Content

What is the Current Natural Aroma Chemicals Market Size and Share?

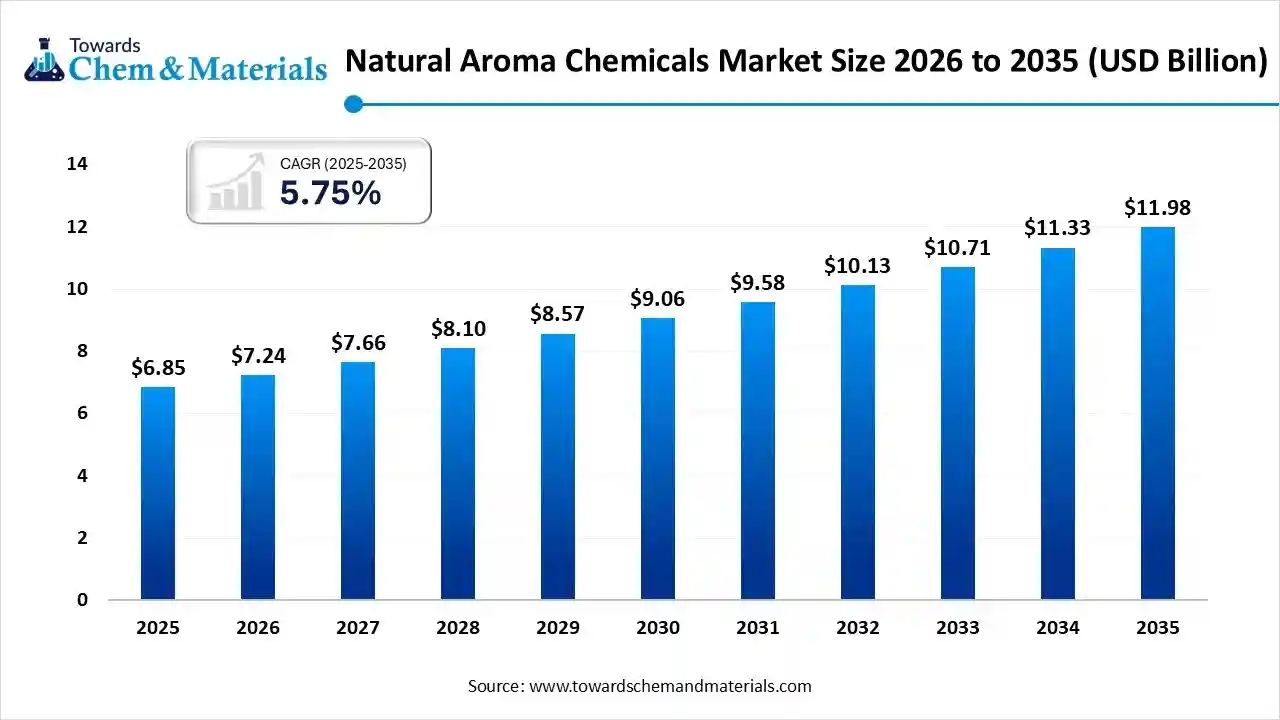

The global natural aroma chemicals market size is estimated at USD 6.85 billion in 2025 and is predicted to increase from USD 7.24 billion in 2026 and is projected to reach around USD 11.98 billion by 2035, The market is expanding at a CAGR of 5.75% between 2026 and 2035. Asia Pacific dominated the natural aroma chemicals market with a market share of 33.75% the global market in 2025.

Natural Aroma Chemicals Market Key Takeaways

- By region, Asia Pacific dominated the market in 2025.

- By application, the food and beverages segment led the market in 2025.

- By nature, the synthetic segment led the market in 2025.

- By form, the liquid segment led the market in 2025.

Natural Aroma Chemicals Market Overview

The natural aroma chemicals market deals with the production and sales of products derived from natural sources like plants and flowers, and they play a major role in various industries, including food and beverages, cosmetics, and pharmaceuticals, for their wide variety of flavors and fragrances. Extraction is the first step for the separation of desired natural products. The extraction method involves solvent extraction, distillation, pressing, and sublimation according to the extraction principle.

The essential oils are generally extracted by two methods. The first is the cold pressing method where the citrus fruits are used to get oil pressed from the peels. The other is steam or hydro distillation, where plant material is heated in water, the aromatic compound rises as steam, and once the steam is cooled, it separates essential oil and water called hydrosol.

There is a rising demand for natural and organic products as consumers are increasingly looking for natural fragrances and flavors in various products like cosmetics, personal care, perfumes, and food products, which drives the demand for natural aroma chemicals and helps expand the market. Concerns about synthetic chemicals and demand for natural products derived from plants and natural sources, which have therapeutic benefits as well, are spurring demand in the space.

Growing public awareness around the benefits of essential oils, such as acting as stress relief and as a calming agent, is one of the many reasons for increasing growth. With changing preferences and changing demand, growth in the fragrance and flavor industries is boosting demand for natural aroma chemicals. These factors drive the natural aroma chemicals market to expand in continuing into the forecasted period.

Natural Aroma Chemicals Market Trends

- Ethical sourcing of ingredients is a key selling point, with consumers increasingly picking fair trade essential oils. Products with no adulteration and hindrance in the quality are piquing consumer interest, inducing supply for sustainable sourcing of the ingredients.

- The rise of personalized fragrances based on individual customer needs and preferences and clean label products, which are free from synthetic additives such as parabens and phthalates, are driving the market to grow.

- Natural are gaining the attention of consumers for functional food and beverages like flavoured water, plant-based foods, and nutraceuticals. And also for functional fragrances, which have mood-enhancing, stress relief, and cognitive benefits, are also in great demand.

- The biotechnological revolution has seen spillover effects in natural aroma production, enabling the production of increased quality and sustainability of the product through yeast and microbial biotechnology, which also reduces reliance on scarce plant sources.

- Growing interest in traditional and indigenous aromas like Oudh (Agarwood) in the Middle East, Ayurvedic-based scents in India, Japanese Hinoki wood, and other unique and regional ingredients in perfumery is fueling the growth of the natural aroma chemicals market.

Natural Aroma Chemicals Market Report Scope

| Report Attributes | Details |

| Market Size in 2026 | USD 7.24 Billion |

| Expected size in 2034 | USD 11.98 Billion |

| Growth Rate | CAGR 5.75% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2026-2034 |

| Dominant Region | North Amercia |

| Segment Covered | By Application,Nature,Form,Region |

| Key Companies Profile | BASF SE, Privi Organics India Limited, Takasago International Corporation, Kao Corporation, Bell Flowers & Fragrance, Givaudan, S H Kelkar andCompany, Symrise, Henkel AG, Eternis Fine Chemicals Ltd., |

Natural Aroma Chemicals Market Opportunity

The expansion of natural aroma chemicals applications will create a great opportunity for the growth of the market.The demand for natural aromatic chemicals is rapidly growing with consumers preferring it over traditional flavour and perfumery. New applications for these chemicals are emerging in the wellness, pharmaceuticals, home care, and biotechnology-driven innovations. The natural aroma chemicals market is expected to experience notable growth because of the extensive demand for the chemical from various industries like pharmaceutical, health, and medical industries for its pharmaceutical and therapeutic applications. The rise of alternative medicine and wellness-based lifestyle brands has led consumers to purchase more essential oils and natural extracts for stress relief, as a sleep aid, and to enhance their moods. In drug formulations, these chemicals are used in respiratory health in inhalers, nasal sprays, and cold rubs which helps the market to grow.

The natural aroma chemicals are also used in the functional food and beverage market for enhancing flavor by replacing the synthetic chemicals. The growth of the market is also seen because of the biotechnological and sustainable innovations in technologies like fermentation-derived aroma chemicals, upcycling agricultural waste, and biodegradable packaging and encapsulation, which play a major role in the formulation and processing, as a result of which the market experiences exponential growth. Growth in the cosmetics and personal care industry due to emerging and changing preferences of the consumers, like demand for sustainable perfumes, natural deodorants, and clean and organic skincare, drives the natural aroma chemicals market to grow in the forecasted period.

Natural Aroma Chemicals Market Challenge

The cost of production of natural aroma chemicals is higher than that of the synthetic alternatives, which hinders the growth of the market.The expensive raw material sourcing, like plant-based sourcing where the natural aroma chemicals are extracted from flowers, fruits, spices, and wood, requires maintenance and proper cultivation and harvesting, which involves innovative methods and technologies, which increases the cost of production and results in a higher cost of the product. And availability of raw materials like sandalwood, vanilla, and rose oil is affected by climate changes and long growth cycles, demand for high production costs, and also requires skilled labor and sustainable framing practices, which adds up to the expenses.

Low yield and high extraction cost as large quantities require a significant amount of raw material and specialized equipment, which increases the cost to the consumer for the product. These increasing complicated formulations often come with a hefty price tag. These factors hinder the growth of the natural aroma chemicals market. However, this challenge can be overcome by biotechnological innovations that lower the costs while maintaining the quality and natural status of the product. Sustainable farming initiatives and upcycling waste materials from the food industry can help the market.

Key Government Initiatives for the Natural Aroma Chemicals Market

| Country | Primary Initiatives | Focus Areas |

| EU | REACH, IFRA standards, Green Chemistry | Strict safety standards and green innovation are driving demand for sustainable aroma chemicals. |

| U.S. | MOCRA, industry trends | Consumer preference for transparency and natural ingredients, backed by stricter cosmetics regulations. |

| China & India | Bio-manufacturing parks, R&D funding, CSIR Aroma Mission | Significant investment in bio-based alternatives and expanding R&D to boost fragrance manufacturing. |

| UAE | Halal Certification, CITES | Specific requirements for Halal-certified products and trade policies governing key ingredients, such as oud. |

Value Chain Analysis

- Research and Development (R&D): This discovers new natural aroma molecules, improves extraction technologies (biotechnology, green chemistry), and ensures safety/compliance.

- Key Players: Givaudan SA, Symrise AG, Firmenich International SA, International Flavors & Fragrances (IFF).

- Raw Material Sourcing & Agriculture: This involves sourcing and cultivating botanicals, such as flowers, fruits, and spices, globally, which are susceptible to climate variability.

- Key Players: Robertet Group, Mane Group, agricultural cooperatives, and specialized sourcing companies.

- Extraction & Processing:Transforming botanicals into essential oils and extracts via distillation, cold pressing, and advanced techniques.

- Key Players: Privi Organics India Limited, Solvay S.A., Oriental Aromatics Limited, and Givaudan SA.

- Logistics & Distribution: Focuses on the safe, careful delivery of high-value concentrates to B2B clients, such as consumer goods companies.

- Key Players: Univar Solutions Inc. and Agility Logistics.

- Application & Formulation in Products: This involves incorporating fragrance concentrates into final consumer products, such as perfumes, soaps, and cosmetics.

- Key Players: Procter & Gamble, Unilever, L'Oréal S.A., and Estée Lauder Companies.

Natural Aroma Chemicals Market Segmental Insights

By Application Insights

The food and beverages segment led the market in 2025. There's been a significant shift toward natural products in recent years, driven by increasing consumer awareness about health, wellness, and sustainability. People are becoming more conscious of what they consume, preferring natural over synthetic chemicals, especially in food and beverages. Natural aroma chemicals are often used in food and beverage products to enhance flavors. With the growing demand for clean-label products (those free from artificial additives and chemicals), natural aroma chemicals are seen as a safer, more attractive alternative. This trend aligns with the desire for transparency in product ingredients.

The cosmetics personal care products segment is seen to grow at a significant rate. Fragrance is a key element in the appeal of many cosmetics and personal care items, such as perfumes, lotions, shampoos, deodorants, and soaps. Natural aroma chemicals are used to create these fragrances in a way that is perceived as safer and more authentic compared to synthetic fragrances. The use of natural ingredients often resonates with consumers who want a more natural, non-toxic experience for their skin and body.

By Nature Insights

The synthetic segment led the market in 2025. Synthetic aroma chemicals are often created by altering the structure of natural molecules or by combining smaller molecules to form larger, more complex ones. These chemicals are created to replicate specific odors or flavors found in nature.

One of the main reasons synthetic aroma chemicals are widely used is because they are often more cost-effective than natural extracts. Natural extraction of aroma chemicals (such as essential oils) can be labor-intensive and require large quantities of raw materials, making it expensive. Synthetically produced aroma chemicals can replicate the same scents at a fraction of the cost, which is appealing to manufacturers aiming to reduce production costs.

The natural segment is seen to grow at the fastest rate during the forecast period. There is an increasing global focus on health and wellness, with consumers seeking products that are perceived as safer and more beneficial for their health. Natural ingredients are often associated with fewer chemicals, toxins, and allergens. This shift is driving demand for products with natural aroma chemicals, particularly in food, beverages, cosmetics, and personal care.

Consumers today are more concerned about the ingredients in the products they use. They prefer clean-label products, which are free from synthetic additives and artificial chemicals. Natural aroma chemicals, sourced from plants, fruits, and flowers, are seen as more transparent and trustworthy by consumers.

By Form Insights

The liquid segment led the market in 2025. Liquid aroma chemicals are highly versatile and can be easily incorporated into a wide range of products, from food and beverages to cosmetics, personal care items, and fragrances. The liquid form allows for easy blending with other ingredients, enhancing the formulation process. This makes liquid aroma chemicals ideal for a variety of industries.

Liquid aroma chemicals are often easier to dose and mix accurately in the production process. This precision is important, especially in industries like food and beverage, where specific flavor profiles are critical. Liquids allow for more consistent and uniform application compared to solid or powdered forms, ensuring better product quality.

Regional Insights

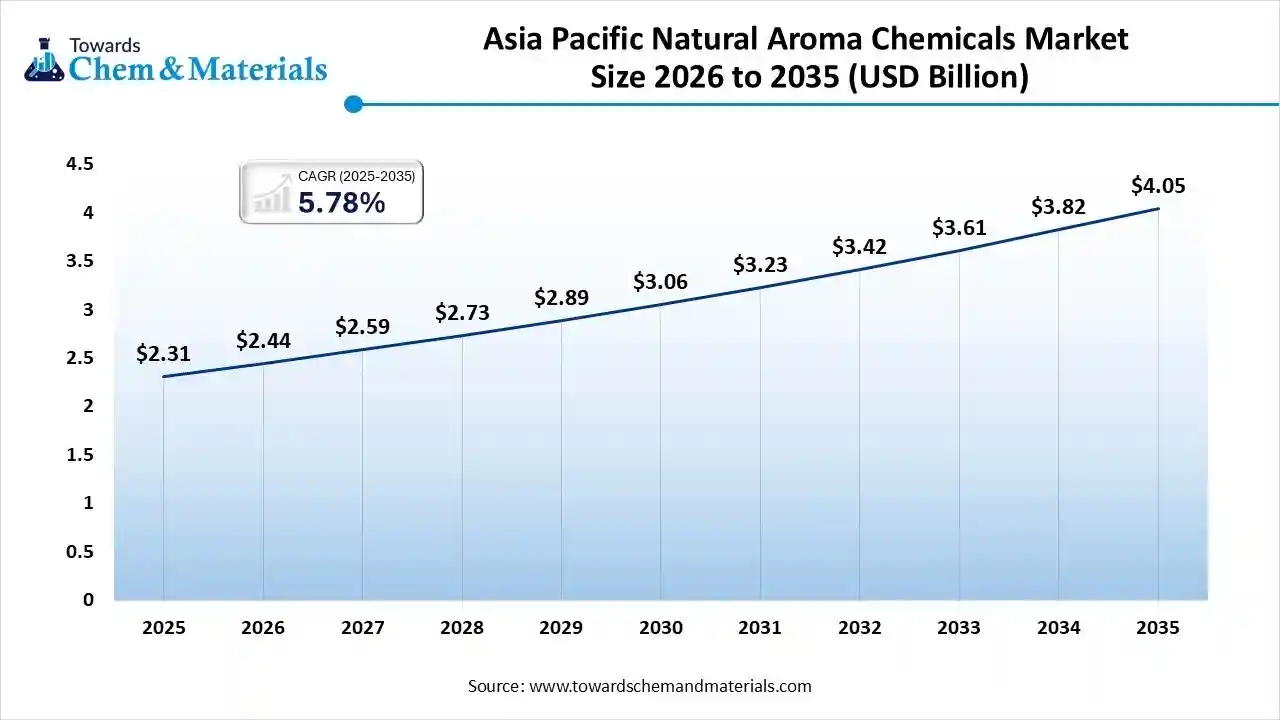

The Asia Pacific natural aroma chemicals market size is valued at USD 2.31 billion in 2025 and is expected to reach USD 4.05 billion by 2035, growing at a CAGR of 5.78% from 2026 to 2035. Asia Pacific held the largest share of the market share 33.75% in 2025.

The increasing demand for natural and organic products is due to increasing awareness of natural and organic products. The region is also the leading producer of essential oils, which reduces the cost of the products. The region also has abundant raw material derived from a vast pool of natural resources, which also helps players in the region overcome the challenges of the high cost of production. The rising disposable income due to the rise in the middle-class population has helped the market to grow significantly in the forecasted period.

North America is expected to grow at the fastest rate. The strong demand for organic and clean-label, plant-based products in personal care, cosmetics, and food products drives the growth of the market in the region. The presence of fragrance manufacturers and a well-established essential oil industry support the growth of the market. Consumer demand for synthetic-chemical free perfumes, deodorants, and skincare products increases the demand for botanical and organic aroma chemicals due to the quality of the product. This helps in the expansion of the market in the region significantly.

How will Europe influence the Natural Aroma Chemicals Market?

Europe is a notable region in the natural aroma chemicals market, driven by innovation and rigorous clean-label and regulatory standards. This market is primarily propelled by high-end perfumery, cosmetics, and the premium food and beverage sectors, with a strong emphasis on traceability and organic standards. Major players like Symrise AG, Givaudan SA, Robertet SA, and DSM-Firmenich are making significant investments in biotechnology, green chemistry, and synthetic biology to produce nature-identical compounds that align with sustainability goals.

Germany Natural Aroma Chemicals Market Trends

Germany holds a prominent position in this market, due to its expertise in chemicals, a strong organic food movement, and a focus on quality. The country is a hub for specialized natural extracts used in functional foods and natural cosmetics. The market is influenced by global flavor and fragrance houses and ongoing research and development in efficient, environmentally friendly extraction technologies. This drives sustainable sourcing and the creation of innovative aroma profiles.

How will Latin America Emerge in the Natural Aroma Chemicals Market?

Latin America occupies a unique role in the global natural aroma chemicals market, driven by its vast biodiversity, investments in sustainable agriculture, and a growing demand for local, natural products. The region offers unique sourcing opportunities for exotic botanical extracts and essential oils. Additionally, the expanding local cosmetics and food industries leverage indigenous ingredients, enhancing the appeal of naturally and authentically sourced products.

Brazil Natural Aroma Chemicals Market Trends

Brazil is the largest market in Latin America, benefiting from significant investments in the cosmetics and personal care industries and the potential of its rich biodiversity. The demand for natural ingredients is driving the adoption of certified organic essential oils and extracts. There is an increasing focus on sustainability and ethical sourcing, especially for Amazonian ingredients, further stimulating market growth supported by local technological development initiatives.

How will the Middle East and Africa contribute to the Natural Aroma Chemicals Market?

The natural aroma chemicals market in the Middle East and Africa is experiencing substantial growth, fueled by rising demand for fine fragrances, a cultural appreciation for traditional scents, and investments in cosmetics and personal care. There is a strong demand for high-quality, authentic natural extracts for luxury perfumery and traditional medicine. Additionally, investments in smart agriculture for aromatic plants and the increasing demand for natural food flavorings are stimulating market expansion.

UAE Natural Aroma Chemicals Market Trends

The UAE plays a crucial role in this market due to its status as a luxury goods hub and its cultural alignment with high-end perfumery. The country is investing in advanced flavor and fragrance development centers and has a high demand for exclusive, high-quality natural ingredients. There is also a growing interest in natural applications in healthcare, including aromatherapy and wellness products, as a regional hub serves as a vital distribution point for high-value natural aroma compounds.

Natural Aroma Chemicals Market Recent Developments

- In January 2025, Azelis, a leading innovation service provider, collaborated with NATARA, a leading independent global manufacturer of flavor and fragrance ingredients. This partnership will allow Azelis to provide consumers with a wide range of high-quality and sustainable ingredients. They aim to offer consumers new and innovative flavors and fragrances, enhancing their product line to meet consumer demand.

- In November 2024, Joon Solid Perfume created a revolutionary, high-quality, and new standard with innovative, alcohol-free solid fragrances. These perfumes provide a safe, moisturizing, and natural alternative to traditional scents.

- In March 2024, Pura, a smart fragrance company, announced the launch of Allos, a new fragrance collection specially designed for the improvement of overall health and wellness. The perfume has therapeutic benefits such as mood-enhancing properties and stress relief benefits.

Top Companies in the Natural Aroma Chemicals Market

- BASF SE

- Privi Organics India Limited

- Takasago International Corporation

- Kao Corporation

- Bell Flowers & Fragrance

- Givaudan

- S H Kelkar and Company

- Symrise

- Henkel AG

- Eternis Fine Chemicals Ltd.

Segments Covered In Report

By Application

- Food Beverages

- Cosmetics Personal Care

- Household Products

- Pharmaceuticals

- Industrial Applications

By Nature

- Synthetic

- Natural

By Form

- Liquid

- Powder

- Granules

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)