Content

What is the Current Chemical Intermediate Market Size and Share?

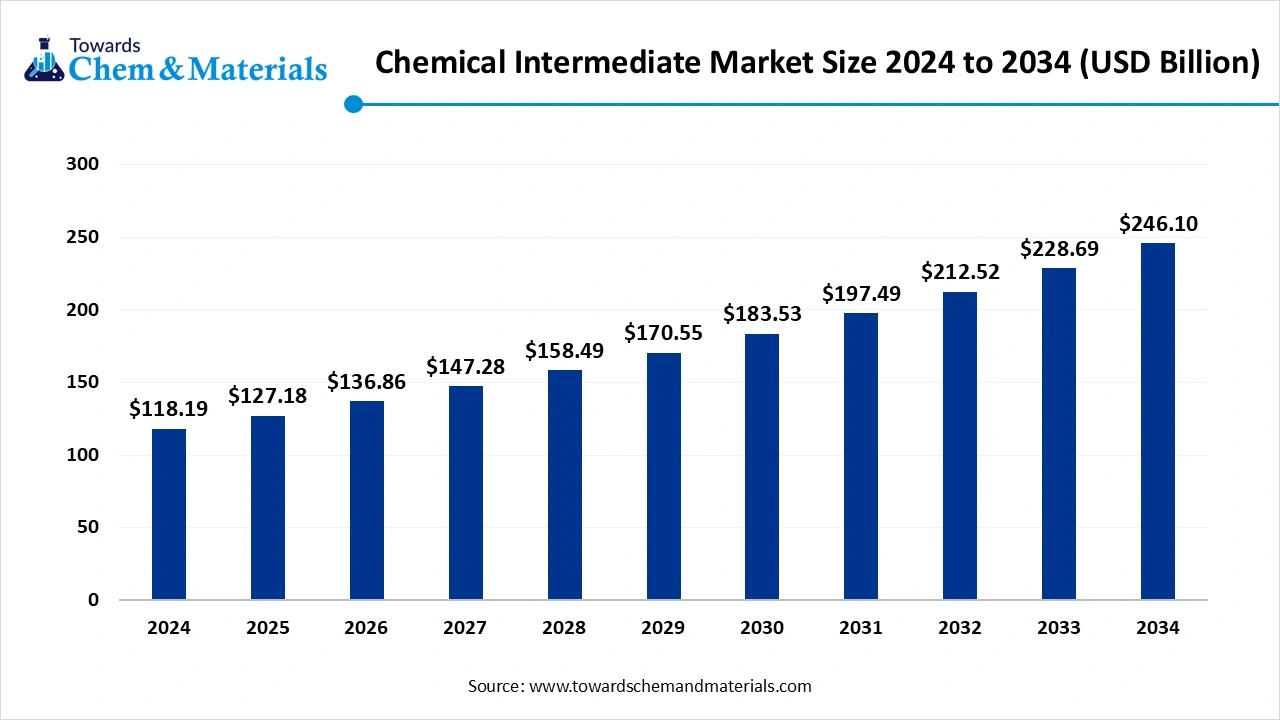

The global chemical intermediate market size was estimated at USD 127.18 billion in 2025 and is expected to increase from USD 136.86 billion in 2026 to USD 264.82 billion by 2035, growing at a CAGR of 7.61% from 2026 to 2035. The growth of the market is driven by rising demand for specialty chemicals from various industries for advanced manufacturing processes, and increasing adoption and shift towards the use of bio-based and sustainable alternatives to traditional chemical intermediates drive the growth.

Key Takeaways

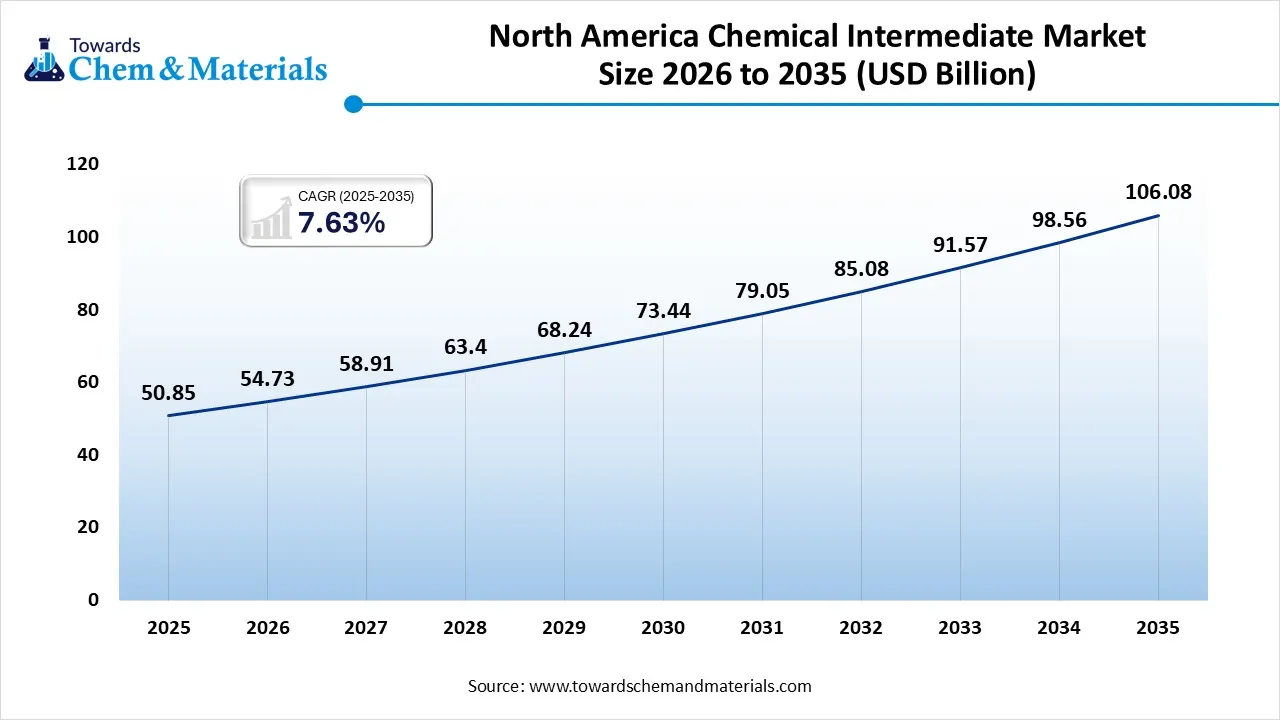

- By region, North America dominated the market in 2025. The growing industrial sector in the region drives the growth of the market.

- By region, Asia Pacific is expected to have significant growth in the market in the forecast period. The growth of the market is driven by the growing pharmaceutical sector in the region.

- By product, the ethylene amines segment dominated the market in 2025. Demand for highly reactive components drives the growth.

- By product, the caustic products segment is expected to grow significantly in the market during the forecast period. The versatile applications fuel the growth.

- By end use, the healthcare segment dominated the market in 2025. Demand for drug discovery boosts the market.

- By end use, the chemicals and petrochemicals segment are expected to grow in the forecast period. Growing applications, benefits drive the growth.

Market Overview

Rising Demand for Specialty Materials: Chemical Intermediate Market to Expand

Chemically speaking, a reaction intermediate is a short-lived substance that forms during a reaction, but it's not a reactant or product of the overall reaction. It only exists for a very brief time, usually just seconds or even less, before it's converted into another intermediate or the final product. These intermediates are highly reactive and have higher energy levels than the reactants and products.

Here are some key characteristics of reaction intermediates: They're transient, meaning they only exist for a short duration during the reaction. They have high energy, making them less stable and more reactive than the reactants and products. They're not included in the overall balanced chemical equation for the reaction. Instead, they're formed in one step and then consumed in a subsequent step.

What Are the Major Drivers Responsible for The Growth of The Chemical Intermediate Market?

The key growth drivers responsible for the growth of the market are the growing demand from various industries like Energy & Power, Healthcare, Chemical & Petrochemical, Agriculture, pharmaceutical, automotive, and consumer goods drive the growth of the market. The growing emphasis and focus on sustainability and the use of green chemicals and biobased alternatives amid rising environmental concerns and demand from consumers fuels the growth of the market.

Technological advancements and integration of AI for enhancing the process and efficiency of the manufacturing process for process optimization to procure accurate and precise products further boost the growth of the market. Government initiatives and policies help and play a crucial role in the market growth, with research and innovation for improvement in chemical intermediates and in processing driving the growth of the market. These factors and drives boost the growth of the market and support its expansion of the market.

Market Trends

- The strong and rising demand from various industries, like pharmaceuticals, automotive, agrochemicals, and consumer goods, as an intermediate, is a building block of any reaction, which boosts the demand.

- Increasing shift towards sustainability and focus on the use of environmentally friendly alternatives like green chemicals and bio-based intermediates drives the growth of the market.

- Technological advancements like the integration of AI help in automation and enhance the productivity and efficiency of the production procedure, which improves the quality and product.

- The growth of the market is also driven by the growth and demand for specialty chemicals, due to their benefits and properties, which fuel the growth.

Report Scope

| Report Attributes | Details |

| Market Size in 2026 | USD 136.86 Billion |

| Expected Size by 2035 | USD 264.82 Billion |

| Growth Rate from 2026 to 2035 | CAGR 7.61% |

| Base Year of Estimation | 2025 |

| Forecast Period | 2026 - 2035 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Product, By End User, By Region |

| Key Companies Profiled | Weyerhaeuser, Dewitt Products LLC, Arauco, Gemini Particleboard Pvt Ltd, Norbord, Pine Wood Canada, Wood Resources International LLC, Finsa, Shannon Wood Products, Sukup Manufacturing Co, Kronospan, Biesse SpA, Veneer Products Ltd, Panel Processing Inc |

Market Dynamics

Market Drivers

The chemical intermediate market is driven by sustained demand from downstream industries such as pharmaceuticals, agrochemicals, polymers, coatings, and specialty chemicals. Expansion of pharmaceutical manufacturing, particularly for active pharmaceutical ingredients and fine chemicals, is increasing consumption of high-purity intermediates. Growth in construction, automotive, and consumer goods manufacturing is also reinforcing demand for intermediates used in resins, plastics, adhesives, and coatings. In addition, industrialization in emerging economies and rising production of packaged and processed goods are supporting steady volume growth across bulk and specialty chemical intermediates.

Market Restraints

The chemical intermediate market faces restraints related to volatility in raw material prices, particularly those derived from petrochemical feedstocks, which can pressure margins and disrupt supply planning. Stringent environmental regulations governing emissions, waste handling, and hazardous chemicals are increasing compliance costs and lengthening approval timelines. Supply chain disruptions, including dependency on limited suppliers for key precursors, can impact production continuity. In some regions, high energy costs and infrastructure constraints reduce the competitiveness of local chemical intermediate manufacturing.

Market Opportunities

Opportunities in the chemical intermediate market are emerging from the growing shift toward specialty and value-added intermediates tailored for high-performance applications. Rising investment in pharmaceutical innovation, biologics, and complex formulations is increasing demand for customized intermediates with tight quality specifications. Sustainability initiatives are encouraging development of bio-based and low-emission chemical intermediates, opening new product segments. Expansion of downstream manufacturing in Asia Pacific, the Middle East, and Latin America is also creating opportunities for capacity additions and regional supply chain integration.

Market Challenges

Key challenges for the chemical intermediate market include managing regulatory compliance across diverse jurisdictions while maintaining cost efficiency and scale. Increasing pressure to reduce environmental impact requires continuous process optimization and capital investment in cleaner technologies. Competition from alternative materials and process innovations can reduce demand for certain traditional intermediates. Additionally, balancing global supply chains amid geopolitical uncertainty and trade policy shifts remains a persistent challenge for chemical intermediate producers.

Value Chain Analysis

- Raw Material Sourcing: This involves the extraction and refining of basic raw materials, primarily crude oil, natural gas, minerals, and ores.

- Key Players: ExxonMobil Chemical, Chevron Corporation, SABIC, Sinopec, and Reliance Industries.

- Research & Development (R&D): This focuses on developing innovative and efficient chemical synthesis processes and patenting new chemical formulas.

- Key Players: BASF SE, Dow Chemical Company, Mitsubishi Chemical Group, and LyondellBasell Industries.

- Intermediate and Specialty Chemical Production: This involves further synthesis and processing of basic chemicals into more complex, often customized, intermediate and specialty products.

- Key Players: BASF SE, Clariant, Evonik Industries, Stepan Company, Invista, and Croda International.

- Packaging, Storage, and Distribution: In this, products are packaged to meet specific regulatory and safety standards, stored, and then distributed globally through various channels to downstream manufacturers.

- Key Players: DHL Group, FedEx Logistics, and UPS Healthcare.

- Marketing, Sales, and End-Use Application: This involves promoting and selling the intermediate and specialty chemicals to manufacturers in various end-user industries.

- Key Players: UPL, Piramal Group, and GlaxoSmithKline.

Segmental Insights

Product Insights

Which Product Segment Dominated the Chemical Intermediate Market In 2025?

The ethylene amines segment dominated the chemical intermediate market in 2025. The growth of the segment is driven by its properties as chemical intermediate like it is a highly reactive molecule and is considered as a building block for synthesis of large molecules and its versatile chemical structure make it ideal for incorporation in various other chemical structure this make it versatile intermediate for different application which boosts the demand for the chemical. It is applicable in the production of epoxy resins, detergents, chelates, textile auxiliaries, lubricants, agrochemicals, petroleum additives, and many other applications, from pigments to coatings. This drives the growth of the market and helps in expansion due to its diverse applications.

The caustic products segment expects significant growth in the chemical intermediate market during the forecast period. It is in growing demand as it serves as a base for synthesizing a wide range of chemicals, including solvents, plastics, synthetic fibers, and more, which increases the demand from industrial processing. It plays a crucial role in many reactions or syntheses as a pH control, neutralizing agent, and reactant, which makes it important and increases the demand for it from various industries. It is specifically used in dyes, pigments, pharmaceuticals, the paper and pulp industry, soap and detergents, textiles, in petroleum products, water treatment, alumina production, and in agrochemicals. These applications make it a versatile product and help in the growth and expansion of the market.

End Use Insights

How Did the Healthcare Segment Dominate the Chemical Intermediate Market In 2025?

The healthcare segment dominated the chemical intermediate market in 2025. The segment has seen significant growth in the market, driven by the growing demand from the healthcare sector for chemical intermediates for the processing and development of new and innovative drugs. Chemical intermediates are crucial building blocks used in the synthesis of active pharmaceutical ingredients for various medications, including antibiotics, cardiovascular drugs, and more, which increases the demand and supports growth and expansion.

The chemicals and petrochemicals segment expects significant growth in the chemical intermediate market during the forecast period. The growth of the market is driven by the growing need for synthesis of new chemical entities and also for cost-effective production, and is our integral part of processing in refineries and petrochemical plants, which increases the demand and supports the growth of the market.

Regional Insights

The North America chemical intermediate market size was valued at USD 50.85 billion in 2025 and is expected to be worth around USD 106.08 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 7.63% over the forecast period from 2026 to 2035. North America dominated the chemical intermediate market in 2025. The large and growing chemicals sector, and also growth in sectors like pharmaceuticals, consumer goods, and agriculture, fuel the growth of the market in the region. Chemical intermediate plays a crucial role in the pharmaceutical sector for drug synthesis and in the agriculture sector for pesticides and fertilizers, where there require chemical reactions are required.

Regions shift and focus towards sustainability and the use of environmentally friendly chemicals like biobased and green chemicals by the manufacturing units and other sectors in the region further drive the growth of the market in North America. These factors and applications drive and boost the growth of the market and further support the growth of the market.

The US Has Seen Significant Growth in The Chemical Intermediate Industry Market, With Technological Advancements in Manufacturing Processes

US has seen a significant growth in the market, the continuous innovation and development of technologically advanced processes of manufacturing of chemical intermediates to meet the changing and growing need of each sector accordingly fuels the growth of the market in the country, the growing focus on sustainability and increasing demand for sustainable chemical intermediates by chemical manufacturers and adoption of green and biobased intermediated and production methods by the producers further drives and boosts the growth of the market. Key players in the country have a significant role in the growth and expansion of the market in the country.

- The world shipped out 13.4k chemical intermediate shipments. These exports were handled by 1771 world exporters to 1230 buyers. (Source: volza.com)

- Globally, the United States, India, and China are the top three exporters of chemical intermediates. The United States is the global leader in chemical intermediate exports with 4986 shipments, followed closely by India with 2532 shipments, and China in third place with 1883 shipments.(Source:Volza)

Asia Pacific Has Seen a Steady Growth in The Chemical Intermediate Market, Driven by The Large Pharmaceutical Sector

Asia Pacific is expected to grow significantly in the chemical intermediate market in the forecast period. The growth of the market is driven by the rapid industrialization in the region and a strong demand for specialty chemicals from various sectors, especially from the pharmaceutical sector, for the formulation and development of new and innovative drugs to process and manufacture high quality drugs, this is due to growing pharmaceutical sector in the region which drives the growth of the market in the region.

The growth in generic drugs manufacturing and demand for API intermediates further fuels the growth of the market in the region. The key players like BASF SE, Deepak Nitrite Ltd., Rosary Biotech Ltd., Stepan Company, INVISTA Nylon Chemical Co. Ltd., and LG Royal DSM are some of the key players who play a crucial role in boosting the growth of the market, contributing to its expansion of the market.

India Has Seen Significant Growth Driven by The Robust Chemical Sector and Government Support

India has seen a significant growth in the market, and the growth is driven by the growing and robust growth in the domestic chemicals industry and government support for the development of the industry and use of sustainable and eco-friendly chemical intermediates, which are biobased and are sustainable to use amid rising environmental concerns which fuels the growth of the market in the country. The growing initiative by the government, like Make in India, where local manufacturing is supported and promoted with heavy investments this boosts the growth of the market.

Major players in the country like Solar Industries India Ltd., Pidilite Industries Ltd., SRF Ltd., and Godrej Industries Ltd also play a crucial and important role in the manufacturing and growth of the market, contributing to the expansion of the market in the country.

- India shipped out 1.4k chemical intermediate shipments. These exports were handled by 176 Indian exporters to 87 buyers. (Source: volza)

- China shipped out 9 chemical intermediate shipments from August 2023 to July 2024 (TTM). These exports were handled by 9 China exporters to 6 buyers, showing a growth rate of 350% over the previous 12 months.(Source: Volza)

How will Europe be considered a Notable Region in the Chemical Intermediate Market?

Europe is anticipated to experience notable growth in the near future, primarily due to its robust innovation ecosystem, highly skilled workforce, and advanced production infrastructure, with an increasing emphasis on sustainability and green chemistry. The EU is at the forefront of the global sustainability movement, implementing stringent regulations such as REACH and pursuing ambitious goals under the European Green Deal to foster innovation in green and circular economy solutions. The region boasts over 60 major integrated chemical parks that facilitate the efficient exchange of raw materials, by-products, and intermediates.

Germany Chemical Intermediate Market Trends

Germany represents a mature market within Europe, serving as a powerhouse of innovation, a skilled workforce, and advanced research and development capabilities. It specializes in high-value, high-purity, and specialty intermediates for various applications. Unique, highly integrated chemical parks and extensive pipeline networks ensure efficient production and logistics, linking raw materials, intermediates, and end-product manufacturing. Furthermore, Germany is home to global leaders such as BASF, Evonik Industries, and Bayer.

Emergence of Latin America in the Chemical Intermediate Market

Latin America is witnessing significant growth in the global market, largely attributed to expanding downstream industries, particularly in agrochemicals and pharmaceuticals, along with increasing industrialization and strategic investments by major chemical companies. Rapid industrialization and steady economic growth in countries like Brazil, Mexico, and Argentina are driving demand for chemicals across various sectors, including automotive, construction, textiles, and personal care products. Favorable government policies and research and development initiatives further bolster this growth.

Brazil Chemical Intermediate Market Trends

Brazil is emerging as a key market within Latin America, primarily due to its abundant natural resources and great domestic demand. The country is increasingly focusing on leveraging its resources to gain a competitive edge in specific intermediate segments. Major production efforts, led by companies like Braskem, emphasize basic petrochemical inputs and thermoplastic resins, such as poly-ethylene, polypropylene, and PVC, to support a diverse manufacturing base.

How will the Middle East and Africa contribute to the Chemical Intermediate Market?

The Middle East and Africa play a crucial role in the global market due to their abundant low-cost hydrocarbon feedstocks, strategic geographical location, and extensive government-led initiatives for industrial diversification. Countries like Saudi Arabia and the UAE are actively seeking to reduce their reliance on crude oil exports by investing heavily in non-oil sectors, particularly the downstream chemical industry and manufacturing. World-class industrial ports facilitate the efficient export of large volumes of chemical intermediates to global markets.

The UAE Chemical Intermediate Market Trends

The UAE holds a distinctive position in the region, thanks to its strategic location, world-class infrastructure, and access to hydrocarbon raw materials. It serves as a vital manufacturing and trading hub for basic chemicals. By capitalizing on its oil and gas reserves, the UAE produces and exports basic industrial chemicals and petrochemical intermediates, focusing on high-volume products and derivatives like polyethylene, polypropylene, ammonia, and urea fertilizer.

Recent Developments

- In January 2025, a collaborative research project led by the University of St Andrews, in Scotland, UK, identified a novel route to convert common household plastic waste into a valuable building block chemical used in the synthesis of anti-cancer medicines and other widely used products. The work has demonstrated that polyethylene terephthalate (PET) waste, commonly found in plastic bottles and synthetic textiles, can serve as a feedstock for high-value chemicals.(Source: www.labmate-online.com)

- In October 2025, researchers have discovered a powerful synergy between gold, manganese, and copper that could transform the way valuable chemicals are produced. By supporting gold nanoparticles on a specially engineered perovskite material, LaMn₀.₇₅Cu₀.₂₅O₃, the research team achieved an acetaldehyde yield of 95% from ethanol at just 225 °C, marking a significant step toward cleaner and more energy-efficient chemical processes. The key to this performance lies in the strategic incorporation of copper, which enhances catalytic activity and selectivity under mild reaction conditions.(Source: www.eurekalert.org)

Top Companies List

- Weyerhaeuser

- Dewitt Products LLC

- Arauco

- Gemini Particleboard Pvt Ltd

- Norbord

- Pine Wood Canada

- Wood Resources International LLC

- Finsa

- Shannon Wood Products

- Sukup Manufacturing Co

- Kronospan

- Biesse SpA

- Veneer Products Ltd

- Panel Processing Inc

Segments Covered

By Product

- Ethylene Amines

- Caustic Products

- Hydraulic Acid

- Others

By End User

- Energy & Power

- Healthcare

- Chemical & Petrochemical

- Agriculture

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait