Content

What is the Carbon Black Market Size and Volume?

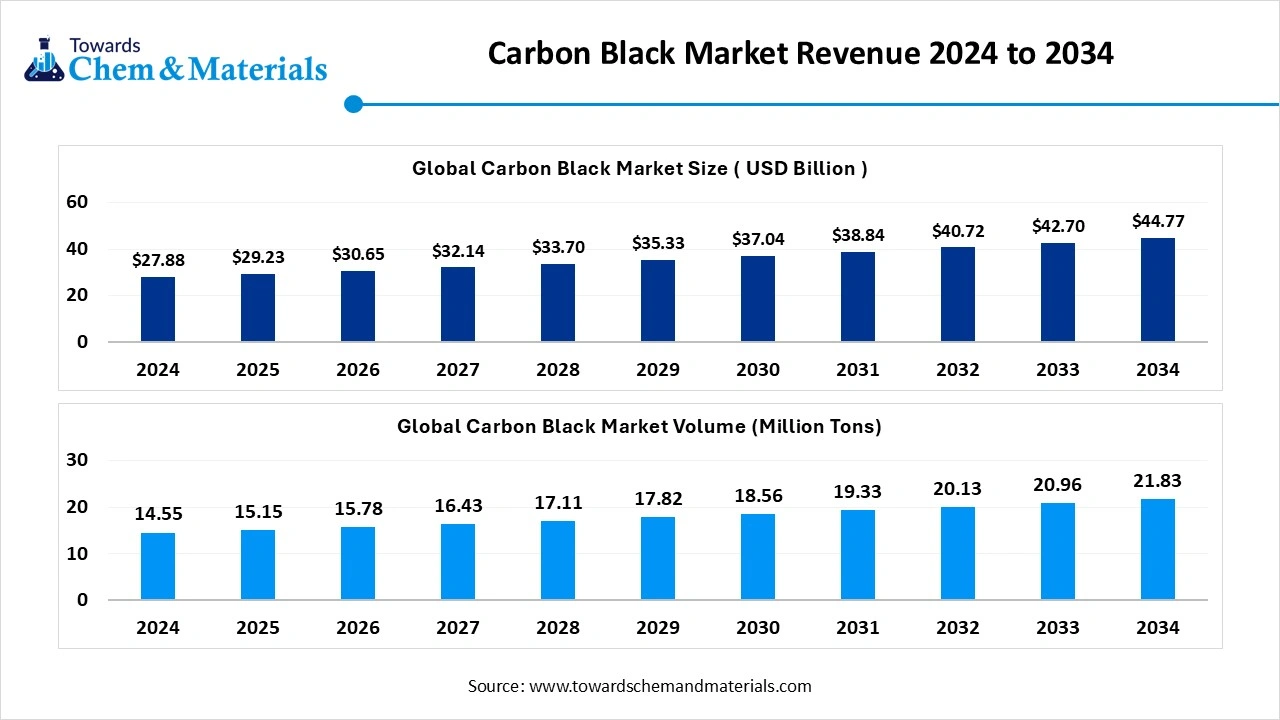

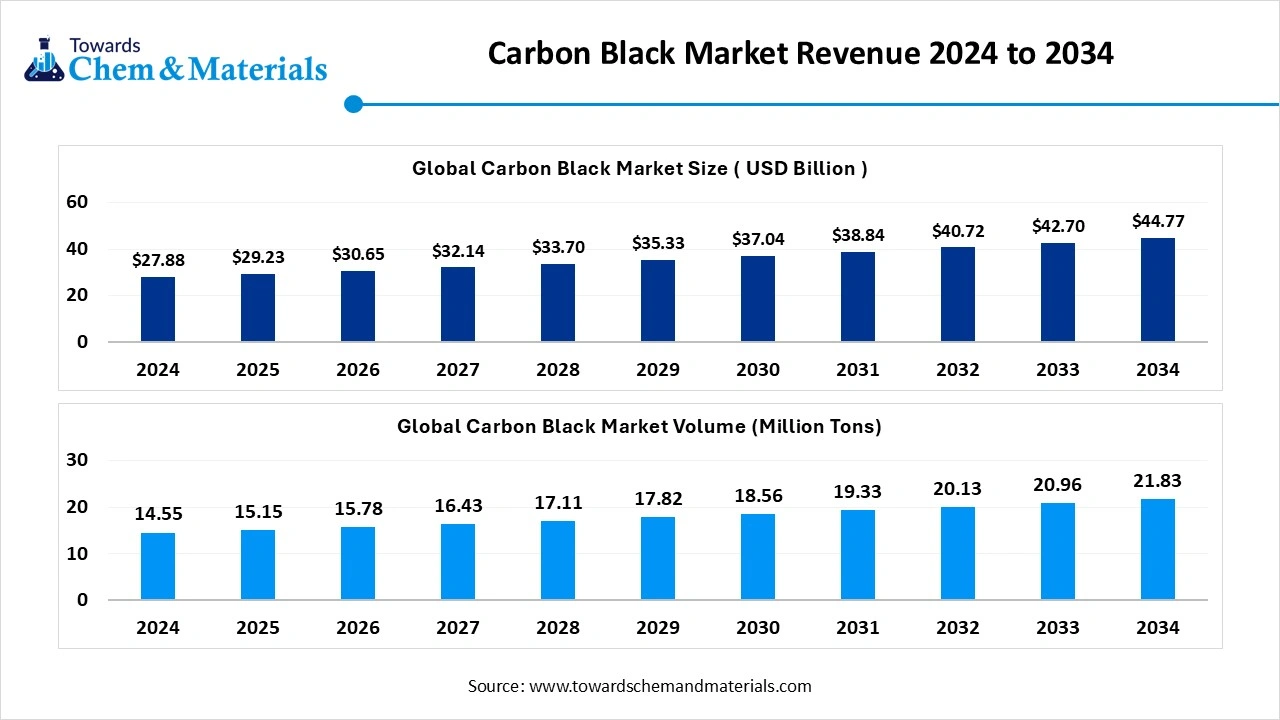

The global carbon black market stands at 15.15 million tons in 2025 and is forecast to reach 21.83 million tons by 2034, expanding at a CAGR of 4.14% from 2025 to 2034.

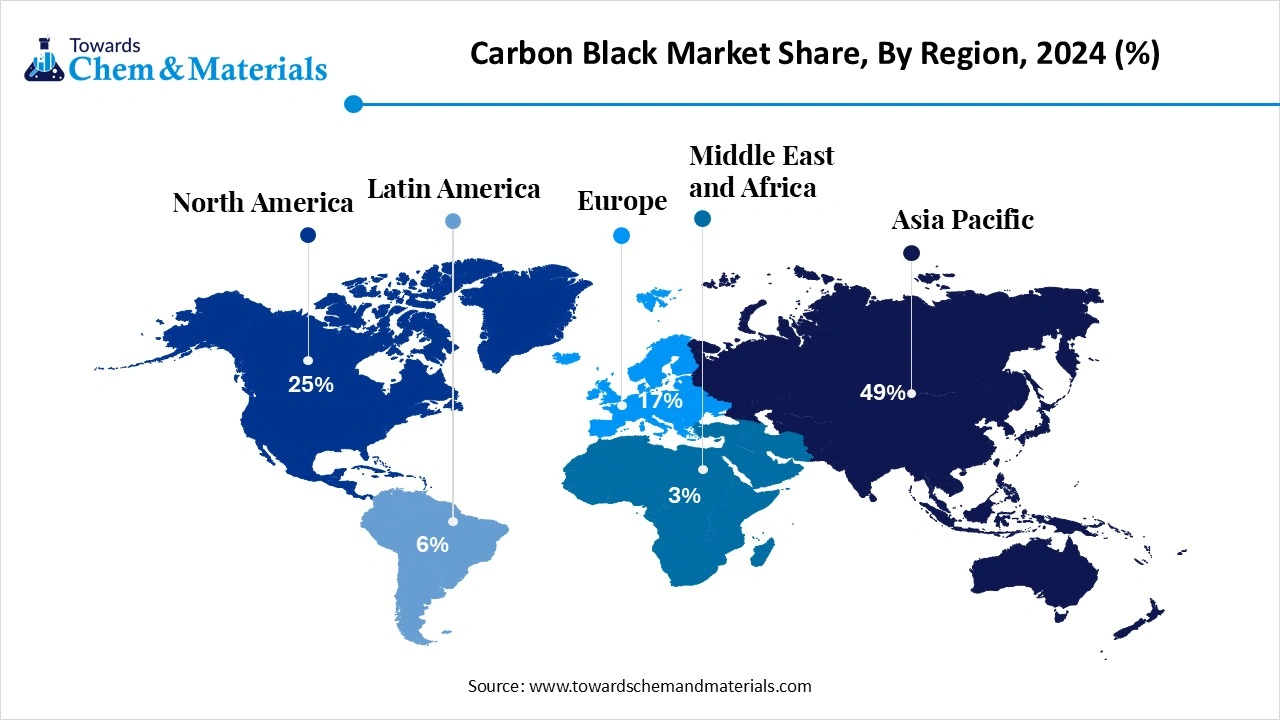

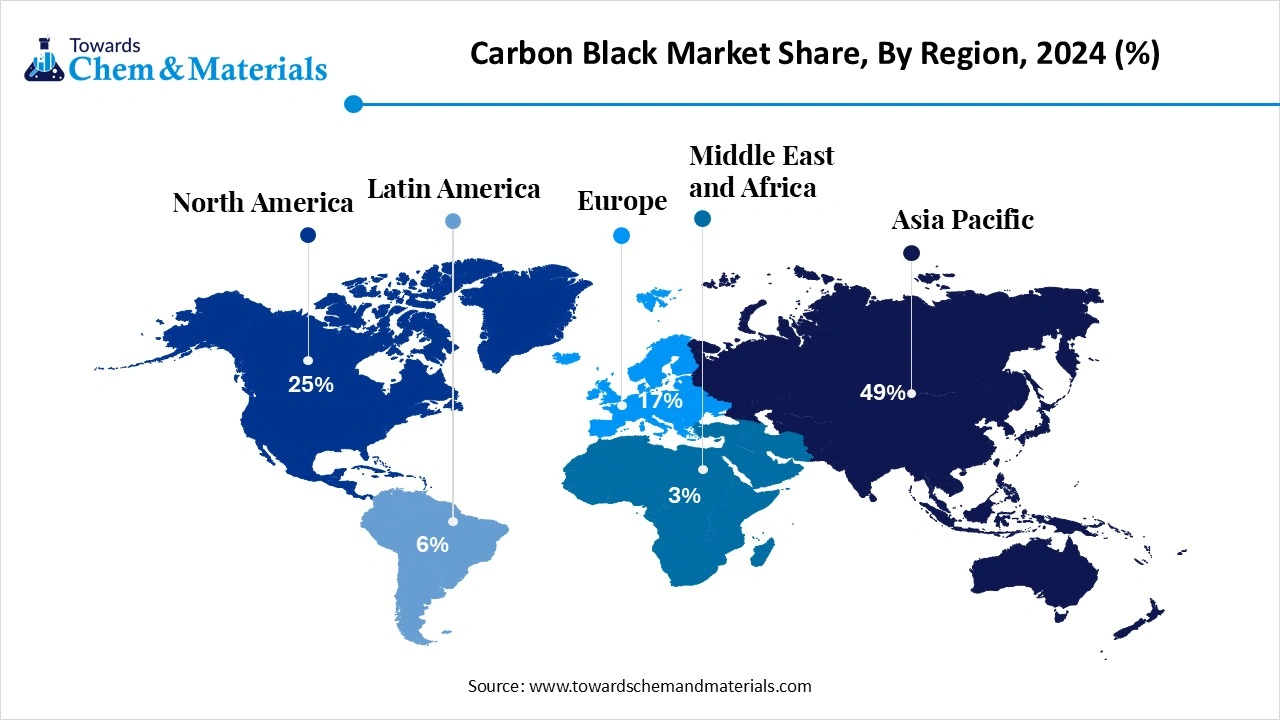

The global carbon black market size is accounted for USD 29.23 billion in 2025 and is anticipated to hit around USD 44.77 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.85% over the forecast period from 2025 to 2034. Asia Pacific carbon black market dominated with the largest revenue share of 58% in 2024. The global expansion of the tire industry is playing a major role in unlocking the industry's growth capacity.

Key Takeaways

- By region, Asia Pacific dominated the carbon black market with approximately 58% share in 2024.

- By region, North America is expected to grow at a notable rate in the future.

- By region, Europe is also a notably growing region in the market.

- By product type, the furnaces' black segment dominated the market with approximately 60% industry share in 2024.

- By product type, the specialty grades segment is expected to grow at the fastest rate in the market during the forecast period.

- By application type, the tires and rubber products segment dominated the market with approximately 55% industry share in 2024.

- By application type, the battery and conductive application segment is expected to grow at the fastest rate in the market during the forecast period.

- By manufacturing process, the furnaces process segment dominated the market with approximately 60% industry share in 2024.

- By manufacturing process, the specialty/acetylene process segment is expected to grow at the fastest rate in the market during the forecast period.

What is Carbon Black?

The carbon black refers to the material that strengthens rubber, gives color to plastic and ink, and improves electrical conductivity in batteries. Moreover, the is made from the burning of hydrocarbons such as natural gas and oil under limited oxygen conditions. It is also seen in making the stringer durable and coating smoother.

Industry Definition

The global carbon black market covers fine, elemental carbon powders produced via incomplete combustion of hydrocarbons, used primarily as reinforcing agents in tires, pigments in inks, coatings, plastics, and specialty applications. Carbon black enhances strength, conductivity, UV resistance, and color properties. Market growth is driven by the automotive industry (tires & rubber), coatings & plastics demand, and emerging applications in electronics, batteries, and energy storage materials. Environmental regulations, process innovations, and specialty grades are shaping supply and product development.

Carbon Black Market Outlook:

- Industry Growth Overview: Between 2025 and 2034, as the tire manufacturers are increasingly considering carbon black as a crucial element in the production of tires, akin to its properties. Moreover, the shifting global attention towards electric vehicles is creating profitable pathways for sector participants in the current industry environment.

- Sustainability Trends: The major manufacturers are increasingly turning towards the sustainable manufacturing of carbon black while using materials like biomass, recovered carbon material, and renewable oils. Also, several companies have been observed applying closed-loop production to recycle CO2 in the past few years.

- Global Expansion: regions like the Asia Pacific and others are having a huge demand for carbon black due to the ongoing industrial and manufacturing boom. Whereas North America and Europe are actively focusing on the sustainable and advanced carbon black to produce high-performance materials and EVs.

Key Technological Shifts in the Carbon Black Market:

The emergence of eco-friendly manufacturing is transforming the carbon black industry towards advanced technology, like recovered carbon black and others. Also, the innovation, like plasma-assisted and electrochemical carbon black production, has enabled the sector to explore untapped potential in recent years.

Report Scope

| Report Attributes | Details |

| Market Size in 2026 | USD 30.65 Billion |

| Expected Size by 2034 | USD 44.77 Billion |

| Growth Rate from 2025 to 2034 | CAGR 4.85% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | Product Type Insights, Application Insights, Manufacturing Process Insights, Regional Insights |

| Key Companies Profiled | Tokai Carbon Co., Ltd., Continental Carbon , Jiangsu C-Chem Co., Ltd. , Himadri Specialty Chemical Ltd. , Sid Richardson Carbon & Energy Company , Raven SR, LLC , Cancarb Limited , Philips Carbon Black Limited , OCI Company Ltd. , Columbian Chemicals Company , Aditya Birla Group |

Trade Analysis of the Carbon Black Market: Import & Export Statistics

- India has exported a huge amount of carbon black to Congo, and export values are US$2.09 thousand.(Source: tradingeconomics.com)

- China exported a significant amount of carbon black in 2024, and the export shipment count was 7,956 between 2023 to 2024.(Source: www.volza.com)

- The United States has imported a significant amount of carbon black and their other forms in 2023, and the estimated trade value of this import is 413,724.35 USD.(Source: wits.worldbank.org)

Valus Chain Analysis of the Carbon Black Market:

- Distribution to Industrial Users : The distributors have mainly supplied carbon black to manufacturing industries, like inks, rubber, and plastics.

- Chemical Synthesis and Processing: Chemical synthesis and the processing of carbon black include the major processes, such as incomplete combustion or thermal decomposition.

- Regulatory Compliance and Safety Monitoring : The safety and regulatory process of carbon black is mainly inspected under the Globally Harmonized System (GHS).

Carbon Black Market’s Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas | Notable Notes |

| United States | Environmental Protection Agency (EPA) | National Emission Standards for Hazardous Air Pollutants (NESHAP) | Emission Control | This agency regulates air and water emissions from carbon black manufacturing facilities under the Clean Air Act and Clean Water Act. |

| European Union | European Chemicals Agency (ECHA) | REACH Regulation (EC) No 1907/2006 | Risk Assessment | This agency manages the registration, evaluation, authorization, and restriction of chemicals under REACH. |

| China | Ministry of Ecology and Environment (MEE) | Environmental Protection Law of the People's Republic of China | Pollution Control | The agencies set and enforce environmental protection standards for manufacturing. |

| India | Bureau of Indian Standards (BIS) | BIS Standard IS 17440:2020 | Carbon Emission Reduction | This agency develops and enforces quality standards for carbon black products used in various industrial applications. |

Segmental Insights

Product Type Insights

How did the Furnace Black Segment Dominate the Carbon Black Market in 2024?

The furnace black segment dominated the market with approximately 60% of market share in 2024 due to its flexibility and offerings like high production efficiency. Also, by allowing manufacturers to control structure, particle size, and surface area, the furnace black segment has gained major industry attention in a wide range of sectors like tires, rubber goods, and plastics.

The specialty grades segment is expected to grow at a notable rate during the forecast period, owing to its demand from the high-value sectors such as batteries, electronics, and coatings. Moreover, the manufacturers of solar panels, advanced polymers, and elastic vehicles have been actively seeking specialty-grade carbon blacks in recent years.

Application Insights

Why does the Tires and Rubber Products Segment Dominate the Carbon Black Market by Application?

The tires and rubber products segment dominated the market with approximately 55% industry share in 2024 because carbon black is essential for strengthening rubber, improving durability, and enhancing wear resistance. It also gives tires their deep black color and protects against UV light damage. With billions of vehicles on the road, tire manufacturing consumes more than half of all carbon black produced. The automotive industry's focus on long-lasting and high-performance tires has kept demand high.

The battery and conductive applications segment is expected to grow at a notable rate during the forecast period, as electric vehicles (EVs) and renewable energy systems expand. Conductive carbon black enhances battery efficiency by improving electrical conductivity and extending charge life. It's also vital for supercapacitors, solar cells, and conductive polymers. As energy storage becomes central to sustainability goals, manufacturers will invest more in conductive carbon black for advanced lithium-ion and solid-state batteries.

Manufacturing Process Insights

How did the Furnace Process Segment Dominate the Carbon Black Market in 2024?

The furnaces process segment dominated the market with approximately 60% industry share in 2024 because it is the most economical and scalable method to produce carbon black. It allows precise control over particle size and structure, giving consistent quality suitable for tire and industrial rubber applications. The process also supports continuous operation and large-volume output, which reduces production costs. Its adaptability to various hydrocarbon feedstocks makes it more flexible than other methods.

The specialty/acetylene process segment is expected to grow at a notable rate during the forecast period, due to the rising need for ultra-pure, conductive, and fine-structured carbon blacks. These types are essential in lithium-ion batteries, conductive coatings, and advanced electronics. The acetylene process produces high-crystallinity carbon black with superior electrical conductivity and dispersibility. As industries shift toward clean energy technologies and smart materials, demand for these high-performance carbon blacks will surge.

Regional Insights

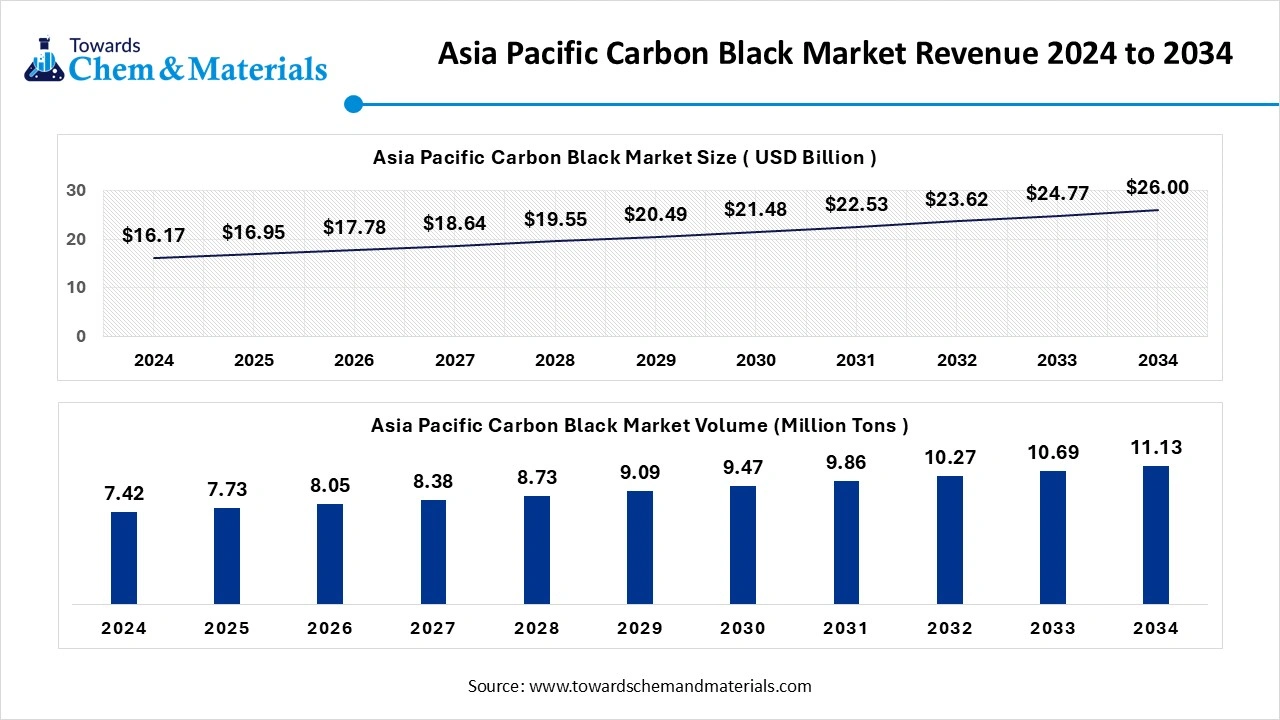

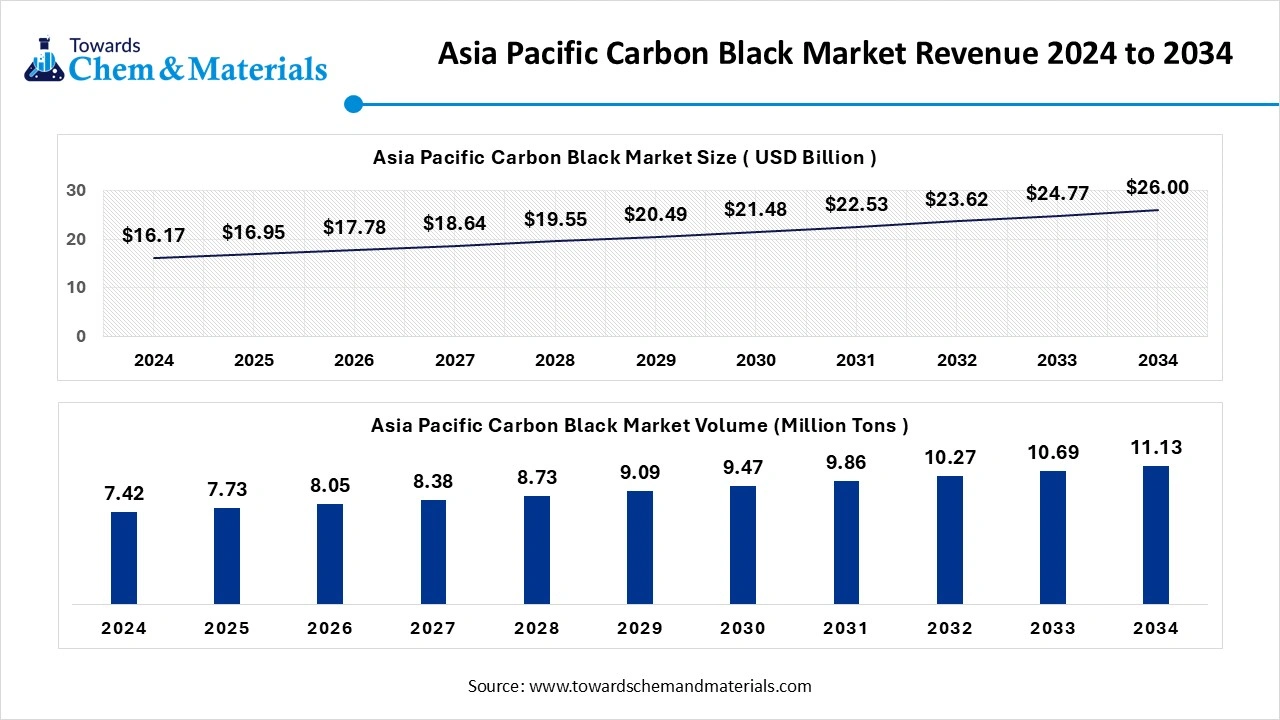

The Asia Pacific carbon black market size is valued at USD 16.95 billion in 2025 and is expected to reach USD 26.00 billion by 2034, growing at a CAGR of 4.86% from 2025 to 2034.Asia Pacific dominated the carbon black market with approximately 58% share in 2024

The Asia Pacific carbon black market stood at approximately 7.73 million tons in 2025 and is anticipated to be likely to reach approximately 11.13 million tons in 2034. growing at a CAGR of 4.16% from 2025 to 2034.

Owing to the presence of the major manufacturing and exporting infrastructure of rubber and tires in the region. furthermore, the regional countries such as India, China, and Thailand have seen greater raw material availability, a stronger automotive industry and lower production, which has provided major attention to the industry in recent years.

What Drives the China Supremacy in the Carbon Black Industry?

China maintained its dominance in the carbon black market, owing to the country is considered the world's largest producer of carbon black. Moreover, the factors such as the enlarged petrochemical infrastructure, presence of the high volume tire industry, and governmental focus towards domestic manufacturing are heavily supporting the industry growth in the current period.

North America Carbon Black Market Analysis

North America is expected to capture a major share of the market during the forecast period, akin to the greater shift towards renewable energy and electric mobility. Also, having access to advanced technology, the region has gained prominence in innovation-led discussions in recent years. Also, the manufacturers in the United States are increasingly in low low-carbon emission production practices.

How is the United States Reinventing Carbon Black Production?

The United States is expected to emerge as a prominent country for the market in the coming years, owing to the country's shift towards clean manufacturing and sustainability initiatives adoption. Moreover, the United States has seen significant development of renewable feedstocks and carbon recovery systems, which have heavily supported capital growth and economic activity in the sector in the past few years.

Europe Carbon Black Market Trends

Europe is a notably growing region, due to rising demand for eco-friendly and specialty grades. The European Union's Green Deal and strict emission regulations are pushing industries to adopt sustainable carbon production methods. Growth will come from battery materials, lightweight plastics, and advanced coatings for renewable energy equipment.

Germany Drives the Future with Sustainable Innovation

Germany is expected to gain a major industry share. With a strong automotive industry and leadership in green chemistry, German companies are focusing on sustainable production and high-performance applications. The country is developing conductive carbon black for EV batteries, fuel cells, and smart coatings.

Recent Developments

- In September 2025, Birla Carbon unveiled its latest line of carbon black solutions. The newly launched carbon solution is designed for the tire and rubber application, as per the report published by the company recently.(Source: www.specialchem.com)

- In April 2025, Orion introduced their production of BioCircular carbon black. Also, this newly launched carbon black is specially designed for sustainable coatings, as per the company's claim.(Source: tyre-trends.com)

Top Vendors in the Carbon black market & Their Offerings:

- Cabot Corporation: A global specialty chemicals and performance materials company.

- Birla Carbon: The world's largest manufacturer and supplier of carbon black additives, producing both rubber and specialty blacks for a wide range of applications, including tires, plastics, and batteries.

- Orion Engineered Carbons: A global supplier of high-performance carbon black products that enhance the properties of materials for industries like coatings, printing inks, polymers, and tires.

- Mitsubishi Chemical Corporation: A large Japanese industrial chemicals company that is a part of the Mitsubishi Chemical Holdings Group and a producer of industrial materials.

Other Key Players

- Tokai Carbon Co., Ltd.

- Continental Carbon

- Jiangsu C-Chem Co., Ltd.

- Himadri Specialty Chemical Ltd.

- Sid Richardson Carbon & Energy Company

- Raven SR, LLC

- Cancarb Limited

- Philips Carbon Black Limited

- OCI Company Ltd.

- Columbian Chemicals Company

- Aditya Birla Group

Segments Covered in the Report:

By Product Type / Grade

- Furnace Black

- Thermal Black

- Acetylene Black

- Lamp Black

- Specialty Grades

By Application

- Tires & Rubber Products

- Plastics & Polymers

- Coatings & Paints

- Inks & Toners

- Battery & Conductive Applications

- Others (Construction, Ceramics, Adhesives)

By Manufacturing Process

- Furnace Process

- Thermal Process

- Acetylene Process

- Gas Black Process

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait