Content

Controlled Release Fertilizers Market Size, Share, and Demand 2025 to 2034

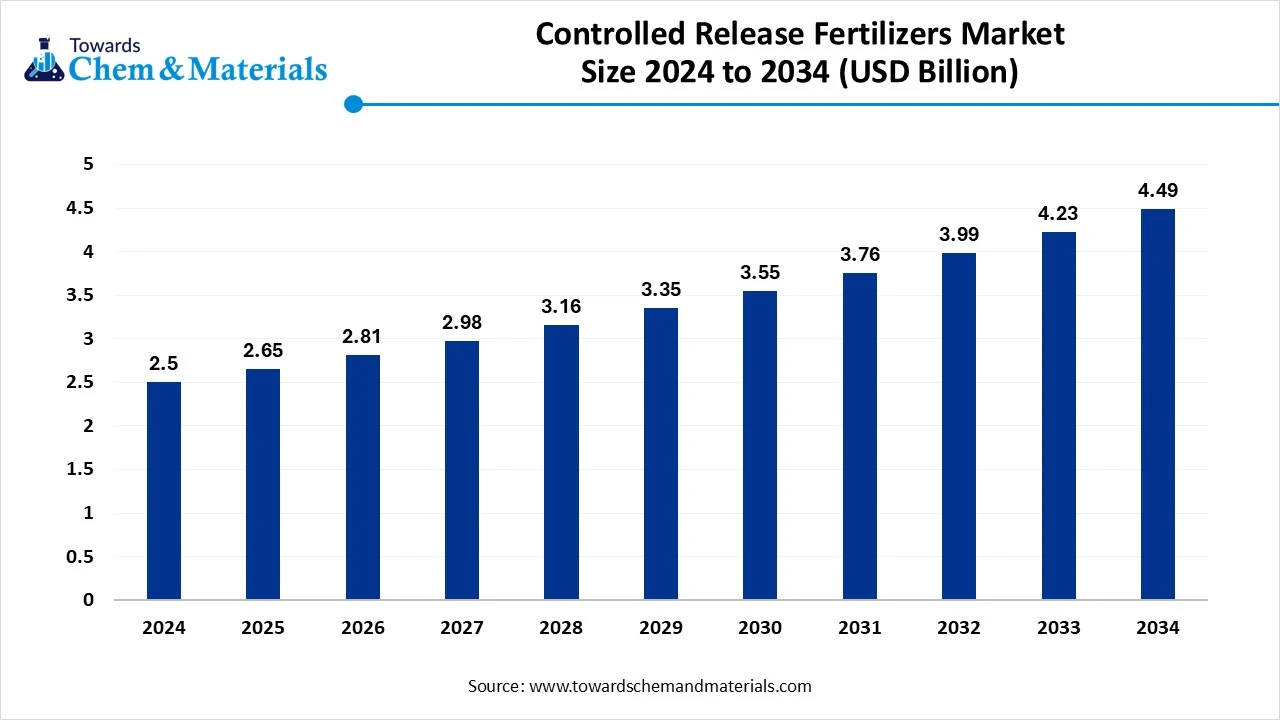

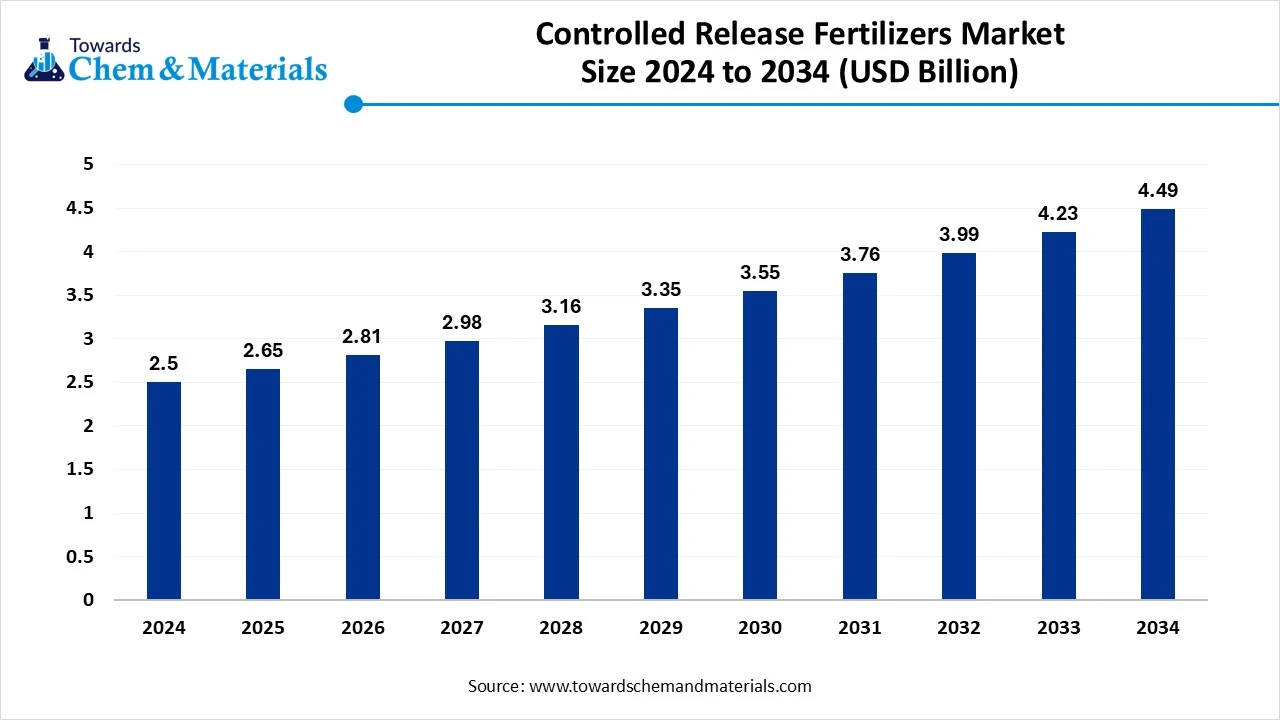

The globalcontrolled release fertilizers market size was estimated at USD 2.95 billion in 2025 and is expected to increase from USD 3.13 billion in 2026 to USD 5.36 billion by 2035, growing at a CAGR of 6.15% from 2026 to 2035. Asia Pacific dominated the controlled release fertilizers market with the largest volume share of 46.19% in 2025. Increasing adoption of precision agriculture is the key factor driving market growth. Also, the surge in demand for resource-efficient farming, coupled with the rise in environmental regulations against conventional fertilizers, can fuel market growth further.

Key Takeaways

- The Asia Pacific dominated the global controlled release fertilizers market with the largest volume share of 46.19% in 2025.

- By product type, the polymer-coated urea segment dominated the market and accounted for the largest volume share of 31.11% in 2025.

- By coating, the synthetic polymer coatings segment led the market with the largest revenue volume share of 38.59% in 2025.

- By application, the row-crop agriculture segment dominated the market and accounted for the largest volume share of 41.54% in 2025.

- By crop type, the cereals and grains segment led the market with the largest revenue volume share of 37.22% in 2025.

- By distribution channel, the agrochemical distributors segment led the market with the largest revenue volume share of 43.11% in 2025.

Technological Advancements are Expanding Market Growth

Controlled-release fertilizers (CRFs) are fertilizer formulations designed to release nutrients gradually over a predetermined period through physical coatings or chemical modification, matching nutrient availability to crop demand to improve nutrient use efficiency and reduce losses. The technology minimizes the demand for frequent fertilizer applications and reduces the nutrient runoff, promoting environmental regulations and goals. There is a growing emphasis on developing more efficient coating technologies, such as resin-based systems, which can impact positive market growth.

Recent Trends in the Controlled Release Fertilizers Market

- Rising Adoption of Precision Agriculture Practices: Growing use of precision farming and data-driven nutrient management is increasing demand for controlled-release fertilizers that deliver nutrients in a predictable, crop-specific manner and reduce over-application.

- Strong Push Toward Sustainable and Environment-Friendly Farming: Concerns over nutrient runoff, soil degradation, and groundwater contamination are accelerating adoption of controlled-release formulations that minimize nitrogen losses and improve nutrient use efficiency.

- Increasing Demand From High-Value Crops: Expansion of horticulture, fruits and vegetables, turf, and specialty crops is driving use of controlled-release fertilizers to support consistent nutrient availability, higher yields, and improved crop quality.

- Technological Advancements in Coating Materials: Innovation in polymer, sulfur, and bio-based coatings is improving release accuracy, durability, and biodegradability, enhancing fertilizer performance under varying soil and climatic conditions.

- Government Support and Regulatory Alignment: Policies promoting efficient fertilizer use and reduction of environmental impact are encouraging adoption of controlled-release fertilizers in both commercial agriculture and landscaping applications.

Report Scope

| Report Attributes | Details |

| Market Size in 2026 | USD 3.13 Billion |

| Expected Size by 2035 | USD 5.36 Billion |

| Growth Rate from 2026 to 2035 | CAGR 6.15% |

| Base Year of Estimation | 2025 |

| Forecast Period | 2026 - 2035 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Product Type, By Coating, By Application, By Crop Type, By Distribution Channel, By Region |

| Key Companies Profiled | Yara International, Nutrien Ltd. , The Mosaic Company , ICL Group , Haifa Group , OCP Group , EuroChem Group , Koch Fertilizer , K+S AG , SQM (Sociedad Química y Minera) , Kingenta Ecological Engineering Group , Fertiberia , Coromandel International , Hubei Jusheng Technology |

Market Drivers

The controlled-release fertilizer market is driven by the rising need to improve nutrient use efficiency while reducing fertilizer losses in modern agriculture. Increasing pressure on farmers to boost crop yields amid shrinking arable land is accelerating adoption of fertilizers that release nutrients in a controlled, crop-aligned manner. Growing awareness of environmental issues such as nitrogen runoff, soil degradation, and groundwater contamination is also pushing regulators and growers toward advanced nutrient delivery solutions. Expansion of high-value crops, including fruits, vegetables, turf, and horticulture, further supports demand, as these crops benefit significantly from consistent and prolonged nutrient availability.

Market Restraints

High production costs remain a major restraint for controlled-release fertilizers, primarily due to the use of specialized coating materials such as polymers, sulfur, or hybrid coatings. These higher costs can limit adoption among small and price-sensitive farmers, especially in developing regions. Limited availability of technical knowledge on correct application rates and crop-specific usage can also reduce effectiveness, leading to hesitation among end users. In addition, performance variability under different soil types, temperature conditions, and moisture levels can affect nutrient release patterns, creating uncertainty in some farming environments.

Market Opportunities

Significant opportunities are emerging from the rapid adoption of precision agriculture and digital farming practices that rely on targeted nutrient management. Controlled-release fertilizers align well with sensor-based soil monitoring and variable-rate application systems, enabling optimized fertilizer use. Government programs promoting sustainable agriculture, nutrient efficiency, and reduction of environmental impact are creating favorable policy support in several regions. Advances in biodegradable and bio-based coating technologies are also opening new opportunities by addressing concerns related to microplastic residues from conventional polymer coatings.

Market Challenges

One of the key challenges in the controlled-release fertilizers market is balancing release accuracy with cost-effectiveness, particularly for large-scale staple crop farming. Ensuring consistent nutrient release under diverse climatic conditions remains technically complex, especially in regions with extreme temperatures or irregular rainfall.

Regulatory scrutiny around coating materials and long-term soil impact is increasing, requiring continuous innovation and compliance testing. Additionally, educating farmers on the agronomic and economic benefits of controlled-release fertilizers is critical, as improper usage can limit performance and slow broader market penetration.

Segmental Insight

Product Type Insight

Which Product Type Segment Dominated the Controlled Release Fertilizers Market in 2024?

The polymer-coated urea segment dominated the market with a 31.11% share in 2024. The dominance of the segment can be attributed to the rapid development of cost-effective and biodegradable coating materials coupled with the rising demand for high-value crops. Additionally, polymer coatings offer a gradual release of nutrients, reducing losses to the environment and soil through leaching or runoff.

The bio-based coated fertilizers segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the growing demand for eco-friendly and sustainable practices across the globe. In addition, bio-based coatings use renewable resources such as straw, vegetable oils, and lignin, which are environmentally compatible and biodegradable in nature.

Coating Insight

Why Synthetic Polymer Coatings Segment Led the Controlled Release Fertilizers Market in 2025?

The synthetic polymer coatings segment held a 38.59% market share in 2025. The dominance of the segment can be linked to the increasing need for sustainable agriculture and the advantages of precision farming. In addition, these coatings ensure a more gradual and sustained release of nutrients, enhancing their uptake by plants to increase fertilizer use efficiency.

The biodegradable polymer coatings segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by the rapid shift towards bio-based and biodegradable coatings, coupled with the ongoing advancements in nanotechnology and smart coating solutions, which are improving the functional properties of biodegradable polymers, driving segment growth soon.

Application Insight

How Much Share Did the Row-Crop Agriculture Segment Held in 2025?

The row-crop agriculture segment led the market by holding a 41.54% share in 2025. The dominance of the segment is owing to the growing global biofuel and food demand and rapid technological advancements in the agriculture sector. Furthermore, practices such as crop rotation, conservation tillage, and utilisation of cover crops are increasingly gaining traction, leading to segment growth.

The horticulture segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment is due to the growing global demand for vegetables, fruits, and other high-value crops backed by technological advancements, government initiatives, and enhanced post-harvest infrastructure. Horticulture provides a potential to increase livelihood security and farm income, particularly for marginal farmers.

Crop Type Insight

Which Crop Type Segment Dominated Energy Dense Materials Market in 2025?

The cereals and grains segment dominated the market with a 37.22% share in 2025. The dominance of the segment can be attributed to the surge in global food demand due to growth in population across the globe and rising urbanization, which leads to a demand for convenient food. Additionally, innovations in high-yield seed technologies enhance overall crop production and stability.

The vegetables segment is expected to grow at the fastest CAGR during the study period. The growth of the segment can be credited to the growing consumer demand for organic, healthy, and plant-based foods. The use of vegetables in products such as soups, frozen meals, and ready-to-eat meals boosts segment demand, which makes them an essential ingredient for the processing industry.

Distribution Channel Insight

Why Did the Agrochemical Distributors segment Held the Controlled Release Fertilizers Market Share in 2025?

The agrochemical distributors segment held a 43.11% market share in 2025. The dominance of the segment can be linked to the increasing adoption of cutting-edge agricultural technologies such as precision farming. In addition, Farmers use agrochemicals to safeguard crops from pests, diseases, and nutrient deficiencies, which leads to higher yields and enhanced crop quality, which further supports the market for their distribution.

The online and e-commerce segment is expected to grow at the fastest CAGR during the forecast period. The growth of the segment can be driven by the growing need for high-quality food products and government policies supporting sustainable agriculture. Furthermore, E-commerce platforms give convenience to farmers to access an extensive range of specialized CRFs.

Regional Insights

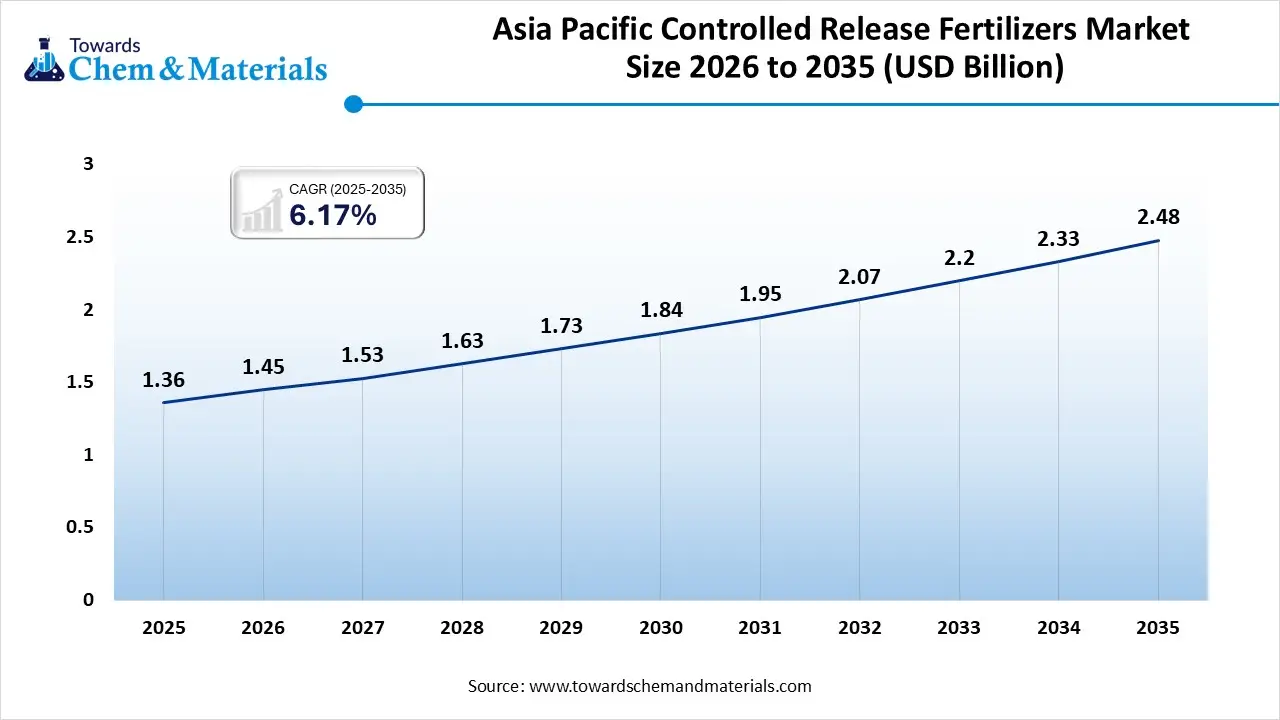

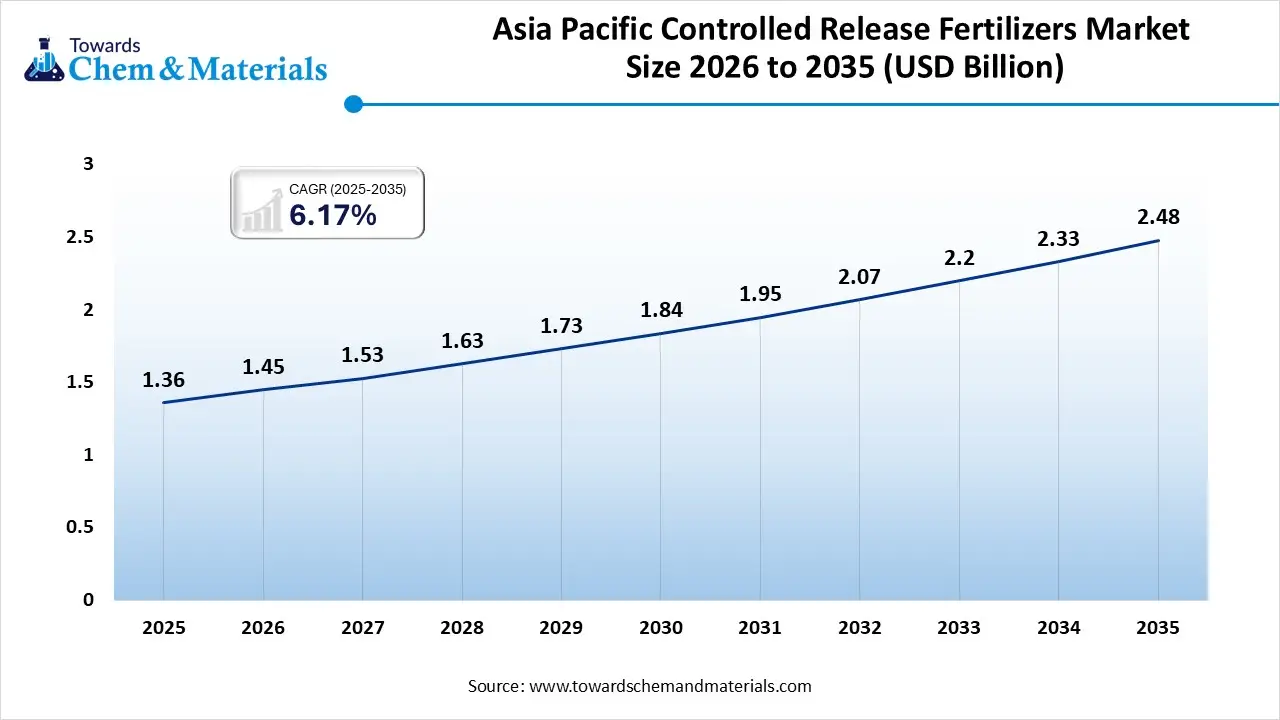

The Asia Pacific controlled release fertilizers market size was valued at USD 1.36 billion in 2025 and is expected to be worth around USD 2.48 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 6.17% over the forecast period from 2026 to 2035.

Asia Pacific dominated the market with a 46.19% share in 2025. The dominance of the region can be attributed to the rising food demand and favourable government policies supporting sustainable agriculture, along with the substantial investments in R&D.Moreover, the increasing population in Asian countries such as China and India has raised the need for food, which drives the demand for sustainable and efficient agricultural goals.

China Controlled Release Fertilizers Market Trends

In the Asia Pacific, China led the market by holding the largest market share, owing to the rapid integration of smart farming technologies and growing demand to enhance nutrient use efficiency (NUE). Also, China's emphasis on improving overall agricultural productivity and sustainability makes it a major driver for CRF market growth.

North America Controlled Release Fertilizers Market Trends

North America is expected to grow at a notable CAGR over the forecast period. The growth of the region can be credited to the surge in environmental concerns and regulatory pressures, coupled with the rising need for high-value crops. Furthermore, government support, such as investments in domestic fertilizer manufacturing and smart agriculture strategies, plays a significant role in market growth in the region, especially in the U.S.

The U.S. Controlled Release Fertilizers Market Trends

The U.S. is the dominant market in North America, driven by strict state-level regulations on nutrient application and growing environmental concerns about water contamination. Major global and local players, including Nutrien Ltd., ICL Group, and Koch Fertilizer, have a strong presence in this market and are actively expanding their production capacities and distribution networks. CRFs are widely used in high-value crops, field crops, and the expanding turf and ornamental sectors.

How will Europe Experience Significant Growth in the Controlled Release Fertilizers Market?

Europe is expected to experience significant growth in the near future, primarily due to stringent environmental regulations, a strong commitment to sustainable agriculture, and the demand for high-value crops that justify the premium cost of CRFs. The region is a hub for innovation in fertilizer technology, with ongoing investment in research and development for advanced coating materials, including biodegradable polymers. This focus on next-generation CRFs addresses the issue of non-degradable polymer residue accumulation in the soil.

Germany Controlled Release Fertilizers Market Trends

Germany represents a substantial market within Europe, characterized by a strong emphasis on environmental sustainability and regulatory compliance. The country’s strict Fertilizer Ordinance aims to limit nitrogen and phosphate emissions, encouraging farmers to adopt CRFs and other enhanced-efficiency fertilizers. There is a growing push for eco-friendly and bio-based fertilizers, with European Union regulations potentially mandating biodegradable coatings in the future.

Emergence of Latin America in the Controlled Release Fertilizers Market

Latin America is also an emerging region in the global market, mainly due to the increasing demand for sustainable agriculture, the expansion of high-value and export-oriented crops, and the growing adoption of precision farming techniques. The region is a major producer and exporter of high-value crops such as soybeans, corn, sugarcane, fruits, and vegetables, leading to improved quality and market value. Governments and major agricultural companies are actively promoting and investing in advanced nutrient management solutions in this region.

Brazil Controlled Release Fertilizers Market Trends

Brazil is a leading market within Latin America, driven by a great and growing demand for fertilizers, despite its heavy reliance on imports. As the world's top producer of soybeans and a significant producer of corn and sugarcane, Brazil's national fertilizer plan and other government initiatives aim to increase domestic production and reduce import dependency in the long term while focusing on sustainable practices.

How did the Middle East and Africa contribute to the Controlled Release Fertilizers Market?

The Middle East and Africa are also contributing regions in the global market. This is largely due to acute water scarcity, strong government initiatives for food security, and the expansion of high-value horticulture and protected agriculture. The region is a major global producer and exporter of nitrogen and phosphate fertilizers, benefiting from abundant, low-cost natural gas feedstock. Countries like South Africa and Saudi Arabia are adopting precision agriculture technologies, including advanced soil testing and automated irrigation systems, which integrate well with the CRF application for optimized results.

UAE Controlled Release Fertilizers Market Trends

The UAE is emerging as a significant market in the region. This is due to its arid environment; the UAE is a pioneer in climate-smart agriculture and desert farming techniques that require highly efficient nutrient delivery systems like CRFs. The UAE is positioning itself as a regional hub for advanced fertilizer solutions, with both local and international players investing in research and development and production capacity to serve the broader Middle East market.

Controlled Release Fertilizers Market -Value Chain Analysis

Feedstock Procurement

Feedstock procurement substantially impacts the growth of the market by impacting production costs, technological advancements, and overall product availability.

Chemical Synthesis and Processing

In this process, the advanced production techniques are used to create products that release nutrients over a significant amount of time. This stage is particularly emphasized on creating the physical barriers, or coatings, to maintain their dissolution.

Packaging and Labelling

It is a crucial process that offers essential information, ensures product integrity, and distinguishes products from competitors. Advancements in packaging solutions are addressing the environmental concerns related to synthetic coatings.

Regulatory Compliance and Safety Monitoring

This stage is important for ensuring overall product quality, decreasing environmental damage, and protecting consumers. This also involves strictly following government regulations and international standards.

Recent Developments

- In July 2025, ICL’s eqo.x became the first biodegradable CRF coating officially certified under the EU Fertilizing Products Regulation, setting a new standard for sustainable innovation. Backed by years of testing, eqo.x ensures efficient nutrient release while fully breaking down into non-toxic components. This certification highlights ICL’s leadership in combining agronomic performance with genuine environmental responsibility, shaping the future of plant nutrition.(Source : icl-growingsolutions.com)

- In February 2025, researchers at Zhengzhou University demonstrated that both the morphological and thermal properties of the composites varied with starch content. The inclusion of starch eliminated the zero-release period, enabling earlier nutrient availability.(Source: onlinelibrary.wiley.com)

Companies List

- Yara International

- Nutrien Ltd.

- The Mosaic Company

- ICL Group

- Haifa Group

- OCP Group

- EuroChem Group

- Koch Fertilizer

- K+S AG

- SQM (Sociedad Química y Minera)

- Kingenta Ecological Engineering Group

- Fertiberia

- Coromandel International

- Hubei Jusheng Technology

Segments Covered

By Product Type

- Polymer-coated urea (PCU)

- Sulfur-coated urea (SCU)

- Resin-coated fertilizers (RCF)

- Polymer-coated NPK blends

- Polymer-coated potassium fertilizers

- Bio-based coated fertilizers

- Stabilized nitrogen fertilizers (with inhibitors)

- Controlled-release micronutrient fertilizers

By Coating

- Synthetic polymer coatings

- Biodegradable polymer coatings

- Sulfur-only coatings

- Resin-only coatings

- Matrix-type formulations

- Micro-encapsulation systems

- Nano-enabled release systems

By Application

- Row-crop agriculture (cereals, grains, oilseeds, pulses, sugar crops)

- Horticulture (vegetables, fruits, ornamentals)

- Turf and landscaping (golf courses, parks, lawns)

- Forestry and plantations (timber, rubber, oil palm)

- Home and garden

By Crop Type

- Cereals and grains

- Oilseeds and pulses

- Vegetables

- Fruits and orchards

- Sugar crops

- Tubers (potatoes, cassava)

- Plantation crops (tea, coffee, rubber, oil palm)

- Forage and fodder crops

By Distribution Channel

- Direct bulk contracts to growers/cooperatives

- Agrochemical distributors and wholesalers

- Retail agro-stores and garden centers

- Online and e-commerce platforms

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait