Content

Building Envelope Market Size and Growth 2025 to 2034

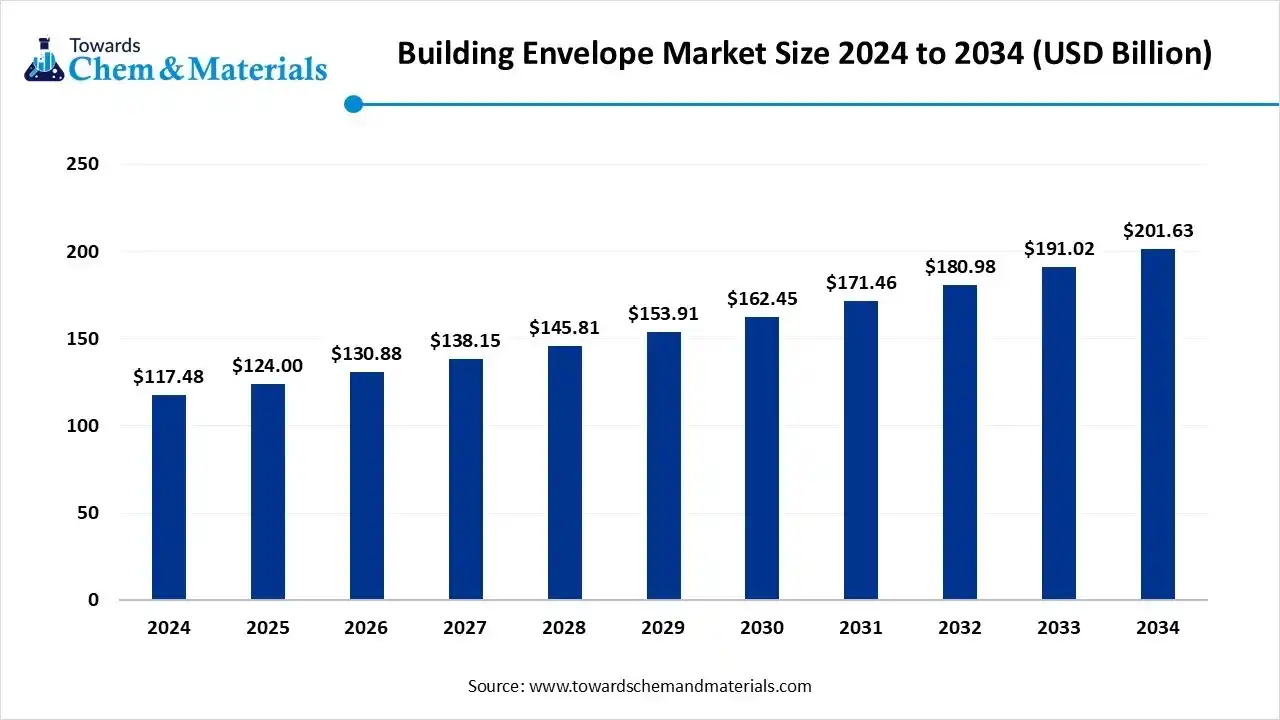

The global building envelope market size was valued at USD 117.48 billion in 2024, grew to USD 124.00 billion in 2025, and is expected to hit around USD 201.63 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.55% over the forecast period from 2025 to 2034. The global push towards energy efficiency has raised awareness among ventures and corporate backers in recent years.

Key Takeaways

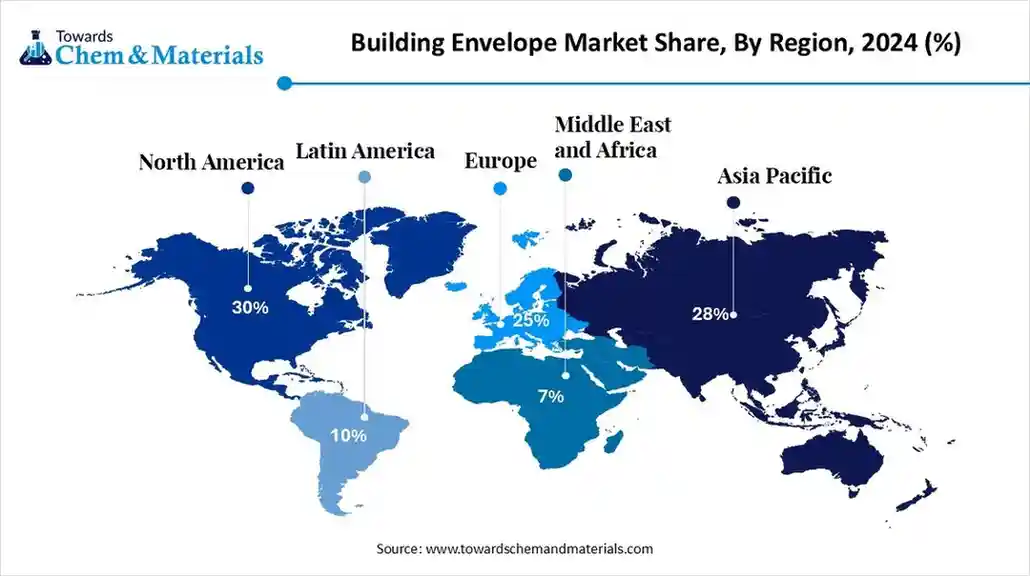

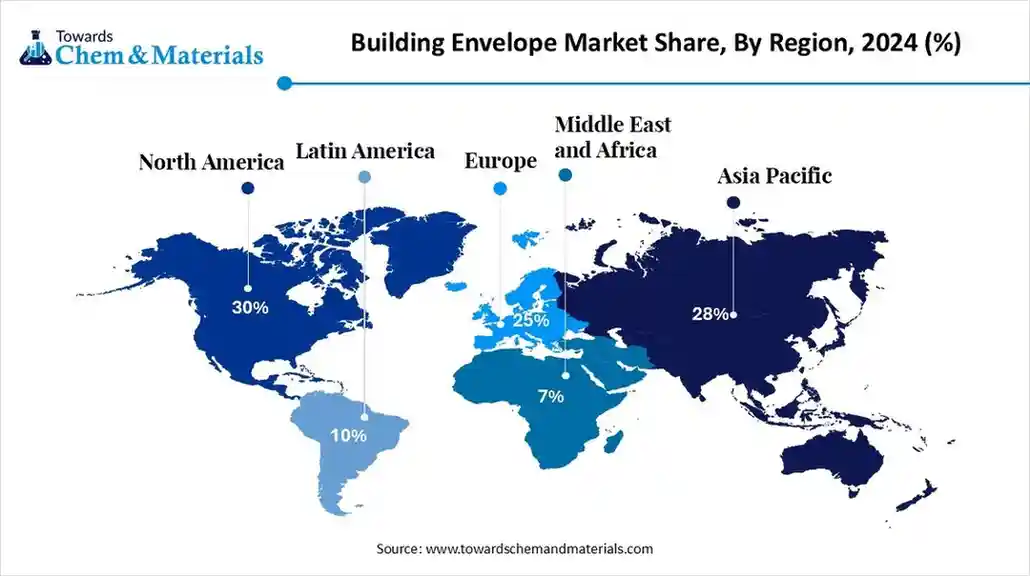

- By region, North America dominated the market with a 30% industry share in 2024.

- By region, Asia Pacific is expected to grow at a notable rate in the future.

- By material type, the glass segment led the market with 30% industry share in 2024.

- By material type, the metal segment is expected to grow at the fastest rate in the market during the forecast period.

- By product type, the wall systems segment emerged as the top-performing segment in the market with 40% industry share in 2024.

- By product type, the window and doors segment is expected to lead the market in the coming years.

- By building type, the commercial building segment led the market with a 45% share in 2024.

- By building type, the residential building segment is expected to capture the biggest portion of the market in the coming years.

- By technology, the smart and energy-efficient solutions segment emerged as the top-performing segment in the market with 50% industry share in 2024.

- By technology, the solar-integrated building envelopes segment is expected to lead the market in the coming years.

- By installation type, the renovation & retrofitting segment led the building envelope market with a 60% share in 2024.

- By installation, the new construction segment is expected to capture the biggest portion of the market in the coming years.

What is a Building Envelope, and What's the Current Industry Status?

The physical barrier that can separate the conditioned interior from the unconditioned exterior atmosphere in the building construction is called the building envelope.

Furthermore, the building envelope industry has experienced sophisticated growth in the past few years, where the need for lower energy bills and healthier interiors has immensely contributed to the industry's potential.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 124.00 Billion |

| Expected Size by 2034 | USD 201.63 Billion |

| Growth Rate from 2025 to 2034 | CAGR 5.55% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | North America |

| Segment Covered | By Material Type, By Product Type, By Building Type, By Technology, By Installation Type, By Region |

| Key Companies Profiled | Rockwool International A/S, Alcoa Corporation , Johnson Controls , BASF SE , USG Corporation, Nichiha Corporation, Boral Limited , LafargeHolcim , ArcelorMittal , Tata Steel Limited , Fletcher Building Limited , Knauf Insulation , Xella Group , Etex Group , CSR Limited , Zhejiang Zhongtai Glass Co., Ltd. |

Building Envelope Market Outlook:

- Industry Growth Overview: Between 2025 and 2034, the market is likely to experience heavy transformation akin to increasing infrastructure updation in global regions. Also, the high-performance glazing, advanced façade, and insulation have been flagged as key areas of market interest in recent years.

- Sustainability Trends: the industry observed under a greater shift from green claims to measurable carbon performance in the building envelopes sector. Also, the buyers are seeking the embodied carbon caps and life-cycle carbon numbers.

- Global Expansion: the global building envelope industry atmosphere has seen the following expansion pattern, where the demand corridors, leapfrogging markets, and micro factory localization are the major key areas in the current condition.

Key Technological Shifts in the Building Envelope Market:

The industry has seen under greater technology adoption in recent years. Also, the building envelope developers are shifting towards intelligent skins to achieve response, sense, and adapt in real time, as per the latest survey.

Moreover, the individuals preferring the advanced systems which has integrated smart membranes and embedded sensors instead of static facades in the past few years.

Trade Analysis of the Building Envelope Market: Import & Export Statistics

- China has exported prefabricated buildings to India in 2024, worth US$23.59 million, according to the published report.(Source: tradingeconomics.com)

- Germany has seen under sophisticated exports of commercial building material to several global regions worth US$18.45 billion in 2024.(Source: tradingeconomics.com)

- The United States exported 16,399 shipments of construction material between 2023 to 2024.(Source: www.volza.com)

- Japan has observed under an import of construction materials like lighting signs, prefabricated buildings, and furniture worth $12.81 million in 2024, as per the published report.(Source: tradingeconomics.com)

Building Envelope Market Values Chain Analysis

- Distribution to Industrial Users: The distributors are actively providing the facades, insulation, and waterproofing, and some are seen under the specialized glazing trades.

- Key Players: Owens Corning, Kingspan Group, and Saint-Gobain

- Chemical Synthesis and Processing: Chemical synthesis and processing of the building envelope is basically integrated with the phase-changing materials for the improvement of the thermal performance, occupant comfort, and energy efficiency.

- Regulatory Compliance and Safety Monitoring:The regulatory and safety framework is mainly designed by the respective region, where the energy standards, building codes, and safety regulations play crucial roles.

Building Envelope Market’s Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas | Notable Notes |

| United States | American Society of Heating, Refrigerating and Air-Conditioning Engineers (ASHRAE) | Section C402.5.1, which defines and guides by outline for the air barriers ASHRAE Standard 90.1 |

Green building development and heat reduction | These governmental firms are actively observing the sustainability development in the United States. |

| European Union | Energy Performance of Buildings Directive (EPBD) | Article 10 for renewable energy generation | Building renovation and carbon emissions | These regulatory bodies can closely watch renovation and green building development in the region. |

| China | Ministry of Housing and Urban-Rural Development (MOHURD) | Design Standard for Energy Efficiency of Public Buildings (GB 50189) | Solar energy utilization and energy conservation | The regulatory body ensures compliance with social norms in new and heavy building projects |

| India | Bureau of Indian Standards (BIS) | National Building Code (NBC) 2016 | Safety and Structural Integrity | These specific standards are actively ensuring the building's safety |

Segmental Insights

Material Type Insights

How did the Glass Segment Dominate the Building Envelope Market in 2024?

The glass segment held a 30% share of the market in 2024, due to the heavy demand for transparent facades and natural lighting in the modern housing era. Moreover, the glass facades have gained immense popularity in residential and commercial sectors in recent years. Also, innovations like electrochromic glass and double-glazed units.

The metal segment is expected to grow at a notable rate during the predicted timeframe, owing to the sudden shift towards recyclability, strength, and adaptability to solar integration. Furthermore, the need for lightweight and durable facades is likely to create lucrative opportunities in industry, where residential and commercial projects are prominent.

Product Type Insights

Why does the Wall Systems Segment Dominate the Building Envelope Market?

The wall systems segment held 40% of the market in 2024 because they are the largest surface area of any building envelope and, therefore, critical for thermal regulation and structural strength. Insulated wall systems, ventilated façades, and curtain walls became the most cost-effective way to enhance energy efficiency and aesthetics simultaneously.

The windows and doors segment is expected to grow at a notable rate during the forecast period because of the rise of dynamic glazing and smart glass technologies. Instead of being just openings, windows are evolving into energy-regulating systems that control light, heat, and glare.

Building Type Insights

How did the Commercial Building Segment Dominate the Building Envelope Market in 2024?

The commercial building segment dominated the market with a 45% share in 2024, because of the heavy use of curtain walls, glass façades, and advanced insulation in corporate towers, malls, and institutions. These projects demanded high-performance envelopes that balanced aesthetics with strict energy codes.

The residential buildings segment is expected to grow at a significant rate during the forecast period due to the rise of sustainable housing demand and affordable retrofits. Homeowners are increasingly adopting spray foam insulation, insulated windows, and reflective coatings to cut energy bills. Governments across Asia and Europe are pushing net-zero housing mandates that require high-performance envelopes.

Technology Type Insights

How did the Smart and Energy-efficient Solutions Segment Dominate the Building Envelope Market in 2024?

The smart and energy-efficient solutions segment dominated the market with a 50% share in 2024 because of its ability to reduce energy costs and meet stringent emission targets. Building envelopes now integrate IoT sensors, reflective coatings, dynamic glass, and ventilated façades to optimize comfort while cutting HVAC loads.

The solar integrated building envelopes segment is expected to grow at a significant rate during the forecast period because it transforms façades and roofs into renewable energy generators. Unlike traditional passive envelopes, these systems actively produce electricity using building-integrated photovoltaics (BIPV).

Installation Type Insights

Why does the Renovation and Retrofitting Segment Dominate the Building Envelope Market by Installation Type?

The renovation and retrofitting segment dominated the market with a 60% share in 2024 because most developed regions like North America and Europe have aging building stocks. Instead of demolishing, owners invested in retrofits with insulated walls, smart glazing, and reflective coatings to meet stricter codes. Retrofitting offered faster ROI by cutting energy costs without full reconstruction.

The new construction segment is expected to grow at a significant rate during the forecast period because of the explosive demand for modern urban housing and infrastructure in the Asia Pacific and the Middle East. Unlike retrofits, new projects can fully integrate solar façades, smart glazing, and adaptive insulation into the design from the start.

Regional Insights

North America Building Envelope Market Size, Industry Report 2034

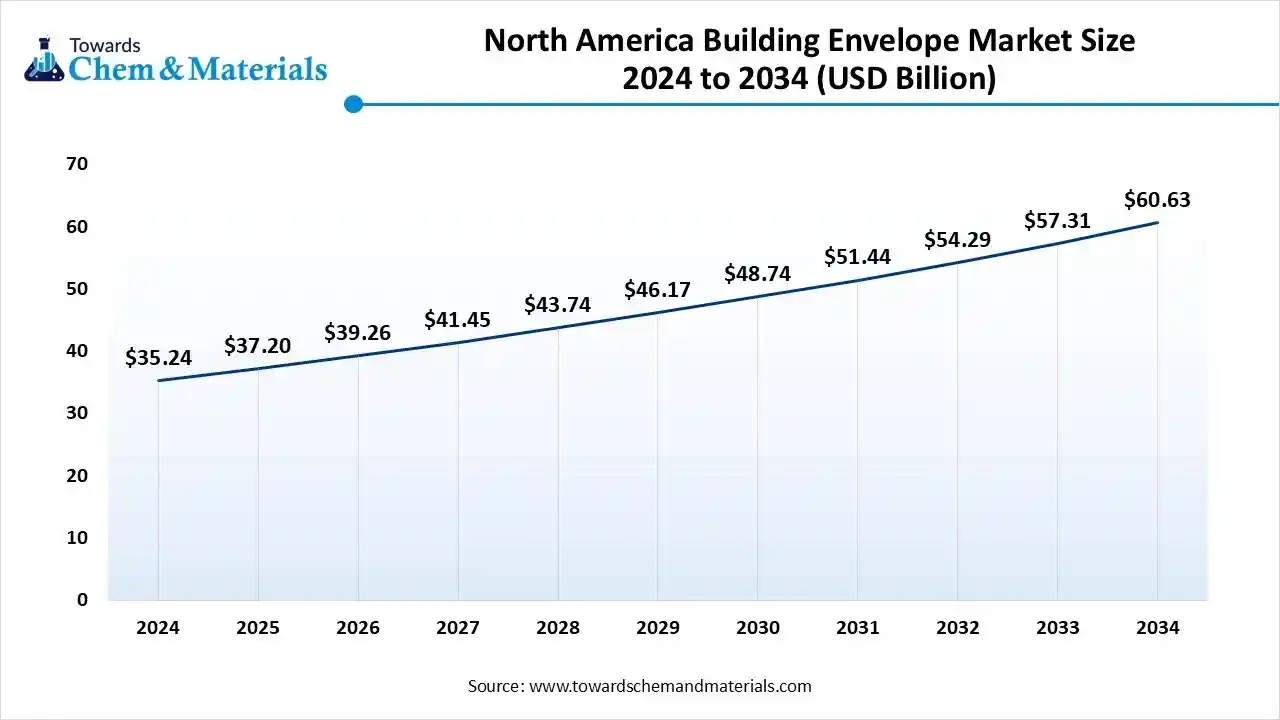

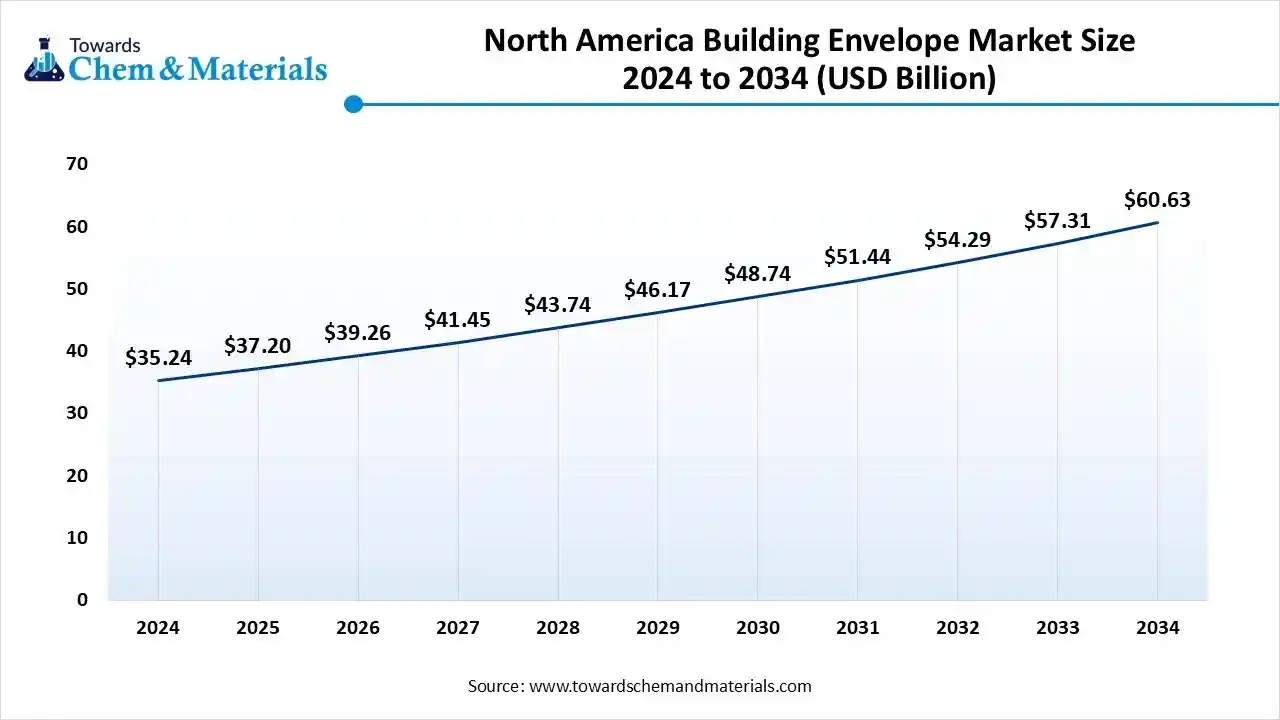

The North America building envelope market size was valued at USD 35.24 billion in 2024 and is expected to surpass around USD 60.63 billion by 2034, expanding at a compound annual growth rate (CAGR) of 5.58% over the forecast period from 2025 to 2034. North America dominated the market in 2024,

owing to the greater adoption of initiatives like green building and sustainable housing development in recent years. Furthermore, the presence of the renowned and modern governmental firms like LEED and WELL has been widely discussed in technological forums and whitepapers in the North America region.

How Are Smart Materials Shaping the Future of American Construction?

The United States maintained its dominance in the market, owing to the increased investment in the R&D programs for climate-adaptive and smart materials in the current period. Moreover, the construction builders in the United States have seen in developing the tailored solutions to tackle the diverse climate zones of the United States, where the demand for building envelopes is increased

Asia Pacific Building Envelope Market Trends

Asia Pacific is expected to capture a major share of the market during the forecast period, akin to the fast-paced urban development and advanced construction boom in recent years.

Moreover, the regional countries such as India, China, and Japan are seen in heavy implementation of the green building standard in their respective regions, while boosting demand for construction materials like building envelopes and others.

Country-level Investments & Funding Trends for the Building Envelopes Industry:

- India: the government has approved 248 green building projects in 2023, and the motive behind the development is to promote sustainability.(Source: ibef.org)

- China: The firms in China have invested in the building and energy sector approximately $33 billion. (Source: odi.org)

- Europe: Europe has implemented stricter regulations of the green building initiatives in recent years and launched a future carbon emission program, such as carbon neutrality by 2050.(Source: www.sustainabletimes.co.uk)

Recent Development

- In March 2025, Typar is planning to launch its own new building envelopes 2025. Also, the company is likely to produce the product called Typar Clear Acrylic Flashing, as per the report published by the company.(Source: www.nonwovens-industry.com)

Top Vendors in the Building Envelope Market & Their Offerings:

- Saint-Gobain: a manufacturer of high-performance construction materials with a presence in 80 countries.

- Kingspan Group: Kingspan is known for the high-performance building material production, with a focused development of building envelope solutions

- Schüco International KG: The company is known for its crucial production of building envelopes.

- Owens Corning: Owens Corning is a prominent developer of building materials like roofing, composites, and insulation.

Other Key Players

- Rockwool International A/S

- Alcoa Corporation

- Johnson Controls

- BASF SE

- USG Corporation

- Nichiha Corporation

- Boral Limited

- LafargeHolcim

- ArcelorMittal

- Tata Steel Limited

- Fletcher Building Limited

- Knauf Insulation

- Xella Group

- Etex Group

- CSR Limited

- Zhejiang Zhongtai Glass Co., Ltd.

Segments Covered in the Report

By Material Type

- Concrete

- Glass

- Metal

- Wood

- Stone

- Other Materials

By Product Type

- Wall Systems

- Curtain Wall Systems

- Cladding

- Insulation

- Roof Systems

- Green Roof Systems

- Roof Windows

- Roof Insulation

- Window & Doors

- Windows

- Doors

- Skylights

- Floor Systems

- Floor Insulation

- Floor Coverings

- Others

By Building Type

- Residential Buildings

- Single-Family Homes

- Multi-Family Homes

- Commercial Buildings

- Office Buildings

- Retail Buildings

- Hospitals & Healthcare

- Educational Institutions

- Industrial Buildings

- Institutional Buildings

By Technology

- Traditional Building Envelope Solutions

- Smart & Energy-Efficient Building Envelope Solutions

- Energy-Efficient Windows

- Insulation Materials

- Thermally Efficient Materials

- Ventilation Systems

- Solar-Integrated Building Envelopes

- Transparent Solar Panels

By Installation Type

- New Construction

- Renovation & Retrofitting

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait