Content

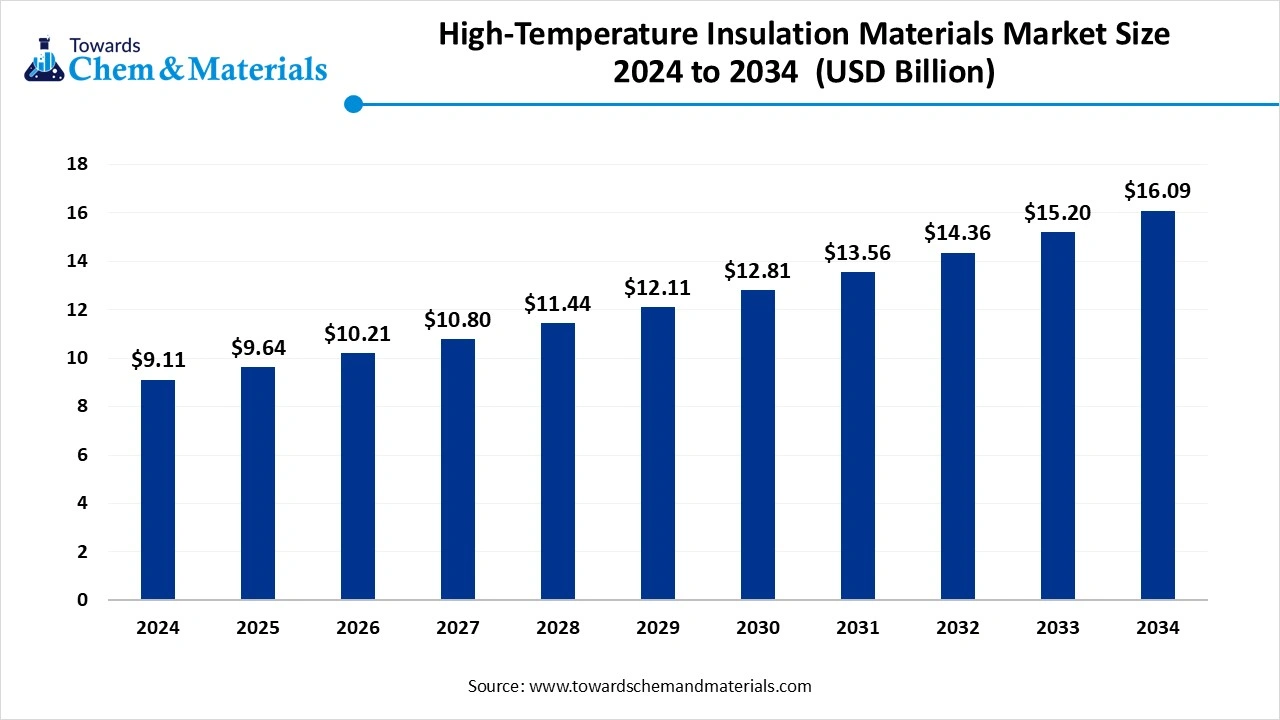

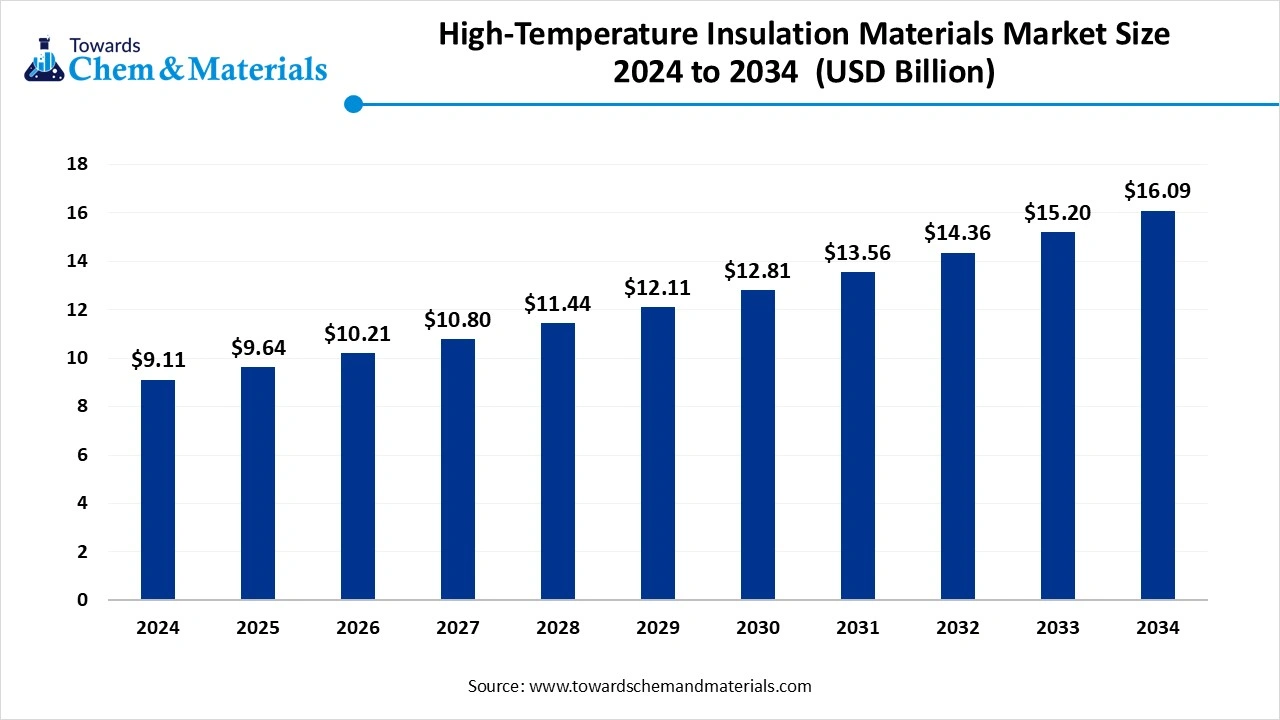

High-Temperature Insulation Materials Market Size, Share | CAGR of 5.85%.

The global high-temperature insulation materials market size was reached at USD 9.11 billion in 2024 and is expected to be worth around USD 16.09 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.85% over the forecast period 2025 to 2034. This market is growing due to increasing demand for energy efficiency and thermal management across industrial processes.

Key Takeaways

- By region, Asia Pacific dominated the high-temperature insulation materials, holding the largest market share of 50% in 2024 because of rising industrial activity and expanding infrastructure development across countries in the region.

- By region, North America is expected to grow at a notable rate in market share due to increasing demand for energy-efficient and sustainable insulation materials in industries like automotive and aerospace.

- By type, the fibrous insulation materials segment held the largest share of the market at 35% in 2024 and expected to sustain its position in the market during the forecast period, because these materials are cost-effective, lightweight, and widely used in thermal insulation applications across multiple industries

- By application, the industrial application segment held the largest share at 40% in 2024 because industries such as metal processing, cement, and glass manufacturing extensively use high-temperature insulation materials to minimize heat loss and improve operational efficiency.

- By application, automotive applications are expected to grow at the fastest rate in the high-temperature insulation materials market, owing to rising demand for thermal protection components in electric vehicles and internal combustion engines.

- By temperature resistance, the 800°C to 1500°C segment held the largest market share of 50% in 2024 because it covers a wide range of high-heat industrial processes where insulation is critical to performance and safety.

- By temperature resistance, the Above 1500°C segment is emerging as the fastest growing, driven by its increasing application in ultra-high temperature environments such as steelmaking and advanced ceramics.

- By end user industry, the power generation segment held the largest share at 35% in 2024 because power plants require large-scale thermal insulation for turbines, boilers, and piping systems to improve efficiency and safety.

- By end user industry, the petrochemicals & oil & gas segment is expected to grow at the fastest rate during the forecast period, due to the wider usage in the LNG facilities, oil refineries, and others.

- By form, the boards segment held the largest share at 45% in 2024, due to its enhancing capabilities like physical strength and water resistance.

- By form, the blankets segment is observed to grow at the fastest rate during the forecast period due to their flexibility, lightweight nature, and sustainability for wrapping around pipes and complex equipment shapes.

Market Overview

High-temperature insulation materials (HTIMs) are materials designed to provide thermal insulation in applications involving extreme temperatures. These materials are used to prevent heat loss or gain, ensuring the safety and efficiency of industrial processes. They are typically employed in industries such as aerospace, automotive, power generation, metallurgy, and chemical processing, where high temperatures are generated. HTIMs play a crucial role in enhancing energy efficiency, preventing damage to equipment, and reducing operational costs.

Which Factor is Driving the High-Temperature Insulation Materials Market?

A key factor driving the high-temperature insulation materials market is the expansion of manufacturing facilities by major players like Morgan Advanced Materials, whose Abu Dhabi plant boosts global supply to meet rising demand in energy-intensive industries. Growing industrialization and energy efficiency regulations are driving the need for advanced insulation materials. Major factors like Morgan's UAE plant are expanding to meet this rising demand globally.

Market Trends

- Rising demand from energy-intensive industries : Industries like petrochemicals, steel, and power generators are increasingly adopting high-temperature isolation to reduce heat loss and improve operational efficiency.

- Stringent environmental regulations : Global push for energy conservation and lower carbon emissions is driving the use of eco-friendly insulation materials in industrial setups.

- Technological advancements in insulation materials : Innovation like aerogel, ceramic fibers, and microporous materials is gaining popularity due to their lightweight nature, thermal stability, and better performance.

- Focus on sustainable and recyclable materials : Companies are investing in green insulation alternatives to align with global sustainability goals and meet the rising preference for eco-conscious solutions.

Market Report

| Report Attribute | Details |

| Market Size in 2025 | USD 9.64 Billion |

| Expected Size by 2034 | USD 16.09 Billion |

| Growth Rate from 2025 to 2034 | CAGR 5.85% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Type, By Application, By Temperature Resistance Range, By End-Use Industry |

| Key Companies Profiled | Rockwool International A/S, Saint-Gobain, Johns Manville (A Berkshire Hathaway Company), Knauf Insulation, Owens Corning, BASF SE, Morgan Advanced Materials, Unifrax, Isolite Insulating Products Co., Ltd., RHI Magnesita, Thermal Ceramics (A Morgan Advanced Materials Company), Beijing Hightemp Insulation Materials Co., Ltd., Tata Steel, Harman International, Huntsman Corporation, Armacell International S.A., Promat International, Lydall, Inc., Shandong Luyang Share Co., Ltd., Zircar Refractory Composites, Inc. |

Market Opportunity

The Growing Demand From The Energy Sector Accelerate The Market Expansion

The high-temperature insulation materials market holds strong growth potential due to the growing need for energy-efficient solutions in the metal processing, petrochemical, and power generation sectors. Advanced insulation materials that minimize heat loss and increase operational efficiency are becoming increasingly necessary as industries work to lower energy consumption and carbon emissions. Increased use of renewable energy sources like hydrogen production and concentrated solar power also creates new opportunities for high-performance insulation.

Further opening new possibilities are technological developments in eco-friendly, long-lasting, and lightweight insulation materials such as bio-based insulators and aerogels. Government policies that encourage thermal efficiency and energy conservation also help the market's growth in both commercial and industrial applications.

Market Challenge

Higher Adaptation Cost

The high-temperature insulation materials market faces key challenges because advanced materials like ceramic fibers and aerogels are expensive. Adoption in cost-sensitive industries is limited by the substantial increase in project costs associated with these materials despite their superior performance. Stricter rules and limitations have also been implemented in several areas due to health and safety issues with handling specific insulation types such as refractory ceramic fibers (RCFs).

Because certain materials may deteriorate or lose their insulating effectiveness over time, maintaining thermal performance under extended exposure to high temperatures presents another difficulty. Furthermore, the adoption of contemporary high-temperature insulation solutions is hampered in developing economies by a lack of knowledge and technical know-how, which limits the potential for market expansion.

Regional Insights

Asia Pacific dominated the high-temperature insulation materials market in 2024, accounting for the largest market share. Rapid industrialization, rising energy consumption, and substantial infrastructure development in nations like China and India are all factors contributing to this dominance. A significant manufacturing base, particularly in the areas of steel, glass, cement, and petrochemicals, has increased demand for effective insulation solutions. Additionally, government programs to reduce carbon emissions and increase energy efficiency have sped up high temperature insulation materials in several end-use sectors.

North America is expected to grow at the fastest rate in the high-temperature insulation materials market during the forecast period. Increased spending on advanced manufacturing, a growing emphasis on sustainability, and strict laws encouraging energy conservation are the main drivers of growth. High-performance insulation materials are being actively incorporated by important industries like power generation, oil and gas, automotive, and aerospace to improve operational safety and energy efficiency. The market is also being fueled by the increasing use of electric cars and the move to cleaner energy sources.

Segmental Insights

Type Insights

Why Did Fibrous Insulation Materials Dominate The High-Temperature Insulation Materials Market In 2024?

Fibrous insulation materials segment dominates the market in 2024 and expected to experience the fastest growth in the market during the forecast period, due to their excellent thermal resistance, lightweight nature, and versatility across multiple high-heat environments. Widely used in power plants, furnaces, and metallurgical applications, materials like ceramic fiber and glass wool offer superior insulation at a reasonable cost, making them the preferred choice for industries looking for energy-efficient and durable solutions.

Adoption of ceramic fibers in high-temperature settings has been accelerated by ongoing advancements in the materials and the expanding use of fibrous products in new industries like EV batteries and aerospace components. The flexibility of fibrous insulation, along with developments in fiber-reinforced composites, provides a balance between weight reduction, strength, and insulation. Furthermore, industries are being encouraged to choose such sustainable thermal solutions by regulations that aim to reduce carbon footprints.

- In June 2025, Alkegen announced full-scale commercial production of AlkeGel fiber-enhanced aerogel insulation for EV battery fire protection.(Source : https://www.prnewswire.com)

Application Insights

Why Did The Industrial Application Segment Hold The Largest High-Temperature Insulation Materials Market Share In 2024?

Industrial application segment dominates the market in 2024, due to high-temperature operations in power plants, metal processing, and cement production. Insulation ensures energy savings, equipment protection, and regulatory compliance. The need to modernize aging infrastructure further boosts demand for thermal insulation. Industries also rely on it to reduce operational costs and downtime.

Automotive applications segment is expected to experience the fastest growth in the market during the forecast period, due to more stringent emissions regulations. High-temperature insulation enhances engine heat management, battery safety, and overall vehicle performance. Compact automotive systems are using more lightweight, flexible materials. Market expansion is being accelerated by the growing need for thermal management in electric drivetrains. Automotive OEMs are actively investing in thermal barrier innovation to enhance vehicle efficiency.

- In May 2025, Owens Corning presented new high-temperature insulation product lines at the 2025 investor day, targeting electric drivetrain heat management.(Source: https://investor.owenscorning.com)

Temperature Resistance Insights

Why Did The 800°C To 1500°C Segment Dominate High High-Temperature Insulation Materials Market In 2024?

800°C to 1500°C segment dominates the market in 2024 due to its importance in common industrial operations like the production of glass powder and metal refining. Stable insulation in a range of conditions is provided by materials like ceramic fibres and calcium silicate. They are preferred by manufacturers due to their availability and longevity. Activities related to maintenance and retrofitting also fall into this category. This category of major insulation systems provides the best value in terms of cost-effectiveness.

Above 1500°C segment is expected to experience the fastest growth in the market during the forecast period, in response to the needs of the nuclear aerospace and specialty metallurgy industries. Nanomaterials and advanced ceramics are making it possible to create insulation solutions for operations involving extremely high heat. Even in oxidizing and corrosive environments, these materials retain their integrity. The growth of defence and space programs around the world is generating interest in this market. Innovation in material science technology also encourages adoption.

End User Industry Insights

Why Did The Power Generation Segment Dominate The High-Temperature Insulation Materials Market In 2024?

Power generation segment dominates the high-temperature insulation materials market in 2024 due to high heat applications, such a boilers, generators, and steam turbines, constantly requiring insulation. Insulation increases equipment longevity, lowers heat loss, and boosts system performance. High-temperature solutions are also being used by renewable thermal and combined cycle plants. Demand is being supported by upgrades to small plants and grid modernization. For power systems to meet sustainability goals, thermal insulation is essential.

- In June 2025, Luyang launched microporous H Board insulation for high-strength kiln applications in power and industrial sectors.(Source: https://www.luyangwool.com)

Petrochemicals & oil & gas segment expects the fastest growth in the market during the forecast period, due to refineries, LNG facilities, and chemical reactors operating at high temperatures. Insulation lowers risks, stops energy loss, and guarantees process stability. Businesses are investing in infrastructure that needs sophisticated thermal protection because of the growing demand for fuel worldwide. Insulation that withstands high temperatures guarantees security in unstable conditions. Insulation use is further accelerated by expanding offshore infrastructure and pipelines.

Form Insights

Why Did The Boards Segment Hold The Largest High-Temperature Insulation Materials Market Share In 2024?

Boards segment dominates the high-temperature insulation materials market in 2024, due to their resilience to physical wear, steady insulation value, and structural strength. They are frequently utilized in high-load settings and furnace lining, where rigid support is crucial. They meet a range of industry needs and come in different densities. They dominate the high-temperature insulation materials due to their superior compressive strength and thermal conductivity. For applications that require long-term use and dimensional accuracy, industries favor boards.

Blankets segment expects the fastest growth in the market during the forecast period, thanks to their flexibility, lightweight structure, and adaptability to complex equipment. They allow quick, non-invasive installation around ducts, pipes, and machines. Ideal for maintenance and temporary insulation, they reduce downtime and labour costs. Growing demand for modular systems in industrial retrofits boosts their appeal. The trend toward pre-engineered portable insulation kits is accelerating blanket usage.

Recent Developments

- In June 2025, Vulcan Shield Global exhibited its new ultra-high temperature alumina fibers at CAMX 2025 in Orlando, capable of withstanding up to 1,600 degrees, aimed at aerospace, turbine, and industrial furnace applications.(Source: https://www.compositesworld.com)

- In August 2024, PPG Industries officially launched PPG PITT-THERMA 909, a silicon-based spray-on insulation coating designed for oil and gas, petrochemical, and infrastructure sectors, built to endure continuous temperature up to 260 degrees, reduce corrosion under insulation, and allow safe-to-touch surfaces up to 150 degrees.(Source: https://news.ppg.com)

High-Temperature Insulation Materials Market Top Companies

- Rockwool International A/S

- Saint-Gobain

- Johns Manville (A Berkshire Hathaway Company)

- Knauf Insulation

- Owens Corning

- BASF SE

- Morgan Advanced Materials

- Unifrax

- Isolite Insulating Products Co., Ltd.

- RHI Magnesita

- Thermal Ceramics (A Morgan Advanced Materials Company)

- Beijing Hightemp Insulation Materials Co., Ltd.

- Tata Steel

- Harman International

- Huntsman Corporation

- Armacell International S.A.

- Promat International

- Lydall, Inc.

- Shandong Luyang Share Co., Ltd.

- Zircar Refractory Composites, Inc.

Segments Covered

By Type

- Fibrous Insulation Materials:

- Mineral Wool (Rock Wool, Slag Wool)

- Ceramic Fiber

- Glass Wool

- Rigid Insulation Materials:

- Calcium Silicate

- Insulating Firebrick (IFB)

- Perlite

- Flexible Insulation Materials:

- Blanket Insulation

- Fabric Insulation

- Other Types:

- Aerogels

- High-Temperature Foam

By Application

- Industrial Applications:

- Power Generation

- Petrochemical & Chemical Processing

- Cement Production

- Steel Manufacturing

- Glass & Ceramics

- Automotive Applications:

- Engine Insulation

- Exhaust Insulation

- Aerospace Applications:

- Heat Shields

- Jet Engine Components

- Energy Applications:

- Nuclear Power Plants

- Solar Thermal Power Systems

- Others

- Cryogenic Insulation

- Household Appliances

By Temperature Resistance Range

- Up to 800°C

- 800°C to 1500°C

- Above 1500°C

By End-Use Industry

- Power Generation

- Petrochemical & Oil & Gas

- Metallurgical

- Automotive

- Aerospace

- Chemical Processing

- Others (Construction, Marine, etc.)

By Form

- Blankets

- Boards

- Papers

- Pastes & Coatings

- Loose Fill Insulation

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia