Content

Glass Manufacturing Market Market Size and Top Companies Analysis, 2034

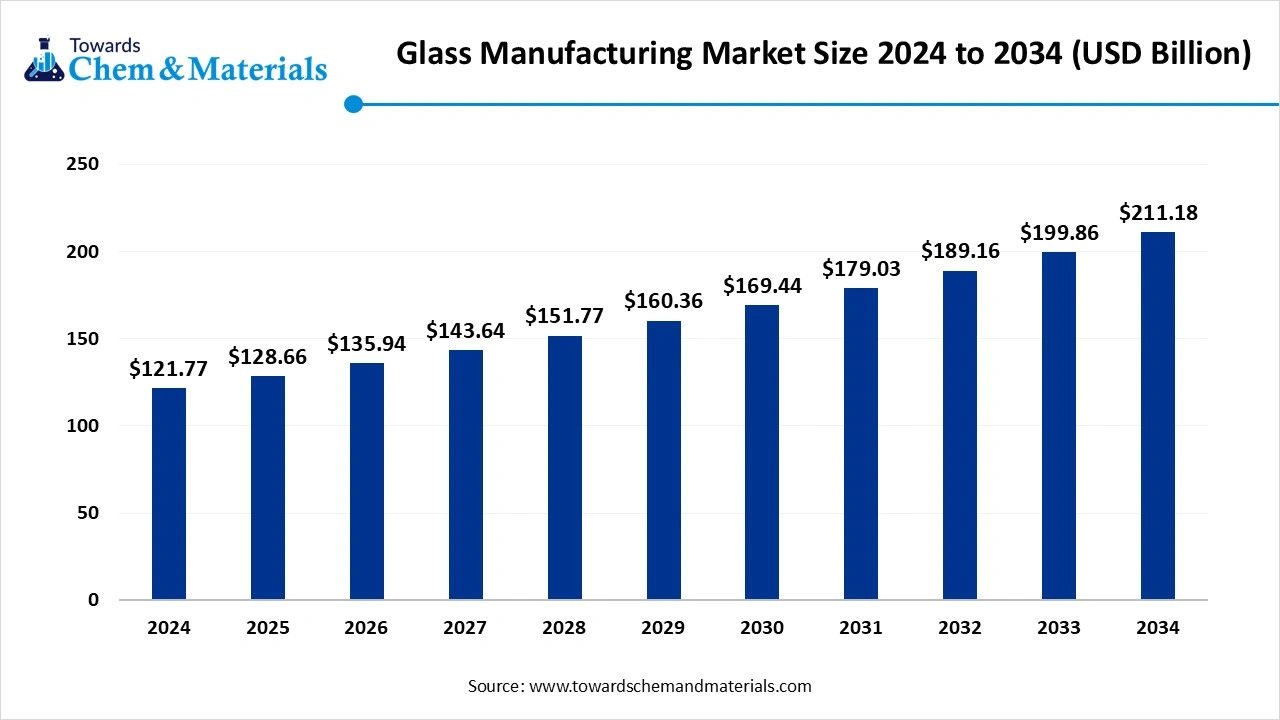

The global glass manufacturing market size was reached at USD 121.77 billion in 2024 and is expected to be worth around USD 211.18 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.66% over the forecast period 2025 to 2034. The growing glass demand from the automotive and construction sectors is the key factor driving market growth. Also, a rapid surge in global population across the globe, coupled with the government regulations supporting energy-efficient construction, can fuel market growth further.

Key Takeaways

- By region, Asia Pacific dominated the market with approximately 50% share in 2024. The dominance of the segment can be attributed to the surge in disposable incomes and lifestyle shifts, along with the expanding automotive sector.

- By region, the Middle East & Africa is expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to the increasing focus on environmental sustainability, which is optimizing low-E coatings.

- By product type, the flat/float glass segment dominated the market with approximately 40% share in 2024. The dominance of the segment can be attributed to the increasing demand for solar energy technologies.

- By product type, the specialty glass segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the growing specialty glass demand from major industries.

- By raw material, the silica sand segment held approximately 45% market share in 2024. The dominance of the segment can be linked to the enhancements in silica sand extraction technologies that improve product efficiency and quality.

- By raw material, the cullet segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by increasing consumer demand for sustainable products.

- By manufacturing process, the float process segment led the market by holding approximately 55% share in 2024. The dominance of the segment is owed to the rapid innovations in glass technology.

- By manufacturing process, the press & blow process segment is expected to grow at the fastest CAGR over the projected period. The growth of the segment is due to the growing demand for heavy-duty and durable glass containers.

- By application, the building & construction segment dominated the market by holding approximately 35% share in 2024. The dominance of the segment can be attributed to the rapid urbanization and infrastructure development.

- By application, the solar energy segment is expected to grow at the fastest during the study period. The growth of the segment can be credited to the growing investments in solar infrastructure, coupled with the rise in public awareness.

- By end-use industry, the construction & infrastructure segment held approximately 40% market share in 2024. The dominance of the segment can be linked to the rapid shift toward sustainable construction and advancements in glass manufacturing technology.

- By end-use industry, the electronics & IT segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment can be driven by the growing need for high-performance glass in electronic displays and other devices.

Technological Advancements are Expanding Market Growth

The global glass manufacturing market refers to the production of glass and glass-based products used across industries, including construction, automotive, packaging, electronics, and solar energy. Glass is primarily produced through processes such as float glass, container glass, and specialty glass manufacturing, utilizing raw materials like silica sand, soda ash, limestone, and cullet (recycled glass).

Growing demand is driven by rising construction & infrastructure projects, increasing consumption of glass packaging in beverages and pharmaceuticals, the automotive industry's safety & design requirements, and the rapid expansion of solar energy & electronics sectors. Technological advancements in lightweight glass, smart glass, and eco-friendly recycling further support market growth.

What Are the Key Trends Influencing the Global Glass Manufacturing Market?

- The ongoing technological innovations in the market are the major trend fuelling the growth of the market. The development of smart glass, which can adapt to different environmental conditions, is increasingly gaining traction. Also, extensive collaborative initiatives between major market players can optimise technological advancements.

- The growing demand for temperature solutions for glass manufacturing is another trend shaping positive market expansion. The glass production sectors need an accurate temperature control because of the high temperatures required for the entire production process, particularly for container glass.

- The ongoing economic growth and industrialization in countries across the Asia-Pacific have increased huge investments in infrastructure development, creating substantial opportunities in the market. Increasing disposable incomes in these regions also propelled the demand for electronic devices and consumer goods, which require glass.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 128.66 Billion |

| Expected Size by 2034 | USD 211.18 Billion |

| Growth Rate from 2025 to 2034 | CAGR 5.66% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Product Type, By Raw Material, By Manufacturing Process, By Application, By End-Use Industry, By Region |

| Key Companies Profiled | AGC Inc., Fuyao Glass Industry Group Co. Ltd., Guardian Industries, Saint-Gobain, O-I Glass Inc., AGI glaspac, Nihon Yamaura Glass Co., Ltd., Vitro, 3B- the fiberglass company |

Market Opportunity

The Surge in Sales of Electronic Display Units

The rapid growth in the sales of electronic display units is the major factor creating lucrative opportunities in the market. The market is witnessing substantial growth due to the growing need for glass in various sectors, especially in electronics and construction. Furthermore, the adoption of innovative technologies like artificial intelligence, virtual reality, and 5G is driving demand for electronic devices with high-quality displays.

- In September 2025, Hue Premium Silica Company unveils $30 mln silica industry project. HPS products are rapidly conquering the wide international markets such as Thailand, Malaysia, and Indonesia, and continue to expand into other emerging markets.(Source: https://en.vneconomy.vn)

Market Challenges

High Energy Costs

Glass manufacturing is an energy-intensive process, which requires furnaces that function at very high temperatures (over 1500°C). This makes production costs heavily reliant on fossil fuel prices, which significantly affects the manufacturers' profitability. Moreover, the cost of raw materials like silica sand and soda ash can be unpredictable and depends on market fluctuations, hindering market expansion further.

Regional Insight

Asia Pacific Global Glass Manufacturing Market Trends

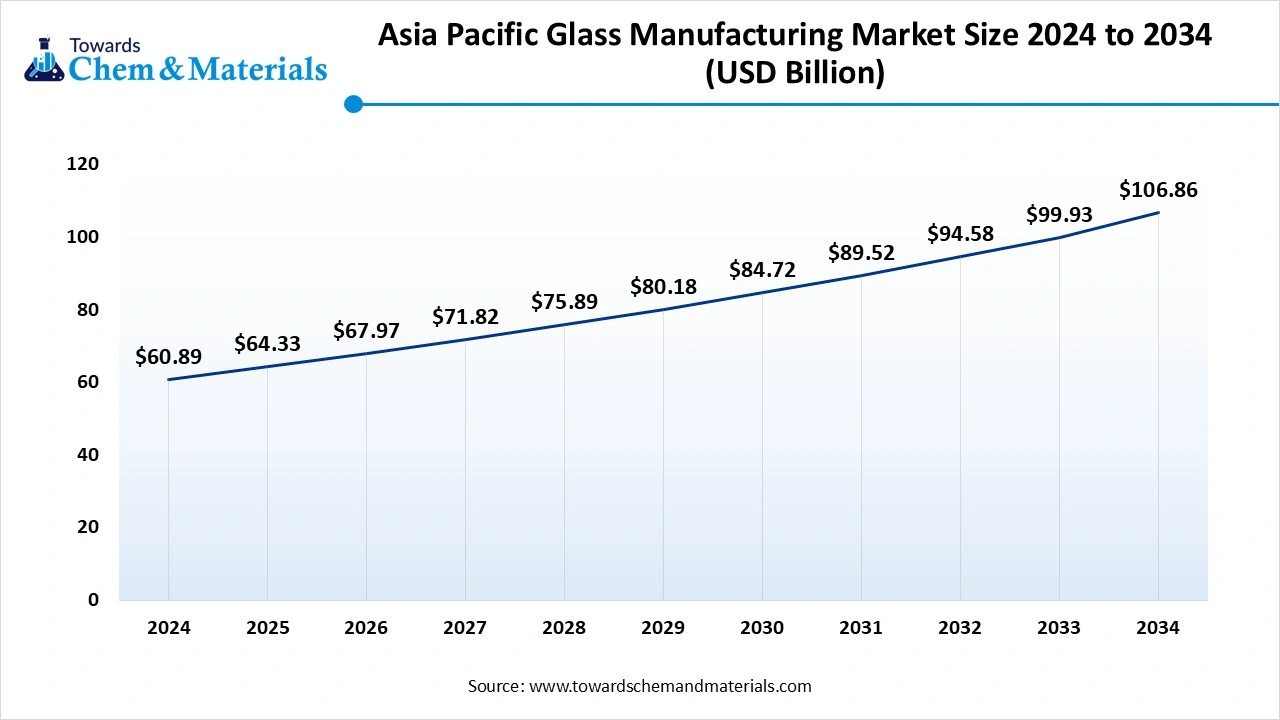

The Asia Pacific glass manufacturing market size was estimated at USD 60.89 billion in 2024 and is anticipated to reach USD 106.86 billion by 2034, growing at a CAGR of 5.79% from 2025 to 2034. Asia Pacific dominated the market in 2024.

The dominance of the segment can be attributed to the surge in disposable incomes and lifestyle shifts, along with the expanding automotive sector, because of increased production and ownership. In addition, the ongoing urbanization in countries like China and India boosts demand for flat glass in windows, building facades, and interior design.

China Global Glass Manufacturing Market Trends

In the Asia Pacific, China led the market owing to the ongoing urbanization and large-scale construction, coupled with the surge in domestic consumption for electronics, consumer goods, and other home appliances. Also, the adoption of cutting-edge technologies such as smart glass, high-performance glass, and optical fibers for faster data transmission has a positive impact on the country.

Middle East & Africa Global Glass Manufacturing Market Trends

The Middle East & Africa are expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to the increasing focus on environmental sustainability, which is optimising low-E coatings, energy-efficient glass, and recyclable packaging. Furthermore, substantial government investment in construction, infrastructure, and renewable energy projects across the region is contributing to market growth in the MEA.

Segmental Insight

Product Type Insight

Which Flat/Float Glass Type Segment Dominated the Global Glass Manufacturing Market in 2024?

The flat/float glass segment dominated the market in 2024. The growth of the segment attributed to the increasing demand for solar energy technologies and growing adoption of energy-efficient building solutions. Additionally, flat glass with enhanced solar control, insulation, and other properties is crucial for fulfilling strict energy efficiency regulations and the construction of green buildings.

The specialty glass segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the growing specialty glass demand from major industries such as electronics, automotive, and construction, along with the technological innovations in production and materials. Moreover, key players are emphasising developing advanced products with improved properties to meet niche applications across different industries.

Raw Material Insight

Why Silica Sand Segment Dominated the Global Glass Manufacturing Market in 2024?

The silica sand segment held the largest market share in 2024. The dominance of the segment can be linked to the enhancements in silica sand extraction technologies that improve product efficiency and quality. Furthermore, silica sand plays an important role in the oil and gas sector as a proppant in hydraulic fracturing (fracking) operations, promoting the extraction of oil and gas.

The cullet segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by increasing consumer demand for sustainable products and less carbon emissions from utilizing cullet as a feedstock. In addition, cullets are also finding extensive applications in construction materials like countertops and aggregates, which is a major market driver.

Manufacturing Process Insight

How Much Share Did the Float Process Segment Held in 2024?

The float process segment led the market in 2024. The dominance of the segment is owed to the rapid innovations in glass technology, coupled with the surge in automotive and construction demand. The float process is a crucial technique for manufacturing high-grade flat glass, which makes it central to the market's expansion.

The press & blow process segment is expected to grow at the fastest CAGR over the projected period. The growth of the segment is due to the growing demand for heavy-duty and durable glass containers in the pharmaceutical, food, beverage, and chemical industries. Moreover, this process enables good control over a glass distribution, which in turn results in improved container strength.

Application Insight

Which Application Type Segment Dominated the Global Glass Manufacturing Market in 2024?

The building & construction segment dominated the market in 2024. The dominance of the segment can be attributed to the rapid urbanization and infrastructure development, especially in developing countries such as China and India. Additionally, a trend towards heavier and larger glass panels for buildings creates a sense of openness and enables more natural light, boosting demand for construction glass with increased strength.

The solar energy segment expects the fastest growth in the market during the study period. The growth of the segment can be credited to the growing investments in solar infrastructure, coupled with the rise in public awareness and preference for clean energy. Furthermore, advanced technologies make solar glass cheaper and more efficient, which makes solar power more appealing and accessible to more users.

End-Use Industry Insight

Why Did The Construction & Infrastructure Segment Held The Largest Global Glass Manufacturing Market Share In 2024?

The construction & infrastructure segment held the largest market share in 2024. The dominance of the segment can be linked to the rapid shift toward sustainable construction and advancements in glass manufacturing technology. In addition, designers and architects use glass for its versatility in maximizing natural light and creating modern architectural designs, offering flexible interior spaces.

The electronics & IT segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment is attributed by the growing need for high-performance glass in electronic displays, fiber optics, and other innovative applications. Also, glass is increasingly being used in more high-tech applications beyond displays, like in electrical and electronics equipment.

Glass Manufacturing Market -- Value Chain Analysis

- Feedstock Procurement : It is the strategic process of sourcing and getting the necessary raw materials needed to manufacture glass. This also involves securing an authentic supply of recycled glass and minerals from different sources.

- Chemical Synthesis and Processing : It refers to the whole chemical-based manufacturing process, from blending raw materials to the final product that determines the glass's characteristics.

- Packaging and Labelling: It includes the physical container, like the glass itself, and the necessary information attached to it. This stage is important for safeguarding the product by meeting regulations.

- Regulatory Compliance and Safety Monitoring: It encompasses an extensive range of practices and standards that govern the manufacturing process, environmental impact, and worker well-being.

Recent Developments

- In February 2025, Ukraine announced it would build its latest float glass production plant in the Kyiv region by 2028. This will decrease the dependence on foreign suppliers, which can make the domestic market more competitive and resilient further.(Source: www.glassonweb.com)

Glass Manufacturing Market Top Companies

- AGC Inc.

- Fuyao Glass Industry Group Co. Ltd.

- Guardian Industries

- Saint-Gobain

- O-I Glass Inc.

- AGI glaspac

- Nihon Yamaura Glass Co., Ltd.

- Vitro

- 3B- the fiberglass company

Segments Covered

By Product Type

- Flat/Float Glass

- Container Glass (bottles, jars)

- Specialty Glass (borosilicate, aluminosilicate, display glass)

- Fiberglass

- Others (tempered, laminated, coated glass)

By Raw Material

- Silica Sand

- Soda Ash

- Limestone

- Cullet (Recycled Glass)

- Others (alumina, feldspar, dolomite)

By Manufacturing Process

- Float Process

- Blow & Blow Process (container glass)

- Press & Blow Process

- Rolled/Sheet Process

- Others (drawing, casting, specialty methods)

By Application

- Building & Construction (windows, facades, insulation, interior design)

- Packaging (food & beverages, pharmaceuticals, cosmetics)

- Automotive & Transportation (windshields, windows, lighting)

- Electronics & Consumer Goods (displays, screens, appliances)

- Solar Energy (photovoltaic panels, solar thermal)

- Others (aerospace, defense, optical uses)

By End-Use Industry

- Construction & Infrastructure

- Packaging & Consumer Goods

- Automotive

- Electronics & IT

- Energy & Utilities

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait