Content

Asia Pacific Green Ammonia Market Size and Growth 2025 to 2034

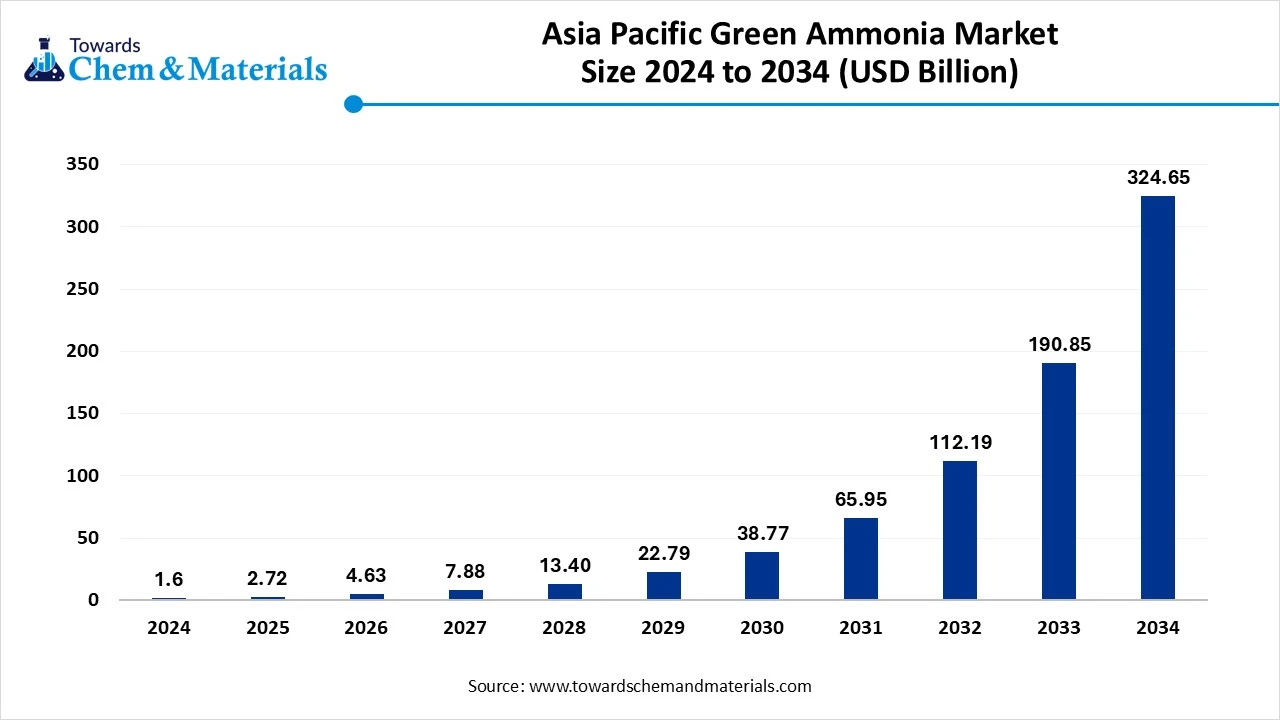

The Asia Pacific green ammonia market size was reached at USD 1.60 billion in 2024 and is expected to be worth around USD 324.65 billion by 2034, growing at a compound annual growth rate (CAGR) of 70.11% over the forecast period 2025 to 2034. The growth of the market is driven by the increasing demand for rapid industrialization, driving agriculture needs, and government support and initiatives fuel the growth of the market.

Key Takeaway

- By production technology, the Haber–Bosch with co-located electrolyzer segment dominated the market in 2024. The Haber–Bosch with co-located electrolyzer segment held a 60% share in the market in 2024. The growing demand due to efficacy fuels the growth.

- By production technology, the direct electrochemical synthesis segment is expected to grow significantly in the market during the forecast period. This method is drawing attention from research institutes and startups in the region.

- By plant capacity, the large-scale (>50–200 ktpa) segment dominated the market in 2024. The large-scale (>50–200 ktpa) segment held a 42% share in the market in 2024. It caters to both domestic consumption and exports.

- By plant capacity, the small-scale (>1–10 ktpa) segment is expected to grow in the forecast period. These facilities typically support distributed applications such as off-grid fertilizer production.

- By process integration, the standalone ammonia production segment dominated the market in 2024. The standalone ammonia production segment held a 52% share in the market in 2024. The simplicity of the model allows faster setup and lower initial investment.

- By process integration, the integrated power-to-X facilities segment is expected to grow in the forecast period. These plants produce green ammonia alongside other hydrogen-derived fuels and chemicals.

- By end-use application, the fertilizer production segment dominated the market in 2024. The fertilizer production segment held a 48% share in the market in 2024. The growing agriculture sector fuels the growth of the market.

- By end-use application, the marine fuel and bunkering segment is expected to grow in the forecast period. Its high energy density and carbon-free combustion make it a promising alternative to heavy fuel oils.

Market Overview

Title- Rising Demand For Durable Materials: Asia Pacific Green Ammonia Market To Expand

Green ammonia is ammonia produced using green hydrogen (from water electrolysis powered by renewable electricity) and nitrogen (from air separation) with net-zero or near-zero lifecycle CO₂ emissions, used as fertilizer, energy carrier/fuel, industrial feedstock, and long-duration energy storage.

What Are The Key Growth Drivers That Support The Growth Of the Asia Pacific Green Ammonia Market?

The growth of the market is driven by the growing demand from the agriculture sector to enhance food security and demand for ammonia-based fertilizers to improve crop yield and soil fertility, which fuels the growth. Other key growth drivers are the abundant renewable energy, government initiatives, and technological innovation, which support the growth. The rapid industrialization and urbanization in the region due to increased demand for ammonia, especially green ammonia due to sustainability trends for chemical production, infrastructure development, and manufacturing, which fuels the growth and expansion of the market.

Market Trends

- Growing demand for fertilizers and sustainable agriculture solutions fuels the growth of the market.

- Rapid growth in production capacity due to the rapid expansion of manufacturing units further fuels the growth of the market.

- Improvements in electrolyzer technology are helping to reduce the cost of green ammonia, making it more viable for wider adoption.

- Government policies and initiatives for the support of promotion of green ammonia production are a growing trend in the market.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 2.72 Billion |

| Expected Size by 2034 | USD 324.65 Billion |

| Growth Rate from 2025 to 2034 | CAGR 70.11% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Production Technology, By Plant Capacity (ktpa NH₃), By Process Integration, By End-Use Application, By Region |

| Key Companies Profiled | Yara International, Nutrien Ltd. , CF Industries Holdings, Inc., IHI Corporation , Mitsubishi Heavy Industries, Ltd. , Thyssenkrupp Uhde , Siemens Energy AG , Nel ASA , Cummins Inc. (Hydrogenics) , Plug Power Inc. , Air Liquide S.A. , Air Products and Chemicals, Inc. , Linde plc , KBR, Inc. , JGC Holdings Corporation , Chiyoda Corporation , Sumitomo Corporation , Indian Oil Corporation Limited (IOCL), NTPC Limited , Petroliam Nasional Berhad (PETRONAS) |

Market Opportunity

What Are The Key Growth Opportunities That Support The Growth Of The Asia Pacific Green Ammonia Market?

The key growth opportunity that supports the growth of the market is the technological advancements in the region, like advanced technologies, particularly electrolysis powered by renewables, to produce carbon-free hydrogen and ammonia, which supports the growth of the market. The strategic collaboration between BASF and AM Green in India is advancing feasibility studies and securing supply chains for green ammonia, which creates an opportunity for the growth and expansion of the market.

Market Challenge

What Are The Key Challenges That Hinder The Growth Of The Asia Pacific Green Ammonia Market?

The key growth challenge that hinders the growth of the market is the high production costs and capital investment are the key hindrances that limits the growth of the market. The other key drivers are the intermittency of renewable energy, infrastructure development, supply chain disruption, technical and safety challenges, and technological maturity, which restrict the growth and expansion of the market. Unlike conventional ammonia derived from natural gas (SMR-based), green ammonia is produced with zero/low carbon emissions. It is used as a sustainable feedstock for fertilizers, marine fuels, energy storage, power generation, and industrial chemicals.

Regional Insights

India Has Seen Growth, Driven By The Government Support.

India has seen significant growth in the market, the growth is driven by government support and missions like the National Green Hydrogen Mission, which provides subsidies and production-linked incentives for green ammonia, increasing production and reducing reliance on imports, which increases the adoption, supporting the growth of the market. The other key growth drivers are the renewable energy integration, decarbonization, and expanding applications, which boost the growth of the market.

The key players, like AM Greens, SBASF, play a significant role in growth. Projects such as Avaada Group's collaboration with Casale to build India's largest green ammonia plant in Odisha demonstrate the focus on building domestic capacity. These factors help in the growth and expansion of the market.

China Has Seen Growth, Driven By Large Projects And Initiatives.

China has seen a steady growth driven by technological advancements, environmental regulations, and the hydrogen economy. The development of green ammonia is a crucial component of China's broader ambitions to establish a hydrogen-based economy. Companies like State Power Investment Corporation and China Energy Engineering Corporation are spearheading green ammonia projects, often siting facilities near renewable energy sources. Enterprises such as Sinopec and China Energy Investment are focusing on "greening" existing petrochemical facilities to produce green ammonia. These projects and initiatives support the growth and expansion of the market.

Asia Pacific Green Ammonia Market Value Chain Analysis

- Chemical Synthesis and Processing :The green ammonia is synthesised and processed through water electrolysis, renewable power, and the Haber-Bosch Process.

- Key players: Thyssenkrupp Uhde, KBR, Topsoe, Casale, and GenCell Energy.

- Quality Testing and Certification: The green ammonia requires CertifHy Scheme, Bureau Veritas Certification, TÜV Rheinland Standards, and TÜV Nord Verification.

- Distribution to Industrial Users: The green ammonia is distributed to the agriculture, transportation, and chemical industries.

- Key players: Yara, Siemens Energy, ACME Group, and Fertiglobe

Segmental Insights

Production Technology

Which Production Technology Segment Dominated The Asia Pacific Green Ammonia Market In 2024?

The Haber–Bosch with co-located electrolyzer segment dominated the Asia Pacific green ammonia market in 2024. In the Asia Pacific green ammonia market, the Haber-Bosch process integrated with co-located electrolyzers remains the most widely explored production technology. It leverages renewable hydrogen through electrolysis, combined with nitrogen to produce ammonia with minimal carbon emissions. This pathway benefits from proven scalability and compatibility with existing infrastructure. Governments and private players across the region are increasingly investing in this technology to support decarbonization in fertilizer and industrial applications.

The direct electrochemical synthesis segment expects significant growth in the Asia Pacific green ammonia market during the forecast period. Direct electrochemical synthesis is emerging as a next-generation approach in the Asia Pacific for green ammonia production. Unlike traditional methods, it bypasses the Haber-Bosch process by directly combining nitrogen and water using electricity, offering greater energy efficiency and lower operating costs. Although still at pilot and demonstration stages, this method is drawing attention from research institutes and startups in the region, aiming to accelerate commercialization and improve sustainability in ammonia production.

Plant Capacity

How did Large-Scale Segment Dominate the Asia Pacific Green Ammonia Market in 2024?

The large-scale (>50–200 ktpa) segment dominated the Asia Pacific green ammonia market in 2024. Large-scale green ammonia plants dominate the Asia Pacific market due to rising demand from industrial sectors and government-backed renewable projects. Facilities in this category cater to both domestic consumption and exports, with capacities designed to serve fertilizer industries and marine fuel markets. Countries like Australia, India, and Japan are actively pursuing large-scale developments, leveraging abundant renewable energy resources and aiming to position themselves as regional exporters of green ammonia.

The small-scale (>1–10 ktpa) segment expects significant growth in the Asia Pacific green ammonia market during the forecast period. Small-scale plants play a crucial role in localized green ammonia production across the Asia Pacific. These facilities typically support distributed applications such as off-grid fertilizer production for agriculture and decentralized energy storage solutions. Their flexibility makes them suitable for regions with renewable energy availability but limited infrastructure. Pilot projects in Southeast Asia and community-level adoption highlight the growing importance of small-scale plants in making green ammonia accessible and sustainable.

Process Integration

Which Process Integration Segment Dominated the Asia Pacific Green Ammonia Market In 2024?

The standalone ammonia production segment dominated the Asia Pacific green ammonia market in 2024. Standalone ammonia production facilities focus purely on ammonia synthesis powered by renewable energy sources without additional integration. In the Asia Pacific, these plants are primarily geared toward fertilizer manufacturing and industrial applications. The simplicity of the model allows faster setup and lower initial investment, making it attractive for early-stage market development. However, demand trends are gradually shifting towards integrated approaches that combine ammonia with broader renewable energy value chains.

The integrated power-to-X facilities segment expects significant growth in the Asia Pacific green ammonia market during the forecast period. Integrated power-to-X facilities are gaining prominence across the Asia Pacific as part of holistic energy transition strategies. These plants produce green ammonia alongside other hydrogen-derived fuels and chemicals, ensuring diversified utilization of renewable power. By combining ammonia production with hydrogen storage, synthetic fuels, or renewable electricity exports, these facilities enhance economic viability. Regional projects, especially in Australia and Japan, are leading investments in such multi-output facilities, aligning with long-term decarbonization goals.

End-Use Application

How Did the Fertilizer Production Segment Dominate The Asia Pacific Green Ammonia Market In 2024?

The fertilizer production segment dominated the Asia Pacific green ammonia market in 2024. Fertilizer production remains the largest application segment for green ammonia in the Asia Pacific. As agriculture is a critical industry in countries like India, China, and Southeast Asia, green ammonia provides a sustainable alternative to conventional fertilizers. Its adoption is driven by policies targeting carbon reduction in food supply chains. With increasing concerns over emissions from traditional fertilizer production, green ammonia is poised to play a pivotal role in greening agriculture.

The marine fuel and bunkering segment expects significant growth in the Asia Pacific green ammonia market during the forecast period. The marine fuel and bunkering segment represents a fast-growing application for green ammonia in the Asia Pacific. Shipping industries in Japan, South Korea, and Singapore are exploring ammonia as a zero-carbon fuel to meet international decarbonization targets. Its high energy density and carbon-free combustion make it a promising alternative to heavy fuel oils. Strategic investments in port infrastructure and pilot vessel trials are accelerating its adoption as a marine fuel across the region.

Recent Developments

- In June 2025, Solar Energy Corporation of India, SECI, launched a Green Ammonia tender; this initiative is to boost the renewable hydrogen use and support the net-zero emission target by 2070, aligning with the vision of a self-reliant and developed Viksit Bharat.(Source: energetica-india.net)

- In August 2025, NH3 Clean Energy, an Australian company has launched two initiatives of the FEED phase for the flagship ammonia project. This project supports the need to separately raise project financing and engage separate construction and operating teams.(Source: www.offshore-energy.biz)

Top Companies List

- Yara International

- Nutrien Ltd.

- CF Industries Holdings, Inc.

- IHI Corporation

- Mitsubishi Heavy Industries, Ltd.

- Thyssenkrupp Uhde

- Siemens Energy AG

- Nel ASA

- Cummins Inc. (Hydrogenics)

- Plug Power Inc.

- Air Liquide S.A.

- Air Products and Chemicals, Inc.

- Linde plc

- KBR, Inc.

- JGC Holdings Corporation

- Chiyoda Corporation

- Sumitomo Corporation

- Indian Oil Corporation Limited (IOCL)

- NTPC Limited

- Petroliam Nasional Berhad (PETRONAS)

Segments Covered:

By Production Technology

- Haber–Bosch with co-located electrolyzer (direct renewable coupling)

- Direct electrochemical ammonia synthesis

- Biomass-integrated green ammonia processes

By Plant Capacity (ktpa NH₃)

- Micro-scale (≤1 ktpa)

- Small-scale (>1–10 ktpa)

- Medium-scale (>10–50 ktpa)

- Large-scale (>50–200 ktpa)

- Mega-scale (>200 ktpa)

By Process Integration

- Standalone ammonia production

- Integrated fertilizer complexes

- Integrated power-to-X facilities

By End-Use Application

- Fertilizer production and agriculture

- Marine fuel and bunkering

- Power generation and long-duration energy storage

- Industrial chemical feedstock

- Export commodityShape

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait