Content

What is the Current Advanced Composite Materials Market Size and Share?

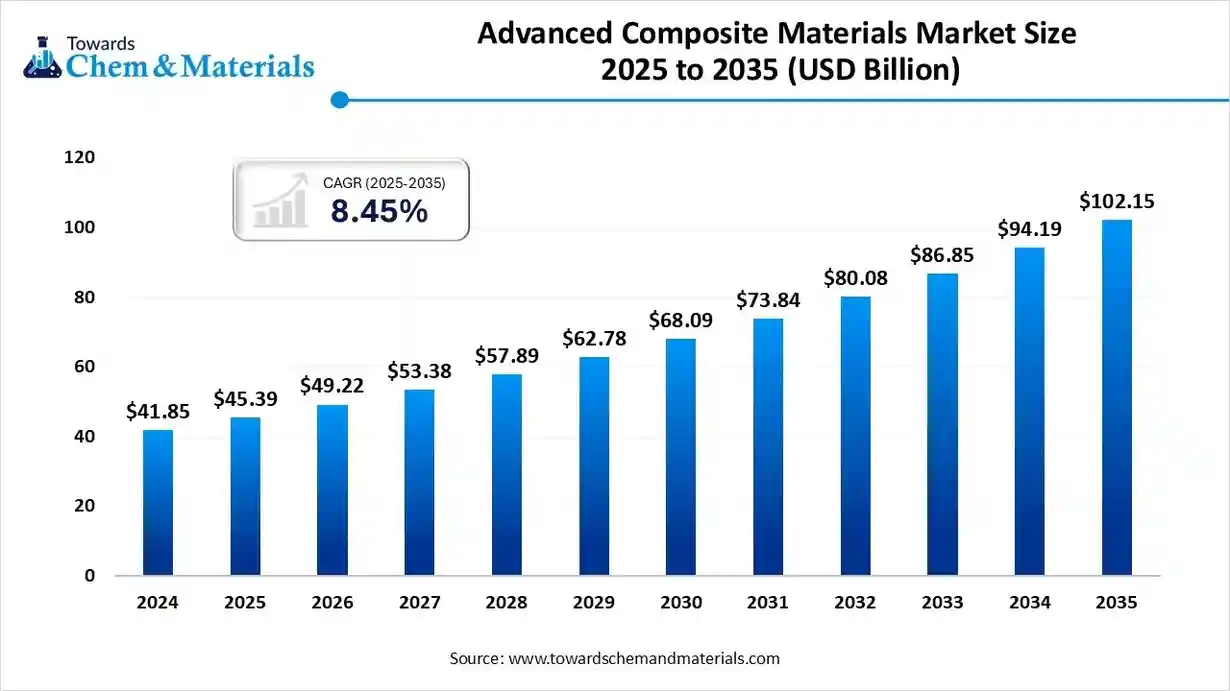

The global advanced composite materials market size is calculated at USD 45.39 billion in 2025 and is predicted to increase from USD 49.22 billion in 2026 and is projected to reach around USD 102.15 billion by 2035, The market is expanding at a CAGR of 8.45% between 2025 and 2035. Asia Pacific dominated the advanced composite materials market with a market share of 46.80% the global market in 2024.

The growth of advanced composites across sectors such as automotive, aerospace, and renewable energy is a key driver of market growth. Also, the ongoing development of more cost-effective manufacturing methods, coupled with the need for durable construction materials, can further fuel market growth.

Key Takeaways

- By region, Asia-Pacific dominated the market with nearly 46.8% share in 2024 and is expected to grow at the fastest CAGR of approximately 8.5% over the forecast period.

- By region, North America is expected to grow at a notable rate over the forecast period.

- By fiber type, the carbon fiber segment dominated the advanced composite materials market

with nearly 47.3% share in 2024. - By fiber type, the aramid fiber segment is expected to grow at the fastest CAGR of approximately 8.4% over the forecast period.

- By matrix type, the thermoset composites segment held nearly 58.6% market share in 2024.

- By matrix type, the thermoplastic composites segment is expected to grow at the fastest CAGR of approximately 7.9% over the forecast period.

- By product/form, the prepregs segment dominated the market with nearly 44.1% share in 2024.

- By product/form, the pultruded profiles segment is expected to grow at the fastest CAGR of approximately 8.2% over the forecast period.

- By resin type, the epoxy resins segment held nearly 38.2% market share in 2024.

- By resin type, the PEEK resins segment is expected to grow at the fastest CAGR of nearly 9.3% during the forecast period.

- By end-use industry, the aerospace & defense segment held approximately 32.4% share of

the advanced composite materials market in 2024. - By end-use industry, the automotive & transportation segment is expected to grow at the highest CAGR of nearly 8.7% during the study period.

What are Advanced Composites?

Increasing demand for fuel efficiency, renewable energy infrastructure, and electric vehicle development are the major factors fuelling market growth. The global advanced composite materials market comprises high-performance engineered materials that combine fiber reinforcements and matrix resins to deliver superior mechanical, thermal, and chemical properties.

These materials include carbon fiber, aramid fiber, glass, and hybrid reinforcements embedded in thermoset or thermoplastic matrices. They are used in applications that demand lightweight strength, durability, and corrosion resistance, particularly in the aerospace, automotive, wind energy, marine, defense, and industrial sectors.

Global Advanced Composite Materials Market Outlook:

- Industry Growth Overview: The push towards lighter vehicles, particularly hybrid and electric models, is a key driver for using innovative composites to reduce emissions and increase fuel economy.

- Sustainability Trends: Key sustainability trends in the market include the development of biodegradable and bio-based materials, fuelled by consumer demand for eco-friendly products.

- Major Investors: Major investors in the market include Toray Industries, Teijin, and Mitsubishi Chemical. These companies invest in R&D and the production of composite materials for various applications.

How Cutting Edge Technologies are revolutionizing the Global Advanced Composite Materials Market?

Advanced technologies are transforming the market by enhancing manufacturing processes, enabling sustainability, and developing high-performance and functional materials. Moreover, innovations in material science are creating next-generation materials such as bio-based composites.

Report Scope

| Report Attributes | Details |

| Market Size in 2026 | USD 49.22 Billion |

| Expected Size by 2035 | USD 102.15 Billion |

| Growth Rate from 2025 to 2035 | CAGR 8.45% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2026 - 2035 |

| Leading Region | Asia-Pacific |

| Fastest Growing Region | North America |

| Segment Covered | By Fiber Type, By Matrix Type, By Product / Form, By Resin Type, By End-Use Industry, By Region |

| Key Companies Profiled | Hexcel Corporation , Toray Industries, Inc. , SABIC Innovative Plastics , Mitsubishi Chemical Corporation , Solvay S.A, 3M Company , Owens Corning , Teijin Limited ,Jushi Group Co., Ltd.., Hyosung Corporation , Parker Hannifin Corporation , General Electric Company , Lockheed Martin Corporation , ArcelorMittal , Northrop Grumman Corporation |

Trade Analysis of Global Advanced Composite Materials Market: Import & Export Statistics:

- In 2024, U.S. international related-party trade in goods was $2,338.0 billion, which made up 44.0% of the total goods trade of $5,312.9 billion. This related-party trade figure is calculated using both total imports for consumption and total exports.(Source: www.census.gov)

- India exported 3,299 shipments of Materials Composite between September 2023 and August 2024 (TTM). These exports involved 316 Indian Exporters and were sent to 410 Buyers, representing a 65% growth rate compared to the preceding 12 months.(Source: www.volza.com)

Global Advanced Composite Materials Market Value Chain Analysis

- Feedstock Procurement : It is the process of sourcing and acquiring the essential raw and intermediate materials required to manufacture advanced composite products.

- Major Players: Toray Industries, Inc., Teijin Limited, Hexcel Corporation.

- Chemical Synthesis and Processing : It refers to the technologies and methods used to create the constituent materials of composites.

- Major Players: BASF, Evonik, Huntsman, Solvay, Toray Industries, and Mitsubishi Chemical.

- Packaging and Labelling : It typically covers the necessary aspects of how composite products are contained, protected, and identified over the supply chain.

- Major Players: Amcor, Mondi, DS Smith, Smurfit Kappa, and Sonoco Products Company.

- Regulatory Compliance and Safety Monitoring : It involves adhering to market-specific regulations using advanced technologies to ensure the reliability, quality, and safety of composite materials.

- Major Players: Toray Industries, Hexcel Corporation, Solvay, and SGL Carbon.

Global Advanced Composite Materials Market's Regulatory Landscape: Global Regulations

| Country/Region | Key Regulations |

| North America (USA, Canada) | The National Center for Advanced Materials Performance (NCAMP) in the US serves as a key body for developing shared standards and data for aerospace applications. |

| Europe | The EU has specific regulations for the import of "composite products" containing processed animal products, requiring adherence to specific heat treatment and approval processes. |

| Asia-Pacific (China, India, Japan, South Korea) | Supportive government policies promoting industrial growth, sustainability, and indigenization (especially in India's defense sector) are contributing factors. |

Segment Insights

Fiber Type Insight

How Much Share Did the Carbon Fiber Segment Hold in 2024?

- The carbon fiber segment dominated the market, accounting for nearly 47.3% of the market share in 2024. The segment's dominance can be attributed to growing carbon fiber demand from the aerospace and automotive sectors for lightweight, high-strength materials, as well as the increasing need for high-pressure storage solutions.

- The aramid fiber segment is expected to grow at the fastest CAGR of approximately 8.4% over the forecast period. The segment's growth can be credited to the growing inclination towards materials that reduce weight without compromising strength. These fibers are gaining traction for their toughness, high strength, and corrosion resistance.

- The glass fiber segment is a major market segment. The segment's growth is driven by rising demand for sustainable, durable materials and by increased infrastructure investment. This type of composite offers exceptional durability and corrosion resistance.

- The growth of the hybrid fiber composites segment is fuelled by the ongoing development of natural fiber composites to meet green standards and by technological advancements, such as improved production and R&D for low-cost composite grades.

Matrix Type Insights

Which Matrix Type Segment Dominated the Global Advanced Composite Materials Market in 2024?

- The thermoset composites segment held nearly 58.6% market share in 2024. The dominance of the segment can be linked to the growing use of thermoset composites in military aircraft, where the strength-to-weight ratio is important, and to the worldwide expansion of the wind energy sector.

- The thermoplastic composites segment is expected to grow at the fastest CAGR of approximately 7.9% over the forecast period. The growth of the segment can be driven by rapid advancements in materials science, faster processing times, and improved recyclability of these composites.

- The metal matrix composites (MMC) segment held a significant market share in 2024. The segment's growth is driven by the growing need for high-performance materials in the automotive and aerospace industries, which favor MMCs for their superior strength-to-weight ratio and wear resistance.

- Ceramic matrix composites (CMCs) are a major market segment.CMCs offer a combination of low weight, high strength, and high-temperature resistance, which makes them crucial for demanding applications.CMCs are increasingly used in the energy sector.

Product Insights

Which Product Type Segment Dominated the Global Advanced Composite Materials Market in 2024?

- The prepregs segment dominated the market, accounting for nearly 44.1% of the market share in 2024. The segment's dominance is driven by growing demand for strong, durable materials for the production of long wind turbine blades. Prepegs also reduce composite weight, thereby enhancing vehicle performance.

- The pultruded profiles segment is expected to grow at the fastest CAGR of approximately 8.2% over the forecast period. The segment's growth is driven by a surge in global investments in civil engineering and infrastructure projects. Pultruded profiles offer exceptional corrosion resistance and durability.

- Laminates are a major market segment. The segment's growth is propelled by increasing focus on environmental responsibility, along with stringent regulations that are optimizing the use of sustainable, recyclable composite materials. These laminates are favoured over traditional materials like concrete.

- The SMC/BMC (sheet & bulk molding compounds) segment held a significant market share in 2024. The segment's growth is driven by ongoing industrialization and infrastructure development, particularly in the Asia-Pacific. Innovations in manufacturing processes can drive segment growth in the near term.

Resin Type Insights

Which Resin Type Segment Dominated the Global Advanced Composite Materials Market in 2024?

- The epoxy resins segment held nearly 38.2%market share in 2024. The segment's dominance can be attributed to the growing demand for high-strength, lightweight materials in the aerospace and automotive sectors, as well as the shift towards bio-based epoxy resins to meet environmental regulations.

- The PEEK resins segment is expected to grow at the fastest CAGR of nearly 9.3% during the forecast period. The segment's growth can be attributed to its high-performance properties, such as mechanical strength and thermal stability. The material also has inherent properties such as high chemical resistance.

- The growth of the polyester resins segment is fuelled by their versatility and cost-effectiveness, which make them suitable for a wide range of applications, including automotive, marine, and construction. Polyester resins are a popular choice because of their high flexibility.

- The vinyl ester resins segment held a significant market share in 2024. The segment is growing due to the high tensile strength and superior chemical resistance of vinyl ester resins, which minimize maintenance costs and promote lightweight construction in marine applications.

End-Use Industry Insights

How Much Share Did the Aerospace & Defense Segment Held in 2024?

- The aerospace & defense segment held approximately 32.4% market share in 2024. The segment's dominance can be linked to the growing need for lightweight materials to improve fuel efficiency and reduce emissions. Moreover, the growing space exploration sectors create new opportunities for advanced composites.

- The automotive & transportation segment is expected to grow at the highest CAGR of nearly 8.7% during the study period. The segment's growth can be driven by rising demand for lightweight, fuel-efficient vehicles amid stringent environmental regulations. A surging middle-class population with increasing disposable income is positively impacting segment growth.

- The growth of the wind energy segment is boosted by the ongoing development of offshore wind farms, which require materials that can withstand harsh environmental conditions, thereby contributing to segment expansion.

- The marine segment held a significant market share in 2024. The segment's growth is driven by advancements in composite production technologies, such as 3D printing, and the increasing popularity of recreational boating. The growing offshore wind sector requires large and durable composite materials.

Regional Insights

The Asia-Pacific advanced composite materials market size was valued at USD 45.39 billion in 2025 and is expected to surpass around USD 102.15 billion by 2035, expanding at a compound annual growth rate (CAGR) of 8.45% over the forecast period from 2025 to 2035. Asia-Pacific dominated the market with nearly 46.8% share in 2024 and is expected to grow at the fastest CAGR of approximately 8.5% over the forecast period. The region's dominance and growth can be attributed to rising product demand from the aerospace and automotive industries. Furthermore, advancements in production technologies are making composites more cost-effective.

China Global Advanced Composite Materials Market Trends

In the Asia Pacific, China held a significant market share due to rising demand for lightweight materials in the aerospace and automotive sectors. Policies such as "Made in China 2025" focus on high-tech materials and innovation, which directly support the market growth.

North America is expected to grow at a notable CAGR over the forecast period. The region's growth can be attributed to increasing demand for corrosion-resistant, durable materials in construction and infrastructure projects, as well as substantial investments in research and development (R&D). The growing wind energy sector's need for lightweight composite materials is also impacting positive market growth.

U.S. Global Advanced Composite Materials Market Trends

In North America, the U.S. led the market due to growth in renewable energy sectors, such as wind power. Also, technological innovations such as lower production costs, automated fiber placement, and 3D printing increase demand for durable materials.

Europe held a significant market share in 2024. The region's growth is driven by the growing need for lightweight materials to improve fuel efficiency and performance. Government policies are driving industries towards bio-based composites and materials with lower carbon footprints.

Germany Global Advanced Composite Materials Market Trends

In Europe, Germany dominated the market due to a growing focus on developing and producing electric vehicles, driven by the need for more cutting-edge composites to save energy. Germany's strong automotive sector uses composites to reduce vehicle weight, improving overall fuel efficiency.

The growth of the Latin American market is driven by increasing demand for innovative materials with properties such as corrosion resistance and high strength-to-weight ratios. The region's investment in renewable energy is boosting demand for composites in wind turbine blades.

Advanced Composite Materials Market Share, By Region, 2024 (%)

| Regional | Revenue Share |

| North America | 24.11% |

| Europe | 18.44% |

| Asia Pacific | 46.80% |

| Latin America | 6.54% |

| Middle East and Africa | 4.11% |

Brazil Global Advanced Composite Materials Market Trends

Brazil is one of the major countries in Latin America. The county's growth can be propelled by rising demand for high-performance, lightweight, and durable materials across industries, supported by a growing focus on technological advancements and sustainability.

Recent Developments

- In November 2025, Alpha Systems introduced Alpha Composites, an unfies source for the RV market's most innovative composite materials. Alpha Composites exhibits both experience and evolution(Source:rvbusiness.com)

- In May 2025, PRF composite materials introduced a year-long out-of-life prepreg RP5365, which cuts any need for refrigeration or freezing while keeping legacy material curing properties.(Source: www.compositesworld.com)

Global Advanced Composite Materials Market Companies

- Hexcel Corporation – Hexcel Corporation is a global leader in advanced composite materials, specializing in lightweight, high-performance products such as carbon fibers, honeycomb structures, and prepregs. Its materials are widely used in the aerospace, defense, wind energy, and industrial markets, enabling high-strength-to-weight ratios and fuel-efficient designs.

- Toray Industries, Inc. – Toray Industries is a leading global manufacturer of advanced composite materials, offering a wide range of thermoset and thermoplastic prepreg systems through its subsidiaries. The company’s carbon fiber composites are integral to the aerospace, automotive, and sporting goods industries, emphasizing innovation, sustainability, and durability.

- SABIC Innovative Plastics – SABIC provides advanced polymer composites and thermoplastic materials for industrial, automotive, and aerospace applications. The company’s high-performance resins and carbon-fiber-reinforced plastics enhance product strength, reduce weight, and improve recyclability.

- Mitsubishi Chemical Corporation – Mitsubishi Chemical manufactures advanced composite materials, including carbon fibers, thermoset resins, and thermoplastic composites. Its materials are used in the aerospace, automotive, and sporting industries, with a strong focus on sustainability and lightweight technologies.

- Solvay S.A. – Solvay develops specialty polymers and composite materials used in high-performance applications across aerospace, defense, and industrial markets. Its advanced composites deliver thermal resistance, durability, and structural integrity for demanding environments.

- 3M Company – 3M produces advanced composite adhesives, structural resins, and reinforcements for aerospace, automotive, and construction sectors. The company’s expertise in materials science contributes to stronger, lighter, and more energy-efficient composite systems.

- Owens Corning – Owens Corning is a global manufacturer of glass-fiber composites used in automotive, marine, wind energy, and infrastructure applications. Its composite solutions improve product performance and environmental efficiency by using lightweight, durable materials.

- Teijin Limited – Teijin manufactures high-performance composite materials, including carbon fibers, aramid fibers, and thermoplastic composites. The company serves the aerospace, automotive, and electronics industries with innovative lightweighting and energy-efficient material technologies.

- Jushi Group Co., Ltd. – Jushi Group is one of the largest producers of fiberglass and composite reinforcements globally. The company provides glass fiber rovings, mats, and fabrics used in automotive, marine, and industrial composite manufacturing.

- Hyosung Corporation – Hyosung produces carbon fiber and aramid-based composite materials used in aerospace, defense, and energy applications. The company focuses on developing lightweight and high-strength materials that improve efficiency and safety in end-use industries.

- Parker Hannifin Corporation – Parker Hannifin offers advanced composite solutions for aerospace and industrial applications, including structural components, seals, and hoses made from reinforced composite materials. Its products enhance performance in extreme environments.

- General Electric Company – GE integrates composite materials into its aerospace and energy systems, including jet engines and wind turbines. The company’s innovations in carbon-fiber composites improve energy efficiency and mechanical strength in large-scale engineering applications.

- Lockheed Martin Corporation – Lockheed Martin uses advanced composites extensively in aerospace and defense manufacturing. The company’s composite technologies contribute to lighter, stronger aircraft structures, stealth systems, and high-performance defense platforms.

- ArcelorMittal – ArcelorMittal develops advanced metal-composite hybrid materials for lightweight structural applications. Its R&D initiatives focus on combining steel with composite reinforcements to improve strength-to-weight ratios and reduce environmental impact in the automotive and construction sectors.

- Northrop Grumman Corporation – Northrop Grumman applies advanced composite materials in aircraft, spacecraft, and defense systems. The company’s expertise in carbon and thermoplastic composites supports next-generation aerospace manufacturing and stealth technology.

Segments Covered in the Report

By Fiber Type

- Carbon Fiber

- PAN-Based Carbon Fibe

- Pitch-Based Carbon Fiber

- Aramid Fiber

- Para-Aramid (Kevlar)

- Meta-Aramid (Nomex)

- Glass Fiber

- S-Glass

- E-Glass

- Hybrid Fiber Composites

- Carbon-Glass Hybrid

- Aramid-Carbon Hybrid

By Matrix Type

- Thermoset Composites

- Epoxy

- Polyester

- Vinyl Ester

- Thermoplastic Composites

- PEEK (Polyether Ether Ketone)

- PPS (Polyphenylene Sulfide)

- Polyamide (PA)

- Metal Matrix Composites (MMC)

- Aluminum-Based

- Titanium-Based

- Ceramic Matrix Composites (CMC)

- Silicon Carbide

- Alumina-Based

By Product / Form

- Prepregs

- Fiber-Resin Pre-Impregnated Sheets

- Autoclave-Ready Rolls

- SMC/BMC (Sheet & Bulk Molding Compounds)

- Automotive & Electrical Components

- Pultruded Profiles

- Beams, Rods, Structural Panels

- Laminates

- Multilayer Sheets, Panels

- Milled & Chopped Fiber Compound

By Resin Type

- Epoxy Resins

- Aerospace & Defense Components

- Polyester Resins

- Automotive & Construction

- Vinyl Ester Resins

- Marine & Industrial

- Polyetheretherketone (PEEK)

- High-Performance Engineering

- Others (Phenolic, Polyimide, Cyanate Ester)

By End-Use Industry

- Aerospace & Defense

- Airframes

- Rotorcraft

- UAV Components

- Automotive & Transportation

- EV Structural Panels

- Lightweight Chassis Components

- Wind Energy

- Turbine Blades

- Nacelles

- Marine

- Hull

- Deck Structures

- Construction & Infrastructure

- Rebars

- Panels

- Sporting Goods & Consumer Products

- Bicycles, Rackets, Helmets

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa