Content

Titanium Dioxide Market Size and Growth 2025 to 2034

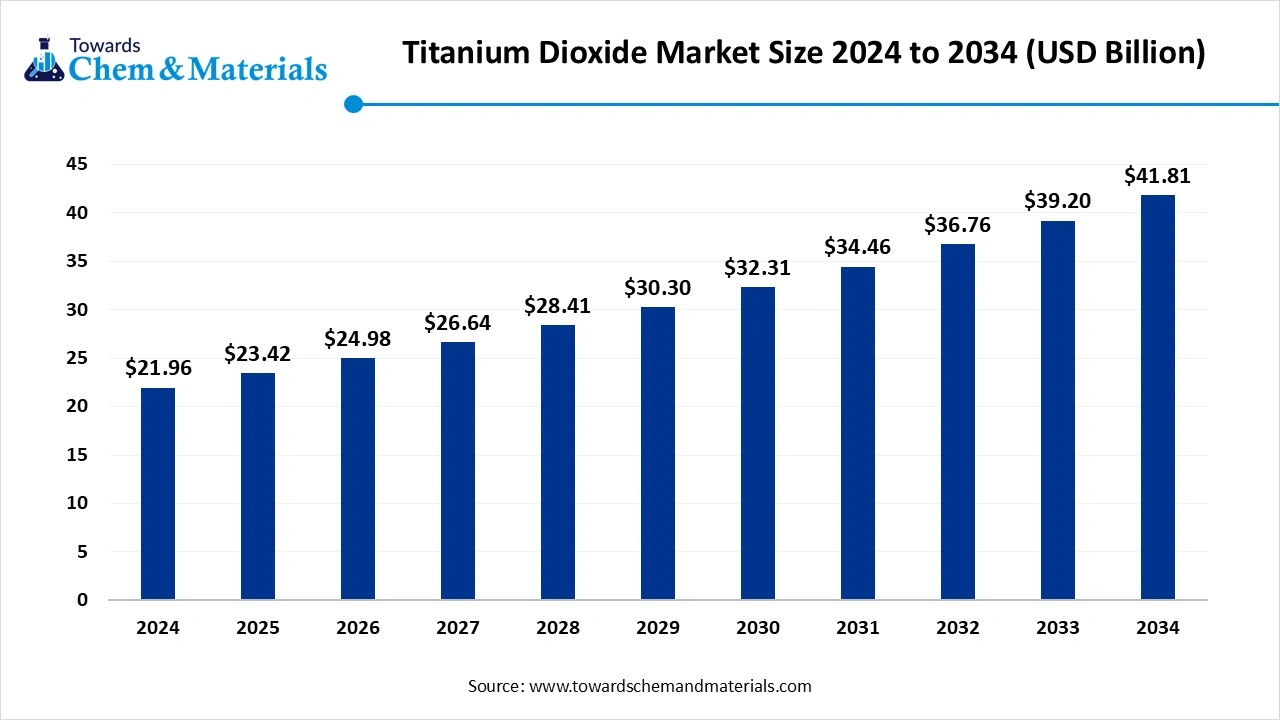

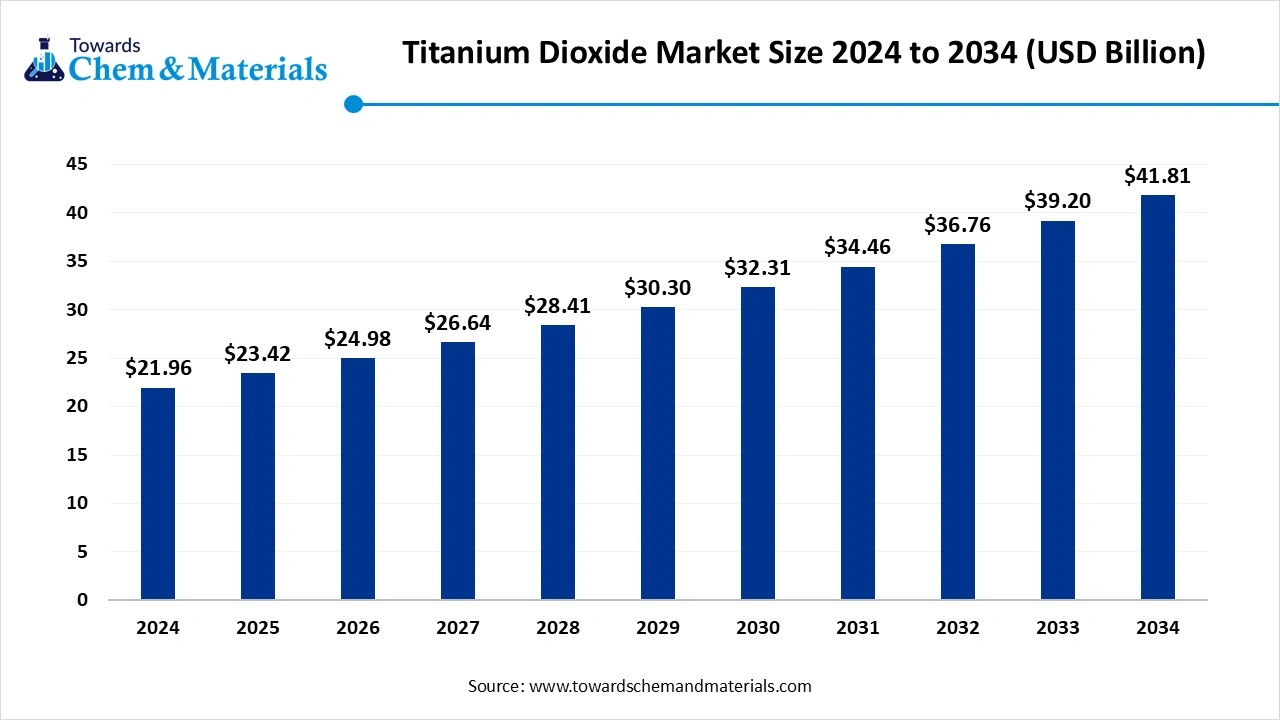

The global titanium dioxide market size was reached at USD 21.96 billion in 2024 and is expected to be worth around USD 41.81 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.65% over the forecast period 2025 to 2034. Surge in investments in the chloride manufacturing processes is the key factor driving market growth. Also, technological advancements in the production processes, coupled with the rising awareness about the benefits of titanium dioxide, can fuel market growth further.

Key Takeaways

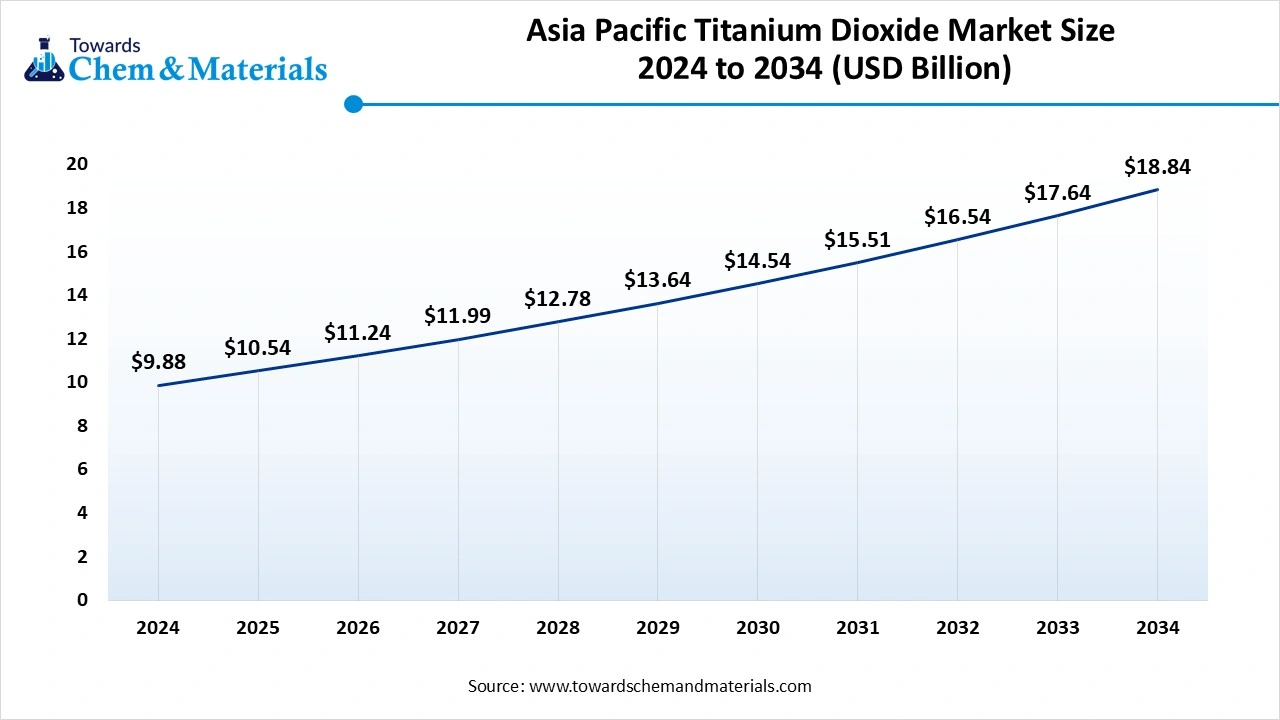

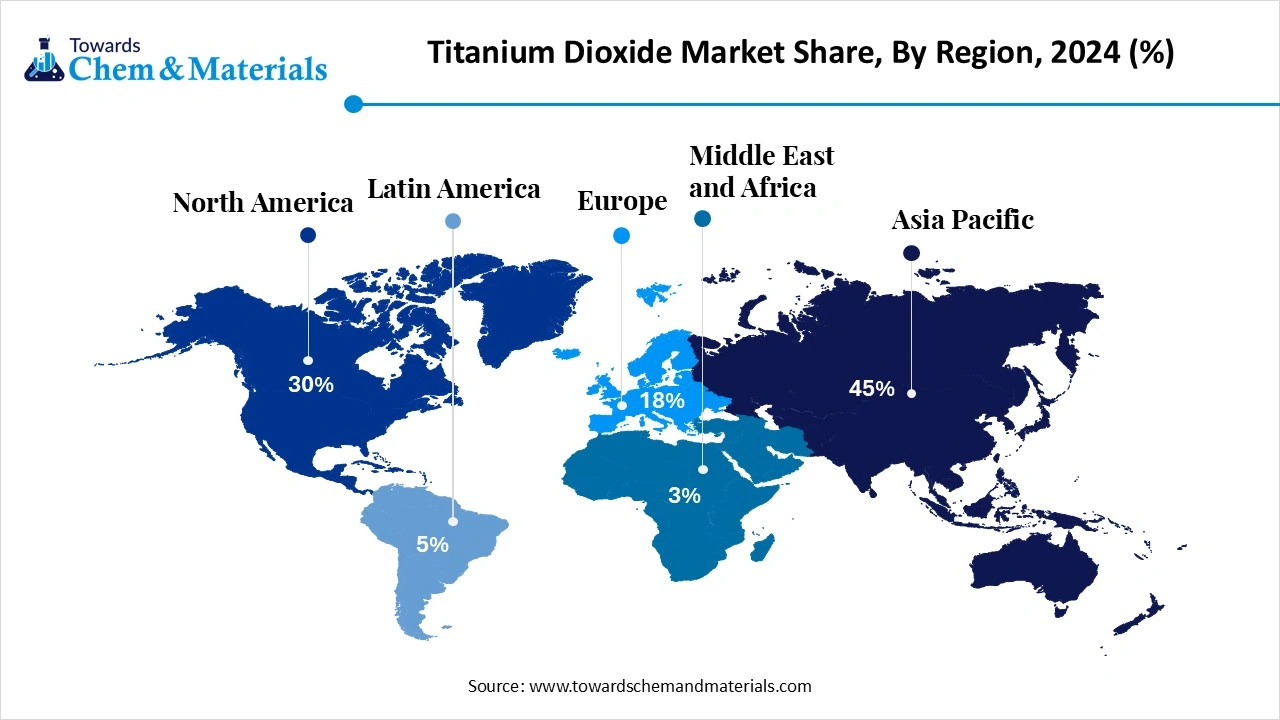

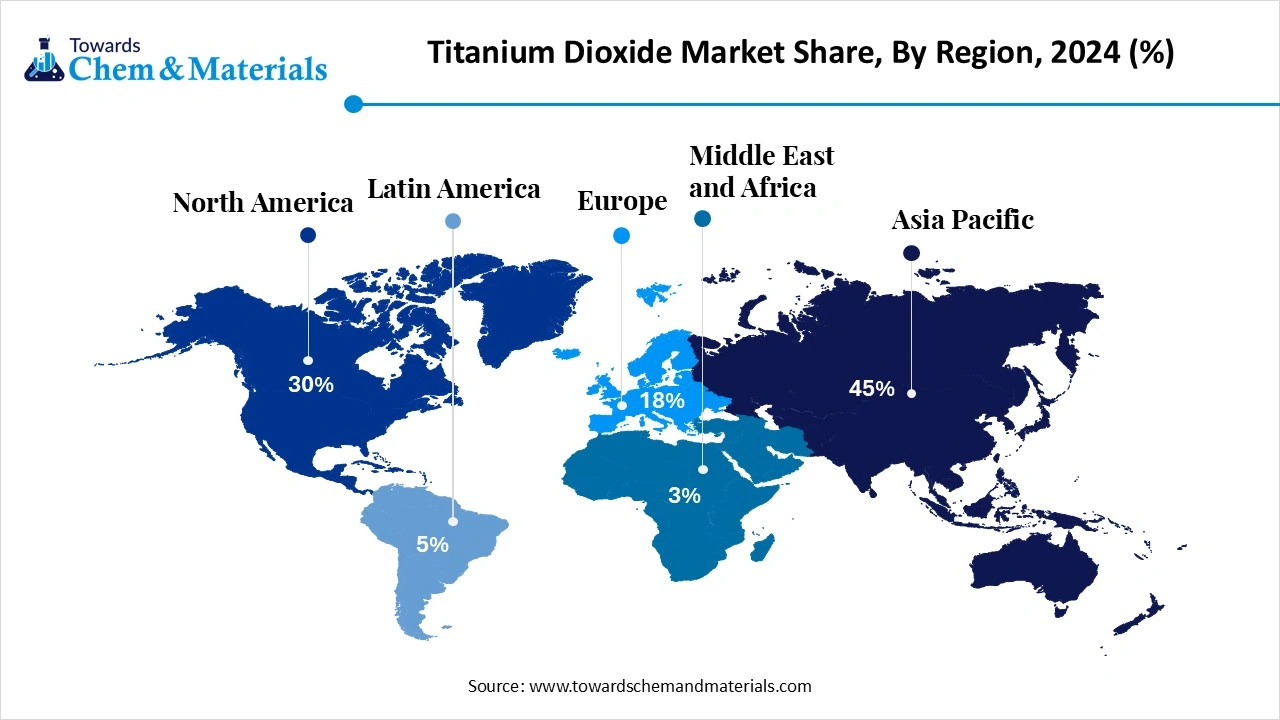

- By region, Asia Pacific dominated the titanium dioxide market with a 45% share in 2024. The dominance of the region can be attributed to the ongoing economic expansion and rapid urbanisation in the emerging economies.

- By region, the Middle East & Africa is expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to the expansion in the coatings and paints industry, coupled with the expansion of the automotive sector in developed countries.

- By grade, the rutile segment dominated the market with a 70% market share in 2024. The dominance of the segment can be attributed to its high weathering properties as compared to anatase.

- By grade, the anatase segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the rising product demand in paints and coatings.

- By production process, the sulfate process segment held a 55% market share in 2024. The dominance of the segment can be linked to its adaptability to various raw materials and cost-effectiveness.

- By production process, the chloride process segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by its ability to create standard quality TiO2 with superior brightness.

- By form, the pigmentary TiO₂ segment led the market by holding 90% market share in 2024. The dominance of the segment is owed to the rising demand from the plastics, coatings, and cosmetics sectors.

- By form, the nanoparticle/ultrafine TiO₂ segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment is due to its unique properties, such as excellent opacity.

- By application, the paints & coatings segment held a 45% market share in 2024. The dominance of the segment can be attributed to the wide application of white pigment TiO2 in this industry.

- By application, the cosmetics & personal care segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment can be credited to the increasing awareness of skincare.

- By end-use industry, the construction segment dominated the market with a 30% market share in 2024. The dominance of the segment can be linked to the rapid urbanization and infrastructure development across the globe.

- By end-use industry, the healthcare segment is expected to grow at the fastest CAGR during the study period. The growth of the segment can be driven by the extensive use of the product in various cosmetics and medical products.

- By distribution channel, the direct sales segment led the market with 65% market share in 2024. The dominance of the segment is owed to the growing product demand from the paints and coatings industry.

- By distribution channel, the online retail segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment is due to increasing consumer awareness and demand for personal care products.

Advancements In Nanotechnology Are Expanding Market Growth

Titanium Dioxide (TiO₂) is a white inorganic compound primarily used as a pigment due to its brightness, high refractive index, and opacity. It is widely utilized across various industries, including paints and coatings, plastics, paper, cosmetics, and food. Its demand is driven by the product's UV-resistant properties, chemical stability, and non-toxic nature, making it suitable for applications ranging from industrial coatings to sunscreen. Nanoscale TiO2 particles provide improved properties such as antibacterial effects, improved UV resistance, and better optical characteristics.

What Are the Key Trends Influencing the Titanium Dioxide Market?

- The rising demand for lightweight vehicles, along with the innovations in technology, is the latest trend in the market. Also, a surge in construction activities, boosted by consumers enhancing lifestyles and ongoing government infrastructure projects, is further promoting the demand for titanium dioxide.

- Rapid urbanisation and infrastructure developments in emerging economies are increasingly creating the demand for high-performance coatings that offer weather resistance, durability, and aesthetic appeal. Sustainability trends are escalating TiO2 applications in air purification, self-cleaning surfaces, and solar panels, which leads to advancements in eco-friendly formulations.

- There is an increasing need for skincare products globally, as it provides a high color context, such as improved brightness and intensity, shields the skin from radiation, etc, hence titanium dioxide is frequently being used in the cosmetic industry, impacting positive market growth soon.

Report Scope

| Report Attribute | Details |

| Market Size in 2025 | USD 23.42 Billion |

| Expected Size by 2034 | USD 41.81 Billion |

| Growth Rate from 2025 to 2034 | CAGR 6.65% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Grade, By Production Process, By Form, By Application, By End-Use Industry, By Distribution Channel, By Region |

| Key Companies Profiled | The Chemours Company, Venator Materials PLC, Kronos Worldwide, Inc., Tronox Holdings PLC, Lomon Billions Group Co., Ltd., LB Group Co., Ltd. (formerly Henan Billions), Ishihara Sangyo Kaisha, Ltd., Tayca Corporation, Cinkarna Celje d.d., INEOS Pigments (acquired by Venator), Evonik Industries AG, Grupa Azoty Zakłady Chemiczne “Police” S.A., Precheza a.s., CNNC Huayuan Titanium Dioxide Co., Ltd., Shandong Doguide Group Co., Ltd., Henan Yuxing Sino-German Titanium Industry Co., Ltd., Cristal (acquired by Tronox), CNNC Lanzhou Titanium Industry Co., Ltd., Taizhou Sunny Chemical Co., Ltd., Titanos Group |

Market Opportunity

Innovations in Nanotechnology

Due to enhancements in product performance and expanding applications, nanotechnology is influencing the market. Because of their exceptional properties, nanoscale TiO2 particles are extensively utilized in self-cleaning surfaces, energy-efficient materials, and advanced coatings. Furthermore, this trend is facilitating advances in high-tech sectors like automotive, electronics, and renewable energy.

- In February 2025, Chemours, a leader in the chemical sector, announced the launch of new grades of titanium dioxide, namely Ti-Pure R-706 and Ti-Pure TS-6706. The new (TiO₂) grade functions smoothly for a range of coating applications.(Source: www.indianchemicalnews.com)

Market Challenges

Competition from Alternative Materials

The market faces competition from alternative materials like calcium carbonate and zinc oxide, which are generally considered more cost-effective while providing the same benefits. Competition from Alternative Materials. Moreover, the market players in the TiO2 industry are constantly under pressure to minimize prices or invest in the latest technology to maintain their market share. Hence, failure to keep up with technological advancements and competitive pricing can reduce the demand for TiO₂.

Regional Insight

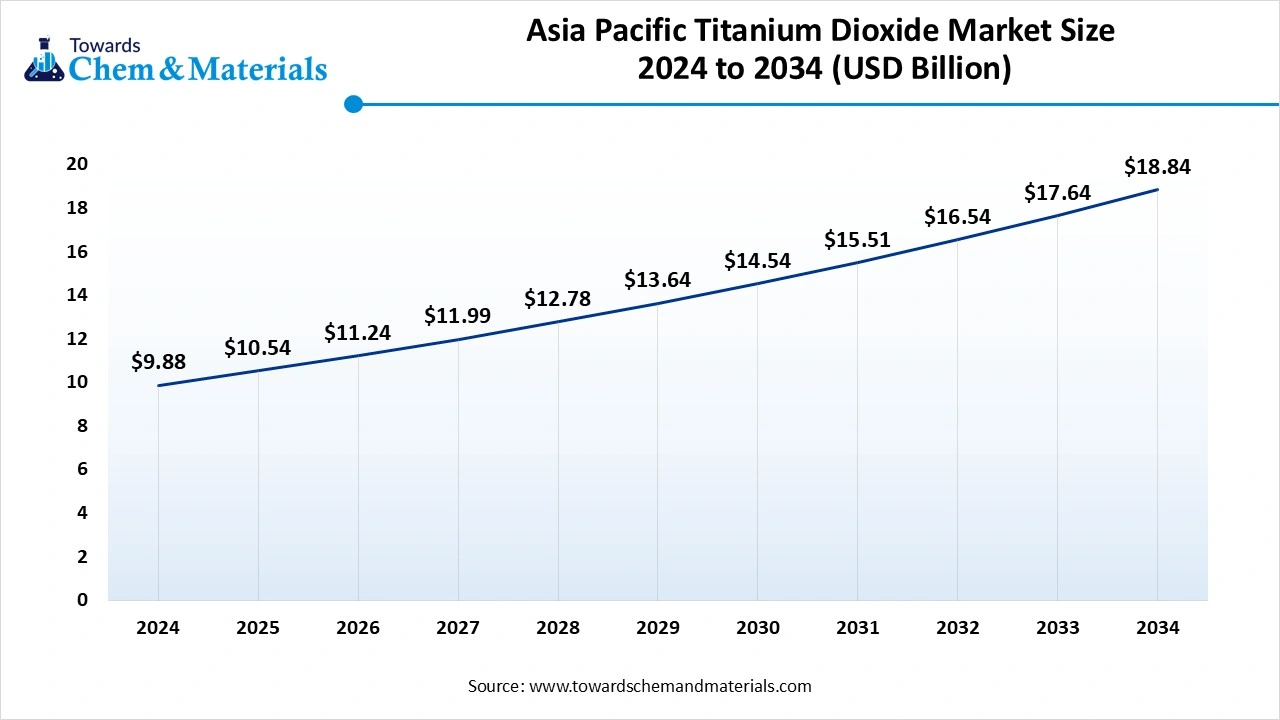

The Asia Pacific titanium dioxide market size was estimated at USD 9.88 billion in 2024 and is anticipated to reach USD 18.84 billion by 2034, growing at a CAGR of 6.67% from 2025 to 2034. Asia Pacific dominated the titanium dioxide market with a 45% share in 2024.

The dominance of the region can be attributed to the ongoing economic expansion and rapid urbanisation in the emerging economies such as China and India. In addition, the growing demand for high-performance paints, coatings, and construction materials further boosts market dominance in the region. The strong presence of major manufacturers and rising industrial activities has a positive impact on market growth.

Titanium Dioxide Market in China

In the Asia Pacific, China led the market due to the rapid urbanization, industrialization, and expanding construction industry. China's ongoing economic growth has propelled substantial industrial growth and urban development. Also, Chinese TiO2 manufacturers are rapidly expanding their manufacturing capacity and innovating with new TiO2 products.

The Middle East & Africa are expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to the expansion in the coatings and paints industry, coupled with the expansion of the automotive sector in developed countries. Furthermore, the MEA market is also witnessing trends such as raised adoption of digital solutions, a surge in infrastructure and innovation, and rising demand for sustainable practices.

Who are Top Countries in Export of Titanium in 2023?

| Countries | Exports in USD |

| United States | 2,190,300,000 |

| Russia | 672,510,000 |

| Germany | 653,070,000 |

| Japan | 650,370,000 |

| United Kingdom | 579,530,000 |

Segmental Insight

Grade Insights

Which Grade Type Segment Dominated the Titanium Dioxide Market in 2024?

The rutile segment dominated the market with a 70% market share in 2024. The dominance of the segment can be attributed to its high weathering properties as compared to anatase. The rutile grade of TiO2 is used to produce titanium oxide pigments, refractory ceramics, and the manufacturing of titanium metal. Additionally, Rutile TiO2 offers superior brightness and opacity, important for achieving strong coverage in paints and coatings.

The anatase segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the rising product demand from paints and coatings, especially in the automotive and construction sectors. Also, the trend towards lightweighting vehicles and rising demand for high-quality and durable plastics in car parts are driving the growth soon.

Production Process Insight

Why Sulphate Process Segment Dominated the Titanium Dioxide Market in 2024?

The sulphate process segment held a 55% market share in 2024. The dominance of the segment can be linked to its adaptability to various raw materials and cost-effectiveness. The sulphate process is related to a strong environmental impact because of the use of sulfuric acid. The ongoing innovations in recycling and byproduct treatment are focusing on solving these concerns soon.

The chloride process segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by its ability to create standard quality TiO2 with superior brightness, UV resistance, and opacity, especially favoured in the plastics and coating industries. The chloride process is important for coatings, paints, and the paper industry.

Form Insight

How Much Share Did the Pigmentary TiO₂ Segment Hold in 2024?

The pigmentary TiO₂ segment dominated the titanium dioxide market by holding 90% market share in 2024. The dominance of the segment is owing to the rising demand from the plastics, coatings, and cosmetics sectors due to the properties of white pigment, such as opacity, brightness, and UV-resistant properties. Moreover, growing demand for personal care products, like cosmetics, can fuel segment growth soon.

The nanoparticle/ultrafine TiO₂ segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment is due to its unique properties, such as excellent opacity, high UV absorption, and photocatalytic activity. In addition, TiO₂ nanoparticles are also used in catalysts, electronics, and other advanced applications where their properties can be beneficial.

Application Insight

Which Application Type Segment Dominated the Titanium Dioxide Market in 2024?

The paints & coatings segment held a 45% market share in 2024. The dominance of the segment can be attributed to the wide application of white pigment TiO2 in this industry, along with the superior properties of TiO2, like exceptional brightness, opacity, and UV resistance. Also, consumers are increasingly prioritizing long-lasting and aesthetic appeal performance of coatings, which propels the demand for TiO2.

The cosmetics & personal care segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment can be credited to the increasing awareness of skincare, coupled with the surge in popularity of cosmetic products. TiO2's whitening and UV-blocking abilities make it a main ingredient in sunscreens and other cosmetic products.

End-Use Industry Insight

Why Did the Construction Segment Held the Largest Titanium Dioxide Market Share in 2024?

The construction segment dominated the market with a 30% market share in 2024. The dominance of the segment can be linked to the rapid urbanization and infrastructure development across the globe. In addition, the government investment in infrastructure projects, coupled with the cost-effective housing programs, can contribute to the expansion of the segment by propelling the demand for TiO2-based paints and coatings.

The healthcare segment is expected to grow at the fastest CAGR during the study period. The growth of the segment can be driven by extensive use of the product in various cosmetics and medical products such as pharmaceuticals, sunscreens, and dental products. Additionally, TiO2's properties like brightness, opacity, and UV-blocking capabilities make it crucial in healthcare applications.

Distribution Channel Insight

How Much Share Did the Direct Sales Segment Held in 2024?

The direct sales segment dominated the titanium dioxide market with a 65% market share in 2025. The dominance of the segment is owing to the growing product demand from the paints and coatings industry, along with the surge in applications in the cosmetics and pharmaceuticals industry. The automotive sector also depends on TiO2 for high-grade coating on vehicles, which will impact positive market growth soon.

The online retail segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment is due to increasing consumer awareness and demand for personal care products and sunscreens containing TiO2. Furthermore, government regulations and initiatives about the use of titanium dioxide can boost segment growth during the forecast period.

Recent Developments

- In March 2025, Venator, a world leader in specialty ingredients and chemicals, launched substantial advancements in TiO2 technology with the launch of its TME-free and TMP TIOXIDE TR81 grade, designed to help customers navigate increasingly strict regulations.(Source : www.chemanalyst.com)

Titanium Dioxide Market Top Companies

- The Chemours Company

- Venator Materials PLC

- Kronos Worldwide, Inc.

- Tronox Holdings PLC

- Lomon Billions Group Co., Ltd.

- LB Group Co., Ltd. (formerly Henan Billions)

- Ishihara Sangyo Kaisha, Ltd.

- Tayca Corporation

- Cinkarna Celje d.d.

- INEOS Pigments (acquired by Venator)

- Evonik Industries AG

- Grupa Azoty Zakłady Chemiczne “Police” S.A.

- Precheza a.s.

- CNNC Huayuan Titanium Dioxide Co., Ltd.

- Shandong Doguide Group Co., Ltd.

- Henan Yuxing Sino-German Titanium Industry Co., Ltd.

- Cristal (acquired by Tronox)

- CNNC Lanzhou Titanium Industry Co., Ltd.

- Taizhou Sunny Chemical Co., Ltd.

- Titanos Group

Segments Covered

By Grade

- Rutile

- Anatase

By Production Process

- Sulfate Process

- Chloride Process

By Form

- Pigmentary TiO₂

- Nanoparticle/Ultrafine TiO₂

By Application

- Paints & Coatings

- Architectural Coatings

- Automotive Coatings

- Industrial Coatings

- Marine Coatings

- Plastics

- Packaging Plastics

- Consumer Goods Plastics

- Engineering Plastics

- Paper & Pulp

- Coated Paper

- Specialty Paper

- Cosmetics & Personal Care

- Sunscreens

- Skin Care Products

- Decorative Cosmetics

- Food & Beverages

- Food Coloring Additives (E171)

- Packaging Applications

- Pharmaceuticals

- Tablet Coatings

- Capsules & Gelatin

- Textiles

- Fiber Treatment

- Fabric Coatings

- Others

- Ceramics

- Inks

- Rubber

By End-Use Industry

- Construction

- Automotive

- Consumer Goods

- Healthcare

- Packaging

- Electronics

- Textile

- Food & Beverage

- Agriculture

- Others

By Distribution Channel

- Direct Sales

- Distributors

- Online Retail

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait