Content

Cosmetic Pigments Market Size and Growth 2025 to 2034

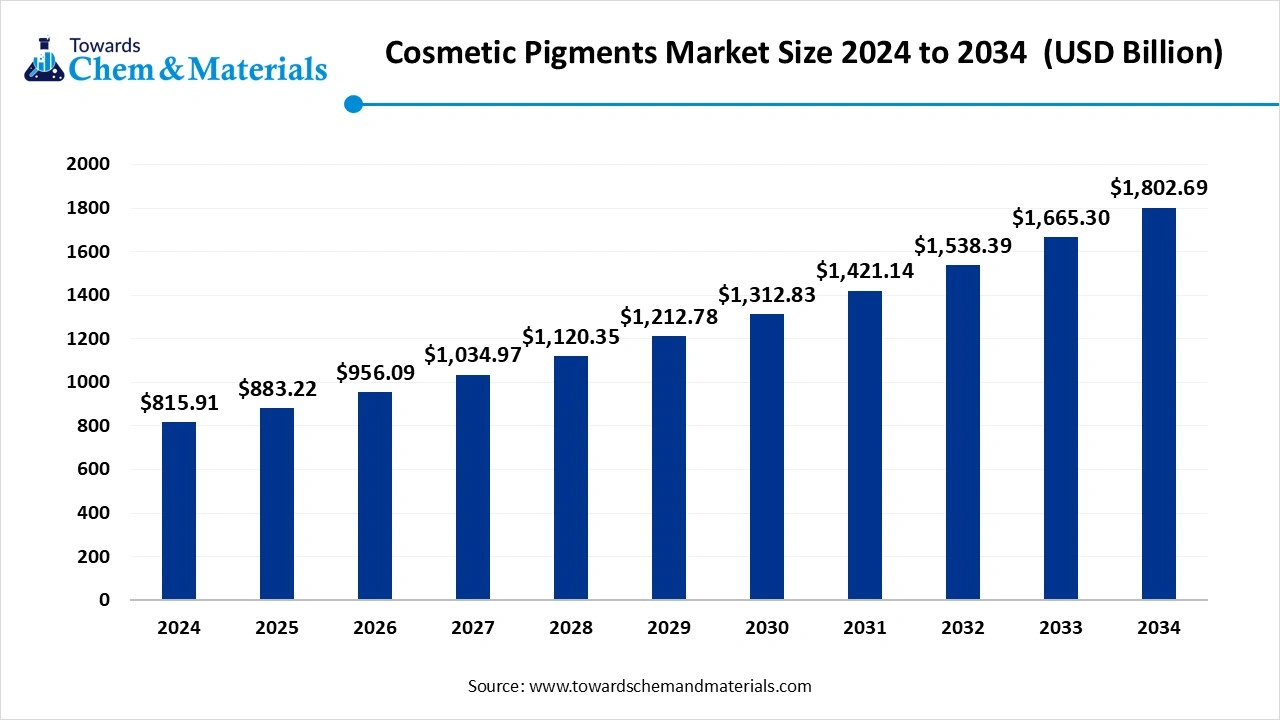

The global cosmetic pigments market size was reached at USD 815.91 billion in 2024 and is expected to be worth around USD 1,802.69 billion by 2034, growing at a compound annual growth rate (CAGR) of 8.25% over the forecast period 2025 to 2034. The rise in demand for organic products is the key factor driving market growth. Also, growing consumer awareness regarding product ingredients, coupled with the innovations in pigment technologies, can fuel market growth.

Key Takeaways

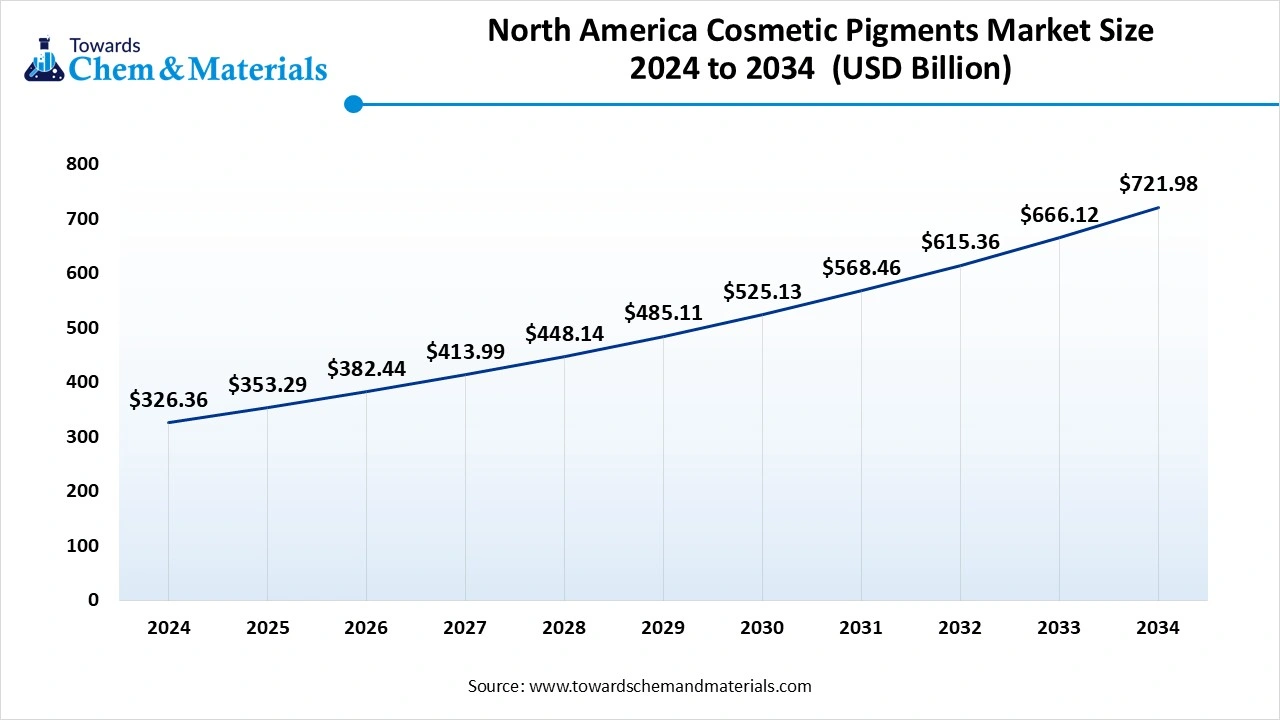

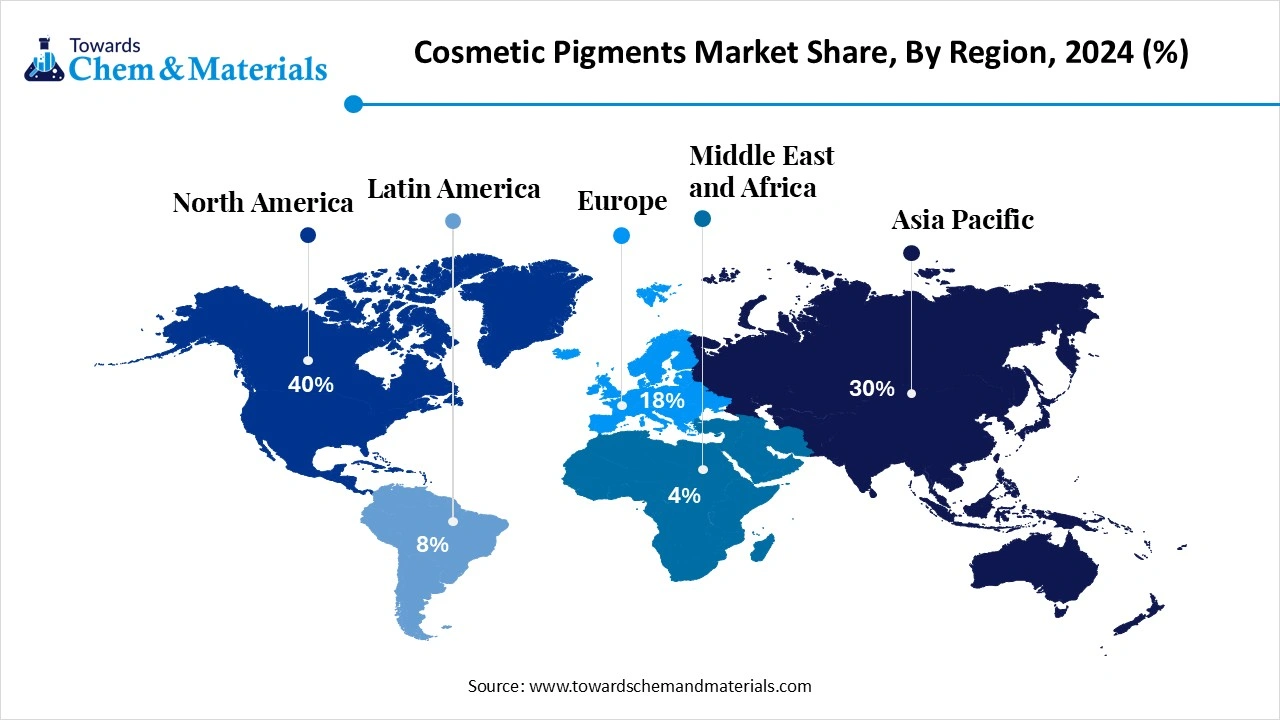

- By region, North America dominated the market with a 40% market share in 2024. The dominance of the segment can be attributed to the surge in demand for high-quality and cutting-edge cosmetic pigment products.

- By region, Asia Pacific is expected to grow at the fastest CAGR during the forecast period. The dominance of the region can be credited to the ongoing industrialization and the wide availability of raw materials.

- By type, the inorganic pigments segment held a 45% cosmetic pigments market share in 2024. The dominance of the segment can be attributed to the rising demand for inorganic pigments, like iron oxides and titanium dioxide, in the cosmetic sector.

- By type, the organic pigments segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to their vivid and bright color option, versatility, and compatibility with different formulations.

- By application, the facial makeup segment led the market by holding the largest market share of 30% in 2024. The dominance of the segment can be linked to the growing consumer demand for foundational products.

- By application, the lip products segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by the ongoing transition towards natural and organic alternatives.

- By pigment form, the powdered pigments segment held a 55% market share in 2024. The dominance of the segment is owed to the growing need for specialty and high-performance pigments.

- By pigment, the liquid pigments segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment is due to the growing demand for liquid makeup products.

- By end user industry, the cosmetics and personal care segment dominated the market with 85% market share in 2024. The dominance of the segment can be attributed to the rise in demand for high-performance pigments.

- By end user industry, the pharmaceuticals segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment can be credited to the rising demand for sustainable and natural ingredients.

- By distribution channel, the offline retail segment led the market by holding 65% market share in 2024. The dominance of the segment can be linked to the growing demand for color cosmetics and the growing preference for hands-on product experiences.

- By distribution channel, the online retail segment is expected to grow at the fastest CAGR during the study period. The growth of the segment can be driven by the growing popularity of online shopping and the rising beauty consciousness across the globe.

Technological Advancements are Expanding Market Growth

The Cosmetic Pigments Market refers to the segment of the cosmetics and personal care industry that is focused on the production, distribution, and usage of pigments used for coloring various cosmetic products. These pigments are primarily utilized in products like makeup (lipsticks, eyeshadows, foundations, etc.), skincare products, hair dyes, and nail polishes. These pigments are either organic or inorganic compounds, carefully selected to meet safety and aesthetic standards for use in the human body.

The market has witnessed significant growth due to the increasing demand for high-quality cosmetic products, advancements in pigment technology, and the rising popularity of cosmetic formulations with natural and sustainable ingredients. Advancements in pigment technology are playing a vital role in market growth soon.

What Are the Key Trends Influencing the Cosmetic Pigments Market?

- The ongoing shift towards sustainable and natural alternatives is the latest trend in the market, boosted by consumer preference for eco-conscious and clean-label products. The development of natural pigments derived from mineral, plant, or microbial origins is increasingly gaining traction during the forecast period.

- The surge in demand for personalization in cosmetic products through functional and customized pigment solutions is another trend propelling market expansion. Functional pigments provide added benefits like anti-aging, UV protection, and antimicrobial activity.

- The rapid innovations in pigment technology have facilitated the development of specialty pigments that provide special visual effects like iridescent and pearlescent finishes and color-shifting. Also, the demand for high-performance pigments that offer superior texture and long-lasting effects is impacting positive market growth.

Report Scope

| Report Attribute | Details |

| Market Size in 2025 | USD 883.22 Billion |

| Expected Size by 2034 | USD 1802.69 Billion |

| Growth Rate from 2025 to 2034 | CAGR 8.25% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | North America |

| Segment Covered | By Type, By Application, By Pigment Form,By End-user Industry, By Distribution Channel, By Region |

| Key Companies Profiled | BASF SE, Clariant AG, Lanxess AG, Kronos Worldwide Inc., Merck Group, Ferro Corporation, Sensient Technologies Corporation, Kleurvision Limited, Tata Chemicals Limited, Cabot Corporation, DIC Corporation, Evonik Industries AG, The Shepherd Color Company, Vibrantz Technologies, Sun Chemical Corporation, Applied Color Systems, Shenzhen Sincere Pigment Co. Ltd., Columbia Pigment Corporation, Imerys S.A., Antaria Limited |

Market Opportunity

Innovations in R&D Methods

Ongoing innovations in research and development, along with the advent of emerging technological trends, are creating lucrative opportunities in the market. Major players are rapidly investing in advanced technologies to design pigments that provide unique features like enhanced dispersion and improved color stability. Furthermore, these advancements further optimize the development of multifunctional pigments, which can be customized for different applications.

- In February 2025, EMD Electronics introduced Ronaflux® cosmetic pigments, the latest and trendiest highly functional metallic pigments without metals. These pigments are a stable formulation that does not fade over time.(Source: cosmeticsbusiness.com)

Market Challenges

Regulatory Complexity and Compliance

Different countries have more diverse and changing regulations for cosmetic ingredients like pigments, which is the major factor hindering market growth. This complexity necessitates substantial investment in R&D to fulfil this extensive demand to stay compliant. Moreover, supply chain disruptions can also affect the affordability and availability of key ingredients, which leads to quality inconsistencies, negatively impacting market growth.

Regional Insight

The North America cosmetic pigments market size was estimated at USD 326.36 billion in 2024 and is anticipated to reach USD 721.98 billion by 2034, growing at a CAGR of 8.26% from 2025 to 2034. North America dominated the cosmetic pigments market with a 40% market share in 2024.

The dominance of the segment can be attributed to the surge in demand for high-quality cutting-edge cosmetic pigment products that give colors that are both long-lasting and bright. In addition, the strong presence of major cosmetic brands and an extensive consumer base provides a robust regulatory environment that boosts consumer confidence and innovation.

Cosmetic Pigments Market in the U.S.

In North America, the U.S. dominated the market by holding the largest market share due to rapid innovations in pigment technology and a surge in demand for color cosmetics. The U.S. has a strong regulatory environment for cosmetic products, such as FDA regulations, which facilitates innovation and the use of safe and high-quality pigments, contributing to further positive market expansion.

Asia Pacific is expected to grow at the fastest CAGR during the forecast period. The dominance of the region can be credited to the ongoing industrialization and wide availability of raw materials, coupled with the expansion of the personal care sector. Furthermore, the e region's rapid commercialization and industrialization, particularly in the personal care sector, are anticipated to further increase the use of inorganic cosmetic pigments over the projected period.

Cosmetic Pigments Market in China

In the Asia Pacific, China led the market due to the expanding cosmetic sector, increasing disposable incomes, and the changing consumer preferences for organic and premium products. Also, E-commerce platforms such as JD.com and Tmall are playing a significant role in growing the reach of cosmetic brands to a wider consumer base.

Who are the Top Cosmetic Exporting Countries in 2024-25?

| Country | Exports in billions |

| France | $12.20 billion |

| South Korea | $8.57 billion |

| USA | $6.19 billion |

| Singapore | $4.92 billion |

| Germany | $4.77 billion |

Segmental Insight

Type Insight

Which Type Segment Dominated the Cosmetic Pigments Market in 2024?

The inorganic pigments segment held a 45% market share in 2024. The dominance of the segment can be attributed to the rising demand for inorganic pigments, like iron oxides and titanium dioxide, in the cosmetic sector because of their exceptional color opacity, stability, and UV protection properties. Inorganic pigments such as titanium dioxide and iron oxides are highly resistant to light, heat, and chemical degradation, which makes them crucial for long-lasting cosmetic formulations.

The organic pigments segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to its vivid and bright color options, versatility, and compatibility with different formulations. Moreover, Organic pigments are extracted from carbon-based molecules recognised for their vibrant colors, making them a convenient choice for cosmetic applications like eyeliners, lipsticks, and nail polishes.

Application Insight

Why Did the Facial Makeup Segment Held the Largest Cosmetic Pigments Market Share in 2024?

The facial makeup segment dominated the market by holding the largest market share of 30% in 2024. The dominance of the segment can be linked to the growing consumer demand for foundational products such as concealers, blushes, and other foundations. Continuous advancements in pigment technologies, including new materials and colorants with enhanced performance, lead to more long-lasting, vibrant, and skin-friendly makeup products.

The lip products segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by the ongoing transition towards natural and organic alternatives and innovations in pigment technology. Additionally, the cosmetic sector is increasingly becoming more inclusive with a surge in demand for products that are specific to a wide range of undertones and skin skintones, driving segment growth shortly.

Pigment Form Insight

How Much Share Did the Powdered Segment Held in 2024?

The powdered pigments segment held a 55% market share in 2024. The dominance of the segment is owed to the growing need for specialty and high-performance pigments and the rapid expansion of the entertainment and fashion industries. Furthermore, a surge in the trend towards men's grooming and the adoption of advanced technologies by manufacturers can fuel segment growth soon.

The liquid pigments segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment is due to growing demand for liquid makeup products such as concealers and foundations, along with the surge in popularity of a special type of cosmetic product. In addition, growing consumer preference for organic and natural cosmetics is contributing to segment expansion in the near future.

End-User Industry Insight

Which End-User Industry Segment Dominated the Cosmetic Pigments Market in 2024?

The cosmetics and personal care segment dominated the market with an 85% market share in 2024. The dominance of the segment can be attributed to the rise in demand for high-performance pigments coupled with the ongoing R&D efforts for the creation of new and enhanced pigments, improving the aesthetic appeal and performance of cosmetic products, leading to further segment growth.

The pharmaceuticals segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment can be credited to the rising demand for sustainable and natural ingredients and rapid innovations in pigment technology, which have led to the development of new pigments with improved dispersion, enhanced color stability, and better compatibility with different formulations.

Distribution Channel Insight

Why Offline Retail Segment Dominated the Cosmetic Pigments Market in 2024?

The offline retail segment dominated the market by holding 65% market share in 2024. The dominance of the segment can be linked to the growing demand for color cosmetics and the growing preference for hands-on product experiences. Also, offline retail environments can help to build brand trust and awareness, especially for niche or new brands that may benefit from their capability to showcase their products directly to consumers.

The online retail segment is expected to grow at the fastest CAGR during the study period. The growth of the segment can be driven by the growing popularity of online shopping and the rising beauty consciousness across the globe. Moreover, the convenience and accessibility of online platforms have substantially contributed to the growth of the segment further.

Recent Developments

- In October 2024, YÊU Cosmetics introduced a science-backed beauty for every skin type. YÊU has unveiled two products, a lip duo and a blush, which are vegan, free of artificial fragrances, parabens, and sulfates. Each product is catered with a skin-first approach.(Source: professionalbeauty.in)

Cosmetic Pigments Market Top Companies

- BASF SE

- Clariant AG

- Lanxess AG

- Kronos Worldwide Inc.

- Merck Group

- Ferro Corporation

- Sensient Technologies Corporation

- Kleurvision Limited

- Tata Chemicals Limited

- Cabot Corporation

- DIC Corporation

- Evonik Industries AG

- The Shepherd Color Company

- Vibrantz Technologies

- Sun Chemical Corporation

- Applied Color Systems

- Shenzhen Sincere Pigment Co. Ltd.

- Columbia Pigment Corporation

- Imerys S.A.

- Antaria Limited

Segments Covered

By Type:

- Organic Pigments

- Azo Pigments

- Quinacridone Pigments

- Phthalocyanine Pigments

- Others (Anthraquinone, etc.)

- Inorganic Pigments

- Titanium Dioxide

- Iron Oxides

- Ultramarine Pigments

- Chromium Oxide Pigments

- Others (Mica-based Pigments, Zinc Oxide, etc.)

By Application:

- Facial Makeup

- Foundations

- Concealers

- Blush

- Highlighters

- Others (Primers, etc.)

- Eye Makeup

- Eyeliners

- Eyeshadows

- Mascara

- Lip Products

- Lipsticks

- Lip Gloss

- Lip Liners

- Nail Products

- Nail Polishes

- Nail Art

- Hair Care Products

- Hair Dyes

- Temporary Hair Color Sprays

- Skin Care Products

- Creams & Lotions

- Sunscreens

- Tinted Moisturizers

- Others

- Body Paints

- Special Effects Makeup

By Pigment Form:

- Powdered Pigments

- Loose Pigments

- Pressed Pigments

- Liquid Pigments

- Water-based

- Oil-based

- Paste Pigments

By End-user Industry:

- Cosmetics and Personal Care

- Pharmaceuticals

- Food and Beverages (used in edible cosmetics or for decorative products)

- Others (e.g., Specialty Industrial Applications)

By Distribution Channel:

- Online Retail

- Offline Retail

- Supermarkets and Hypermarkets

- Specialty Stores

- Pharmacies and Drugstores

- Beauty and Cosmetics Stores

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait