Content

Industrial Boiler Market Size and Growth 2025 to 2034

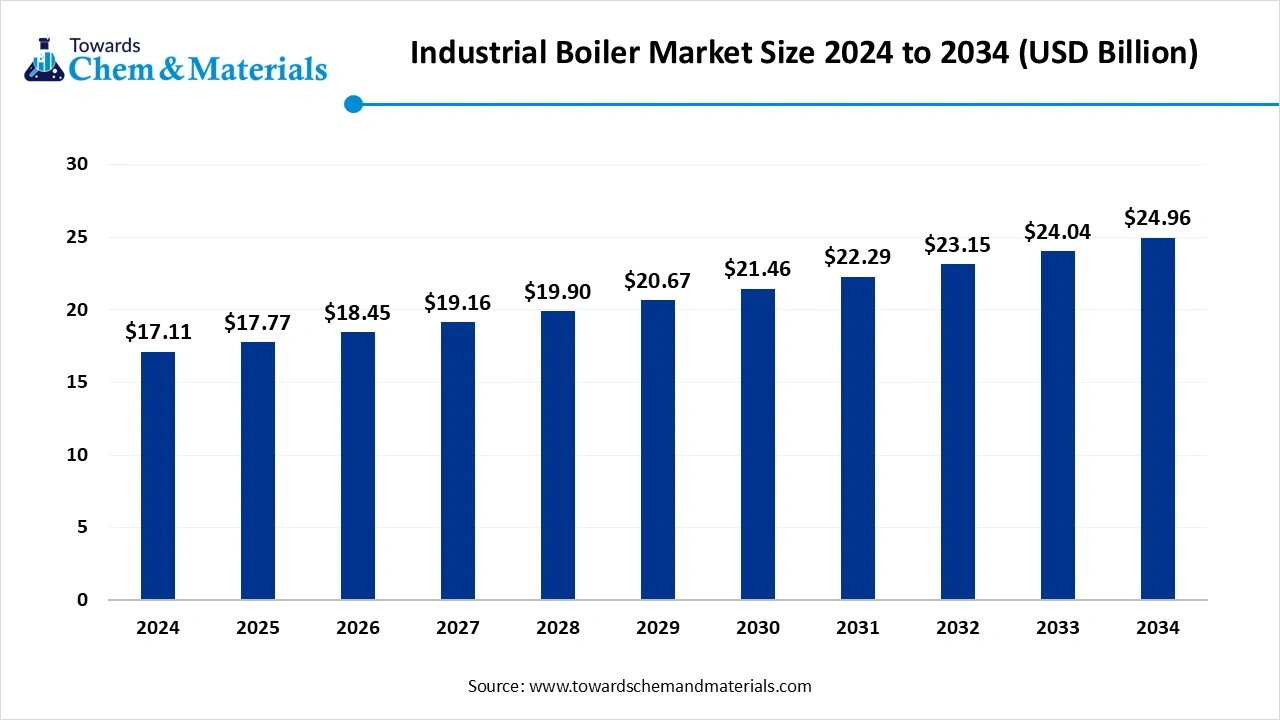

The global industrial boiler market size was reached at USD 17.11 billion in 2024 and is expected to be worth around USD 24.96 billion by 2034, growing at a compound annual growth rate (CAGR) of 3.85% over the forecast period 2025 to 2034. The growth of the market is driven by the growing industrialization, government initiatives, and energy demand boosts the growth of the market.

Key Takeaways

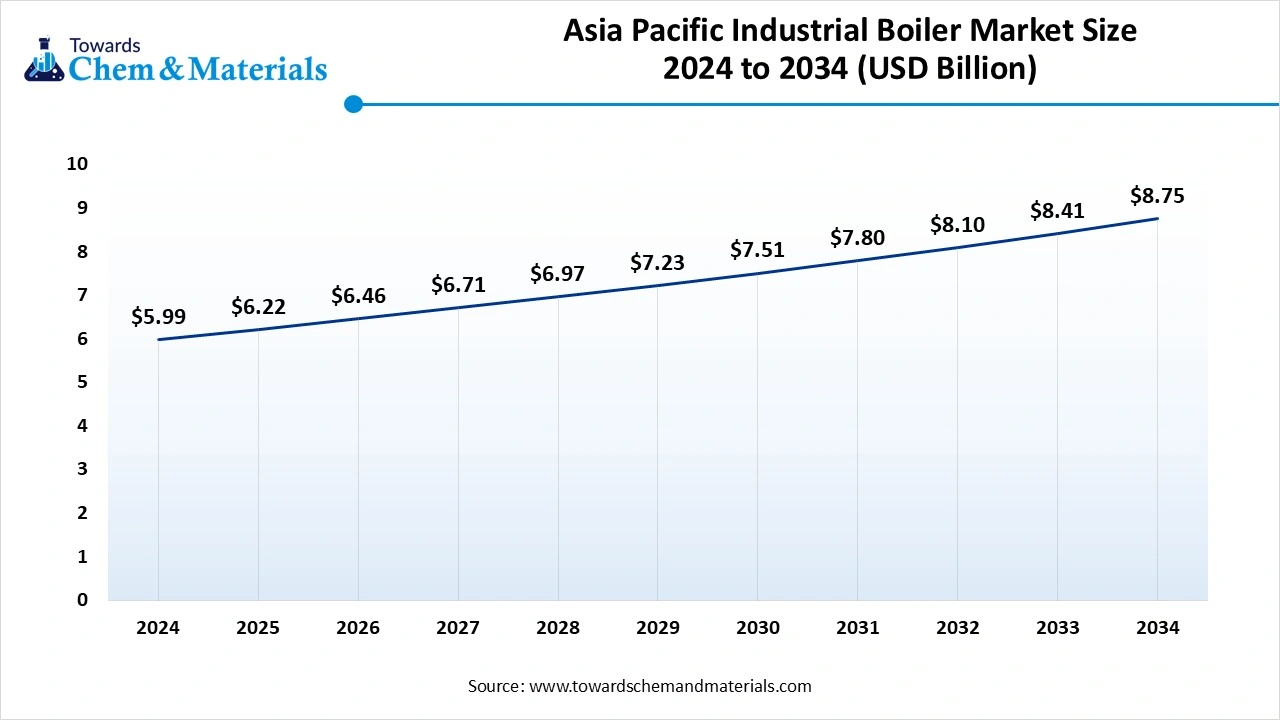

- The Asia Pacific industrial boiler market size was estimated at USD 5.99 billion in 2024 and is expected to reach USD 8.75 billion by 2034, growing at a CAGR of 3.86% from 2025 to 2034.

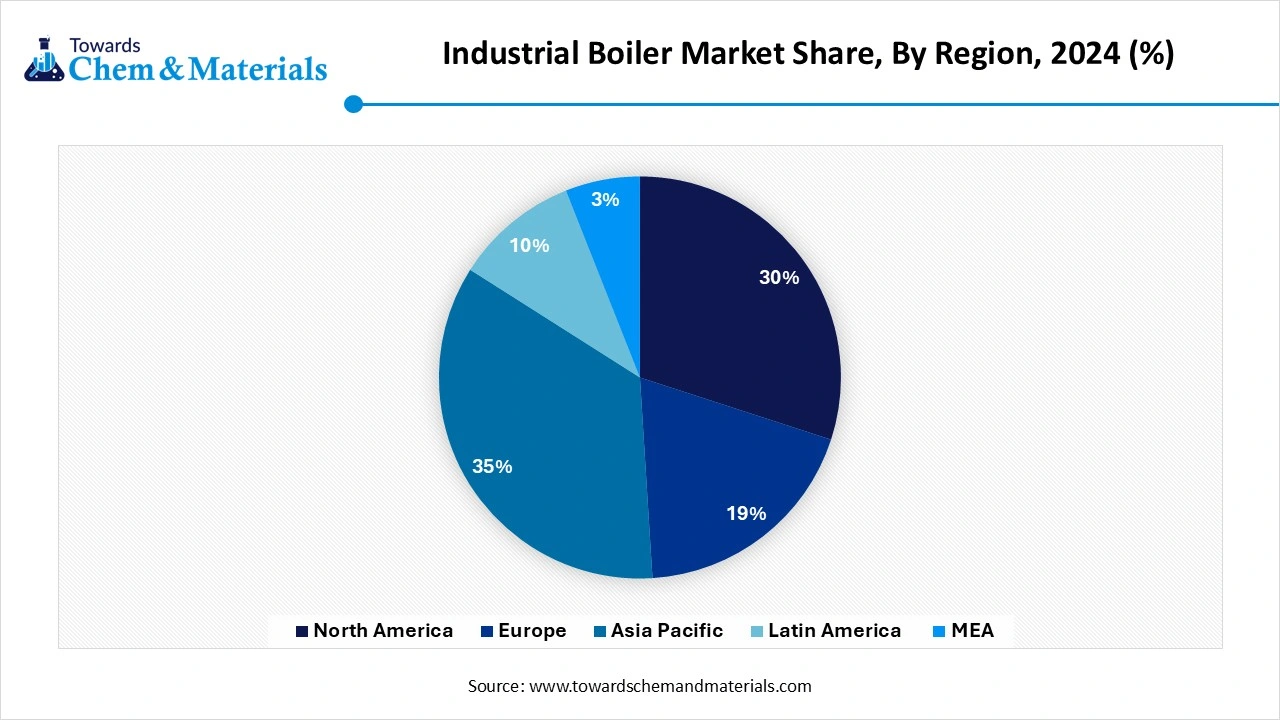

- By region, the Middle East and Africa are expected to have significant growth in the market in the forecast period. Increasing use of renewable energy sources drives the growth of the market.

- By boiler type, the food grade segment dominated the market in 2024. The fire-tube boiler segment held a 55% share in the market in 2024. The ease of application and applications drive the growth.

- By boiler type, the water-tube boiler segment is expected to grow significantly in the market during the forecast period. They are widely used due to their efficiency, which drives growth.

- By fuel type, the natural gas segment dominated the market in 2024. The plastic segment held a 42% share in the market in 2024. The easy accessibility increases the demand.

- By fuel type, the biomass segment is expected to grow in the forecast period. Demand for sustainable alternatives drives the growth.

- By boiler horsepower, the 10–150 bhp segment dominated the market in 2024. The 10–150 bhp segment held a 40% share in the market in 2024. Cost-effectiveness fuels the growth of the market.

- By boiler horsepower, the 301–600 bhp segment is expected to grow in the forecast period. Varied applications boost the growth of the market.

- By pressure range, the low-pressure (0–15 psi) segment dominated the market in 2024. The low-pressure (0–15 psi) segment held a 35% share in the market in 2024. Energy efficiency drives the demand.

- By pressure range, the high-pressure (above 150 psi) segment is expected to grow in the forecast period. High capacity and the need for large volumes increase the demand.

- By application, the process heating segment dominated the market in 2024. The process heating segment held a 38% share in the market in 2024. Their ability to maintain consistent temperatures and support large-scale.

- By application, the power generation segment is expected to grow in the forecast period. Their ability to operate under high-pressure and temperature conditions.

- By end use, the chemical & petrochemical segment dominated the market in 2024. The chemical & petrochemical segment held a 25% share in the market in 2024. The growing industry needs and demand increase the growth.

- By end use, the pharmaceuticals segment is expected to grow in the forecast period. The growing demand from the industry increases the demand.

- By design, the horizontal boilers segment dominated the market in 2024. The horizontal boilers segment held a 70% share in the market in 2024. The capability of heat transfer attracts the consumers.

- By design, the vertical boilers segment is expected to grow in the forecast period. Suitability for small areas increases the demand for the segment.

- By technology, the non-condensing boilers segment dominated the market in 2024. The non-condensing boilers segment held a 65% share in the market in 2024. Ease of maintenance contributes to the growth of the market.

- By technology, the condensing boilers segment is expected to grow in the forecast period. High energy efficiency demand increases the growth of the market.

Market Overview

Rising Demand for Durable Materials: Industrial Boiler Market to Expand

The market refers to the global market for boilers that are used in industrial applications to generate steam or hot water for process heating, power generation, space heating, or other uses. These boilers operate at varying pressures and are designed based on the type of fuel, capacity, and application.

What Are the Key Growth Drivers Responsible for The Growth of The Industrial Boiler Market?

The market is mainly propelled by industrial expansion, rising energy needs, and strict environmental standards. Leading companies are emphasizing technological innovations and extensive service packages to leverage these trends. Rapid industrialization and the growing emphasis on energy efficiency are driving demand across sectors such as chemicals, petroleum, food and beverages, pulp and paper, power generation, and oil and gas, further fueling market growth.

Market Trends

- Rapid industrialization and expansion in emerging economies, is a major driver of the market, which fuels the growth.

- The rising energy needs and demand from various industries and the increased adoption of industrial boilers fuel the growth of the market.

- Technological advancements like the integration of AI and smart technologies are a growing trend in the market, which influences the growth.

- Rising shift towards renewable energy sources and adoption of electric boilers, aligning with the growing environmental concerns, drives the growth of the market.

Report Scope

| Report Attribute | Details |

| Market Size in 2025 | USD 17.77 Billion |

| Expected Size by 2034 | USD 24.96 Billion |

| Growth Rate from 2025 to 2034 | CAGR 3.85% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | Boiler Type Insights, Fuel Type Insights, Boiler Horsepower Insights, Pressure Range Insights, Application Insights, End-Use Industry Insights, Design Insights, Technology Insights, By Region |

| Key Companies Profiled | General Electric (GE Power), Bosch Industriekessel GmbH , Cleaver-Brooks , Fulton Boiler Works, Inc., Mitsubishi Heavy Industries, Ltd. , Siemens Energy , Babcock & Wilcox Enterprises, Inc. , Thermax Limited, Forbes Marshall , Miura Co., Ltd. , Johnston Boiler Company , Hurst Boiler & Welding Co., Inc., Bryan Steam LLC , Superior Boiler Works, Inc. , IHI Corporation , Viessmann Group , Rentech Boiler Systems , ANDRITZ Group , Doosan Heavy Industries & Construction , Harbin Electric Company Limited |

Market Opportunity

What Are the Key Growth Opportunities Responsible for The Growth of The Industrial Boiler Market?

The industrial boiler market is witnessing substantial expansion, fueled by rising industrialization, the need for energy efficiency, and stricter environmental laws. Major opportunities involve adopting energy-saving technologies. Industries are more focused on cutting energy use and emissions, increasing demand for boilers that use advanced technology for lower fuel costs and operating expenses. Incorporating smart systems and expanding into emerging markets are key growth drivers that further support this upward trend.

Market Challenge

What Are the Key Challenges That Hinder the Growth of The Industrial Boiler Market?

The market encounters several major challenges, such as high upfront costs, volatile fuel prices, rising energy expenses, the demand for regulatory compliance, and a shortage of skilled workers. Furthermore, the complexity of modern boiler systems and the necessity for continuous maintenance and upgrades further compound these challenges.

Regional Insights

How Did Asia Pacific Dominate the Industrial Boiler Market in 2024?

The Asia Pacific industrial boiler market size was estimated at USD 5.99 billion in 2024 and is anticipated to reach USD 8.75 billion by 2034, growing at a CAGR of 3.86% from 2025 to 2034. Asia Pacific dominated the industrial boiler market in 2024. The growth of the market is driven by rapid industrialization, which demands efficient and reliable energy production, increasing the growth of the market in the region. The government initiatives to promote the use of renewable energy sources and the adoption of sustainable practices and solutions, and the adoption of biomass boilers and other advanced technology solutions drive the growth of the market in the region. Other key factors that fuel the growth of the market are shifting fuel preferences and technological advancements drive the growth of the market.

China Has Seen Significant Growth Driven by Increased Energy Demand.

The growth of the market is driven by the growing demand and need for energy with efficient heat and steam generation, which fuels the growth of the market. The key aspects that boost the growth of the Chinese market are the dominance of coal-fired boilers, the growing natural gas and biomass boiler demand, technological advancements, and environmental regulations, which increase the growth of the market in the country. The key players play a crucial role due to the large number of manufacturers in the country, which boosts the growth of the market.

The Middle East and Africa Have Seen Significant Growth in The Market, Driven Using Renewable Energy Sources.

The Middle East and Africa are expected to experience significant growth in the industrial boiler market in the forecast period. The growth of the market is driven by the growing demand and use of renewable sources and increasing energy demand, which fuels the growth of the market. The key growth drivers of the market are industrial expansion, energy demand, infrastructural development, focus on energy efficiency, and the increasing food industry, which boosts the growth of the market in the region.

Saudi Arabia Has Seen Significant Growth in The Market, Driven by The Key Players' Support.

The country is experiencing growth driven by the growing demand for energy, and government initiatives for promoting and adopting sustainable practices fuel the growth of the market in the country. Government initiatives like Saudi Vision 2030 and other government supports to promote cleaner energy technologies and sustainable industrial practices influence the adoption of energy-efficient boilers, which boosts the growth of the market in the country.

- World shipped out 1.3K Industrial Boilers. These exports were handled by 131 world exporters to 108 buyers. (Source: www.volza.com)

- Globally, Italy, China, and the United States are the top three exporters of Industrial boilers. Italy is the global leader in Industrial Boiler exports with 828 shipments, followed closely by China with 227 shipments, and the United States in third place with 76 shipments.(Source: www.volza.com)

Segmental Insights

Boiler Type Insights

Why did Fire Tube Boiler Segment Held The Largest Industrial Boiler Market Share in 2024?

The fire-tube boiler segment dominated the market in 2024. They are commonly used in manufacturing plants, hospitals, and other establishments that require process steam and heating. The growth of the market is driven by eh growing advantages offered by the boiler, like simple design, reliability, lower cost, ease of maintenance, with a wide range of applications, like use in various industries for heating, power generation, and process steam, which fuels the growth and expansion of the market.

The water-tube boiler segment expects significant growth in the industrial boiler market during the forecast period. The growth of the market is driven by the key features and operations like water circulation, high-pressure steam, efficiency, compact design, and variable steam loads increases the demand for the market supporting the growth and expansion of the market.

Fuel Type Insights

Which Fuel Type Segment Dominated the Industrial Boiler Market In 2024?

The natural gas segment dominated the market in 2024. Natural gas is widely used as fuel in industrial boilers, also due to its ready availability, which increases the demand for the market. The growing applications and properties like clean burning, efficiency, cost effectiveness, safety, storage, and suitability for condensing technology, reduced emissions, and wide availability due to its convenient fuel choice make it a preferred choice by various industries, which boosts the growth and expansion of the market.

The biomass segment expects significant growth in the industrial boiler market during the forecast period. They use organic material like wood, agricultural residues, and a certain type of waste to generate heat and steam, which increases the demand for the market. Commonly used biomass fuels include wood pellets, corn cobs, rice husks, straw, various agricultural wastes, and wood chips. The growth of the market is driven by the growing benefits offered, like waste reduction, reduced carbon emission, renewable energy sources, cost effectiveness, and energy security fuel the growth of the market.

Boiler Horsepower Insights

Why Did 10–150 BHP Segment Dominated the Industrial Boiler Market in 2024?

The 10–150 BHP segment dominated the market in 2024. They are commonly used for small to medium-scale operations requiring moderate steam or hot water output. These boilers are ideal for applications such as food processing, small manufacturing plants, hospitals, and commercial heating systems. Their compact size, energy efficiency, and relatively lower installation and operating costs make them attractive for facilities with limited space and budget constraints, driving demand and supporting steady market growth in this segment.

The 301–600 BHP segment expects significant growth in the industrial boiler market during the forecast period. They are essential for medium- to large-scale operations requiring substantial steam or hot water capacity. These boilers are widely used in industries such as chemical manufacturing, pharmaceuticals, large food processing plants, and district heating systems. Their ability to deliver high output reliably and efficiently makes them ideal for continuous, intensive operations. The demand for robust, high-capacity boilers supports market growth and encourages technological advancements in this segment.

Pressure Range Insights

Which Low-Pressure (0–15 Psi) Segment Dominated the Industrial Boiler Market In 2024?

The low-pressure (0–15 psi) segment dominated the market in 2024. They are widely used due to their safety, cost-effectiveness, and suitability for various light-duty applications. These boilers generate steam or hot water at lower pressures, making them ideal for heating, sterilization, laundry services, and food processing where high-pressure steam is not required. Their simpler design, lower maintenance needs, and reduced regulatory requirements drive their demand, supporting market growth and widespread adoption across small- to medium-scale industrial operations.

The high-pressure (above 150 psi) segment expects significant growth in the industrial boiler market during the forecast period.

They are crucial due to their ability to generate steam at high pressures and temperatures, which is essential for demanding applications. These boilers are widely used in power generation, chemical processing, oil refining, and large-scale manufacturing, where high thermal efficiency and continuous, reliable steam supply are critical. Their capacity to support intensive industrial processes drives strong demand, supporting market growth and encouraging technological advancements in boiler systems.

Application Insights

Why Did Process Heating Segment Dominated the Industrial Boiler Market In 2024?

The process heating segment dominated the market in 2024. The growth of the market is driven, as it is essential for various manufacturing and production activities. Industrial boilers provide reliable and efficient heat energy required for processes like drying, sterilization, distillation, and chemical reactions. Their ability to maintain consistent temperatures and support large-scale, continuous operations makes them crucial in industries such as chemicals, food and beverages, pharmaceuticals, and textiles. This critical role boosts demand, supporting market expansion and technological advancement.

The power generation segment expects significant growth in the industrial boiler market during the forecast period. Power generation is a key application segment fueling growth in the market, as boilers play a vital role in producing steam to drive turbines for electricity generation. Their ability to operate under high-pressure and temperature conditions ensures efficient energy conversion and a reliable power supply. Widely used in thermal power plants and captive power setups in industries, these boilers help meet growing energy demands. This essential function drives strong market demand, supporting expansion and innovation in boiler technologies.

End-Use Industry Insights

Why did Chemical & Petrochemical Segment Hold the Largest Industrial Boiler Market Share in 2024?

The chemical & petrochemical segment dominated the market in 2024. The types of boilers used are steam boilers and thermal oil heaters due to their benefits and applications increases the demand for the market. The key considerations, like reliability, safety, efficiency, and corrosion resistance, play a crucial role in the growth of the market. The key applications also play a role as a driver for the growth of the market, like chemical production, process heating, power generation, and heat exchangers, which help in the growth and expansion of the market.

The pharmaceuticals segment expects significant growth in the industrial boiler market during the forecast period. The growth of the market is driven by the key considerations for pharmaceutical boilers like steam quality, efficiency and energy saving, reliability, and safety, with compliance playing crucial role in maintaining the quality and safety of the pharmaceutical products, which ensures temperature and pressure, which also helps in preventing contamination, which drives the growth of the market.

Design Insights

Why Did Horizontal Boilers Segment Dominated the Industrial Boiler Market in 2024?

The horizontal boilers segment dominated the market in 2024. Horizontal boilers are widely adopted in the market due to their compact design, ease of installation, and efficient heat transfer capabilities. These boilers offer a larger heating surface area, which enhances steam generation and improves operational efficiency. Their simple maintenance, stable performance, and ability to handle high steam loads make them suitable for various industrial applications such as food processing, chemical manufacturing, and textile production. These advantages drive demand, supporting market growth and widespread usage.

The vertical boilers segment expects significant growth in the industrial boiler market during the forecast period. Vertical boilers are favored in the market for their space-saving design and suitability for small to medium-scale applications. Their vertical structure allows installation in facilities with limited floor space, making them ideal for compact industrial setups. They offer quick steam generation, easy maintenance, and lower initial costs compared to larger horizontal designs. These features make vertical boilers highly attractive for industries such as laundry, food processing, and small manufacturing units, supporting steady market demand and growth.

Technology Insights

Which Technology Segment Dominated The Industrial Boiler Market in 2024?

The non-condensing boilers segment dominated the market in 2024. They are widely used due to their simpler design, lower upfront cost, and ease of maintenance. These boilers operate at higher temperatures and expel hot flue gases without capturing latent heat, making them suitable for applications where high-temperature steam or hot water is required. Their robust performance and cost-effectiveness drive strong demand, particularly in industries prioritizing initial investment savings, thus supporting market expansion and continued adoption.

The condensing boilers segment expects significant growth in the industrial boiler market during the forecast period. They are gaining attention due to their high energy efficiency and reduced environmental impact. These boilers capture and reuse latent heat from exhaust gases, achieving efficiency levels above 90%, which significantly lowers fuel consumption and operational costs. Additionally, they help industries meet strict emission regulations by reducing greenhouse gas output. Their superior performance and sustainability advantages drive demand, supporting market growth and encouraging a shift toward greener heating solutions.

Recent Developments

- In May 2025, Fujifilm’s Tilburg, the Netherlands company, launched a brand new electric industrial boiler which helps in supplying green steam to the operational sites which aligning with sustainability and creating environmental impact. (Source: pharmaceuticalmanufacturer.media)

- In July 2025, Thermogenics, a North American leader in boiler lifecycle solutions, launched a new biogas system that allows industrial boilers to which will run on renewable biogas I combination with natural gas. This initiative aligns with sustainability, which aligns with growing environmental concerns.(Source: bioenergytimes.com)

Top Companies List

- General Electric (GE Power)

- Bosch Industriekessel GmbH

- Cleaver-Brooks

- Fulton Boiler Works, Inc.

- Mitsubishi Heavy Industries, Ltd.

- Siemens Energy

- Babcock & Wilcox Enterprises, Inc.

- Thermax Limited

- Forbes Marshall

- Miura Co., Ltd.

- Johnston Boiler Company

- Hurst Boiler & Welding Co., Inc.

- Bryan Steam LLC

- Superior Boiler Works, Inc.

- IHI Corporation

- Viessmann Group

- Rentech Boiler Systems

- ANDRITZ Group

- Doosan Heavy Industries & Construction

- Harbin Electric Company Limited

Segments Covered

By Boiler Type

- Fire-Tube Boiler

- Water-Tube Boiler

- Electric Boiler

By Fuel Type

- Natural Gas

- Oil

- Coal

- Biomass

- Others (e.g., waste heat, electricity)

By Boiler Horsepower (BHP)

- 10–150 BHP

- 151–300 BHP

- 301–600 BHP

- Above 600 BHP

By Pressure Range

- Low Pressure (0–15 psi)

- Medium Pressure (16–150 psi)

- High Pressure (Above 150 psi)

By Application

- Process Heating

- Power Generation

- HVAC & Hot Water Supply

- Food Sterilization

- Others (e.g., waste incineration)

By End-Use Industry

- Chemical & Petrochemical

- Food & Beverage

- Paper & Pulp

- Metals & Mining

- Textile

- Pharmaceuticals

- Oil & Gas

- Power Utilities

- Others (e.g., cement, sugar)

By Design

- Horizontal Boilers

- Vertical Boilers

By Technology

- Condensing Boilers

- Non-Condensing Boilers

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait