Content

What is the Current Aluminum Metal Powder Market Size and Volume?

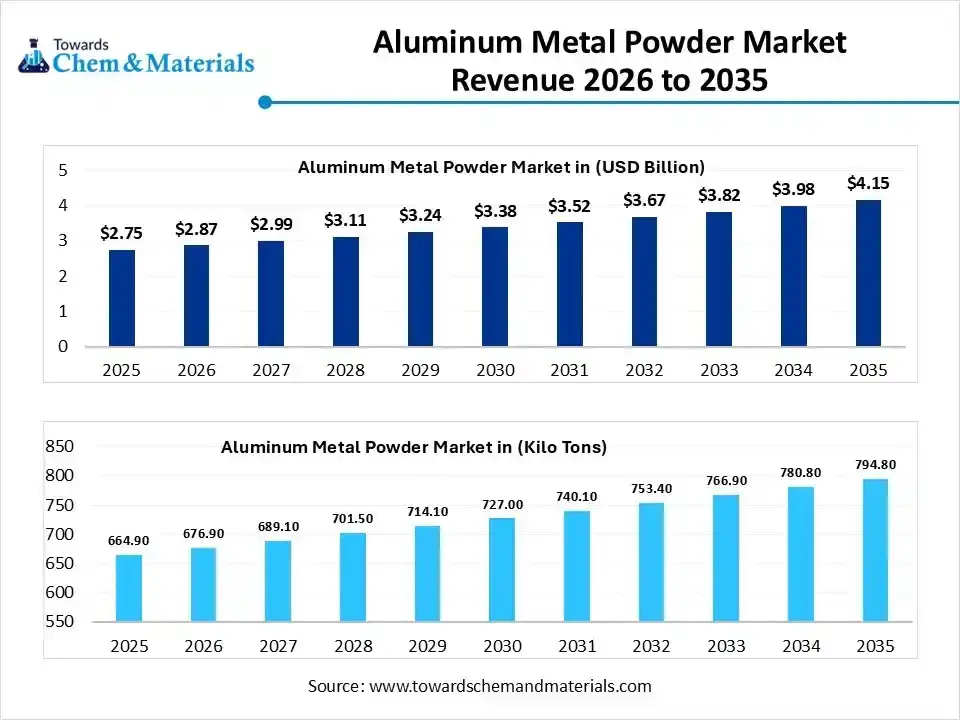

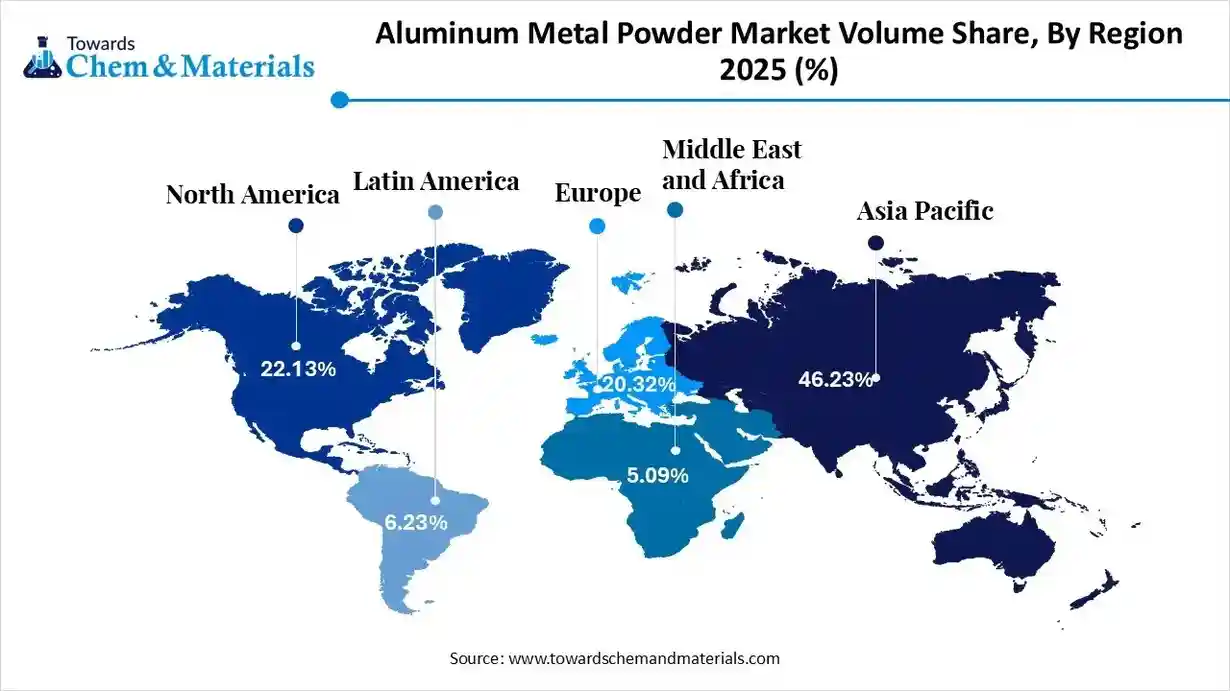

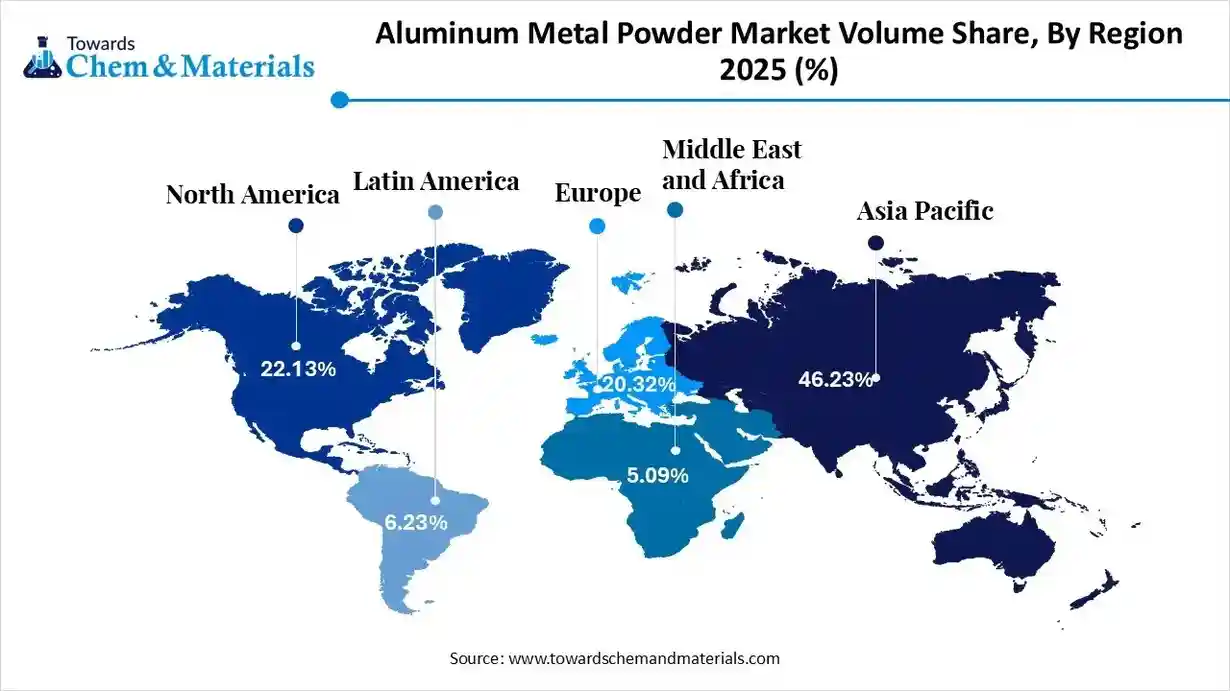

The global aluminum metal powder market size was estimated at USD 2.75 billion in 2025 and is expected to increase from USD 2.87 billion in 2026 to USD 4.15 billion by 2035, growing at a CAGR of 4.19% from 2026 to 2035. In terms of volume, the market is projected to grow from 664.9 kilo tons in 2025 to 794.8 kilo tons by 2035. growing at a CAGR of 46.23% from 2026 to 2035. Asia Pacific dominated the aluminum metal powder market with the largest volume share of 46.23% in 2025. The expansion of lightweighting in the automotive industry and the increased utilization of industrial coatings drive the market growth.

The aluminum metal powder market growth is driven by the rapid expansion of urban areas, increasing need for conductive inks, high demand for automotive finishes, development of complex defense equipment, production of longer EV range, increasing use of lightweight concrete, and the higher production of intricate parts. the Aluminum metal powder is a silvery-white to grey powder made by grinding elemental aluminum. It is lightweight, flammable, and extremely reactive. It is produced using methods like mechanical flaking and atomization. Aluminum metal powder is widely used in applications like sparklers, foundries, additive manufacturing, paints, and chemical synthesis.

Report Highlights

- The Asia Pacific dominated the global aluminum metal powder market with the largest volume share of 46.23% in 2025.

- The aluminum metal powder market in North America is expected to grow at a substantial CAGR of 2.93% from 2026 to 2035.

- The Europe aluminum metal powder market segment accounted for the major volume share of 20.32% in 2025.

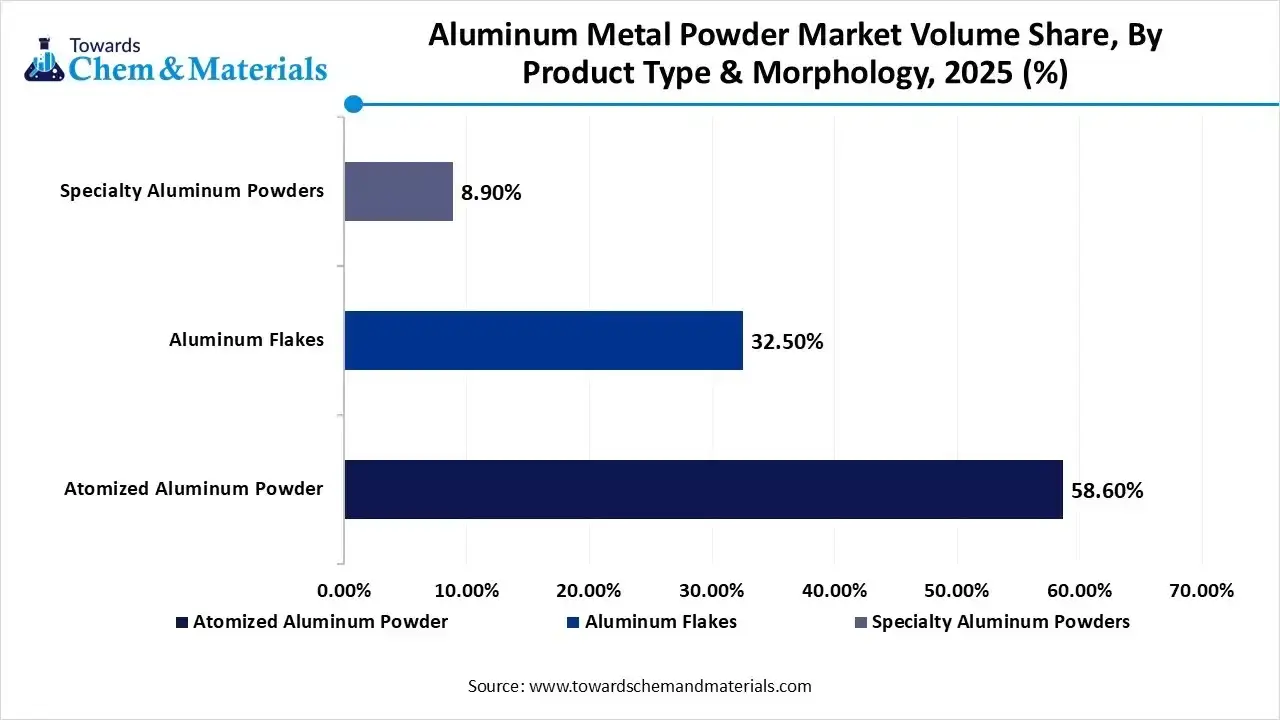

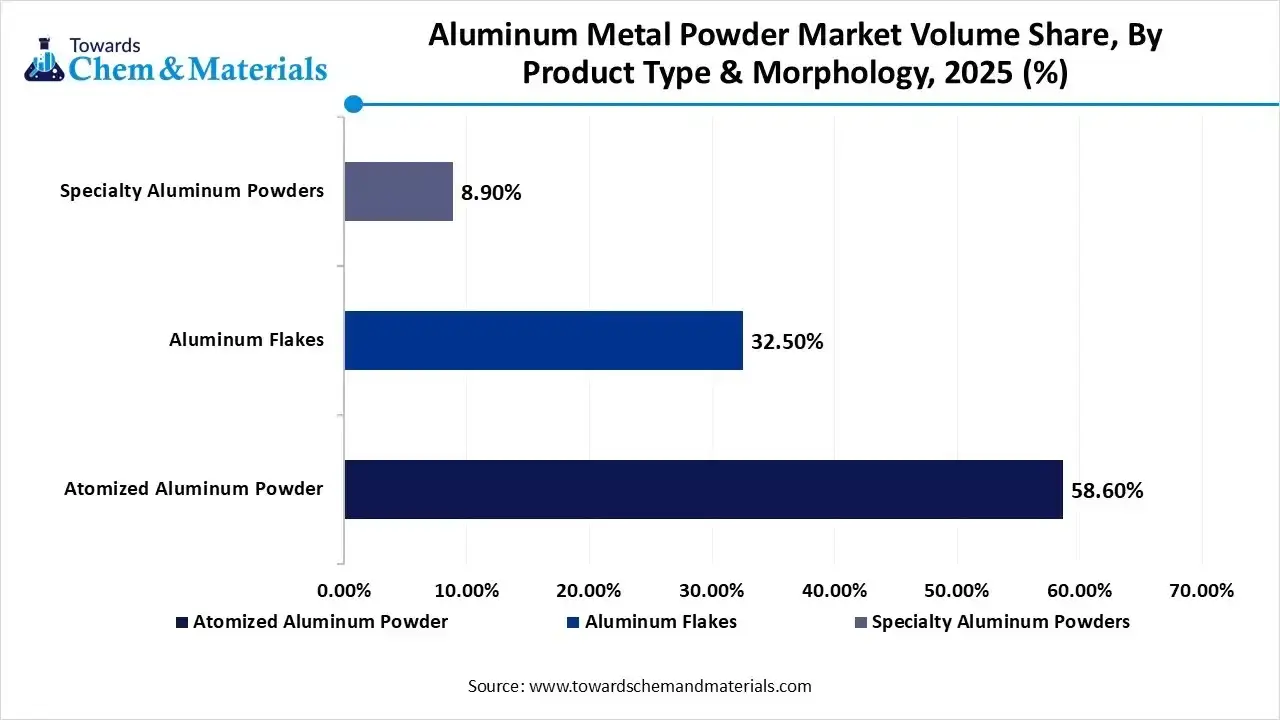

- By product type, the atomized aluminum powder segment dominated the market and accounted for the largest volume share of 58.60% in 2025.

- By product type, the specialty aluminum powder segment is expected to grow at the fastest CAGR of 3.82% from 2026 to 2035 in terms of volume.

- By process, the atomization segment led the market with the largest revenue volume share of 58.6% in 2025.

- By purity level, the high purity segment dominated the market and accounted for the largest volume share of 39.8% in 2025.

- By end-use sector, the automotive and transportation segment led the market with the largest revenue volume share of 36.5% in 2025.

Aluminum Metal Powder Market Trends:

- Expansion of 3D Printing:- The increased creation of stronger complex geometries and growing customization across diverse industries increases demand for 3D printing, which requires aluminum metal powder.

- Growing Construction Projects:- The rapid urbanization and growing use of lightweight building materials increase demand for aluminum metal powder. The focus on enhancing thermal efficiency in construction and the increasing use of paints requires aluminum metal powder.

- Rising Semiconductor Demand:- The increased production of advanced semiconductor devices and the development of conductive pastes require aluminum metal powder. The creation of complex cooling channels requires aluminum metal powder.

- Increasing Use of Specialty Powder:- The increased production of battery components and thriving electrification of vehicles increases demand for specialty powder. The strong focus on effective thermal management across various industries increases demand for specialty powder.

Report Scope

| Report Attribute | Details |

| Market Size and Volume in 2026 | USD 2.87 Billion / 676.9 Kilo Tons |

| Revenue Forecast in 2035 | USD 4.15 Billion / 794.8 KiloTons |

| Growth Rate | CAGR 4.19% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Units Considered | Value (Billion / Million), Volume (Kilo Tons) |

| Dominant Region | Asia Pacific |

| Segment Covered | By Product Type & Morphology, By Production Process (Technology), By Purity Level, By End-Use Sector, By Region |

| Key companies profiled | Valimet, Inc., Höganäs AB, AMG Advanced Metallurgical Group, Toyo Aluminium K.K., U.S. Metal Powders, Inc. (AMPAL) (USA), Rusal (Russia), Kymera International , ECKART GmbH (Germany), MMP Industries Ltd. (India), The Metal Powder Company Limited (MEPCO) (India), Zhangqiu Metallic Pigment Co., Ltd. (China), Xinfa Group Co., Ltd. (China), Arasan Aluminium Industries (P) Ltd. (India), CNPC Powder Group Co., Ltd. (China), Angang Group (China) |

Key Technological Shifts in the Aluminum Metal Powder Market:

The aluminum metal powder market is undergoing key technological shifts driven by the demand for sustainability, higher purity, and quality. The technological innovations like automation, machine learning, simulation, and integration of robotics enhance efficiency and sustainable production. One of the major technological changes is the incorporation of AI minimizes waste and enhances quality control.

AI fine-tunes the dimensions of production processes and produces higher-quality powders. AI inspects the size of particle powder and early predicts failures of machinery. AI analyzes properties of powder and creates powder with desired characteristics. AI enhances the mechanical properties of powder and supports the better management of supply chains. AI analyzes the impact of impurities in powder and lowers defects. Overall, AI accelerates the production efficiency of aluminum metal powder.

Trade Analysis of Aluminum Metal Powder Market: Import & Export Statistics

- Russia exported 144 shipments of aluminum metal powder.

- The United States exported $189M of aluminum powder in 2023.

- Malaysia imported $237M of aluminum powder in 2023.

- The United States exported 21,720 shipments of aluminum flakes.

- The United States imported $78.4M of aluminum powder in 2024.

- China imported $15.4M of aluminum powder in 2024.

Aluminum Metal Powder Market Value Chain Analysis

- Feedstock Procurement: This stage involves the sourcing of raw materials like alloying elements, bauxite ore, scrap aluminum, and pure aluminum ingots for the production of aluminum metal powder.

- Key Players:- Rio Tinto, Hindalco Industries Limited, Norsk Hydro, Emirates Global Aluminum, Alcoa Corporation

- Chemical Synthesis and Processing: The chemical synthesis involves steps like solution reduction, chemical vapor synthesis, electrolysis, and vacuum evaporation. The chemical processing includes methods like atomization and mechanical milling.

- Key Players:- AP&C, Heraeus GmbH, TOYAL Group, MEPCO, Alcoa Corporation, Sandvik Materials Technology

- Quality Testing and Certifications: This stage primarily focuses on the evaluation of attributes like particle average size, specific gravity, atomic absorption, shape, elasticity, grain size, hardness, & flow rate. The certifications for aluminum metal powder include ASTM, ISO 9001, MTCs, and ISO 14001.

- Key Players:- Bureau Veritas, Mitra SK Private Limited, TCR Engineering, SGS India, Elca Labs, Intertek

Country-Wise Footprint of Aluminum Metal Powder

| Country | Major Manufacturing Process Used | Major Applications | Key Players |

| India | Atomization |

|

|

| United States | Air Atomization |

|

|

| Brazil | Atomization |

|

|

| France | Inert Gas Atomization |

|

|

Segmental Insights

By Product Type & Morphology Insights

Why the Atomized Aluminum Powder Segment Dominates the Aluminum Metal Powder Market?

The atomized aluminum powder segment dominated the aluminum metal powder market with a 58.60% share in 2025. The increased creation of complex designs and the development of lighter vehicle components require atomized aluminum powder. The increasing use of functional coatings and the manufacturing of battery cooling systems require atomized aluminum powder. The production of an energy storage system and the increasing use of fuel-efficient vehicles require atomized aluminum powder, driving the overall market growth.

The specialty aluminum powders segment is the fastest-growing in the market during the forecast period. The development of intricate aerospace parts and the growing utilization of solid rocket propellants require specialty aluminum powders. The increasing use of advanced electronics and the production of AAC blocks requires specialty aluminum powders. The expansion of specialty metallurgy and the growing need for battery components require specialty aluminum powders, supporting the overall market growth.

Aluminum Metal Powder Market Volume and Share, By Product Type & Morphology 2025-2035

| By Product Type & Morphology | Market Volume Share (%), 2025 | Market Volume (Million Tons)2025 | Market Volume (Million Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| Atomized Aluminum Powder | 58.60% | 389.7 | 447.8 | 1.56% | 56.34% |

| Aluminum Flakes | 32.50% | 216.1 | 264.1 | 2.25% | 33.23% |

| Specialty Aluminum Powders | 8.90% | 59.2 | 82.9 | 3.82% | 10.43% |

Production Process Insights

How did the Atomization Segment hold the Largest Share in the Aluminum Metal Powder Market?

The atomization segment held the largest revenue share of 58.6% in the aluminum metal powder market in 2025. The strong focus on sustainable manufacturing and the increasing production of contamination-free powders increases demand for atomization. The higher utilization of thermal spray coatings and the shift towards EVs increase demand for atomization. The high performance, faster production, & excellent flowability, and increased use of gas atomization drive the overall market growth.

The electrolysis & chemical reduction segment is experiencing the fastest growth in the market during the forecast period. The strong focus on lowering emissions and enhancing recycling efficiency increases demand for electrolysis & chemical reduction. The increased production of specialized grades of powder and the focus on energy efficiency increase demand for electrolysis & chemical reduction, supporting the overall market growth.

Purity Level Insights

Why the High Purity Segment Dominates the Aluminum Metal Powder Market?

The high purity segment dominated the aluminum metal powder market in 2025. The growing demand for high-performance metal parts and increased production of critical components require high purity powder. The increased production of specialty alloys and growing specialized chemical processes increases demand for high purity powder. The high reactivity, superior thermal conductivity, high ductility, and excellent electrical conductivity of high purity powder drive the overall market growth.

The commercial grade segment is the fastest-growing in the market during the forecast period. The growing development of architectural finishes and increasing use of solar cells requires commercial grade powder. The growing use of fireworks and the development of engine parts require commercial grade powder. The increased production of sealants and the rising manufacturing of organic chemicals increase demand for commercial grade powder, supporting the overall market growth.

End-Use Sector Insights

Which End-Use Sector held the Largest Share in the Aluminum Metal Powder Market?

The automotive & transportation segment held the largest revenue share of 36.5% in the market in 2025. The intense focus on enhancing the fuel efficiency of vehicles and the development of heavy batteries requires aluminum metal powder. The strong push for lightweighting of vehicles and growth in electric vehicles requires aluminum metal powder. The increased production of engine components and the focus on extending the lifespan of vehicle structural components increase demand for aluminum metal powder, supporting the overall market growth.

The aerospace & defense segment is experiencing the fastest growth in the market during the forecast period. The increased production of lightweight vehicle parts and the rocket boosters requires aluminum metal powder. The rapid modernization of the defense industry and the expansion of private space ventures increase demand for aluminum metal powder. The development of space systems and the focus on enhancing the durability of military equipment require aluminum metal powder.

Regional Insights

The aluminum metal powder market size was valued at USD 1.27 billion in 2025 and is expected to be worth around USD 1.92 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 4.21% over the forecast period from 2026 to 2035. the aluminum metal powder market volume was estimated at 307.4 kilo tons in 2025 and is projected to reach 343.7 kilo tons by 2035, growing at a CAGR of 1.25% from 2026 to 2035.

Asia Pacific dominated the market with a 46.23% share in 2025. The growing expansion of industrial operations and a strong chemical manufacturing base increases demand for aluminum metal powder. The rapid growth in construction projects development and the increased use of additive manufacturing create a huge demand for aluminum metal powder. The development of lightweight components and the surging electric vehicle industry require aluminum metal powder, driving the overall market growth.

From Ore to Powder: China’s Aluminum Metal Powder Footprint

China is a major contributor to the market. The abundance of raw materials and a strong focus on self-reliance increase the production of aluminum metal powder. The surging development of large-scale infrastructure projects and the expanding aerospace industry creates huge demand for aluminum metal powder. The strong focus on the adoption of solar energy and the increased production of EV battery components requires aluminum metal powder, supporting the overall market growth.

- China exported $41.4M of aluminum powder in 2024.

Aluminium Metal Powder Market Volume Share, By Region, 2025 (%)

| By Region | Market Volume Share (%), 2025 | Market Volume (Million Tons)2025 | Market Volume (Million Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| North America | 22.13% | 147.2 | 190.9 | 2.93% | 24.01% |

| Europe | 20.32% | 135.1 | 167.9 | 2.44% | 21.12% |

| Asia Pacific | 46.23% | 307.4 | 343.7 | 1.25% | 43.24% |

| Latin America | 6.23% | 41.4 | 52.1 | 2.57% | 6.55% |

| Middle East & Africa | 5.09% | 33.8 | 40.4 | 1.98% | 5.08% |

North America Aluminum Metal Powder Market Trends

The North America aluminum metal powder market volume was estimated at 147.2 Kilotons in 2025 and is projected to reach 190.9 Kilotons by 2035, growing at a CAGR of 2.93% from 2026 to 2035. North America is experiencing the fastest growth in the market during the forecast period. The growing creation of complex parts and the increasing use of lightweight components in the defense sector increase demand for aluminum metal powder. The increased popularity of the electrification of vehicles and the growth in the development of construction projects require aluminum metal powder. The growing manufacturing of wind turbines and the rise development of consumer electronic products require aluminum metal powder, driving the overall market growth.

United States: The Aluminum Metal Powder Giant

The United States is a key contributor to the market. The growth in manufacturing aircraft components and the shift towards lightweight electric vehicles create demand for aluminum metal powder. The rapid adoption of additive manufacturing and the focus on enhancing the fuel efficiency of vehicles require aluminum metal powder. The strong focus on advanced defense systems and the increasing need for protective coatings requires aluminum metal powder, supporting the overall market growth. The United States exported $227M of aluminum powder in 2025.

Europe Aluminum Metal Powder Market Trends

The Europe aluminum metal powder market volume was estimated at 135.1 Kilotons in 2025 and is projected to reach 167.9 Kilotons by 2035, growing at a CAGR of 2.44% from 2026 to 2035. Europe is growing notably in the market. The strong focus on vehicle emission reduction and the growing development of high-strength aerospace structural parts require aluminum metal powder. The higher utilization of 3D printing and intense focus on energy efficiency created demand for aluminum metal powder. The presence of an advanced manufacturing base and the development of lightweight building materials require aluminum metal powder, driving the overall market growth.

Germany’s Excellence in Aluminum Metal Powder Production

Germany is growing substantially in the market. The increased manufacturing of precision vehicle parts and the growing demand for solid rocket fuels require aluminum metal powder. The growth in the development of high-performance machinery components and the huge production of aircraft engine components require aluminum metal powder. The booming electronics sector supports the overall market growth.

Germany exported $83.7M of aluminum powder in 2025.

Middle East & Africa Aluminum Metal Powder Market Trends

The Middle East & Africa aluminum metal powder market volume was estimated at 33.8 Kilotons in 2025 and is projected to reach 40.4 Kilotons by 2035, growing at a CAGR of 1.98% from 2026 to 2035. The Middle East & Africa are significantly growing in the market. The huge construction activities and the increasing use of electric vehicles increase demand for aluminum metal powder. The increased spending on the defense sector and the creation of high-precision parts require aluminum metal powder. The presence of an advanced manufacturing base and the high investment in renewable energy require aluminum metal powder, driving the overall market growth.

From Energy to Aluminum Powder: Saudi Arabia’s Excellent Story

Saudi Arabia is growing in the market. The strong presence of additive manufacturing and the expanding packaging industry increases demand for aluminum metal powder. The increased creation of corrosion-resistant building materials and the development of specialized defense components require aluminum metal powder. The growing production of new battery technologies requires aluminum metal powder, supporting the overall market growth. Saudi Arabia exported $2.14M of aluminum powder in 2025.

South America Aluminum Metal Powder Market Trends

The South America aluminum metal powder market volume was estimated at 41.4 Kilotons in 2025 and is projected to reach 52.1 Kilotons by 2035, growing at a CAGR of 2.57% from 2026 to 2035. South America is growing substantially in the market. The rapid growth in the manufacturing of motors and the increasing use of specialized materials in infrastructure projects require aluminum metal powder. The growing expansion of city areas and the strong local manufacturing base require aluminum metal powder. The rise of chemical processing and the increasing use of conductive pastes require aluminum metal powder, supporting the overall market growth.

Brazil’s Rising Expansion of Aluminum Powder Production

Brazil is growing significantly in the market. The growing adoption of electric vehicles and increasing use of 3D printing in the medical industry require aluminum metal powder. The growing production of electrical components and the increasing use of energy-efficient construction materials require aluminum metal powder, supporting the overall market growth.

Recent Developments

- In May 2025, CNPC launched high electric and thermal conductive aluminum powder, CNPC-AI0407, for additive manufacturing. The powder consists of high flowability and lowers post-processing costs. The powder is made by utilizing AMP technology and is heavily used in industries like E&TC, aerospace, and new energy vehicles. (Source: www.metal-am.com)

- In December 2024, Runaya collaborated with Eckart to launch a sustainable aluminum powder facility in Orissa, India. The facility produces spherical atomized aluminum granules and reduces the carbon footprint. The powder is used across applications like high-value effect pigments, aerospace, and solar panels.(Source: www.runaya.com)

- In September 2025, TRUNNANO launched spherical aluminum nitride powder for EV materials. The powder has high thermal conductivity and is manufactured using plasma-assisted synthesis. The powder is useful across the ceramic and electronic sectors. (Source: chargedevs.com )

Market Top Companies

- Toyo Aluminium K.K.:- The Japan-based company produces advanced aluminum products like paste, foil, and powder to support industries like food packaging, electronics, pharmaceuticals, and building materials.

- AMG Advanced Metallurgical Group:- The critical materials company manufactures aluminum alloy and specialty aluminum powders for energy transition and high-technological industry.

- Höganäs AB:- The company produces non-ferrous metal and iron powders to support industries like energy, chemical, food, aerospace, brazing, automotive, metallurgical, construction, and pharmaceuticals.

- Valimet, Inc.:- The U.S.-based company develops spherical powders of AIMg, aluminum, and AISi for applications like cold spray, ordnance, 3D printing, solid propellants, thermal spray, and electronics.

- Valimet, Inc.

- Höganäs AB

- AMG Advanced Metallurgical Group

- Toyo Aluminium K.K.

- U.S. Metal Powders, Inc. (AMPAL) (USA)

- Rusal (Russia)

- Kymera International

- ECKART GmbH (Germany)

- MMP Industries Ltd. (India)

- The Metal Powder Company Limited (MEPCO) (India)

- Zhangqiu Metallic Pigment Co., Ltd. (China)

- Xinfa Group Co., Ltd. (China)

- Arasan Aluminium Industries (P) Ltd. (India)

- CNPC Powder Group Co., Ltd. (China)

- Angang Group (China)

Segments Covered

By Product Type & Morphology

- Atomized Aluminum Powder

- Spherical Powder (High-flowability for 3D printing)

- Irregular/Granular Powder

- Aluminum Flakes

- Leafing Flakes (Surface-oriented for coatings)

- Non-Leafing Flakes (Deep-lustre for automotive paints)

- Specialty Aluminum Powders

- Ultra-fine/Nano Aluminum Powder

- Aluminum Alloy Powders (e.g., AlSi10Mg, Scalmalloy)

By Production Process (Technology)

- Atomization

- Gas Atomization (Inert gas for high purity)

- Air Atomization

- Water Atomization

- Mechanical Methods

- Ball Milling (Primary for flake production)

- Comminution

- Electrolysis & Chemical Reduction

By Purity Level

- Ultra-High Purity (>99.9%)

- High Purity (99.5% – 99.8%)

- Commercial Grade (92% – 99%)

By End-Use Sector

- Aerospace & Defense

- Automotive & Transportation

- Building & Construction

- Electrical & Electronics

- Renewable Energy (Solar/PV)

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa