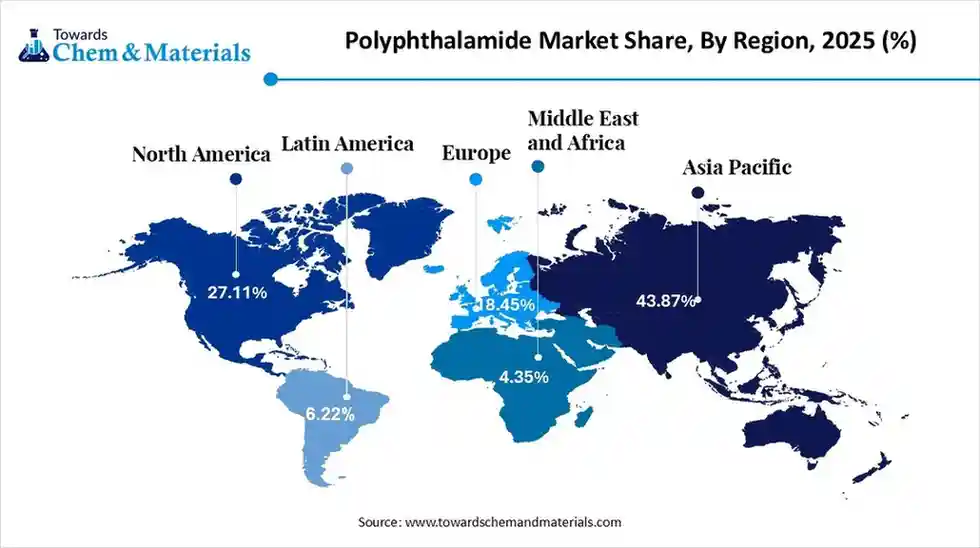

The global polyphthalamide market size is calculated at USD 3.85 billion in 2025 and is predicted to increase from USD 4.13 billion in 2026 and is projected to reach around USD 7.82 billion by 2035, The market is expanding at a CAGR of 7.35% between 2026 and 2035. Asia Pacific dominated the polyphthalamide market with a market share of 43.87% the global market in 2025.The global shift towards durable and lightweight materials has fueled market growth in recent years.

Key Takeaways

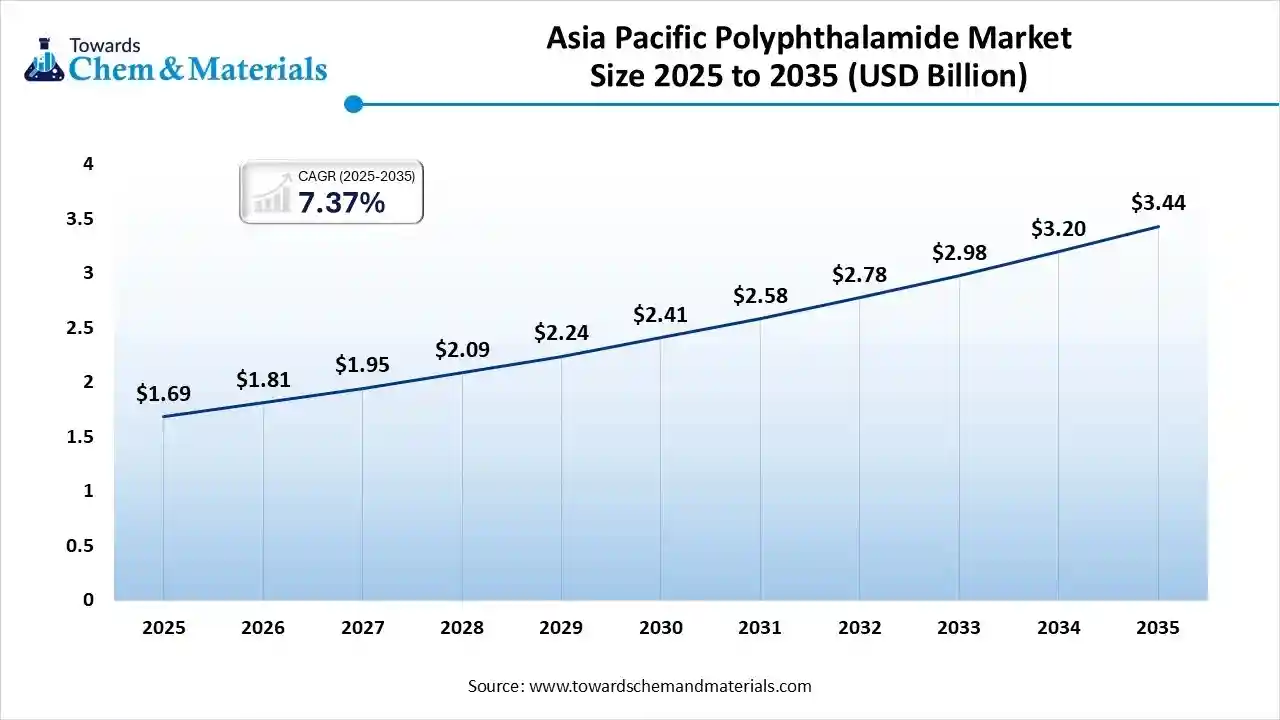

- By region, Asia Pacific led the polyphthalamide market with the largest revenue share of over 43.87% in 2025.

- By product type, the unfilled polypathalamide segment dominated the market in 2025.

- By application type, the automotive segment dominated the market in 2025.

Where Strength Meets Stability: The Rise of Polypathalamide

The polypatahalamide refers to the special nylon that has heat and chemical resistance and can handle high pressure in harsh environments. Moreover, these polypatahalamide are much tougher than the regular plastic and do not easily bend or change shape even the higher usage. Furthermore, having lightweight properties and durability has provided sophisticated consumers to the industry in recent years.

Polyphthalamide Market Trends:

- The shift towards metal replacement in high-heat components and smaller engines is aligned with evolving consumer preferences while offering fresh prospects in the industry nowadays. Moreover, the major companies are using this PPA for the industrial equipment and pumps, as per the recent observation.

- The emergence of high-speed electronics and miniature connectors is stimulating the demand-led growth in the manufacturing sector in the current period. Also, by maintaining the shape even in very small parts with greater heat resistance, the polypathalamide has strengthened the bottom line for production firms in recent years.

- The sudden manufacturing shift towards the sustainable and low-emission compounds, where the PPA material is used for the reduction of energy usage in recent years. Also, by allowing lightweight designs, several manufacturers have been using PPA for energy efficiency in the past few years.

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | USD 4.13 Billion |

| Revenue Forecast in 2035 | USD 7.82 Billion |

| Growth Rate | CAGR 7.35% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Dominant Region | Asia Pacific |

| Fastest Growing Region | North America |

| Segments covered | By Product , By Application, By Region |

| Key companies profiled | BASF SE, Arkema, Celanese Corporation, Akro-Plastic., Evonik Industries AG, Syensqo, SABIC, KURARAY CO., LTD., Ems-Chemie, RTP Company Inc., Xiamen Keyuan Plastic Co., Ltd, Teknor Apex |

Innovation Unleashed: PPA Blends That Withstand Heat, Stress & Precision Needs

The major technological shift in the market is the move toward advanced formulations that can survive extreme conditions while remaining easy to mold. New PPA blends are now reinforced with glass fiber, carbon fiber, and nano-fillers to improve strength, reduce warping, and boost heat stability.

Trade Analysis of the Polyphthalamide Market:

Import, Export, Consumption, and Production Statistics

- South Korea has exported many thermoplastic polymers shipments across the world in 2025, and the estimated shipment number is 458, as per the published report.

- China becomes the second largest nation in the thermoplastic polymer export with the estimated shipment count is 143, as per the research report.

Value Chain Analysis of the Polyphthalamide Market:

- Distribution to Industrial Users : The industrial polyphthalamide market is characterized by a mix of major chemical manufacturers and specialized distributors, supplying end-users in key sectors like automotive, electronics, and industrial equipment.

- Key Players: BASF SE, DuPont, Solvay, and Arkema S.A.

- Chemical Synthesis and Processing: Polyphthalamide (PPA) is a semi-aromatic, high-performance thermoplastic synthesized through polycondensation and typically processed using industrial methods like injection molding.

- Key Players: DuPont de Nemours Inc., Solvay S.A., BASF SE, and Arkema S.A.

- Regulatory Compliance and Safety Monitoring: Polyphthalamide (PPA) is a crucial high-performance, semi-aromatic thermoplastic known for its superior thermal resistance, strength, and chemical stability, making it an indispensable material across demanding industrial sectors such as automotive, electronics, and industrial equipment.

- The material's life cycle is governed by stringent operational and safety standards: it is synthesized via the chemical process of polycondensation of aromatic and aliphatic monomers and processed primarily through high-temperature injection molding.

- Key Agencies: ECHA (European Chemicals Agency), European Commission (EC), and EPA (U.S. Environmental Protection Agency)

Polyphthalamide Market Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas |

| United States | Environmental Protection Agency (EPA) | Toxic Substances Control Act (TSCA) | Reducing hazardous air pollutant (HAP) emissions during production |

| European Union | European Chemicals Agency (ECHA) | REACH Regulation (EC) 1907/2006 | Implementing the circularity and sustainability rules |

| China | National Medical Products Administration (NMPA) | GB 26572-2025 (China RoHS) | Aligning electronics regulations with EU RoHS standards |

Segmental Insights

Product Insights

How did the Unfilled Polypthalamides Segment Dominate the Polyphthalamide Market in 2025?

The unfilled polypathalamide segment dominated the market in 2025 due to its offering easy processing with strength and durability. Furthermore, by working efficiently with complex and small components that are usually used in valves, connectors, and others, the unfilled segment has gained major industry attention in recent years.

The carbon fiber-filled segment is expected to grow at a significant rate owing to the increasing demand for stronger materials that have lightweight properties. Furthermore, by giving very high stiffness and durability to the polypathalamide, the segment has gained major industry attention in recent years.

The glass fiber-filled segment is also notably growing, owing to its affordability. Furthermore, the heavy demand for automotive cooling systems, pump housing, and industrial machinery is anticipated to create lucrative opportunities for the segment during the forecast period.

Application Insights

Why does the Automotive Segment dominate the Polyphthalamide Market?

The automotive segment dominated the market in 2025 because PPA is perfect for high-heat parts under the hood, such as fuel systems, air systems, cooling modules, and engine-related components. Cars need lightweight materials to improve fuel efficiency, and PPA helps replace heavy metals without losing performance.

The electronics and electrical segment is expected to grow at a significant CAGR because devices are getting smaller, faster, and hotter. PPA can handle high temperatures, making it perfect for connectors, chargers, 5G components, and EV electronics. As industries push for miniaturization, PPA's dimensional stability becomes essential.

The consumer and personal care segment is also notably growing because brands want premium materials that are durable, stylish, and safe for daily use. PPA offers a strong, smooth finish that works well for toothbrushes, grooming tools, premium appliance parts, and wearable device components.

Regional Insights

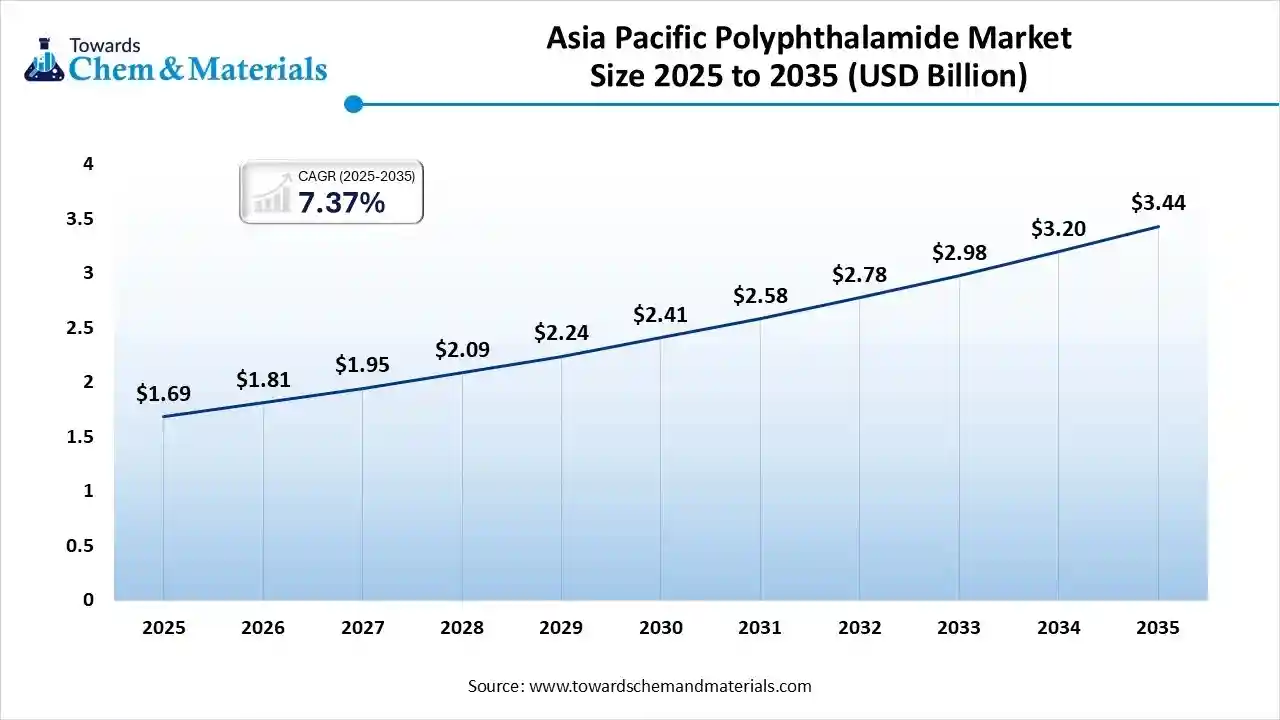

The Asia Pacific polyphthalamide market size was valued at USD 1.69 billion in 2025 and is expected to reach USD 3.44 billion by 2035, growing at a CAGR of 7.37% from 2026 to 2035. Asia Pacific dominated the polyphthalamide market share 43.87% in 2025, owing to the region having one of the largest manufacturing bases of the automotive, industrial goods, and electronics, where the PPA is considered the ideal material. Furthermore, the regional countries such as Japan, China, and India have seen under a heavy production of smartphones, home appliances, and electric vehicles using high-performance plastics like PPA.

Industrial Powerhouse: China Drives Massive PPA Demand

China maintained its dominance in the market due to the increasing demand for motor parts, battery connectors, and industrial machinery. Also, the country has seen the heavy export of consumer electronics and smartphones, which is leading sales for stable and high heat materials like PPA.

North America Polyphthalamide Market Examination

North America is expected to capture a major share of the market, owing to the increasing investments in robotics, renewable energy systems, and high-performance electronics. Furthermore, several major brands are seen under sophisticated research for the development of the new PPA formulations with better thermal stability.

United States Emerges as a High-Growth Hub for PPA Demand

The United States is expected to emerge as a prominent country for the polyphthalamide market in the coming years, owing to increasing PPA demand from sectors like aerospace engineering and advanced electronics in recent years. Also, the United States has seen a heavy expansion of semiconductor manufacturing, which is expected to lead to PPA demand in the country.

Europe Polyphthalamide Industry Evaluation

Europe is a notably growing region due to strong demand for sustainable materials and advanced automotive technologies. European automakers are heavily focused on electric vehicles, which require lightweight and heat-stable polymers like PPA. The region also has strict environmental rules, pushing manufacturers to replace metals and low-performance plastics with more efficient materials.

Automotive Innovation Drives Germany’s Rising PPA Demand

Germany is expected to gain a major industry because it has world-leading automotive, industrial machinery, and electronics companies. German automakers use PPA to reduce vehicle weight, improve fuel efficiency, and support electric motor systems. The country also produces advanced electronics and high-speed connectors, which require stable and heat-resistant materials.

Polyphthalamide Market Study in the Middle East and Africa

The Middle East and Africa are expected to capture a notable share of the market because industries are modernizing rapidly, especially in automotive assembly, electronics manufacturing, and industrial equipment. Countries in the region are adopting new technologies requiring durable and heat-resistant materials like PPA. Growing construction, energy projects, and smart infrastructure also increase demand for high-performance engineering plastics.

Saudi Arabia Powers Up PPA Demand Under Vision 2030

Saudi Arabia is expected to emerge as a prominent country for the market in the coming years due to its growing industrial and manufacturing sectors. The country is investing heavily in automotive assembly, electrical equipment production, and advanced materials under its Vision 2030 plan. As Saudi Arabia builds more EV charging networks, smart factories, and renewable energy projects, the need for high-heat and chemically stable materials like PPA increases.

Polyphthalamide Market Study in South America

The polyphthalamide market in South America is expanding steadily, driven by growth in automotive, electrical, and industrial manufacturing sectors. Automakers increasingly use PPA for lightweight, high-temperature-resistant components that improve fuel efficiency and durability. The region’s electronics industry also relies on PPA for connectors and housings due to its strength and thermal stability. Brazil and Argentina lead demand, supported by ongoing industrialization and adoption of advanced polymers. Rising investment in renewable energy and infrastructure further boosts usage in high-performance parts.

Brazil Polyphthalamide Market Trends

In Brazil, the market is growing as the country strengthens its automotive, electrical, and industrial manufacturing sectors. Brazilian automakers are adopting PPA for lightweight, heat-resistant parts that enhance engine efficiency and meet emission standards. The expanding electronics industry also contributes to demand, using PPA for connectors, sensors, and precision components. Industrial machinery manufacturers value its durability and chemical resistance in harsh operating environments.

Recent Developments

- In January 2025, BASF introduced its new polypatahlamide product line. The newly launched product is called the Utramide T6000 Polypathalamide, and it is a flame-retardant grade polypathalamide as per the published report.(Source: www.indianchemicalnews.com)

Top Vendors in the Polyphthalamide Market & Their Offerings:

- BASF SE: As a leading global chemical company, BASF produces and supplies a wide range of engineering plastics, including high-performance polyamides and advanced polyphthalamides (PPAs) like its Ultramid brand, for various industrial applications.

- Arkema: A global specialty materials company that offers expertise in a variety of high-performance polymers, including a range of technical polyamides and PPAs under brands like Rilsan and Kepstan, used in automotive, electronics, and construction.

- Celanese Corporation: A global technology and specialty materials company that manufactures and supplies a broad portfolio of engineered polymers, including high-performance polyphthalamides (PPAs) under the Fortron brand (PPS) and others.

- Akro-Plastic.: A German compounder and part of the Feddersen Group, specializing in the production of innovative and high-performance technical thermoplastics, including a comprehensive line of customized PPA compounds.

Top Companies in the Polyphthalamide Market

- Evonik Industries AG

- Syensqo

- SABIC

- KURARAY CO., LTD.

- Ems-Chemie

- RTP Company Inc.

- Xiamen Keyuan Plastic Co., Ltd

- Teknor Apex

Segments Covered in the Report

By Product

- Unfilled

- Mineral Filled

- Glass Fiber Filled

- Carbon Fiber Filled

By Application

- Automotive

- Electronics & Electrical

- Industrial Equipment & Apparatus

- Consumer & Personal Care

- Other Applications

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa