Content

What is the Current Defoamers Market Size and Share?

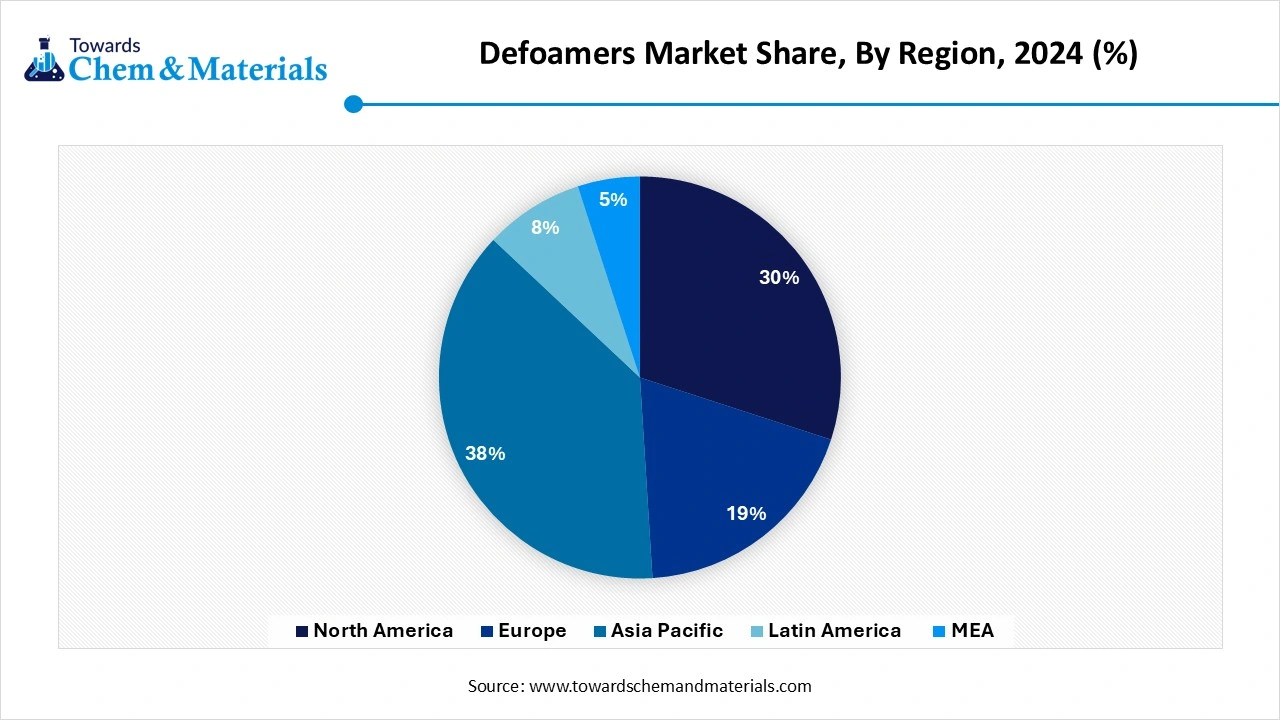

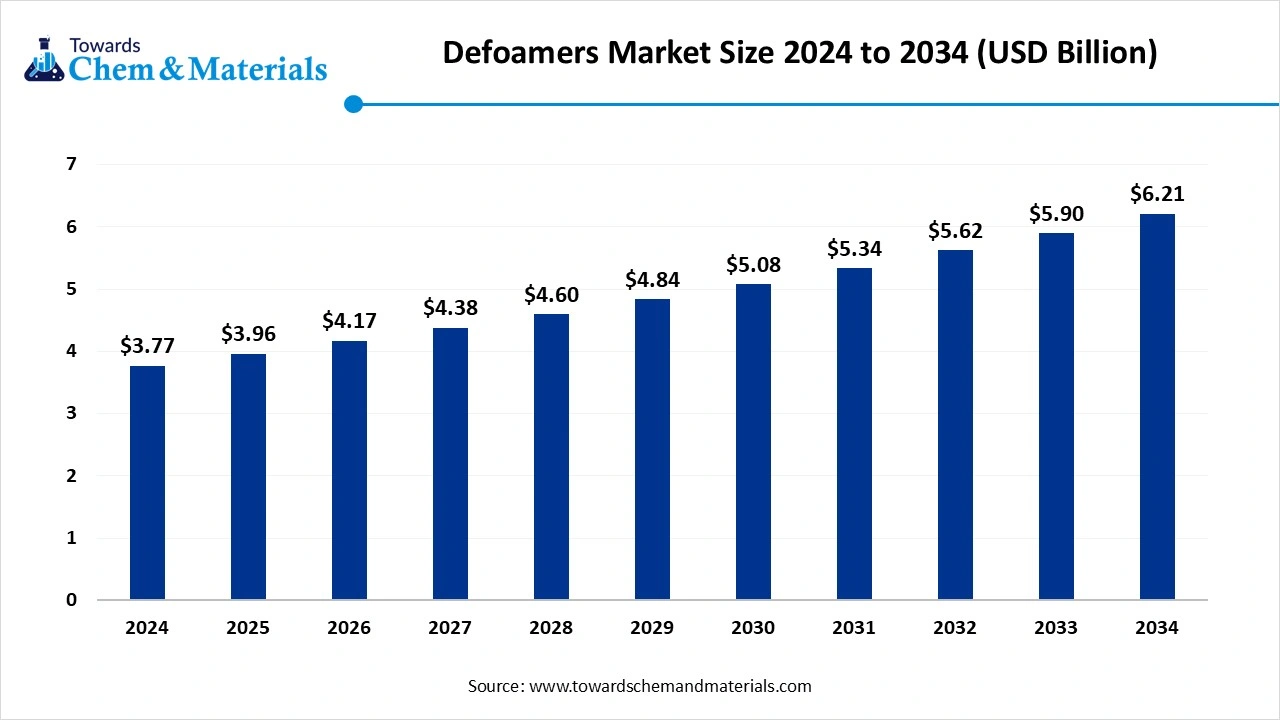

The global defoamers market size was 3.96 billion in 2025 and is predicted to increase from USD 4.12 billion in 2026 and is expected to be worth around USD 5.84 billion by 2035, growing at a CAGR of 5.11% from 2026 to 2035. Asia Pacific dominated the defoamers market with the largest revenue share of 39% in 2025. The increasing demand for agrochemicals globally is the key factor driving market growth. Also, a surge in the need for wastewater treatment, coupled with the rising preference for sustainable defoamers, can fuel market growth further

Key Takeaways

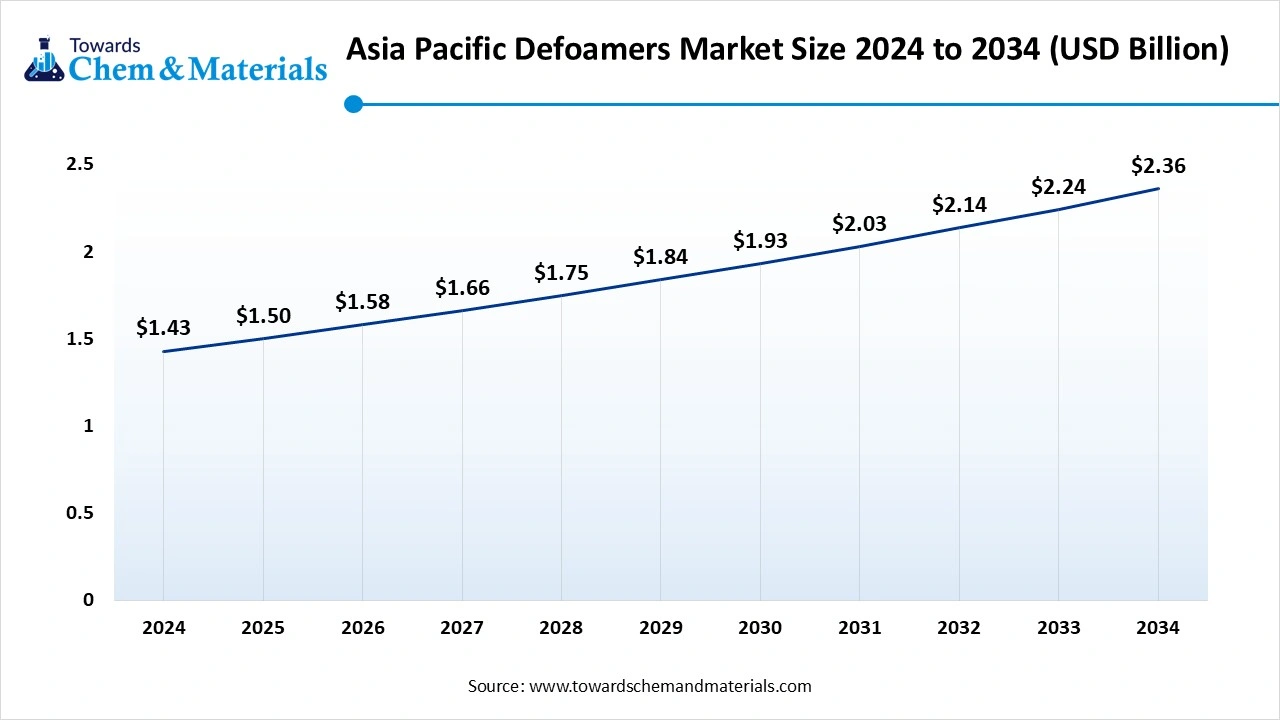

- Asia Pacific defoamers market held the largest revenue share of 39% in 2025.

- By region, North America is expected to grow at a significant CAGR over the forecast period. The growth of the region can be driven by stringent environmental regulations and ongoing technological advancements.

- By type, the silicone-based defoamers segment dominated the market and accounted for the largest revenue share of 36% in 2025.

- By type, the polyether siloxane-based defoamers segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the surge in industrial production.

- By medium, the emulsion-based segment led the market with the largest revenue share of 41% in 2025.

- By application industry, the pulp & paper segment dominated the market and accounted for the largest revenue share of 25% in 2025.

- By function, the surface foam suppression segment led the market with the largest revenue share of 46% in 2025.

- By distribution channel, the direct sales segment dominated the market and accounted for the largest revenue share of 56% in 2025.

- By formulation compatibility, the aqueous systems segment dominated the market by holding 61% market share in 2025.

Technological Advancements in the Sector are Expanding Market Growth

Defoamers, also known as anti-foaming agents, are chemical additives that reduce and hinder the formation of foam in industrial process liquids. Foam can cause defects in surface coatings, hinder processing capacity, or result in poor product quality. Defoamers are used across multiple industries, including paints & coatings, food & beverages, water treatment, and pulp & paper, among others. Growing demand in sectors such as pulp & paper, oil & gas, paints & coatings, and pharmaceuticals is positively impacting market growth.

What Are the Key Trends Influencing the Defoamers Market?

- The rise in demand for crude oil globally is anticipated to fuel the global market expansion and is the latest trend in the market. Oil and Gas are among the largest energy resources; therefore, it becomes crucial to distribute and use crude oil in an efficient and productive way.

- Ongoing industrialization is another major factor driving market growth. The expansion of industrial sectors in different countries leads to the growth in production activities to offer textiles, food, automotive, and other products. Also, developing countries are witnessing substantial growth over the forecast period.

- The growing demand for defoamers in water treatment is another trend boosting market growth, suggesting an increasing need for convenient foam regulation in various water management procedures. Water treatment facilities in both municipal and industrial arenas aim to increase their efficiency to maintain high water quality.

Report Scope

| Report Attributes | Details |

| Market Size and Volume in 2026 | USD 3.96 Billion |

| Expected Size by 2035 | USD 5.84 Billion |

| Growth rate from 2025 to 2035 | CAGR 5.11% |

| Base Year of Estimation | 2025 |

| Forecast Period | 2026 - 2035 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Type, By Medium/Formulation, By Application Industry, By Function, By Distribution Channel, By End-Use Formulation Compatibility, By Region |

| Key Profiled Companies | BASF SE, Evonik Industries AG, Dow Inc., Kemira Oyj, Shin-Etsu Chemical Co., Ltd., Air Products and Chemicals, Inc., Ashland Global Holdings Inc., Clariant AG, Wacker Chemie AG, Huntsman Corporation, Momentive Performance Materials Inc., Elkem ASA, Solvay S.A., Elementis PLC, BYK-Chemie GmbH (ALTANA Group), Munzing Chemie GmbH, SAGITTA (KCC Corporation), Kao Corporation, Resil Chemicals Pvt. Ltd., King Industries, Inc. |

Value Chain Analysis

- Research & Development (R&D): This focuses on developing new defoamer formulations to meet specific performance needs, regulatory requirements, and cost constraints of various applications.

- Key Players: BASF SE, Evonik Industries AG, The Dow Chemical Company, Wacker Chemie AG, Shin-Etsu Chemical Co., Ltd., and Ashland Inc.

- Raw Material Sourcing and Production: This involves procuring essential raw materials, such as silicone monomers, oils, surfactants, and silica.

- Key Players: BASF, Dow, Shin-Etsu, and Evonik.

- Manufacturing and Quality Control :This stage covers the batch processing, mixing, heating, and emulsification of raw materials to produce the final defoamer product.

- Key Players: Kemira Oyj, Clariant AG, and Elementis PLC.

- Distribution and Logistics:This involves storing and transporting chemical products through various channels to reach industrial customers globally.

- Key Players: BASF SE, Evonik Industries AG, and Wacker Chemie AG.

- Application and End-User Integration:This involves the application of defoamers by end-user industries to control foam during their processes.

- Key Players: BASF SE, Evonik Industries, Dow Inc., Wacker Chemie AG, and Elementis PLC.

Market Dynamics

Market Drivers

The defoamers market is driven by growing demand from process industries where foam control is critical to operational efficiency and product quality. Expanding applications across water and wastewater treatment, pulp and paper, paints and coatings, food and beverage processing, and oil and gas are reinforcing steady consumption.

Increasing industrial production and stricter process control requirements are encouraging the use of defoamers to prevent equipment overflow, reduce downtime, and improve throughput. Growth in construction activity is also supporting demand for defoamers in cement, concrete admixtures, and coatings. In addition, rising focus on process optimization and cost reduction is sustaining long-term market growth.

Market Restraints

The defoamers market faces restraints related to environmental and regulatory concerns associated with certain silicone-based and petroleum-derived formulations. Compliance with evolving environmental standards, particularly in food, beverage, and water treatment applications, can limit the use of specific chemical types. Volatility in raw material prices, including oils, surfactants, and solvents, impacts production costs and pricing stability. In some applications, overdosing or incompatibility with formulations can negatively affect end-product quality, discouraging adoption. Limited awareness of proper dosage and performance optimization can also constrain market expansion.

Market Opportunities

Opportunities in the defoamers market are emerging from increasing demand for bio-based, water-based, and low-VOC formulations that align with sustainability and regulatory requirements. Expansion of wastewater treatment infrastructure and industrial effluent management is creating new growth avenues, particularly in emerging economies. Advances in formulation chemistry are enabling the development of highly efficient defoamers that perform at lower dosages, improving cost-effectiveness. Growth in specialty coatings, adhesives, and high-performance materials are expanding application scope. In addition, rising industrialization and infrastructure development in Asia Pacific, the Middle East, and Africa present long-term opportunities.

Market Challenges

The defoamers market faces challenges in balancing performance, cost, and environmental compliance across diverse industrial applications. Developing formulations that remain effective under varying temperatures, pH levels, and process conditions requires continuous R&D investment. Increasing competition from alternative foam-control technologies can pressure margins. Fragmented regulatory frameworks across regions complicate product standardization and global distribution. Ensuring consistent performance while transitioning to more sustainable formulations remains a key challenge for defoamer manufacturers.

Segmental Insight

Type Insight

Which Type Segment Dominated the Defoamers Market in 2025?

The silicone-based defoamers segment held a 36% market share in 2025. The dominance of the segment can be attributed to the exceptional versatility and performance of these defoamers and their ability to function smoothly in extreme conditions, like fluctuating pH levels and high temperatures, which makes them favourable in many sectors. Additionally, these defoamers provide effectiveness, superior stability, and long-lasting results in diverse applications.

The polyether siloxane-based defoamers segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the surge in industrial production, rising product demand from end-use industries, and rapid technological innovations in the industry. Also, the low surface tension of polyether siloxane-based defoamers gives the required properties for end-use applications.

Medium Insight

Why Emulsion-based Segment Dominated the Defoamers Market in 2025?

The emulsion-based segment led the market with 41% market share in 2025. The dominance of the segment can be linked to the growing complexity of industrial processes and the rapid expansion of the food and beverage sector. Innovations in emulsion technology, like the development of high-performance silicone emulsions, are improving the applicability and effectiveness of emulsion-based defoamers.

The granular segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by raised demand from several industries such as paper and pulp, water treatment, and coatings, where foam control is necessary for product quality and efficiency, driving segment growth shortly.

Application Industry Insight

How Pulp & Paper Segment Held the Largest Defoamers Market Share in 2025?

The pulp & paper segment dominated the market with a 25% market share in 2025. The dominance of the segment is owed to the growing demand for hygiene products and paper-based packaging along with the surge in paper recycling. Moreover, the expansion of e-commerce and the packaging industry is fuelling the demand for more paper-based packaging materials, growing the demand for defoamers utilized in paper manufacturing.

The paints & coatings segment is expected to grow at a CAGR during the projected period. The growth of the segment is due to its crucial role as defoamers in controlling foam over production and application processes. The escalating need for high-performance coatings and inks, coupled with the demand for swift application processes.

Function Insight

How Did the Surface Foam Suppression Segment Dominated the Defoamers Market in 2025?

The surface foam suppression segment held a 46% market share in 2025. The dominance of the segment can be attributed to the increasing demand for efficient manufacturing processes and rapid industrialization across the globe. Additionally, the development of responsive defoaming agents is compatible with changing foam conditions, propelling segment growth soon.

The deaeration agent segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the rising product demand from various sectors, such as petrochemicals, food & beverage, power generation, and pharmaceuticals.

Distribution Channel Insight

Which Distribution Channel Segment Held the Largest Defoamers Market Share in 2025?

The direct sales segment led the market with a 56% market share in 2025. The dominance of the segment can be linked to the growing need for enhanced manufacturing processes, rapid industrialization, and the development of specialized defoamers such as bio-based and silicone-based options. Defoamers are important for optimising production processes by controlling foam, which can affect production and thus product quality.

The online platforms segment is expected to grow at the fastest CAGR during the study period. The growth of the segment can be driven by stringent environmental regulations, ongoing industrialization, and increasing awareness of water conservation. Online platforms offer convenient access to an extensive range of defoamers.

Formulation Compatibility Insight

Why Aqueous Systems Segment Dominated the Defoamers Market in 2025?

The aqueous systems segment dominated the market by holding 61% market share in 2025. The dominance of the segment is due to escalating need for water-based and eco-friendly solutions across different industries, especially in the construction, paints and coatings, and water treatment sectors. There's a strong emphasis on adopting water-based deformers due to their lower environmental impact.

The high-viscosity systems segment is expected to grow at the fastest CAGR during the foreseeable future. The growth of the segment is owed to the innovations in defoamer technology, like the development of high-performance and eco-friendly formulations. Industries are looking for defoamers that provide superior performance, including longer-lasting effectiveness and better foam control in high-viscosity applications.

Regional Insights

The Asia Pacific defoamers market size accounted for USD 1.50 billion in 2025 and is forecasted to hit around USD 2.36 billion by 2034, representing a CAGR of 5.14% from 2025 to 2034. Asia Pacific dominated the defoamers market with 39% market share in 2025, and the region is expected to sustain this position during the forecast period. The dominance of the region can be attributed to the rising consumer awareness, surge in regional population, along technological advancements in the industry. In addition, ongoing implementation of environmental regulations and polices around industrial emissions and waste management, coupled with the expansion of the food & beverage industry, will drive market growth soon.

Defoamers Market in China

In the Asia Pacific, China led the market owing to the rapid industrialization, especially in sectors such as water treatment and chemicals, paints & and coatings. Rising environmental awareness and an emphasis on sustainable solutions are also major factors impacting positive market growth. The Chinese government is promoting collaboration among large and medium-sized players to enhance industry competitiveness.

North America is expected to grow at a significant CAGR over the forecast period. The growth of the region can be driven by stringent environmental regulations, ongoing technological advancements, and rapid industrial growth in countries such as the U.S. and Canada. Furthermore, growing regions' emphasis on biodegradable and sustainable developers aligns properly with regulatory needs aimed at minimizing environmental impact.

How will Europe be considered Notable Growth in the Defoamers Market?

Europe is anticipated to experience notable growth in the near future. This growth is mainly attributed to stringent environmental regulations, a focus on sustainability, a well-established industrial base, and technological innovation. The region serves as a hub for research and development in chemical technologies. EU directives, such as the REACH regime and the Water Framework Directive, enforce strict limits on VOC emissions and industrial waste discharge. Key players in countries like Germany, the UK, and France are heavily investing in developing innovative, high-efficiency defoamer chemistries.

Germany Defoamers Market Trends

Germany stands out as a major player in Europe due to its robust industrial foundation, particularly in the chemical, pharmaceutical, automotive, and food and beverage sectors, which are all significant end-users of defoamers. The country is home to major global chemical manufacturers, including BASF SE, Evonik Industries AG, and Wacker Chemie AG, which are at the forefront of research and development and product innovation, especially regarding advanced silicone-based and eco-friendly defoamers.

Emergence of Latin America in the Defoamers Market

Latin America is an emerging region in the global market, driven by rapid industrialization and urbanization, as well as expanding manufacturing activities across various sectors. There is a growing emphasis on sustainable and high-quality manufacturing processes. Major international chemical companies, such as Dow and Clariant, have established a strong presence in the region, offering localized solutions and leveraging existing infrastructure and distribution networks. Increasing environmental regulations and a preference for sustainable products are driving demand for bio-based defoamers.

Brazil Defoamers Market Trends

Brazil plays a distinctive position within Latin America, particularly due to the expansion of end-user industries such as construction, automotive, packaging, food processing, and pulp and paper. The chemical industry in Brazil accounts for a significant portion of Latin America's chemical sales. The market features collaborations between local manufacturers and global chemical firms, exemplified by Kemira's agreement to distribute pulp defoamers in Brazil.

How will the Middle East and Africa contribute to the Defoamers Market?

The Middle East and Africa represent a contributing region in the global market, largely due to swift industrialization, significant infrastructure and construction projects, and increasingly stringent environmental regulations on wastewater treatment and emissions. Rapid industrialization across MEA economies, including Saudi Arabia, the UAE, and South Africa, is heightening the demand for defoamers to enhance efficiency and product quality, ensuring a uniform finish and higher durability in manufacturing processes.

The UAE Defoamers Market Trends

The UAE plays a pivotal role within the region, focusing on industrial diversification and encouraging investments in research and development to innovate eco-friendly and high-performance defoamers, particularly silicone-based solutions. This strategy aims to reduce reliance on imports and cater to regional demand. With its strategic location and pro-innovation government initiatives, the UAE is positioned as a potential hub for market expansion and a key contributor to the broader market.

Recent Development

- In February 2025, PennWhite India Private Limited (PWI), a company incorporated in India for specialty chemicals and a wholly owned subsidiary of PennWhite Limited, UK announce the successful acquisition of the defoamer business of the Specialty Chemicals Division of Sicagen India Limited (Sicagen), a company incorporated in India. PWI is the Indian subsidiary of PennWhite Limited, UK a company based in Middlewich (UK), which is a leading manufacturer of antifoam chemistry under the renowned FoamDoctor brand.(Source: www.indianchemicalnews.com)

Top Companies List

- BASF SE

- Evonik Industries AG

- Dow Inc.

- Kemira Oyj

- Shin-Etsu Chemical Co., Ltd.

- Air Products and Chemicals, Inc.

- Ashland Global Holdings Inc.

- Clariant AG

- Wacker Chemie AG

- Huntsman Corporation

- Momentive Performance Materials Inc.

- Elkem ASA

- Solvay S.A.

- Elementis PLC

- BYK-Chemie GmbH (ALTANA Group)

- Munzing Chemie GmbH

- SAGITTA (KCC Corporation)

- Kao Corporation

- Resil Chemicals Pvt. Ltd.

- King Industries, Inc.

Segments Covered

By Type

- Silicone-based Defoamers

- Oil-based Defoamers

- Water-based Defoamers

- Powder-based Defoamers

- EO/PO-based Defoamers

- Polyether Siloxane-based Defoamers

- Alkyl Polyacrylate-based Defoamers

By Medium/Formulation

- Liquid

- Solvent-based

- Emulsion-based

- Granular

- Paste/Gel

By Application Industry

- Pulp & Paper

- Paints & Coatings

- Water & Wastewater Treatment

- Food & Beverage

- Oil & Gas

- Pharmaceuticals

- Textiles

- Agrochemicals (Pesticides, Fertilizers)

- Adhesives & Sealants

- Chemical Manufacturing

- Metalworking Fluids

By Function

- Surface Foam Suppression

- Entrained Air Removal

- Deaeration Agent

By Distribution Channel

- Direct Sales

- Distributors/Wholesalers

- Online Platforms

By End-Use Formulation Compatibility

- Aqueous Systems

- Non-aqueous (Solvent-based) Systems

- High-viscosity Systems

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait