Content

What is the Chemical Distribution Market Size and Volume?

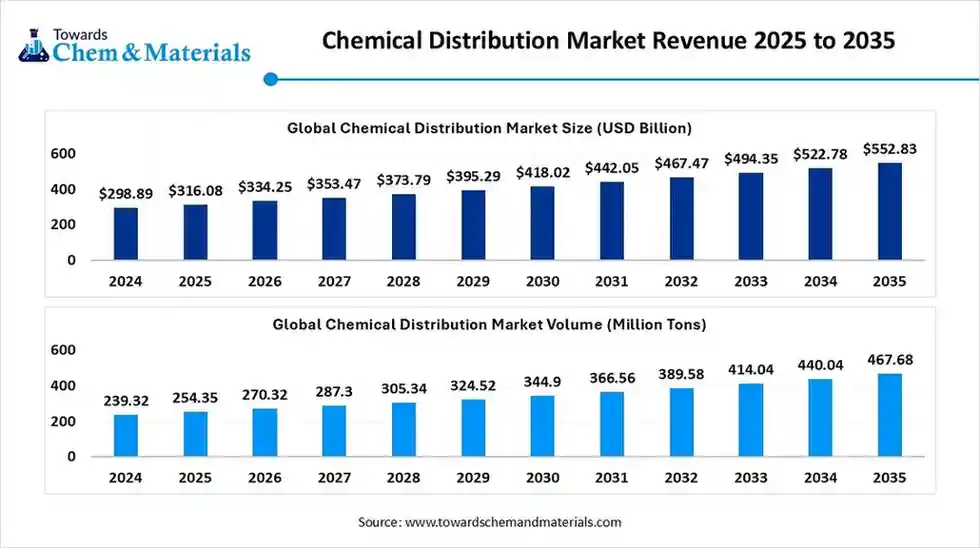

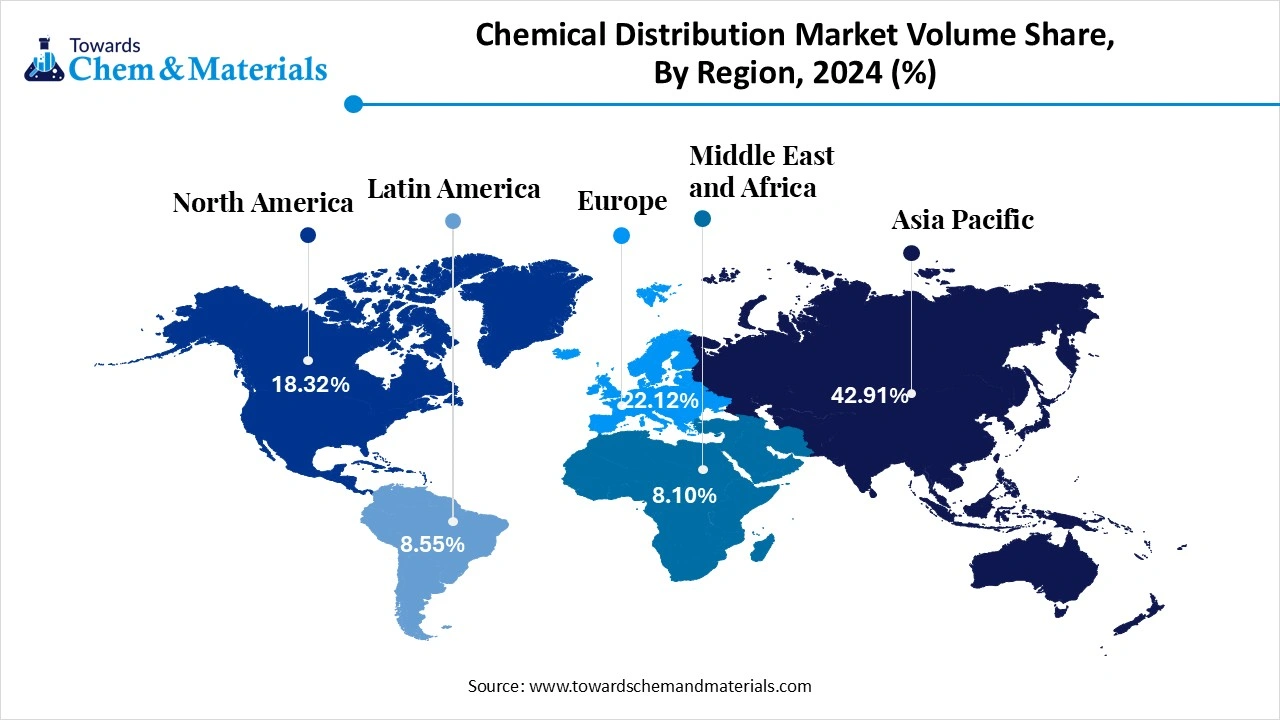

The global Chemical Distribution market size was estimated at USD 316.08 billion in 2025 and is expected to increase from USD 334.25 billion in 2026 to USD 552.83 billion by 2035, growing at a CAGR of 5.75% from 2026 to 2035. Asia Pacific dominated the Chemical Distribution market with the largest revenue share of 42.91% in 2025. the growth of the market is driven by increasing demand for specialty chemicals from various industries like healthcare, pharmaceutical. Electronics and food which drives the growth.

The global chemical distribution market is expected to reach a volume of approximately 254.35 million tons in 2025, with a forecasted increase to 467.68 million tons by 2035, growing at a CAGR of 6.28% from 2025 to 2035.

Key Takeaway

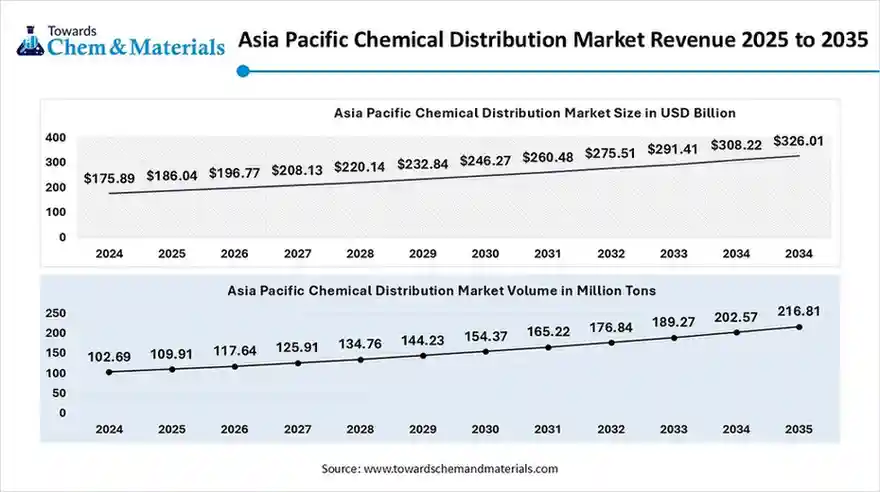

- The Asia pacific chemical distribution market volume is estimated at 109.91 million tons in 2025, and is expected to reach 216.81 million tons by 2035, at a CAGR of 7.03% during the forecast period 2025-2035

- The Asia Pacific chemical distribution market dominated with the largest Volume Share of 42.91% in 2025

- The North America chemical distribution market is expected to grow at a CAGR of over 5.62% from 2025 to 2034

- The Europe has held Volume Share of around 22.12% in 2024.

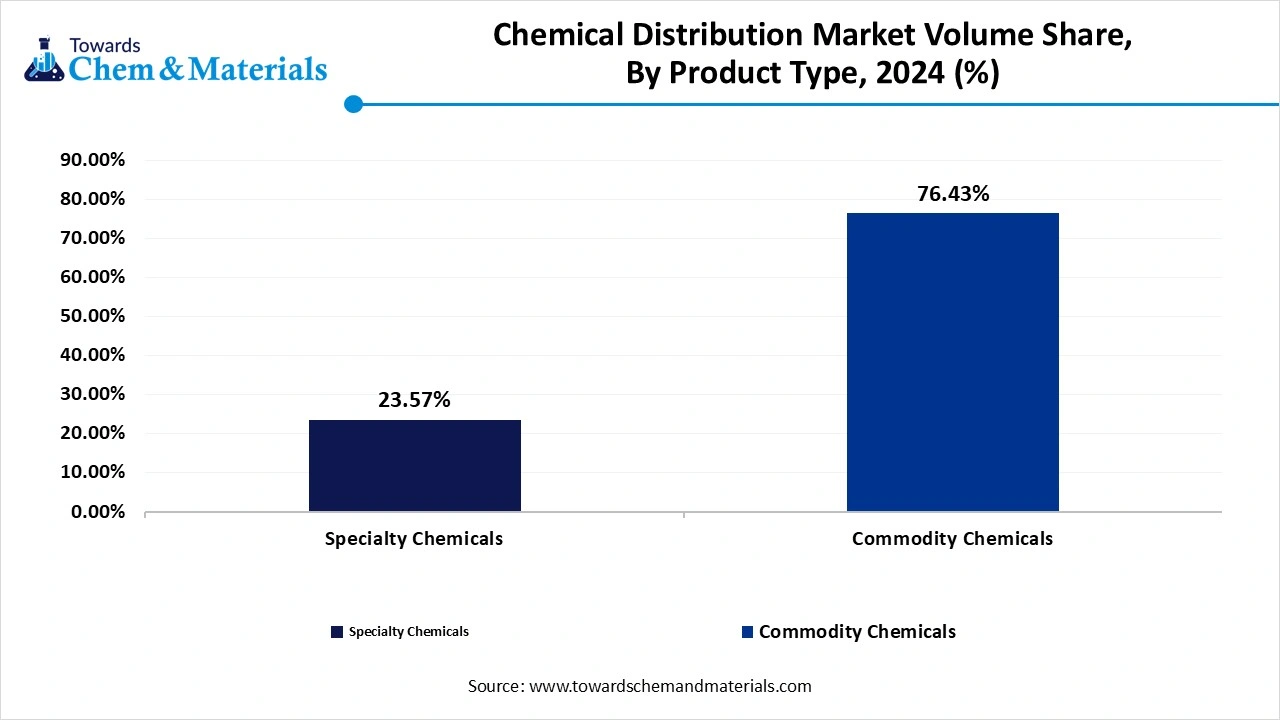

- By product, the Commodity chemicals segment led the market with the largest Volume Share of 76.43% in 2024.

- By product, the specialty chemicals segment is anticipated to register the fastest growth with a CAGR of 5.10% worldwide during the forecast period.

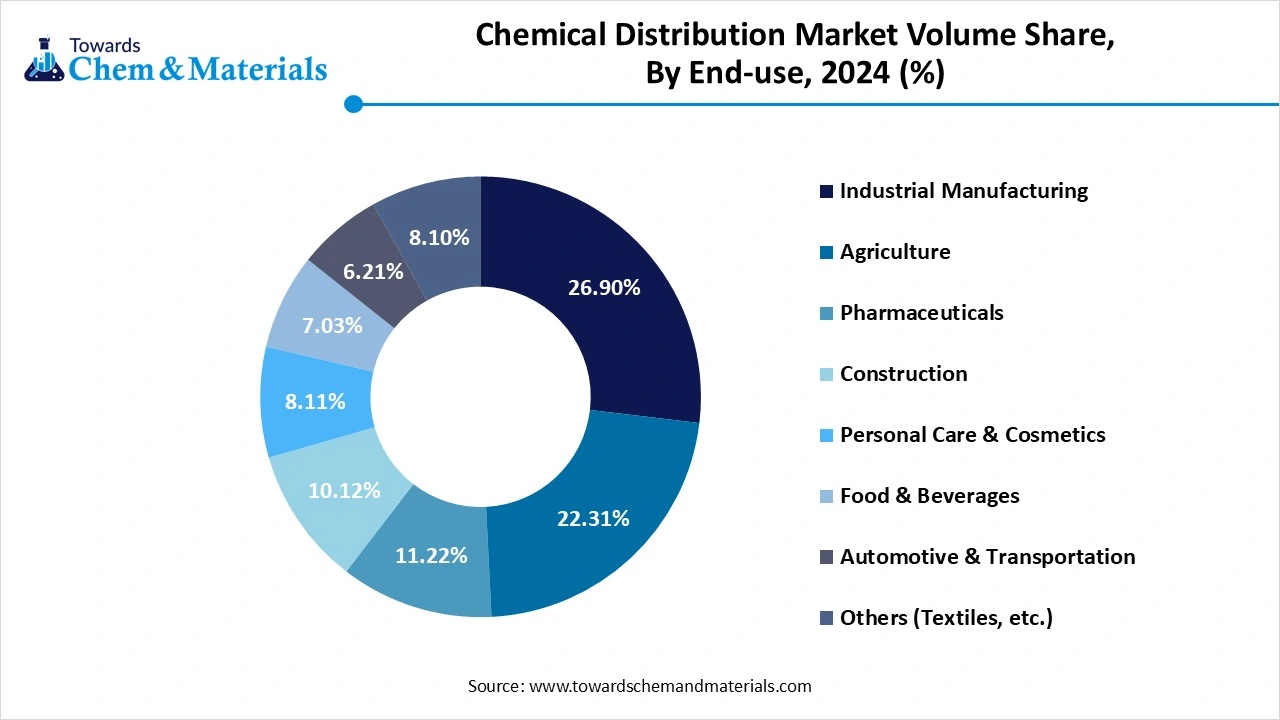

- By end use, the industrial manufacturing segment accounted for the largest Volume Share of 26.90% in 2024.

- By end use, the pharmaceuticals segment is likely to be the fastest-growing segment with a CAGR of 7.95% during the coming years

Rising Demand For Specialty Chemicals: Chemical Distribution Market To Expand

Chemical distribution is a process in which chemical products are sourced from the manufacturers and delivered to end users across various industries such as agriculture, pharmaceutical, construction, and consumer goods. This process involves transportation, storage of chemicals, and services like product formulation, packaging, regulatory compliance, and technical support. Distributors are mediators that help manufacturers reach broader markets and also ensure customers receive the right chemicals in the correct form and quantity, maintaining the quality. The market plays a crucial role in maintaining a safe, efficient, and reliable supply chain for both specialty and commodity chemicals.

The chemical distribution market is driven by various factors, which are influenced by increasing demand for specialty chemicals by various industries according to the need, increasing industrialization in emerging economies due to large investments for research and development, which drives the growth of the market. The strict environmental regulation and demand for professional chemical handling, shift towards outsourced distribution services for cost efficiency and compliance, help in the expansion of the market. These drivers help the market to grow through innovation, research, and improved services.

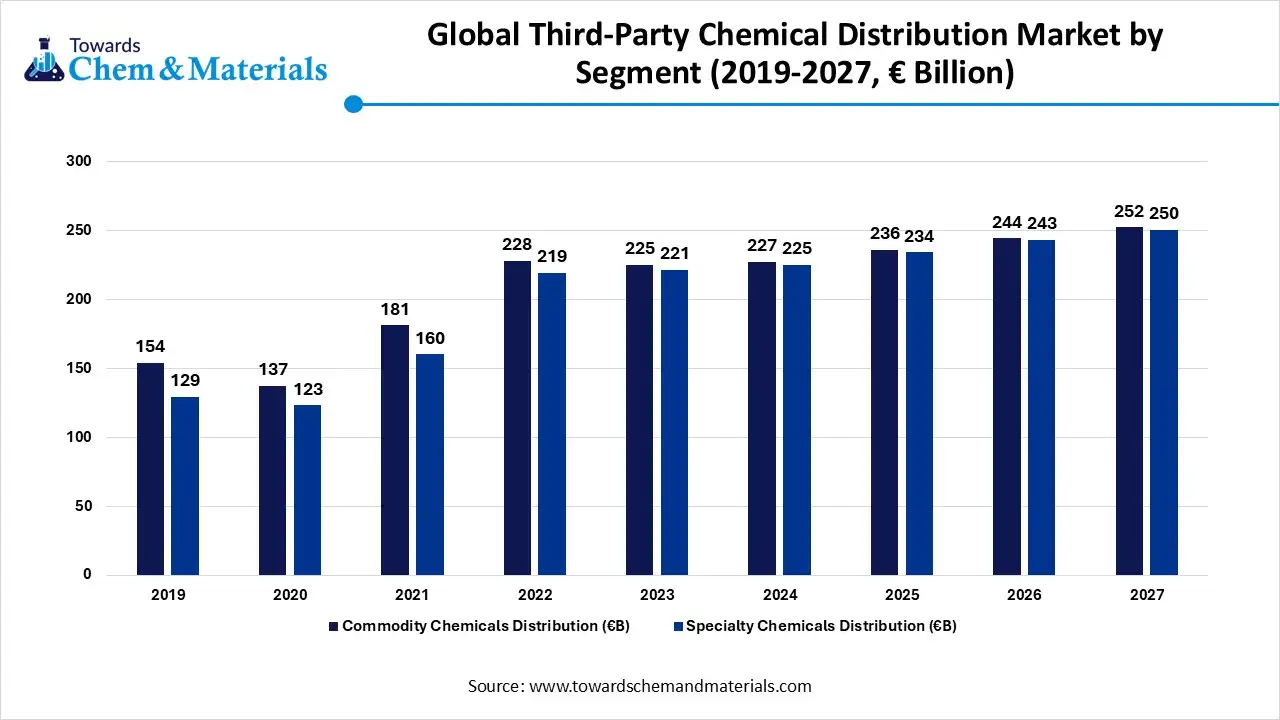

Global Third-Party Chemical Distribution Market by Segment (2019–2027, € Billion)

| Year | Commodity Chemicals Distribution (€B) | Specialty Chemicals Distribution (€B) | Total Market Size (€B) |

|---|---|---|---|

| 2019 | 154 | 129 | 283 |

| 2020 | 137 | 123 | 260 |

| 2021 | 181 | 160 | 341 |

| 2022 | 228 | 219 | 447 |

| 2023 | 225 | 221 | 446 |

| 2024 | 227 | 225 | 452 |

| 2025 | 236 | 234 | 470 |

| 2026 | 244 | 243 | 487 |

| 2027 | 252 | 250 | 502 |

Chemical Distribution Market Trends

- Increasing demand for specialty chemicals in various industries like healthcare, electronics, and food drives the growth.

- Chemical distributors are increasingly adopting digital platforms to enhance operational efficiency and customer engagement, which drives the chemical distribution market.

- The growing emphasis on sustainability and green chemistry solutions due to stringent environmental regulation and consumer awareness drives the growth of the market.

- Technological advancement in product offering, like the introduction of eco-friendly product increases the demand and also adoption by the consumers.

- Investments by large companies in research and development to create innovative solutions that meet the demand and needs of the industries drive the growth.

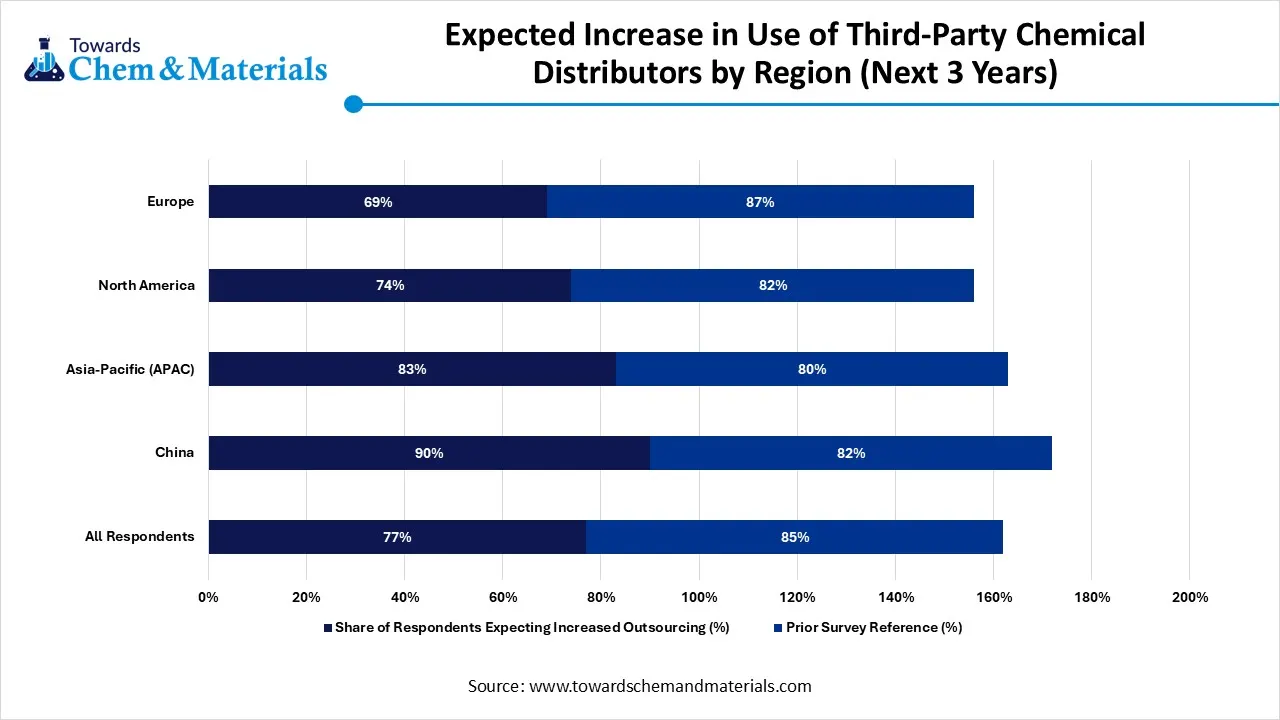

Expected Increase in Use of Third-Party Chemical Distributors by Region (Next 3 Years)

| Region | Share of Respondents Expecting Increased Outsourcing (%) | Prior Survey Reference (%) |

|---|---|---|

| All Respondents | 77% | 85% |

| China | 90% | 82% |

| Asia-Pacific (APAC) | 83% | 80% |

| North America | 74% | 82% |

| Europe | 69% | 87% |

Market Report Scope

| Report Attributes | Details |

| Market Size in 2026 | USD 334.25 billion |

| Expected Size in 2035 | USD 552.83 Billion |

| Growth Rate from 2025 to 2035 | CAGR 5.75% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025-2035 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Product, By End Use, By Region |

| Key Company Profiled | Brenntag SE, Univar Solutions Inc., IMCD N.V., Nexeo Solutions, Azelis Holdings S.A., Corteva Agriscience, Harima Chemicals, Inc., Helm AG, SABIC Innovative Plastics, Kraton Corporation, Groupe Charles André, DIC Corporation, Eastman Chemical Company, Merck Group, INEOS Group |

Chemical Distribution Market Opportunity

The Growing Demand For Sustainable and Green Chemicals Across the Globe Amid Rising Environmental Concerns Drives the Growth of the Market.

The growing demand for sustainable and green chemicals is a key opportunity for the growth of the chemical distribution market. The increasing demand for chemicals across various industries and the priority of industry, as well as the government worldwide, to adopt eco-friendly products and practices.

The shift helps and opens the door for chemical distributors to expand their reach and portfolios with biodegradable, bio-based, and less hazardous chemicals, meeting the needs of environmentally conscious consumers. These factors ensure compliance with evolving sustainability regulations, which helps create opportunities for the growth and expansion of the chemical distribution market.

Market Challenge

The Complex and Evolving Regulatory Compliance Across Different Industries The navigation of complex and evolving regulatory compliance across different regions hinders the growth of the chemical distribution market. Distributors must ensure the strict regulatory, safety, environmental, and transportation regulations according to the region and their conditions, which is a challenge for the growth of the market.

Ensuring compliance with the region and regulation requires constant monitoring, updated documentation, specialized storage and handling practices, and sometimes costly certifications, which hinders growth. Failure to meet these regulations can result in legal penalties, reputational damage, and disrupted supply chains, making regulatory complexity a persistent and critical hurdle for chemical distributors.

Segmental Insights

Product Insights

The commodity chemicals segment dominated the chemical distribution market in 2024. Commodity chemicals are basic, bulk chemicals that are produced in large volumes and serve as essential raw materials for a wide range of industries, including agriculture, manufacturing, textiles, and construction. These chemicals, such as acids, solvents, and industrial gases, are generally standardized and undifferentiated, making price and supply reliability key competitive factors.

The distribution of commodity chemicals focuses heavily on logistics efficiency, storage capabilities, and regulatory compliance due to the often-hazardous nature of these substances. While the margins are typically lower compared to specialty chemicals, the high volume and constant demand ensure a stable revenue stream for distributors operating in this segment.

The specialty chemicals segment expects significant growth in the chemical distribution market during the forecast period. Specialty chemicals are high-value, low-volume products tailored for specific applications across industries such as pharmaceuticals, personal care, food and beverage, electronics, and agriculture. Unlike commodity chemicals, specialty chemicals are performance-driven and often require technical expertise, customized formulations, and close collaboration with end-users.

Chemical Distribution Market Volume & Share, By Product Type, 2024 (%)

| By Product Type | Market Volume Share, 2024 (%) | Market Volume - (Million Tons) 2024 | Market Volume Share, 2034 (%) | Market Volume - (Million Tons) 2034 | CAGR |

| Specialty Chemicals | 23.57% | 56.41 | 31.68% | 139.45 | 9.47% |

| Commodity Chemicals | 76.43% | 182.91 | 68.32% | 300.73 | 5.10% |

| Total | 100% | 239.32 | 100% | 440.18 | 6.28% |

Their distribution involves not just logistics, but also regulatory support, quality assurance, and sometimes even product development services. Distributors in this segment focus on building long-term customer relationships, offering tailored solutions, and maintaining strong partnerships with manufacturers. This segment typically commands higher margins due to its complexity, innovation, and the critical role these chemicals play in specialized processes.

End Use Insights

The construction segment dominated the chemical distribution market in 2024. The construction segment in chemical distribution involves supplying a wide range of products used in building materials, infrastructure development, and architectural applications. These chemicals include adhesives, sealants, coatings, waterproofing agents, concrete additives, and insulation materials that enhance the durability, strength, and efficiency of construction projects.

Distributors serving this segment must ensure timely delivery, product consistency, and technical support to meet project specifications and regulatory standards. With increasing emphasis on sustainable and energy-efficient buildings, there is a growing demand for eco-friendly construction chemicals, offering opportunities for innovation and value-added services in this sector.

The pharmaceuticals segment expects significant growth in the chemical distribution market during the forecast period. The pharmaceutical segment in chemical distribution focuses on providing high-purity raw materials, active pharmaceutical ingredients (APIs), excipients, and intermediates essential for drug formulation and production. This segment demands strict compliance with regulatory standards such as Good Manufacturing Practices (GMP), along with meticulous quality control and traceability.

Chemical Distribution Market Volume & Share, By End-use, 2024 (%)

| By End-use | Market Volume Share, 2024 (%) | Market Volume (Million Tons) - 2024 | Market Volume Share, 2034 (%) | Market Volume (Million Tons) 2034 | CAGR |

| Industrial Manufacturing | 26.90% | 64.38 | 25.39% | 111.76 | 5.67% |

| Agriculture | 22.31% | 53.39 | 20.03% | 88.17 | 5.14% |

| Pharmaceuticals | 11.22% | 26.85 | 13.11% | 57.71 | 7.95% |

| Construction | 10.12% | 24.22 | 9.22% | 40.58 | 5.30% |

| Personal Care & Cosmetics | 8.11% | 19.41 | 10.00% |

44.02 | 8.53% |

| Food & Beverages | 7.03% | 16.82 | 8.00% | 35.21 | 7.67% |

| Automotive & Transportation | 6.21% | 14.86 | 7.21% | 31.74 | 7.88% |

| Others (Textiles, etc.) | 8.10% | 19.38 | 7.04% | 30.99 | 4.80% |

| Total | 100% | 239.32 | 100% | 440.18 | 6.28% |

Distributors play a crucial role in ensuring consistent supply, documentation, and technical support, especially as pharmaceutical companies increasingly rely on outsourced distribution to streamline operations. The growing demand for healthcare products, personalized medicine, and biotechnology solutions continues to drive expansion in this segment, making it one of the most regulated yet promising areas in chemical distribution.

Regional Insights

The Asia Pacific chemical distribution market is was estimated at USD 186.04 billion in 2025 and is projected to reach USD 326.01 billion by 2035, growing at a CAGR of 5.77% from 2025 to 2035. The Asia Pacific chemical distribution market stands at 109.91 million tons in 2025 and is forecast to reach 216.81 million tons by 2035, growing at a CAGR of 7.03% from 2025 to 2035.

The Asia-Pacific Growth Is Driven By Large Industrial Sectors Drive The Growth, Asia Pacific dominated the chemical distribution market in 2024. The growth is driven by large industrial sectors, which include healthcare, food, electronics, and pharmaceuticals. The Asia-Pacific region represents a dynamic and rapidly growing market for chemical distribution, driven by increasing industrial activity, urbanization, and rising demand across sectors such as agriculture, manufacturing, pharmaceuticals, and personal care. The region benefits from a strong manufacturing base and a growing middle class, which fuels consumption of both commodity and specialty chemicals. The region’s cost advantages and market potential make it a strategic focus for global expansion. Tailored services, local partnerships, and investment in supply chain capabilities are key to success in this competitive landscape.

Rapid Expansion in Various Industries Drives the Growth of the Market in the Country, India is an emerging and rapidly expanding market for chemical distribution, driven by robust growth in industries such as agriculture, pharmaceuticals, textiles, and construction. The country’s expanding manufacturing sector, favorable government policies, and increasing demand for both commodity and specialty chemicals create significant opportunities for distributors. As the market matures, strategic partnerships, digitalization, and sustainability initiatives will play a vital role in shaping the future of chemical distribution in 155,674 shipments of Chemical from Nov 2023 to Oct 2024 (TTM) exported by India. These exports were made by 7,393 Indian Exporters to 16,524 Buyers.

- The top three exporters of chemicals are China, the United States, and India.(Source: volza)

North America is a Mature And Highly Regulated Market for Chemical Distribution, Which Increases the Growth, North America is anticipated to grow in the chemical distribution market in the forecasted period. North America is a mature and highly regulated market for chemical distribution, characterized by well-developed infrastructure, advanced technology adoption, and a strong emphasis on safety and compliance. The region has a high demand for specialty chemicals used in industries such as pharmaceuticals, personal care, and high-performance manufacturing. Distributors in North America often focus on value-added services such as custom blending, formulation support, and regulatory consulting to differentiate themselves. While market growth is steady, key factors such as strict environmental regulations, making innovation, efficiency, and sustainability key priorities for continued success.

Chemical Distribution Market Volume & Share, By Region, 2024- 2034 (%)

| By Region | Market Volume Share, 2025(%) | Market Volume - 2024 (Million Tons) | Market Volume Share, 2034 (%) | Market Volume - (Million Tons) 2034 | CAGR |

| North America | 18.32% | 43.84 | 17.21% | 75.75 | 5.62% |

| Europe | 22.12% | 52.94 | 20.23% | 89.05 | 5.34% |

| Asia Pacific | 42.91% | 102.69 | 46.01% | 202.53 | 7.03% |

| Latin America | 8.55% | 20.46 | 7.43% | 32.71 | 4.80% |

| Middle East & Africa | 8.10% | 19.38 | 9.12% | 40.14 | 7.55% |

| Total | 100% | 239.32 | 100% | 440.18 | 6.28% |

The U.S. Market is Driven by a Strong Focus On Specialty Chemicals And Value-Added Services, The United States is one of the most established and sophisticated markets for chemical distribution, supported by advanced infrastructure, strict regulatory oversight, and a high level of technological integration. The market is largely driven by demand from industries such as healthcare, automotive, electronics, and consumer goods, with a strong focus on specialty chemicals and value-added services. Distributors in the U.S. often lead in adopting digital platforms, sustainability practices, and custom solutions to meet complex client needs. This drives the growth of the market in the country.

Recent Developments

- In March 2025, Centrium Energy SolutionsTM, the leading oil and gas distributor introduced the domestic distribution model for addressing issues in logistics, sourcing, and performance. (Source : oilfieldtechnology)

- In April 2025, Tilley Distribution announced the launch of AI-powered catalog by Knowde's AI platform, which is designed for the chemical industry and provides accurate connected data. The interface helps users to efficiently search, access documentation, team technical data, and request quotes directly within the catalog. (Souce : digitalcommerce360)

- April 2025, LLB Specialties, a key player in distributing specialty chemicals and ingredients across North America, announced a new collaboration with Kerry Group, a world-renowned provider of taste and nutrition solutions for the pharmaceutical industry and, food and beverage industry. The partnership aims to enhance the availability and quality of pharmaceutical lactose ingredients for use in life sciences applications. (Source: prnewswire)

Top Companies List

- Helm AG

- Univar Inc.

- Omya AG

- Jebsen& Jessen Offshore Pte. Ltd.

- TER Group

- Barentz B.V.

- Azelis Holding S.A.

- Solvadis

- Ashland, Inc.

- Brenntag AG

- Nexeo Solution Holding LLC

- ICC Chemicals, Inc.

Segments Covered in the Report

By Product

- Specialty Chemicals

- CASE

- Electronic

- Agrochemical

- Construction

- Specialty Resins & Polymers

- Commodity Chemicals

- Synthetic Rubber

- Petrochemicals

- Plastic & Polymers

- Explosives

- Others

By End Use

- Automotive & Transport

- Agriculture

- Construction

- Consumer Goods

- Industrial Manufacturing

- Textiles

- Pharmaceuticals

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait