Content

High-Performance Pigments Market Size and Share 2034

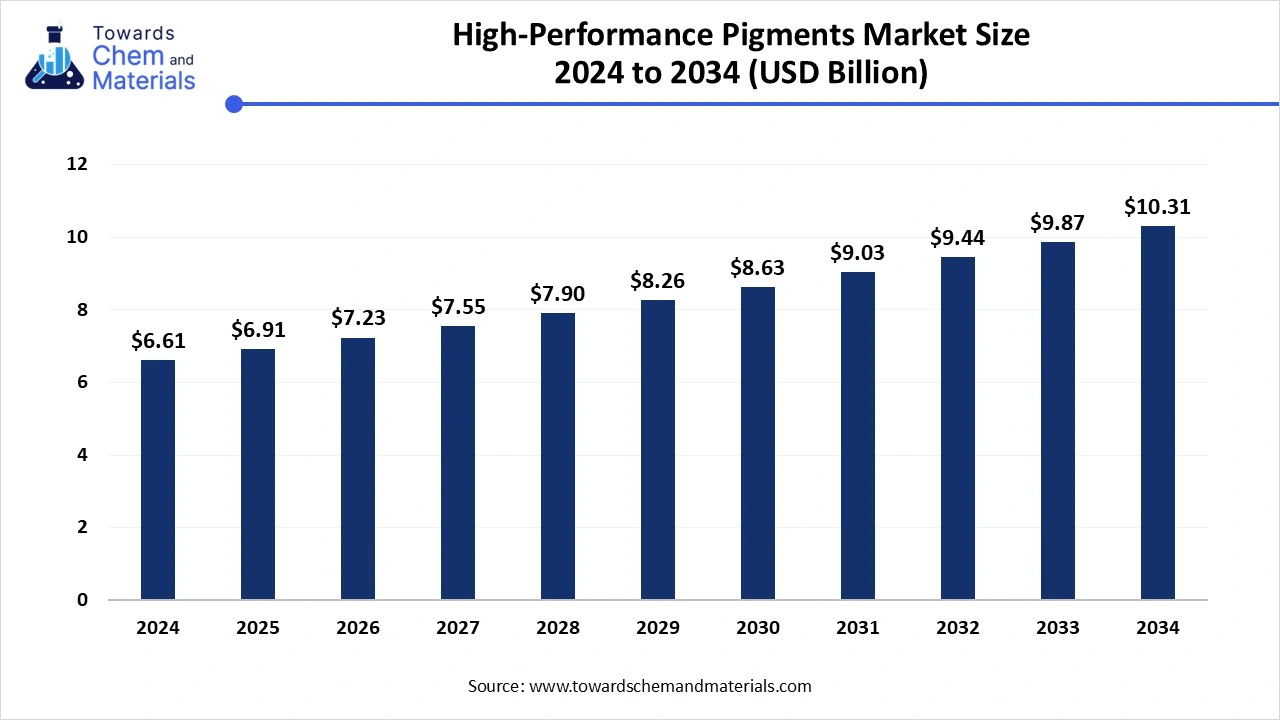

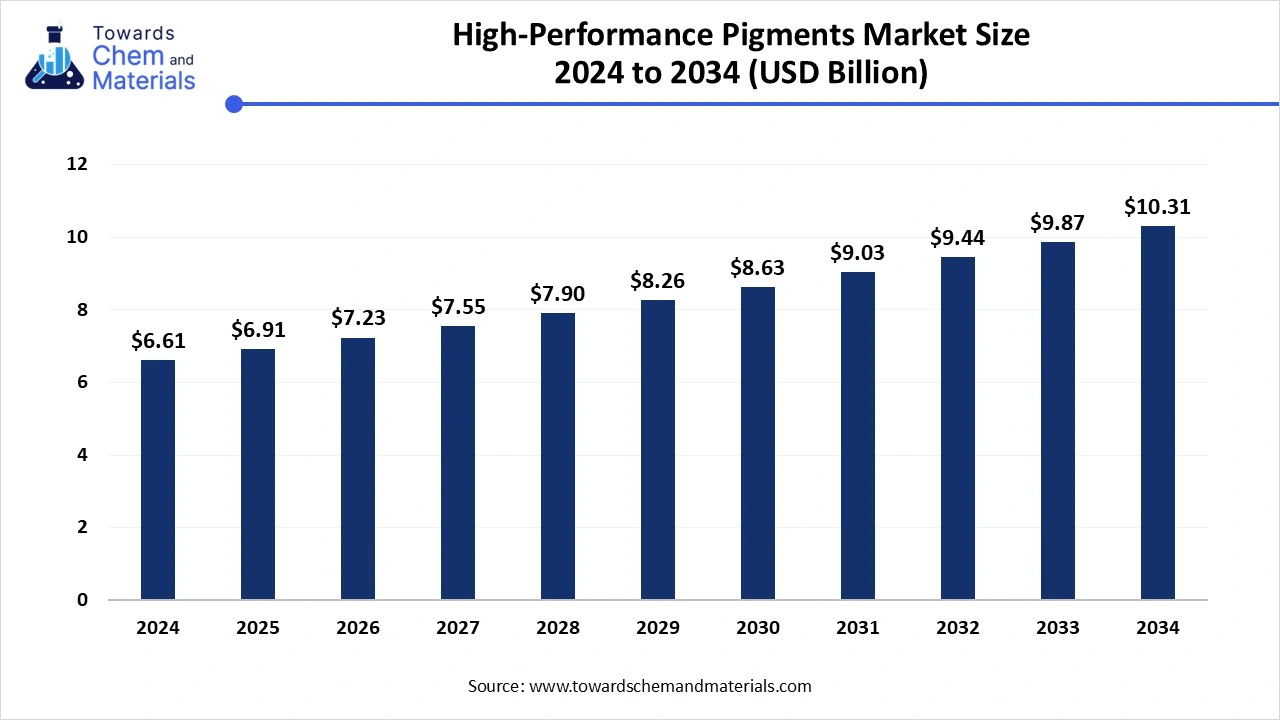

The global high-performance pigments market size was valued at USD 6.61 billion in 2024 and is growing to approximately USD 10.31 billion by 2034, with a developing compound annual growth rate (CAGR) of 4.55% over the forecast period 2025 to 2034. The expansion of the automotive and construction industries with technological.

High-Performance Pigments Market Key Takeaways

- Asia Pacific High-Performance pigments market size was estimated at USD 2.32 billion in 2024 and is projected to grow at a CAGR of 4.58% from 2025 to 2034.

- Asia Pacific dominates the high-Performance pigments market with the largest revenue share of 35.11% in 2024.

- The Europe has held revenue share of around 30.85% in 2024.

- By product type, the inorganic segment held the dominating share of 60.87% in 2024.the high-performance pigments market in 2024, akin to its properties such as durability, stability, and strength to face extreme weather conditions.

- By product type, The organic segment is expected to grow at the fastest CAGR of 4.98% over the forecast period.

- By application, the coating segment held the dominating share of 63.11% the high-performance pigments market in 2024, with an expansion of the automotive industry.

- By application, the plastic segment is expected to experience significant market growth in the future, attributed to increasing demand for affordable material in several industries.

High-Performance Pigments Market Overview

The high-performance pigments market has witnessed fast-paced growth in the recent period. The market growth is attributed to advancements in material science and increasing demand for durability in end-use industries in the current period. The high-performance pigments provide higher resistance to heat, chemicals, and light, which can make it a preferred solution for the various applications in end-use industries such as automotive, packaging, and others.

Moreover, major brands are seeking product longevity and material resilience; by fulfilling their demands, high-performance pigments gained major market traction over the years. Also, the need for lightweight material in automotive industries is heavily contributing to industry growth as automakers are seen in heavy usage of plastic, which is made up of high-performance plastic in the current period.

The expansion of the construction and infrastructure industry is driving the high-performance pigments market in the current period. The need for aesthetic appeal and durable materials are heavily contributing to the growth of the market. High-performance pigments are used in the architectural coatings for resisting fading in upcoming years, and these properties of HPP have gained market attraction in the construction industry nowadays.

Moreover, several developers are suing high-performance pigment for the exterior application owing to its excellent weather.

High-Performance Pigments Market Trends

- Increased need for coatings which is durable and can withstand harsh weather conditions in the automotive industry has been driving sector growth in recent years. Automotive developers are seen in applying attractive vehicle finishes in the current period. Thus, the high-performance pigments are an ideal solution for this attractive coating with exceptional resistance to heat, chemicals, and UV radiation in the current market conditions.

- Technological advancements in pigment technology have led to industry growth in recent years. Researchers are actively looking for product innovation that offers enhanced performance characteristics. Moreover, the development in dispersion and milling technologies is expected to contribute

- The sudden shift toward the sustainable pigment has been accelerating the market growth in recent years. Several governments are implementing stricter regulations against hazardous chemicals thus, the need for the alternative pigments is increased over traditional pigments. The manufacturers are actively investing in research and development programs to develop environment-friendly pigments that gain first-move advantage in the coming period.

High-Performance Pigments Market Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 6.91 Billion |

| Expected Size in 2034 | USD 10.31 Billion |

| Growth Rate | CAGR of 4.55% from 2025 to 2034 |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025-2034 |

| High Impact Region | Asia Pacific |

| Segment Covered | By Product, By Application, By Region |

| Key Companies Profiled | Sun Chemical,Clariant,BASF SE,Ferro Corporation,Vijay Chemical Industries,Meghmani Organics Ltd.,VOXCO India,Heubach GmbH,ALTANA AG, Trust Chem Co., Ltd.,Merck KGaA |

High-Performance Pigments Market Opportunity

Pigments Get a Glow-Up: Personal Care Boom Sparks New Market Frontiers

The expansion of the personal care and cosmetic industry is anticipated to create lucrative opportunities for high-performance pigment manufacturers in the coming years. The usage of pigments is heavily seen in products such as foundation, nail paints, and sunscreens nowadays.

By developing pigments that are sweat-proof, stable under sunlight, and nontoxic, the manufacturers can gain substantial market share during the forecast period. Furthermore, the trend toward vegan and clean-label beauty products is expected to lead to pigment sales in the coming years. Also, the pigment producer can make partnerships with personal care brands that help to extend their product marketing globally.

High-Performance Pigments Market Challenges

High Performance, Low Priority: Markets Shift Toward Cheaper Pigment Options

Rising use of the low-cost pigment alternative is projected to hinder market growth during the forecast period. In the less stringent environmental regulations of some countries, pigment manufacturers are seen in the bulk production of both organic and inorganic pigments at lower pricing compared to high-performance pigments.

Thus, industries such as paper, textile, and local automotive are actively looking for this type of cheap products that can hamper the high-performance pigments market growth during the forecast period.

High-Performance Pigments Market Regional Insights

Asia Pacific dominated the high-performance pigments market in 2024.

Having strong industrial base and innovation-driven chemical industries maintained regional dominance in the current market scenario. Moreover, countries such as China, India, Japan, and South Korea are considered the world's largest paint, plastics, and coating producers in recent years.

This growth is driven by increasing construction and infrastructural growth in the region. Also, the electronic and automotive industries have been contributing to the growth of pigment sales in recent years, as the automotive sector is seen in using advanced coloration with heat resistance in vehicle making to maintain the vehicle color formation long-lasting.

Global High-Performance Pigments Market Revenue, By Regional, 2024-2034 (USD Billion)

| By Regional | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

| North America | 1.52 | 1.58 | 1.65 | 1.71 | 1.78 | 1.86 | 1.93 | 2.01 | 2.09 | 2.18 | 2.27 |

| Europe | 1.78 | 1.85 | 1.92 | 1.99 | 2.07 | 2.15 | 2.23 | 2.31 | 2.40 | 2.49 | 2.58 |

| Asia-Pacific | 2.51 | 2.64 | 2.77 | 2.92 | 3.06 | 3.22 | 3.38 | 3.56 | 3.74 | 3.93 | 4.13 |

| Latin America | 0.40 | 0.42 | 0.44 | 0.46 | 0.49 | 0.52 | 0.54 | 0.57 | 0.60 | 0.64 | 0.67 |

| Middle East & Africa | 0.40 | 0.42 | 0.44 | 0.46 | 0.49 | 0.52 | 0.54 | 0.57 | 0.60 | 0.64 | 0.67 |

China’s Dual Strategy: Strong Domestic Base and Global Export Growth

The country has a strong domestic consumer base. Moreover, favorable government policies are encouraging manufacturers to produce high-end and sustainable pigments in China. Also, demand for the specialized coating for the aesthetic appeal in vehicle manufacturing is providing the enlarged consumer base for the market in recent years. Furthermore, the technology advances are set to revolutionize the pigment industry in China in the coming years. Also, the ongoing expansion of the automotive industry can create substantial growth opportunities in the country as per market observation

Europe is expected to dominate the high-performance pigments market in the coming period. The demand for sustainable and long-lasting color solutions is likely to drive market growth in the coming years in the region. Europe has a mature industry base that can contribute to pigment sales in the future. Organic pigments sis expected to have substantial growth opportunities in Europe, as the region has seen in implementing the strict regulations for hazardous chemicals in the current period.

Moreover, the initiatives like energy-efficient building and demand for the decorative coating are anticipated to lead regions dominance during forecast period. as developer are seen in usage of specialized coatings which have UV resistance and reflective pigment in the current market conditions.

The United Kingdom's Strategic Investments in R&D Accelerate High-Performance Pigment Adoption

The United Kingdom is expected to gain major market share during the forecast period. The increasing investments for research and development activities are likely to lead the country’s growth in the coming years.

Researchers are seen in the development of advanced pigment technologies, which include hybrid pigments and sustainable alternatives in recent years. Moreover, the expansion of the packaging industry and demand for sustainable packaging solutions can provide major market attraction to high-performance pigments in the coming years.

High-Performance Pigments Market Segmental Insights

By Product

The inorganic segment held the dominating share of the high-performance pigments market in 2024. Having durability, stability, and strength to face extreme weather conditions with economic advantages is a leading segment growth in the current period.

Moreover, inorganic pigments are highly resistant to heat, chemicals, and light, which makes them an ideal option for various industries such as architectural paints, automotive coatings, and industrial equipment in recent years. Also, by providing higher opacity than organic pigments, the inorganic pigment is gaining major market attraction in the current industry scenario.

The organic segment is expected to experience significant market growth in the future. The rising sustainability initiatives and need for strong colour strength are likely to drive segment growth during the forecast period.

Several industries are seeking pigments that can maintain consistent color quality over time withstand out in appearance, thus, the organic segment is likely to be raised as the ideal solution for these industries in the coming years. furthermore, major brands are seen in heavy promotion of ecofriendly materials which can create greater market environment for the organic pigment in future.

By Application

The coatings segment led the high-performance pigments market in 2024. The wide applications in many industries are leading the segment growth in the current period. By providing resistance to UV radiation, heat, and chemicals, the coating segment gained major market attraction in recent years.

Furthermore, the automotive industry has gained major market share in the current market scenario as demand for durable automotive paints and coating are increased. Also, the need for coating that provides aesthetic appeal and long-lasting protection of the architectural projects is leading to pigment sales growth in the present market conditions.

Global High-Performance Pigments Market Revenue, By Application, 2024-2034 (USD Billion)

| By Application | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

| Coating | 2.97 | 3.10 | 3.22 | 3.35 | 3.49 | 3.63 | 3.78 | 3.94 | 4.10 | 4.26 | 4.44 |

| Plastics | 1.32 | 1.39 | 1.47 | 1.54 | 1.63 | 1.71 | 1.80 | 1.90 | 2.00 | 2.11 | 2.22 |

| Inks | 1.65 | 1.72 | 1.79 | 1.87 | 1.94 | 2.02 | 2.11 | 2.19 | 2.28 | 2.38 | 2.48 |

| Cosmetics | 0.40 | 0.43 | 0.46 | 0.49 | 0.52 | 0.56 | 0.60 | 0.64 | 0.68 | 0.73 | 0.77 |

| Other | 0.26 | 0.28 | 0.29 | 0.30 | 0.32 | 0.33 | 0.35 | 0.36 | 0.38 | 0.39 | 0.41 |

This plastic segment is expected to grow at the fastest rate during the forecast period. The heavy use of colored and durable plastic products in several industries is likely to drive segment growth in the future. Having affordability and versatility is anticipated to lead to industry growth during the forecast period.

Furthermore, technological advancement in polymer processing can create a beneficial market environment for plastic producers in the coming years. Also, industries such as packaging and automotive are likely to provide a vast consumer base for the pigment industry in the future, akin to demand for premium and branded products and vehicles at the same time.

High-Performance Pigments Market Recent Developments

EMD Electronics

- Product Launch: In 2025, EMD Electronics introduced their latest high-performance metallic pigment called Ronaflux. This is a personal care pigment that is considered as metallic pigment without metals. The pigment acts as a chroma intensifier without diluting color

Crescent Chemicals

- Launch: In 2024, Cresent unveiled its latest product range of high-performance pigments with weathering properties. This pigment has good light fastness and is applicable for various paints and coatings, such as powder coating, digital inks, and automotive paints.

Lanxess

- Portfolio Expansion: In 2025, Lanxess announced the expansion of its pigment portfolio by introducing new pigment types. The company is ready to launch its latest type of pigment called micronized iron oxide yellow pigments with aims to minimize carbon footprints. This pigment can reduce carbon footprint by 35%.

High-Performance Pigments Market Top Companies List

- Sun Chemical

- Clariant

- BASF SE

- Ferro Corporation

- Vijay Chemical Industries

- Meghmani Organics Ltd.

- VOXCO India

- Heubach GmbH

- ALTANA AG

- Trust Chem Co., Ltd.

- Merck KGaA

Segments Covered in the report

By Product

- Organic

- Inorganic

By Application

- Coating

- Plastics

- Inks

- Cosmetics

- Other

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- Thailand

- Latin America

- Brazil

- Argentina

- The Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait