Content

Transparent Ceramics Market Size and Forecast 2025 to 2034

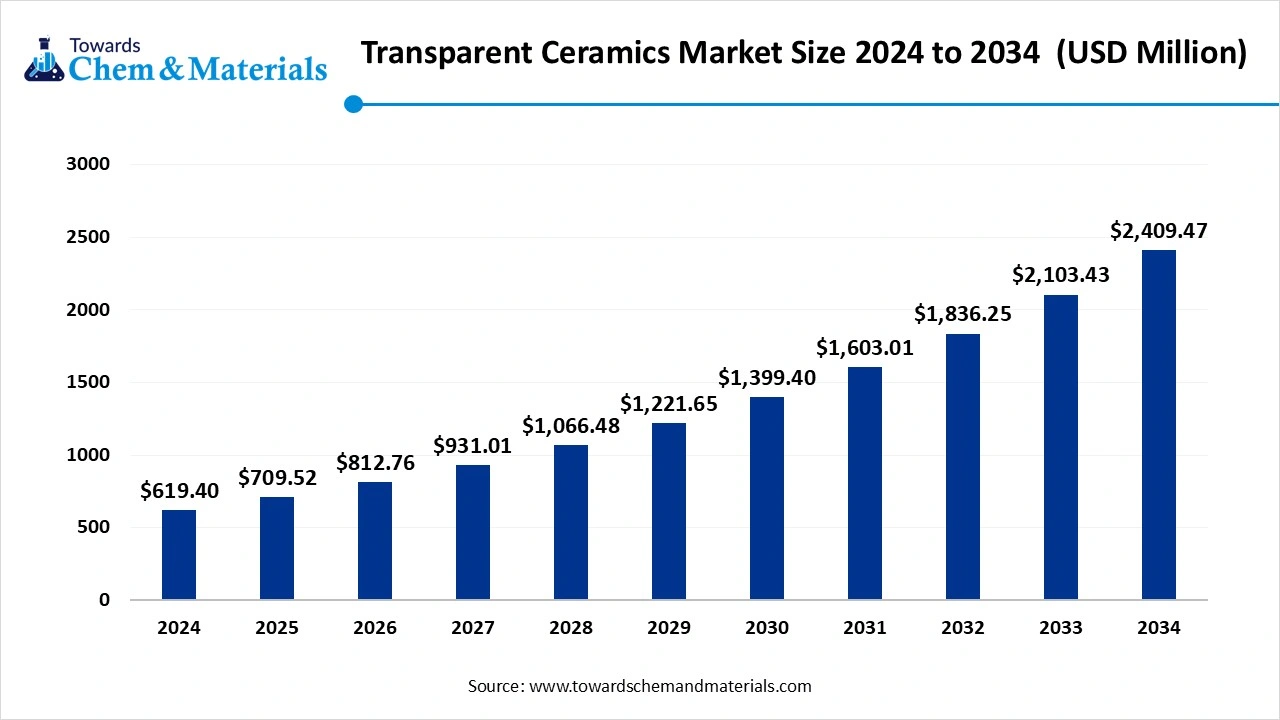

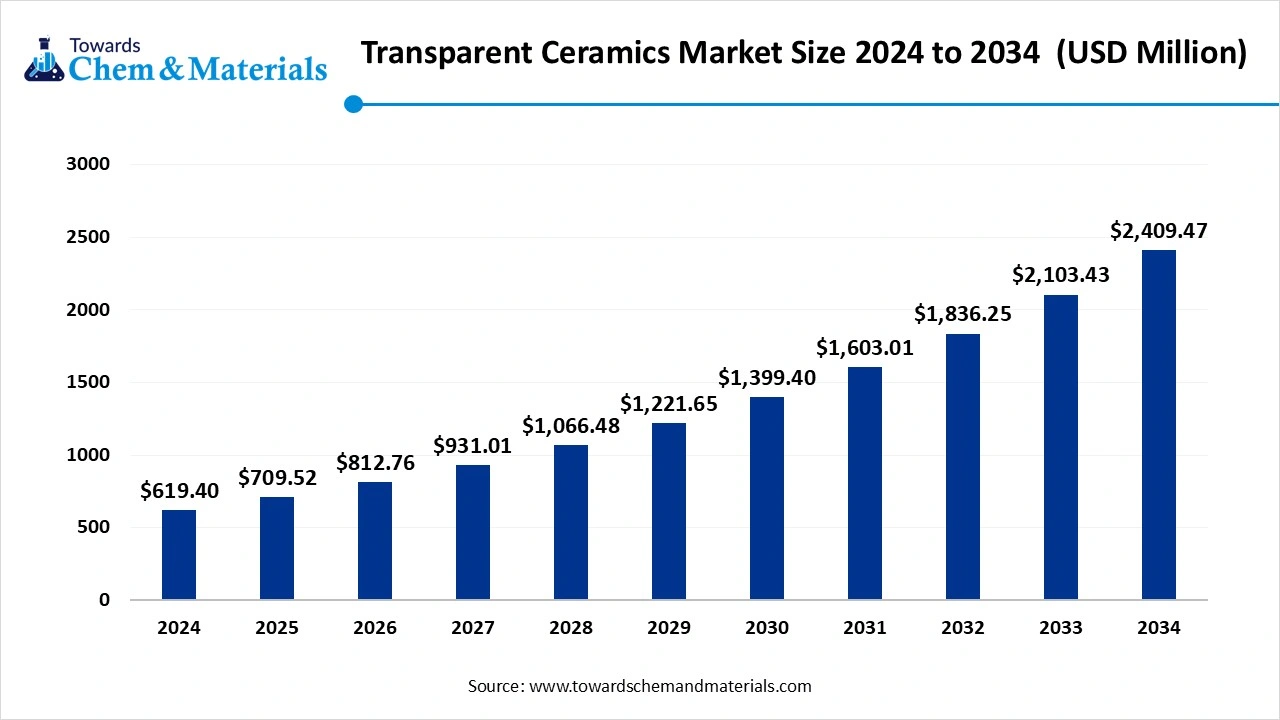

The global transparent ceramics market size was reached at USD 619.40 million in 2024 and is expected to be worth around USD 2,409.47 million by 2034, growing at a compound annual growth rate (CAGR) of 14.55% over the forecast period 2025 to 2034. The demand for transparent ceramics is rising due to their exceptional optical, thermal, and mechanical properties, which make them suitable for aerospace, defense, healthcare, and electronics applications.

Key Takeaways

- By region, North America dominated the transparent ceramics market in 2024, holding the largest market share of 33% due to strong R&D capabilities, advanced manufacturing infrastructure, and high demand in defense, aerospace, and medical sectors.

- By region, Asia Pacific is expected to grow fastest, driven by increasing investments in electronics, defense modernization, and medical innovation, along with the rising adoption of durable optical materials.

- By material type, sapphire held the largest share of 35% in 2024 due to its excellent optical clarity, scratch resistance, and widespread use in aerospace, electronics, and medical devices.

- By application, YAG (Yttrium Aluminum Garnet) is the fastest-growing material type, supported by rising applications in laser systems, photonics, and diagnostic imaging tools.

- By application, optics & optoelectronics dominated the market with a market share of 40% in 2024 owing to extensive use in lenses, IR windows, sensors, and precision optical systems across industrial and consumer applications.

- By application, defense & security is the fastest-growing application segment, fueled by increasing adoption of transparent ceramics in ballistic armor, sensor housings, and infrared surveillance systems.

- By product type, ceramic sheets held the largest share of 38% in 2024, due to their broad usage in transparent armor, IR covers, and large protective windows for defense and industrial settings.

- By product type, ceramic lenses are growing at the fastest rate, with growing demand from compact optical systems in lasers, night vision, medical diagnostics, and wearable devices.

- By end user, aerospace and defense dominated the end-user segment with 45% of the market share in 2024, given the material's crucial role in high-performance optics, cockpit protection, and guidance systems.

- By end user, consumer electronics is the fastest-growing end-use sector, as manufacturers increasingly adopt transparent ceramics in smartphones, camera lenses, and wearable tech for durability and optical precision.

Market Overview

The optically clear polycrystalline materials known as transparent ceramics are renowned for their exceptional optical performance, mechanical strength, and heat resistance. These ceramics, in contrast to conventional glass, provide exceptional hardness and durability in harsh environments, which makes them appropriate for high-energy laser systems, infrared domes, and bulletproof windows. The demand for transparent ceramics is growing internationally due to increased demand in the electronics, healthcare, aerospace, and military industries.

Which Factor is Driving the Transparent ceramics market?

A major factor driving the transparent ceramics market is the increased military spending on advanced optics. Governments are investing heavily in transparent ceramic-based infrared domes, windows, and armor for enhanced durability and visibility in combat. For instance, companies like Surmet Corporation have been actively involved in supplying transparent ceramic components to defense programs, supporting consistent market growth.

Market Trends

- Increased demand for infrared applications :Transparent ceramics are gaining traction in infrared optics for defense, night vision systems, and thermal imaging due to their durability and clarity across a broad wavelength range.

- Rising healthcare applications : Medical lasers, endoscopic lenses, and dental diagnostics increasingly incorporate transparent ceramics for better performance and longevity.

- Smartphone and consumer electronics integration : Sapphire-based transparent ceramics are being used for scratch-proof screens and camera lenses in smartphones and wearables, boosting consumer electronics demand.

- Focus on lightweight armor solutions : The defense industry is shifting to lightweight yet tough transparent armor systems, increasing the relevance of transparent ceramics over traditional glass.

Report Scope

| Report Attribute | Details |

| Market Size in 2025 | USD 709.52 Million |

| Expected Size by 2034 | USD 2,409.47 Million |

| Growth Rate from 2025 to 2034 | CAGR 14.55% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | North America |

| Segment Covered | By Material Type, By Application, By Product Type, By End-Use Industry, By Region |

| Key Companies Profiled | CoorsTek Inc., CeramTec GmbH, Surmet Corporation, Kyocera Corporation, Saint-Gobain Ceramics, Schott AG, Morgan Advanced Materials, Ceramics Ltd., Rohm and Haas (Dow Chemical), Jiangsu Lida Optoelectronics Co., Ltd., Alcoa Corporation, Heraeus Holding GmbH, Mach 1 Inc., Jiangxi Yinghe Technology Co., Ltd., Advanced Ceramic Materials, ORCO Group, Shanghai Nanyang Special Ceramics Co., Ltd., Norplex-Micarta, Sapphire Technology Ltd., Tosoh Corporation |

Market Opportunity

Infrared and Optoelectronic Devices

The use of transparent ceramics for infrared windows laser systems and photonic devices is growing in response to the increased demand for sophisticated surveillance thermal imaging and night vision systems. In the industrial and security sectors where precision optics are essential their exceptional transmission over a broad spectral range offers substantial growth potential. Homeland security border control and high-end industrial sensing are areas with the highest demand. Transparent ceramics also help powerful laser systems become more durable and clear which promotes their development in scientific research and materials processing.

Market Challenge

Higher Cost Of Production

The high cost of production and intricate manufacturing process are two of the biggest obstacles facing the transparent ceramics market. Transparent ceramics are more expensive overall because they require sophisticated sintering methods exact temperature control and pricey raw materials like spinel or ALON unlike conventional glass or plastics. Additionally mass production is challenging due to low yield rates during fabrication and limited scalability. The market is also contested by substitute transparent materials like polycarbonates and high-strength glass composites which are more affordable for certain uses. Particularly in high-performance industries like aerospace and defense, maintaining constant optical quality and removing microstructural flaws further increases the manufacturing burden.

Regional Insights

North America dominated the transparent ceramics market in 2024, driven by strong R&D capabilities, medical technology breakthroughs, and increased defense spending. The region has remained at the forefront of the adoption of transparent ceramics due to its focus on creating strong, lightweight optical materials for the military, aerospace, and healthcare industries. Ceramic manufacturers are still working with major defense and aerospace contractors to develop innovative infrared domes and lightweight armor systems. Additionally, the demand for high-precision transparent ceramics in imaging and surgical instruments is strengthened by the existence of a reputable medical device industry.

Asia Pacific expects the fastest growth in the market during the forecast period, fueled by expanding electronics manufacturing, growing investment in defense modernization, and the rapid evolution of healthcare infrastructure. The region is emerging as a major hub for transparent ceramic production and innovation, supported by strong demand across both industrial and consumer electronics sectors. Defense organizations and private firms are adopting advanced optical materials for high-performance surveillance, sensors, and targeting systems. Simultaneously, the thriving consumer electronics market is boosting the use of transparent ceramics in devices like smartphones, wearables, and optical components.

Segmental Insights

Material Type Insights

Why Did the Sapphire Segment Dominates the Transparent ceramics market In 2024?

Sapphire segment dominates the transparent ceramics market in 2024, because of its remarkable chemical resistance, optical transparency, and hardness. It is widely utilized in endoscopic lenses, military optics, and smartphone parts. Because of its ability to withstand harsh conditions, the material is the material of choice for high-stress and long-life applications, especially in aerospace and defense settings where dependability is essential. The substance is also useful for both visible and infrared applications because it works with a variety of wavelengths. To lower production costs and enhance quality, manufacturers are still investing in sapphire growth technologies.

Yttrium Aluminum Garnet (YAG) segment expects the fastest growth in the market during the forecast period, fueled by its growing application in medical imaging devices, optical isolators, and laser systems. Excellent thermal conductivity, optical clarity, and structural integrity are all provided by YAG. The growing global need for non-invasive surgical techniques and solid-state lasers is fueling its ascent. Additionally, this substance is used in photonic devices and high-energy laser cavities where resistance to thermal shock is essential. The performance of YAG in precision optics is being further enhanced by developments in doping and sintering technologies.

Application Insights

Why Did the Optics and Optoelectronics Segment Held the Largest Transparent ceramics market Share In 2024?

Optics and Optoelectronics segment dominate the transparent ceramics market in 2024, because of the great transmittance, hardness, and thermal stability of transparent ceramics. Infrared windows, lenses, laser optics, and photonics equipment all make extensive use of them. The use of these materials is becoming more widespread in the optics sector due to advancements in photonic sensors, augmented reality (AR), and sophisticated surveillance. They are also perfect for aerospace and space optics because of their dependability in high-temperature and high-radiation settings. For highly sought-after optical paths, industries are increasingly selecting transparent ceramics over glass.

Defense and Security segment expects the fastest growth in the market during the forecast period, because more money is being spent on sensor enclosures, IR domes, and protective armor. Advanced protective systems are made possible by transparent ceramics, which provide a stronger, lighter substitute for conventional ballistic glass. The need for these ceramics in armored vehicles, drones, and targeting systems is growing quickly as military programs modernize. Their wide spectral range and ability to withstand combat stress are also driving their use in unmanned platforms and thermal imaging. Lightweight, specially designed solutions are being developed to satisfy the optical requirements unique to the defense industry.

Product Type Insights

Why Did the Ceramic Sheets Segment Dominate Transparent ceramics market In 2024?

Ceramic Sheets segment dominates the market in 2024, the product segment due to their extensive application in viewing windows, IR sensor covers, and bulletproof glass. Because of their consistent thickness, high flexural strength, and optical clarity, they are perfect for applications that need protection and visibility. For reliable, extensive deployments, these sheets are preferred in the industrial and defense sectors. Their scalability and resilience to physical impact without compromising transparency help the aerospace and armored vehicle industries achieve mass production. Their environmental and ballistic resistance is also being improved by advancements in ceramic lamination.

Ceramic Lenses segment expects the fastest growth in the market during the forecast period, because of their growing use in wearable electronics, laser systems, and night vision optics. Ceramic lenses are becoming more popular as the electronics and optics sectors shrink in size because they provide better clarity, durability, and heat resistance in small systems, particularly in smart devices and biomedical instruments. Additionally, they are becoming important parts of high-resolution imaging systems where high hardness and minimal distortion are essential. Medical and industrial inspection tools are in greater demand due to the development of automated and AI-driven diagnostics.

End-Use Industry Insights

Why Did the Aerospace and Defense Segment Dominate the Transparent ceramics market In 2024?

Aerospace and defense segment dominate the transparent ceramics market in 2024, because space-grade sensors cover missile guidance systems, and cockpit displays all depend on transparent ceramics. The materials provide the strength, thermal endurance, and optical clarity required for vital aerospace missions. The demand for satellite systems and hypersonic technology is still high due to rising investment. These ceramics are also preferred for use in space telescope components, infrared tracking, and unmanned aerial vehicles. Reliable high-performance optical materials are becoming increasingly popular in orbital sensors and new-generation spacecraft as space exploration missions spread throughout the world.

Consumer electronics segment expects the fastest growth in the market during the forecast period, due to the expanding use of transparent ceramics in smartphone displays, camera lenses, and wearables. The trend toward sleek, scratch-resistant, and durable designs is pushing manufacturers to adopt materials like sapphire and ALON, ensuring device longevity and clarity. Transparent ceramics also support facial recognition and biometrics through IR-transparent sensor windows. As device makers seek lighter and stronger display materials, transparent ceramics provide a next-gen alternative to traditional glass and polymers.

Recent Developments

- In March 2025, Corning Incorporated launched Corning® Gorilla® Glass Ceramic, a new transparent glass-ceramic material built to improve drop performance in mobile device covers. The product blends the transparency of glass with the toughness of ceramics, targeting smartphones and wearables. It marks an important expansion of Corning’s flagship Gorilla Glass portfolio.(Source: https://www.corning.com )

- In July 2025, Murata Manufacturing announced the introduction of its latest line of transparent ceramic products, showcased at an international exhibition. Although the specific date was not disclosed, the products demonstrated remarkable strength and optical clarity, suitable for electronics, sensors, and emerging medical applications. This reflects Murata’s drive to innovate in high-performance ceramic solutions.(Source: https://ggsceramic.com)

Transparent ceramics market Top Companies

- CoorsTek Inc.

- CeramTec GmbH

- Surmet Corporation

- Kyocera Corporation

- Saint-Gobain Ceramics

- Schott AG

- Morgan Advanced Materials

- Ceramics Ltd.

- Rohm and Haas (Dow Chemical)

- Jiangsu Lida Optoelectronics Co., Ltd.

- Alcoa Corporation

- Heraeus Holding GmbH

- Mach 1 Inc.

- Jiangxi Yinghe Technology Co., Ltd.

- Advanced Ceramic Materials

- ORCO Group

- Shanghai Nanyang Special Ceramics Co., Ltd.

- Norplex-Micarta

- Sapphire Technology Ltd.

- Tosoh Corporation

Segments Covered

By Material Type

- Aluminum Oxide (Al2O3)

- Sapphire

- Spinel

- Yttrium Aluminum Garnet (YAG)

- Zirconia (ZrO2)

- Others

By Application

- Optics and Optoelectronics

- Defense and Security

- Medical Devices

- Energy & Power

- Electronics

- Others

By Product Type

- Ceramic Sheets

- Ceramic Lenses

- Ceramic Windows

- Ceramic Tubes and Cylinders

By End-Use Industry

- Aerospace and Defense

- Medical

- Consumer Electronics

- Automotive

- Energy and Power

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia