Content

Carbon Fiber Reinforced Plastic (CFRP) Market Size and Growth 2025 to 2034

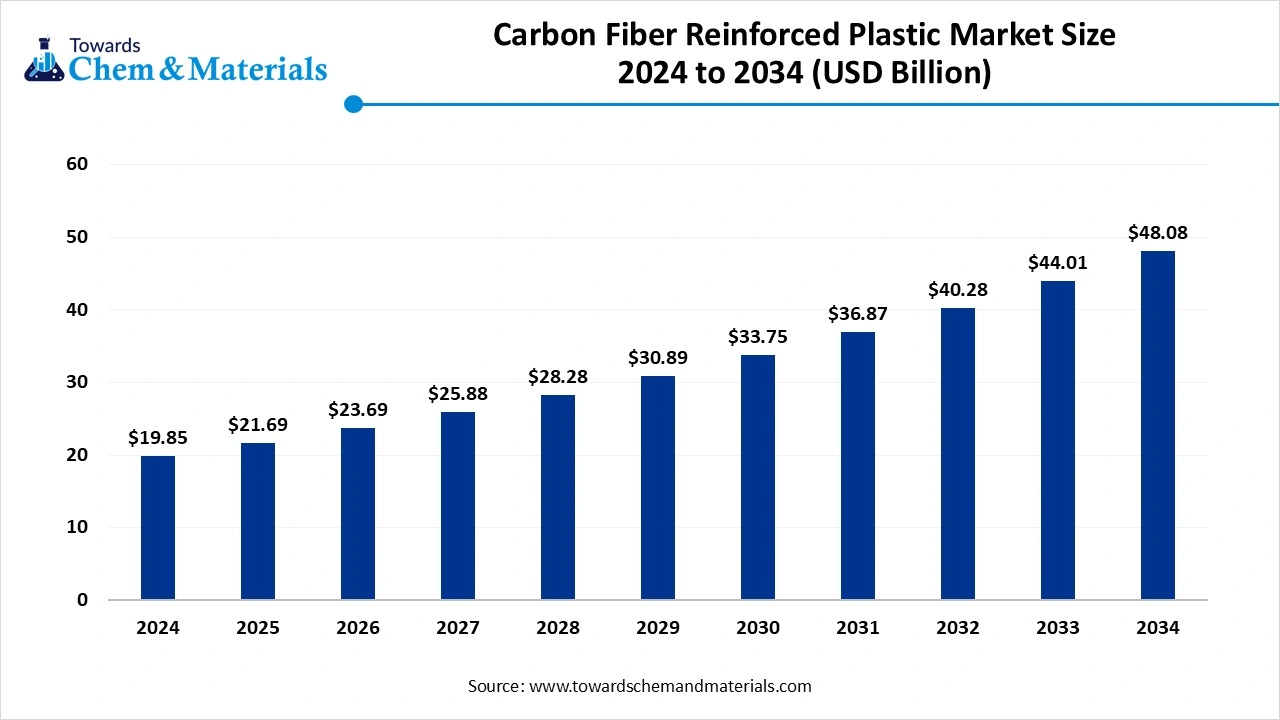

The global carbon fiber reinforced plastic (CFRP) market size was approximately USD 19.85 billion in 2024 and is projected to reach around USD 48.08 billion by 2034, with an estimated compound annual growth rate (CAGR) of about 9.25% between 2025 and 2034 The growth of the market is driven by rising demand for lightweight and high-strength materials in various industries such as aerospace, wind energy, automotive, and the construction sector, which drives the growth of the market.

Key Takeaways

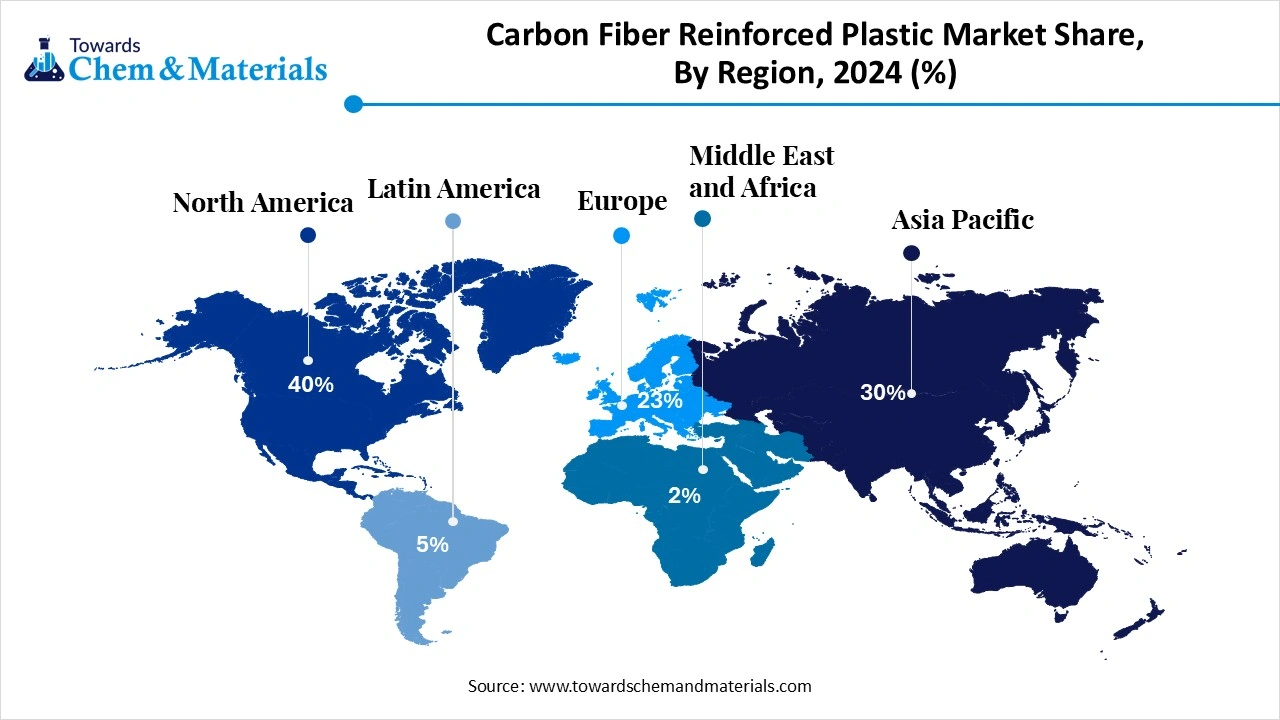

- By region, North America dominated the market with a 40% share in 2024.

- By region, Asia Pacific is expected to have significant growth in the market in the forecast period.

- By type, the continuous fiber segment dominated the market with a 40% share in 2024.

- By type, the woven fiber segment is expected to grow significantly in the market during the forecast period.

- By resin type, the epoxy resin segment dominated the market with a 55% share in 2024.

- By resin type, the polyester resin segment is expected to grow in the forecast period.

- By manufacturing process, the prepreg lay-up segment dominated the market with a 35% share in 2024.

- By manufacturing process, the compression molding segment is expected to grow in the forecast period.

- By end-use industry, the automotive segment dominated the market with a 45% share in 2024.

- By end-use industry, the aerospace & defense segment is expected to grow in the forecast period.

- By fiber type, the carbon fiber segment dominated the market with a 65% share in 2024.

- By fiber type, the hybrid fiber (carbon + glass) segment is expected to grow in the forecast period.

Market Overview

What Is The Significance Of The Carbon fiber reinforced plastic (CFRP) market?

The carbon fiber reinforced plastic plays a significant role in the various industries, and there is also a growing demand due to its durability, high performance, and lightweight materials in industries such as aerospace, wind energy, automotive, and civil engineering, which also results in increased demand for the market.

The properties such as corrosion resistance, ability to improve fuel efficiency and reduce emissions, and enhanced structural performance drive the demand for the market due to its significant characteristics and growth.

Specialty Chemicals Market Outlook:

- Industry Growth Overview: Between 2025 and 2034, the CFRP market is set to grow at a strong pace, fueled by rising adoption in aerospace, automotive, wind energy, and sporting goods. Demand is supported by CFRP’s lightweight, high-strength properties that enable fuel efficiency and performance optimization.

- Sustainability Trends: Sustainability is a major focus, with increased emphasis on recycling and reprocessing of carbon fiber composites to reduce waste and dependence on virgin fiber. Bio-based resins, closed-loop recycling technologies, and energy-efficient production processes are being adopted to meet stricter environmental regulations and OEM carbon-neutral goals.

- Global Expansion: Leading CFRP manufacturers are expanding production capacity in Asia and Eastern Europe to align with automotive and wind energy growth hubs. Partnerships and joint ventures with aerospace and EV manufacturers are becoming common to secure long-term supply.

Key Technological Shifts in Carbon fiber reinforced plastic (CFRP) market:

Key technological shifts in the carbon fiber reinforced plastic (CFRP) market include the incredible adoption of automation and AI integration in various industries for manufacturing and processing which helps in reducing the cost and increasing efficiency with advancements in resin system increasing the performance and gaster curing which creates opportunity for growth in the forecasted period drives the growth and demand for light weight and high performance solution through automation, ML and Artificial Intelligence with process optimization.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 21.69 Billion |

| Expected Size by 2034 | USD 48.08 Billion |

| Growth Rate from 2025 to 2034 | CAGR 9.25% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | North America |

| Segment Covered | By Type, By Resin Type, By Manufacturing Process, By End-Use Industry, By Fiber Type, By Region |

| Key Companies Profiled | Solvay S.A., Owens Corning , BASF SE , Formosa Plastics Corporation , Cytec Solvay Group , LeMond Carbon , PLP Composites , Axiom Materials , Zoltek Companies, Inc. , GKN Aerospace , DowAksa , Safran S.A. , Ferrari Composite Materials , Hexagon Composites , Gurit Holding AG |

Trade Analysis Of Carbon Fiber Reinforced Plastic (CFRP) Market: Import & Export Statistics

- In the May 2024-April 2025 period, India's CFRP exports saw significant growth, driven by a 127% increase in shipments compared to the previous year. (Source: www.volza.com)

- Globally, India, the United States, and China are identified as the top three exporters of Carbon Fibre

- The principal export destinations for Indian Carbon Fibre are Ukraine, the United Kingdom, and Finland

- Major manufacturers like Hexcel and global chemical companies also play a large role in exporting high-performance carbon fiber and CFRP products.(Source : www.hexcel.com)

- Major companies in the CFRP sector include Teijin Ltd., Toray Industries Inc., and Formosa Plastics Corporation.

- The top importers of Carbon Fibre Products are the United Kingdom, Brazil, and Finland.

- Asian countries are dominant in both the supply and demand for carbon fiber.

Carbon Fiber Reinforced Plastic (CFRP) Market Value Chain Analysis

- Chemical Synthesis and Processing : Carbon fiber reinforced plastic is synthesized and processed using methods such as fiber production from precursors, injection molding, molding techniques (like RTM and compression molding), and chemical recycling.

- Key players: Toray Industries, SGL Carbon, Teijin, and Mitsubishi Chemical Group

- Quality Testing and Certification: Quality assurance for CFRP involves a combination of destructive testing (DT) and non-destructive testing (NDT).

- Key players: ASTM International and UL Solutions

- Distribution to Industrial Users: The carbon fiber reinforced plastic is distributed to the automotive, electronics, and construction industries.

- Key players: Bhor Chemicals and Plastics, Rockman Advanced Composites, Carbonext India Pvt Ltd, Teijin Limited, and Solvay.

Carbon Fiber Reinforced Plastic (CFRP) Market Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas | Notable Notes |

| United States | FAA (Federal Aviation Administration), ASTM International, SAE International | - FAA FAR 25.853 (flammability in aircraft interiors) - ASTM D3039 (tensile properties of composites) - SAE ARP standards (aerospace composites) |

- Structural integrity - Fire resistance - Aerospace & automotive safety |

CFRP in aerospace must undergo FAA certification. ASTM standards are widely used across the automotive & construction sectors. |

| European Union | EASA (European Union Aviation Safety Agency), CEN, ISO | - EASA CS-25 (large aircraft certification) - EN ISO 14126 (compressive properties of composites) - REACH (restrictions on chemicals in composite resins) |

- Aviation & automotive safety - Mechanical performance - Environmental compliance |

EU emphasizes sustainability—end-of-life recycling of composites under discussion. REACH impacts resin/epoxy systems used in CFRP. |

| China | CAAC (Civil Aviation Administration of China), SAC (Standardization Administration of China) | - GB/T 3356 (tensile testing of CFRP) - GB/T 1447 (mechanical property testing) - CAAC aircraft material certification |

- Material quality control - Aerospace certification - Industrial applications |

China strongly promotes CFRP in aerospace and wind energy. Local certification is required even if ASTM/ISO compliance exists. |

| India | BIS (Bureau of Indian Standards), DRDO (for defense applications), DGCA (aviation) | - IS 16086 (testing of polymer composites) - DGCA aircraft component approval - Defense standards for composite materials |

- Mechanical/thermal testing - Aerospace & defense use - Industrial safety |

India is expanding CFRP use in aerospace and defense; BIS standards are aligning with ISO/ASTM guidelines. |

| Japan | JIS (Japanese Industrial Standards), JCMA (Japan Carbon Fiber Manufacturers Association), MLIT | - JIS K 7073 (tensile testing of CFRP) - JIS K 7076 (interlaminar shear strength) - MLIT transport material certification |

- Automotive lightweighting - Structural durability - Transport safety |

Japan is a global leader in CFRP production (Toray, Teijin). Strong focus on automotive applications under fuel-efficiency regulations. |

Segmental Insights

Type Insights

Which Type Segment Dominated The Carbon Fiber Reinforced Plastic (CFRP) Market In 2024?

The continuous fiber segment dominated the market with a 40% share in 2024. Continuous fiber CFRP offers exceptional strength and stiffness, making it a preferred choice in structural applications where durability and lightweight performance are critical. It is widely used in aerospace and high-performance automotive components, delivering superior load-bearing capacity.

Industries prioritize continuous fiber composites for applications that demand long life cycles and reduced maintenance. Their ability to withstand extreme environmental conditions further enhances adoption, particularly in advanced engineering sectors where efficiency and weight reduction are primary considerations.

The woven fiber segment expects significant growth in the carbon fiber reinforced plastic (CFRP) market during the forecast period. Woven fiber CFRP combines strength with flexibility, offering enhanced impact resistance and easier handling during the manufacturing process. Its design versatility makes it suitable for complex geometries and parts that require a balance of durability and formability.

This type is particularly used in sports equipment, automotive interiors, and aerospace panels, where weight reduction and resilience are equally important. Woven fiber composites are gaining traction due to their ability to optimize performance while offering more design freedom compared to unidirectional continuous fibers.

Resin Type Insights

How Did The Epoxy Resin Segment Dominate The Carbon Fiber Reinforced Plastic (CFRP) Market In 2024?

The epoxy resin segment dominated the market with a 55% share in 2024. Epoxy resin-based CFRP dominates the market due to its superior mechanical strength, thermal resistance, and excellent adhesion properties. It is widely used in aerospace, automotive, and wind energy applications where high performance under stress is critical.

Epoxy’s ability to provide reliable bonding and fatigue resistance ensures long service life in demanding environments. Additionally, advancements in curing techniques and lightweight resin systems are supporting wider adoption across industries that prioritize both efficiency and sustainability.

The polyester resin segment expects significant growth in the carbon fiber reinforced plastic (CFRP) market during the forecast period. Polyester resin CFRP is recognized for its cost-effectiveness and versatility, making it suitable for applications where moderate performance is sufficient. It offers good chemical resistance and processing ease, which is particularly useful in construction, automotive components, and marine applications.

While not as strong as epoxy, polyester resin composites remain popular for mid-range applications requiring durability at lower costs. Continued research is expanding their use in lightweight solutions where balancing affordability with strength is important.

Manufacturing Process Insights

Which Manufacturing Process Segment Dominated The Carbon Fiber Reinforced Plastic (CFRP) Market In 2024?

The prepreg lay-up segment dominated the market with a 35% share in 2024. Prepreg lay-up is a highly controlled manufacturing process that ensures consistent fiber alignment and resin distribution, resulting in superior performance composites. It is widely used in aerospace, defense, and motorsports for critical components where precision and mechanical reliability are essential. Although the process is cost-intensive, its ability to deliver high-quality products with predictable performance makes it indispensable in advanced industries. Automation in prepreg processing is further enhancing productivity and expanding its industrial adoption.

The compression molding segment expects significant growth in the carbon fiber reinforced plastic (CFRP) market during the forecast period. Compression molding offers fast production cycles and scalability, making it attractive for high-volume applications such as automotive components and consumer goods. It enables manufacturers to produce complex shapes at lower costs compared to traditional hand lay-up methods.

Compression-molded CFRP parts deliver a good balance between performance and efficiency, making them suitable for industries demanding both lightweight properties and economic viability. Continuous improvements in tooling and automation are strengthening its position in mass manufacturing environments.

End-Use Industry Insights

How Did The Automotive Segment Dominate The Carbon Fiber Reinforced Plastic (CFRP) Market In 2024?

The automotive segment dominated the market with a 45% share in 2024. In the automotive sector, CFRP is valued for reducing vehicle weight while maintaining strength, thereby enhancing fuel efficiency and overall performance. Luxury and sports car manufacturers are leading adopters, using CFRP in body panels, interiors, and structural reinforcements.

With the shift toward electric vehicles, demand for lightweight materials is rising, making CFRP increasingly relevant. As production costs decrease, CFRP is expected to find broader applications across mid-range vehicles, contributing to improved energy efficiency and reduced emissions.

The aerospace & defense segment expects significant growth in the carbon fiber reinforced plastic (CFRP) market during the forecast period. CFRP plays a critical role in aerospace and defense due to its high strength-to-weight ratio and ability to withstand extreme conditions. It is extensively used in aircraft fuselages, wings, and defense systems where performance, fuel efficiency, and safety are paramount.

Defense organizations adopt CFRP for lightweight armored vehicles and protective systems. As commercial and military aviation expands, CFRP demand continues to grow, supported by technological advancements in resin systems and fiber production aimed at reducing overall material costs.

Fiber Type Insights

Which Fiber Type Segment Dominated The Carbon Fiber Reinforced Plastic (CFRP) Market In 2024?

The carbon fiber segment dominated the market with a 65% share in 2024. Pure carbon fiber CFRP is renowned for its unmatched stiffness, strength, and lightweight characteristics. It dominates high-performance sectors such as aerospace, motorsport, and defense, where precision and endurance are vital.

Continuous developments in carbon fiber production are reducing costs, making it more accessible to broader industries like automotive and wind energy. Its superior fatigue resistance and thermal stability ensure long-lasting applications, reinforcing carbon fiber’s role as the backbone of advanced composite markets.

The hybrid fiber (carbon + glass) segment expects significant growth in the carbon fiber reinforced plastic (CFRP) market during the forecast period. Hybrid fiber CFRP, which combines carbon and glass fibers, offers a balance of strength, flexibility, and cost-effectiveness. This composite is particularly appealing in industries seeking affordability without sacrificing significant performance. It is used in automotive parts, construction materials, and sports equipment where moderate strength and lightweight features are sufficient. The hybrid approach also improves impact resistance compared to pure carbon fiber, making it a strategic choice for applications that require performance and economic feasibility.

Regional Insights

North America Dominate The Carbon Fiber Reinforced Plastic (CFRP) Market Size, Industry Report 2034

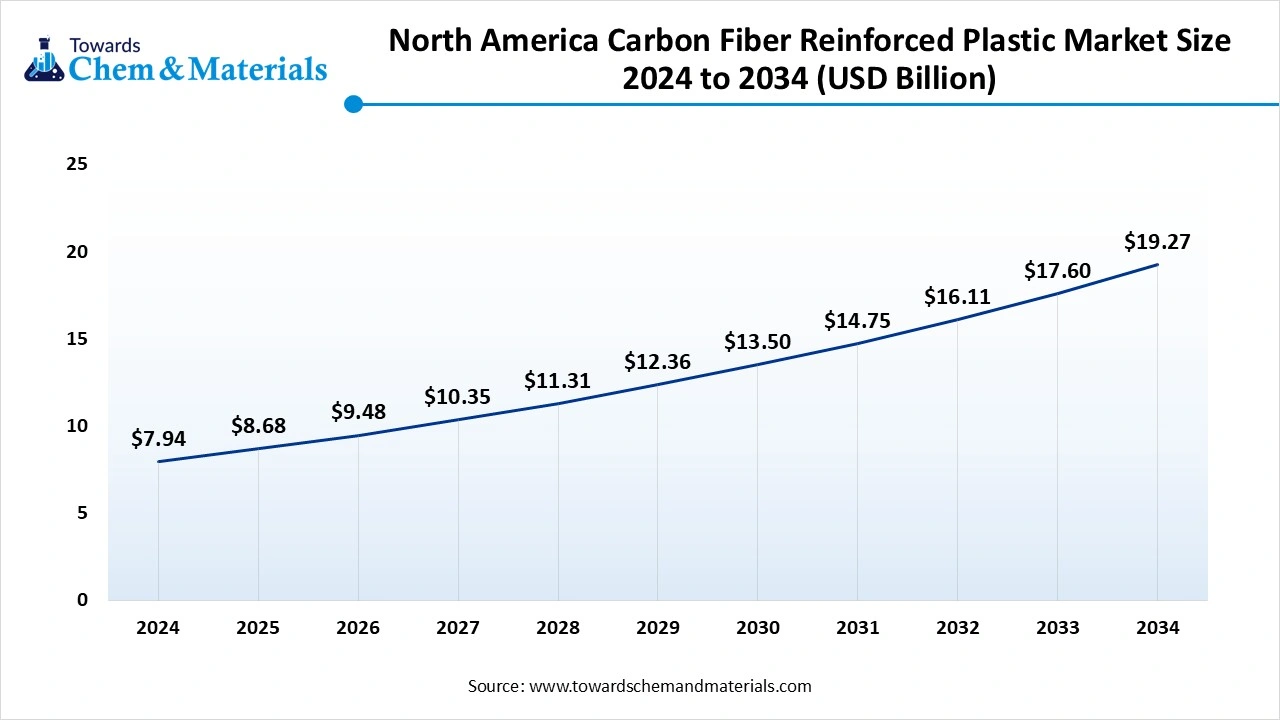

The North America carbon fiber reinforced plastic market size was estimated at USD 7.94 billion in 2024 and is projected to reach USD 19.27 billion by 2034, growing at a CAGR of 9.27% from 2025 to 2034.

North America dominated the market with a 40% share in 2024, driven by its strong aerospace, defense, and automotive sectors. The U.S. dominates regional demand, with companies investing heavily in advanced composites for fuel-efficient aircraft and lightweight vehicles. Government support for defense programs and technological innovation further strengthens adoption.

Additionally, the presence of major manufacturers and research institutions accelerates the development and commercialization of high-performance CFRP solutions. The shift toward sustainable and lightweight materials keeps North America at the forefront of global CFRP innovation.

The U.S. Has Seen Growth Due To the Rising Demand For The Market From Various Industries.

The U.S. holds a dominant share in the market due to its well-established aerospace and defense industries. Boeing, Lockheed Martin, and other major players drive demand for high-performance composites in next-generation aircraft and defense systems.

Additionally, U.S. automotive manufacturers are integrating CFRP into high-performance and electric vehicles to improve efficiency and meet stringent environmental regulations. Strong R&D investments, robust supply chains, and a focus on innovation ensure the U.S. remains a leader in CFRP technology and adoption.

Asia Pacific Has Seen Significant Growth Driven By Growing Manufacturing Hubs.

Asia Pacific expects the fastest growth in the market during the forecast period, supported by rapid industrialization and the expansion of automotive, aerospace, and wind energy industries. Countries like China, Japan, and South Korea are investing in large-scale production facilities to meet rising demand.

The growth of electric vehicles and renewable energy infrastructure is fueling wider adoption of lightweight composites. Cost competitiveness and government-backed initiatives in advanced materials research are positioning the Asia Pacific as a key hub for CFRP manufacturing and application development.

Country-Level Investments & Funding Trends For The Carbon Fiber Reinforced Plastic (CFRP) Market:

- India: Several companies are prominent in the Indian CFRP market, including Time Technoplast, Jindal Advanced Materials (JAM), Tata Advanced Materials, Lohia Group, and Adani Defense and Aerospace.

- China: Large-scale wind energy and electric vehicle (EV) programs. In China, wind turbines are expected to account for 12.7% of the CFRP market in 2024.

- China: China's carbon fiber production capacity nearly quintupled between 2019 and 2023, reaching 135,500 tons by the end of 2024. Leading manufacturers like Kangdexin and Zhongfu Shenying have significant expansion plans.

- USA: In 2024, the Department of Energy announced a $25 million investment for research into polymer upcycling to reduce plastic waste.

- Saudi Arabia: Government initiatives provide funding, subsidies, and partnerships to support the adoption of advanced materials.

- Germany: Major players like SGL Carbon are investing heavily in expanding production capacity. SGL Carbon announced a €100 million investment in 2023 for a new plant producing carbon fiber composites for the automotive industry.

Recent Developments

- In July 2025, Samsung may use a carbon fiber-reinforced plastic backplate in the Galaxy Z Fold 8, which could potentially allow for the return of S-Pen support.(Source: www.indiatoday.in)

- In November 2024, the University of Bristol launched advanced carbon fiber reinforced polymers (CFRP) to the International Space Station (ISS) for testing. These materials will undergo testing on the ISS for 12 to 18 months to assess their durability in the extreme conditions of low Earth orbit.(Source: www.compositesworld.com )

Top Companies List Of Carbon Fiber Reinforced Plastic (CFRP) Market & Their Offerings:

- Toray Industries Inc.: The global leader in carbon fiber production, Toray offers a wide range of CFRP materials used in aerospace, automotive, wind energy, and sports equipment. Its expertise spans both fibers and composite solutions.

- Hexcel Corporation: Specializes in advanced composites, providing high-performance carbon fibers, prepregs, and honeycomb materials primarily for aerospace, defense, and industrial applications.

- Mitsubishi Chemical Holdings Corporation: Through its composites division, Mitsubishi supplies carbon fiber and CFRP solutions for automotive, sporting goods, and industrial applications, with a strong focus on lightweighting technologies.

- SGL Carbon SE: A key European player in the CFRP market, SGL Carbon manufactures carbon fibers, fabrics, and composite materials for industries including automotive, aerospace, energy, and industrial systems.

- Teijin Limited: Offers PAN-based carbon fibers and CFRP solutions with applications across automotive, aerospace, and renewable energy, emphasizing high strength and lightweight performance.

Other major players are:

- Solvay S.A.

- Owens Corning

- BASF SE

- Formosa Plastics Corporation

- Cytec Solvay Group

- LeMond Carbon

- PLP Composites

- Axiom Materials

- Zoltek Companies, Inc.

- GKN Aerospace

- DowAksa

- Safran S.A.

- Ferrari Composite Materials

- Hexagon Composites

- Gurit Holding AG

Segments Covered

By Type

- Continuous Fiber

- Chopped Fiber

- Woven Fiber

- Unidirectional Fiber

By Resin Type

- Epoxy Resin

- Polyester Resin

- Vinyl Ester Resin

- Phenolic Resin

- Polyamide Resin

By Manufacturing Process

- Prepreg Lay-up

- Resin Transfer Molding (RTM)

- Compression Molding

- Hand Lay-up

- Pultrusion

- Filament Winding

By End-Use Industry

- Automotive

- Aerospace & Defense

- Construction & Infrastructure

- Wind Energy

- Sports & Leisure

- Marine

- Electronics & Electrical

- Industrial Equipment

By Fiber Type

- Carbon Fiber

- Hybrid Fiber (Carbon + Glass)

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait