Content

What is the Current Medical-Grade Foam Materials Market Size and Volume?

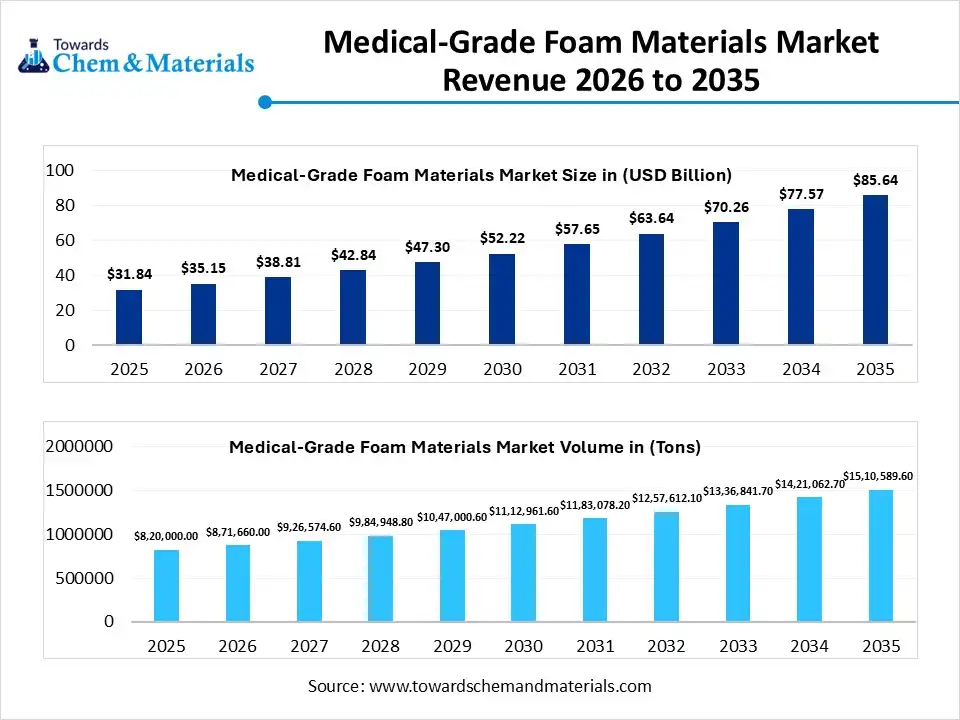

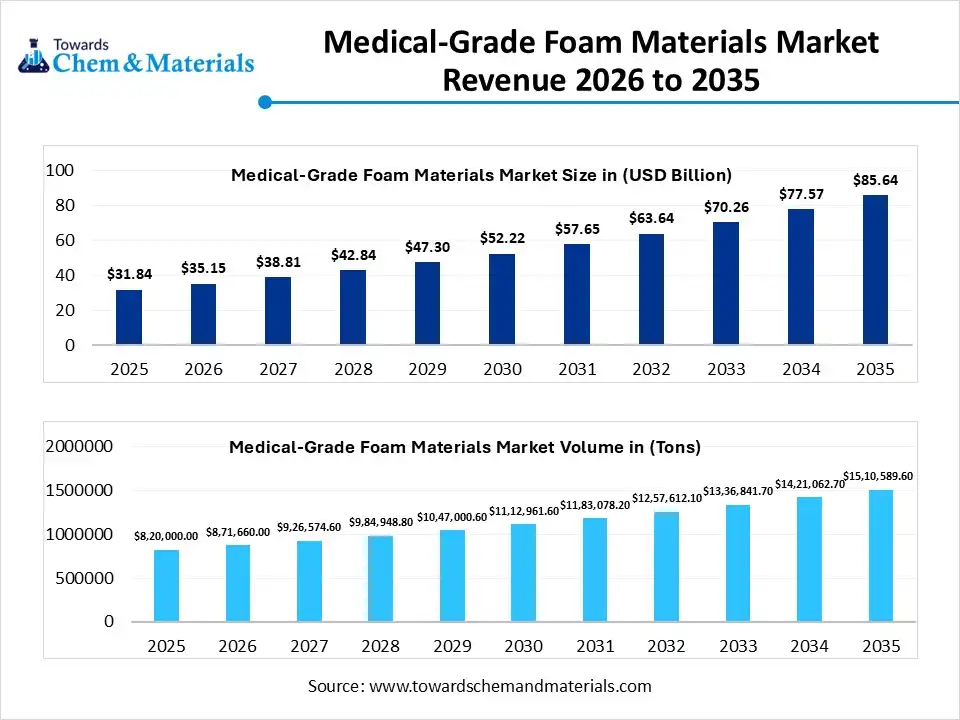

The global medical-grade foam materials market size was estimated at USD 31.84 billion in 2025 and is expected to increase from USD 35.15 billion in 2026 to USD 85.64 billion by 2035, growing at a CAGR of 10.4% from 2026 to 2035. In terms of volume, the market is projected to grow from 820000 tons in 2025 to 1,510,589.60 tons by 2035. growing at a CAGR of 6.30% from 2026 to 2035. North America dominated the medical-grade foam materials market with the largest volume share of 35.00% in 2025.The greater shift towards better patient care and advanced healthcare has fueled the industry's growth in recent years.

Market Highlights

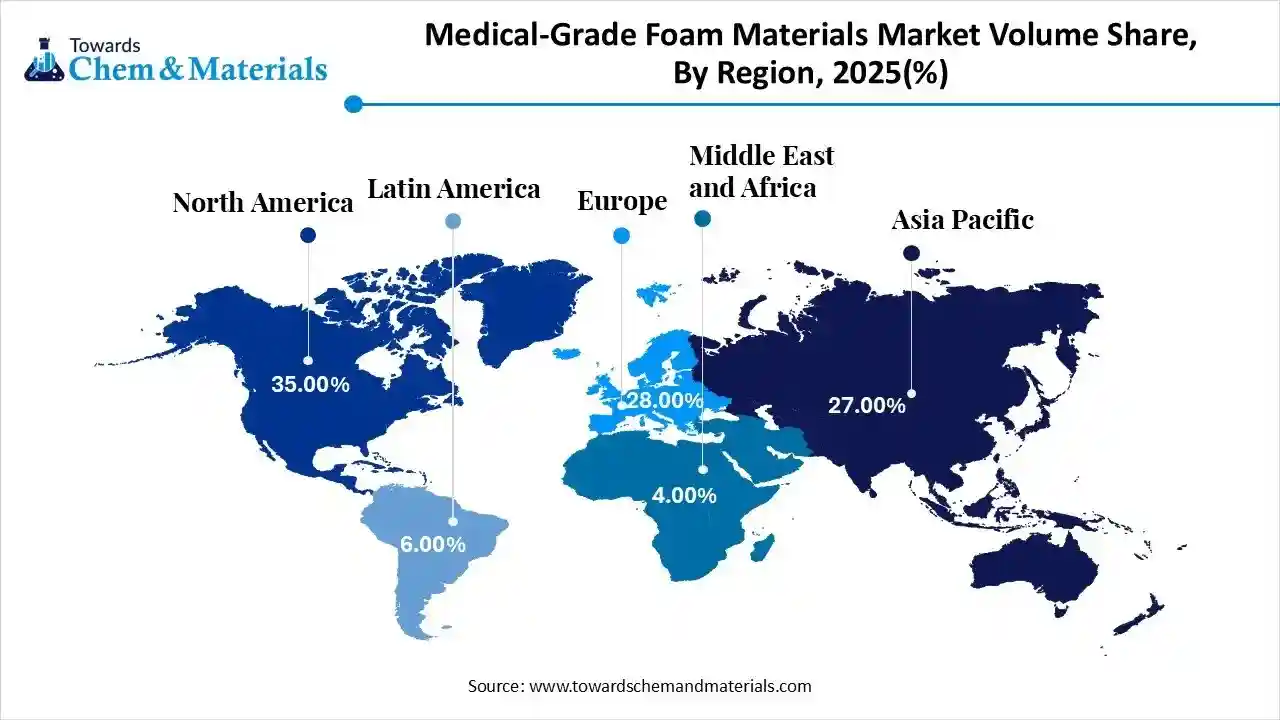

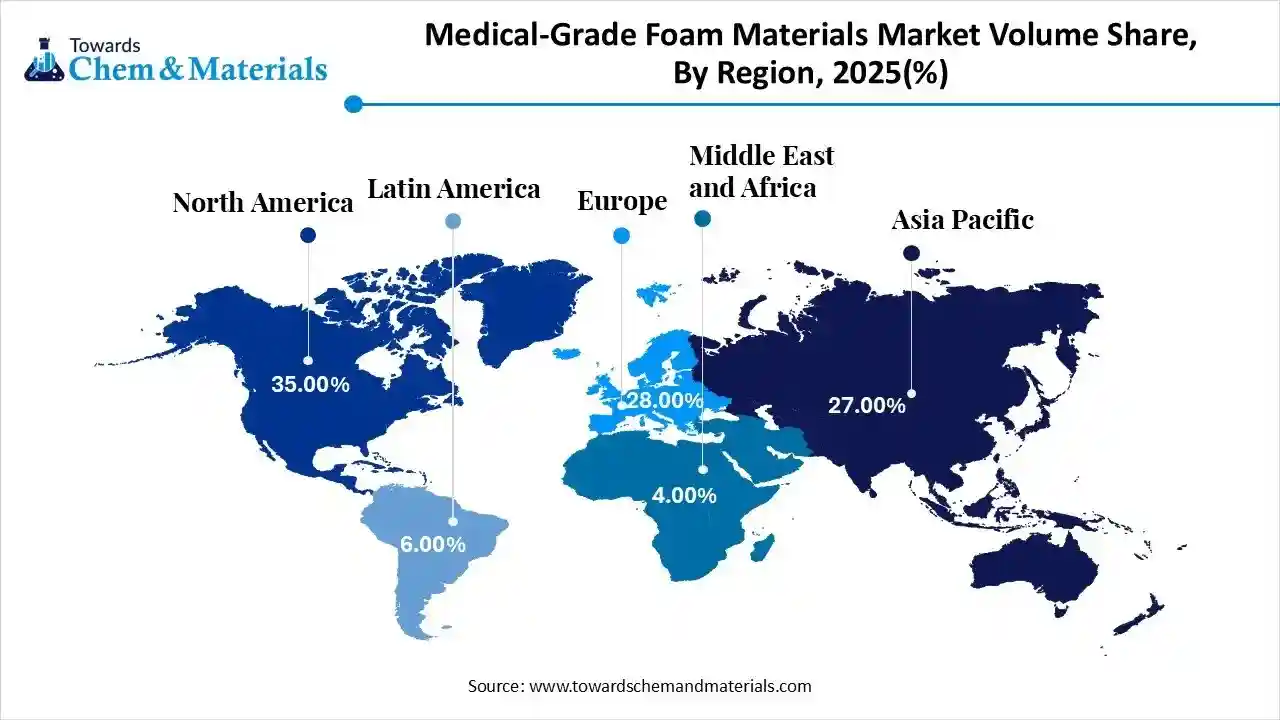

- The North America dominated the medical-grade foam materials market with the largest volume share of 35.00% in 2025.

- The medical-grade foam materials market in Europe is expected to grow at a substantial CAGR of 6.28% from 2026 to 2035.

- The Asia Pacific medical-grade foam materials market segment accounted for the major volume share of 27.00% in 2025.

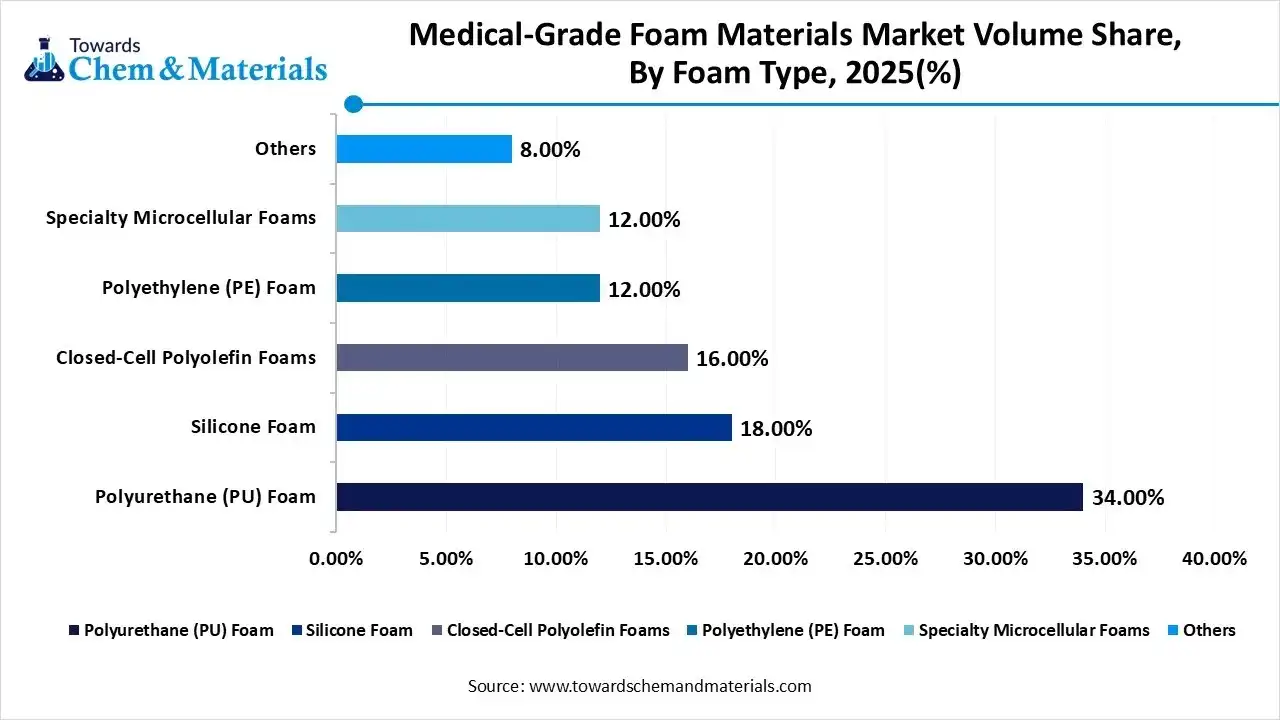

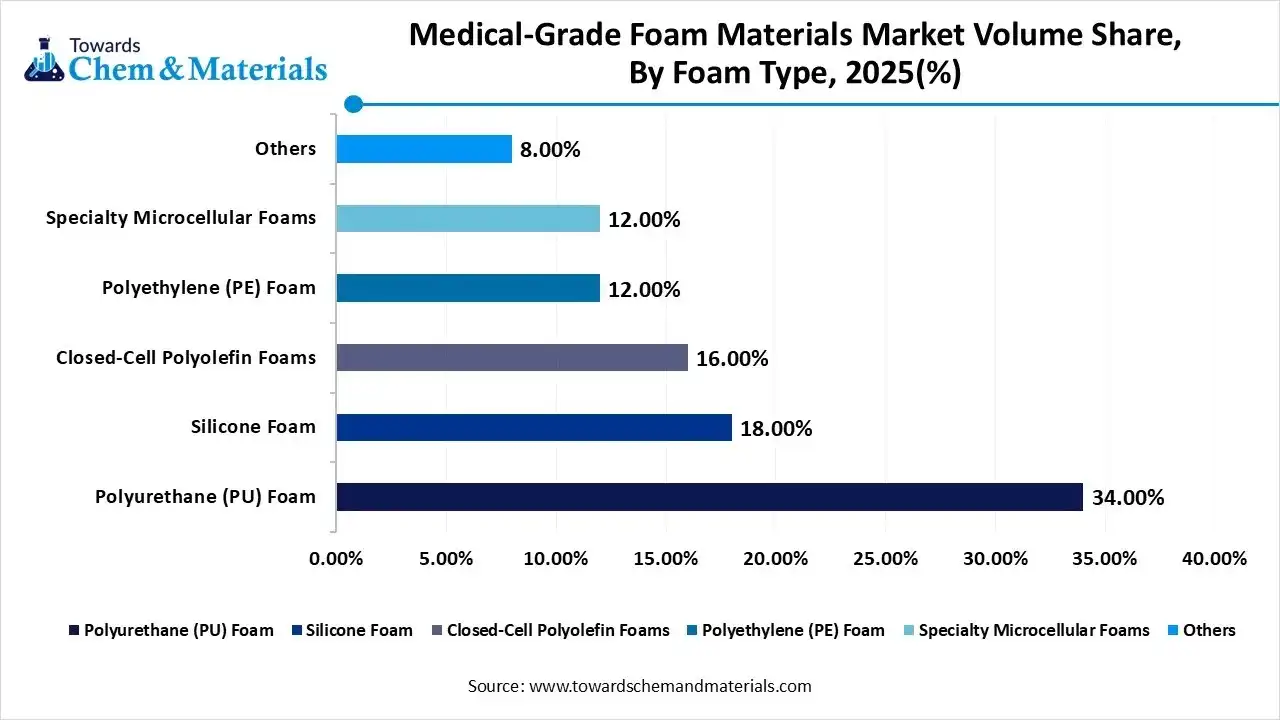

- By foam type, the polyurethane foam segment dominated the market and accounted for the largest volume share of 34% in 2025.

- By foam type, the silicon foam segment is expected to grow at the fastest CAGR of 8.36% from 2026 to 2035 in terms of volume.

- By raw material, the polyurethane chemistry segment led the market with the largest revenue volume share of 36% in 2025.

- By end-use, the hospitals and clinics segment dominated the market and accounted for the largest volume share of 40% in 2025.

Medical Grade Foam: The Backbone of Modern Healthcare

The foam, which is specifically made for medical purposes, has biocompatibility and is designed to prevent infections called as the medical grade foam material. Also, the major healthcare specialist has seen using it in applications such as the surgical padding, wound dressings, and prosthetic liners, which has created its own presence of the medical grade foam materials in the healthcare industry nowadays.

Medical-Grade Foam Materials Market Trends

- The shift towards the biodegradable and eco-friendly foam has attracted increased capital and investment in manufacturing in recent years. Also, several manufacturers are seen investing in R&D activities where researchers are trying to make foam from plant-based materials instead of traditional petroleum based once.

- The unique foam designs, which include active health monitoring is expected to result in high yield outcomes for industrial players in the coming years. Several manufacturers are trying to integrate their foam material with the tiny, embedded sensors, which are likely to track pressure, moisture, and movements.

- The trend towards the tailored foam is anticipated to increase return on investment for manufacturers in the coming years. Also, the major manufacturers are seen in exploring the customised foam solutions, which also provide the exact solution to the patients instead of one-size-fits-all products in the current manufacturing environment.

Report Scope

| Report Attribute | Details |

| Market Size and Volume in 2026 | USD 35.15 Billion / 820000 Tons |

| Revenue Forecast in 2035 | USD 85.64 Billion / 1,510,589.60 Tons |

| Growth Rate | CAGR 10.40% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Units Considered | Value (Billion / Million), Volume (Tons) |

| Dominant Region | North America |

| Segment Covered | By Foam Type, By Raw Material / Chemistry, By End-User, By Region |

| Key companies profiled | Rogers Corporation, Zotefoams, Carpenter, UFP Technologies, Armacell, Recticel, Sekisui Chemical, BASF, Dow, Huntsman, 3M, FXI, Rempac Foam, Trelleborg, Vitafoam |

Smart Foams Transforming Modern Patient Care

The industry environment is rapidly moving from just being soft padding to smart, high-tech material. New foams can sense pressure, moisture, and movement, helping nurses prevent bedsores or monitor patients without checking constantly. Foams are also being made from plant-based and eco-friendly materials, so they are safer for the environment. Technology now allows customized foams made to fit a patient's exact body shape, even using 3D printing.

Trade Analysis of the Medical-Grade Foam Materials Market:

Import, Export, Consumption, and Production Statistics

- China exported 66 shipments of plain foam sheet, which is handled by 15 China exporters to 15 buyers.

- The United States exported 744 shipments for plastic foam in between May 2024 to April 2025. The exports handled by 210 United states Exporters to 164 Buyers.

- The leading three exporters of plastic foam are China, Vietnam, and South Korea. Were Vietnam leads with the 343,453 shipments, China with 121,717 shipments, and South Korea with 17,184 shipments.

Value Chain Analysis of the Medical-Grade Foam Materials Market:

- Distribution to Industrial Users: The medical-grade foam materials market is characterized by a strong shift toward specialized, high-performance applications such as advanced wound care and medical device packaging.

- Key Players: Covestro AG and Evonik Industries AG.

- Chemical Synthesis and Processing: The chemical synthesis and processing of medical-grade foam are increasingly focused on biocompatibility, sterility, and sustainable feedstocks. Synthesis largely depends on the material type, with Polyurethane (PU) remaining the market leader.

- Key Players: Huntsman International and Dow Chemical

- Regulatory Compliance and Safety Monitoring: The medical-grade foam materials market is navigating a landmark year for regulatory transitions, characterized by the convergence of new quality system mandates in the U.S. and critical compliance deadlines in the European Union.

- Safety Standards- U.S. FDA Quality Management System Regulation (QMSR) and EU Medical Device Regulation (MDR) Deadlines

Medical-Grade Foam Materials Market Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas |

| United States | Food & Drug Administration (FDA) | 21 CFR Part 820 (Quality Management System Regulation - QMSR) | Harmonization with ISO 13485:2016, risk-based quality management across the lifecycle, and packaging/labeling controls |

| European Union | European Medicines Agency (EMA) | Regulation (EU) 2017/745 (Medical Device Regulation - MDR) | Strict clinical evidence requirements, EUDAMED database transparency, and rigorous post-market surveillance. |

| China | National Medical Products Administration (NMPA) | Good Manufacturing Practice (GMP) for Medical Devices (2025 Revision) | Lifecycle risk management, digital/intelligent manufacturing, and oversight of contract manufacturing/outsourcing |

Segmental Insights

Foam Type Insights

How did the Polyurethane Foam Segment Dominate the Medical-Grade Foam Materials Market in 2025?

The polyurethane foam segment volume was valued at 278,800.0 tons in 2025 and is projected to reach 485,201.4 tons by 2035, expanding at a CAGR of 6.35% during the forecast period from 2025 to 2035. The polyurethane foam segment dominated the market with approximately 34.00% share in 2025, due to factors such as durability, versatility, and cost-effectiveness in the current market conditions. Also, by providing better pressure distribution, greater cushioning, and fluid absorption, the segment is expected to translate into favorable financial prospects for the producers in the upcoming years. Moreover, this polyurethane foam can be customized in thickness and density.

The silicon foam segment volume was valued at 147,600.0 tons in 2025 and is projected to reach 303,930.6 tons by 2035, expanding at a CAGR of 8.36% during the forecast period from 2025 to 2035, owing to the characteristics like better thermal stability and chemical resistance. Also, having greater biocompatibility than polyurethane, the silicone foam is anticipated to present new business models for the forward-thinking manufacturers in the coming years. Moreover, the silicone foam has seen not degraded when exposed to harsh chemicals and moisture, which is expected to create lucrative opportunities in the industry during the forecast period.

Medical-Grade Foam Materials Market Volume and Share, By Foam Type, 2025-2035

| By Foam Type | Market Volume Share (%), 2025 | Market Volume ( Tons)2025 | Market Volume ( Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| Polyurethane (PU) Foam | 34.00% | 278,800.0 | 485,201.4 | 6.35% | 32.12% |

| Silicone Foam | 18.00% | 147,600.0 | 303,930.6 | 8.36% | 20.12% |

| Closed-Cell Polyolefin Foams | 16.00% | 131,200.0 | 248,189.9 | 7.34% | 16.43% |

| Polyethylene (PE) Foam | 12.00% | 98,400.0 | 183,083.5 | 7.14% | 12.12% |

| Specialty Microcellular Foams | 12.00% | 98,400.0 | 173,687.6 | 6.52% | 11.50% |

| Others | 8.00% | 65,600.0 | 116,496.7 | 6.59% | 7.71% |

Raw Material Insights

How did the Polyurethane Chemistry Segment Dominate the Medical-Grade Foam Materials Market in 2025?

The polyurethane chemistry segment dominated the market with approximately 36% share in 2025, due to its wide availability, cost efficiency, and ease of processing. Polyurethane's chemistry allows for tunable mechanical properties, enabling manufacturers to produce foams ranging from soft cushioning to rigid supports. Also, it can be formulated to meet strict medical safety standards, including non-toxicity and sterilization compatibility, which is essential for hospitals and clinics.

The specialty elastomers segment is expected to grow due to their unique combination of flexibility, durability, and chemical resistance. These materials enable the production of high-performance foams that can withstand repeated compression, extreme temperatures, and exposure to disinfectants without losing integrity. Specialty elastomer foams are ideal for advanced prosthetics, wearable sensors, and long-term patient support surfaces, where standard polyurethane cannot meet performance needs.

End Use Insights

How did the Hospitals and Clinics Segment Dominate the Medical-Grade Foam Materials Market in 2025?

The hospitals and clinics segment dominated the market with approximately 40% share in 2025, because they are the largest consumers of patient support, wound care, and surgical padding products. These institutions require high volumes of foam mattresses, cushions, and dressing materials, making them the primary buyers. Polyurethane foams are preferred due to cost-effectiveness, durability, and sterilization compatibility, allowing for repeated clinical use.

The medical device manufacturers segment is expected to grow with a rapid CAGR, owing to the growth of wearable devices, implants, and home healthcare solutions. These manufacturers increasingly require high- performance foams, such as silicone and specialty elastomers, for precision cushioning, vibration isolation, and patient-specific designs. The rise of personalized healthcare and advanced prosthetics makes these foams essential for device integration and functionality.

Regional Insights

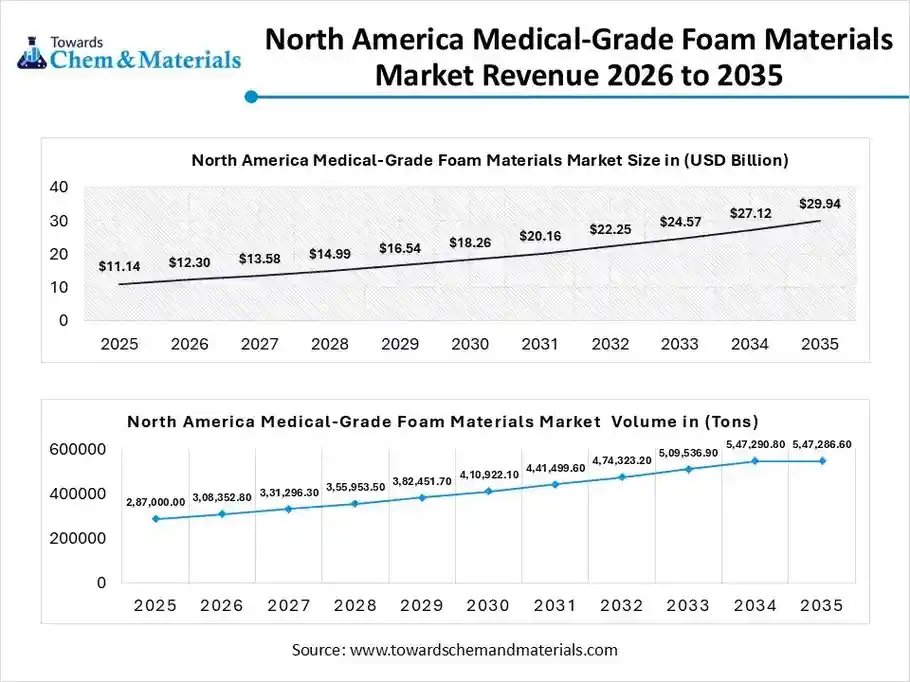

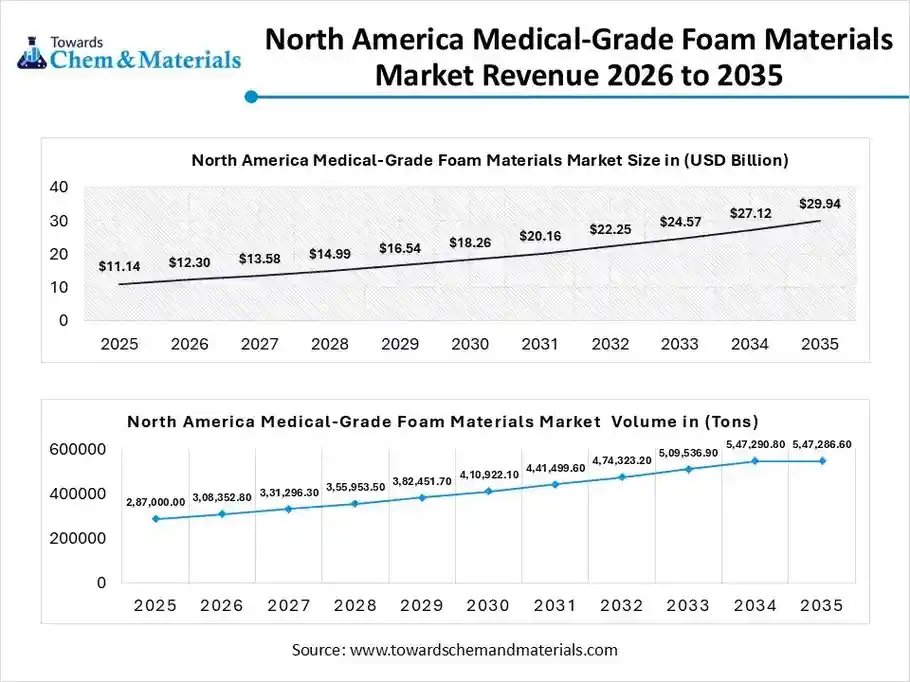

The North America medical-grade foam materials market size was valued at USD 11.14 billion in 2025 and is expected to be worth around USD 29.94 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 10.39% over the forecast period from 2026 to 2035.

The North America medical-grade foam materials volume was estimated at 287,000.0 tons in 2025 and is projected to reach 547,286.6 tons by 2035, growing at a CAGR of 7.44% from 2026 to 2035. North America dominated the medical-grade foam materials market with approximately 35% share in 2025, due to factors like the adoption of advanced medical technologies with upgraded healthcare infrastructure. Also, greater patient awareness has actively driven the industry growth in the region nowadays. Furthermore, the emerging demand for higher-quality foam for wound care and surgical applications is forecasted to support the reshaping of supply and demand dynamics in the region.

United States at the Forefront of Medical Foams

The United States maintained its dominance in the market, owing to the greater regional investment towards the patient care solutions. Also, the regional hospitals have seen in prioritizing the safe and durable silicone and polyurethane foams for the applications for cushions, mattresses, and wound care products in the current period. Moreover, the factors such as the heavy domestic manufacturing and advanced research are projected to open profitable avenues for the manufacturers in the years in the country.

Asia Pacific Medical-Grade Foam Materials Market Evaluation

The Asia Pacific medical-grade foam materials volume was estimated at 221,400.0 tons in 2025 and is projected to reach 431,273.3 tons by 2035, growing at a CAGR of 7.69% from 2026 to 2035, owing to the rapidly expanding healthcare infrastructure, rising population, and increasing awareness of advanced patient care solutions. Countries in the region are investing heavily in hospitals, medical devices, and home healthcare, creating strong demand for polyurethane, silicone, and specialty foams. The growing middle class and improvements in insurance coverage support access to high-quality medical products.

Healthcare Expansion Fueling China’s Medical Foams

China is expected to emerge as a prominent country for the market in the coming years due to a rapidly modernizing healthcare system, large hospital network, and an expanding medical device industry, which are driving demand for advanced foam materials. Moreover, the domestic manufacturers are increasingly producing high-quality polyurethane and silicone foams for wound care, prosthetics, and patient support. Rising government investment in healthcare infrastructure, combined with growing urban populations, increases the consumption of foam-based medical products.

Europe Medical-grade Foam Materials Market Examination

The Europe medical-grade foam materials volume was estimated at 229,600.0 tons in 2025 and is projected to reach 397,285.1 tons by 2035, growing at a CAGR of 6.28% from 2026 to 2035. Europe is notably growing in market, owing to rising healthcare spending, aging populations, and the adoption of advanced patient care technologies. Hospitals and clinics are increasingly replacing older products with high-performance polyurethane, silicone, and specialty elastomer foams that enhance comfort and reduce pressure injuries. The region benefits from strong regulatory frameworks, research innovation, and sustainable material initiatives, which encourage the production and adoption of premium foams.

Germany’s Leadership in Advanced Healthcare Foams

Germany is expected to gain a major industry share due to its advanced healthcare system, strong medical device manufacturing, and focus on innovation. Hospitals and clinics prioritize durable, safe, and high-performance foams for mattresses, surgical pads, and prosthetic liners. Germany also leads in specialty foam research and production, particularly in silicone and elastomer foams for advanced medical applications.

Medical-Grade Foam Materials Market Volume and Share, By Region, 2025-2035

| By Region | Market Volume Share (%), 2025 | Market Volume ( Tons)2025 | Market Volume ( Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| North America | 35.00% | 287,000.0 | 547,286.6 | 7.44% | 36.23% |

| Europe | 28.00% | 229,600.0 | 397,285.1 | 6.28% | 26.30% |

| Asia Pacific | 27.00% | 221,400.0 | 431,273.3 | 7.69% | 28.55% |

| Latin America | 6.00% | 49,200.0 | 88,973.7 | 6.80% | 5.89% |

| Middle East & Africa | 4.00% | 32,800.0 | 45,770.9 | 3.77% | 3.03% |

Recent Developments

- In January 2024, Arcutis Biotherapeutics Inc. a leading biopharmaceutical company works on the development of revolution in immuno-dermatology, introduced ZORYVE® (roflumilast) topical foam, 0.3%, for the treatment of seborrheic dermatitis in the United States.(Source: www.arcutis.com)

Top Vendors in the Medical-Grade Foam Materials Market & Their Offerings:

- Rogers Corporation: A global leader in engineered materials, specializing in high-performance polyurethane (PORON®) and silicone (BISCO®) foams used for medical device sealing, cushioning, and vibration isolation.

- Zotefoams: A pioneer in cellular materials that uses a unique high-pressure nitrogen expansion process to produce ultra-pure, biocompatible foams (ZOTEK® and PLASTAZOTE®) free from chemical blowing agents.

- Carpenter: One of the world’s largest chemical processors of flexible polyurethane foams, providing industrial-scale manufacturing of specialty foams for medical bedding, patient positioning, and wound care applications.

- UFP Technologies

- Armacell

- Recticel

- Sekisui Chemical

- BASF

- Dow

- Huntsman

- 3M

- FXI

- Rempac Foam

- Trelleborg

- Vitafoam

Segments Covered in the Report

By Foam Type

- Polyurethane (PU) Foam

- Silicone Foam

- Closed-Cell Polyolefin Foams

- Polyethylene (PE) Foam

- Specialty Microcellular Foams

- Others

By Raw Material / Chemistry

- Polyurethane Chemistry

- Silicone Chemistry

- Polyolefin-Based Materials

- EVA & Vinyl-Based Materials

- Specialty Elastomers

By End-User

- Hospitals & Clinics

- Medical Device Manufacturers

- Home Healthcare & Long-Term Care

- Orthotics & Prosthetics OEMs

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa