Content

Europe Foam Market - Size, Share & Industry Analysis

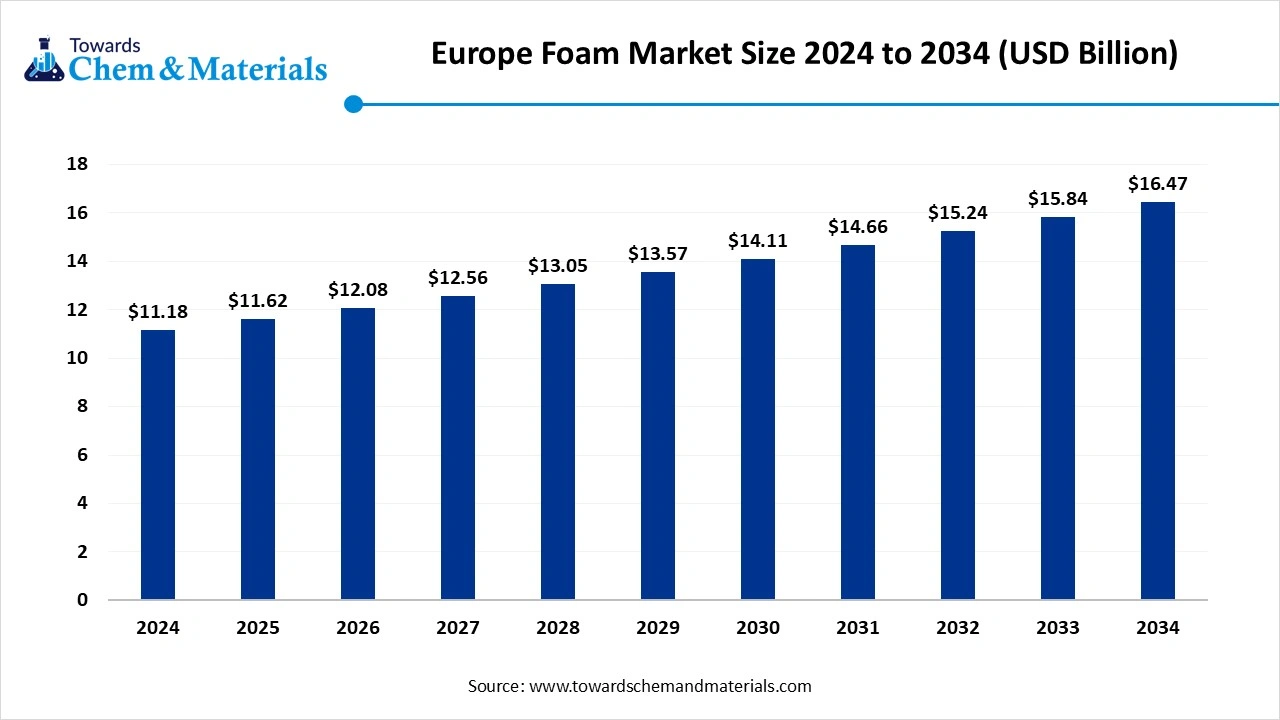

The Europe foam market size is calculated at USD 11.18 billion in 2024, grew to USD 11.62 billion in 2025, and is projected to reach around USD 16.47 billion by 2034. The market is expanding at a CAGR of 3.95% between 2025 and 2034. The growing demand for lightweight materials in the aerospace and automotive industries is the key factor driving market growth. Also, innovations in foam manufacturing and applications, coupled with the growing demand for energy-efficient solutions, can fuel market growth further.

Key Takeaways

- By type, the polyurethane foam segment dominated the market in 2024. The dominance of the segment can be attributed to the growing product demand from the automotive sector.

- By type, the others segment, especially PVC foam, is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the growing demand for durable, lightweight, and recyclable materials.

- By foam, the flexible form segment held the largest Europe foam market share in 2024. The dominance of the segment can be linked to the growing consumer spending and the trend towards high-performance, lightweight materials for fuel comfort and efficiency.

- By foam, the rigid foam segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by a surge in renovation in the commercial and residential sectors.

- By application, the building & construction segment held the largest market share in 2024. The dominance of the segment is owed to the growing demand for energy-efficient and sustainable buildings.

- By application, the other segment, especially consumer goods, are expected to grow at the fastest CAGR during the projected period. The growth of the segment is due to growing consumer demand for durable and comfortable products.

- By end-use industry, the building & construction segment held the largest Europe foam market share in 2024. The dominance of the segment can be attributed to the growing need for energy-efficient building materials, boosted by green building initiatives.

- By end-use industry, the healthcare segment is expected to grow at the fastest CAGR during the forecast period. The growth of the segment can be credited to the rapid surge in the aging population.

Technological Advancements Are Expanding Market Growth

The Europe foam market refers to the industry focused on the production, distribution, and application of foam materials such as polyurethane, polystyrene, polyethylene, and specialty foams, which are widely utilized in construction, automotive, packaging, furniture, footwear, healthcare, and consumer goods industries.

Foams are valued for their lightweight structure, thermal and acoustic insulation, cushioning, flexibility, and energy absorption properties, making them a critical material for both industrial and consumer applications across the European region.

What Are the Key Trends Influencing the Europe Foam Market?

- The growing demand for energy-efficient construction solutions is the latest trend in the market. Energy-efficient construction is boosting the need for foam insulation in the region, which helps to reduce the energy loss by improving indoor temperature stability by creating thermal barriers, and aligns with EU directives.

- Strict sustainability & circular economy regulations are fuelling the demand for low-emission, recyclable, and bio-based foam materials. Various initiatives are focusing on creating circular supply chains for foam, such as recycling processes for products like automotive seats and mattresses. The aerospace and automotive industries seek lightweight foams to enhance fuel performance and efficiency.

- Advancements in manufacturing processes, like cutting-edge spray foam technologies, are enhancing the product efficiency and performance. Also, the expanding e-commerce sector is propelling the adoption of PU foams for protective packaging to ensure safe delivery of goods.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 11.62 Billion |

| Expected Size by 2034 | USD 16.47 Billion |

| Growth Rate from 2025 to 2034 | CAGR 3.95% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Type, By Form, By Application, By End-Use Industry |

| Key Companies Profiled | BASF SE, Covestro AG, Huntsman Corporation, Dow Inc., Recticel NV/SA, Armacell International S.A., Sekisui Alveo AG, Vita Group, Zotefoams plc, Eurofoam Group, Trocellen GmbH, FoamPartner (a member of Recticel Group), Sika AG, Synthos S.A., Saint-Gobain Performance Plastics |

Market Opportunity

Growing Demand for High-Strength Materials

High-performance foams have applications in many industries, such as electronics, transportation, and building supplies, because of their high strength. These foams can help to enhance thermal and mechanical properties, which are part of thermal insulation and fuel efficiency.

- Furthermore, they also have the capability to minimize total system weight, which contributed to the overall market expansion soon.

Market Challenge

Manufacturing and Market Competition

The market is highly competitive, with various global and local players. Which is the major factor hindering market growth, and which results in smaller profit margins and price pressures, particularly for smaller companies? Moreover, the market is also witnessing substantial supply chain issues due to regional conflicts, which can hamper market growth further.

Country Insight

Germany dominated the market by holding the largest market share in 2024. The dominance of the region can be attributed to the stringent government regulations supporting insulation and reduction in emissions, which fuel the demand for polyurethane foams and polyolefin foams in the country. Moreover, Germany's robust R&D and emphasis on digital technologies propel the development of cutting-edge foam solutions across industries.

Segmental Insight

Type Insight

Which Type Segment Dominated the Europe Foam Market in 2024?

The polyurethane foam segment dominated the market in 2024. The dominance of the segment can be attributed to the growing product demand from the automotive sector and strong infrastructure development in the region. Additionally, PU foam decreases vehicle weight, enhancing fuel performance and efficiency, a key trend that is boosting the adoption of electric and hybrid vehicles.

The other segment, especially PVC foam, is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the growing demand for durable, lightweight, and recyclable materials in the automotive, construction, and advertising sectors. In addition, PVC foam provides an exceptional chemical resistance and strength-to-weight ratio, which makes it a convenient alternative to conventional materials such as metal and wood.

Form Insight

Why Flexible Form Segment Dominated The Europe Foam Market In 2024?

The flexible foam segment held the largest market share in 2024. The dominance of the segment can be linked to the growing consumer spending and the trend towards high-performance, lightweight materials for fuel comfort and efficiency. Also, rising inclination towards energy-efficient insulation solutions and building materials drives the demand for flexible foams in construction, leading to further segment growth.

The rigid foam segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by a surge in renovation in commercial and residential sectors, along with the strict energy efficiency regulations. Furthermore, rigid foams are necessary for roofing, wall cavities, and insulation panels due to their dimensional stability and superior thermal performance.

Application Insight

How Much Share Did the Building & Construction Segment Held in 2024?

The building & construction segment held the largest market share in 2024. The dominance of the segment is owed to the growing demand for energy-efficient and sustainable buildings, coupled with the stringent energy efficiency regulations. Advancements in foam technologies, which lead to enhanced durability and performance, also contribute to market expansion in demanding construction environments.

The other segment, especially consumer goods, is expected to grow at the fastest CAGR during the projected period. The growth of the segment is due to growing consumer demand for durable and comfortable products like furniture and mattresses, fuelled by rapid urbanisation. Furthermore, the ongoing expansion of e-commerce creates a lucrative demand for flexible foam packaging that offers protection and cushioning for fragile consumer goods and appliances.

End-Use Industry Insight

Which End Use Industry Segment Dominated the Europe Foam Market in 2024?

The construction segment held the largest market share in 2024. The dominance of the segment can be attributed to the growing need for energy-efficient building materials, boosted by green building initiatives and stringent regulations. Foam's core materials are preferred for their excellent stiffness, high strength-to-weight ratio, and impact resistance, which makes them ideal for roofing systems and wall panels.

The healthcare segment is expected to grow at the fastest CAGR during the forecast period. The growth of the segment can be credited to the rapid surge in the aging population, which leads to greater demand for support devices and wound care. Additionally, raised healthcare spending in Europe propels segment expansion as healthcare providers invest more in innovative foam products to improve patient care.

Europe Foam Market Value Chain Analysis

- Feedstock Procurement : It is the strategic sourcing of raw materials for producing polymer foams. The process is complicated by supply chain disruptions and high price volatility.

- Chemical Synthesis and Processing : This stage refers to the chemical reactions and production methods utilized to produce foam products. This stage also involved the innovative processes utilized to create specialized foam materials.

- Packaging and Labelling : This stage involves the stringent and changing regulations that control how foam products and packaging must be prepared for the market.

- Regulatory Compliance and Safety Monitoring : It is a complex framework of national regulations aimed at protecting human health and the environment.

Recent Development

- In February 2025, Smithers-Oasis, a leader in the floral design sector, introduced a new, plant-based, OASIS® Renewal™floral foam. This foam is free from colorants and dyes. This also results in less cost for designing and labour.(Source: thursd.com)

Europe Foam Market Top Companies

- BASF SE

- Covestro AG

- Huntsman Corporation

- Dow Inc.

- Recticel NV/SA

- Armacell International S.A.

- Sekisui Alveo AG

- Vita Group

- Zotefoams plc

- Eurofoam Group

- Trocellen GmbH

- FoamPartner (a member of Recticel Group)

- Sika AG

- Synthos S.A.

- Saint-Gobain Performance Plastics

Segments Covered

By Type

- Polyurethane Foam (Flexible & Rigid)

- Polystyrene Foam (EPS, XPS)

- Polyethylene Foam

- Phenolic Foam

- Silicone Foam

- Others (PVC Foam, Melamine Foam, etc.)

By Form

- Flexible Foam

- Rigid Foam

By Application

- Building & Construction (Insulation, Roofing, Flooring)

- Automotive (Seating, Interiors, Noise Reduction, Safety Components)

- Packaging (Protective, Food Packaging, Logistics)

- Furniture & Bedding (Cushions, Mattresses, Upholstery)

- Footwear (Sports, Casual, Industrial Shoes)

- Healthcare (Medical Devices, Orthopedic Supports, Hygiene Products)

- Others (Consumer Goods, Aerospace, Marine, Electronics)

By End-Use Industry

- Construction

- Automotive

- Furniture & Bedding

- Packaging

- Healthcare

- Others (Footwear, Sports, Consumer Goods, Aerospace, Marine)