Content

What is the Current Additive Manufacturing With Metal Powders Market Size and Volume?

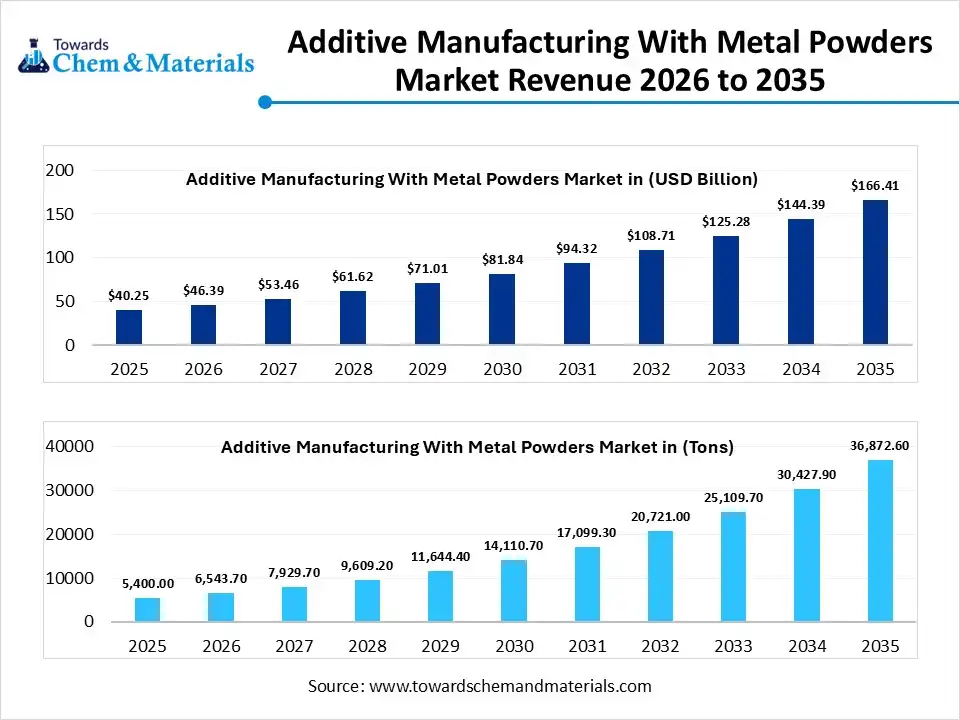

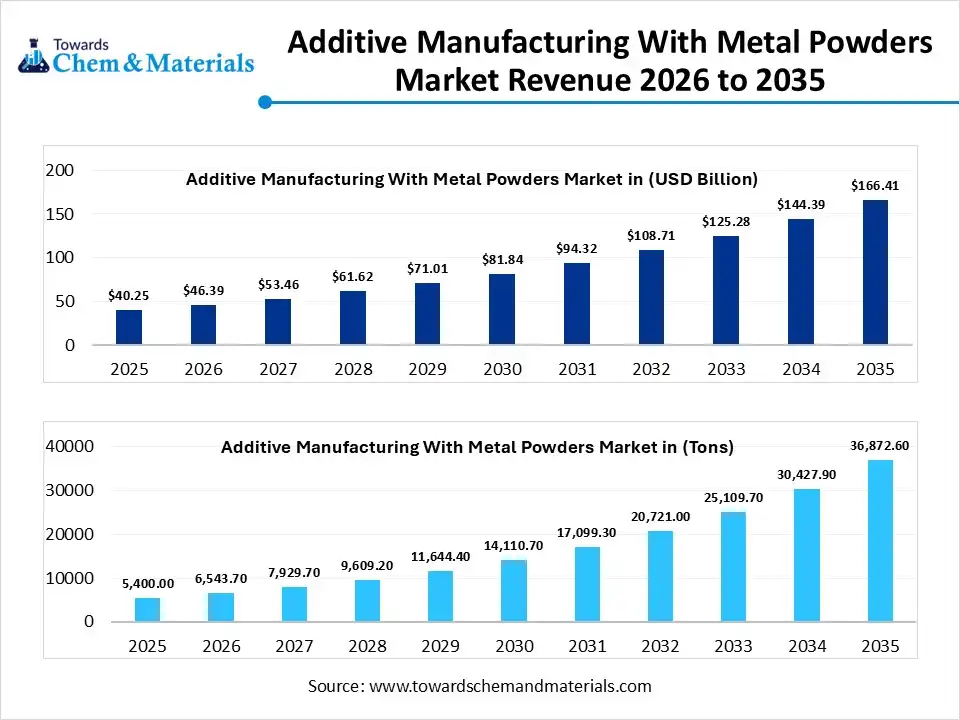

The global additive manufacturing with metal powders market size was estimated at USD 40.25 billion in 2025 and is expected to increase from USD 46.39 billion in 2026 to USD 166.41 billion by 2035, growing at a CAGR of 15.25% from 2026 to 2035. In terms of volume, the market is projected to grow from 5,400.00 tons in 2025 to 36,872.60 tons by 2035. growing at a CAGR of 21.18% from 2026 to 2035. North America dominated the additive manufacturing with metal powders market with the largest volume share of 38.5% in 2025. The growth of the market is driven by rising demand for lightweight, high-precision, and complex metal components across aerospace, automotive, medical, and industrial applications.

The additive manufacturing with metal powders market is witnessing rapid growth fueled by developments in 3D printing technology and growing use in the industrial automotive, aerospace, and healthcare sectors. Metal powders make it possible to produce intricate, lightweight, and highly durable parts with little waste of materials. The market is expanding due to growing demand for cost-effective manufacturing, customized parts, and quick prototyping. Performance and scalability are being improved by ongoing innovation in printing and powder quality.

Report Highlights

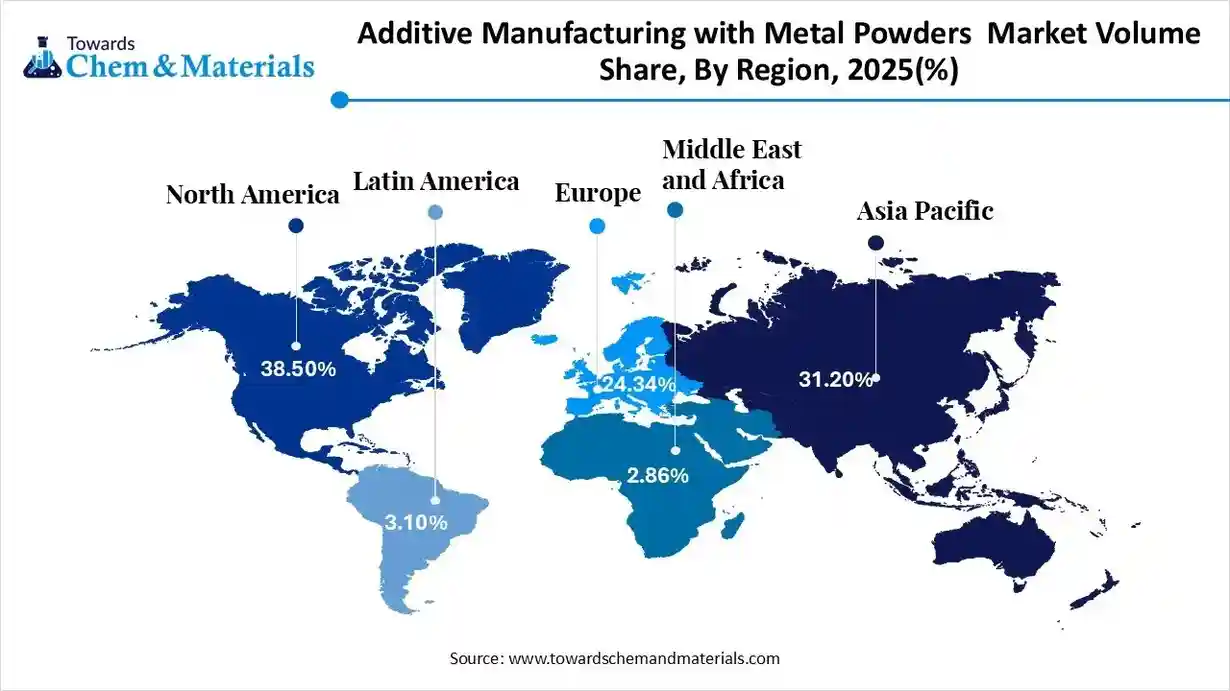

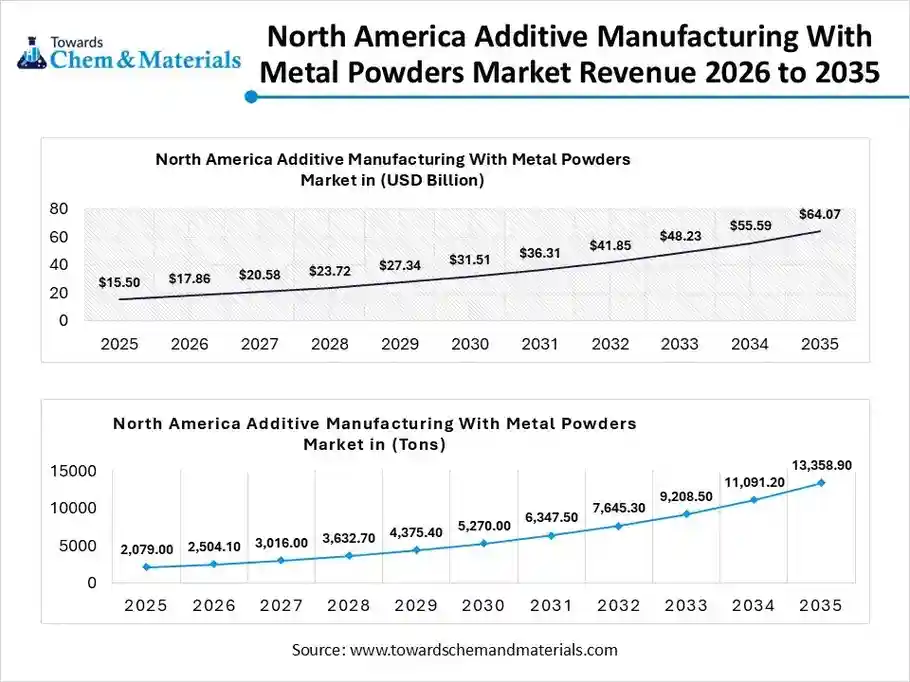

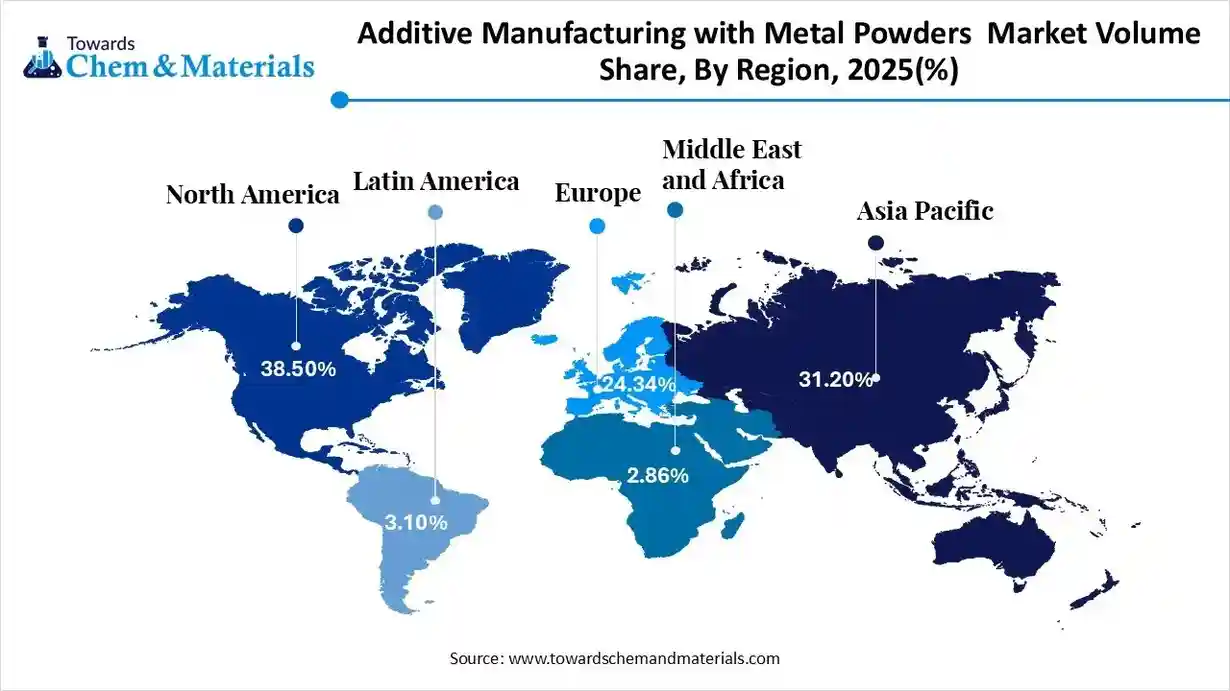

- North America dominated the additive manufacturing with metal powders market with the largest volume share of 38.50% in 2025.

- The additive manufacturing with metal powders market in Asia Pacific is expected to grow at a substantial CAGR of 24.62% from 2026 to 2035.

- The Europe additive manufacturing with metal powders market segment accounted for the major volume share of 24.34% in 2025.

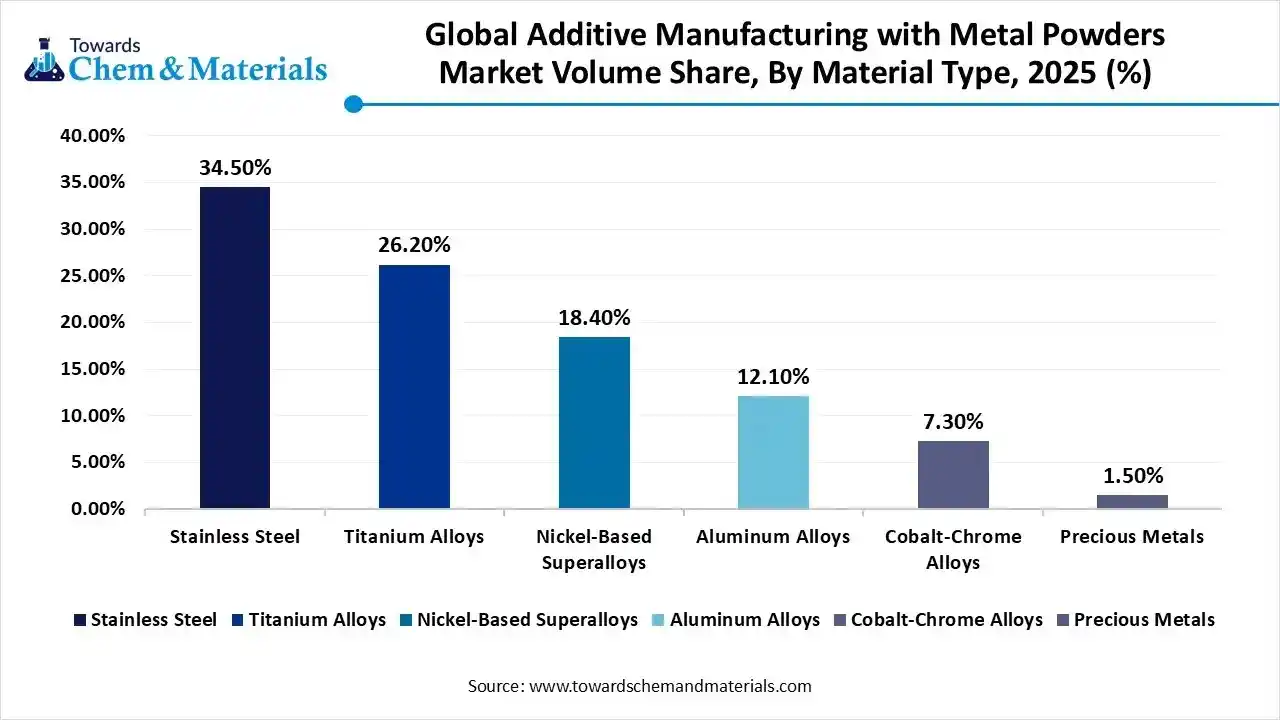

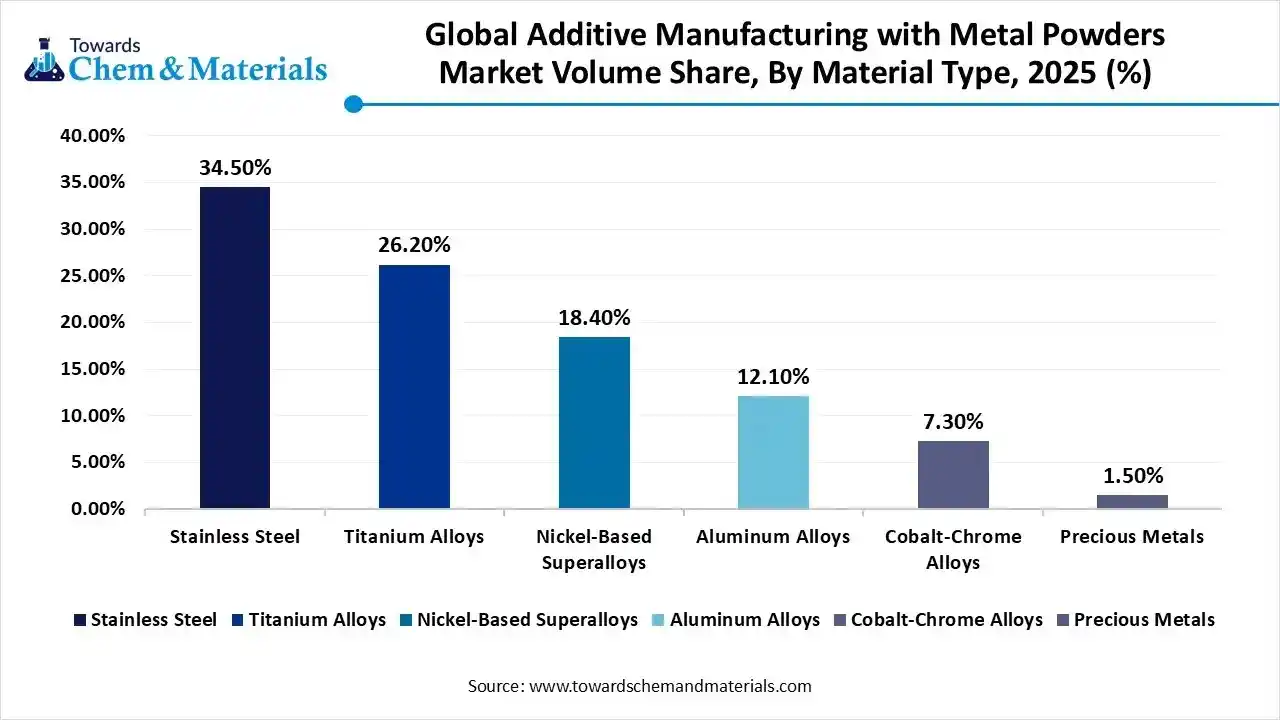

- By material type, the stainless-steel segment dominated the market and accounted for the largest volume share of 38.4% in 2025.

- By material type, the titanium alloys segment is expected to grow at the fastest CAGR of 24.70% from 2026 to 2035 in terms of volume.

- By technology (process), the powder bed fusion (PBF) segment led the market with the largest revenue volume share of 76.20% in 2025.

- By powder production method, the gas atomization segment dominated the market and accounted for the largest volume share of 68.40% in 2025.

- By application area, the functional part production segment led the market with the largest revenue volume share of 52% in 2025.

- By end-use sector, the aerospace & defense segment dominated the market and accounted for the largest volume share of 39.80% in 2025.

Market Trends

- Industry Growth Overview: The market is growing due to the rising adoption of metal 3D printing for lightweight, complex, and high-strength components across key industries.

- Sustainability Trends: Growth is supported by lower material waste, recyclable metal powders, and energy-efficient manufacturing processes.

- Startup Ecosystem: The ecosystem is expanding with startups innovating metal powders, printing technologies, and customized additive manufacturing solutions.

Report Scope

| Report Attribute | Details |

| Market Size and Volume in 2026 | USD 46.39 Billion / 6543.70 Tons |

| Revenue Forecast in 2035 | USD 166.41 Billion / 36872.60 Tons |

| Growth Rate | CAGR 15.25% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Units Considered | Value (Billion / Million), Volume (Tons) |

| Dominant Region | North America |

| Segment Covered | By Material Type (Feedstock), By Technology (Process), By Powder Production Method, Application, By End-Use Sector, By Region |

| Key companies profiled | Hoganas AB, Sandvik AB (Osprey®), Carpenter Technology (Carpente Additive), GKN Powder Metallurgy, AP&C (A GE Additive Company), Oerlikon AM, ATI (Allegheny Technologies), Rio Tinto Metal Powders, Kymera International, H.C. Starck, LPW Technology, Erasteel |

Key Technological Shifts

- Advanced Printing Technologies: Adoption of advanced laser-based and binder jetting metal 3D printing technologies, enabling faster production and complex geometries

- Improved Powder Quality: Improved metal powder quality for higher strength and precision, enhancing part consistency and reliability

- Automation & Monitoring: Increased automation and in-process monitoring systems, reducing defects and improving yield rates

- AI & Simulation: Use of AI and simulation tools for design optimization, lowering development time and material usage

- Smart Manufacturing Integration: Integration with digital and smart manufacturing platforms, supporting scalable and cost-efficient production

- Hybrid Manufacturing Focus: Growing focus on multi-material and hybrid manufacturing approaches, expanding application possibilities

Trade Analysis

- According to Global Export data, the World exported 36 shipments of titanium metal powder. These were handled by 14 exporters and bought by 15 buyers.

- Most titanium metal powder export from the World is destined for Vietnam, the Netherlands, and India.

- Globally, the top three exporters are South Korea, Russia, and Germany, with South Korea leading at 53 shipments, followed by Russia with 48 shipments and Germany with 25 shipments.

Value Chain Analysis

- Chemical Synthesis and Processing: Chemical synthesis and processing involve atomization, alloy blending, and powder refinement to achieve consistent particle size and purity for 3D printing. Leading companies focus on producing high-quality spherical powders that improve print accuracy and mechanical strength.

- Key players: Höganas AB, Sandvik AB, Carpenter Additive, AP&C (GE Additive), GKN Powder Metallurgy, and EOS GmbH.

- Quality Testing and Certification: Quality testing ensures metal powders meet strict standards for composition, flowability, and performance, especially for aerospace and medical uses. Certification bodies and testing labs play a vital role in maintaining reliability and regulatory compliance.

- Key players: ASTM International, ISO/ASTM AM standards, AM CoE (ASTM), ISO 9001, AS9100, ISO 13485 accredited testing labs.

- Distribution to Industrial Users: Metal powders are distributed through direct supply agreements, specialized distributors, and partnerships with additive manufacturing equipment providers. Efficient logistics and technical support are key to serving industrial customers.

- Key players: KBM Advanced Materials, Sandvik distribution partners, EOS authorized resellers, Carpenter Additive direct supply, and regional materials distributors.

Segmental Insights

Material Type Insights

What Made Stainless Steel Segment Dominate The Additive Manufacturing With Metal Powders Market In 2025?

The stainless-steel segment dominates the additive manufacturing with metal powders market, accounting for 34.5% of the total Volume share. Motivated by its superior mechanical strength, corrosion resistance, and affordability in contrast to high-performance alloys, because stainless steel powders are easy to process, consistently printable, and suitable for both prototyping and large-scale functional part production, they are widely used in aerospace, automotive, industrial tooling, and energy applications.

The titanium alloys segment is expected to experience the fastest growth in the market during the forecast period, supported by growing demand from the defense, medical, and aerospace sectors. Titanium powders are perfect for lightweight aircraft parts and medical implants because of their outstanding heat resistance, high biocompatibility, and superior strength to weight ration. The use of titanium alloys in additive manufacturing is accelerated by improvements in powder production technologies and falling material costs.

Additive Manufacturing With Metal Powders Market Volume and Share, By Material Type 2025-2035

| By Material Type | Market Volume Share (%), 2025 | Market Volume (Million Tons)2025 | Market Volume (Million Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| Stainless Steel | 34.50% | 1,863.0 | 12,215.9 | 23.24% | 33.13% |

| Titanium Alloys | 26.20% | 1,414.8 | 10,316.9 | 24.70% | 27.98% |

| Nickel-Based Superalloys | 18.40% | 993.6 | 7,002.1 | 24.23% | 18.99% |

| Aluminum Alloys | 12.10% | 653.4 | 4,505.8 | 23.93% | 12.22% |

| Cobalt-Chrome Alloys | 7.30% | 394.2 | 2,363.5 | 22.02% | 6.41% |

| Precious Metals | 1.50% | 81.0 | 468.3 | 21.53% | 1.27% |

Technology (Process) Insights

Why Did Powder Bed Fusion (PBF) Segment Dominate The Additive Manufacturing With Metal Powders Market In 2025?

The powder bed fusion (PBF) segment dominates the market with a 76.2% market share because of its exceptional surface quality, high precision, and capacity to produce intricate shapes. To produce high-performance components with precise tolerances, PBF technologies like Electron Beam Melting and Selective Laser Melting are widely used. This method is widely used in the industrial, medical, and aerospace industries where material density and part accuracy are crucial.

The binder jetting segment is expected to experience the fastest growth in the market during the forecast period, due to its scalability for mass production and high-speed production capability. Binder jetting is appealing for cost-sensitive industrial applications because it enables faster build rates and lower energy consumption than laser-based systems. The quick uptake of binder jetting technology is also being aided by growing investments in post-processing innovations like sintering and infiltration.

Powder Production Method Insights

Why Did the Gas Atomization Segment Dominate The Additive Manufacturing With Metal Powders Market?

The gas atomization segment dominates the powder production segment with a 68.4% market share, supported by its capacity to generate powders with a uniform particle size distribution that are extremely spherical. To achieve consistent layer deposition in additive manufacturing, these powders have outstanding flowability and packaging density. The most popular technique for making powders of aluminum, nickel-based alloys, and stainless steel is still gas atomization.

The plasma atomization segment is expected to experience the fastest growth in the market during the forecast period, motivated by its capacity to generate extremely spherical and high-purity metal powders. Titanium and reactive metal powders used in medical and aerospace applications are especially well suited for this process. The use of plasma atomization techniques is accelerated by the growing demand for high-end powders with exceptional mechanical performance.

Application Area Insights

Why Did Functional Part Production Segment Dominate The Additive Manufacturing With Metal Powders Market In 2025?

The functional part production dominates the application segment with a 52% market share, demonstrating how additive manufacturing has moved from prototyping to final production. Metal additive manufacturing is being used more by industries to create intricate, lightweight, and performance-critical parts. Widespread adoption in the automotive, aerospace, and industrial sectors is being fueled by the capacity to minimize material waste and facilitate design optimization.

The repair & maintenance segment is expected to experience the fastest growth in the market during the forecast period, supported by growing demand for high-value components to have longer lifespans. Precise material deposition is made possible by additive manufacturing, which lowers replacement costs and downtime for worn-out or damaged parts. The aerospace defense and heavy machinery sectors are seeing a significant increase in the use of this application.

End Use Sector Insights

What Made Aerospace & Defense Segment dominate the Additive Manufacturing with Metal Powders Market in 2025?

The aerospace & defense segment dominates the market with 39.8% market share, due to the growing demand for the lightweight strong, intricate components. Design flexibility, quick production, and part consolidation are made possible by additive manufacturing, all of which are essential for defense and aircraft systems. This segment's leadership is sustained by rising defense and aircraft systems. This segment's leadership is sustained by rising defense spending and expanding adoption of advanced manufacturing technologies.

The medical & dental segment is expected to experience the fastest growth in the market during the forecast period, due to the increasing demand for dental prosthetics, components, and customized implants. Patient-specific designs with better fit and functionality are made possible by metal additive manufacturing. Growth in this industry is being accelerated by ongoing developments in biocompatible metal powders and regulatory clearances.

Regional Insights

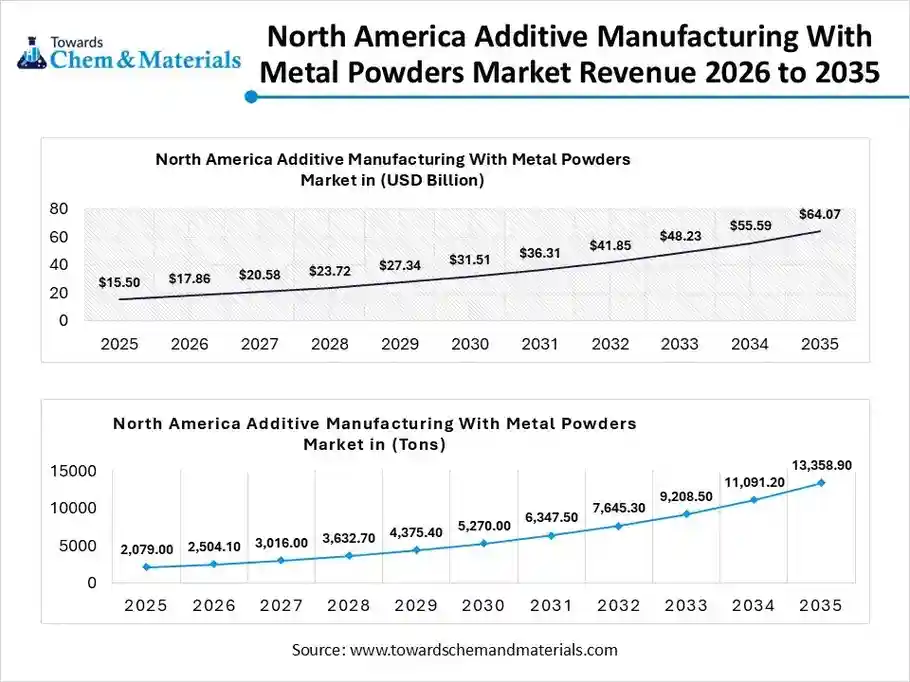

The North America additive manufacturing with metal powders market size was valued at USD 15.50 billion in 2025 and is expected to be worth around USD 64.07 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 15.27% over the forecast period from 2026 to 2035.

The North America additive manufacturing with metal powders market volume was estimated at 2,079.0 tons in 2025 and is projected to reach 13,358.9 tons by 2035, growing at a CAGR of 22.96% from 2026 to 2035.

North America dominates the additive manufacturing with metal powders market, holding a 38.5% market share. The growth of the market is attributed due to the early adoption of additive manufacturing technologies, robust presence of aerospace and defense manufacturers, and sophisticated R&D infrastructure. North America's market position is still being strengthened by significant investments in industrial automation and supportive government initiatives.

U.S. Additive Manufacturing With Metal Powders Market

The United States holds the largest technologically advanced market for metal additive manufacturing. The U.S. market position has been strengthened by strong demand from the aerospace, defense, and medical sectors, substantial R&D investment, and favorable federal policies, leading OEMs and service providers to use metal powders for high precision applications, and continuous supply chain integrations and innovations keep the US at the forefront of AM adoption worldwide.

Asia Pacific Additive Manufacturing With Metal Powders Market

The Asia Pacific additive manufacturing with metal powders market volume was estimated at 1,684.8 tons in 2025 and is projected to reach 12,212.2 tons by 2035, growing at a CAGR of 24.62% from 2026 to 2035. Asia Pacific expects the fastest growth in the market during the forecast period, driven by growing adoption of advanced manufacturing technologies, growing aerospace and automotive production, and fast industrialization. They are making significant investments in additive manufacturing capabilities. Growing demand for affordable manufacturing solutions and increased government support are driving regional market expansion.

India Additive Manufacturing With Metal Powders Market

India’s additive manufacturing with metal powders market is expanding, backed by robust government programs designed to increase Make in India and advanced manufacturing. The nation's healthcare, automotive, and aerospace industries are using metal additive manufacturing technologies to frequently create customized medical implants and lightweight high-performance parts. Growth is being driven by rising investments in industrial automation and cost-effective production, with several domestic and international companies joining the Indian market.

Additive Manufacturing With Metal Powders Market Volume and Share, By Region 2025-2035

| By Region | Market Volume Share (%), 2025 | Market Volume (Tons)2025 | Market Volume (Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| North America | 38.50% | 2,079.0 | 13,358.9 | 22.96% | 36.23% |

| Europe | 24.34% | 1,314.4 | 9,222.6 | 24.17% | 25.01% |

| Asia Pacific | 31.20% | 1,684.8 | 12,212.2 | 24.62% | 33.12% |

| Latin America | 3.10% | 167.4 | 1,290.5 | 25.48% | 3.50% |

| Middle East & Africa | 2.86% | 154.4 | 788.3 | 19.86% | 2.14% |

Europe Additive Manufacturing With Metal Powders Market.

The Europe additive manufacturing with metal powders market volume was estimated at 1,314.4 tons in 2025 and is projected to reach 9,222.6 tons by 2035, growing at a CAGR of 24.17% from 2026 to 2035. Europe remains a major market for additive manufacturing with metal powders, led by a robust industrial base in the machinery, automotive, and aerospace industries. Powder bed fusion and binder jetting technologies are widely used for both end-use production and prototyping in Western and Northern European countries. Europe's leading position in the global AM landscape is maintained by regional investments in digital manufacturing, sustainability objectives, and cross-border corporations.

Germany Additive Manufacturing With Metal Powders Market

Germany stands out as a leading European country in metal additive manufacturing, supported by a cutting-edge metal powder supply chain and a robust engineering ecosystem. Metal AM is widely used by the nation's automotive tooling and industrial equipment manufacturers to produce intricate and precise parts. Germany is driving the adoption of high-value metal AM across industries with continuous innovation in materials science and process automation.

South America Additive Manufacturing With Metal Powders Market.

The South America additive manufacturing with metal powders market volume was estimated at 167.4 tons in 2025 and is projected to reach 1,290.5 tons by 2035, growing at a CAGR of 25.48% from 2026 to 2035. In South America, the additive manufacturing with metal powders market is at an emerging stage but is showing promising growth due to growing interest from the business and academic sectors. As manufacturers investigate metal AM for small batch production and prototyping, the adoption is especially apparent in Brazil, Mexico and Argentina. Regional uptake is being accelerated by cost-effective implementation strategies and increased industry-academia collaboration.

Brazil Additive Manufacturing With Metal Powders Market.

Brazil is one of the key South America markets for metal additive manufacturing, fueled by expansion in the production of automotive tools, aerospace parts, and custom healthcare solutions. To shorten lead times and cut down on material waste, local manufacturers and engineering service providers are investing in metal powder technologies. Initiatives from the public and private sectors to improve manufacturing competitiveness are helping Brazil’s market.

MEA Additive Manufacturing With Metal Powders Market.

The Middle East & Africa additive manufacturing with metal powders market volume was estimated at 154.4 tons in 2025 and is projected to reach 788.3 tons by 2035, growing at a CAGR of 19.86% from 2026 to 2035. The MEA region is emerging as a growth frontier for metal additive manufacturing, with increasing investments in industrial infrastructure and technology adoption. Metal powders are being investigated for use in specialized medical devices, oil and gas tools, and aerospace components. AM technology adoption and interest are being boosted by government initiatives to diversify beyond traditional industries.

UAE is the forefront of AM adoption within the MEA region, utilizing strategic objectives to establish a hub for advanced manufacturing in the region. Metal additive technologies are being invested in by both public invested in by both public and private organizations to support the aerospace defense construction and healthcare industries. The UAE's emphasis on innovation, smart manufacturing, and the development of specialized talent is speeding up the integration of metal powder AM into industrial value chains.

Recent Developments

- In November 2025, Xact Metal launched the XM200G µHD metal 3D printer along with new metal powder offerings to expand access to industrial metal additive manufacturing.(Source: www.designnews.com)

- In November 2025, Equispheres launched oxygen-free copper powder optimized for laser powder bed fusion, targeting high-volume and high-conductivity applications. (Source : 3dprintingindustry.com)

- In October 2025, Continuum Powders announced commercial availability of OptiPowder CoCr F75 alloy for demanding aerospace, medical, and industrial 3D printing uses.(Source: 3dprint.com )

- In April 2025, ADDiTEC unveiled its Fusion S laser powder bed fusion metal 3D printing system with integrated powder handling and post-processing features.(Source: 3dprintingindustry.com)

Market Top Companies

- Hoganas AB: A global leader in sustainable metal powders that recently expanded its portfolio with low-carbon iron and stainless steel for the electric vehicle market.

- Sandvik AB (Osprey®): Specializes in high-quality gas-atomized powders and recently launched advanced HWTS 50 tool steel for high-temperature industrial applications.

- Carpenter Technology (Carpenter Additive): Provides end-to-end material solutions and premium specialty alloys tailored for critical, high-performance aerospace and medical components.

- GKN Powder Metallurgy: A major integrated supplier that combines large-scale metal powder production with advanced 3D printing services for the automotive and industrial sectors.

- AP&C (A GE Additive Company)

- Oerlikon AM

- ATI (Allegheny Technologies)

- Rio Tinto Metal Powders

- Kymera International

- H.C. Starck

- LPW Technology

- Erasteel

Segments Covered in the Report

By Material Type (Feedstock)

- Stainless Steel

- Titanium Alloys

- Nickel-Based Superalloys

- Aluminum Alloys

- Cobalt-Chrome Alloys

- Precious Metals

By Technology (Process)

- Powder Bed Fusion (PBF)

- Selective Laser Melting (SLM) / Direct Metal Laser Sintering (DMLS)

- Electron Beam Melting (EBM)

- Directed Energy Deposition (DED)

- Laser Engineering Net Shaping (LENS)

- Electron Beam Additive Manufacturing (EBAM)

- Binder Jetting

- Metal Extrusion (Bound Powder Extrusion)

By Powder Production Method

- Gas Atomization

- Plasma Atomization

- Water Atomization

- Mechanical Milling

By Application Area

- Prototyping

- Functional Part Production

- Tooling & Molds

- Repair & Maintenance

By End-Use Sector

- Aerospace & Defense

- Medical & Dental

- Automotive

- Energy & Power

- Consumer Goods

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa