Content

Generative AI in Chemical Market Size and Growth 2025 to 2034

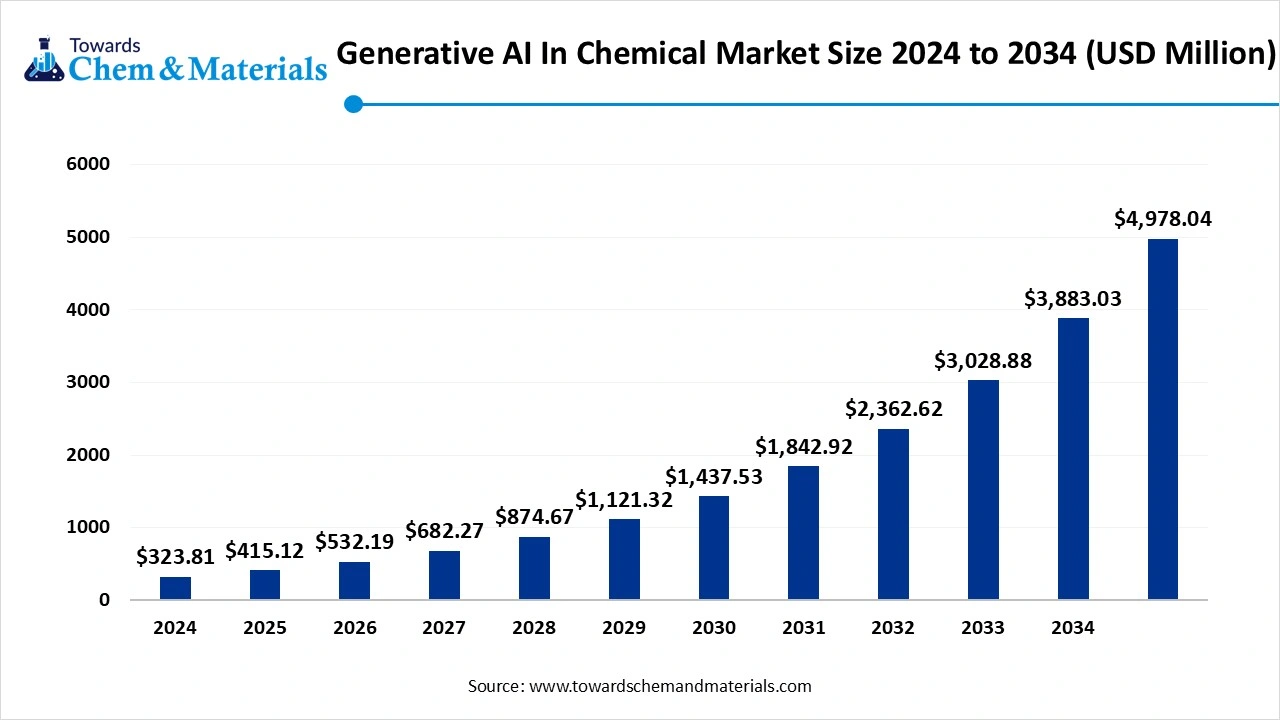

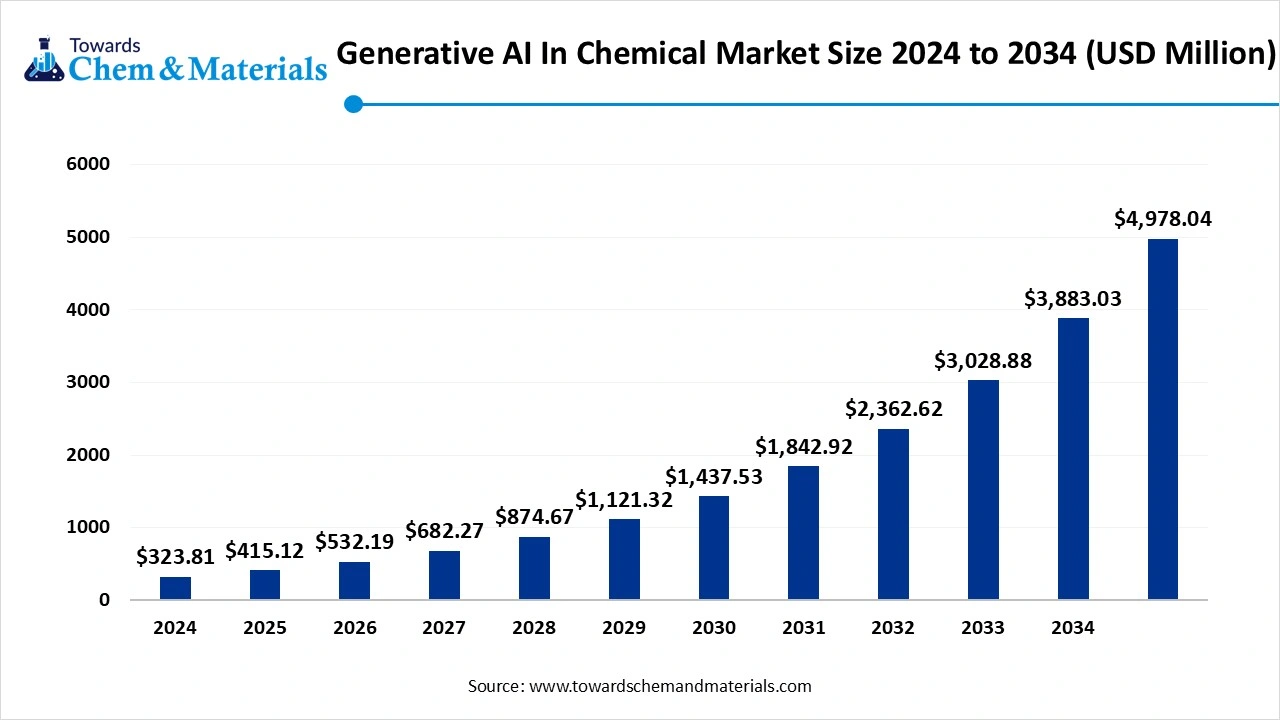

The global generative AI in chemical market size is calculated at USD 323.81 billion in 2024, grew to USD 415.12 billion in 2025 and is predicted to hit around USD 4,978.04 billion by 2034, expanding at healthy CAGR of 28.20% between 2025 and 2034. Booming research and development sector and rising need for manufacturing optimization, drive the market of market.

Key Takeaways

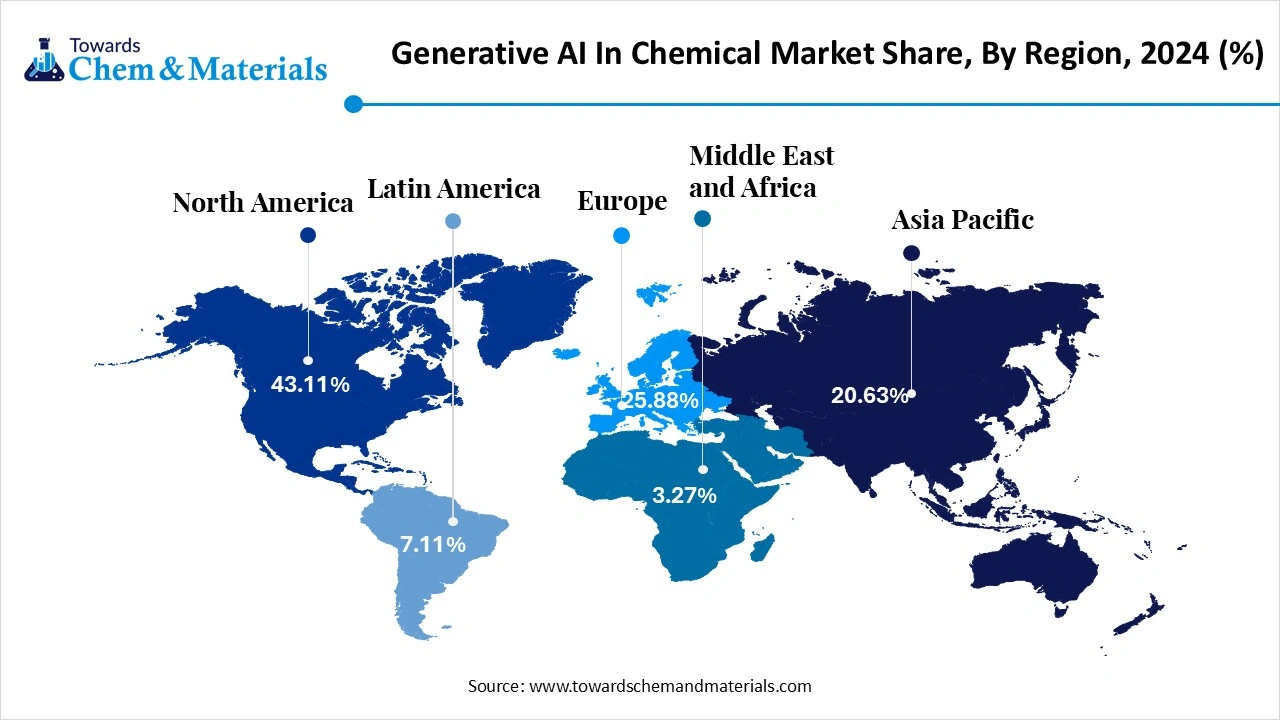

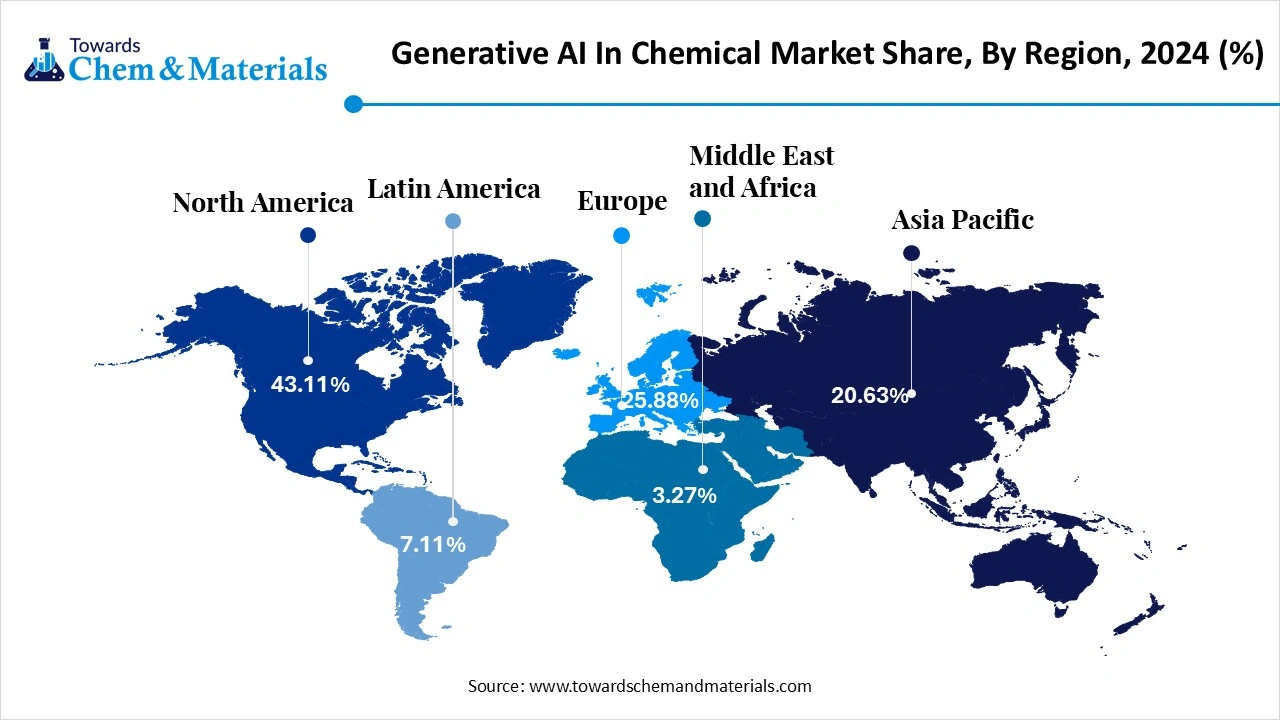

- By region, North America dominated market in 2024, attributed to strong technological infrastructure, growing innovation ecosystem, and supportive government policies.

- By region, Asia Pacific expects significant growth in market during the forecast period, attributed to strong industrial growth and rising investment in technology.

- By technology, machine learning segment held the dominating share of generative AI in chemical market in 2024, due to its versatility and efficiency in analyzing large datasets and making accurate prediction.

- By technology, deep learning observed to grow at the fastest rate during the forecast period due to its ability to analyze large datasets, and make accurate prediction.

- By application, molecular design and drug discovery segment held the dominating share of market in 2024, due to strong ability of generative AI model to generate novel molecule and optimize drug development efficiency.

- By application, process optimization and chemical engineering segment observed to grow at the fastest rate during the forecast period, due to AI ability to automate task and accelerate innovation, leads sustainable and efficient chemical processes.

Rising Demand for Generative AI in Applications Like Research and Development & Identifying New Applications for Existing Chemicals

Accelerate the Market Expansion

The generative AI is the use of artificial intelligence algorithms to design, optimize, and generate new chemical compounds, materials, and processes. It uses machine learning to learn about the chemicals and biological information, accelerate the research and development, and driving innovation. AI model can be used to predict the efficacy and safety of new molecule, reduces the time and cost and improve the drug development rate. They are widely used to design novel materials with properties like higher strength, improved conductivity, and increases advancement in industries. AI algorithms can analyze real time data from chemical processes and optimize parameters like temperature, pressure, and flow rates, improves efficiency and reduce waste, further drives the generative AI in chemical market.

Market Trends

- Application in R&D, Generative AI is widely used in R& D for discovery of new materials, optimizing existing processes and driving innovation, contributes to market growth. By using AI model researcher can analyze vast datasets and design novel molecules and materials. It is also used to predict the outcomes of chemical reactions and identify optimal reaction conditions, boost the generative AI in chemical market.

- Technology advancement, By automating task like virtual screening and molecular modeling generative Ai is reduces time and boost the research and development. Generative Ai is also used in process optimization, improves the quality and improves the predictive maintenance, further reduces waste and increases efficiency. Advancement including the personalize solution offer tailored products and services, further enhances customer experience and drive the market.

- Rising focus on sustainability, Generative AI can optimize production process, reduces waste, and enhances energy efficiency, leads to more sustainable manufacturing practice. AI can be used to design the product that are easier to recycle and repurpose, reduces the environmental impact, and further drives the generative AI in chemical market.

Market Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 415.12 Billion |

| Expected Size by 2034 | USD 4,978.04 Billion |

| Growth Rate from 2025 to 2034 | CAGR 28.20% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| High Impact Region | North America |

| Segment Covered | By Technology, By Application, By Region |

| Key Companies Profiled | IBM Corporation, Google, Mitsui Chemicals, Accenture, Azelis Group NV, Tricon Energy Inc., Biesterfeld AG, Omya AG, HELM AG, Sinochem Corporation, Other |

Market Opportunities

Material Discovery and Development

Generative AI offers significant market opportunities in chemical material discovery and development by accelerating the process, optimizing properties, and enhancing sustainability. AI can be used to optimize the properties of materials, such as energy density, mechanical strength and stability. It is also used to design the molecule with specific functionability, allow developing the novel material in various applications. By automating parts of the R&D process and speeding up discovery, generative AI can reduce the time and cost associated with traditional methods. AI is also used design of new materials with improved performance, such as those for energy storage, catalysis, and advanced composites, shows future generative AI in chemical market opportunities.

Process Optimization

Generative AI offers significant process optimization opportunities in the chemical industry by accelerating research and development, optimizing material properties. Generative AI can be used to design materials with enhanced properties, including the increased energy density, improved mechanical strength, or enhanced recyclability. AI can analyze data from sensors and control systems to predict equipment failures and optimize maintenance schedules which reduces downtime and improving operational efficiency. Additionally Generative AI can help optimize logistics, reduce inventory costs, and improve overall supply chain efficiency, shows future market opportunities.

Market Challenge

High Initial Investment and Complexity of Implementation

The high initial investment and complex implementation of generative AI pose significant challenge to its adoption in the chemical industry. Building and maintance is necessary for AI infrastructure including the hardware and software, can be expensive. Implementation of AI requires the skilled person including data scientist and AI engineer, which can be costly, further limits the market .Integrating AI solutions into legacy system can be complex, requires the careful planning and implementation, further limits the market.

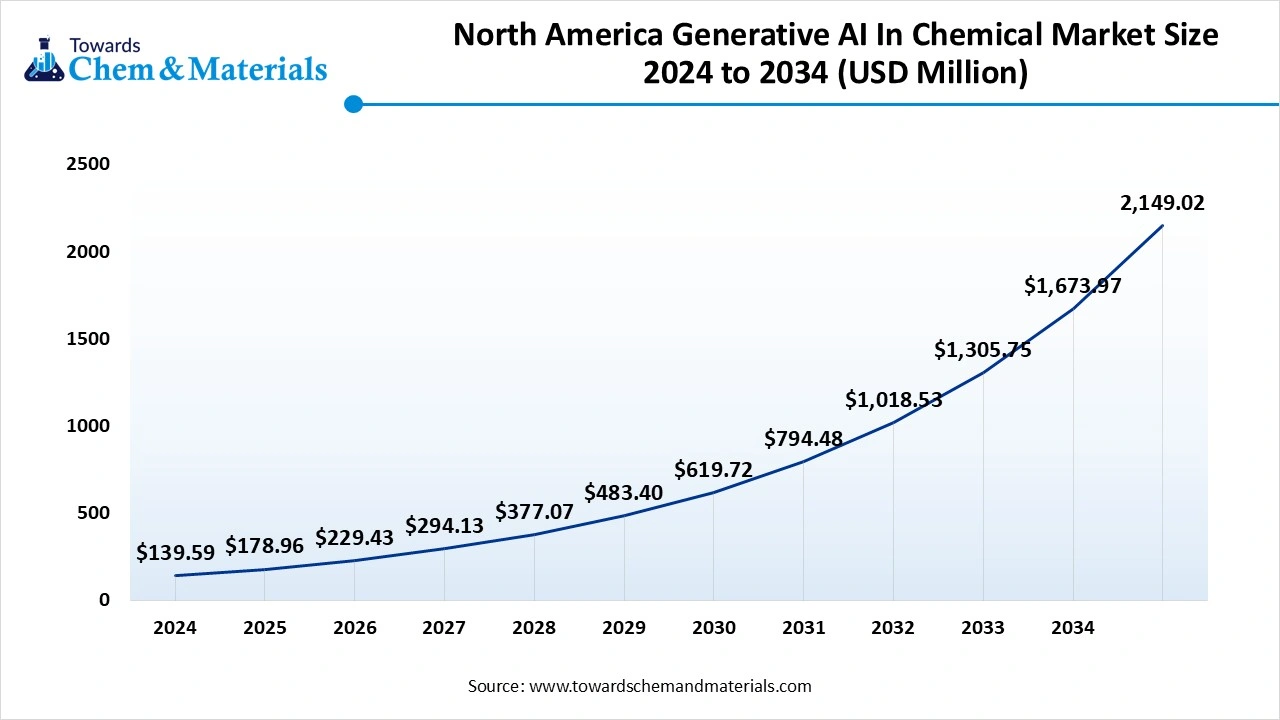

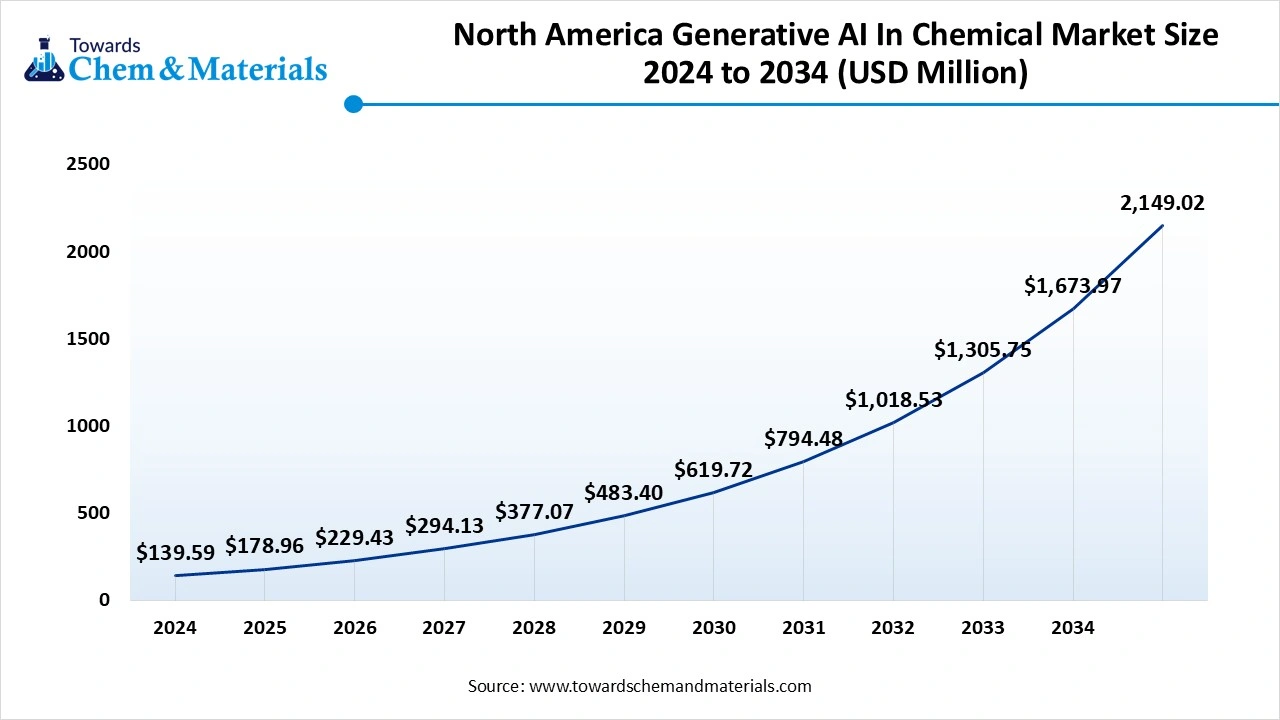

Regional Insights

The North America generative AI in chemical market size was valued at USD 139.59 million in 2024 and is expected to be worth around USD 2,149.02 million by 2034, growing at a compound annual growth rate (CAGR) of 31.44% over the forecast period 2025 to 2034. North America dominated generative AI in chemical market in 2024.

Strong technological infrastructure, growing innovation ecosystem, and supportive government policies, contribute to drive the market. North America has strong ecosystem and various technology companies, research institutes, fuels the growth. Well developed technological infrastructure, including high speed internet and cloud computing, facilitate development of AI solutions. North America is the major hub of AI research and development along with significant investment from both government and private sources. Well skilled workforce in AI including engineers, scientist, and researcher contribute to drive the market across this region. Supportive government policies and regulatory framework in North America is showing business friendly environment for Ai innovation and adoption. Robust chemical companies in North America, drive the demand for generative AI solution. Growth of the pharmaceutical and chemical manufacturing sectors in North America further demands AI driven solutions.

- For Instances, In November 2023, Accenture announced that they will launch a network of Generative AI studios in North America to help companies explore how to optimize and reinvent their businesses using generative AI applications responsibly. These studios will be located in cities like San Francisco, Toronto, and Washington D.C., and will offer specialized expertise in various industries and function. (Source: newsroom)

Asia pacific expects significant growth in generative AI in chemical market during the forecast period. Strong industrial growth and rising investment in technology contribute to market growth across this region. The robust industrial growth in Asia-Pacific, particularly in countries like China and India, is driving the need for more efficient and scalable production. Booming chemical industry is increasing need to optimize operations, reduce costs, and enhance product quality. Generative AI offers unique opportunities for innovation, efficiency, and competitiveness within these sectors, boost the market. Various government initiatives are encouraging companies o adopt AI technologies and explore the potential. Asia-Pacific countries are also exploring AI for new material development to support their technology sectors.

Segmental Insights

Type Insights

The machine learning segment held the dominating share of generative AI in chemical market in 2024 due to its versatility and efficiency in analyzing large datasets and making accurate prediction. Machine learning algorithms are widely used in processing and understanding complex datasets allows identification of relationship in chemical processes. These algorithms can be trained to predict outcomes and improve the efficiency of chemical reaction and processes. The chemical industry is increasingly adopting machine learning across various stages of its operation, which includes R&D, manufacturing, contribute to dominate the market of this segment. Machine learning is widely used in various stages of the chemical industry, from research and development to production and quality assurance, driving the market. It is also integrated with other technologies like quantum computing and reinforcement learning, opening doors for material discovery and process optimization, boosts the market

The deep learning segment observed to grow at the fastest rate during the forecast period due to its ability to analyze large datasets and make accurate prediction. Deep learning is the subset of machine learning which uses artificial neural network to learn from the data, which is important for optimizing chemical process and enhancing quality control. Deep learning is used for various application including the predictive maintance, process optimization, material discovery, and drug discovery. Deep learning has various advantages including the data analysis, pattern recognition, automation; contribute to increase market growth of this segment.

Application Insights

The molecular design and drug discovery segment held the dominating share of generative AI in chemical market in 2024. Generative AI model can generate novel molecules with desired properties, optimize the drug development efficiency. Generative AI is widely used in learning vast chemical and biological datasets to predict and optimize molecular structure. By minimizing the need for extensive lab experiment, it reduces overall cost of drug development. Generative AI used in the optimization of chemical properties of molecule for improved efficacy, safety, and bioavailibity. It is used in tailoring compounds to specific biological targets, allows more personalized drug design. Generative AI can be used to identify potential drug candidates, improves drug discovery process, reduces cost and further boost the market.

The process optimization and chemical engineering segment observed to grow at the fastest rate during the forecast period. AI can automate task, improve decision making, and accelerate innovation, leads sustainable and efficient chemical processes. AI can analyze vast amounts of data from chemical processes by identifying patterns which enhanced efficiency. It is also used to analyze sensor data and predict equipment failures, which maintain and minimize e downtime and cost. AI can used to design novel material with specific properties, leads to improve and improves discovery of new materials and processing, further boost the market.

Recent Developments

- In March 2023, Mitsui Chemicals and IBM Japan have successfully used a combination of Generative Pre-trained Transformer (GPT) through Microsoft Azure OpenAI and IBM Watson to achieve three key outcomes: increased agility and accuracy in discovering new applications for their products. Specifically, this has led to doubling the number of new applications discovered, increased the efficiency of keyword extraction, and accelerated the process of identifying new uses for their products (Source: jpmitsuichemicals)

- In September 2023, NobleAI announced its Science-Based AI solutions for chemical and material informatics on the Microsoft Azure Marketplace. These solutions, including Noble Reactor, NobleBattery, and Noble Chemistry, are designed to help chemical, materials, and energy companies reduce costs and accelerate product development.

(Source: globenewswire) - In December 2024, ABB launched Genix Copilot in collaboration with Microsoft. This solution aims to provide real-time, actionable insights across industrial organizations, leveraging large language models like GPT-4. It is designed to enhance user experience, facilitate collaboration, and enable data-driven decision-making. (Source: newabb )

Top Companies List

- IBM Corporation

- Mitsui Chemicals

- Accenture

- Azelis Group NV

- Tricon Energy Inc.

- Biesterfeld AG

- Omya AG

- HELM AG

- Sinochem Corporation

- Other Key Players

Segments Covered in the Report

By Technology

- Machine Learning

- Deep Learning

- Generative Models (GAN & VAE)

- Quantum Computing

- Reinforcement Learning

- Natural Language Processing (NLP)

- Others

By Application

- Molecular Design and Drug Discovery

- Process Optimization and Chemical Engineering

- Market Trend Analysis & Pricing Optimization

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait