Content

What is the Current Cathode Materials Market Size and Volume?

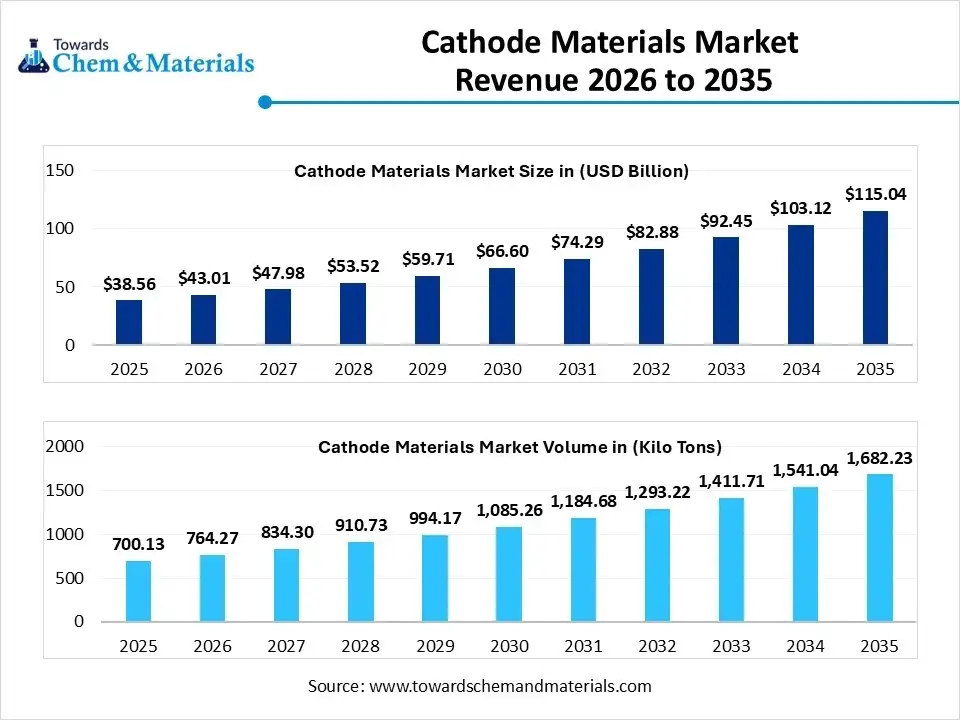

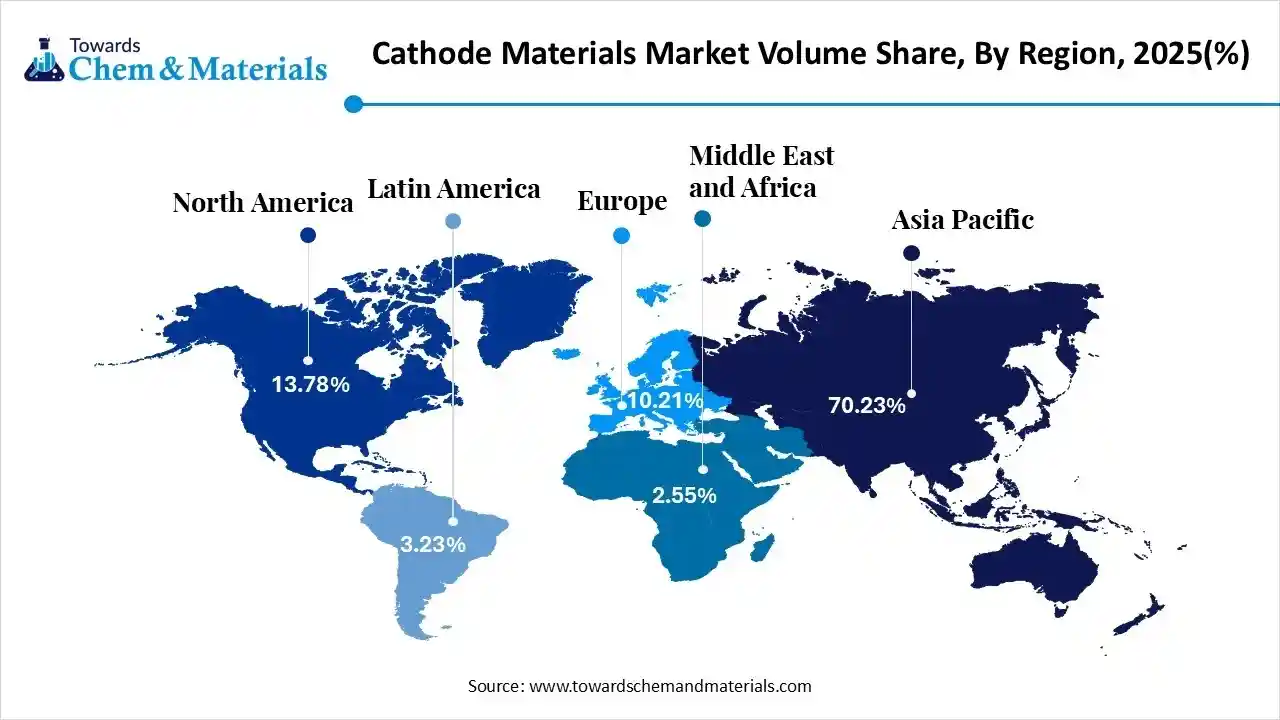

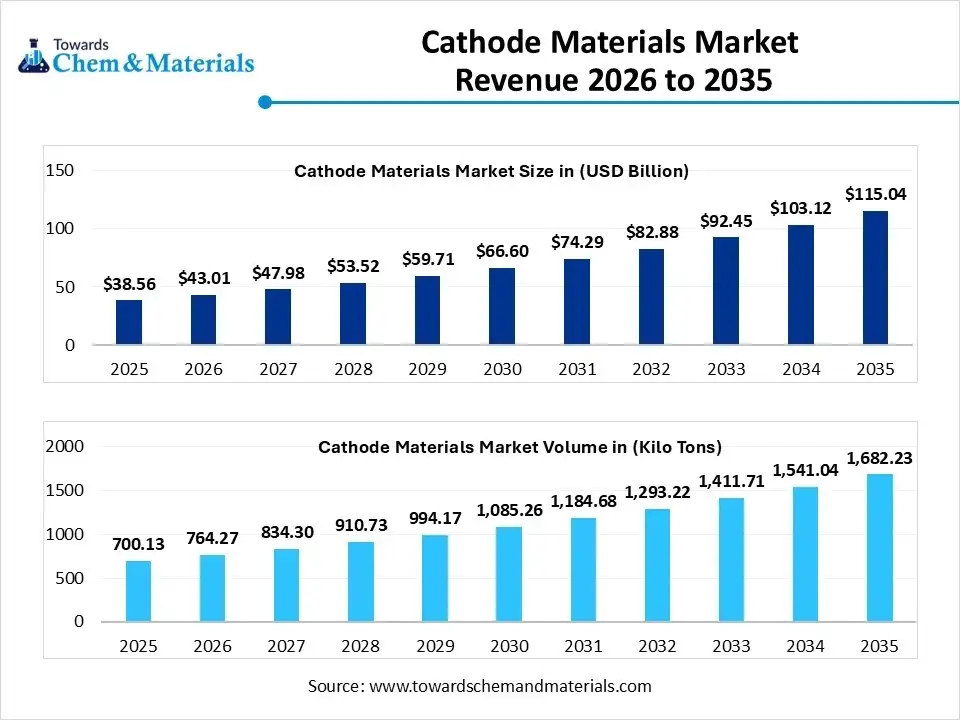

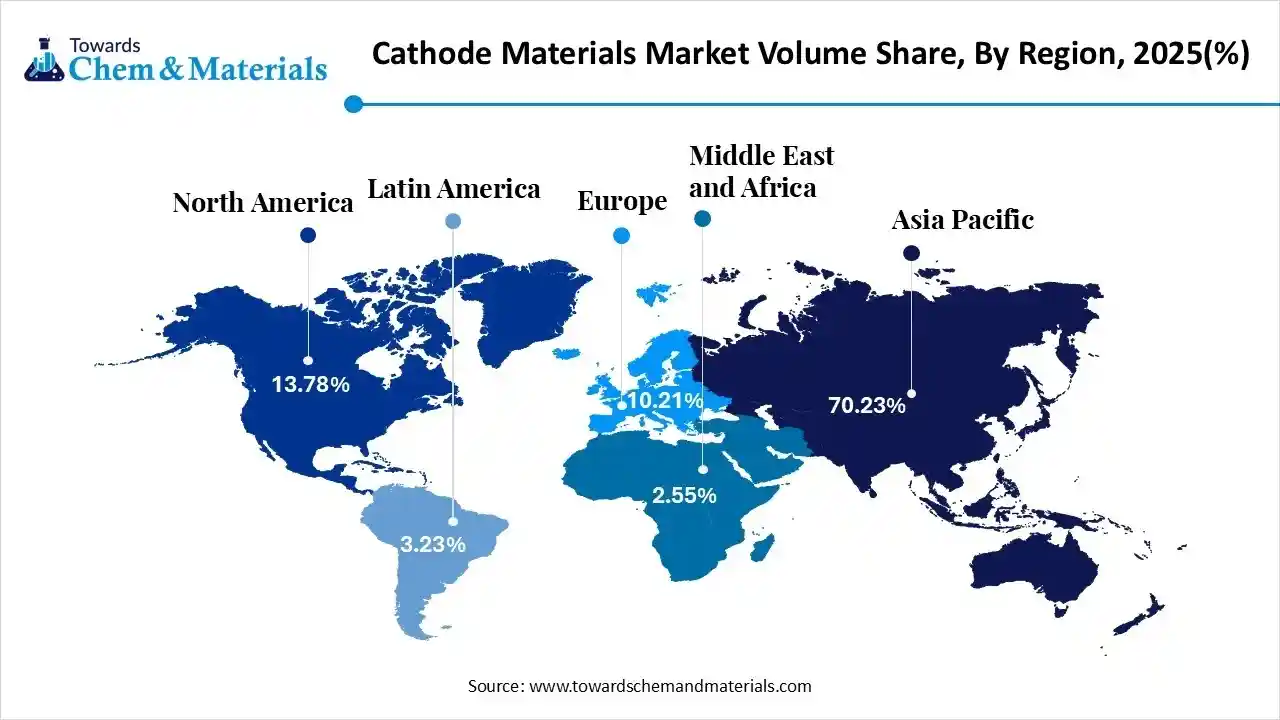

The global cathode materials market size was estimated at USD 38.56 billion in 2025 and is expected to increase from USD 43.01 billion in 2026 to USD 115.04 billion by 2035, growing at a CAGR of 11.55% from 2026 to 2035. In terms of volume, the market is projected to grow from 700.13 kilo tons in 2025 to 1682.23 kilo tons by 2035. growing at a CAGR of 9.16% from 2026 to 2035. Asia Pacific dominated the cathode materials market with the largest volume share of 70.23% in 2025.The growth of the market is driven by booming Electric Vehicle (EV) adoption, spurred by clean energy policies, and strong demand from consumer electronics for high-performance batteries.

Market Highlihgts

- The Asia Pacific dominated the global cathode materials market with the largest volume share of 34.88% in 2025.

- The cathode materials market in North America is expected to grow at a substantial CAGR of 12.33% from 2026 to 2035.

- The Europe cathode materials market segment accounted for the major volume share of 10.21% in 2025.

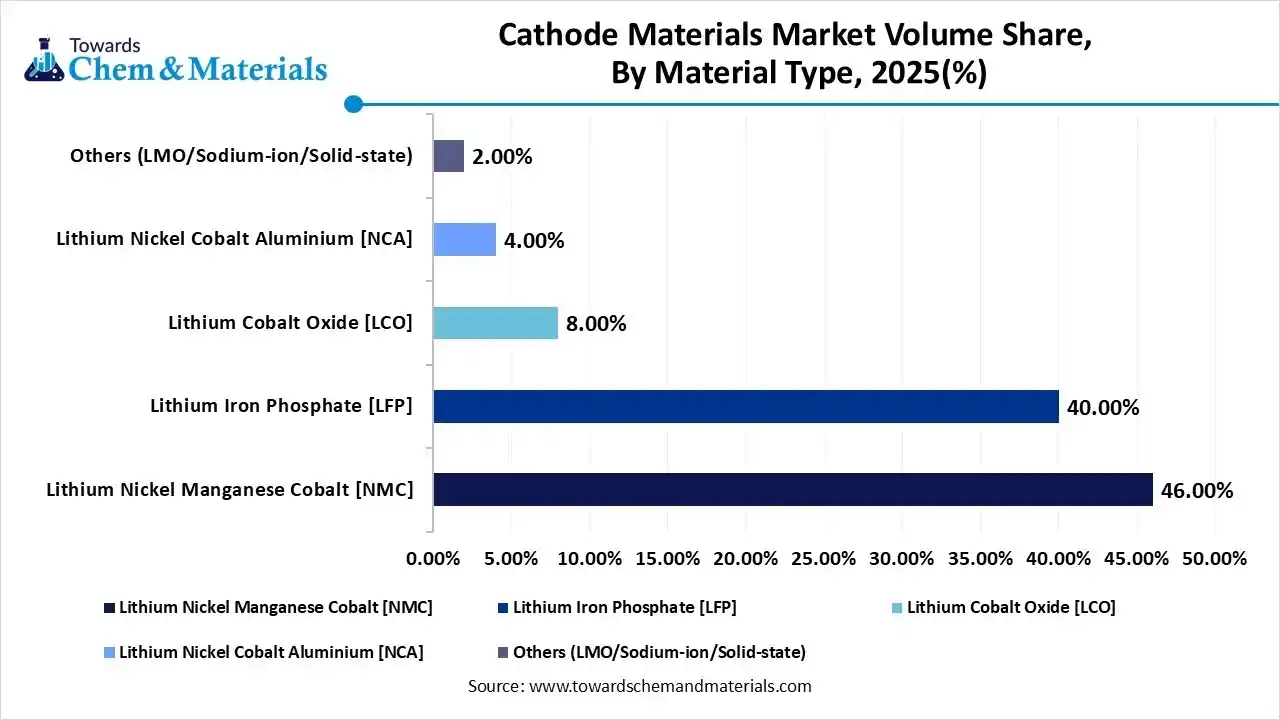

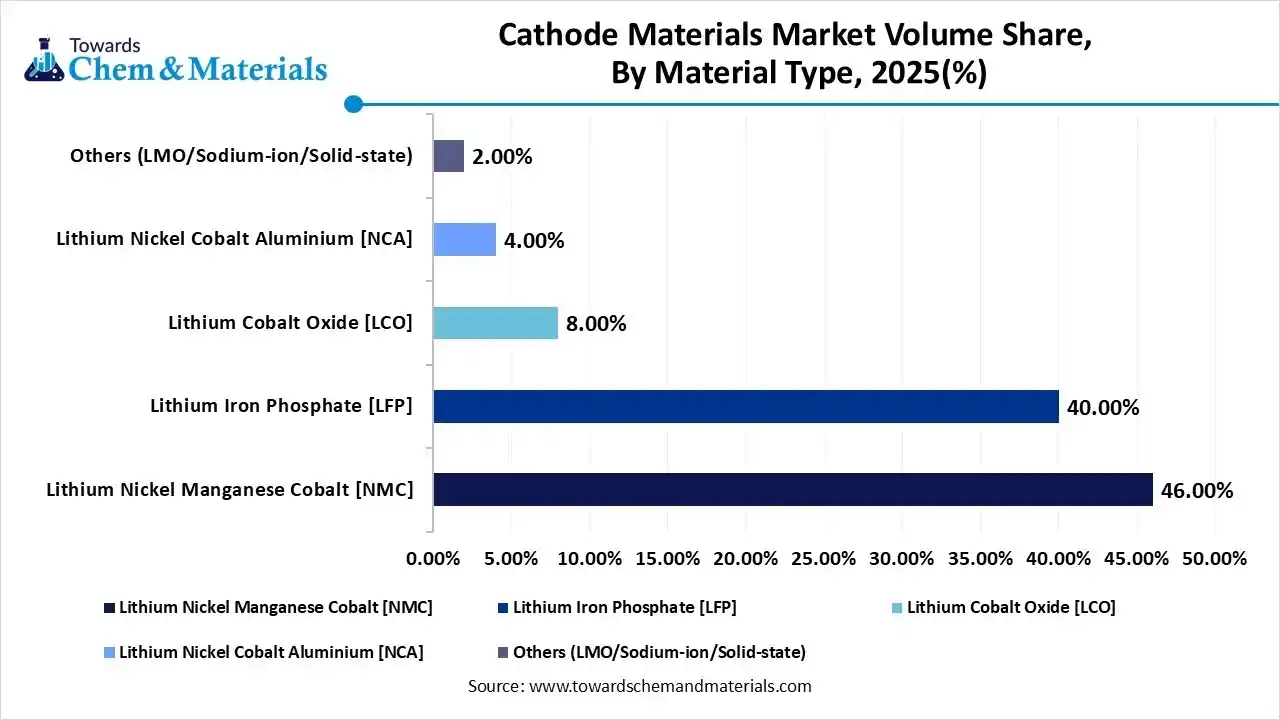

- By material type, the lithium nickel manganese cobalt segment dominated the market and accounted for the largest volume share of 46.00% in 2025.

- By material type, the lithium iron phosphate segment is expected to grow at the fastest CAGR of 11.47% from 2026 to 2035 in terms of volume.

- By battery chemistry sub-type, the LFP & LMFP segment led the market with the largest revenue volume share of 40% in 2025.

- By manufacturing process, the co-precipitation segment dominated the market and accounted for the largest volume share of 68% in 2025.

- By application, the automotive segment led the market with the largest revenue volume share of 62% in 2025.

Market Overview

What Is The Significance Of The Cathode Materials Market?

The significance of the cathode materials market lies in its critical role in enabling the performance, energy density, and lifespan of rechargeable batteries, especially lithium-ion batteries, driving the global transition to cleaner energy and advanced technology. Innovations in high-nickel and cobalt-free chemistries address supply chain, cost, and ethical concerns, making it central to future energy infrastructure.

Cathode Materials Market Growth Trends:

- Cobalt Reduction/Elimination: Driven by supply chain risks, ethical concerns, and cost, researchers are focusing on cobalt-free or low-cobalt materials.

- High-Energy Density Materials: Innovations aim for better performance and longer range in EVs.

- Sustainability Focus: Growing emphasis on responsible sourcing, recycling, and more environmentally friendly production.

- Application-Specific Solutions: Tailoring cathodes for specific needs like LFP for budget cars, high-Ni for premium.

Report Scope

| Report Attribute | Details |

| Market Size and Volume in 2026 | USD 43.01 Billion / 764.27 Kilo Tons |

| Revenue Forecast in 2035 | USD 115.04 Billion / 1682.23 Kilo Tons |

| Growth Rate | CAGR 11.55% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Units Considered | Value (Billion / Million), Volume (Kilo Tons) |

| Dominant Region | Asia Pacific |

| Segment Covered | By Material Type, By Battery Chemistry Sub-Type, By Manufacturing Process, By Application, By Regions |

| Key companies profiled | Umicore S.A, BASF SE, LG Chem / LG Energy Solution, POSCO Future M, Nichia Corporation, Sumitomo Metal Mining Co., Ltd., CATL (Contemporary Amperex Technology Co., Ltd.), Shanshan Co., Ltd., EcoPro BM, Targray Technology International, Johnson Matthey (Battery Materials Division), LanzaTech / LanzaJet (Carbon-based precursors), ZTC New Energy Materials, Mitsubishi Chemical Group, Huayou Cobalt |

Key Technological Shifts In The Cathode Materials Market:

Key shifts in the cathode materials market involve moving to low/no-cobalt chemistries for cost/sustainability, developing next-gen materials, boosting recycling, and enhancing performance driven by EV and grid storage demand, all while tackling supply chain volatility and environmental concerns.

Trade Analysis Of Cathode Materials Market: Import & Export Statistics

- According to Global Export data, the world exported 100,914 shipments of Copper Cathodes. The exports handled by 2,794 exporters to 2,588 buyers. The majority of these exports went to Tanzania, United States, and China.

- Globally, the top three exporters are Congo, Chile, and Zambia. Congo leads with 196,045 shipments, followed by Chile with 19,386, and Zambia with 15,347.

- Between June 2024 and May 2025 (TTM), the world exported 597 shipments of Cathodes Of Copper to India, by 28 exporters to 23 India buyers.

- The main destinations for these exports are Tanzania, China, and the United States. The top exporters of Cathodes Of Copper are Congo, Chile, and Zambia, with Congo leading at 196,045 shipments, Chile with 19,386, and Zambia with 15,347.

Cathode Materials Market Value Chain Analysis

- Material Synthesis and Processing: Cathode materials are produced through processes such as precursor synthesis, co-precipitation, solid-state or sol–gel processing, calcination, particle coating, and performance optimization to manufacture materials.

- Key players: Umicore, BASF SE, LG Chem, Sumitomo Metal Mining

- Quality Testing and Certification: Cathode materials require certifications ensuring electrochemical performance, material purity, thermal stability, and compliance with battery safety and environmental regulations.

- Key players: ISO (International Organization for Standardization), IEC (International Electrotechnical Commission), UL Solutions, TÜV SÜD.

- Distribution to Industrial Users: Cathode materials are supplied to lithium-ion battery manufacturers serving electric vehicles, consumer electronics, energy storage systems, and industrial power applications.

- Key players: Umicore, LG Chem, BASF SE.

Cathode Materials Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas |

| United States | U.S. Environmental Protection Agency (EPA) OSHA (Occupational Safety & Health Administration) Department of Transportation (DOT) |

TSCA (Toxic Substances Control Act) Clean Air Act (CAA) – emissions from manufacturing Clean Water Act (CWA) – wastewater/effluent controls OSHA Hazard Communication Standard DOT Hazardous Materials Regulations (49 CFR) |

Chemical inventory status & risk evaluation Emissions & effluent control in cathode production Worker safety (handling of active materials/solvents) Transportation of hazardous cathode precursors |

| European Union | European Chemicals Agency (ECHA) European Commission |

REACH Regulation (EC 1907/2006) CLP Regulation (EC 1272/2008) Battery Directive (proposed Battery Regulation) Industrial Emissions Directive (IED) |

Chemical registration & hazard classification Labeling and safety data Sustainable battery value chain (recycling, content reporting) Emission controls for production facilities |

| India | Ministry of Environment, Forest & Climate Change (MoEFCC) CPCB (Central Pollution Control Board) |

Proposed Chemicals (Management & Safety) Rules Hazardous & Other Wastes (Management & Transboundary Movement) Rules Air/Water Acts |

Chemical safety & reporting Emission & effluent control Hazardous waste handling |

Segmental Insights

Material Type Insights

How Did The Lithium Nickel Manganese Cobalt Segment Dominate The Cathode Materials Market In 2025?

The lithium nickel manganese cobalt segment volume was valued at 322.06 kilo tons in 2025 and is projected to reach 712.26 kilo tons by 2035, expanding at a CAGR of 9.22% during the forecast period from 2025 to 2035. The lithium nickel manganese cobalt segment dominated the market with a share of 46% in 2025. The market growth is due to their balanced combination of high energy density, thermal stability, and long cycle life. Increasing adoption of EVs, continuous advancements in nickel-rich formulations, and efforts to reduce cobalt content to manage cost and supply risks are driving sustained demand for NMC cathode materials.

The lithium iron phosphate segment volume was valued at 280.05 kilo tons in 2025 and is projected to reach 744.05 kilo tons by 2035, expanding at a CAGR of 11.47% during the forecast period from 2025 to 2035. The lithium iron phosphate segment is projected to grow at the fastest CAGR between 2026 and 2035 in the market. It is gaining strong traction owing to its superior thermal stability, longer lifespan, and enhanced safety characteristics compared to nickel-based chemistries. Rising focus on affordable EVs, grid-scale storage, and sustainability is accelerating the adoption of LFP cathodes globally.

Cathode Materials Market Volume and Share, By Material Type, 2025-2035

| By Material Type | Market Volume Share (%), 2025 | Market Volume (Kilo Tons)2025 | Market Volume (Kilo Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| Lithium Nickel Manganese Cobalt [NMC] | 46.00% | 322.06 | 712.26 | 9.22% | 42.34% |

| Lithium Iron Phosphate [LFP] | 40.00% | 280.05 | 744.05 | 11.47% | 44.23% |

| Lithium Cobalt Oxide [LCO] | 8.00% | 56.01 | 121.63 | 9.00% | 7.23% |

| Lithium Nickel Cobalt Aluminium [NCA] | 4.00% | 28.01 | 68.97 | 10.53% | 4.10% |

| Others (LMO/Sodium-ion/Solid-state) | 2.00% | 14.00 | 35.33 | 10.83% | 2.10% |

Battery Chemistry Sub-Type Insights

Which Battery Chemistry Sub-Type Segment Dominates the Cathode Materials Market In 2025?

The LFP & LMFP segment dominated the market with a share of 40% in 2025. They are increasingly preferred for applications requiring high safety, extended cycle life, and stable performance under harsh conditions. Growing investments in renewable energy integration, grid stability projects, and cost-sensitive EV segments are strengthening the market demand for LFP and LMFP cathode materials.

The high-nickel NMC segment is projected to grow at the fastest CAGR between 2026 and 2035 in the market. High nickel NMC battery chemistries, such as NMC 811 and NMC 9½½, are witnessing rapid adoption due to their significantly higher energy density and improved driving range capabilities. Ongoing research to enhance thermal stability, reduce cobalt dependency, and improve recycling efficiency continues to support the growth of high nickel NMC cathode materials.

Manufacturing Process Insights

How Did Co-Precipitation Segment Dominate The Cathode Materials Market In 2025?

The co-precipitation segment dominated the market with a share of 68% in 2025. The co-precipitation manufacturing process is the most widely used technique for producing cathode materials due to its ability to deliver uniform particle size, consistent composition, and scalable production efficiency. Increasing battery gigafactory expansions, demand for quality consistency, and improvements in process automation are driving the widespread adoption of co-precipitation methods.

The hydrothermal/solvothermal segment is projected to grow at the fastest CAGR between 2026 and 2035 in the market. They are gaining importance for producing advanced cathode materials with controlled morphology and enhanced electrochemical performance. Increasing R&D activities, pilot-scale adoption, and demand for high-performance batteries are supporting the growth of these manufacturing techniques.

Application Insights

Which Application Segment Dominates The Cathode Materials Market In 2025?

The automotive segment dominated the market with a share of 62% in 2025. The growth is driven by the rapid global shift toward electric mobility. Government incentives, tightening emission regulations, and expanding EV model portfolios across passenger and commercial vehicles are significantly boosting demand for high-performance cathode materials in the automotive sector.

The energy storage systems segment is projected to grow at the fastest CAGR between 2026 and 2035 in the market. The growth is supported by increasing renewable energy installations and grid modernization initiatives. Rising investments in utility-scale storage, residential backup systems, and energy transition projects are driving consistent growth in cathode material demand for energy storage applications.

Regional Insights

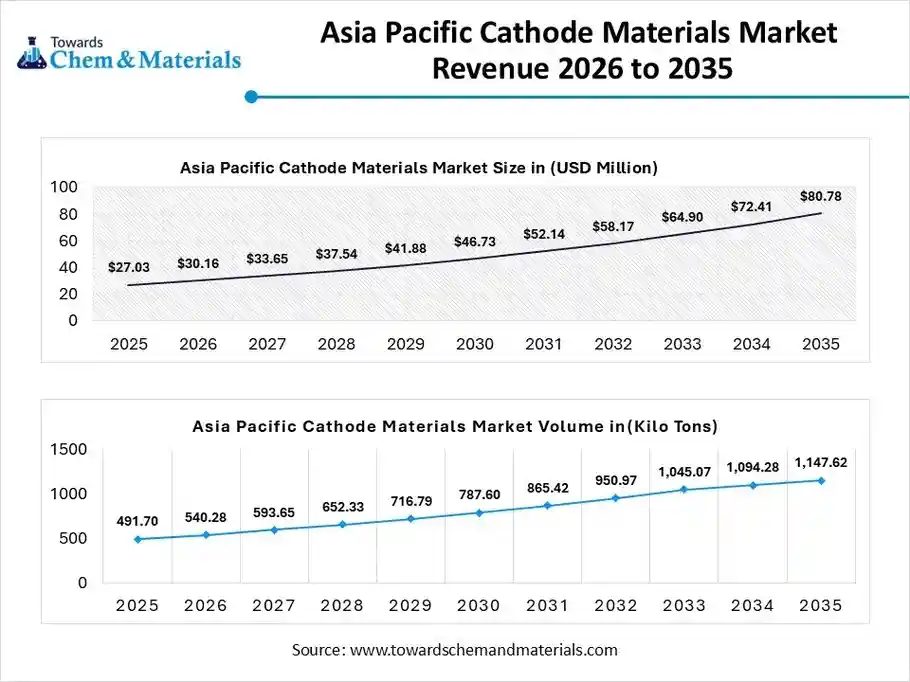

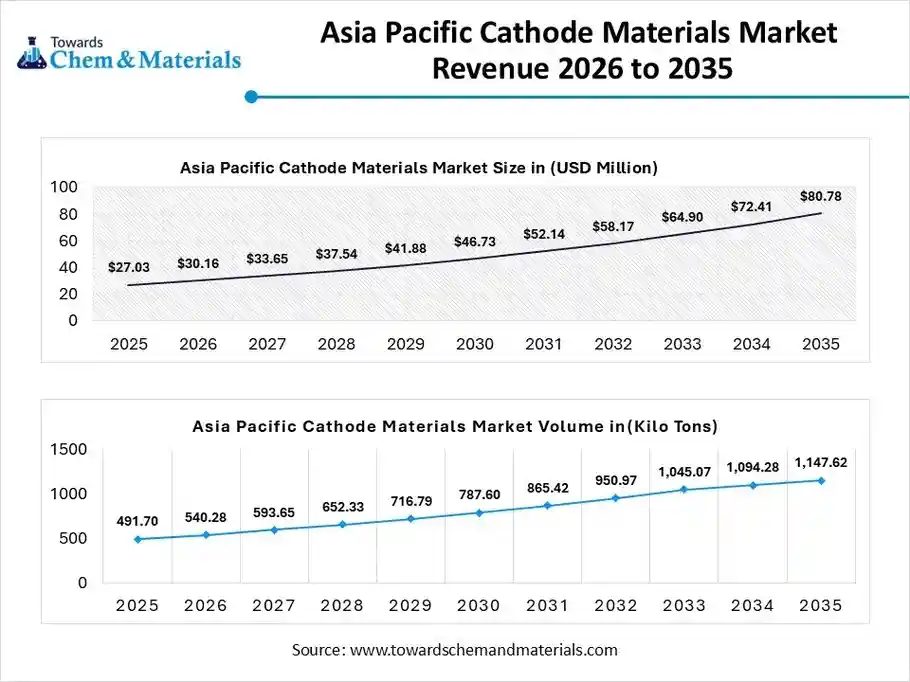

The Asia Pacific cathode materials market size was valued at USD 27.03 billion in 2025 and is expected to be worth around USD 80.78 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 11.57%% over the forecast period from 2026 to 2035.

The Asia Pacific cathode materials market volume was estimated at 491.70 kilo tons in 2025 and is projected to reach 1147.62 kilo tons by 2035, growing at a CAGR of 9.88% from 2026 to 2035.Asia Pacific dominates the market, driven by its strong battery manufacturing ecosystem, large-scale electric vehicle adoption, and extensive investments in lithium-ion battery supply chains. Countries across the region benefit from integrated cathode production, raw material processing, and cell manufacturing capabilities, supporting rapid capacity expansion and cost competitiveness.

China: Cathode Materials Market Growth Trends

China leads the global cathode materials market due to its vertically integrated battery value chain, strong domestic EV demand, and government-backed industrial policies. The country hosts major producers of LFP, NMC, and NCA cathode materials, supported by large-scale refining of lithium, nickel, and cobalt, and continuous advancements in cathode chemistry innovation.

North America Cathode Materials Market Growth Is Driven By Growing Support

The cathode materials market volume was estimated at 96.48 kilo tons in 2025 and is projected to reach 274.71 kilo tons by 2035, growing at a CAGR of 12.33% from 2026 to 2035. North America is experiencing accelerated growth in the market, supported by rising EV penetration, domestic battery manufacturing investments, and policy-driven localization initiatives. Strategic focus on reducing dependence on imports and building regional battery supply chains is driving capacity additions and partnerships across the cathode materials ecosystem.

Cathode Materials Market Volume and Share, By Region, 2025-2035

| By Region | Market Volume Share (%), 2025 | Market Volume (Kilo Tons)2025 | Market Volume (Kilo Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| North America | 13.78% | 96.48 | 274.71 | 12.33% | 16.33% |

| Europe | 10.21% | 71.48 | 188.58 | 11.38% | 11.21% |

| Asia Pacific | 70.23% | 491.70 | 1147.62 | 9.88% | 68.22% |

| South America | 3.23% | 22.61 | 35.50 | 5.14% | 2.11% |

| Middle East & Africa | 2.55% | 17.85 | 35.83 | 8.05% | 2.13% |

United States: Cathode Materials Market Growth Trends

The U.S. cathode materials market is expanding due to increased investments in battery gigafactories, clean energy transition policies, and incentives for domestic material sourcing. Growing demand from electric vehicles and energy storage systems is encouraging the development of local cathode production facilities and innovation in high-energy-density materials.

Recent Developments

- In October 2025, Toyota Motor Corporation and Sumitomo Metal Mining (SMM) announced a joint development agreement, focused on the mass production of cathode materials for all-solid-state batteries (ASSBs). The collaboration aims to accelerate the adoption of advanced battery technology.(Source: global.toyota)

- In December 2025, South Korean battery materials manufacturer EcoPro completed and inaugurated its first overseas cathode material production facility in Debrecen, Hungary,(Source:battery-news.de)

Top players in the Cathode Materials Market & Their Offerings:

- Umicore S.A.: Umicore is a leading global provider of advanced cathode materials, including NMC (Nickel Manganese Cobalt), LFP (Lithium Iron Phosphate), and precursor solutions.

- BASF SE: BASF supplies high-performance cathode active materials for lithium-ion batteries (e.g., NMC and LFP chemistries). The company emphasizes scalable production, high energy density, and optimized cycle life for automotive, industrial, and renewable energy storage applications.

- LG Chem / LG Energy Solution: LG Energy Solution produces a wide range of cathode materials tailored for EVs, portable electronics, and ESS. Its materials include high-nickel NMC grades optimized for energy density and long operational life, supporting global battery manufacturers.

- POSCO Future M

- Nichia Corporation

- Sumitomo Metal Mining Co., Ltd.

- CATL (Contemporary Amperex Technology Co., Ltd.)

- Shanshan Co., Ltd.

- EcoPro BM

- Targray Technology International

- Johnson Matthey (Battery Materials Division)

- LanzaTech / LanzaJet (Carbon-based precursors)

- ZTC New Energy Materials

- Mitsubishi Chemical Group

- Huayou Cobalt

Segments Covered

By Material Type

- Lithium Nickel Manganese Cobalt (NMC)

- Lithium Iron Phosphate (LFP)

- Lithium Cobalt Oxide (LCO)

- Lithium Nickel Cobalt Aluminum (NCA)

- Others (LMO/Sodium-ion/Solid-state)

By Battery Chemistry Sub-Type

- High-Nickel NMC (e.g., NMC 811)

- Low/Medium-Nickel NMC (e.g., NMC 532)

- LFP & LMFP

- Specialty Cathodes

By Manufacturing Process

- Co-precipitation

- Solid-State Synthesis

- Hydrothermal/Solvothermal

By Application

- Automotive (EV/HEV)

- Consumer Electronics

- Energy Storage Systems (ESS)

- Industrial & Power Tools

- Others (Medical/Aerospace)

By Regions

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa