Content

Erucic Acid Market Size and Forecast 2025 to 2034

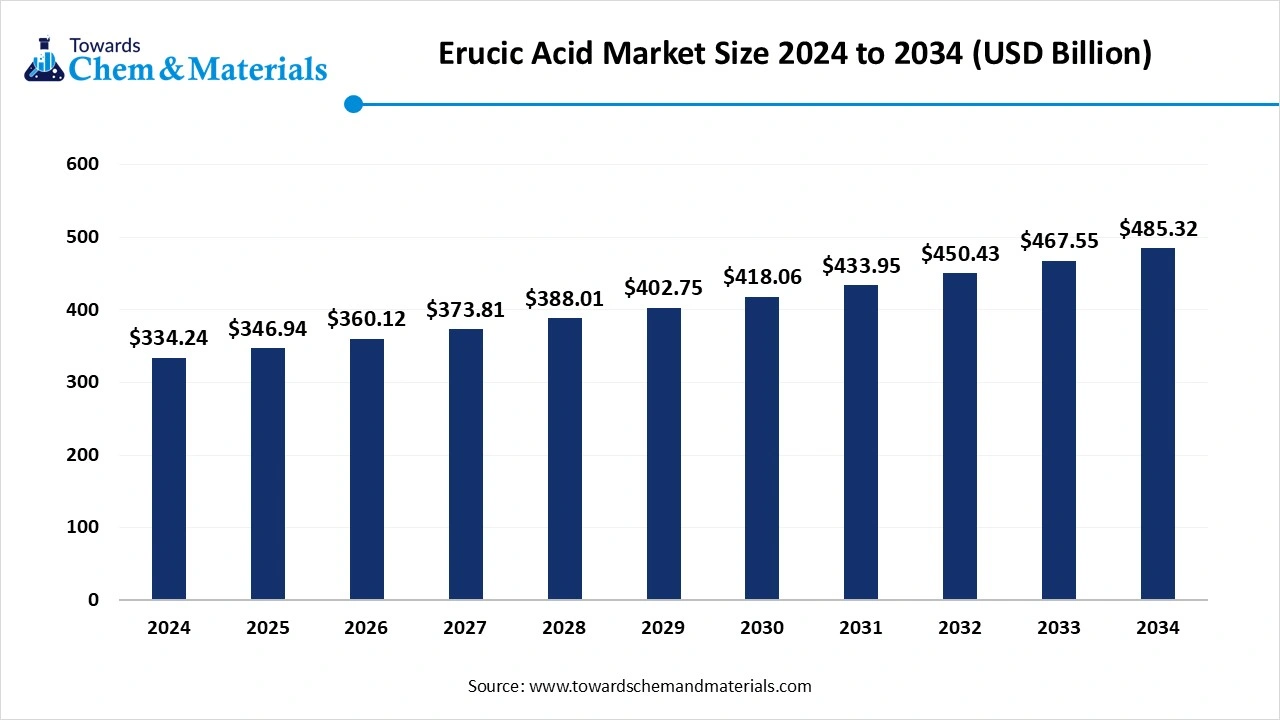

The global erucic acid market size was reached at USD 334.24 million in 2024 and is estimated to surpass around USD 485.32 million by 2034, growing at a compound annual growth rate (CAGR) of 3.80% during the forecast period 2025 to 2034. Growing demand for biobased, and rising applications in various industries such as lubricants, plastics, cosmetics, and pharmaceuticals drive the market.

Erucic Acid Market Key Takeaway

- By region, North America dominated the market in 2024. The market is driven by the growing demand for sustainable and bio-based products

- By region, Asia Pacific is anticipated to have significant growth in the market in the forecasted period. The market is witnessing steady growth due to expanding industrial applications and increasing environmental awareness

- By application, the cosmetic segment dominated the market in 2024. The market is driven by rising consumer demand for natural and plant-based ingredients.

- By application, the food industry segment is anticipated to grow significantly in the market during the forecasted period. Their favorable fatty acid composition increases the demand.

- By end use, the automotive segment dominated the market in 2024. Its high thermal stability, lubricating properties, and low viscosity make it suitable for use

By end use, the industrial segment is anticipated to grow in the forecasted period. Its diverse applications in producing lubricants, plasticizers, surfactants, and coatings drive the demand. - By source, the synthetic segment dominated the market in 2024. The growing demand for high-performance, eco-friendly synthetic materials drives the growth.

- By source, the natural segment is anticipated to grow in the forecasted period. It supports clean-label and eco-friendly product development, especially in regions with a strong regulatory focus on sustainability.

- By form, the liquid segment dominated the market in 2024. Its efficient incorporation into formulations increases the demand.

- By form, the solid segment is anticipated to grow in the forecasted period. Stability during storage and transport drives the growth.

Rising Demand From Various Industries: Erucic Acid Market To Expand

Erucic acid is a monounsaturated omega-9 fatty acid primarily found in rapeseed oil and mustard oil. It has 22 carbon atoms and one double bond, making it long-chain and non-essential in human nutrition. Industries use erucic acid to produce lubricants, plastics, cosmetics, and surfactants. Although high intake may pose health risks, regulated levels in food ensure safety. Scientists continue to explore its industrial and pharmaceutical potential.

The erucic acid market growth is driven by the growing demand for bio-based and environmentally friendly products across various industries. Manufacturers increasingly use erucic acid in the production of biodegradable lubricants, plasticizers, and surfactants, replacing petroleum-based alternatives. Its application in cosmetics and personal care products as an emollient further boosts demand.

Additionally, the rising need for erucic acid in pharmaceuticals and the polymer industry contributes to market expansion. Government support for sustainable chemicals and increasing awareness of green chemistry practices also act as key growth drivers. Expanding industrialization, particularly in emerging economies, continues to create new opportunities for erucic acid applications.

Erucic Acid Market Trends

- Increasing demand of the market in personal care and cosmetics, due to its applications and properties offered, which drives the demand from consumers.

- Expansion of application of erucic acid in various industries drives the growth of the market, with increasing demand from manufacturers.

- Technological advancement in the formulation and process optimizes the application and helps in innovation in the product, which drives the growth.

- Government initiatives and regulatory support for the use of sustainable products increase the demand and drive the market.

Erucic Acid Market Report Scope

| Report Attributes | Details |

| Market Size in 2025 | $ 346.94 Million |

| Expected Size in 2034 | $ 485.32 Million |

| Growth Rate | CAGR of 3.80% from 2025 to 2034 |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025-2034 |

| High Impact Region | North America |

| Segment Covered | By Application, By End Use, By Source, By Form , By Region |

| Key Companies Profiled |

Kraton Corporation,Fujiko Chemical, PMC Biogenix, Vantage Oleochemicals ,BASF, Jatropha Oil Co., Cargill, H and E Chemical, Emery Oleochemicals , |

Erucic Acid Market Opportunity

The Rising Demand for Biodegradable Material By Manufacturers and Consumers

One significant opportunity in the erucic acid market is its growing application in the biodegradable lubricants segment. As industries and governments push for sustainable and eco-friendly alternatives to petroleum-based lubricants, erucic acid’s natural, non-toxic, and biodegradable properties make it an ideal ingredient.

This shift is particularly strong in Europe and North America, where regulations favor bio-lubricants. Additionally, erucic acid’s high thermal stability and lubricity enhance performance in industrial and automotive applications, positioning it as a valuable component in the development of next-generation, environmentally responsible lubricant formulations.

Erucic Acid Market Challenge

The Fluctuating Supply of Raw Material

One major challenge in the erucic acid market is the fluctuation in raw material supply, particularly from high erucic acid rapeseed. Climate change, unpredictable weather patterns, and shifting agricultural trends affect crop yields and oil content, leading to inconsistent supply and price volatility.

In regions like India, farmers are switching to alternative crops due to unfavourable weather, reducing rapeseed cultivation. This inconsistency hampers long-term planning for manufacturers and increases production costs. Additionally, strict regulatory limits on erucic acid levels in food products further constrain its application in certain markets.

Erucic Acid Market Regional Insights

North America dominated the erucic acid market in 2024. North America’s market is driven by the growing demand for sustainable and bio-based products. The region's well-established industrial sectors, including chemicals, lubricants, and plastics, are increasingly adopting erucic acid due to its eco-friendly properties. In the pharmaceutical and personal care industries, erucic acid is valued for its beneficial effects as an emollient and stabilizing agent. Government regulations promoting environmental sustainability and green chemistry further stimulate market growth. Despite challenges like fluctuating raw material supply and production costs, the North American market continues to expand, fueled by technological innovations and investments in sustainable manufacturing practices.

The United States' Increasing Industrial Base and Growing Demand For Bio-Based Chemicals Drive The Growth Of The Market

The United States plays a significant role in the North American erucic acid market, driven by the strong industrial base and growing demand for bio-based chemicals. Industries such as lubricants, plastics, and personal care products are increasingly incorporating erucic acid for its sustainable and eco-friendly properties. Additionally, the U.S. pharmaceutical sector utilizes erucic acid for its beneficial emollient and stabilizing characteristics. As environmental regulations tighten, there is a rising shift toward green chemistry and renewable resources, further boosting market demand. Challenges such as raw material price fluctuations and supply disruptions persist, but innovation and investment in sustainability continue to drive market growth.

Asia Pacific is anticipated to grow in the erucic market in the forecast period.

The Asia-Pacific erucic acid market is witnessing steady growth due to expanding industrial applications and increasing environmental awareness. The region benefits from a large agricultural base for raw material supply and growing demand in sectors such as personal care, pharmaceuticals, and lubricants. Rising consumer preference for sustainable and bio-based products supports the market’s trend. Additionally, favourable government initiatives promoting green chemistry and eco-friendly alternatives drive industrial adoption. Countries across Asia-Pacific are investing in local production capacities and research, making the region a key contributor to global market expansion. Urbanization and economic development further fuel product demand across industries.

India Has Seen Growth Due to its Large-Scale Cultivation And Extraction of Resources

India holds a strategic position in the erucic acid market due to its large-scale cultivation of mustard and rapeseed, which serve as primary sources for extraction. The country’s pharmaceutical, cosmetic, and industrial sectors are increasingly incorporating erucic acid for its emollient, lubricant, and plasticizing properties. Growing consumer demand for bio-based products further fuels this market. However, agricultural challenges, such as shifting weather patterns and crop substitution by farmers, may impact raw material availability. Despite these concerns, India’s expanding industrial base, combined with supportive government policies and rising awareness of sustainable chemicals, continues to drive the market’s positive outlook.

- India exported 34 shipments of erucic acid to South Korea from October 2023 to September 2024.

- Globally, the top three exporters of Erucic Acid are Ukraine, Russia, and India. Ukraine leads the world in Erucic Acid exports with 18,134 shipments, followed by Russia with 6,792 shipments, and India taking the third spot with 2,411 shipments.

Erucic Acid Market Segmental Insights

Application Insights

The cosmetic segment dominated the erucic acid market in 2024. The cosmetics segment represents a growing share of the market, driven by rising consumer demand for natural and plant-based ingredients. Erucic acid is widely used in skincare and haircare products due to its emollient, moisturizing, and protective properties. It helps form a barrier on the skin to prevent moisture loss and improve texture, making it ideal for lotions, creams, and conditioners. As awareness around clean beauty and sustainability increases, manufacturers are incorporating erucic acid into formulations as a safer alternative to synthetic ingredients. This drives the growth and expansion of the market.

The food industry segment expects significant growth in the erucic acid market during the forecast period. Erucic acid is primarily found in rapeseed and mustard oils, which have limited use in food due to health concerns associated with their high levels. To address these concerns, low-erucic acid rapeseed varieties, such as canola oil, have become more prevalent in the food industry. These oils are commonly used in cooking, frying, and processed food products because of their favorable fatty acid composition. Low-erucic acid rapeseed oils have replaced traditional high-erucic acid oils in most food applications, ensuring safety and quality. This drives the growth and expansion of the market.

End Use Insights

The automotive segment dominated the erucic acid market in 2024. In the automotive industry, erucic acid is primarily used in the formulation of biodegradable lubricants, plasticizers, and other industrial chemicals. Its high thermal stability, lubricating properties, and low viscosity make it suitable for use in high-performance engines and automotive systems, enhancing efficiency and reducing wear.

Erucic acid derivatives, such as erucamide, are also utilized in the production of automotive components like tires, seals, and interior parts, where flexibility and durability are crucial. As the automotive sector increasingly shifts towards sustainable materials, erucic acid's role in producing eco-friendly and biodegradable automotive products continues to grow.

The industrial segment expects significant growth in the erucic acid market during the forecast period. The industrial segment holds a significant share of the market due to its diverse applications in producing lubricants, plasticizers, surfactants, and coatings. Erucic acid’s chemical stability and long carbon chain make it ideal for manufacturing biodegradable lubricants used in machinery and heavy equipment. It also functions as a slip agent and anti-static additive in plastics, enhancing product quality in packaging and automotive materials.

- Furthermore, erucic acid derivatives are employed in metalworking fluids and corrosion inhibitors. As industries shift toward greener, bio-based inputs, erucic acid’s role in sustainable manufacturing continues to expand, driving steady market demand.

Source Insights

The synthetic segment dominated the erucic acid market in 2024. In synthetic applications, erucic acid is a valuable intermediate in the production of specialty chemicals and polymers. It serves as a precursor for erucamide, which is widely used as a slip and anti-block agent in the plastic and packaging industries. Its long-chain structure allows for the creation of synthetic lubricants, emulsifiers, and surfactants with enhanced performance and biodegradability. Erucic acid also contributes to the synthesis of specialty polyamides and esters used in textiles, adhesives, and coatings. With growing demand for high-performance, eco-friendly synthetic materials, erucic acid continues to gain attention in various chemical manufacturing processes.

The natural segment expects significant growth in the erucic acid market during the forecast period. In the natural products segment, erucic acid is gaining prominence due to its plant-based origin and versatility. Extracted mainly from rapeseed and mustard seeds, it aligns well with the rising demand for naturally derived ingredients in cosmetics, personal care, and industrial formulations. Consumers and manufacturers increasingly prefer bio-based alternatives over synthetic chemicals for health, safety, and environmental reasons. Erucic acid is used in natural skincare, organic lubricants, and biodegradable surfactants. Its use supports clean-label and eco-friendly product development, especially in regions with a strong regulatory focus on sustainability. This trend strengthens erucic acid’s role in the natural products

Form Insights

The liquid segment dominated the erucic acid market in 2024. Liquid erucic acid is commonly used across various industries due to its ease of handling, blending, and processing. In this form, it is especially valuable in applications like lubricants, plasticizers, and surfactants, where consistent viscosity and flow are essential. The liquid state allows for efficient incorporation into formulations in cosmetics, pharmaceuticals, and industrial chemicals. It also facilitates faster absorption and better distribution in skincare products. Additionally, liquid erucic acid supports improved chemical reactivity in synthesis processes, making it suitable for producing derivatives like erucamide. The rising demand for liquid bio-based materials continues to strengthen its presence in the market.

The solid segment expects significant growth in the erucic acid market during the forecast period. Solid erucic acid, often found as flakes or pellets, is utilized in applications where controlled melting and precise dosing are critical. This form is preferred in manufacturing processes that require stability during storage and transport. It is commonly used in the production of slip agents, plastic additives, and specialty chemicals. Solid erucic acid also offers advantages in terms of reduced spillage and improved handling in large-scale industrial operations. In cosmetics and personal care, solid forms can be melted and blended into balms, creams, and salves. The stability and shelf-life of solid erucic acid contribute to its demand in bulk processing. This drives the growth

Recent Developments in Erucic Acid Market

- In 2025, erucic acid consumption has grown significantly, and the rise in consumption is due to the strategic cost-cutting and realignment of the product in the sectors. The growing focus on sustainability and eco-friendly products further supports the upward trends.

University of Florida

- In a study carried by the University of Florida, the Lactobacillus johnsonii N6.2 indicated the consumption of erucic acid and efficiently use it as a source of fatty acid. various methods were performed like transcriptomics to identify genes and pathways involved in the erucic acid utilization.

Erucic Acid Market Top Companies List

- Kraton Corporation

- Fujiko Chemical

- PMC Biogenix

- Vantage Oleochemicals

- BASF

- Jatropha Oil Co.

- Cargill

- H and E Chemical

- Emery Oleochemicals

- Suntheanine

- Nanjing Lvfeng Chemical

- Zhejiang Jianye Chemical

- Nisshin OilliO Group

- Shaanxi Dideu Chemical

- AkzoNobel

Segments Covered in the Report

By Application

- Lubricants

- Surfactants

- Plastics

- Cosmetics

- Food Industry

By End Use

- Automotive

- Industrial

- Consumer Goods

- Pharmaceuticals

By Source

- Natural

- Synthetic

By Form

- Liquid

- Solid

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait