Content

What is the Current Unsaturated Polyester Resin Market Size and Volume?

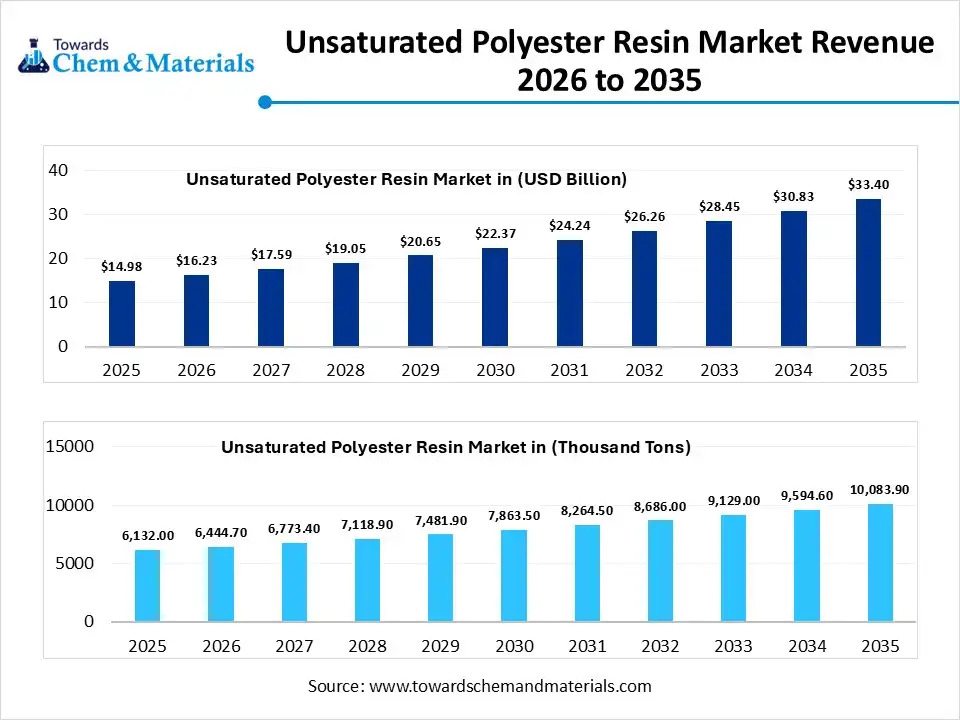

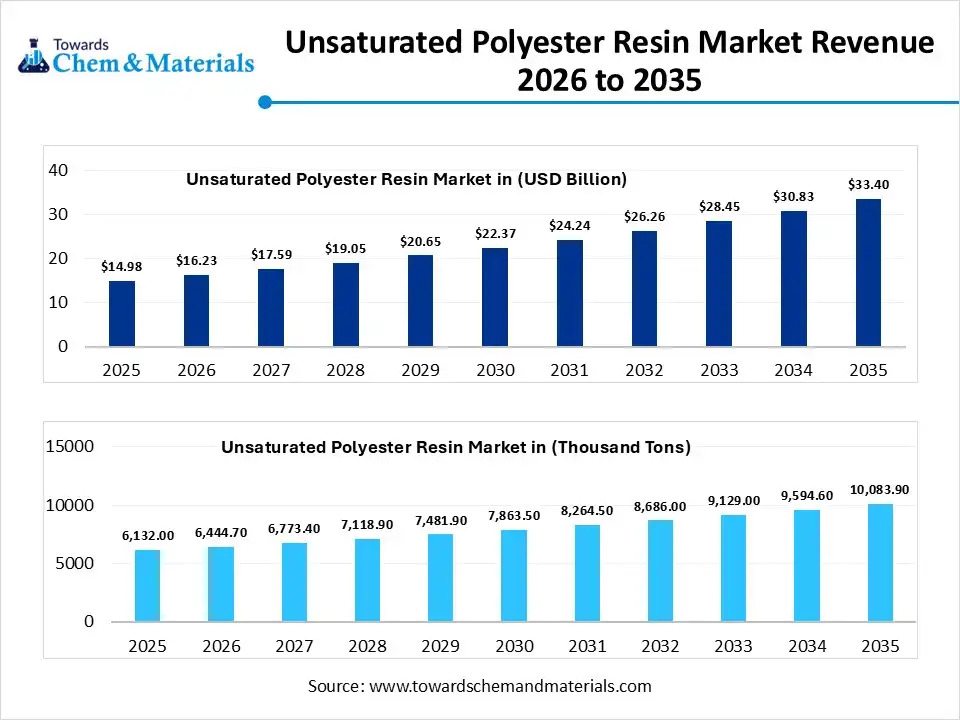

The global unsaturated polyester resin market size was estimated at USD 14.98 billion in 2025 and is expected to increase from USD 16.23 billion in 2026 to USD 33.40 billion by 2035, growing at a CAGR of 8.35% from 2026 to 2035. In terms of volume, the market is projected to grow from 6,132.00 thousand tons in 2025 to 10,083.90 thousand tons by 2035. growing at a CAGR of 5.10% from 2026 to 2035. Asia Pacific dominated the unsaturated polyester resin market with the largest volume share of 59.31% in 2025. The sectors such as marine, automotive, and construction have fueled the industry’s growth in recent years.

Report Highlights

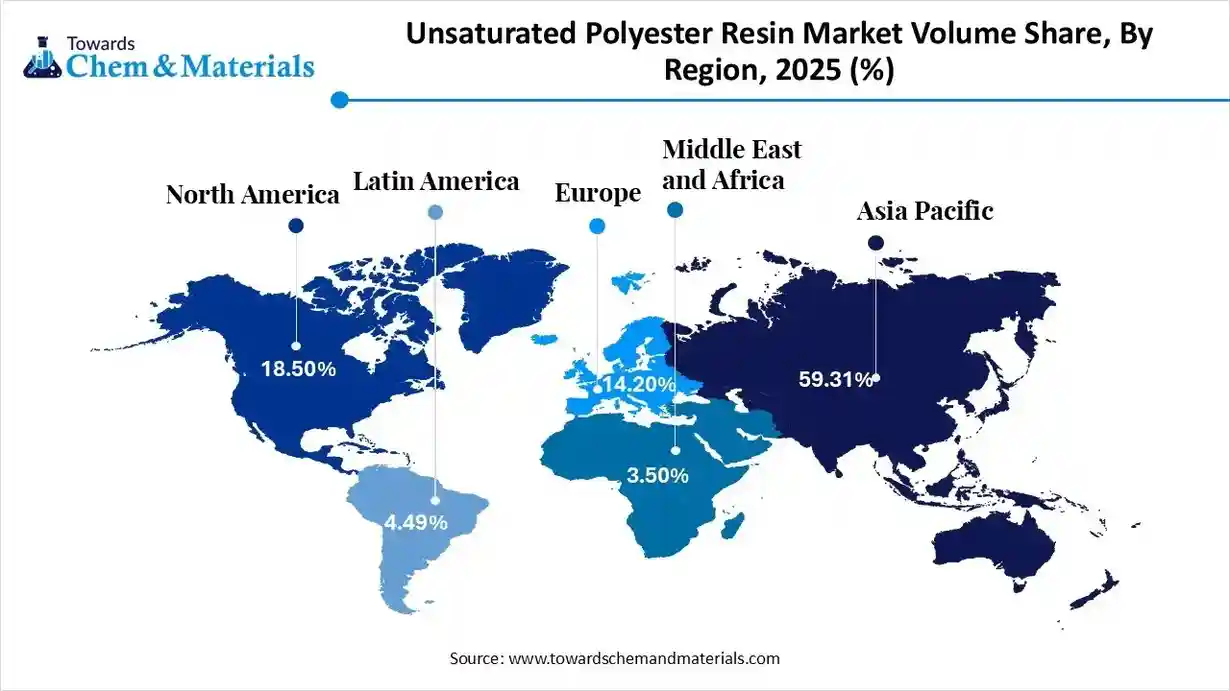

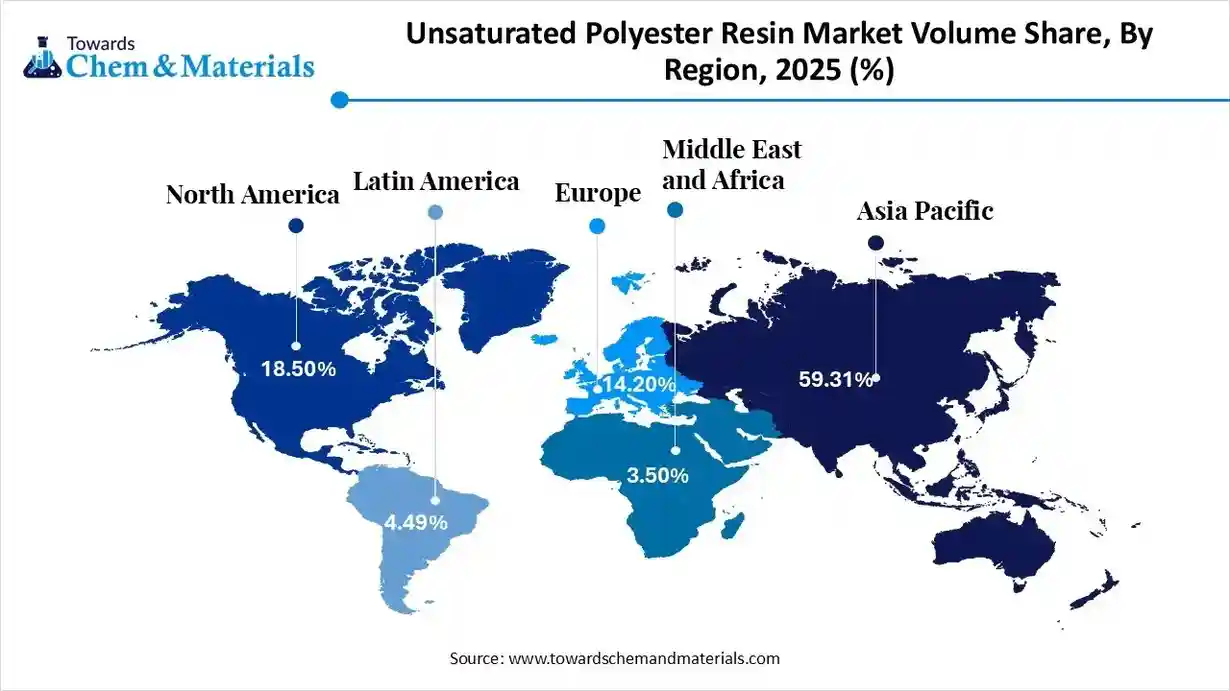

- The Asia Pacific dominated the unsaturated polyester resin market with the largest volume share of 59.31% in 2025.

- The unsaturated polyester resin market in North America is expected to grow at a substantial CAGR of 5.92% from 2026 to 2035.

- The Europe unsaturated polyester resin market segment accounted for the major volume share of 14.20% in 2025.

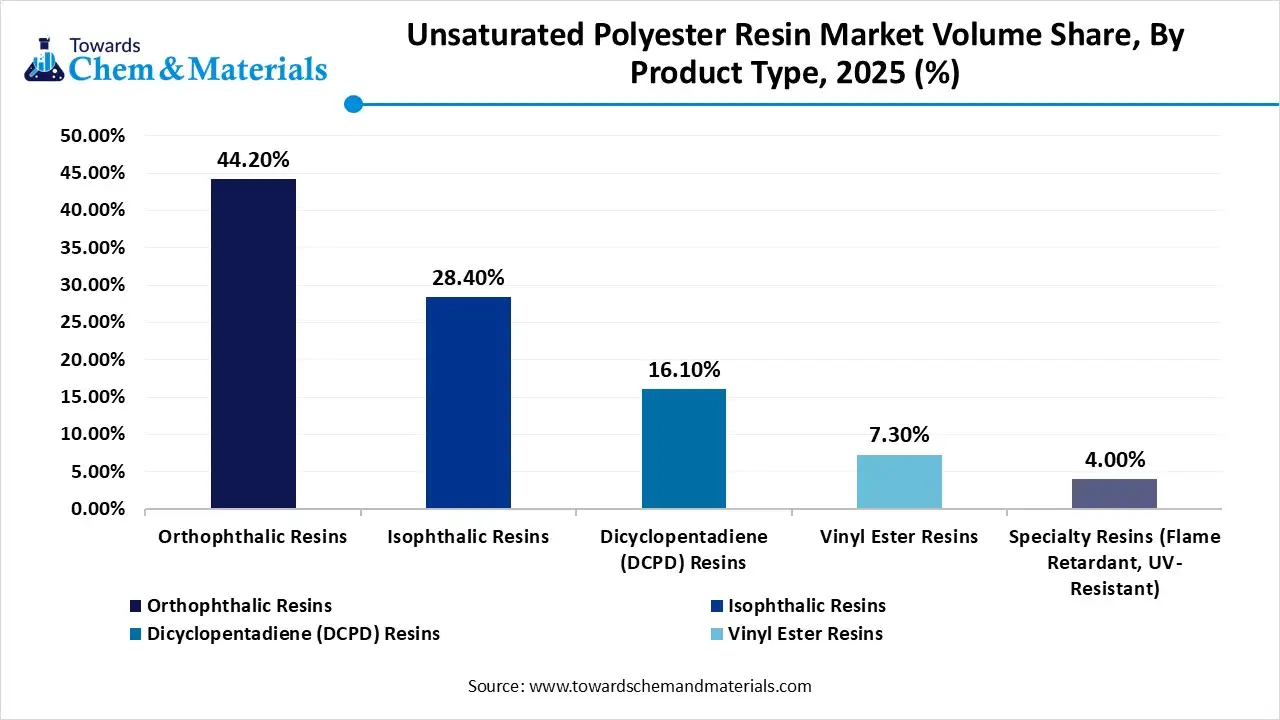

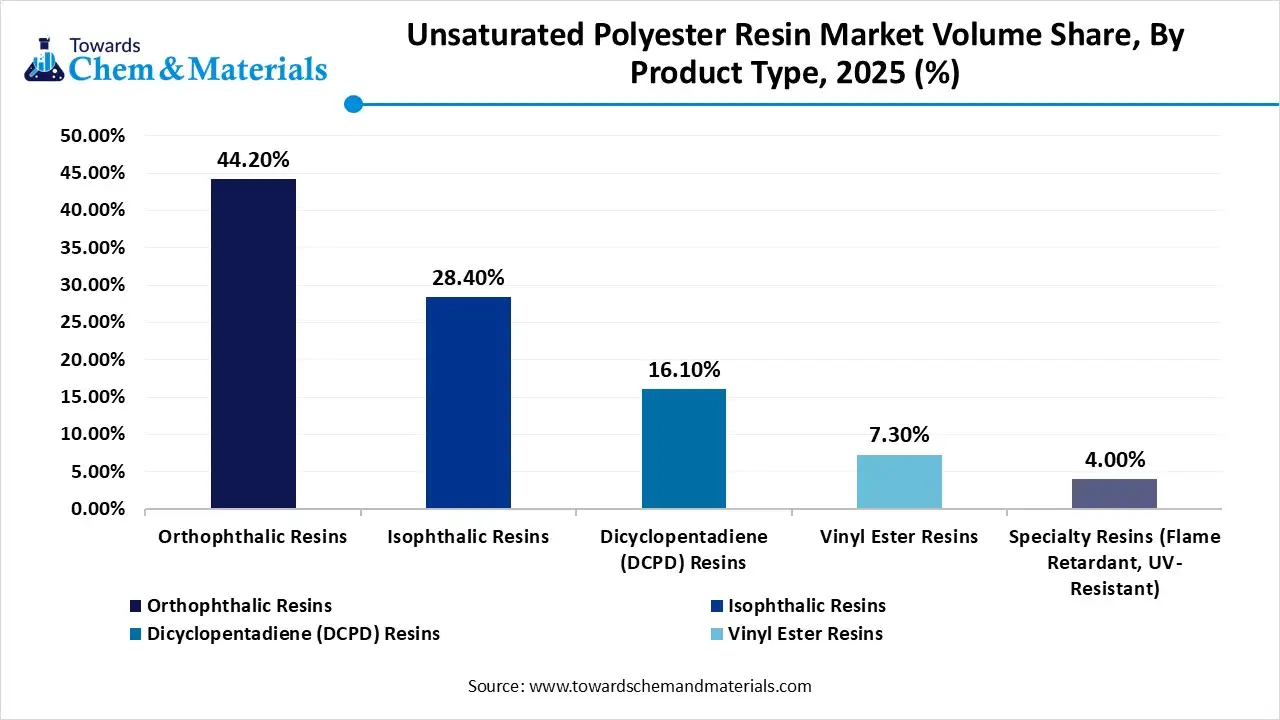

- By product type, the orthophthalic resins segment dominated the market and accounted for the largest volume share of 44.20% in 2025.

- By product type, the dicyclopentadiene (DCPD) resins segment is expected to grow at the fastest CAGR of 7.03% from 2026 to 2035 in terms of volume.

- By process, the open moulding resinsegment segment led the market with the largest revenue volume share of 41.5% in 2025.

- By form, the liquid resin segment dominated the market and accounted for the largest volume share of 82.0% in 2025.

- By end use, the building & construction segment led the market with the largest revenue volume share of 38.0% in 2025.

Why Saturated Polyester Resin Matters Today

The unsaturated polyester resin refers to the thermosetting polymer, which is primarily made by chemically reacting unsaturated acids with polyols. Also, by forming the three-dimensional cross-linked structure, the UPR transforms liquid into a rigid, heat-resistant, and durable solid. Moreover, the production sectors like coatings, composites, and moulded parts have seen under the heavy demand for unsaturated polyester resins in recent years.

Unsaturated Polyester Resin Market Trends:

- The emergence and need for purpose-built adhesives have generated value-added opportunities for industry participants in recent years. Moreover, several brands are seen in designing the reins for the specific performances from the specific industry nowadays, which include faster curing, high surface finish, and others.

- The shift towards the low process energy resin development is expected to pave the way for economic benefits in the manufacturing sector during the forecast period. Also, the manufacturers are focusing on redesigning resins that cure at low temperature of shorter cycle times instead of raw material sustainability these days.

- The sudden turn towards the technical understanding from buyers over price alone is likely to unlock new business opportunities for producers in the upcoming years. Also, the consumers are observed in comparing performance data and processing behaviours of resins in the current period.

Report Scope

| Report Attribute | Details |

| Market Size and Volume in 2026 | USD 16.23 Billion / 6444.7 Thousand Tons |

| Revenue Forecast in 2035 | USD 33.40 Billion / 10083.9 Thousand Tons |

| Growth Rate | CAGR 8.35% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Units Considered | Value (Billion / Million), Volume ( Thousand Tons) |

| Dominant Region | Asia Pacific |

| Segment Covered | By Product Type, By Manufacturing Process, By Form, By End-Use Sector, By Region |

| Key companies profiled | DIC Corporation , Ashland Inc. , Scott Bader Company Ltd. , Sino Polymer Co., Ltd. , Interplastic Corporation , Tianhe Resin Co., Ltd. , Swancor Holding Co., Ltd. , Eternal Materials Co., Ltd. , Upica Company Ltd., Allnex GMBH , MMP Industries Ltd. |

From Experimentation to Intelligent Resin Design

The market has experienced a greater technological shift, such as the adoption of performance-predictive development frameworks. Moreover, these frameworks prioritize consistency, scalability, and process alignment over traditional formulation experimentation. Also, the manufacturers increasingly focus on designing resins that behave reliably across different production environments, reducing downtime and material loss.

Trade Analysis of the Unsaturated Polyester Resin Market:

Import, Export, Consumption, and Production Statistics

- The United States has reached heavy polyester resin exports with 32,947 shipments, according to the published report.

- China has seen under the sophisticated export of the unsaturated polyester resin with 2,865 shipments, as per the latest survey.

Value Chain Analysis of the Unsaturated Polyester Resin Market:

- Distribution to Industrial Users : Unsaturated polyester resin is primarily distributed to industrial users in the construction, automotive, and marine sectors. Distribution channels increasingly focus on localized hubs to ensure prompt delivery for industrial timelines.

- Key Players: Polynt-Reichhold Group (Italy/USA) and AOC (USA)

- Chemical Synthesis and Processing: Chemical synthesis of unsaturated polyester resins (UPR) is primarily a polycondensation process where glycols react with dicarboxylic acids to form long-chain molecules, which are subsequently dissolved in a reactive monomer for industrial use.

- Key Players: INEOS Composites and Scott Bader Company Ltd

- Regulatory Compliance and Safety Monitoring: The unsaturated polyester resin (UPR) market is under significant pressure from evolving environmental and safety regulations, particularly regarding volatile organic compound (VOC) emissions and styrene handling.

- Key Agencies- EU REACH & CBAM and U.S. EPA (TSCA)

Unsaturated Polyester Resin Market Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas |

| United States | Environmental Protection Agency (EPA) | Toxic Substances Control Act (TSCA) | Reduction of styrene emissions |

| European Union | European Chemicals Agency (ECHA) | REACH Regulation (EC) 1907/2006 | Mandatory reporting of Carcinogenic, Mutagenic, or Reproductive Toxic (CMR) substances (with 16 new substances added in August 2025), and microplastic restrictions |

| China | State Administration for Market Regulation (SAMR) | GB 26572-2025 (China RoHS) | Aligning with international safety standards. |

Segmental Insights

Product Insights

How did the Orthophthalic Resins Segment Dominate the Unsaturated Polyester Resin Market in 2025?

The orthophthalic resins segment dominated the market with 44.20% industry share in 2025, due to their offerings such as performance, ease of use, and greater balance between cost in the current period. Moreover, having the simple processing behavior and wide raw material availability, the manager has increasingly preferred the orthopathalic resins in recent years.

The dicyclopentadiene (DCPD) resins segment is expected to grow with a rapid CAGR 7.03%, owing to it enable tougher, lighter, and faster processing materials. Also, by offering lower viscosity, better surface finish, and improved shrink control while improving the product quality, the dicyclopentadiene resin is likely to create its own space in the industry for the coming years.

Unsaturated Polyester Resin Market Volume and Share, By Product Type 2025-2035

| By Product Type | Market Volume Share (%), 2025 | Market Volume (Thousand Tons)2025 | Market Volume (Thousand Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| Orthophthalic Resins | 44.20% | 2,710.3 | 4,347.2 | 5.39% | 43.11% |

| Isophthalic Resins | 28.40% | 1,741.5 | 2,768.0 | 5.28% | 27.45% |

| Dicyclopentadiene (DCPD) Resins | 16.10% | 987.3 | 1,819.1 | 7.03% | 18.04% |

| Vinyl Ester Resins | 7.30% | 447.6 | 782.5 | 6.40% | 7.76% |

| Specialty Resins (Flame Retardant, UV-Resistant) | 4.00% | 245.3 | 367.1 | 4.58% | 3.64% |

Process Insights

Why does the Open Moulding Segment Dominate the Unsaturated Polyester Resin Market?

The open moulding resins segment dominated the market with 41.5% share in 2025, owing to its operational simplicity and cost efficiency. This processing method allows manufacturers to produce complex shapes without investing in high-pressure equipment or closed tooling systems.

The closed molding (RTM/Infusion) segment is expected to grow at a rapid CAGR, akin to its ability to deliver enhanced process control and superior product uniformity. Also, by enclosing the resin system, manufacturers reduce environmental exposure and material loss. Moreover, this approach improves workplace safety and ensures compliance with evolving regulatory standards.

Form Insights

How did the Liquid Resin Segment Dominate the Unsaturated Polyester Resin Market in 2025?

The liquid resin segment dominated the market with 82.0% share in 2025, akin to it is easy to handle, mix, and apply across multiple processing methods. It flows well into molds, wets fibers efficiently, and allows visual inspection during processing. Liquid resins also support additives, pigments, and fillers without complex equipment.

The powder resin segment is expected to grow with a rapid CAGR due to it supports clean, controlled, and automated manufacturing. Powder formats eliminate solvent handling, reduce emissions, and allow precise material dosing. They also improve shelf life and storage safety. Powder resins enable uniform melting and curing, which improves product consistency.

End Use Insights

How did the Building & Construction Segment Dominate the Unsaturated Polyester Resin Market in 2025?

The building & construction segment dominated the market with 38.0% share in 2025, akin to its high-volume and repetitive demand for durable, cost-effective materials. Moreover, unsaturated polyester resins are widely used in panels, roofing, pipes, and structural components. They offer corrosion resistance, design flexibility, and long service life.

The marine segment is expected to grow with a rapid CAGR due to it demands lightweight, corrosion-resistant, and high-strength materials. Also, the marine structures face constant exposure to water, salt, and stress, making advanced UPR systems ideal.

Regional Insights

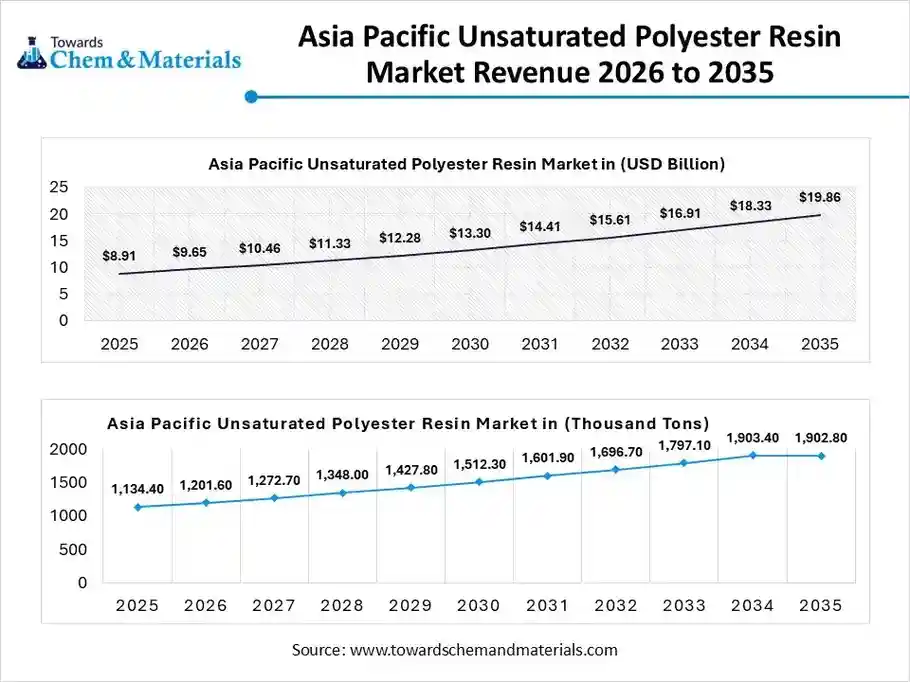

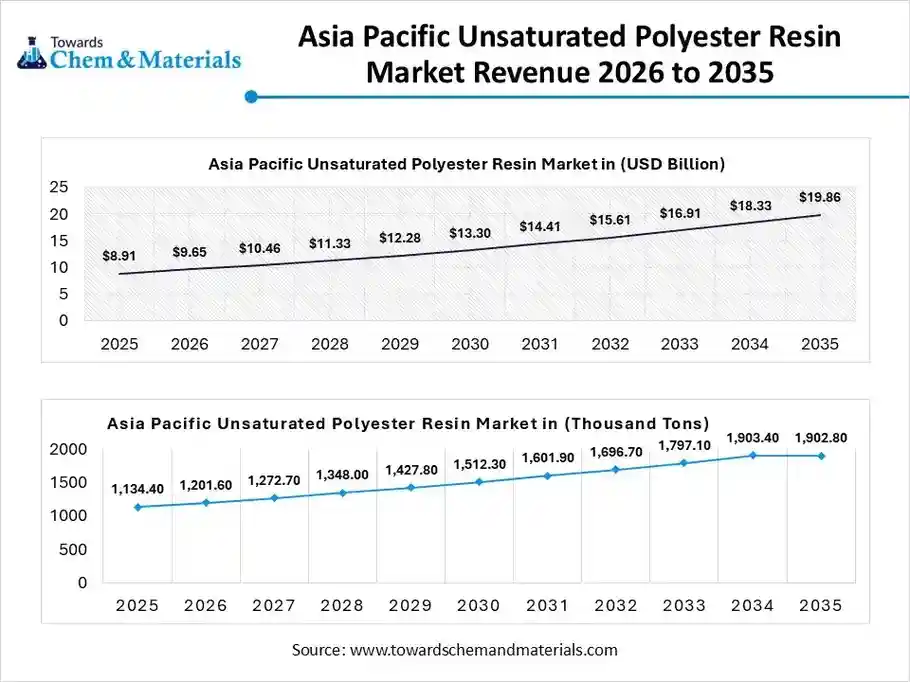

The Asia Pacific unsaturated polyester resin market size was valued at USD 14.98 billion in 2025 and is expected to be worth around USD 33.40 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 8.35% over the forecast period from 2026 to 2035. The Asia Pacific unsaturated polyester resin market volume was estimated at 3,636.9 thousand tons in 2025 and is projected to reach 6,281.3 thousand tons by 2035, growing at a CAGR of 4.37% from 2026 to 2035.

Asia Pacific dominated the market with 59.31% share in 2025, due to the heavier manufacturing base and advanced infrastructure development needs. Moreover, the region has seen a significant increase in the consumption of high volumes of cost-effective materials for sectors like transport, housing, and industrial goods, which is leading the sales of industry nowadays. Moreover, the regional manufacturers have been actively demanding versatile resins in recent years.

Volume Consistency Supports China’s Market Leadership

China maintained its dominance in the market, owing to higher domestic material needs and consumption. Also, the sudden increase in infrastructure development and transportation components has created lucrative opportunities for the unsaturated polyester resin manufacturers. Moreover, the country has seen in focusing on volume consistency these days.

North America Unsaturated Polyester Resin Market Examination

The North America unsaturated polyester resin market volume was estimated at 1,134.4 Thousand Tons in 2025 and is projected to reach 1,902.8 Thousand Tons by 2035, growing at a CAGR of 5.92% from 2026 to 2035.North America is expected to capture a major share of the market with a rapid CAGR, owing to the increasing demand for the high performance resins in recent years. Also, having advanced technology access has maintained quality and precision in the rein production in the current period in the region. Also, the sectors like electric vehicle, renewable energy, and aerospace have been seeking advanced resin systems that can provide a huge consumer base to the URP manufacturers.

Unsaturated Polyester Resin Market Volume and Share, By Region 2025-2035

| By Region | Market Volume Share (%), 2025 | Market Volume (Thousand Tons)2025 | Market Volume (Thousand Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| North America | 18.50% | 1,134.4 | 1,902.8 | 5.92% | 18.87% |

| Europe | 14.20% | 870.7 | 1,221.6 | 3.83% | 12.11% |

| Asia Pacific | 59.31% | 3,636.9 | 6,281.3 | 6.26% | 62.29% |

| Latin America | 4.49% | 275.3 | 404.7 | 4.37% | 4.01% |

| Middle East & Africa | 3.50% | 214.6 | 273.6 | 2.73% | 2.71% |

Innovation and Investment Power United States Unsaturated Polyester Resin Market

The United States is expected to emerge as a prominent country for the market in the coming years, akin to the heavy investment toward the advanced and high-performance resin production. Moreover, factors like consistency, compliance with stricter standards, and quality have accelerated the industry growth in the country nowadays.

Europe Unsaturated Polyester Resin Market Evaluation

The Europe unsaturated polyester resin market volume was estimated at 870.7 Thousand Tons in 2025 and is projected to reach 1,221.6 Thousand Tons by 2035, growing at a CAGR of 3.83% from 2026 to 2035. The unsaturated polyester resin market in Europe is expected to grow at a substantial CAGR of 3.83% from 2026 to 2035.Europe is a notably growing region, owing to its focus on sustainable materials, renovation projects, and advanced engineering applications in recent years. Also, the region emphasizes replacing older materials with durable, lightweight composites. Demand is driven by transportation upgrades, energy-efficient buildings, and industrial modernization.

Automotive and Machinery Propel Resin Adoption

Germany is expected to gain a major industry share, akin to the engineering excellence and industrial precision of the country. Moreover, the unsaturated polyester resins are used in automotive components, machinery, and infrastructure renovation. The market in Germany highlights material efficiency, durability, and compliance with environmental standards.

South America Unsaturated Polyester Resin Market Evaluation

The South America unsaturated polyester resin market volume was estimated at 275.3 Thousand Tons in 2025 and is projected to reach 404.7 Thousand Tons by 2035, growing at a CAGR of 4.37% from 2026 to 2035. South America is a notably growing region due to industrial recovery, infrastructure investment, and rising domestic manufacturing. The region is observed in modernizing transportation systems, housing, and industrial facilities, which increases resin demand. Manufacturers are shifting toward local production to reduce import dependency.

Rising Construction Lifts Polyester Resin Demand

Brazil is expected to gain a major industry share, akin to construction activity, industrial production, and domestic material demand. Unsaturated polyester resins are used in housing, transportation, and consumer products in the country these days. The country has been strengthening local manufacturing to reduce imports in recent years.

Unsaturated Polyester Resin Market Study in the Middle East and Africa

The Middle East & Africa unsaturated polyester resin market volume was estimated at 214.6 Thousand Tons in 2025 and is projected to reach 273.6 Thousand Tons by 2035, growing at a CAGR of 2.73% from 2026 to 2035. The Middle East and Africa are expected to capture a notable share of the industry, due to large-scale infrastructure development and industrial diversification of the region. Also, regional governments are investing in urban expansion, industrial zones, and material self-sufficiency. Unsaturated polyester resins are favored for their durability in harsh environments.

Economic Diversification Fuels Saudi Resin Growth

Saudi Arabia is expected to emerge as a prominent country, akin to economic diversification and large-scale construction projects. Unsaturated polyester resins are seen in used in infrastructure, industrial facilities, and material manufacturing in the country. Also, the local availability of feedstock supports downstream material development.

Recent Developments

- In September 2024, Excel Composites finalized a deal of purchasing more than 100 tons of Envirez bio-based unsaturated polyester thermoset resin from one of the leading suppliers called Ineos. This deal will minimize the use of the hydrocarbon-derived resins in the coming years, as per the published report by the company.(Source: www.plasticstoday.com)

Top Companies in the Unsaturated Polyester Resin Market & Their Offerings:

- Polynt-Reichhold Group: A leading global vertically integrated manufacturer of specialty chemicals, specializing in the production of unsaturated polyester resins and gelcoats for the composites, coatings, and construction markets.

- AOC, LLC: A premier global supplier of high-quality resins, gelcoats, and colorants, known for developing advanced unsaturated polyester and vinyl ester technologies for a wide range of industrial applications.

- INEOS Composites: A major business unit of INEOS that manufactures a broad portfolio of unsaturated polyester resins and specialty coatings, focusing on high-performance solutions for the marine, transportation, and infrastructure sectors.

- BASF SE: As a world-leading chemical company, BASF produces essential precursors and innovative additives used to enhance the performance, durability, and sustainability of unsaturated polyester resin formulations.

- DIC Corporation

- Ashland Inc.

- Scott Bader Company Ltd.

- Sino Polymer Co., Ltd.

- Interplastic Corporation

- Tianhe Resin Co., Ltd.

- Swancor Holding Co., Ltd.

- Eternal Materials Co., Ltd.

- Upica Company Ltd.

- Allnex GMBH

- MMP Industries Ltd.

Segments Covered in the Report

By Product Type

- Orthophthalic Resins

- Isophthalic Resins

- Dicyclopentadiene (DCPD) Resins

- Vinyl Ester Resins

- Specialty Resins

By Manufacturing Process

- Open Molding

- Closed Molding

- Continuous Processes

By Form

- Liquid Resin

- Powder Resin

- Prepregs & Pastes

By End-Use Sector

- Building & Construction

- Marine

- Automotive & Transportation

- Electrical & Electronics

- Renewable Energy

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa