Content

Asia Pacific Fertilizers Market Size and Growth 2025 to 2034

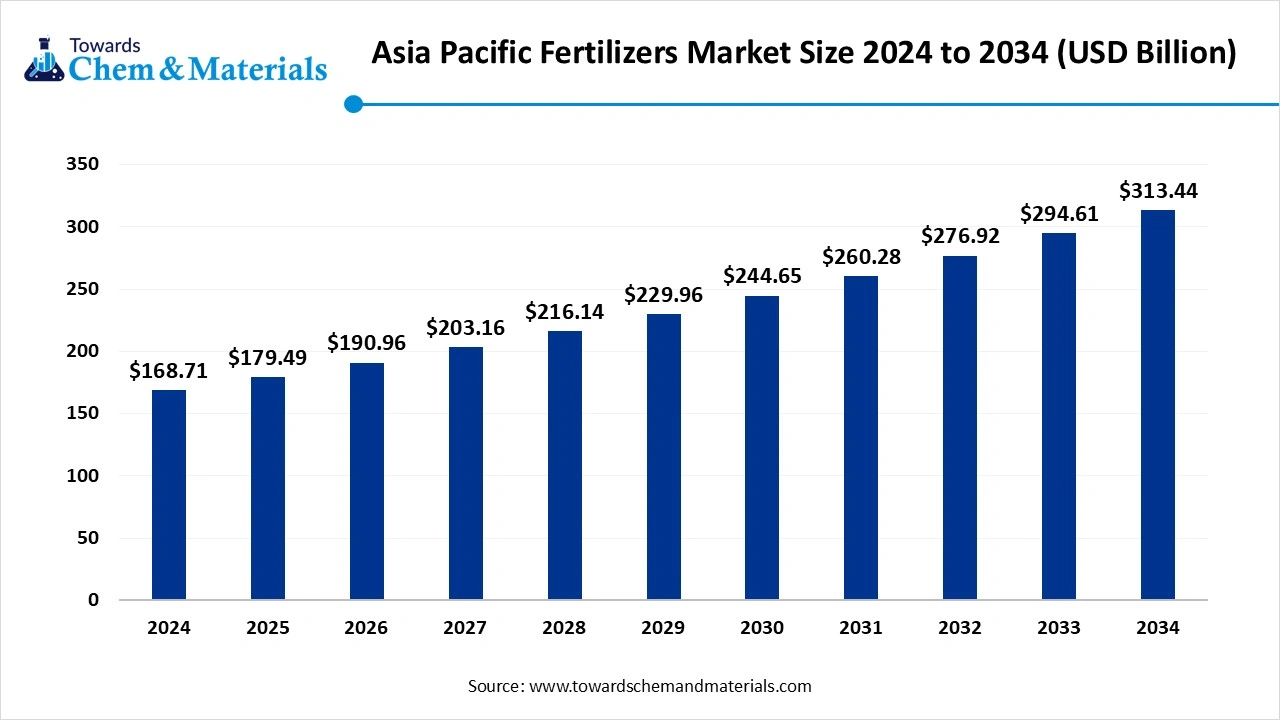

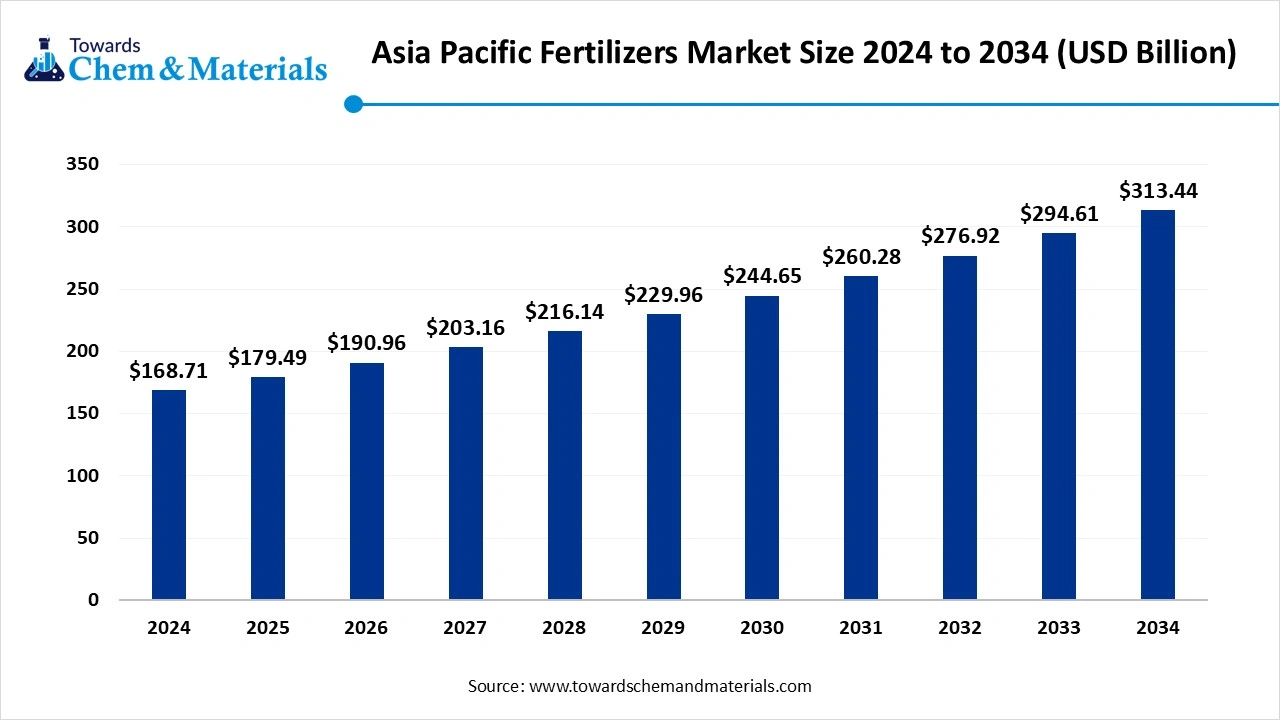

The Asia Pacific fertilizers market size was valued at USD 168.71 billion in 2024 and is anticipated to reach around USD 313.44 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.39% over the forecast period from 2025 to 2034.The growing food demand, adoption of modern agricultural practices, and decreasing cultivable land drive the market growth.

Key Takeaways

- China held approximately a 40% share in the Asia Pacific fertilizers market in 2024 due to the strong presence of the agriculture sector.

- By nutrient, the nitrogenous segment held approximately a 45% share in the market in 2024 due to the need for maximizing crop productivity.

- By crop type, the cereals & grains segment held approximately a 55% share in the market in 2024 due to the growing consumption of staple foods.

- By application method, the soil application/broadcasting segment held approximately a 65% share in the market in 2024 due to the growing cultivation of various crops.

- By form, the solid/granular/prilled segment held approximately an 80% share in the market in 2024 due to the ease of handling.

- By end user, the smallholder farmers segment held approximately a 60% share in the market in 2024 due to the strong focus on improving agricultural output.

- By distribution, the agri-input retailers/dealers segment held approximately a 58% share in the Asia Pacific fertilizers market in 2024 due to being a trusted information source.

Role of Asia Pacific Fertilizers in Crop Nutrition and Modern Agriculture

Asia Pacific fertilizers refer to synthetic or natural substances added to plant tissues to enhance crop yields. They offer macro and micro nutrients to plants for functions like the production of fruits, the development of roots, and many more. Factors like increasing food demand, intensive cultivation, and soil nutrient depletion increase demand for fertilizers.

The growing production of crops like wheat, cotton, rice, and soybeans in the Asia Pacific increases demand for fertilizers. The various types of fertilizers used in the Asia Pacific are synthetic and organic fertilizers. They are available in different forms, like liquid and solid. Factors like large cereal acreage (rice, wheat), rising horticulture output, government subsidy programs, precision irrigation expansion, and a shift toward higher-efficiency & sustainable inputs contribute to the growth of the Asia Pacific fertilizers market.

- India exported $177M of fertilizers in 2023. (Source: oec.world )

- India exported $48.2M of nitrogenous fertilizers in 2023. (Source: oec.world )

- Australia exported $189M of chemical and mixed mineral fertilizers in 2023. (Source: oec.world )

- South Korea exported $414M of fertilizers in 2024. (Source: oec.world )

Growing Agriculture Sector Surges Demand for Fertilizers

The growing agriculture sector in the Asia Pacific region increases demand for fertilizers to improve crop yields. The increasing food demand and focus on enhancing crop productivity increase the adoption of fertilizers to provide essential nutrients. The growing advancements in agricultural practices, like precision agriculture and the increasing adoption of sustainable agriculture practices, lead to higher demand for fertilizers.

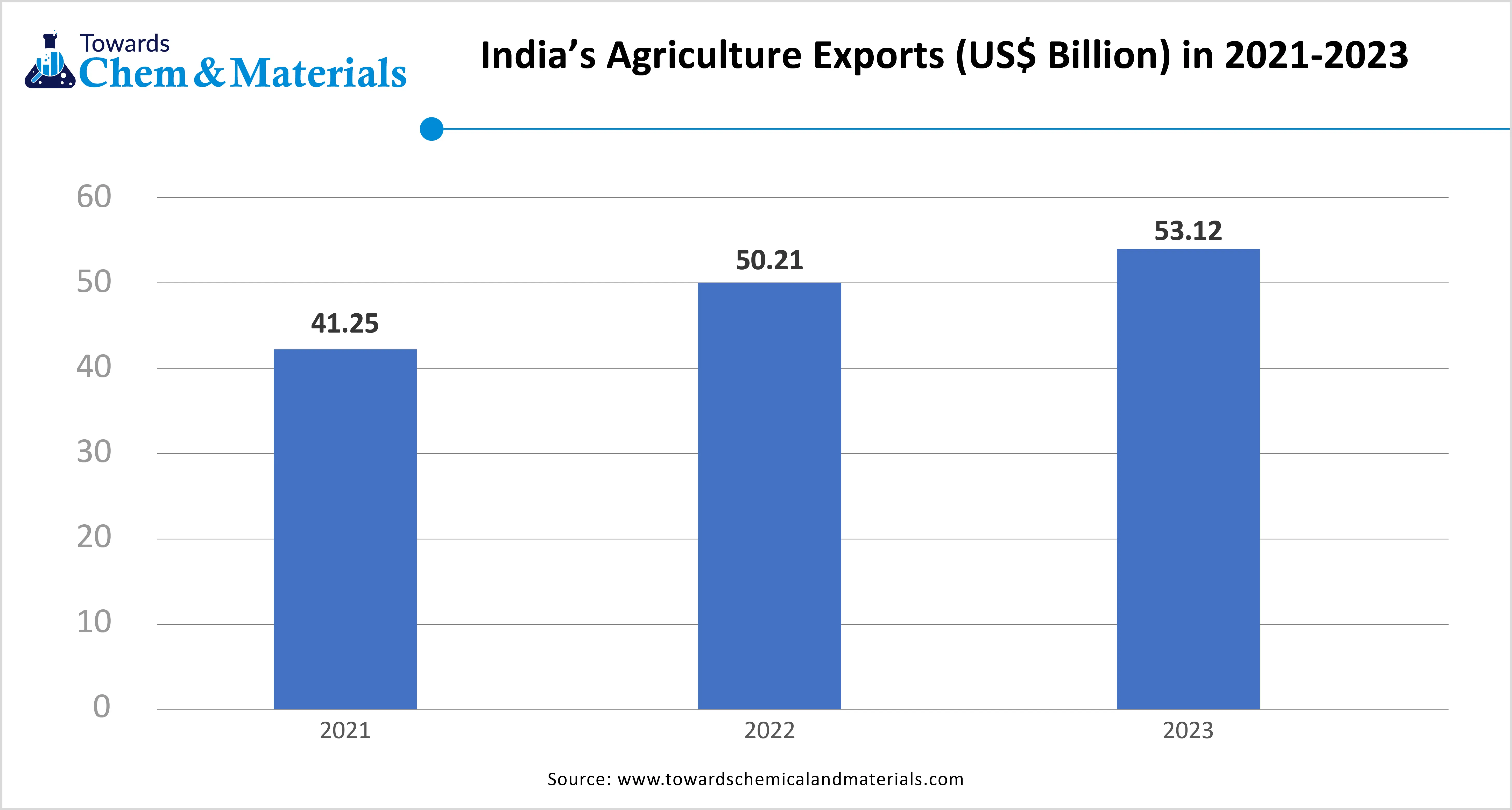

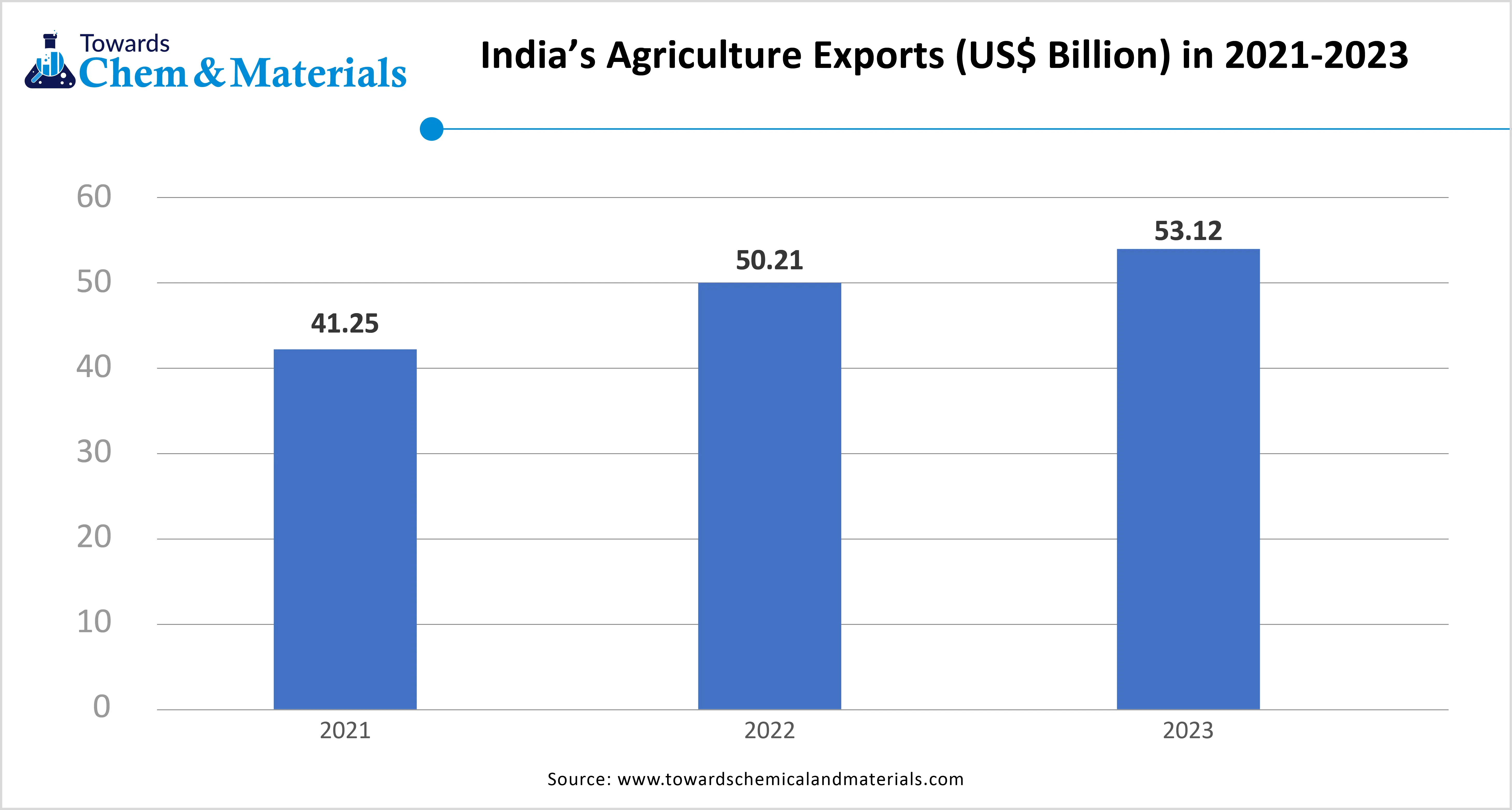

The growing cultivation of crops like fruits, cereals, vegetables, pulses, grains, and many more increases demand for fertilizers to protect crops from weeds & diseases. The strong government support for the advanced agriculture practices and focus on food security in countries like India increases demand for fertilizers. The growing agriculture sector is a key driver for the growth of the Asia Pacific fertilizers market. India has the largest area planted for cotton, wheat, & rice, and is the second largest agricultural land in the world.

Market Trends

- Growing Population: The rapid urbanization and growing population in countries like China and India increase demand for food, which requires fertilizers. The growing pressure on the agriculture sector leads to higher demand for fertilizers.

- Government Support: The strong government support for fertilizers through various policies and subsidies helps market growth. The government initiatives, like Nutrient Based Subsidy and others, increase the use of fertilizers.

- Sustainable Agricultural Practices: The growing focus on sustainable agriculture practices and increasing demand for lowering the utilization of chemical fertilizers increases the development of organic fertilizers.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 179.49 Billion |

| Expected Size by 2034 | USD 313.44 Billion |

| Growth Rate from 2025 to 2034 | CAGR 6.39% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Nutrient/Product Type, By Crop Type, By Application Method, By Form, By End User, By Distribution Channel, By Country |

| Key Companies Profiled | Sinochem Group , Sinofert Holdings Limited , Coromandel International Limited , Lee Kun Kee Group , Sumitomo Chemical Co., Ltd. , Indian Farmers Fertilizer Cooperative Limited , Hanfeng Evergreen Inc. , Tata Chemicals Ltd. , Multiplex Group , Camson Bio Technologies Limited , Wengfu Group , Luxi Chemical Group , China BlueChemical Ltd. Sichuan Chemical Co. Ltd. |

Market Opportunity

Adoption of Precision Agriculture Unlocks Market Opportunity

The increasing adoption of precision agriculture in the Asia Pacific increases demand for fertilizers for various applications. The growing utilization of technologies like drones, GIS, and sensors in precision agriculture helps in the application of fertilizers. The strong focus on precise nutrient management and strong crop health increases demand for fertilizers. The availability of variable-rate technology in precision agriculture and an advanced monitoring system increases demand for fertilizers.

The growing nutrient deficiency problems increase the adoption of precision agriculture. The increasing environmental awareness and growing investment in precision agriculture increase the production of fertilizers. The growing adoption of precision agriculture creates an opportunity for the growth of the Asia Pacific fertilizers market.

Market Challenge

High Cost of Raw Materials

Despite several benefits of the fertilizers in the Asia Pacific, the high cost of raw materials restricts the market growth. Factors like growing demand and geopolitical issues are responsible for the high raw material cost. The high cost of raw materials like phosphate rock and natural gas directly affects the market.

The increasing need for resource-intensive raw materials like potassium, nitrogen, and phosphorus increases the cost of raw materials. The geopolitical issues, like conflicts, trade restrictions, and tensions, increase the cost of raw materials. The high cost of raw materials hampers the growth of the Asia Pacific fertilizers market.

Regional Insights

China Asia Pacific Fertilizers Market Trends

China dominated the Asia Pacific fertilizers market in 2024. The growing cultivation of crops like corn, rice, and wheat increases the demand for fertilizers. The well-established agriculture sector and focus on achieving food security increase the adoption of fertilizers.

The strong government support for sustainable farming practices and the growing modernization of agriculture increase demand for fertilizers. The increasing adoption of specialty fertilizers and well-established infrastructure for the production of fertilizers drives the overall growth of the market.

- China exported $8.5B of fertilizers in 2024. (Source: oec.world )

- China exported $51.2M of potassic fertilizers in 2024. (Source: oec.world )

ASEAN Asia Pacific Fertilizers Market Trends

ASEAN is experiencing the fastest growth in the market during the forecast period. The rapid growth in population and increasing demand for food increases the adoption of fertilizers. The growing modernization of agriculture, like precision farming and strong government support for farmers, increases the demand for fertilizers.

The increasing demand for higher-quality foods and the growth in the cultivation of crops like cash crops, fruits, & vegetables increases demand for fertilizers. The increasing production of crops like palm oil & soybeans requires fertilizers, supporting the overall growth of the market.

- Indonesia exported $759M of fertilizers in 2023. ( Source: oec.world )

- Indonesia exported $5.58M of phosphatic fertilizers in 2023. (Source: oec.world )

- Thailand exported $265M of fertilizers in 2023. (Source: oec.world )

- Vietnam exported $13.4M of animal or vegetable fertilizers in 2023. (Source: oec.world )

Segmental Insights

Nutrient Insights

Why did Nitrogenous Segment Dominate the Asia Pacific Fertilizers Market?

The nitrogenous segment dominated the Asia Pacific fertilizers market in 2024. The strong focus on healthy plant growth and increasing demand for higher crop yields increases the demand for nitrogenous fertilizers. The focus on maximizing crop productivity and increasing the adoption of precision farming increases demand for nitrogenous fertilizers. The growing production of crops like corn, wheat, and rice increases demand for nitrogenous fertilizers. The availability of nitrogenous fertilizers in forms like solid, granular, liquid, & pelleted and ease of application drives the overall growth of the market.

The specialty segment is the fastest-growing in the market during the forecast period. The growth in precision agriculture and growing food demand increases the adoption of specialty fertilizers. The strong focus on sustainable farming practices and the need for enhancing nutrient efficiency in plants increases demand for specialty fertilizers. The focus on improving the disease resistance of plants and advancements in fertilizer technology, like water-soluble fertilizers & CRFs, support the overall growth of the market.

Crop Type Insights

How Cereals & Grains Held the Largest Share in the Asia Pacific Fertilizers Market?

The cereals & grains segment held the largest revenue share in the Asia Pacific fertilizers market in 2024. The strong focus on food security and increasing consumption of staple foods increases demand for cereals & grains. The growing organic food demand and growing population increase demand for cereals & grains. The growing cultivation of crops like rice, corn, & wheat and increasing demand for sustainable food products drive the overall growth of the market.

The fruits & vegetables segment is experiencing the fastest growth in the market during the forecast period. The growing health awareness and shift towards organic farming increase the production of fruits & vegetables. The strong consumer focus on healthier diets and increasing preference for organic food increases demand for fruits & vegetables. The busy lifestyles of consumers and focus on boosting immunity increase the consumption of fruits & vegetables, supporting the overall growth of the market.

Application Method Insights

What Made the Soil Application/Broadcasting Segment Dominate the Asia Pacific Fertilizers Market?

The soil application/broadcasting segment dominated the Asia Pacific fertilizers market in 2024. The large-scale agricultural production and increasing cultivation of crops like row crops, cereals, & horticulture crops increases the adoption of soil application/broadcasting. The simplicity of application and cost-effectiveness help the market growth. The focus on long-term soil fertility and increasing compatibility with dry fertilizers increases the use of soil application/broadcasting. The growing adoption of soil application in advanced farming and traditional farming drives the overall growth of the market.

Asia Pacific Fertilizers Market Revenue, By Application Method, 2024-2034 (USD Billion)

| By Application Method | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

| Soil Application/Broadcasting | 104.6 | 109.13 | 113.81 | 118.65 | 123.63 | 128.78 | 134.07 | 139.51 | 145.11 | 150.84 | 156.72 |

| Fertigation (Drip/Sprinkler) | 30.37 | 33.74 | 37.43 | 41.44 | 45.82 | 50.59 | 55.78 | 61.43 | 67.57 | 74.24 | 81.49 |

| Foliar Application | 16.87 | 18.31 | 19.86 | 21.53 | 23.34 | 25.3 | 27.4 | 29.67 | 32.12 | 34.76 | 37.61 |

| Blends/Customized Fertilizer Application | 16.87 | 18.31 | 19.86 | 21.54 | 23.35 | 25.29 | 27.4 | 29.67 | 32.12 | 34.77 | 37.62 |

The fertigation segment is the fastest-growing in the market during the forecast period. The focus on optimizing nutrient delivery and improving nutrient absorption in crops increases demand for the fertigation method. The need for water conservation and focus on reducing soil degradation increases demand for fertigation. The growing adoption of precision agriculture and focus on customizing nutrient application increases demand for fertigation. The strong government support for precision farming and the expansion of micro-irrigation increases demand for fertigation. The increasing utilization of liquid fertilizers & water-soluble fertilizers supports the overall growth of the market.

Form Insights

How Solid or Granular, or Prilled Segment Held the Largest Share in the Asia Pacific Fertilizers Market?

The solid/granular/prilled segment held the largest revenue share in the Asia Pacific fertilizers market in 2024. The strong focus on long-term nutrient supply and broad-acre farming increases demand for solid form. The ease of handling and availability of machinery like planters & spreaders help the market growth. The longer shelf life and focus on even application increase the adoption of solid or granular form. The need to reduce the loss of nutrients and the adoption of precision agriculture techniques increase demand for the granular form. The superior blending properties and availability of spherical & small pellets of prilled form support the overall growth of the market.

The liquid segment is experiencing the fastest growth in the market during the forecast period. The increasing need for rapid nutrient uptake and precision agriculture techniques, like foliar spraying & fertigation, increases the adoption of liquid form. The focus on the uniform distribution of fertilizers and improving nutrient efficiency increases demand for liquid forms. The growing food demand and strong support for modern farming practices increase the adoption of liquid forms. The availability of customized formulations and the rise in bio-based liquid fertilizers support the overall growth of the market.

End User Insights

Which End User Dominated the Asia Pacific Fertilizers Market?

The smallholder farmers segment dominated the Asia Pacific fertilizers market in 2024. The focus on enhancing agricultural output and increasing demand for food requires smallholder farmers. The intensive farming practices in small farms and increasing demand for essential nutrients for plant growth increase the adoption of fertilizers. The limited land areas and strong government support for the smallholder farmers through various policies & subsidies help the market growth. The growing demand for specialized fertilizers among smallholder farmers drives the overall growth of the market.

The horticulture & protected cultivation segment is the fastest-growing in the market during the forecast period. The growing production of high-value crops like flowers, fruits, and vegetables increases demand for fertilizers. The focus of horticulture is on precision nutrient management, and increasing the utilization of fertigation techniques increases the adoption of fertilizers. The focus on better management of diseases and pests, and the shrinking of land resources, increases the adoption of fertilizers, supporting the overall growth of the market.

Distribution Channel Insights

How Agri-Input Retailers or Dealers Segment Held the Largest Share in the Asia Pacific Fertilizers Market?

The agri-input retailers/dealers segment held the largest revenue share in the Asia Pacific fertilizers market in 2024. The need for high accessibility to farmers and focus on reducing travelling times for purchasing fertilizers increases the adoption of retailers. The increasing need for guidance on product use and advisory services related to fertilizers requires retailers or dealers. The focus on bridging information gaps and growing development of localized trust systems increases buying fertilizers from dealers, driving the overall growth of the market.

The online/marketplace platforms segment is experiencing the fastest growth in the market during the forecast period. The increasing purchase of fertilizers from homes and the availability of a broad range of products increase purchases from online platforms. The availability of direct delivery and new suppliers & buyers helps market growth. The high transparency in pricing and growing adoption of smartphones increase buying fertilizers from online marketplaces. The strong government support for digitalization and the rise in agritech startups support the overall growth of the market.

Asia Pacific Fertilizers Market Value Chain Analysis

1. Feedstock Procurement

The feedstock procurement for fertilizers is atmospheric nitrogen, natural gas, naphtha, phosphate rock, mined potash ores, compost, organic waste, manures, and crop residue.

2. Compound Formulation and Blending

The compound formulation and blending contain two or more essential plant nutrients, like potassium, nitrogen, and phosphorus, in one fertilizer solution.

3. Regulatory Compliance and Safety Monitoring

The regulatory compliance for fertilizers in the Asia Pacific countries involves the Fertilizer Control Order, National Fertilizer Industry Standard, DOA-Fertilizer Control Division, Fertilizers and Pesticides Authority, and many more supporting quality monitoring, safety thresholds, and testing of fertilizers.

Recent Developments

- In July 2023, YARA opened a water-soluble fertilizer plant in China. The plant supports smallholder farmers and increases the productivity of crops. The fertilizers are of high quality and improve soil health. (Source: global-agriculture )

- In January 2025, Super Crop Safe launched bio-fertilizer Super Gold WP+ in India. The fertilizer supports sustainable agriculture, enhances root growth, improves crop yield, and improves soil health. (Source: global-agriculture.)

- In July 2024, Coromandel launched Magnesium-Enriched Paramfos Plus fertilizer in India. The fertilizer contains 20% phosphorus, 0.6% magnesium, 16% nitrogen, and 13% sulphur. The fertilizer applicable in crops like cotton, sugarcane, ragi, oilseeds, paddy, maize, pulses, groundnut, and vegetables as a top dressing & basal. (Source: chemanalyst )

Asia Pacific Fertilizers Market Top Companies

- Sinochem Group

- Sinofert Holdings Limited

- Coromandel International Limited

- Lee Kun Kee Group

- Sumitomo Chemical Co., Ltd.

- Indian Farmers Fertilizer Cooperative Limited

- Hanfeng Evergreen Inc.

- Tata Chemicals Ltd.

- Multiplex Group

- Camson Bio Technologies Limited

- Wengfu Group

- Luxi Chemical Group

- China BlueChemical Ltd.

- Sichuan Chemical Co. Ltd.

Segments Covered

By Nutrient/Product Type

- Nitrogenous (Urea, Ammonium Sulfate, Ammonium Nitrate, CAN)

- Phosphatic (DAP, MAP, TSP/SSP)

- Potassic (MOP, SOP)

- Specialty & Others (Water-Soluble NPK, Controlled/Slow-Release, Micronutrients, Biofertilizers)

By Crop Type

- Cereals & Grains (Rice, Wheat, Maize)

- Oilseeds & Pulses

- Fruits & Vegetables

- Plantation & Cash Crops (Tea, Coffee, Sugarcane, Cotton, Rubber)

- Others (Fodder, Horticulture Misc.)

By Application Method

- Soil Application/Broadcasting

- Fertigation (Drip/Sprinkler)

- Foliar Application

- Blends/Customized Fertilizer Application

By Form

- Solid/Granular/Prilled

- Liquid (Solutions, Suspensions)

By End User

- Smallholder Farmers

- Commercial/Corporate Farms & Grower Groups

- Horticulture & Protected Cultivation (Greenhouses, Polyhouses)

By Distribution Channel

- Agri-Input Retailers/Dealers

- Cooperatives & Government Procurement Channels

- Direct Institutional & Contract Sales

- Online/Marketplace Platforms

By Region

- China

- India

- ASEAN (Indonesia, Vietnam, Thailand, Philippines, Malaysia, etc.)

- Australia & New Zealand

- Japan & South Korea

- Rest of APAC (Pakistan, Bangladesh, Sri Lanka, Others)