Content

Pigments Market Size, Share & Growth Report, 2034

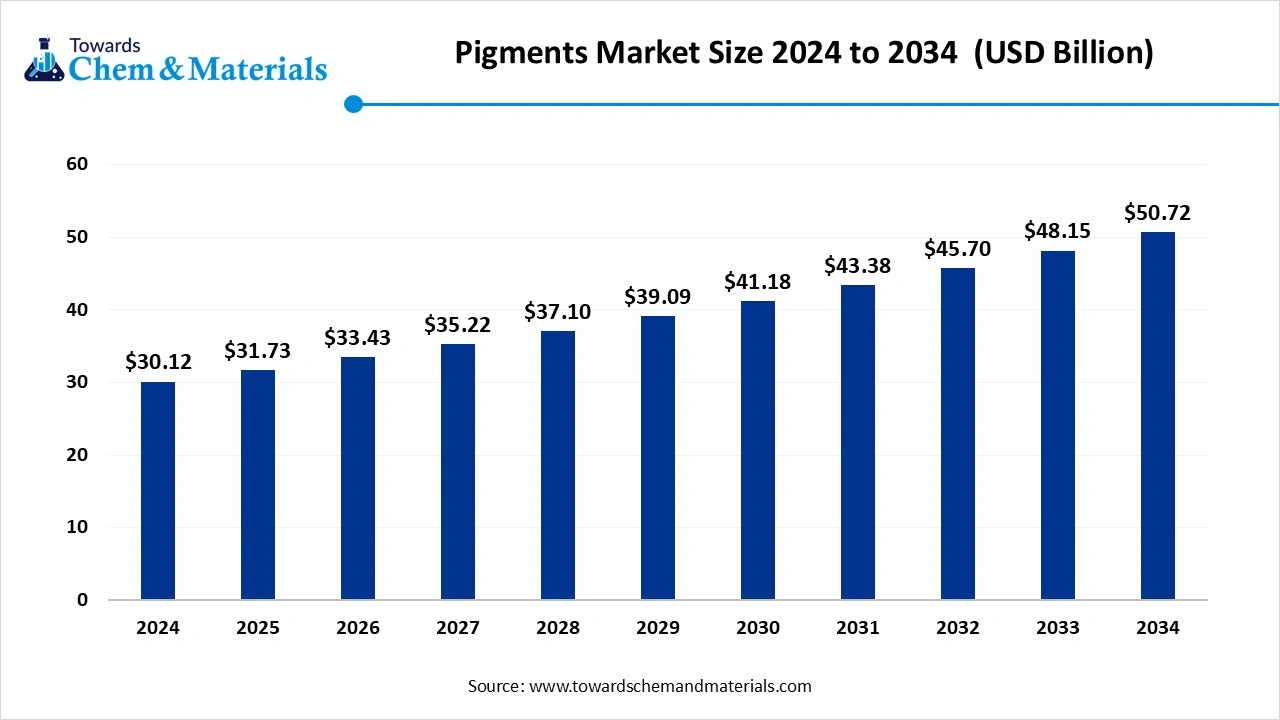

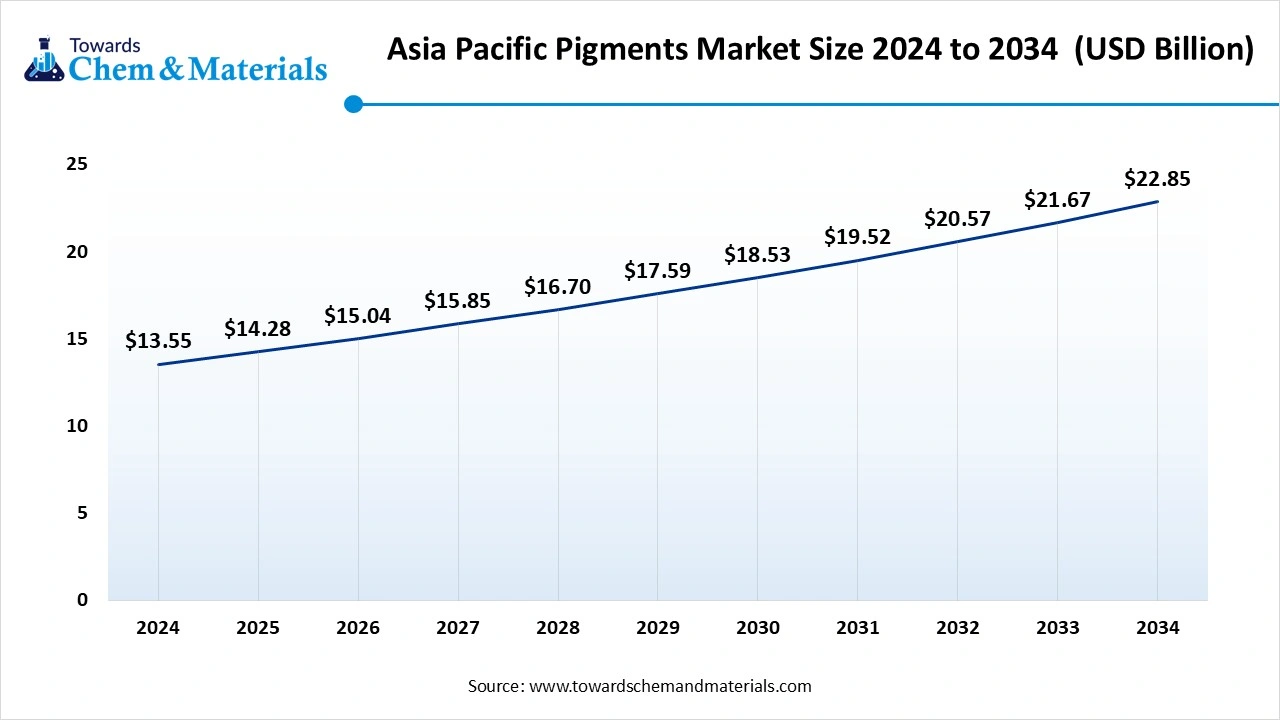

The global pigments market size was reached at USD 30.12 billion in 2024 and is expected to be worth around USD 50.72 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.35% over the forecast period 2025 to 2034. The rapid urbanization and growing demand across end-user industries like plastics, digital printing, & paints & coatings drive the market growth.

Key Takeaways

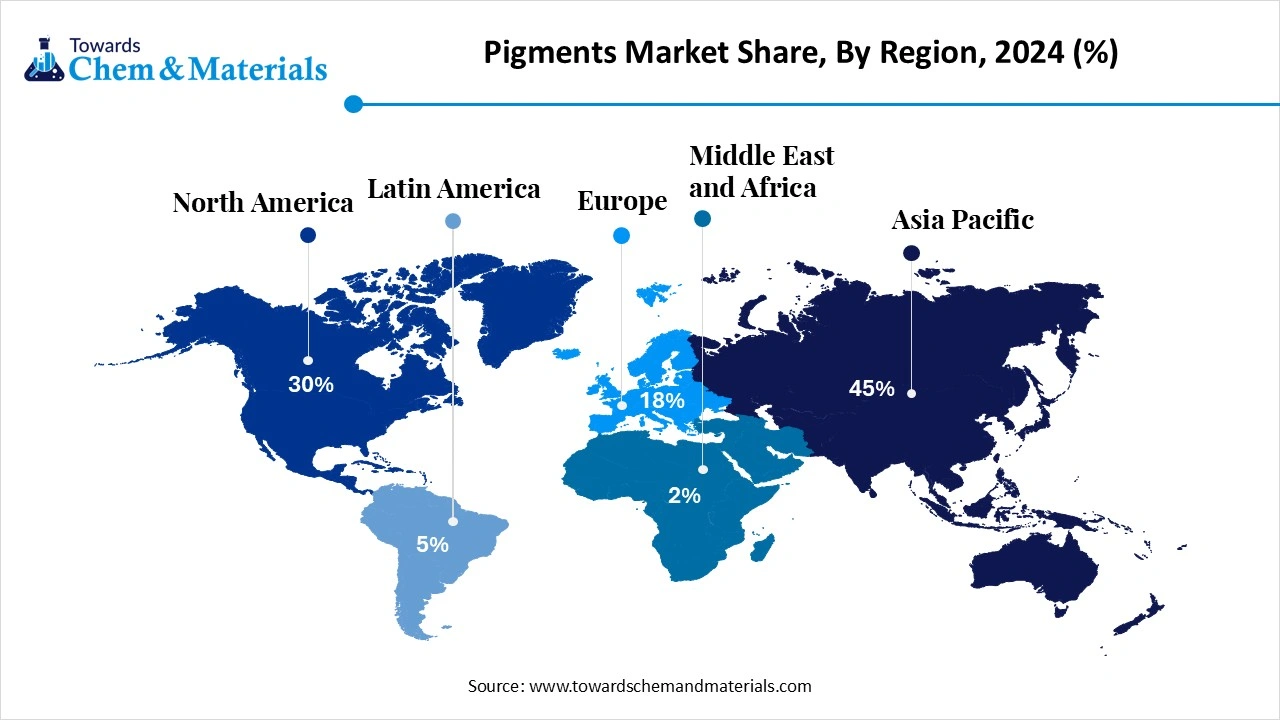

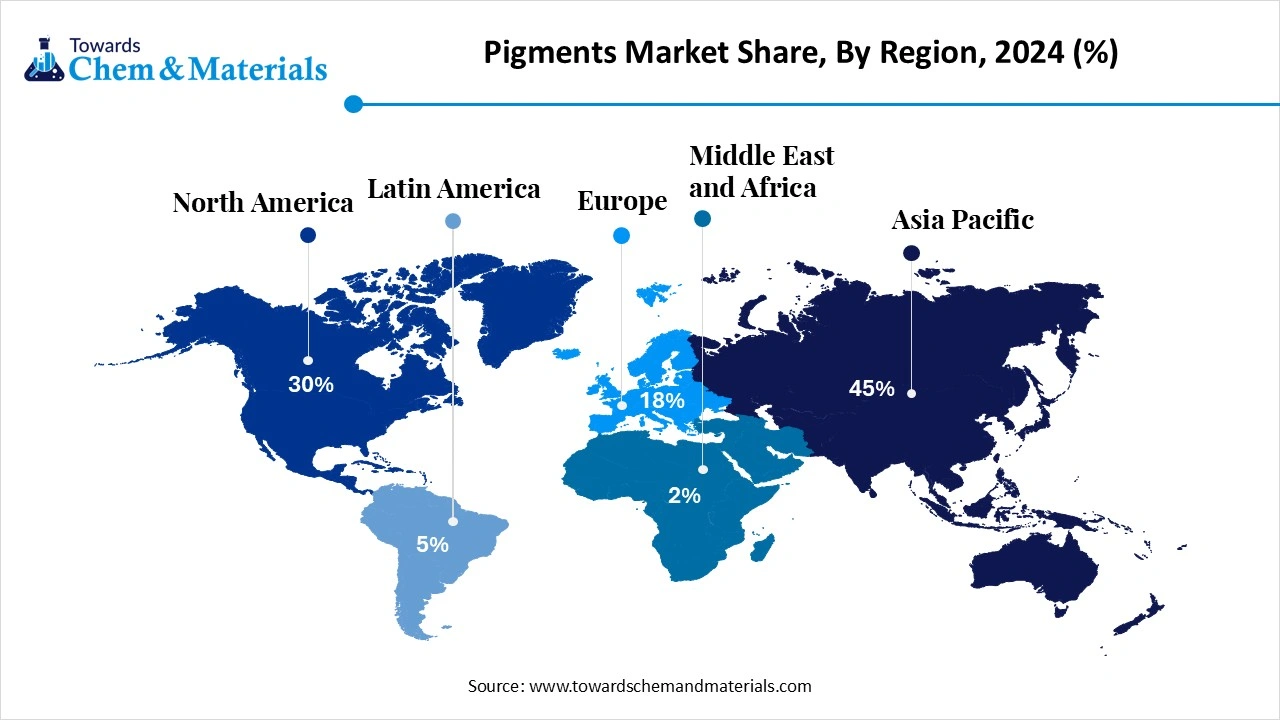

- By region, Asia Pacific held a 45% share in the pigments market in 2024 due to the well-established pigments manufacturing base.

- By region, North America is growing at the fastest CAGR in the market during the forecast period due to the robust growth in the automotive industry.

- By type, the inorganic pigments segment held a 60% share in the market in 2024 due to the growing construction activities.

- By type, the organic pigments segment is expected to grow at the fastest CAGR in the market during the forecast period due to the growing food & beverage industry.

- By application, the paints & coatings segment held a 40% share in the market in 2024 due to the increasing production of automotive components.

- By application, the plastics segment is expected to grow at the fastest CAGR in the market during the forecast period due to the growth in the packaging industry.

- By source, the synthetic pigments segment held a 70% share in the market in 2024 due to the ability to produce a wide range of saturated colors.

- By source, the natural pigments segment is expected to grow at the fastest CAGR in the market during the forecast period due to the growing expansion of the cosmetic sector.

- By form, the powdered pigments segment held a 50% share in the market in 2024 due to the easy dispersion in various mediums.

- By form, the liquid pigments segment is expected to grow at the fastest CAGR in the market during the forecast period due to the growing demand for textile printing.

- By end-use industry, the automotive segment held a 30% share in the market in 2024 due to the growth in electric vehicles.

- By end-use industry, the consumer goods segment is expected to grow at the fastest CAGR in the market during the forecast period due to the growing spending on consumer goods.

- By color type, the white pigments segment held a 25% share in the pigments market in 2024 due to the increasing demand for paints & coatings.

- By color type, the blue pigments segment is expected to grow at the fastest CAGR in the market during the forecast period due to the growing production of eyeshadows and mascaras.

The Power of Pigments in Paints, Coatings, Plastics, and Beyond

Pigments are a substance that alters the colors and visual appearance of materials like plastics, inks, paints, and many more. They are insoluble in water and change colors by absorbing certain wavelengths of light. Pigments are divided into types: organic and inorganic. Organic pigments are produced naturally through simple processes, and inorganic pigments are made up of metals & mineral salts.

Pigments are widely used to improve aesthetics, visual appeal, and enhance functionality like environmental elements resistance, UV protection, and durability. The ongoing technological advancements in pigments like customized pigments, improvements in pigment performance, and innovation in digital printing help market growth. The growing demand across applications like plastics, ceramics, cosmetics, coatings, textiles, food, and printing contributes to the growth of the pigments market.

- Colombia exported 33,253 shipments of pigments. (Source: www.volza.com)

- India exported 10,871 shipments of dyes pigments. (Source: www.volza.com)

- Germany exported $457M of nonaqueous pigment in 2023. (Source: oec.world)

- India exported 2661 shipments of Pigment Red 122. (Source: www.volza.com)

Who are the Leading Exporters of Prepared Pigments in 2023? 4/6

| Country | Export |

| Spain | $1.01B |

| China | $636M |

| Japan | $493M |

Growing Construction Activities Drive Pigments Market Growth

The rapid urbanization and growing construction activities in various regions increase demand for pigments for various applications. The increasing development of infrastructure projects like bridges, roads, buildings, and many more increases demand for pigments for paints & coatings applications. The growing industrial structures, architectural coatings, and road markings increase demand for pigments for weather resistance, color, and opacity.

The growth in commercial and residential construction increases demand for pigments for exterior & interior applications. The need for cement and concrete in construction activities requires pigments for creating colored and decorative applications. The focus on sustainable construction practices increases demand for pigments like CICPs. The growing construction activities are a key driver for the growth of the pigments market.

Market Trends

- Growing Consumer Focus on Aesthetics: The growing consumer focus on the aesthetics of products like consumer goods, textiles, and others increases demand for pigments to enhance the aesthetics.

- Growing Demand for Natural Pigments: The increasing consumer health awareness increases demand for natural pigments. The focus on sustainability increases the adoption of natural pigments in the food & beverage and cosmetics industry.

- Technological Advancements: The ongoing technological advancements like high-performance pigments, nano-pigments, liquid dispersion, and low VOC emission help the market growth. The technological advancements enhance properties like chemical resistance, durability, and color fastness.

Report Scope

| Report Attribute | Details |

| Market Size in 2025 | USD 31.73 Billion |

| Expected Size by 2034 | USD 50.72 Billion |

| Growth Rate from 2025 to 2034 | CAGR 5.35% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Type, By Application, By Source, By Form, By End-User Industry, By Color Type, By Region |

| Key Companies Profiled | BASF SE, The Dow Chemical Company, Clariant AG, AkzoNobel N.V., Cabot Corporation, LANXESS AG, DuPont, PPG Industries Inc., Arkema S.A., Huntsman Corporation, Tronox Holdings, Sudarshan Chemical Industries Ltd., Kraton Polymers, Heubach GmbH, Imerys, Ferro Corporation, Evonik Industries AG, Bayer AG, Merck Group, Vibfast Pigments Pvt. Ltd. |

Market Opportunity

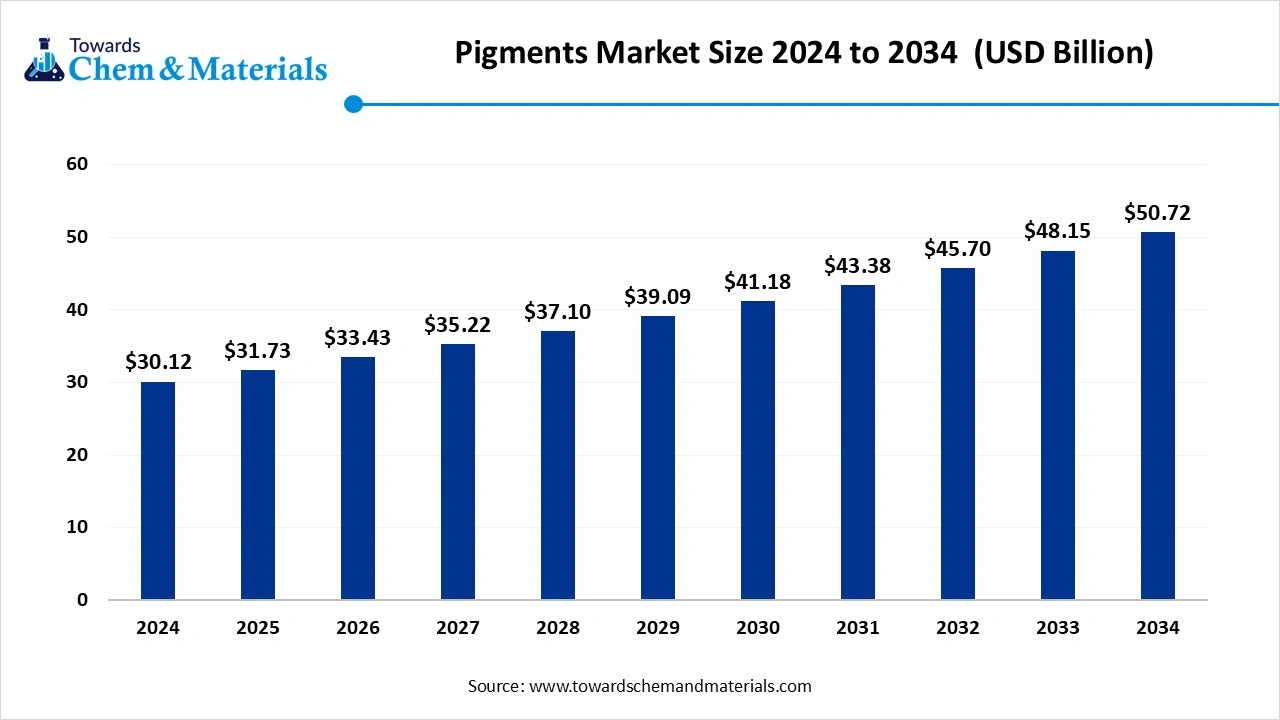

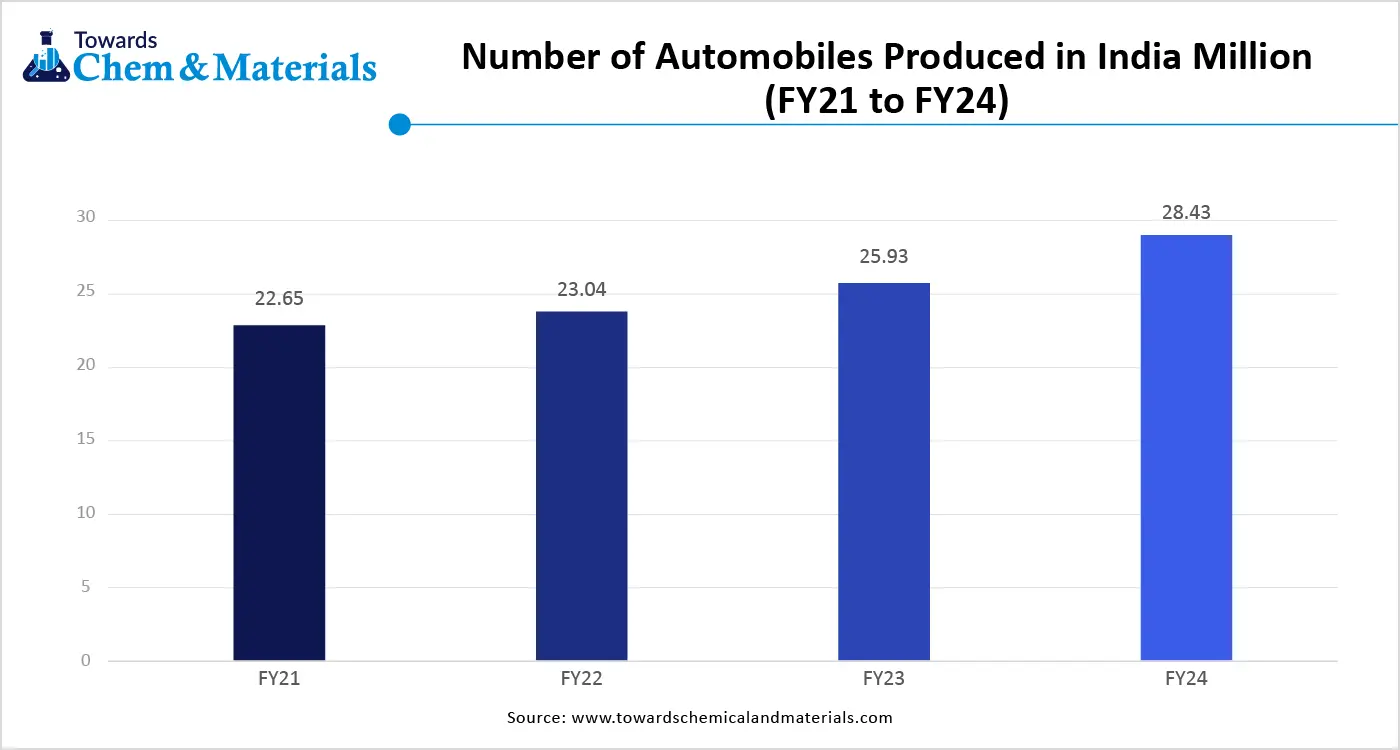

Growing Expansion of the Automotive Industry Surges Demand for Pigments

The growing expansion of the automotive industry in various regions increases demand for pigments for numerous applications. The increasing production of vehicles fuels demand for pigments for coating applications. The focus on enhancing the aesthetic appeal of vehicles and durability fuels demand for pigments. The increasing customization of vehicles and innovation in vehicles increases demand for sustainable and eco-friendly pigments.

The stricter environmental regulations for vehicle emissions and sustainability increase demand for white inorganic pigments. The rise in electric vehicles fuels demand for pigments for aesthetics and lightweight. The growing advancements in vehicle production increase demand for high-quality pigments. The growing expansion of the automotive industry creates an opportunity for the growth of the pigments market.

Market Challenge

Fluctuating Raw Materials Prices Restrain Pigments Market Growth

Despite several benefits of the pigments in various industries, the fluctuating prices of raw materials restrict the market growth. Factors like changing demand, supply chain disruptions, and geopolitical events are responsible for fluctuating raw materials prices. Raw materials are essential for the production of pigments, and the fluctuating cost of raw materials directly affects the market.

The supply chain disruptions due to trade wars and political instability increase the cost of raw materials. The stricter environmental regulations and natural disasters like earthquakes & floods increase the cost of raw materials. The fluctuating raw materials prices hamper the growth of the pigments market.

Regional Insights

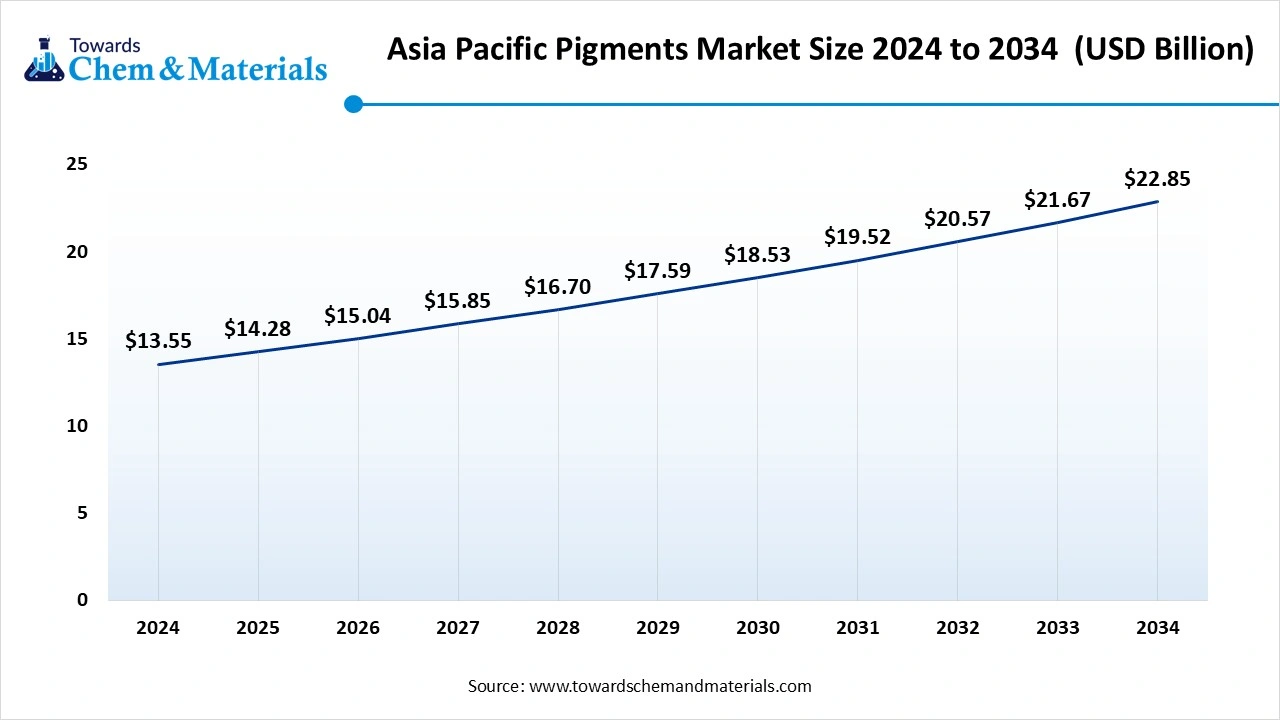

How Asia Pacific Dominated the Pigments Market?

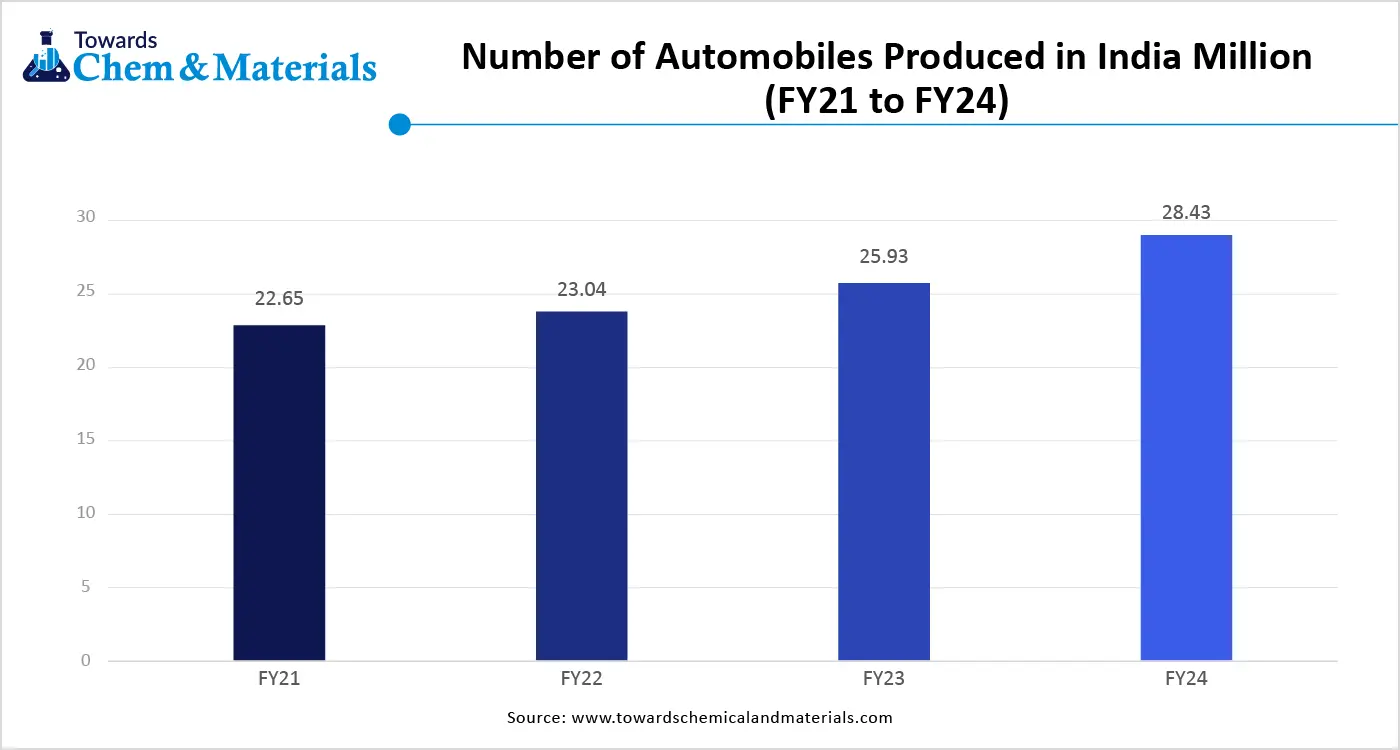

The Asia Pacific pigments market size was estimated at USD 13.55 billion in 2024 and is anticipated to reach USD 22.85 billion by 2034, growing at a CAGR of 5.36% from 2025 to 2034. Asia Pacific dominated the pigments market in 2024.

The rapid urbanization and growing infrastructure development increase demand for pigments. The lower manufacturing cost of pigments and a strong manufacturing base help the market growth. The supportive government policies in countries like India & China increase the manufacturing of pigments. The increasing disposable incomes and growing spending on consumer goods products increase demand for pigments. The rising demand across end-user industries like shipbuilding, coatings, and automotive manufacturing supports the drives the overall market growth.

China Pigments Market Trends

China is a major contributor to the pigments market. The strong presence of the industrial base and increasing demand for pigments in various industries help the market. The strong government support for the chemical industry and initiatives like Made in China increase the production of pigments. The growing production of fluorescent pigments and rising domestic demand in industries like plastics, printing inks, coatings, paints, and textiles support the market growth.

- China exported 10,066 shipments of pigments. (Source: www.volza.com)

- China exported $226M of nonaqueous pigments in 2023. (Source: www.volza.com)

- China exported 765 shipments of Pigment Red 122.(Source: www.volza.com)

Why North America Experiences the Fastest Growth in the Pigments Market?

North America experiences the fastest growth in the market during the forecast period. The growing development of residential buildings and infrastructure increases demand for pigments for concrete, paints, and coatings. The increasing production of vehicles and the growing automotive industry increases demand for pigments. The focus on sustainability and stringent regulations about VOC emissions increases demand for eco-friendly pigments. The easy access to raw materials increases the production of pigments. The growing demand across end-user industries like construction, textile, consumer goods, and packaging drives the market growth.

United States Pigments Market Trends

The United States is a key contributor to the pigments market. The well-established industrial base and growing manufacturing of various chemicals increase the production of pigments. The ongoing R&D in pigments and a focus on manufacturing high-performance pigments help the market growth. The stricter environmental regulations and growing end-user industries like architectural, automotive, and aerospace increase demand for pigments. The presence of major players like Sun Chemical, BASF, and Clariant supports the overall growth of the market.

- The United States exported 6814 shipments of pigments. (Source: www.volza.com )

- The United States exported $226M of nonaqueous pigments in 2023.(Source: oec.world)

Segmental Insights

Type Insights

Why did the Inorganic Pigments Segment Dominate the Pigments Market?

The inorganic pigments segment dominated the pigments market in 2024. The growth in industrial paints, architectural coatings, and automotive finishes increases demand for inorganic pigments like iron oxide & titanium oxide. The growing construction industry increases demand for inorganic pigments used in building materials, concrete, & mortar. Inorganic pigments offer excellent resistance to UV degradation and withstand high temperatures. It provides good chemical resistance and excellent hiding power. Inorganic pigments require a lower production cost and provide a high production yield. The growing demand across applications like consumer goods, packaging, and automotive components drives the market growth.

The organic pigments segment is the fastest-growing in the market during the forecast period. The stringent environmental regulations and increasing demand for eco-friendly products fuel the adoption of organic pigments. The growing demand for exterior and interior coatings in automotive applications increases the demand for organic pigments, helping the market growth. The rapid urbanization and growing infrastructure development increase demand for organic pigments for construction materials, paints, and coatings. Organic pigments provide good dispersion, color strength, and tinting strength. The growing food & beverage and the expansion of the consumer goods industry increase demand for organic pigments, supporting the overall market growth.

Application Insights

How Paints & Coatings Segment Held the Largest Share in the Pigments Market?

The paints & coatings segment held the largest revenue share in the market in 2024. The growing infrastructure development and construction activities increase demand for paints & coatings. The increasing demand for a wide range of shades & colors of paints & coatings requires pigments. The focus on visual appeal and growing production of electric vehicles increases demand for paints & coatings. The growing demand across various sectors like automotive, architectural, and industrial drives the overall market growth.

The plastics segment experiences the fastest growth in the market during the forecast period. The rapid growth in the packaging industry and increasing production of exterior & interior components of vehicles increases demand for plastics. The growing demand for colored plastics across various applications helps the market growth. The growing demand across end-user industries like consumer goods, packaging, and automotive supports the overall growth of the market.

Source Insights

Why did the Synthetic Pigments Segment Dominate the Pigments Market?

The synthetic pigments segment dominated the market in 2024. The growing demand for high-performance pigments increases the production of synthetic pigments with properties like excellent lightfastness, heat resistance, and chemical resistance. Synthetic pigment produces a wide range of saturated colors and offers excellent resistance to fading. It is widely used for large-scale industrial applications and produces consistent quality. The growing adoption in various industries like plastics, printing inks, coatings, textiles, and cosmetics drives the market growth.

The natural pigments segment is the fastest-growing in the market during the forecast period. The growing consumer awareness and increasing environmental concerns increase demand for natural pigments. The growing food & beverage industry increases demand for natural pigments to offer appealing visuals. The expansion of the cosmetics industry fuels demand for natural pigments for the manufacturing of products like moisturizers & lipsticks. The focus on creating sustainable & unique colorations in textiles requires natural pigments. The growing demand for paints & coatings increases adoption of organic paints, supporting the overall market growth.

Form Insights

How Powdered Segment Held the Largest Share in the Pigments Market?

The powdered segment held the largest revenue share in the pigments market in 2024. The focus on ease of handling and increasing demand for affordable pigments fuels the demand for powdered pigments. The need for easy dispersion in a wide range of media, like coatings, paints, and plastics, increases the demand for powdered coatings, helping the market growth. Powdered pigments have higher hiding power and color intensity. The focus on customization and growing demand for powder pigments across industries like decorative coatings, plastics, automotive coatings, and many more drives the market growth.

The liquid segment experiences the fastest growth in the market during the forecast period. The growth in textile applications like textile printing & dyeing increases demand for liquid pigments. The increasing demand for coloring various plastic products increases the adoption of liquid pigments. The focus on reducing extensive milling & grinding and simplifying formulation methods increases demand for liquid pigments. They offer consistent colors and better suspension properties. The growing demand for color filters, cosmetics, and digital printing inks increases the adoption of liquid pigments, supporting the overall market growth.

End-User Industry Insights

Which End-User Industry Dominated the Pigments Market?

The automotive segment dominated the market in 2024. The focus of the automotive industry is to sustain conditions like temperature fluctuations, UV radiation, and chemical increases the demand for pigments. The increasing demand for creating aesthetic appeal and finishes in vehicles fuels the adoption of pigments. The growing demand for various pigments in the automotive industry, like complex inorganic color pigments and white inorganic pigments, helps the market growth. The stricter environmental regulations in the automotive industry and the rise in electric vehicles increase demand for pigments, driving the overall market growth.

The consumer goods segment is the fastest-growing in the market during the forecast period. The focus on creating attractive consumer goods products increases demand for pigments. The increasing creation of sustainable products fuels demand for eco-friendly pigments. The increasing disposable incomes and growing spending on consumer goods help the market growth. The growing demand for various consumer goods like plastic products, cosmetics, home care products, and other products supports the market growth.

Color Type Insights

How White Pigments Segment Held the Largest Share in the Pigments Market?

The white pigments segment held the largest revenue share in the market in 2024. The growth in construction activities increases demand for white pigments for paints & coatings applications. The increasing need for aesthetically appealing and durable coatings in the automotive sector fuels demand for white pigments. The rising spending on consumer goods, home decoration, and personal care products increases the adoption of white pigments. They offer high opacity, UV resistance, and longevity. The presence of key players like KRONOS Worldwide Inc., The Chemours Company, BASF, and Tronox Limited drives the market growth.

The blue pigments segment experiences the fastest growth in the pigments market during the forecast period. The increasing focus on car paints and coatings fuels the adoption of blue pigments. The growing infrastructure development and growth in construction activities increase demand for blue pigments for paints & coating applications. The growing electronics industry increases demand for blue pigments for technologies like microLEDs & OLEDs. The increasing production of cosmetics products like mascaras and eyeshadows increases demand for ultramarine blue pigments. The growing demand across end-user industries like construction, cosmetics, automotive, and electronics supports the market growth.

Recent Developments

- In February 2025, Lanxess launched sustainable yellow pigments for the coatings industry. The pigments include Bayferrox 3920, 3910, and 3910 LV, and they offer seamless integration in the paint systems. The product supports sustainability and lowers the carbon footprint.(Source: www.chemanalyst.com)

- In July 2025, Nature Coatings launched BioBlack bio-based pigment. The pigment is made up of recycled pre-consumer wood waste and is certified by FSC. The pigment is long-lasting and has the highest light fastness ratings. It is applicable in industries including automotive, paints, packaging, and apparel.(Source: www.coatingsworld.com)

- In March 2025, Venator launched TIOXIDE TR81 pigment. The pigment offers exceptional brightness, durability, opacity, and dispersibility. The pigments are useful in industries like inks, coatings, and plastics & they enhance aesthetic appeal.(Source: www.chemanalyst.com)

Pigments Market Top Companies

- BASF SE

- The Dow Chemical Company

- Clariant AG

- AkzoNobel N.V.

- Cabot Corporation

- LANXESS AG

- DuPont

- PPG Industries Inc.

- Arkema S.A.

- Huntsman Corporation

- Tronox Holdings

- Sudarshan Chemical Industries Ltd.

- Kraton Polymers

- Heubach GmbH

- Imerys

- Ferro Corporation

- Evonik Industries AG

- Bayer AG

- Merck Group

- Vibfast Pigments Pvt. Ltd.

Segments Covered

By Type

- Organic Pigments

- Azo Pigments

- Phthalocyanine Pigments

- Quinacridone Pigments

- Perylene Pigments

- Others (Anthraquinone, Diketopyrrolo-Pyrrole, etc.)

- Inorganic Pigments

- Titanium Dioxide

- Iron Oxide

- Chromium Oxide

- Ultramarine

- Carbon Black

- Other Inorganic Pigments (Zinc Oxide, Cobalt Blue, etc.)

By Application

- Paints & Coatings

- Architectural Coatings

- Industrial Coatings

- Automotive Coatings

- Powder Coatings

- Decorative Coatings

- Plastics

- PVC (Polyvinyl Chloride)

- Polypropylene

- Polystyrene

- Engineering Plastics

- Bioplastics

- Printing Inks

- Flexographic Inks

- Gravure Inks

- Offset Inks

- Digital Inks

- Screen Inks

- Textiles

- Apparel

- Home Textiles

- Technical Textiles

- Cosmetics

- Hair Dyes

- Skin Care Products

- Nail Care

- Makeup

- Food & Beverages

- Natural Food Colors

- Synthetic Food Colors

- Ceramics & Glass

- Ceramic Tiles

- Glaze Coloring

- Glass Coatings

- Other Applications

- Construction (Pigmented Concrete, Road Markings)

- Pharmaceuticals (Pigments for Medicine)

By Source

- Natural Pigments

- Plant-based

- Animal-based

- Mineral-based

- Synthetic Pigments

- Azo-based

- Phthalocyanine-based

- Quinacridone-based

- Other synthetic pigments

By Form

- Powdered Pigments

- Liquid Pigments

- Paste Pigments

By End-User Industry

- Construction & Infrastructure

- Automotive

- Consumer Goods

- Packaging

- Textiles

- Cosmetics and Personal Care

- Agriculture (Bio-based Pigments)

- Pharmaceuticals

By Color Type

- Red Pigments

- Blue Pigments

- Yellow Pigments

- Green Pigments

- Orange Pigments

- Black Pigments

- White Pigments

- Other Colors (Violet, Brown, etc.)

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait