Content

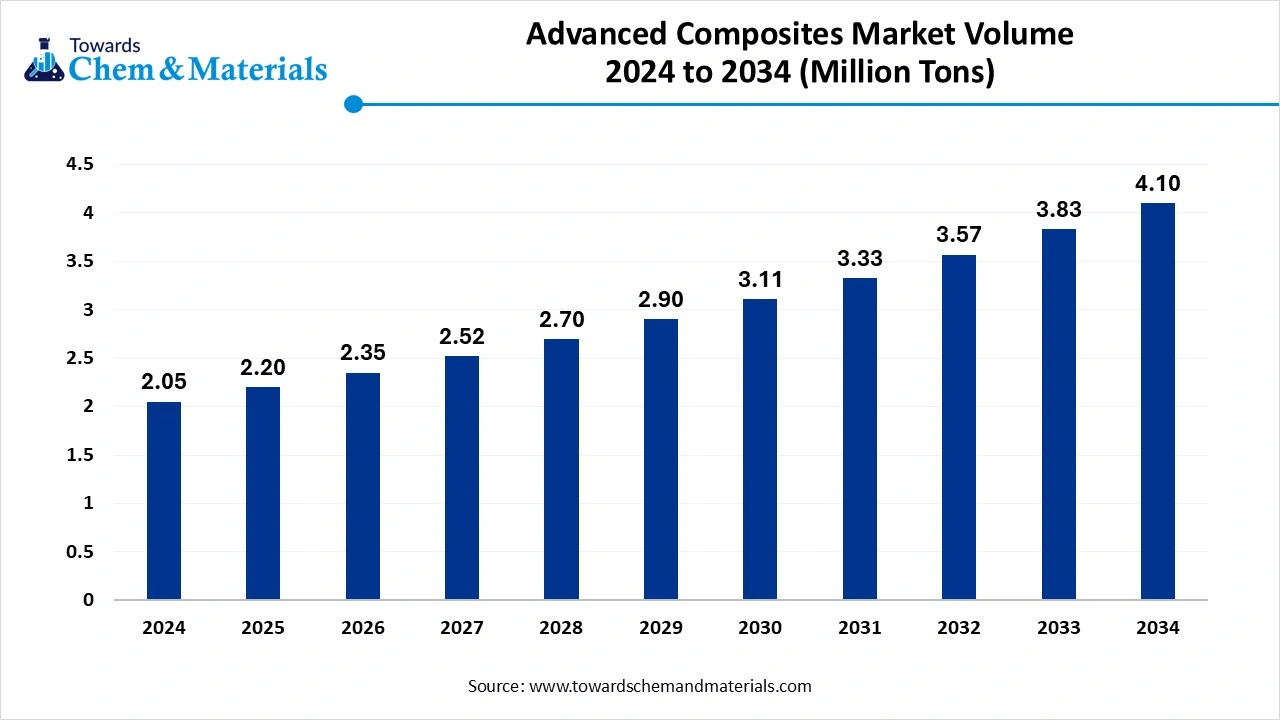

Advanced Composites Market Volume and Growth 2025 to 2034

The global advanced composites market volume is calculated at 2.05 million tons in 2024, grew to 2.20 million tons in 2025, and is projected to reach around 4.10 million tons by 2034.The market is expanding at a CAGR of 7.16% between 2025 and 2034. the sudden expansion of industries such as aerospace and automotive is fueling

Key Takeaways

- By region, North America dominated the advanced composites market in 2024, akin to its strong demand from aerospace, automotive, and defense sectors.

- By region, Asia Pacific is expected to grow at a fastest pace in the coming period, akin to rapid industrial growth, expanding automotive production, and large-scale infrastructure development.

- By product, the carbon fiber segment dominated the market with the largest share in 2024, akin to its exceptional strength-to-weight ratio, fatigue resistance, and stiffness, making it indispensable in aerospace, defense, and high-end automotive applications.

- By product, the glass fiber segment is expected to experience notable market growth in the future, owing to its cost-effectiveness, versatility, and expanding use in industries like wind energy, construction, and consumer goods.

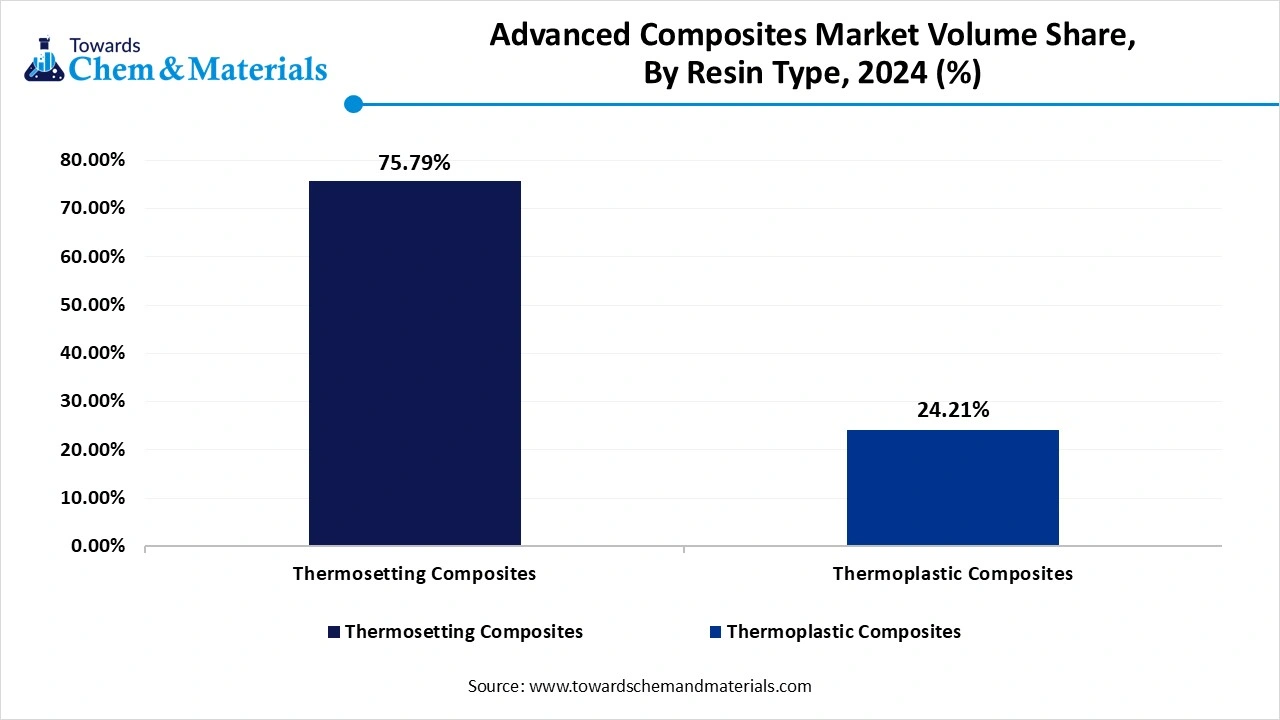

- By resin type, the advanced thermosetting composites segment held the dominating share of the advanced composites market in 2024 due to its widespread use in high-performance applications such as wind energy, aerospace, and automotive sectors.

- By resin type, the advanced thermoplastic composites segment is seen to grow at a notable rate during the predicted timeframe, owing to increasing preferences for materials that support faster production cycles, recyclability, and easy repair.

- By application, the automotive segment dominated the market with the largest share in 2024, akin to its increasing need for lightweight, high-strength materials that enhance fuel economy and reduce emissions.

- By application, the aerospace & defense segment is expected to grow at the fastest rate in the market during the forecast period due to rising air travel demand, lightweight aircraft needs, and stringent fuel-efficiency goals.

From Carbon to Capability – The Rise of Advanced Composites

The advanced composites market is experiencing fast-paced growth due to increasing demand from automotive, aerospace, construction, and renewable energy sectors in the current period. With industries focusing on lightweight and durable components, manufacturers are expanding their capabilities to meet evolving application requirements. Moreover, sustainability trends are driving innovation in bio-based and recyclable composites in recent years.

As industrial processes modernize, global producers are implementing production strategies with regional demand trends and regulatory standards, reshaping the role of advanced composites in next-generation manufacturing environments for the future, as per the observation.

The growing demand for lightweight materials in the aerospace sector is spearheading the industry's growth in the current period. Moreover, aircraft manufacturers are increasingly seen in integrating composites to reduce overall weight, enhance fuel efficiency, and comply with stringent emission regulations. Furthermore, this sudden shift is pushing suppliers to innovate with advanced fiber-reinforced polymers and carbon composites that offer superior performance and durability. The demand for commercial and defense aircraft continues to rise globally, material suppliers are increasing production with aerospace-grade quality standards. This trend is also reshaping global supply chains, as several brands are investing in localized production factories to support regional aerospace ecosystems in the current period.

Advanced Composites Market Trends

- The increasing adoption in the automotive sector is driving advanced composites market growth in the current period. As automakers are increasingly shifting toward lightweight materials like carbon fiber and glass fiber composites to improve fuel efficiency and meet stringent emission regulations. As electric vehicles (EVs) gain traction, demand for advanced composites in battery enclosures, structural frames, and interior components is rising.

- The aerospace industry continues to be a major consumer of advanced composites, particularly for structural components that require high strength-to-weight ratios. Aircraft manufacturers are incorporating carbon fiber composites in fuselage, wings, and interior panels to reduce weight and enhance fuel economy.

- Rapid expansion of the renewable energy sector is fueling demand for advanced composites, especially in wind energy. Composite materials such as glass fiber are extensively used in wind turbine blades due to their strength, corrosion resistance, and long service life. As countries increase their wind power capacities, manufacturers are developing longer, lighter blades using advanced molding technologies.

- Advanced composites are gaining attention in the construction industry for use in infrastructure, bridges, and building components. Fiber-reinforced polymers (FRPs) offer corrosion resistance, low maintenance, and high strength, making them ideal for long-term applications in harsh environments. With rising demand for durable, lightweight building materials, the construction sector is integrating smart composite technologies for structural reinforcement in the current period.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | 2.20 Million Tons |

| Expected Size by 2034 | 4.10 Million Tons |

| Growth Rate | CAGR 7.16% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | North America |

| Segment Covered | By Product, By Resin, By Application, By Region |

| Key Companies Profiled | Toray Industries, Inc., Koninklijke Ten Cate NV Teijin Limited, Hexcel Corporation, SGL Group, Cytec Solvay Group, Owens Corning, E. I. Dupont De Nemours and Company, Huntsman Corporation, Momentive Performance Materials Inc., WS Atkins plc, AGY Holdings Corp., Formosa Plastics Corporation, Plasan Carbon Composites, Strata Manufacturing |

Advanced Composites Market Opportunity

Precision Performance : Composites for Every Application

Product customization and targeting niche markets in several regions is expected to create significant opportunities for the advanced composites market during the forecast period. From sports equipment and medical devices to marine and robotics applications, end-users are seeking tailored solutions that meet specific performance criteria. This demand is opening new opportunities for specialized composite formulations with unique mechanical, thermal, and aesthetic properties. Manufacturers who can offer design flexibility and small-batch production capabilities stand to capture high margins in the coming years.

Advanced Composites Market Challenge

High-Tech, High Cost

High production costs and limited production volume are expected to hamper the advanced composites market growth during the forecast period. The complexity of processing materials like carbon fiber and the need for specialized equipment can produce production expenses in the coming years. Moreover, scaling operations while maintaining consistent quality creates a challenge, specifically for small and mid-sized investors or producers. Also, these cost barriers can hinder wider adoption in price-sensitive sectors such as automotive or construction.

Regional Insights

North America dominated the advanced composites market in 2024, akin to its strong demand from aerospace, automotive, and defense sectors. Also, the region is gaining advantage from a well-established manufacturing infrastructure and significant investments in lightweight materials to enhance fuel efficiency and performance. Moreover, technological advancements and the presence of major brands have accelerated product innovation in the current period. The implementation of regulations for sustainability and emissions control is also contributing to the industry's growth in the country in recent years. Furthermore, the region is accelerating growth by having a skilled labor force, R&D capabilities, and a robust supply chain in the current period.

Aerospace Powerhouse: United States’ Edge in Composites Technology, The United States maintained its dominance owing to its aerospace sector, with major aircraft manufacturers such as Boeing and defense contractors relying heavily on carbon fiber and other composites for structural components in the current period. Also, government-supported defense initiatives and space programs are significantly contributing to R&D spending, pushing technological innovation in the country nowadays. Moreover, the automotive industry is also adopting composites for electric vehicles to reduce weight and increase range. Furthermore, U.S.-based companies are integrating smart manufacturing and automation to

Asia Pacific is expected to grow at the fastest pace in the advanced composites market during coming period, akin to rapid industrial growth, expanding automotive production, and large-scale infrastructure development. Moreover, governments in the region have seen in promotion of lightweight, high-strength materials to support energy efficiency and urbanization needs in recent years. Also, the increasing use of composites in wind energy, transportation, and construction is further fueling demand. Furthermore, regional manufacturers are increasing production capacities and investing in technology to serve both domestic and global markets.

Innovation with Intent: China’s Push Toward Material Independence, China is expected to dominate the advanced composites market in the future, akin to booming aerospace, wind energy, and high-speed rail sectors. The government's "Made in China 2025" initiative is promoting advanced materials, including carbon fiber, to reduce import dependency and build domestic innovation. From the other region, China is focused on vertical integration from raw material production to end-use applications, ensuring better control over quality and costs. Moreover, brands in China have been creating global partnerships and acquiring overseas assets to gain technology access in the past few years, as per the observation.

Segmental Insights

Product Insights

The carbon fiber segment dominated the advanced composites market with the largest share in 2024, akin to its exceptional strength-to-weight ratio, fatigue resistance, and stiffness, making it indispensable in aerospace, defense, and high-end automotive applications. It enables lightweight structures that significantly enhance fuel efficiency and performance. Demand surged from sectors prioritizing weight reduction without compromising mechanical strength in the current period. Also, carbon fibre’s compatibility with various resin systems and solid high-performance end uses has maintained its leading position.

The glass fiber segment is expected to experience notable advanced composites market growth in the future, owing to its cost-effectiveness, versatility, and expanding use in industries like wind energy, construction, and consumer goods. From the carbon fibre, glass fibre offers a more economical solution for applications that require moderate strength but high durability and corrosion resistance. Its compatibility with various resins and ease of manufacturing make it suitable for mass production. As sustainability gains traction, glass fibre’s recyclability and lower environmental footprint are also gaining importance. The growing demand for affordable lightweight materials in emerging economies is further driving their adoption across industries in the future.

Resin Type Insights

The advanced thermosetting composites segment held the dominating share of the advanced composites market in 2024 due to its widespread use in high-performance applications such as wind energy, aerospace, and automotive sectors. Also, these composites offer excellent heat resistance, dimensional stability, and superior strength-to-weight ratio, making them ideal for structural components.

Epoxy, phenolic, and polyester resins are extensively used due to their strong bonding and lightweight properties. Furthermore, established manufacturing techniques like filament winding and resin transfer molding have supported large-scale production. Their long-standing reliability in mission-critical applications has driven steady demand, specifically where mechanical strength and thermal stability are crucial.

The advanced thermoplastic composites segment is seen to grow at a notable rate during the predicted timeframe owing to increasing preferences for materials that support faster production cycles, recyclability, and easy repair. Industries are shifting towards thermoplastics like Polyether Ether Ketone (PEEK), Polyphenylene Sulfide (PPS), and Polyetherimide (PEI) due to their reprocessability and superior impact resistance. Moreover, these composites are gaining traction in electric vehicles and aerospace for lightweighting without compromising structural performance. Additionally, advancements in automated processing methods such as automated fiber placement (AFP) are enabling mass production, which is contributing to segment growth.

Application Insights

The automotive segment dominated the advanced composites market with the largest share in 2024, akin to its increasing need for lightweight, high-strength materials that enhance fuel economy and reduce emissions. Composites are increasingly used in structural components, body panels, and interiors to meet regulatory and performance standards. OEMs have integrated advanced composites into both luxury and mass market vehicles to boost efficiency without compromising safety. Additionally, electric vehicle production has increased composite usage for battery enclosures and aerodynamic designs in the current period.

The aerospace & defense segment is expected to grow at the fastest rate in the advanced composites market during the forecast period due to rising air travel demand, lightweight aircraft needs, and stringent fuel-efficiency goals. Advanced composites significantly reduce aircraft weight while enhancing performance, safety, and operational life. Aircraft manufacturers are increasingly adopting carbon fiber and thermoplastics in airframes, interiors, and engine components. With the rapid expansion of commercial aviation and space exploration programs, composites offer strategic advantages in reducing maintenance costs and increasing design versatility. As production scales and material technologies mature, aerospace applications will become the primary growth driver for the market.

Recent Developments in Advanced Composites Market

Toray

- Launch: In September 2024, Toray Advanced Composites introduced their latest thermoplastic composite material. This material is called the Cetex TC 1130 PESU. Moreover, this material is aimed at addressing the increasing demand for lightweight and environmentally sustainable.

Navrattan Group

- Launch: In June 2024, the Navrattan group introduced E-Bus with integrated advanced glass fibre composites technology. The company that used this component is due of its exceptional durability and resistance to wear and tear.

Norplex

- Announcement: In 2024, the company introduced its new name called Montana Advanced Composites. Also, thus newly launched MAC can develop hot melt composites, prepregs, and laminates. Moreover, the company is U.S owned and privately limited as per the company report.

Top Companies list

- Toray Industries, Inc.

- Koninklijke Ten Cate NV

- Teijin Limited

- Hexcel Corporation

- SGL Group

- Cytec Solvay Group

- Owens Corning

- E. I. Dupont De Nemours and Company

- Huntsman Corporation

- Momentive Performance Materials Inc.

- WS Atkins plc

- AGY Holdings Corp.

- Formosa Plastics Corporation

- Plasan Carbon Composites

- Strata Manufacturing

Segment Covered in the Report

By Product

- Aramid Fiber

- Carbon Fiber

- Glass Fiber

By Resin

- Advanced Thermosetting Composites

- Advanced Thermoplastic Composites

By Application

- Aerospace & Defense

- Automotive

- Wind Energy

- Sporting Goods

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- Thailand

- Latin America

- Brazil

- Argentina

- The Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait