Content

Asia Pacific Oil & Gas Market Size and Growth 2025 to 2034

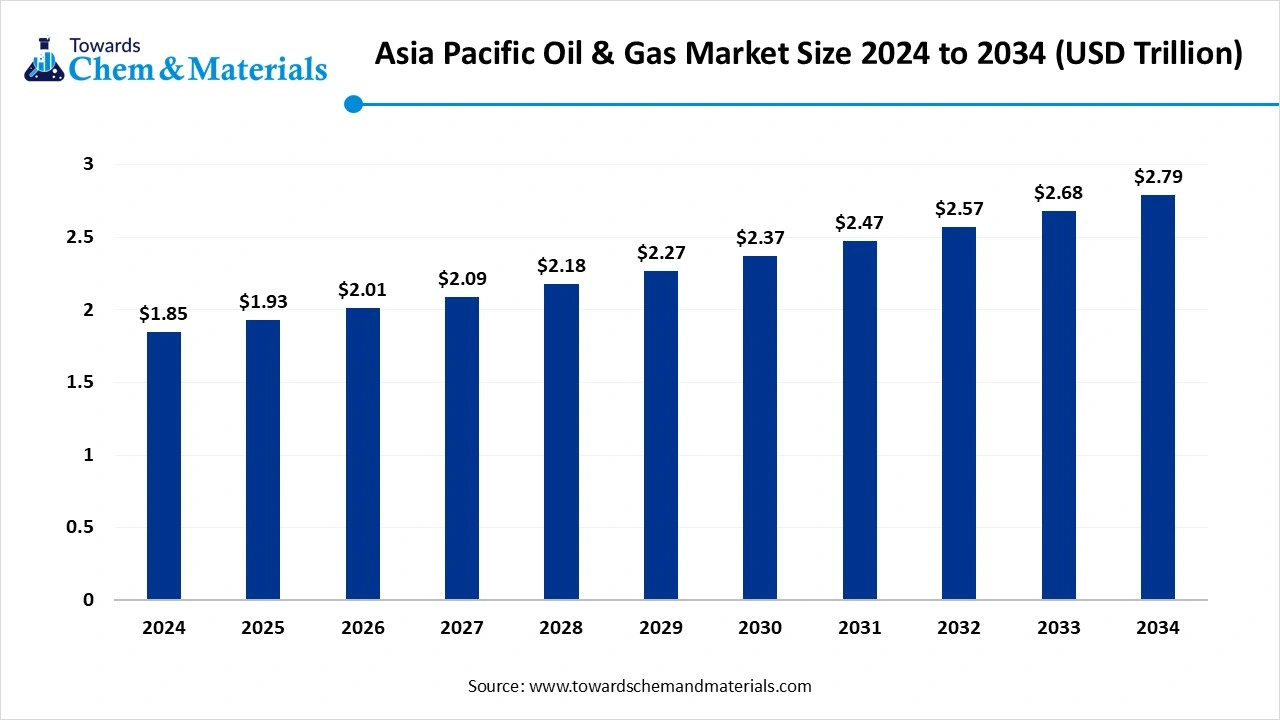

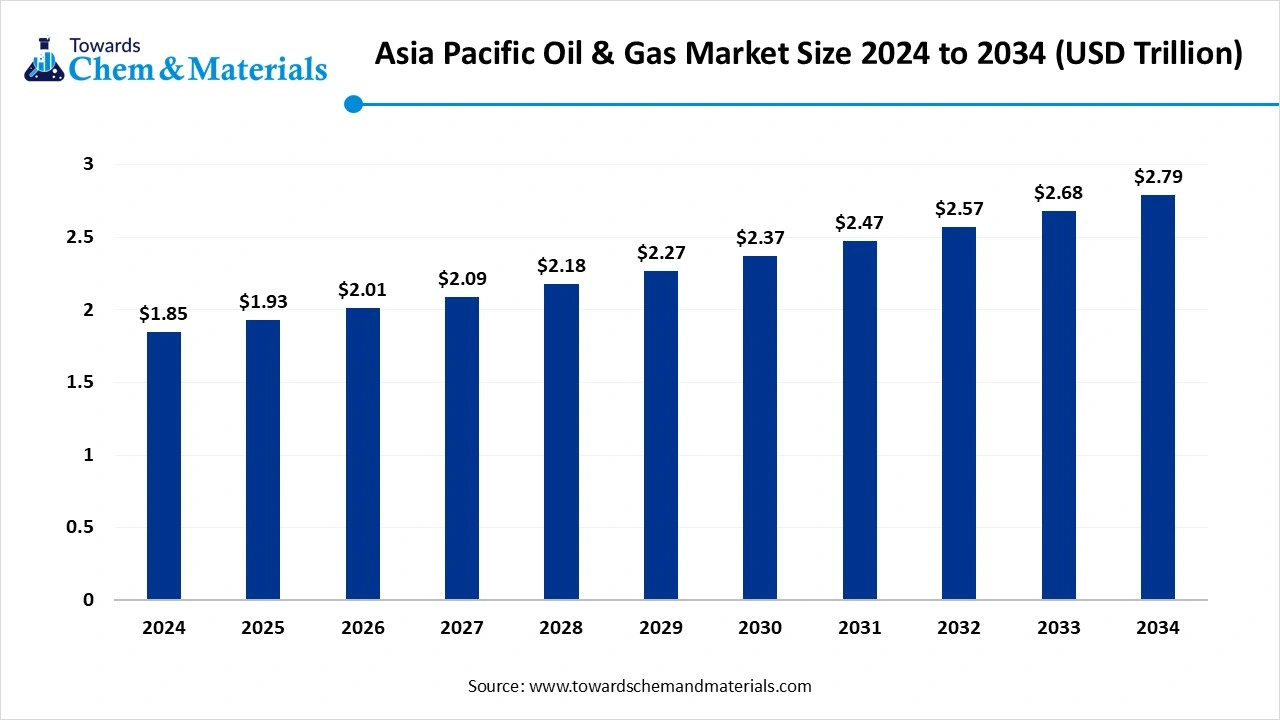

The Asia Pacific oil & gas market volume was reached at USD 1.85 trillion in 2024 and is expected to be worth around USD 2.79 trillion by 2034, growing at a compound annual growth rate (CAGR) of 4.21% over the forecast period 2025 to 2034. The growth of the market is driven by the rapid industrialization and increasing population, which demand for market for transportation and storage, which increasing the growth of the market.

Key Takeaways

- By sector, the downstream (refining and retail) segment dominated the market with 44% share in the market in 2024. The growth is driven by the rising fuel consumption.

- By sector, the midstream (LNG terminals and pipelines) segment is expected to grow significantly in the market during the forecast period. The increased demand and need for efficient energy transport drives the growth of the market.

- By resource type, the natural gas segment dominated the market with 53% share in the market in 2024. The green initiatives and natural gas need to influence the growth of the market.

- By resource type, the LNG segment is expected to grow in the forecast period. Demand for clear fuel transition fuels the growth of the market. Rising energy demand and clean fuel transition drive the growth of the market.

- By extraction, the conventional offshore segment dominated the market with 57% share in the market in 2024. Ongoing enhancements in recovery and infrastructure drive the growth of the market.

- By extraction, the unconventional segment is expected to grow in the forecast period. Technological advancements and policies influence the growth of the market.

- By end use, the transportation segment dominated the market with 38% share in the market in 2024. The growing transportation adoption increases the demand for the market.

- By end use, the petrochemical feedstock and urban power generation segments are expected to grow in the forecast period. Large reserve potential and growing energy demand influence the growth of the market.

- By deployment, the offshore segment dominated the market with 48% share in the market in 2024. Investment in deepwater and ultra-deepwater fuels the growth of the market.

- By deployment, the onshore segment is expected to grow in the forecast period. The lower development costs and easy accessibility fuel the growth of the market.

- By technology, the remote monitoring and SCADA systems segment dominated the market with 42% share in the market in 2024. Continuous surveillance and real-time decision-making support the growth of the market.

- By technology, the AI-driven digital oilfields segment is expected to grow in the forecast period. Integration of AI in enhancing optimization drives the growth of the market.

- By distribution, the National Oil Companies (NOCs) segment dominated the market with 55% share in the market in 2024. The collaborations and partnerships for the development of the infrastructure drive the growth.

- By distribution, the LNG importers and city-gas grid operators segment is expected to grow in the forecast period. Rapid urbanization and clean energy policies influence the growth of the market.

Market Overview

Rising Demand For Durable Materials: Asia Pacific Oil & Gas Market To Expand

The Asia Pacific oil & gas market spans a geographically vast and economically diverse region, comprising both energy-rich countries like Australia, China, and Malaysia and energy-dependent economies like Japan, India, and South Korea. The market includes the full value chain upstream (exploration and production), midstream (transportation and storage), and downstream (refining and retailing).

What Are The Key Growth Drivers Responsible For The Growth Of The Asia Pacific Oil & Gas Market?

Asia Pacific is central to global energy demand growth, driven by industrialization, urbanization, and population expansion. Key trends shaping the region include LNG import/export expansion, offshore exploration, refining capacity growth, and clean energy transition efforts (e.g., CCS, hydrogen, and digital oilfield adoption). Governments across the region are investing heavily in infrastructure and energy security, particularly amid geopolitical shifts and supply chain rebalancing.

Market Trends

- The increasing demand due to rapid industrialization and urbanization leads to an increasing demand for energy, which fuels the growth of the market.

- The technological advancements to enhance the efficiency and accessibility of the market support the growth of the market.

- The heavy investment in upstream activities and enhanced oil recovery techniques is a growing trend in the market.

- The growing focus on energy independence and reliance on imports, and the development of production infrastructure, drives the growth of the market.

Report Scope

| Report Attributes | Details |

| Market Volume in 2025 | USD 1.93 Trillion |

| Expected Volume by 2034 | USD 2.79 Trillion |

| Growth Rate from 2025 to 2034 | CAGR 4.21% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Pipeline Type, By Material, By Diameter, By Application (End-User Sector), By Component |

| Key Companies Profiled | Tenaris, Vallourec, TMK, U.S. Steel Tubular Products, Nucor Tubular Products, JM Eagle, Shawcor, McWane, Mueller Water Products, Flowserve, Emerson, Honeywell, Itron, Siemens Energy, GE Vernova, Baker Hughes, MAN Energy Solutions, Howden, Atlas Copco, Sulzer |

Market Opportunity

What Are The Key Growth Opportunities That Support The Growth Of The Asia Pacific Oil & Gas Market?

The key growth opportunities that support the growth of the market are the technological advancements like digitalization and automation to enhance efficiency through the integration of AI and IoT, and improvements in subsea technology, which increases the demand for the market, supporting growth. Other key opportunities are government initiatives and policies for encouraging and developing the strategies in the sector drive the growth. The focus of the government on energy security and prioritizing energy independence by increasing domestic production influences the growth and expansion of the market, creating great growth opportunities.

Market Challenge

What Are The Key Growth Challenges That Hinder The Growth Of The Asia Pacific Oil & Gas Market?

The key challenge that hinders the growth of the market is the environmental concerns, geopolitical and regulatory complexities, and the global push towards energy transition limit the growth of the market. The complexities and volatility in global crude oil prices also affect the growth and hinder the expansion of the market.

Regional Insights

India Has Seen Growth Driven By The Focus On Domestic Production

India has seen a significant growth in the oil and gas market, the growth of the market is driven by various factors like growing demand and consumption of oil and gas due to the rapidly growing population in the country, which promotes the growth of the market. The growing focus on domestic production due to growing domestic companies and focus on attracting foreign direct investments through initiatives like the Hydrocarbon Exploration and Licensing Policy (HELP) also contributes to the growth and expansion of the market in the country.

China's Market Growth Is Driven By The Growing Infrastructure, Which Supports Expansion.

China has seen a significant growth in the market, driven by the growing demand and infrastructure development, supportive government initiatives for heavy investment in promoting the development of the oil and gas sector through policy reforms, financial incentives, and subsidies, which fuel the growth of the market. The technological advancements in the country to enhance our recovery and carbon capture, and storage influence the growth of the market and support the expansion in the country.

- India shipped out 3806 Petroleum shipments from November 2023 to October 2024 (TTM). These exports were handled 428 exporters to 724 buyers.(Source: www.volza.com)

- Globally, the United States, European Union, and Lithuania are the top three exporters of Petroleum. The United States is the global leader in Petroleum exports with 106,807 shipments, followed closely by the European Union with 77,304 shipments, and Lithuania in third place with 47,052 shipments.(Source: www.volza.com)

Segmental Insights

Sector Insights

Which Sector Segment Dominated The Asia Pacific Oil & Gas Market In 2024?

The downstream (refining and retail) segment dominated the market in 2024. The downstream sector in the Asia-Pacific oil and gas market is experiencing steady growth, driven by rising fuel consumption, petrochemical demand, and expanding retail networks. Countries like China and India are investing in refinery capacity upgrades and digitalized fuel distribution. The sector is also adapting to cleaner fuels and low-sulfur regulations. Increasing urbanization and vehicle ownership are further propelling demand for refined products across both industrial and retail channels.

The midstream (LNG terminals and pipelines) segment expects significant growth in the Asia Pacific oil & gas market during the forecast period. The midstream sector in Asia-Pacific is expanding rapidly, fueled by growing LNG demand and the need for efficient energy transport infrastructure. Countries like China, India, and South Korea are investing heavily in LNG import terminals and cross-border pipeline networks to enhance energy security. Rising natural gas consumption, regional integration efforts, and cleaner fuel policies are driving midstream development, with LNG playing a crucial role in the energy transition strategy.

Resource Type Insights

How did the Natural Gas Segment Dominate the Asia Pacific Oil & Gas Market in 2024?

The natural gas segment dominated the market in 2024. Natural gas is gaining prominence in the Asia-Pacific energy mix due to its cleaner-burning properties and rising demand for low-emission fuels. Countries like China, India, and Japan are increasing investments in LNG infrastructure, domestic gas production, and pipeline connectivity. Industrial, power generation, and residential sectors are key drivers. Policy support for decarbonization, along with energy diversification goals, is accelerating the shift toward natural gas across the region.

The LNG segment expects significant growth in the Asia Pacific oil & gas market during the forecast period. Liquefied Natural Gas (LNG) is playing a vital role in meeting Asia-Pacific’s rising energy demand and clean fuel transition. Countries like China, India, South Korea, and Japan are expanding LNG import capacity through new terminals and floating storage units. LNG supports power generation, industrial fuel switching, and energy security amid fluctuating pipeline supplies. Regional collaborations and long-term supply agreements are strengthening LNG’s position as a strategic energy resource in the region.

Extraction Insights

Which Extraction Segment Dominated The Asia Pacific Oil & Gas Market In 2024?

The conventional offshore segment dominated the market in 2024. Conventional offshore extraction remains a key component of oil and gas production in Asia-Pacific, with significant activity in regions like Southeast Asia, Australia, and the South China Sea. Mature offshore fields continue to supply crude oil and natural gas, supported by ongoing investments in enhanced recovery and infrastructure. Offshore exploration remains essential for meeting regional energy needs and ensuring long-term resource security.

The unconventional segment expects significant growth in the market during the forecast period. Unconventional oil and gas extraction, including shale gas, tight oil, and coalbed methane, is gradually gaining momentum in Asia-Pacific. Countries like China and Australia are investing in hydraulic fracturing and horizontal drilling to unlock hard-to-reach reserves. As conventional resources decline, unconventional plays are becoming vital for energy diversification and security. Technological advancements and supportive policies are encouraging exploration, despite environmental concerns and high production costs associated with these methods.

End Use Insights

How did Transportation Segment Dominated The Asia Pacific Oil & Gas Market In 2024?

The transportation segment dominated the market in 2024. The growth of the market is driven by the growing demand and rising population, which enhances in use of transportation, resulting in a surge in demand for oil and gas, fueling the growth of the market. The growing transportation, especially pipelines, trucks, rail, and ships, also a surge in the usage of oil and gas in the Asia Pacific market, which supports the growth and expansion of the market.

The petrochemical feedstock & urban power generation segment expects significant growth in the Asia Pacific oil & gas market during the forecast period. The growth of the market is driven by the growing demand for power generation and a focus on sustainability and sustainable petroleum production. The growing environmental concerns, transition to renewables, circular economy, and integrated value chain are key growth drivers that support the growth and expansion of the market.

Deployment Insights

Which Deployment Segment Dominated The Asia Pacific Oil & Gas Market In 2024?

The offshore segment dominated the market in 2024. Offshore deployment plays a crucial role in Asia-Pacific’s oil and gas industry, with major operations in regions like Australia, Malaysia, Indonesia, and the South China Sea. These projects contribute significantly to crude oil and natural gas production. Investment in deepwater and ultra-deepwater drilling is rising, supported by technological innovations. Offshore deployment remains essential due to its large reserve potential and growing regional energy demand.

The onshore segment expects significant growth in the Asia Pacific oil & gas market during the forecast period. Onshore deployment continues to dominate oil and gas operations in Asia-Pacific due to lower development costs and easier accessibility. Countries like China, India, and Indonesia have extensive onshore infrastructure supporting exploration, drilling, and production activities. Shale and conventional fields, along with pipeline networks and refineries, are key components. Rising domestic energy demand and government efforts to boost self-sufficiency are driving further investment in onshore oil and gas projects across the region.

Technology Insights

How Did Remote Monitoring And SCADA Systems Segment Dominate The Asia Pacific Oil & Gas Market In 2024?

The remote monitoring and SCADA systems segment dominated the market in 2024. Remote monitoring and SCADA (Supervisory Control and Data Acquisition) systems are increasingly adopted in Asia-Pacific’s oil and gas sector to enhance operational efficiency, safety, and real-time decision-making. These technologies enable continuous surveillance of pipelines, drilling rigs, and processing units. With growing focus on automation and predictive maintenance, energy companies are investing in digital infrastructure to reduce downtime, optimize production, and comply with stringent environmental and safety regulations.

The AI-driven digital oilfields segment expects significant growth in the Asia Pacific oil & gas market during the forecast period. AI-driven digital oilfields are transforming oil and gas operations in Asia-Pacific by enabling data-driven decision-making, real-time monitoring, and predictive analytics. These technologies integrate sensors, machine learning, and automation to optimize drilling, enhance recovery, and reduce operational costs. Countries like China, Australia, and India are adopting AI solutions to modernize legacy infrastructure, boost efficiency, and improve safety in both onshore and offshore environments amid rising energy demand and sustainability goals.

Distribution Insights

Which Distribution Segment Dominated The Asia Pacific Oil & Gas Market In 2024?

The National Oil Companies (NOCs) segment dominated the market in 2024. National Oil Companies (NOCs) play a dominant role in the Asia-Pacific oil and gas market, controlling key upstream, midstream, and downstream assets. Entities like China National Petroleum Corporation (CNPC), Petronas, and ONGC drive exploration, production, and domestic energy security. Backed by government support and long-term policy mandates, NOCs lead large-scale infrastructure projects and partnerships, ensuring stable supply chains while aligning with national energy strategies and economic development goals.

The LNG importers & city-gas grid operators segment expects significant growth in the Asia Pacific oil & gas market during the forecast period. LNG importers and city gas grid operators are critical in meeting Asia-Pacific’s growing urban energy needs. These entities facilitate the distribution of imported LNG through regasification terminals and extensive pipeline networks to residential, commercial, and industrial users. Rapid urbanization, clean energy policies, and increasing household gas consumption are driving expansion. Countries like Japan, South Korea, and India are heavily investing in LNG terminals and city gas infrastructure to ensure a reliable supply.

Recent Developments

- In November 2024, SK Innovation and SK E&S collaborated to launch a new and the largest private comprehensive energy company in Asia Pacific. The aim is to encompass both current and future energy sectors, including petroleum energy, chemicals, LNG, power, batteries, and renewable energy.(Source: skinnonews.com)

Asia Pacific Oil & Gas Market Top Companies

- CNPC / PetroChina (China)

- Sinopec (China)

- CNOOC (China Offshore)

- ONGC (India)

- Reliance Industries Ltd. (India)

- Woodside Energy (Australia)

- Santos Ltd. (Australia)

- Oil Search (Papua New Guinea)

- Petronas (Malaysia)

- PTT Exploration & Production (Thailand)

- Pertamina (Indonesia)

- SK Innovation (South Korea)

- Inpex Corporation (Japan)

- JX Nippon Oil & Gas Exploration (Japan)

- Vietnam Oil and Gas Group (PetroVietnam)

- Bangladesh Petroleum Corporation (BPC)

- GAIL (India) Ltd. (Gas & pipeline operator)

- KazMunayGas (Kazakhstan)

- Turkmenistan (Turkmenistan)

- Chiyoda Corporation (Japan) (Engineering/LNG infrastructure)

Segments Covered

By Sector

- Upstream (Exploration & Production)

- Midstream (Pipelines, LNG Terminals, Storage)

- Downstream (Refining, Distribution, Retail Fueling)

By Resource Type

- Crude Oil

- Natural Gas

- Liquefied Natural Gas (LNG)

- Refined Petroleum Products

By Extraction Technique

- Conventional Onshore

- Offshore Exploration & Production

- Unconventional (Shale, CBM – limited to China, Australia, India)

By End Use

- Power Generation

- Industrial Consumption

- Transportation

- Petrochemical Feedstock

- Residential & Commercial Heating

By Deployment Type

- Onshore Basins (India, China, Central Asia)

- Offshore Fields (South China Sea, Timor Sea, Java Sea, NW Shelf Australia)

By Technology

- Hydraulic Fracturing (in China & Australia)

- Carbon Capture & Storage (CCS)

- Seismic Imaging & Remote Monitoring

- AI & Predictive Maintenance

- Digital Oilfield Technologies

By Distribution Channel

- National Oil Companies (NOCs)

- Integrated Oil Majors

- LNG Traders & Importers

- Pipeline Operators

- Fuel Retailers & Utility Distributors

By Region

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand