Content

Silica For S-SBR Market Size and Forecast 2025 to 2034

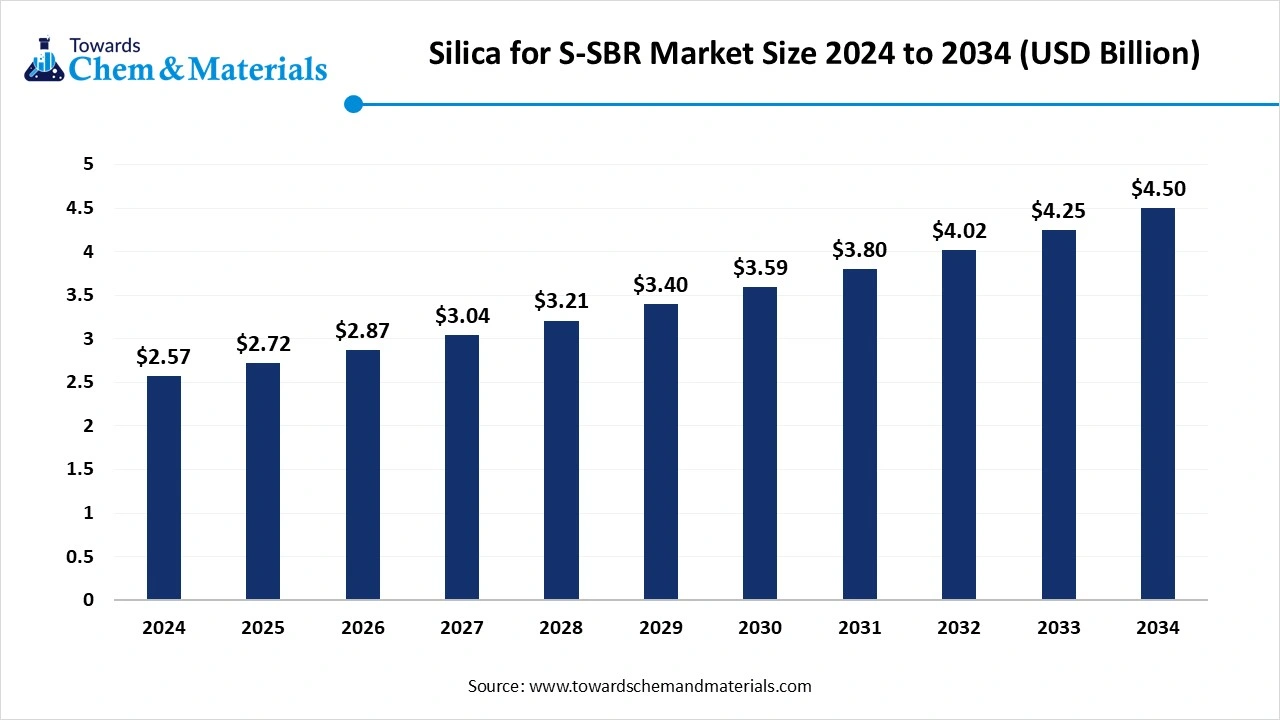

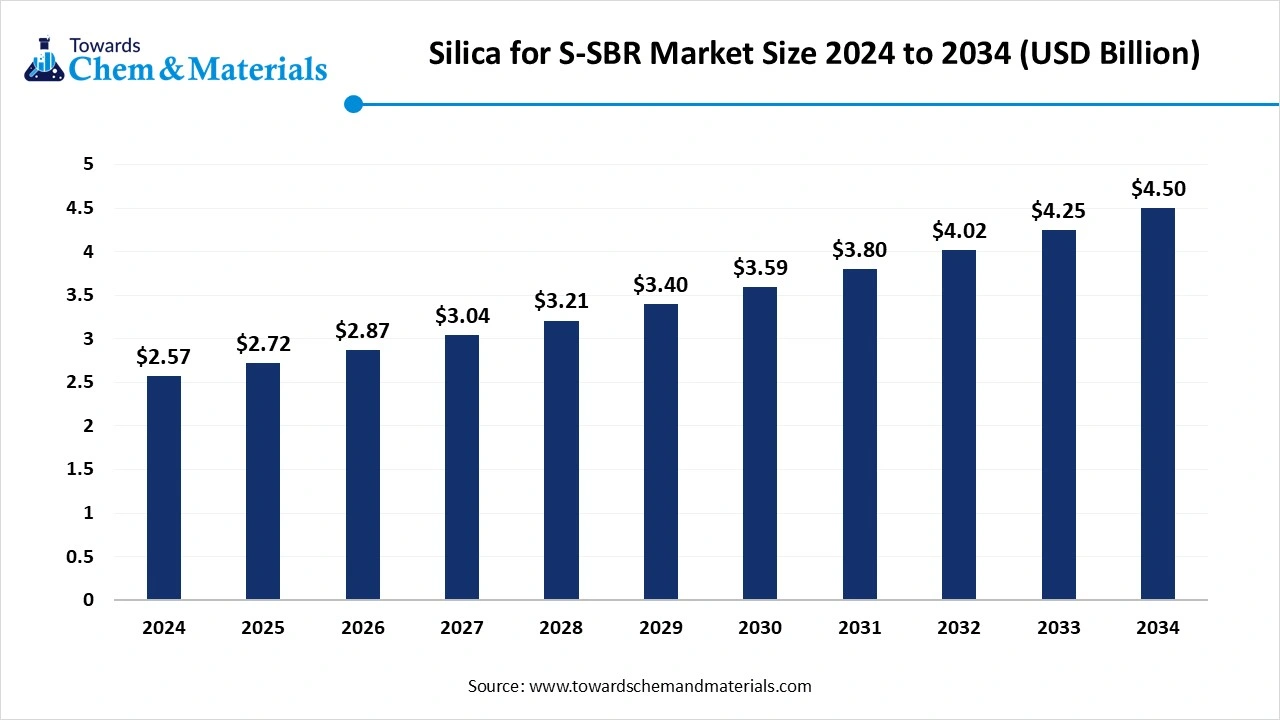

The global silica for s-sbr market size is calculated at USD 2.57 billion in 2024, grew to USD 4.50 billion in 2025, and is projected to reach around USD 4.50 billion by 2034. The market is expanding at a CAGR of 5.75% between 2025 and 2034. The growing demand from automotive & construction applications and the rapid growth of the tire industry drive the growth of the market.

Key Takeaways

- Asia Pacific dominated the silica for S-SBR market due to the growing urbanization & well-established manufacturing base.

- North America is experiencing the fastest growth in the market due to the well-established industrial sector and growing demand for high-performance tyres.

- By application, the tires segment dominated the silica for the S-SBR market in 2024 due to the rapid growth in commercial and passenger vehicles.

- By application, the footwear segment is expected to grow at the fastest rate in the market during the forecast period due to the growing demand for various types of footwear.

- By type, the fumed silica segment dominated the silica for S-SBR market with the largest share in 2024 due to the strong reinforcing properties and rising demand from various applications.

- By type, the colloidal silica segment is expected to grow at the fastest rate in the market during the forecast period due to the growing demand for eco-friendly materials.

- By end use, the automotive segment dominated the silica for S-SBR market in 2024 due to the growing adoption of electric vehicles.

- By end use, the consumer goods segment is expected to grow at a significant rate in the market during the forecast period due to the increasing adoption of various consumer goods.

- By physical form, the powder segment dominated the silica for S-SBR market in 2024 due to the wide range of applications like adhesives, paints, and many more.

- By physical form, the granules segment is expected to grow significantly in the market during the forecast period due to the increasing demand from the tire industry.

Silica for S-SBR: contribution to high-performance application

Silica for S-SBR is the utilization of silica as a reinforcing filler material in the S-SBR rubber matrix. Silica naturally occurring compound made up of silicon & oxygen, and it is known as silicon dioxide. Silica is a mineral which used as a reinforcing filler in various rubber materials. S-SBR is Solution-polymerized Styrene Butadiene Rubber used in tyre threads and is a type of synthetic rubber. Silica improves the mechanical properties of S-SBR, which enhances the durability of materials. Silica for S-SBR offers several benefits like improved fuel efficiency, lower rolling resistance, higher wet traction, and good resistance to wear & tear.

Silane coupling agents are widely used to improve bonding between the S-SBR polymer and silica particles. The growing development in silica manufacturing for reactivity and better dispersion with S-SBR to achieve optimal performance helps in the market growth. The growing demand for high-performance tyres in various regions increases demand for silica for S-SBR. Factors like growing demand from various sectors, like automotive, construction, electronics, and consumer goods, increasing demand for various footwear, and growing demand for green tires contribute to the growth of silica for the S-SBR market.

- According to Volza’s United States Export data, South Korea exported 3445 shipments of SSBR .

- According to Volza’s United States Export data, Russia exported 1627 shipments of SSBR

- According to Volza’s Thailand Export data, from October 2023 to September 2024, Thailand exported 398 shipments of SSBR with a growth rate of 2 %.

- According to Volza’s India Export data, Vietnam exported 53182 shipments of silicone rubber.

- According to OEC, Thailand exported $2.72B of synthetic rubber in 2023 .

- According to OEC, South Korea exported $2.64B of synthetic rubber in 2023 .

The construction industry surges demand for silica for S-SBR

The growing construction activities in various projects like industrial, commercial, residential, and commercial sectors increase demand for silica for the S-SBR. The growing construction projects, like bridges, roads, and buildings, increase demand for stability & longevity, fueling demand for silica for the S-SBR. The growing demand for concrete and cement in construction activities increases demand for silica to enhance resistance to wear & tear, strength, and durability.

The growing construction materials, like artificial stone and bricks, increase demand for silica. The growing demand for waterproofing applications in construction activities increases demand for styrene-butadiene rubber. The growing urbanization and the growing focus on sustainable construction practices increase demand for silica. The rapid growth in the construction sector in various regions increases demand for cement, concrete, and mortar, which is a key driver for the silica for S-SBR market growth.

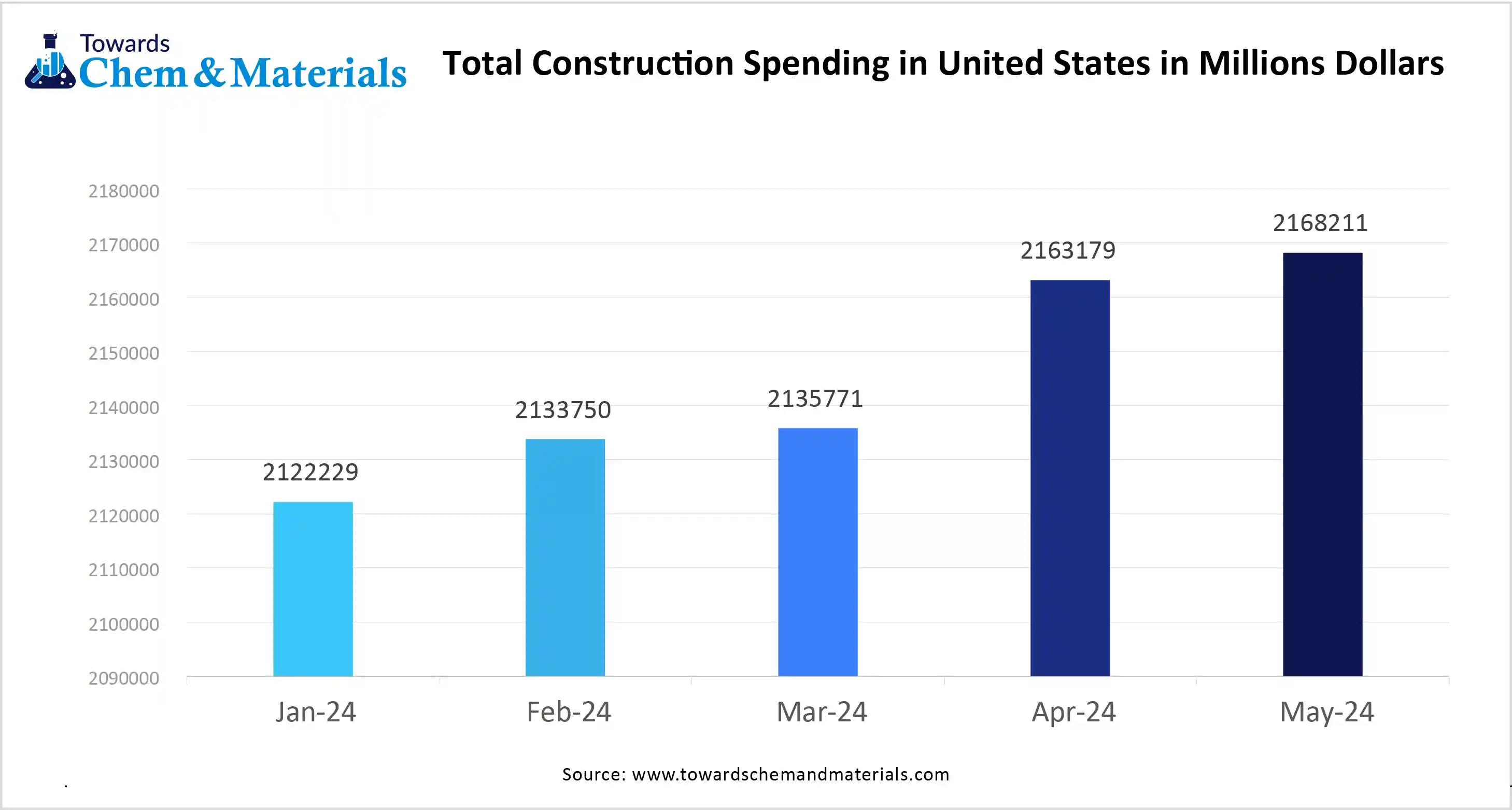

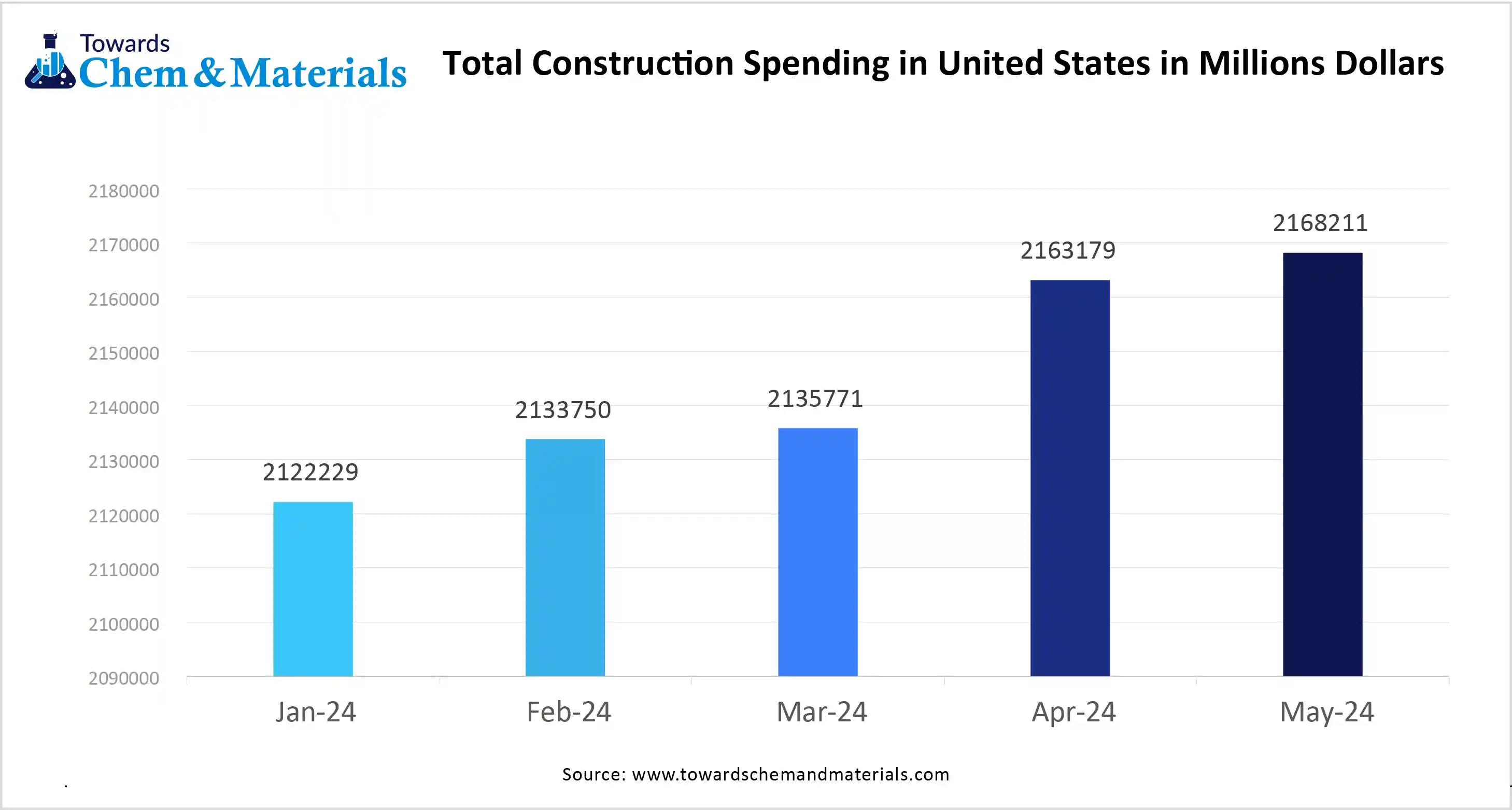

- According to the Federal Reserve Bank of St.Louis, the United States' total spending on construction from January to May 2024 is shown in the graph. The United States construction spending is growing monthly .

Silica For S-SBR Market Trends

- Growing demand for green tyres:- The growing depletion of fossil fuels, concerns about sustainability, and increasing energy costs increase demand for green tyres. The silica for S-SBR in green tyres improves fuel efficiency, lowers rolling resistance, and enhances tyre performance. Green tyres lower CO2 emissions and fuel consumption, and they contribute to an eco-friendly automotive industry.

- Growing adoption of electric vehicles:- The growing popularity and adoption of electric vehicles in various regions increases demand for durable, light-weight, and energy-efficient tyres, which fuels demand for silica for S-SBR. The growing production of electric vehicles is fueling demand for silica for S-SBR.

- Technological advancements:- The ongoing technological advancements and innovations in silica for S-SBR enhance its applications in various sectors. The advancements, like silane coupling agents, in-situ modification of silica, and the use of coupling agents, improve S-SBR properties, enhance silica dispersion, and improve filler tube interaction for better performance of tyres.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 2.72 Billion |

| Expected Size by 2034 | USD 4.50 Billion |

| Growth Rate from 2025 to 2034 | CAGR 5.75% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025-2034 |

| High Impact Region | Asia Pacific |

| Segment Covered | By Application, By Type, By End Use, By Physical Form , By Region |

| Key Companies Profiled | Solvay S.A., Wacker Chemie AG, Sibelco, IQSIL, Tokuyama Corporation, Fuso Chemical Co., Ltd., Huntsman Corporation, Asahi Glass Co., Ltd.,Showa Denko K.K., China National Chemical Corporation, Kraton Corporation, PPG Industries, Evonik Industries, Mitsubishi Chemical Corporation, Cabot Corporation |

Silica For S-SBR Market Opportunity

Tyre demand drives silica for the S-SBR market

The growing automotive sector increases demand for tyres, which creates an opportunity for market growth. The growing disposable incomes increase the purchase of scooters, two-wheelers, commercial vehicles, and passenger cars, which increases demand for highly durable tyres. People are using vehicles in their daily lives, which increases the demand for tire replacement. Silica for S-SBR improves the performance of the tire, fuel efficiency, wet grip, and durability.

The growing production and adoption of electric vehicles increases demand for silica for S-SBR for tires. The growing demand for the replacement of carbon black in some tire applications increases demand for silica for S-SBR. The growing demand for sustainability increases demand for silica for S-SBR as it reduces CO2 emissions. The rapid expansion of logistics and e-commerce requires commercial vehicles, which increases demand for high-performance tyres. The growing technological innovation in tyre production increases demand for silica for S-SBR, which creates an opportunity for silica for the S-SBR market.

Market Challenge

High production cost limits the expansion of Silica for the S-SBR market

Despite several advantages of silica for S-SBR in various industries, the high production cost is a major challenge for the market growth. Factors like energy-intensive processes, high raw materials costs, and supply chain disruptions may restrict the growth of the market. Production of silica involves various processes like processing, refining, and mining that require various resources and energy.

The resources, like a large amount of water and methods like electric arc furnace, increase the production cost. The cost of raw materials like wood chips, coal, and coke is increasing, which directly affects market growth. The growing demand for high-purity silica in industries like electronics & semiconductors requires costly processing methods. High cost of electricity and supply chain disruptions increase the overall cost. The high production cost hampers the growth of silica for the S-SBR market.

Silica For S-SBR Market Regional Insights

Silica for S-SBR surge in Asia Pacific. Asia Pacific dominated silica for the S-SBR market in 2024. The strong manufacturing base in various applications increases demand for silica for S-SBR, which helps in the market growth. The growing urbanization and rapid industrialization in the region increase demand for silica for S-SBR for various sectors like consumer goods, construction, and infrastructure development.

The growing consumer spending and increasing preference for comfortable footwear in the region drive the growth of the market. The strong presence of rubber production in countries like Thailand, China, and India helps in the growth of the market. Additionally, the presence of key end-user industries like electronics and automotive contributes to the market growth.

China's key contribution to silica for S-SBR. China is a major contributor to silica for the S-SBR market. The presence of the large-scale manufacturing sector in the rubber manufacturing and chemical industry helps in the growth of the market. The favorable government policies and good supply of raw materials like butadiene and styrene propel market growth. The growing industrialization and civilization increase demand for silica for S-SBR in various applications like adhesives, manufacturing, sealants, and footwear. Furthermore, the well-established automotive and tire production industry supports the overall growth of the market.

- According to Volza’s India Export data, China exported 191057 shipments of silicon rubber.

Role of India in Silica for S-SBR. India is significantly growing in silica for the S-SBR market. The growing demand for high-performance tires, like better fuel efficiency, improved grip, and reduced rolling resistance, helps in the market growth. The ongoing technological advancements in tires and favorable government initiatives drive the market growth. For instance, the government initiative North East Mission of Tire Industry for Rubber Augmentation focuses on expanding rubber plantations, ensuring a stable raw material supply like silica, and supporting the growth of the tire industry. Additionally, the growing automotive industry in the region contributes to the market growth.

- According to Volza’s India Export data, India exported 75192 shipments of silicone rubber.

- According to Volza’s India Export data, from November 2023 to October 2024,

- India exported 19715 shipments of silicone rubber with a growth rate of 10%.

Rise of Silica for S-SBR in North America. North America experiences the fastest growth in the market during the forecast period. The growing demand for high-performance tyres and extensive research & development in silica production help in the growth of the market. The well-established industrial sector and significant presence of the automotive industry drive the market growth.

The growing adoption of electric vehicles in the region increases demand for silica for S-SBR. The growing consumption of silica in the oil & gas & construction industry and the availability of raw materials contribute to the market growth.

United States powering Silica for S-SBR market, The United States is significantly growing in silica for the S-SBR market. The well-developed automotive industry and growing demand for hybrid vehicles and Electric vehicles in the region help in the growth of the market. The growing technological advancements in tire technology increase demand for silica for the S-SBR. The growing demand for energy-efficient and sustainable products in various industries like construction & paints supports the market growth.

- According to Volza’s United States Export data, from October 2023 to September 2024, the United States exported 292 shipments of SSBR .

- According to Volza’s United States Export data, the United States exported 1275 shipments of SSBR .

- According to OEC, the United States exported $2.44B of synthetic rubber in 2023 .

Segmental Insights

By Application

The tires segment dominated the silica for the S-SBR market in 2024. The growing demand for commercial & passenger vehicles increases demand for tires, which drives the growth of the market. The continuous advancements in tire technology to enhance durability, performance, and fuel efficiency are fueling demand for silica for the S-SBR. The rapid growth in the automotive industry and the growing shift towards electric vehicles drive the growth of the market. Furthermore, manufacturers like Bridgestone & Michelin are investing in the development of new innovative tires, contributing to the market growth.

The footwear segment is the fastest-growing in the market during the forecast period. The growing demand for various footwear components like heels, soles, and other rubber parts helps in the market growth. Properties like water absorption and resistance to deformation, and cost-effectiveness increase demand for silica for the S-SBR in footwear. Additionally, growing demand for footwear and manufacturers' improving cost-effectiveness & performance support the overall growth of the market.

By Type

The fumed silica segment held the largest share of the silica for the S-SBR market in 2024. The growing utilization of various high-performance applications increases demand for fumed silica, which helps in the market growth. Fumed silica consists of strong reinforcing properties, achieves desirable thixotropy, and helps in better shaping & processing of material. In hot conditions, fumed silica maintains the shape of tire threads.

The growing demand for high-performance tyres and applications in various areas like sealants, coatings, and adhesives drives the growth of the market.

The colloidal silica segment is the fastest-growing in the market during the forecast period. The growing adoption of eco-friendly and natural materials increases demand for silica for S-SBR, which helps in the market growth.

The growing development of sustainable tire applications and the development of green tires increases demand for colloidal silica. This type of silica withstands wear & tear, enhances durability & tensile strength, and improves traction performance. The growing utilization in various applications like industrial goods, tire manufacturing, construction materials, and footwear contributes to the overall growth of the market.

By End Use

The automotive segment dominated the silica for S-SBR market in 2024. The worldwide rapid growth of the automotive industry helps in the growth of the market. The growing demand for automotive tires increases the demand for silica for the S-SBR to enhance rolling resistance, wear resistance, and grip. The growing demand for fuel efficiency and the increasing demand for high-performance passenger car tires drive the market growth. The growing production and adoption of electric vehicles in many regions help in the market growth. Furthermore, growing vehicle production, increasing car ownership, growing demand for commercial vehicles, and growing innovation in tire technology support the growth of the market.

The consumer goods segment is the fastest-growing in the market during the forecast period. The growing demand for various consumer goods helps in the growth of the market. The growing demand for sustainable and eco-friendly products increases the demand for silica for S-SBR. The ongoing development and innovation in consumer goods increases demand for silica for S-SBR. The growing demand for athletic footwear, industrial goods, and other consumer goods drives the growth of the market.

By Physical Form

The powder segment dominated the silica for S-SBR market in 2024. The growing demand for cost-effective options in many industries helps in the growth of the market. The growing adoption of sustainable methods and the requirement for longevity increases demand for powder form. The availability of customization and rapid growth in the construction industry help in the market growth. Additionally, a wide range of applications like adhesives, paints, paper processing, and coatings support the market growth.

The granules segment experiences the fastest growth in the market during the forecast period. The growing demand from the tire industry for better durability, tread wear, and dynamic properties helps in the growth of the market. Granules help in increasing abrasion resistance, tensile strength, and tear resistance of the rubber compound. Additionally, the rising adoption of electric vehicles and the growing automotive industry contribute to the market growth.

Silica For S-SBR Market Recent Developments

Sumitomo Chemical

- Contribution: In May 2023, Sumitomo Chemical to cease production of SSBR at its Singapore plant. The synthetic rubber materials plant produces approximately 40000 metric tons per year. The company decided to withdraw from the production of chemical fertilizers, caprolactam, and dyestuffs .

J K Tyre

- Launch: In April 2023, JK Tyre launched the UX Green Tyre, made up of recycled and sustainable materials. The tyre is developed using 80% sustainable material like steel wire, recovered carbonaceous black, bio-based oil, recycled polyester, natural rubber, recycled rubber powder, and bio-attributed SBR & BR .

Arlanxeo

- Launch: In February 2023, Arlanxeo launched a 65 kilotonnes per annum polybutadiene rubber plant in Triunfo, Brazil. Arlanxeo announced an investment to produce advanced Lithium Butadiene Rubber and Neodymium Butadiene Rubber for non-tire & tire applications in the Triunfo facility .

Sinopec

- Contribution: In April 2023, Sinopec began operation of the 170000 TPA styrene butadiene copolymer project in Hainan, China. In this project, Sinopec Hainan Refining & Chemical Co., and Bailing New Material invested 279.74 million. The new plant produces 170000 tons of SEBS and SBS products annually, including 50000 SEBS products and 120000 tons of SBS products. The plant consists of 13 units, like coalescence, refining, polymerization, post-treatment, recycling, auxiliaries preparation, and supporting production & public facilities.

Top Companies List

- Solvay S.A.

- Wacker Chemie AG

- Sibelco

- IQSIL

- Tokuyama Corporation

- Fuso Chemical Co., Ltd.

- Huntsman Corporation

- Asahi Glass Co., Ltd.

- Showa Denko K.K.

- China National Chemical Corporation

- Kraton Corporation

- PPG Industries

- Evonik Industries

- Mitsubishi Chemical Corporation

- Cabot Corporation

Segments Covered in the Report

By application

- Tires

- Footwear

- Industrial Rubber Goods

- Sealants

- Coatings

By type

- Fumed Silica

- Colloidal Silica

- Precipitated Silica

- Hydrophobic Silica

By end use

- Automotive

- Consumer Goods

- Construction

- Electronics

By physical form

- Powder

- Granule

- Dispersion

By region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait