Content

Bio-based Solvents Market Volume and Share 2034

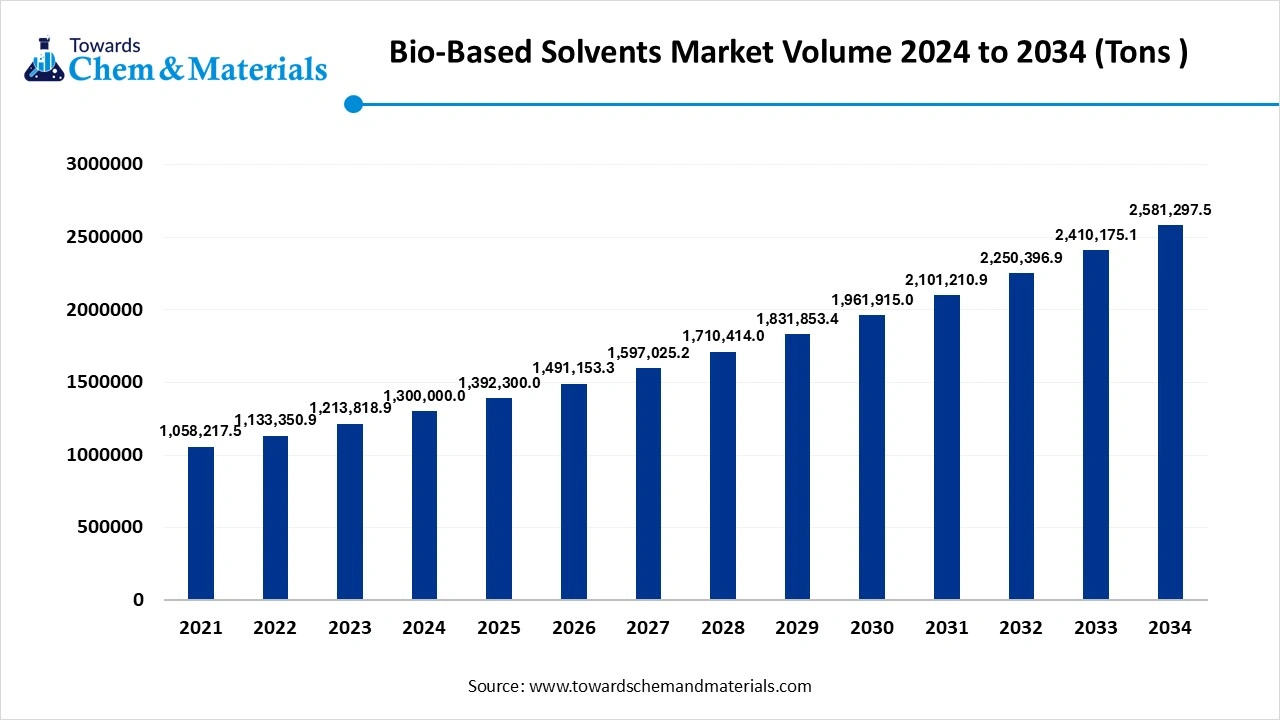

The global bio-based solvents market volume was reached at 13,00,000.0 tons in 2024 and is expected to be worth around 25,81,297.5 tons by 2034, growing at a compound annual growth rate (CAGR) of 7.10% over the forecast period 2025 to 2034. The growth of the market is driven by the increasing demand from various industries, including pharmaceuticals, adhesives, and paints and coatings, which fuels the growth of the market.

Key Takeaway

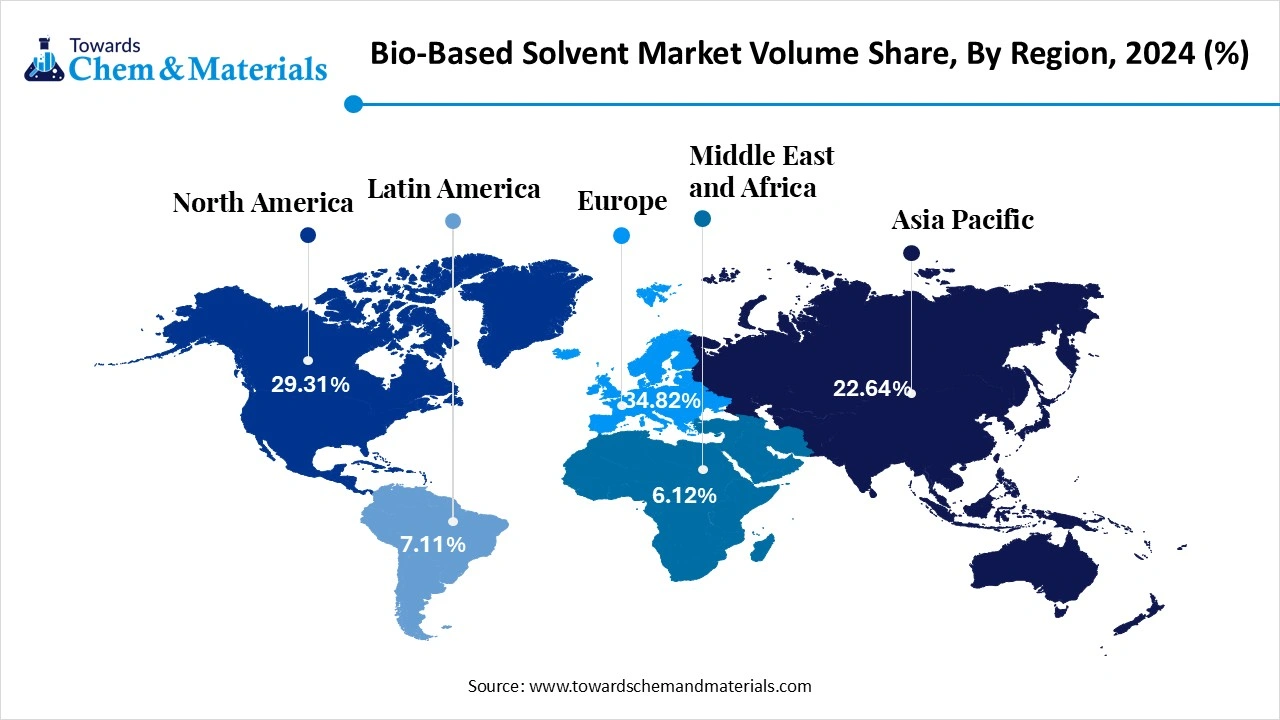

- By region, Europe dominated the market in 2024. Europe held a 38% share in the market in 2024. The government initiatives and policies support the growth of the market.

- By region, Asia Pacific is expected to have significant growth in the market in the forecast period. The sustainability initiatives and lower environmental impact influence the growth of the market.

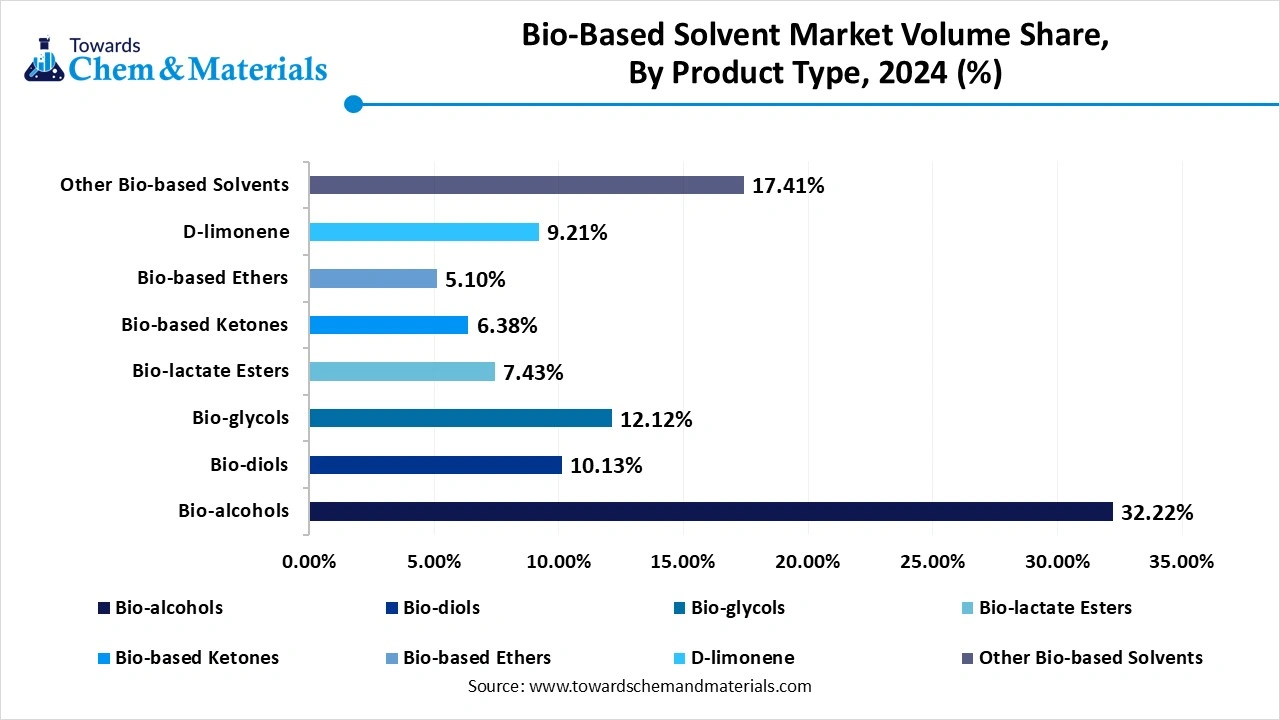

- By product type, the bio-alcohols segment dominated the market in 2024. The bio-alcohols segment held a 28% share in the market in 2024. The growing use in industries and the benefits offered support the growth.

- By product type, the bio-lactate esters segment is expected to grow significantly in the market during the forecast period. The sustainability offered in place of traditional petroleum-based alternatives increases the demand.

- By feedstock source, the sugar-based segment dominated the market in 2024. The sugar-based segment held a 35% share in the market in 2024. The use of renewable biomass sources influences the growth of the market.

- By feedstock source, the cellulose-based segment is expected to grow in the forecast period. The growing applications and green initiatives fuel the growth.

- By application, the paints & coatings segment dominated the market in 2024. The paints & coatings segment held a 30% share in the market in 2024. The growing application and environmental benefits offered support the growth.

- By application, the industrial & domestic cleaners segment is expected to grow in the forecast period. The renewable and sustainable resources promote the growth of the market.

- By end use, the automotive segment dominated the market in 2024. The automotive segment held a 22% share in the market in 2024. The growing automotive sector in the developing regions supports the growth.

- By end use, the healthcare & pharmaceuticals segment is expected to grow in the forecast period. The growing pharmaceutical sector fuels the growth of the market.

- By distribution channel, the direct/B2B segment dominated the market in 2024. The direct/B2B segment held a 52% share in the market in 2024. The increase in reach promoted by direct sales supports the growth of the market.

- By distribution channel, the online retail segment is expected to grow in the forecast period. The convenience offered supports the growth of the market.

Market Overview

Rising Demand For Durable Materials: Bio-Based Solvents Market To Expand

The Bio-based Solvents Market comprises solvents derived from renewable, biological sources such as sugarcane, corn, soybean, cellulose, and another biomass. These solvents are sustainable alternatives to petroleum-based solvents and are used for their low toxicity, biodegradability, and reduced VOC emissions across industries such as paints & coatings, adhesives, cleaning, pharmaceuticals, and agrochemicals.

What Are The Key Growth Drivers Responsible For The Growth Of The Bio-based Solvents Market?

The key growth drivers that support the growth of the market are the growing environmental regulations and concerns, which demand low VOC emission solvents and products, which drive the growth of the market. The consumer demand for sustainability and awareness of environmental issues, and demand for eco-friendly products, increases the demand for biobased solvents, supporting market growth. The technological advancements, like improved production methods, development of new feedstocks, and enhanced performance with innovative technologies, contribute to the growth and expansion of the market.

Market Trends

- The increasing demand for bio-based solvents across different sectors, especially paints and coatings, drives the growth of the market.

- The growing adoption of biobased solvents in paints and coatings to reduce emissions and to improve durability fuels the demand and growth of the market.

- The pharmaceutical and adhesive applications for eco-friendly and performance enhancement demand biobased solvents.

- The non-toxicity and versatility of bio-alcohols and lactate esters are prominent biobased solvents used, due to their applications.

Report Scope

| Report Attribute | Details |

| Market Volume in 2025 | 13,92,300.0 Tons |

| Expected Volume by 2034 | 25,81,297.5 Tons |

| Growth Rate from 2025 to 2034 | CAGR 7.10% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Europe |

| Segment Covered | By Product Type, By Feedstock Source, By Application, By End-Use Industry, By Distribution Channel, By Region |

| Key Companies Profiled | BASF SE, Archer Daniels Midland Company (ADM), The Dow Chemical Company, Huntsman Corporation, Vertec BioSolvents Inc. , Corbion N.V. , Cargill Incorporated, LyondellBasell Industries Holdings B.V. , DuPont de Nemours, Inc. , Lactel (Vertec Group) , Myriant Corporation (GC Innovation America), Florida Chemical Company , Green Biologics Ltd. , Solvay S.A. , AkzoNobel N.V., Stepan Company, Croda International Plc, Genomatica, Inc. , Galactic S.A. , NatureWorks LLC |

Market Opportunity

What Are The Key Growth Opportunities That Support The Growth Of The Bio-based Solvents Market?

The key growth opportunities that contribute to the growth of the market are the government support and initiatives for research and development of specialized and innovative biobased solvents drive the growth of the market. The regulations, like the Clean Air Act in the US and the REACH regulations in the EU, also support the adoption of eco-friendly solutions supporting growth. The expanding applications, like in paint and coatings, adhesives, and other applications in pharmaceuticals, cosmetics, and other industrial applications, create great opportunities for the growth of the market.

Market Challenge

What Are The Key Challenges That Hinder The Growth Of The Bio-based Solvents Market?

The key challenge that limits the growth of the market is the high production costs of biobased solvents than traditional petroleum-based solvents, which also leads to inconsistent quality and supply, leading to fluctuation of product cost, limiting the growth of the market. The limited adoption and awareness of benefits and performance hinders the growth of the market.

Regional Insights

How Did Europe Dominate The Bio-Based Solvents Market In 2024?

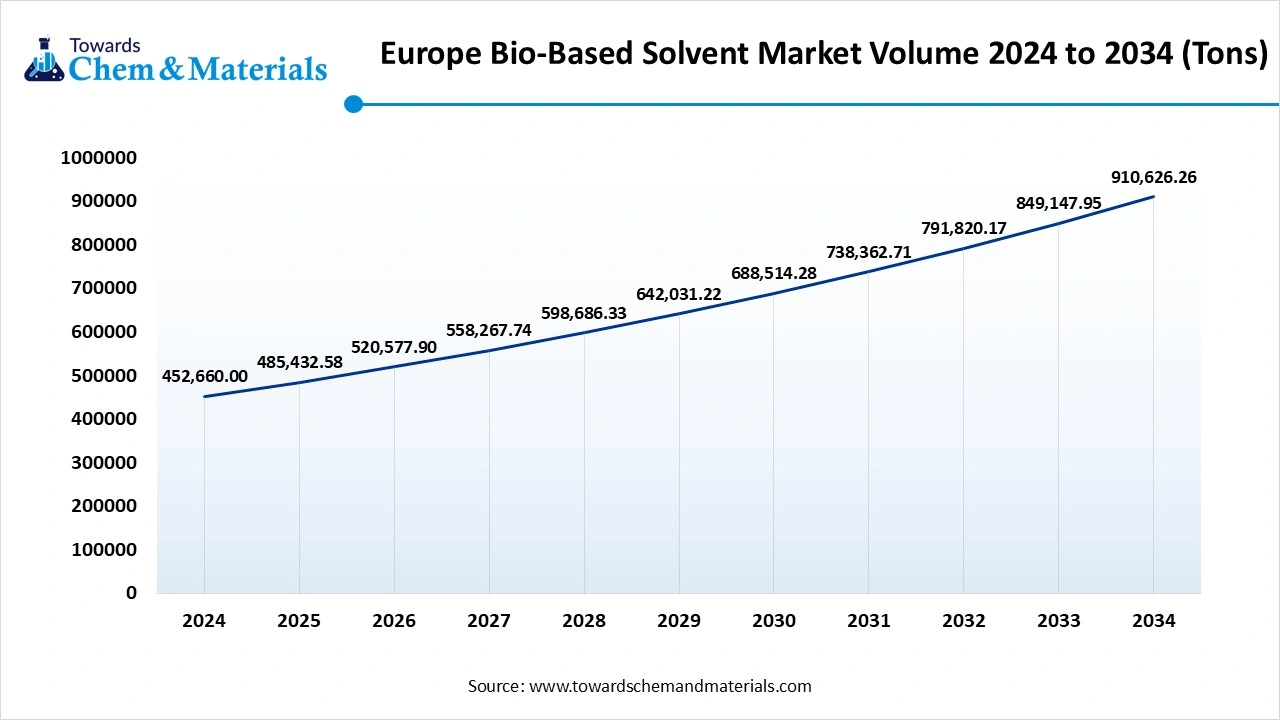

The Europe bio-based solvents market volume was estimated at 4,52,660.0 tons in 2024 and is anticipated to reach 910.626.26 tons by 2034, growing at a CAGR of 7.24% from 2025 to 2034. Europe dominated the bio-based solvents market in 2024.

The growth of the market is driven by the key drivers in the region, like environmental regulations, sustainability and oils, due to rising focus on environment and sustainability due to rising environmental concerns which fuels the growth of the market in the region. The technological advancements, like research and development in bio-based products, also further boost the growth of the market in the region.

The Key Players In The UK Play A Significant Role In The Growth Of The Market

The growth of the market in the UK is driven by the rising technological advancements, like the use of new technologies in the production process to improve and enhance the performance and cost effectiveness of the products accelerate the market expansion in the country. Major players in the UK market include BASF, Cargill, Circa Group, Dow, and Vertec Bio solvents; they play a crucial role in the growth and expansion of the market in the country.

The Government Regulations And Green Initiatives Fuel The Growth.

Asia Pacific is expected to have significant growth in the bio-based solvents market in the forecast period. The growth of the market is driven by the rapid industrialization and urbanization, like growth in industries such as manufacturing, construction, and other sectors, which demand biobased solvents due to rising environmental regulations in the region. The government regulation in the regions and green initiatives resulting from growing environmental awareness and a shift towards bio-based solvents propel the growth of the market in the region.

Sustainability goals and advancements in production drive the growth in India.

The growth of the market in India is driven by the advancements in production and sustainability goals, which fuel the growth of the market. The growing environmental concerns and government initiatives, such as the National Policy on Biofuels, promote the adoption of bio-based products, which increases the market growth in India.

- The World shipped out 38,007 Organic Solvent shipments from October 2023 to September 2024 (TTM). These exports were handled by 4,603 global exporters to 5,608 buyers.(Source: www.volza.com)

- Globally, Vietnam, the United States, and China are the top three exporters of Organic Solvent. Vietnam is the global leader in Organic Solvent exports with 50,807 shipments, followed closely by the United States with 6,458 shipments, and China in third place with 5,809 shipments.(Source : www.volza.com)

Bio-based Solvents Market Volume Share, By Region, 2024-2034 (%)

| By Region | Volume Share, 2024 (%) | Market Volume Tons - 2024 | Volume Share, 2034 (%) | Market Volume Tons - 2034 | CAGR (2025 - 2034) |

| North America | 29.31% | 3,81,030.0 | 28.41% | 7,33,346.6 | 7.55% |

| Europe | 34.82% | 4,52,660.0 | 32.89% | 8,48,988.7 | 7.24% |

| Asia Pacific | 22.64% | 2,94,320.0 | 24.79% | 6,39,903.7 | 9.01% |

| Latin America | 7.11% | 92,430.0 | 7.59% | 1,95,920.5 | 8.71% |

| Middle East & Africa | 6.12% | 79,560.0 | 6.32% | 1,63,138.0 | 8.31% |

| Total | 100% | 13,00,000.0 | 100% | 25,81,297.5 | 7.10% |

Segmental Insights

Product Type

Which Product Segment Dominated The Bio-Based Solvents Market In 2024?

The bio-alcohols segment dominated the bio-based solvents market in 2024. Bio-alcohols, such as bioethanol and bio-butanol, hold a significant share in the biobased solvents market due to their versatility and eco-friendly nature. Derived from renewable sources like corn, sugarcane, and biomass, they are widely used in coatings, adhesives, pharmaceuticals, and personal care. Their low volatility and biodegradability make them ideal replacements for petrochemical solvents. Increasing regulatory pressure and consumer preference for sustainable chemicals are fueling demand for bio-alcohol-based solvents.

The bio-lactate esters segment expects significant growth in the market during the forecast period. Bio lactate, primarily derived from lactic acid fermentation of renewable feedstocks like corn and sugar, is gaining traction as a green solvent alternative. It is widely used in industrial cleaners, coatings, inks, and degreasers due to its high solvency power and low toxicity. With increasing focus on sustainable and safe chemical formulations, bio lactate is becoming a preferred choice in sectors seeking effective, biodegradable, and VOC-compliant solvent solutions.

Bio-based Solvents Market Volume Share, By Product Type, 2024-2034 (%)

| By Product Type | Volume Share, 2024 (%) | Market Volume Tons - 2024 | Volume Share, 2034 (%) | Market Volume Tons - 2034 | CAGR (2025 - 2034) |

| Bio-alcohols | 32.22% | 4,18,860.0 | 29.28% | 7,55,803.9 | 6.78% |

| Bio-diols | 10.13% | 1,31,690.0 | 11.12% | 2,87,040.3 | 9.04% |

| Bio-glycols | 12.12% | 1,57,560.0 | 13.31% | 3,43,570.7 | 9.05% |

| Bio-lactate Esters | 7.43% | 96,590.0 | 8.12% | 2,09,601.4 | 8.99% |

| Bio-based Ketones | 6.38% | 82,940.0 | 7.12% | 1,83,788.4 | 9.24% |

| Bio-based Ethers | 5.10% | 66,300.0 | 5.73% | 1,47,908.3 | 9.33% |

| D-limonene | 9.21% | 1,19,730.0 | 8.89% | 2,29,477.3 | 7.50% |

| Other Bio-based Solvents (e.g., Terpenes, Polyols, Organic Carbonates) | 17.41% | 2,26,330.0 | 16.43% | 4,24,107.2 | 7.23% |

| Total | 100% | 13,00,000.0 | 100% | 25,81,297.5 | 7.10% |

Feedstock Source

How Did Sugar-Based Segment Dominate the Bio-Based Solvents Market In 2024?

The sugar-based segment dominated the market in 2024. Sugar-based feedstocks, such as sugarcane, sugar beet, and molasses, are extensively used in the production of biobased solvents like bioethanol and bio-lactate. These feedstocks offer a reliable and renewable source for fermentation processes. Their widespread availability and established supply chains make them a preferred choice for solvent manufacturers. Increasing demand for sustainable chemicals and supportive bioeconomy policies are encouraging the continued use of sugar-based raw materials in solvent production.

The cellulose-based segment expects significant growth in the bio-based solvents market during the forecast period. Cellulose-based feedstocks, derived from agricultural residues, wood pulp, and other non-food biomass, are emerging as a sustainable source for biobased solvents. These solvents are valued for their biodegradability, low toxicity, and minimal environmental footprint. Cellulose-derived solvents are increasingly used in coatings, paints, and pharmaceuticals. As industries seek non-food alternatives and reduce reliance on fossil fuels, cellulose offers a circular, waste-utilizing pathway for green solvent production.

Application Insights

Which Application Segment Dominated The Bio-Based Solvents Market In 2024?

The paints & coatings segment dominated the market in 2024. Biobased solvents are increasingly used in paints and coatings due to their low toxicity, reduced VOC emissions, and environmental compatibility. They serve as effective alternatives to petroleum-based solvents, offering similar performance in dispersion and drying. Applications span architectural, industrial, and automotive coatings. Growing environmental regulations and demand for sustainable formulations are encouraging manufacturers to incorporate biobased solvents to meet eco-labeling standards and enhance worker and consumer safety.

The industrial & domestic cleaners segment expects significant growth in the bio-based solvents market during the forecast period. Biobased solvents are widely used in industrial and domestic cleaners due to their strong solvency, low toxicity, and biodegradability. They effectively remove grease, oil, and dirt while minimizing environmental impact. Commonly derived from corn, soy, and sugar-based sources, these solvents are replacing traditional chemicals in surface cleaners, degreasers, and disinfectants. Growing demand for non-toxic, eco-labelled cleaning products is accelerating their adoption across commercial facilities and household applications.

End-Use Industry Insights

How Did the Automotive Segment Dominate the Bio-Based Solvents Market In 2024?

The automotive segment dominated the market in 2024. The automotive industry is increasingly incorporating biobased solvents in applications such as metal cleaning, paint formulations, degreasing, and maintenance fluids. These solvents offer effective performance while reducing VOC emissions and worker exposure to harmful chemicals. As automakers move toward greener manufacturing practices and sustainability goals, the demand for environmentally friendly, renewable solvents is rising. Regulatory pressure and innovation in biochemistry are further encouraging their integration into automotive production and servicing.

The healthcare & pharmaceuticals segment expects significant growth in the bio-based solvents market during the forecast period. Biobased solvents are gaining prominence in the healthcare and pharmaceutical industries due to their high purity, low toxicity, and environmental safety. They are used in drug formulation, extraction processes, and equipment cleaning. Derived from renewable sources, these solvents help meet stringent regulatory standards and sustainability targets. Growing demand for cleaner production methods and reduced exposure to hazardous chemicals is driving their adoption across pharmaceutical manufacturing and healthcare product development.

Distribution Channel

Which Distribution Channel Segment Dominated The Bio-Based Solvents Market In 2024?

The direct/B2B segment dominated the market in 2024. The direct or B2B distribution channel dominates the market, as bulk buyers such as manufacturers in pharmaceuticals, paints, automotive, and personal care industries prefer sourcing directly from producers. This channel ensures better pricing, consistent supply, and tailored technical support. With rising industrial demand for sustainable raw materials, B2B partnerships and long-term contracts are expanding, particularly among key market players focused on green chemistry and custom solvent solutions.

The online retail segment expects significant growth in the bio-based solvents market during the forecast period. Online retail is an emerging distribution channel for biobased solvents, especially for small-scale buyers and DIY consumers seeking eco-friendly cleaning and maintenance solutions. E-commerce platforms offer easy access to a variety of solvent products, including household cleaners and specialty solvents for niche applications. Growing digitalization, consumer awareness about green products, and the convenience of doorstep delivery are fueling the rise of online retail as a viable channel in the biobased solvents market.

Recent Developments

- In February 2025, BioBond, well well-known and global leader in sustainable and high-performance materials, announced the launch of a new and innovative line of bio-based protective coatings for food processing and distribution industries.(Source: www.newswire.com)

Top Companies List

- BASF SE

- Archer Daniels Midland Company (ADM)

- The Dow Chemical Company

- Huntsman Corporation

- Vertec BioSolvents Inc.

- Corbion N.V.

- Cargill Incorporated

- LyondellBasell Industries Holdings B.V.

- DuPont de Nemours, Inc.

- Lactel (Vertec Group)

- Myriant Corporation (GC Innovation America)

- Florida Chemical Company

- Green Biologics Ltd.

- Solvay S.A.

- AkzoNobel N.V.

- Stepan Company

- Croda International Plc

- Genomatica, Inc.

- Galactic S.A.

- NatureWorks LLC

Segments Covered

By Product Type

- Bio-alcohols

- Bio-ethanol

- Bio-methanol

- Bio-butanol

- Bio-diols

- 1,3-Propanediol (PDO)

- 1,4-Butanediol (BDO)

- Bio-glycols

- Ethylene Glycol

- Propylene Glycol

- Bio-lactate Esters

- Ethyl Lactate

- Methyl Lactate

- Bio-based Ketones

- Acetone

- Methyl Ethyl Ketone (MEK)

- Bio-based Ethers

- Dimethyl Ether (DME)

- Diethyl Ether

- D-limonene

- Other Bio-based Solvents (e.g., Terpenes, Polyols, Organic Carbonates)

By Feedstock Source

- Sugar-based (Sugarcane, Sugar Beet)

- Starch-based (Corn, Wheat, Cassava)

- Cellulose-based (Wood, Agricultural Residues)

- Vegetable Oil-based (Soybean, Palm, Canola)

- Algae-based

- Glycerol-based (By-product of biodiesel)

By Application

- Paints & Coatings

- Adhesives & Sealants

- Industrial & Domestic Cleaners

- Printing Inks

- Pharmaceuticals

- Agrochemicals

- Personal Care & Cosmetics

- Plastic & Polymer Processing

- Food Processing

By End-Use Industry

- Automotive

- Building & Construction

- Healthcare & Pharmaceuticals

- Food & Beverage

- Electronics

- Packaging

- Textile & Leather

- Agriculture

- Household & Institutional

By Distribution Channel

- Direct/B2B (Industrial Bulk Supply)

- Distributors & Wholesalers

- Online Retail

- Specialty Chemical Stores

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait