Content

What is the Current Aluminum Flat Products Market Size and Volume?

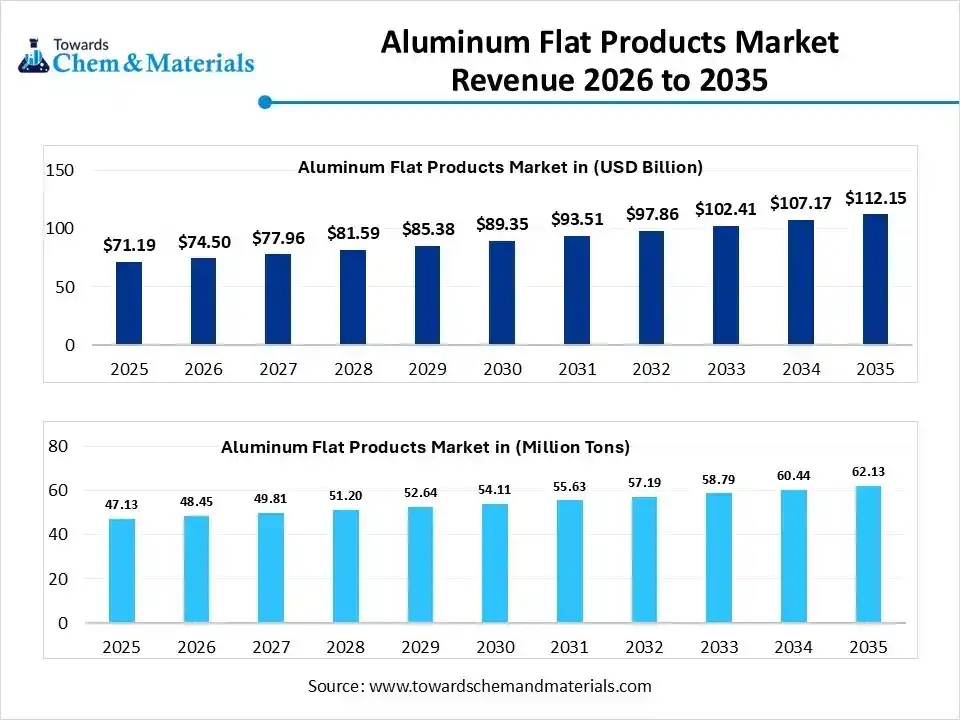

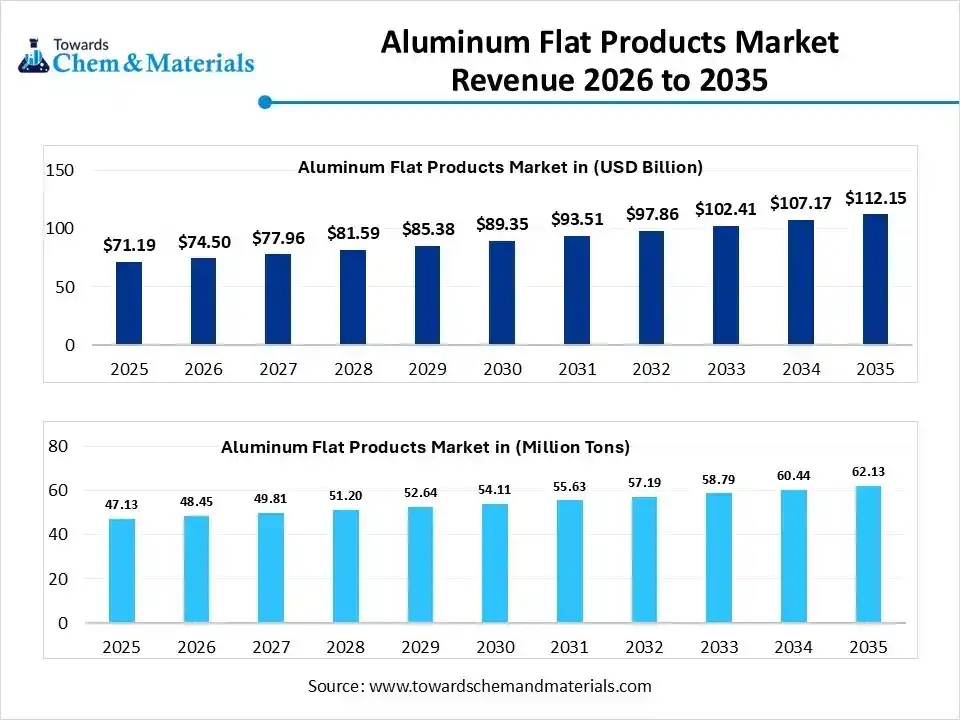

The global aluminum flat products market size was estimated at USD 71.19 billion in 2025 and is expected to increase from USD 74.50 billion in 2026 to USD 112.15 billion by 2035, growing at a CAGR of 4.65% from 2026 to 2035. In terms of volume, the market is projected to grow from 47.13 million tons in 2025 to 62.13 million tons by 2035. growing at a CAGR of 2.80% from 2026 to 2035. Asia Pacific dominated the aluminum flat products market with the largest volume share of 48.6% in 2025. The growth of the market is driven by rising demand from the automotive, construction, and packaging industries, driven by lightweighting, sustainability, and improved material performance.

The aluminum flat products market is witnessing steady growth, propelled by the growing use of corrosion-resistant and lightweight materials in industrial packaging, construction, and automotive applications. Aluminum is becoming more popular than conventional materials due to increased emphasis on fuel efficiency, recyclability, and sustainable manufacturing. Product performance and cost efficiency are being enhanced by technological developments in rolling and alloy development. Long-term market growth is still supported by expanding infrastructure projects and growing consumer packaging demand.

Report Highlights

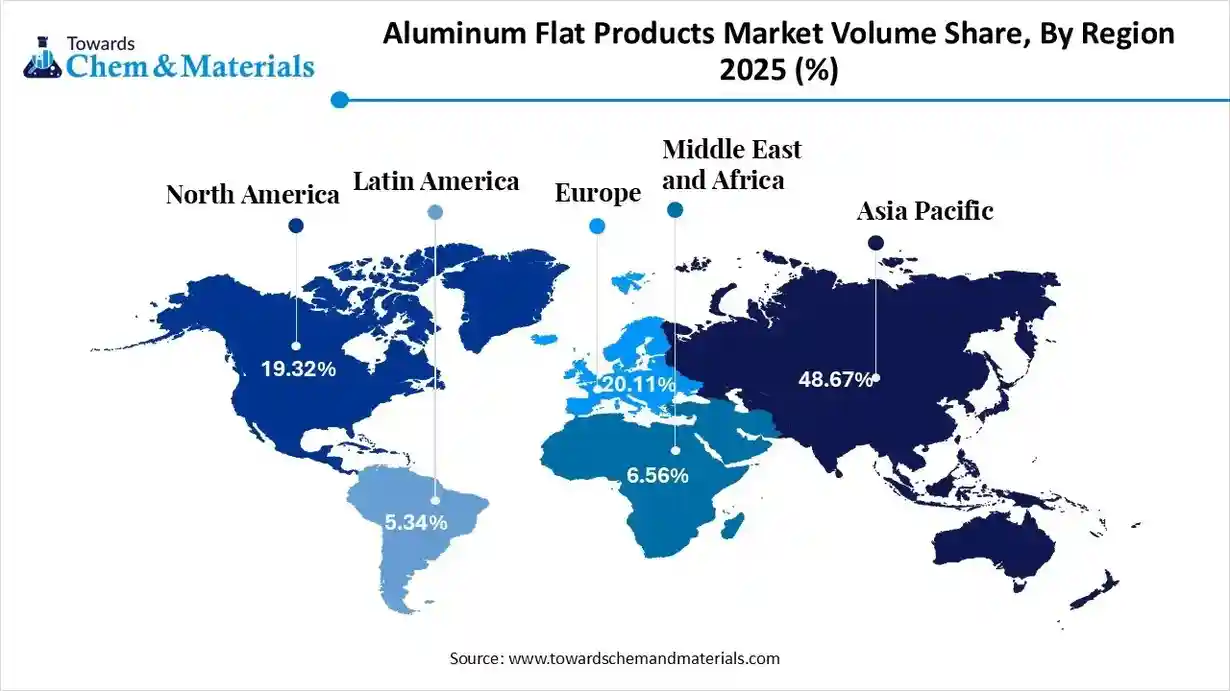

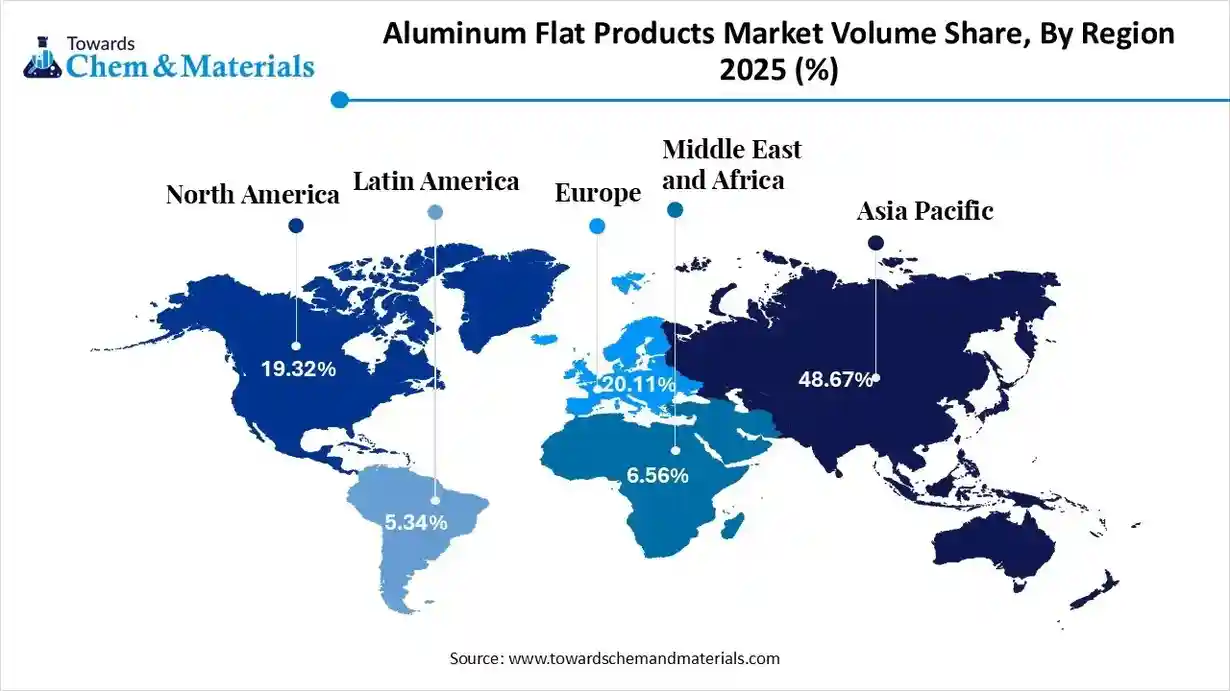

- The Asia Pacific dominated the global aluminum flat products market with the largest volume share of 48.6% in 2025.

- The aluminum flat products market in North America is expected to grow at a substantial CAGR of 3.86% from 2026 to 2035.

- The Europe aluminum flat products market segment accounted for the major volume share of 20.11% in 2025.

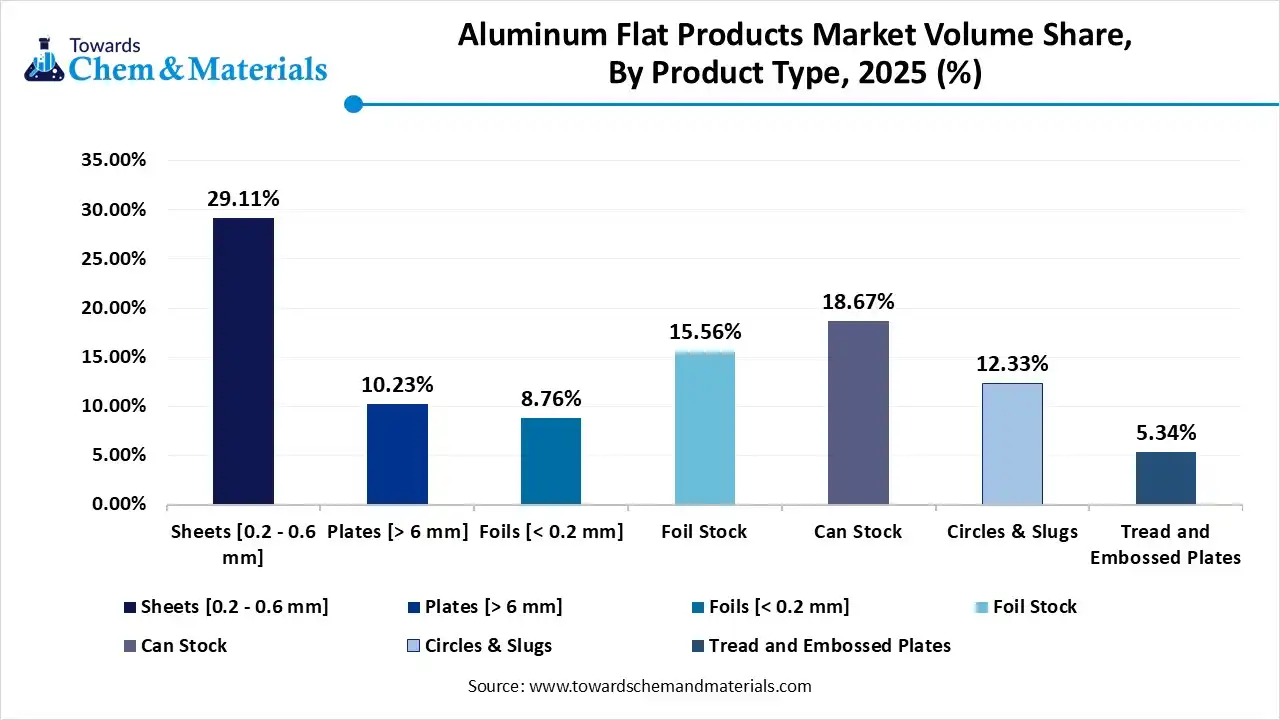

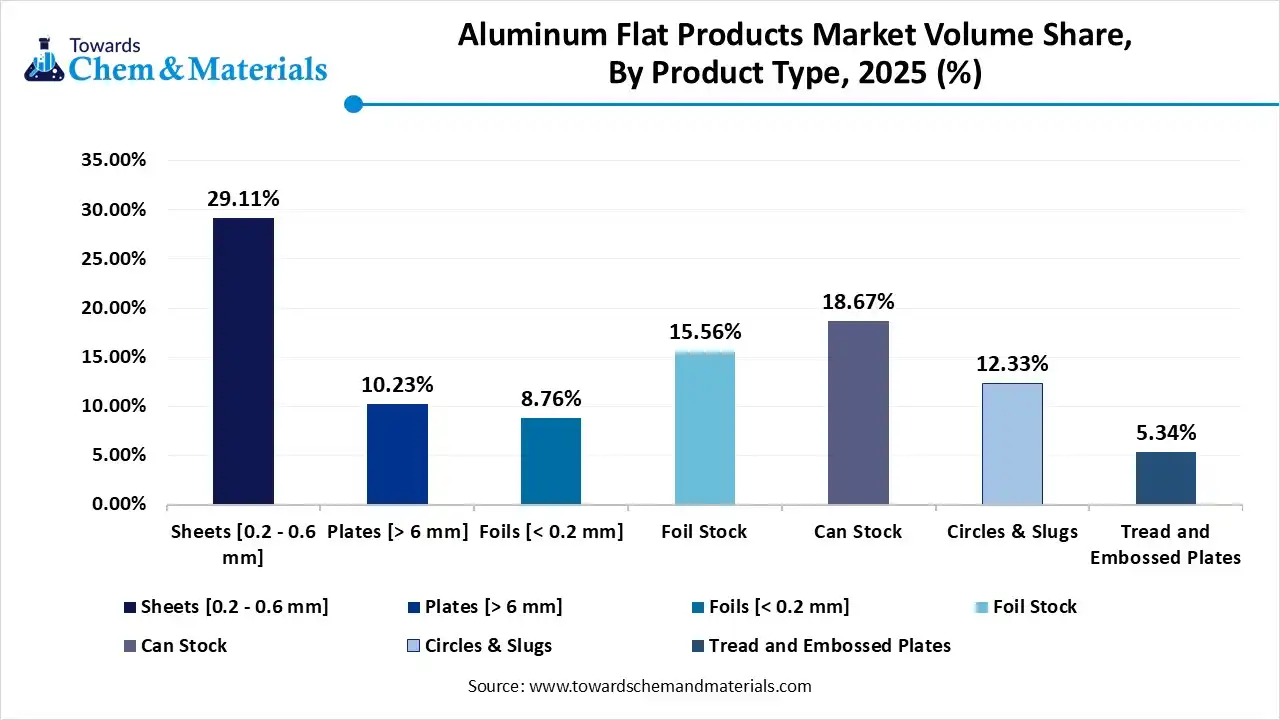

- By product type, the Sheets [0.2 - 0.6 mm] segment dominated the market and accounted for the largest volume share of 29.11% in 2025.

- By product type, the plates segment is expected to grow at the fastest CAGR of 4.17% from 2026 to 2035.

- By alloy series, the 3xxx series segment led the market with the largest revenue volume share of 34.2% in 2025.

- By processing, the cold rolling segment dominated the market and accounted for the largest volume share of 58.8% in 2025.

- By end-use industry, the packaging segment led the market with the largest revenue volume share of 39.4% in 2025.

Market Trends

- Industry Growth Overview: The market is growing steadily due to strong demand from automotive, construction, and packaging sectors, supported by lightweighting and infrastructure development.

- Sustainability Trends: Manufacturers are increasing recycled content, adopting low-carbon production methods, and improving energy efficiency to meet sustainability goals.

- Startup Ecosystem: Startups focus on recycling innovations, AI-based manufacturing, and advanced aluminum alloys, often partnering with large industry players.

Report Scope

| Report Attribute | Details |

| Market Size and Volume in 2026 | USD 74.50 Billion / 48.45 Million Tons |

| Revenue Forecast in 2035 | USD 112.15 Billion / 62.13 Million Tons |

| Growth Rate | CAGR 4.65% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Units Considered | Value (Billion / Million), Volume (Million Tons) |

| Dominant Region | Asia Pacific |

| Segment Covered | Product Type, By Alloy Series, By Processing Technology, By End-Use Industry, By Region |

| Key companies profiled | Novelis Inc., Alcoa Corporation, Norsk Hydro ASA, Constellium SE, Alcoa Corporation, Norsk Hydro ASA, Constellium SE, Novelis Inc., Arconic Corporation, UACJ Corporation, United Company RUSAL, Speira GmbH |

Key Technological Shifts In The Aluminum Flat Products Market

- Adoption of advanced rolling and heat-treatment technologies for improved strength and surface finish

- Increased development and use of high-performance and lightweight aluminum alloys

- Integration of automation, AI, and digital quality inspection in manufacturing processes

- Growing focus on low-carbon aluminum production technologies

- Expansion of closed-loop recycling and secondary aluminum processing systems

- Use of precision coating and surface treatment technologies to enhance corrosion resistance and aesthetics

- Adoption of energy-efficient smelting and rolling processes to reduce production costs and emissions.

- Increasing use of simulation and digital twin technologies for process optimization and faster product development.

Trade Analysis of the Aluminum Flat Products Market

- According to Global Export data, the world exported 4,332 shipments of aluminum flat bars. These were handled by 260 exporters and bought by 289 buyers.

- Most aluminum flat bars exports from the World is destined for Netherlands, United Kingdom and Malaysia.

- Globally, the top three exporters are India, Malaysia, and China, with India leading at 2,583 shipments, followed by Malaysia with 573, and the China with 398 shipments.

Value Chain Analysis

- Chemical Synthesis & Processing: Operates production process of alloyed and raw aluminum for flat products. Major integrated producers handle smelting, alloying, and casting.

- Key Players: Alcoa Corporation, Rio Tinto Group, China Hongqiao Group, RUSAL, Chalco (Aluminum Corporation of China), Hindalco Industries (Novelis), and Norsk Hydro ASA

- Quality Testing & Certification: Ensures products meet mechanical, chemical, and surface standards. Key certifications include ISO 6361, ASTM B209, EN 10204, ISO 9001, ISO/IEC 17025, IATF 16949, and AS9100.

- Testing Labs / Certification Bodies: SGS, Intertek, TÜV SÜD, Bureau Veritas, and UL Solutions

Distribution to Industrial Users: Aluminum flat products reach industries like automotive, construction, and packaging via distributors and service centers. - Key Distributors: O’Neal Steel (USA), Klöckner & Co (Germany), Thyssenkrupp Materials (Global), and Ryerson (North America)

Segmental Insights

Product Type Insights

What Made Sheets Segment Dominate The Aluminum Flat Products Market In 2025?

The sheets segment dominates the aluminum flat products market, accounting for 29.11% volume share in 2025. This dominance is driven by its wide range of uses in the building, automotive, and packaging industries, where strong, lightweight materials are becoming more popular because of their numerous uses. Sheets are a common product in both consumer and industrial settings.

The plates segment is expected to experience the fastest growth in the market during the forecast period, fueled by heavy machinery, automotive, and aerospace applications. Growing applications in modern manufacturing, defense, and the maritime industry are driving its expansion. The industry gains advancements in plate processing technology, which boost productivity and product quality.

Aluminum Flat Products Market Volume and Share, By Product Type 2025-2035

| By Product Type | Market Volume Share (%), 2025 | Market Volume (Million Tons)2025 | Market Volume (Million Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| Sheets [0.2 - 0.6 mm] | 29.11% | 13.72 | 17.53 | 2.76% | 28.21% |

| Plates [> 6 mm] | 10.23% | 4.82 | 6.96 | 4.17% | 11.21% |

| Foils [< 0.2 mm] | 8.76% | 4.13 | 5.73 | 3.72% | 9.23% |

| Foil Stock | 15.56% | 7.33 | 10.08 | 3.60% | 16.23% |

| Can Stock | 18.67% | 8.80 | 12.49 | 3.97% | 20.11% |

| Circles & Slugs | 12.33% | 5.81 | 6.49 | 1.24% | 10.45% |

| Tread and Embossed Plates | 5.34% | 2.52 | 2.83 | 1.32% | 4.56% |

Alloy Series Insights

Why Did the 3xxx Series Segment Dominate The Aluminum Flat Products Market In 2025?

The 3xxx series segment dominates with 34.2% market volume share in 2025, due to superior formability cost effectiveness and corrosion resistance. Its widespread industrial use and high recyclability contribute to its dominance. It is a popular option worldwide due to its reliable performance in a variety of climates.

The 6xxx series segment is expected to experience the fastest growth in the market during the forecast period, supported by demand in the construction, automotive, and aerospace industries. Adoption is supported by developments in surface treatments and alloying. Its growth is further accelerated by increasing use in high-strength structural components. Its quick expansion is anticipated to be sustained by rising investments in lightweight and energy-efficient materials.

Processing Insights

What Made Cold Rolling Segment Dominate The Aluminum Flat Products Market In 2025?

The cold rolling segment dominates with 58.8% market volume share in 2025, providing exceptional strength, dimensional accuracy, and surface finish. Market leadership is sustained by its robust supply chains and established procedures. Its industrial preference is increased by its capacity to create intricate shapes. For premium sheets and plates used in crucial applications, cold rolling is still favored.

The continuous casting segment is expected to experience the fastest growth in the market during the forecast period, enabling consistent product quality, increased throughput, and energy efficiency. Its growth is accelerated by automation and smart manufacturing. Additionally, the process decreases waste, which makes manufacturers more interested in it. Its accelerated market expansion is supported by growing adoption in large-scale industrial production.

End-Use Industry Insights

What Made Packaging Segment Dominate The Aluminum Flat Products Market In 2025?

The packaging segment dominates with 39.4% market volume share in 2025, driven by aluminum's strength, light weight, and recyclability. Demand is further bolstered by eco-friendly packaging trends, and e-commerce aluminum is widely used because of its safe food and drinks preservation capabilities. The expanding processed food and beverage sectors are important drivers of long-term demand.

The automotive and transportation segment is expected to experience the fastest growth in the market during the forecast period, propelled by fuel efficiency rules, hybrid cars, and electric vehicles. Growth is accelerated by green initiatives and the demand for lightweight vehicles. Aluminum consumption is predicted to rise further due to the rising demand for high-performance automobiles. Aluminum's growing use in aerospace and commercial vehicles contributes to the segment's expansion.

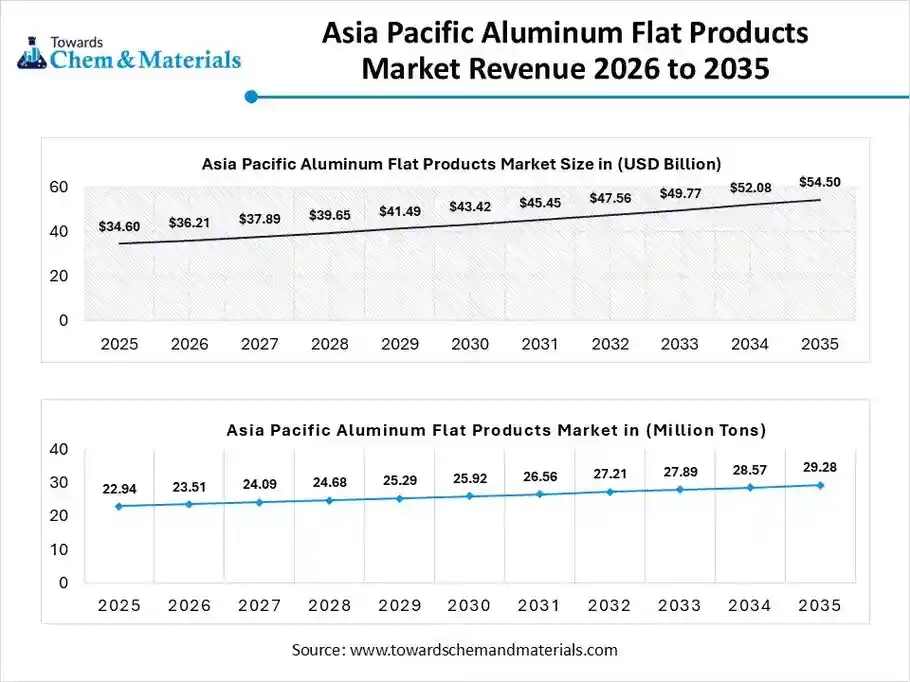

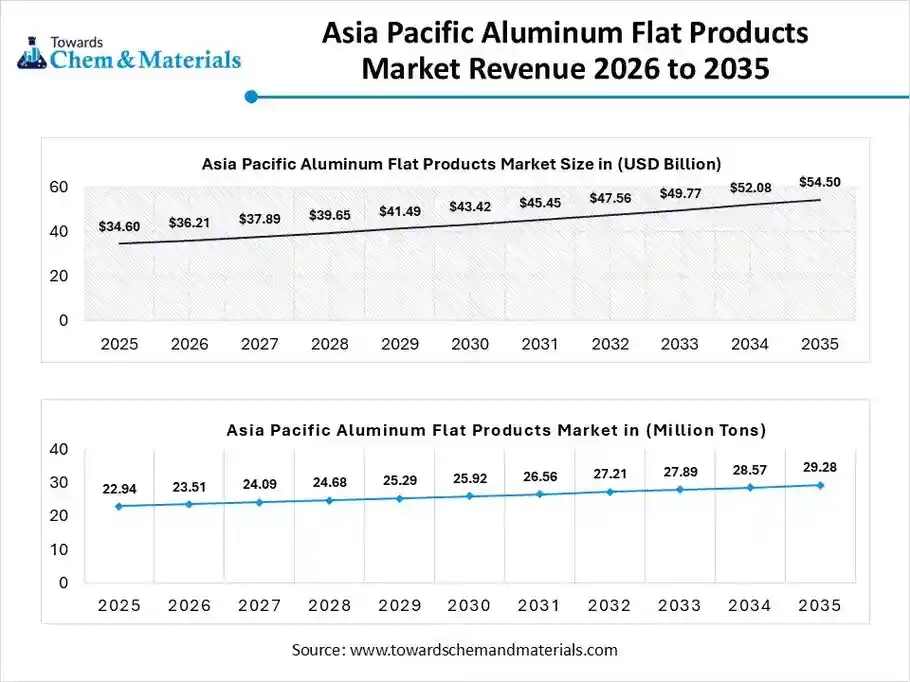

Regional Insights

The aluminum flat products market size was valued at USD 34.60 billion in 2025 and is expected to be worth around USD 54.50 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 4.68% over the forecast period from 2026 to 2035. the aluminum flat products market volume was estimated at 22.94 million tons in 2025 and is projected to reach 29.28 million tons by 2035, growing at a CAGR of 7.75% from 2026 to 2035. Asia Pacific dominates with 48.6% market volume share in 2025, led by industrial, automotive production, and infrastructure development to sustain its lead. Supportive government policies and investments in manufacturing also strengthen its market position. The region's growing export capacity ensures continued dominance in global markets.

India Aluminum Flat Products Market Trends

India is dominating the aluminum flat products market, driven by rising demand in the packaging, automotive, and infrastructure industries. While quality testing and certifications ensure dependability across industrial applications ensure dependability across industrial applications integrated production integrated production and downstream distribution networks support market expansion.

North America Aluminum Flat Products Market Trends

The North America aluminum flat products market volume was estimated at 9.11 million tons in 2025 and is projected to reach 12.80 million tons by 2035, growing at a CAGR of 3.86% from 2026 to 2035. North America expects the fastest growth in the market during the forecast period, driven by the need for eco-friendly packaging, lightweight automotive parts, and aerospace. Growth is accelerated by technological developments and sustainability programs. Growing emphasis on high-value applications and energy-efficient production speeds up regional expansion. Demand in the area is anticipated to increase as EV production and aerospace projects grow.

U.S. Aluminum Flat Products Market Trends

The U.S. aluminum flat products market is driven by robust production capabilities and reputable distribution systems. By adhering to ISO, ASTM, and EN standards, the market ensures high-quality products for the automotive, aerospace, and construction industries, and testing labs to certify compliance. Market expansion is further supported by ongoing technological developments in rolling finishing and alloying processes.

Europe Aluminum Flat Products Market Trends

The Europe aluminum flat products market volume was estimated at 9.48 million tons in 2025 and is projected to reach 13.13 million tons by 2035, growing at a CAGR of 3.69% from 2026 to 2035. Europe's aluminum flat products market is driven by a combination of production and distribution capabilities, which provide the automotive, aerospace, and engineering industries with premium sheets, plates, and coils. Certified testing facilities and international standards guarantee the quality of the product. Demand is further accelerated by the growing use of aluminum in the transportation and green construction industries.

Germany Aluminum Flat Products Market Trends

Germany’s market is driven by the automotive and industrial sectors, whose strong demand ensures a timely supply of aluminum flat products through a focus on accuracy, dependability, and adherence to international quality standards. Effective distribution is supported by the nation's robust engineering and manufacturing ecosystem.

Aluminum Flat Products Market Volume and Share, By Region 2025-2035

| By Region | Market Volume Share (%), 2025 | Market Volume (Million Tons)2025 | Market Volume (Million Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| North America | 19.32% | 9.11 | 12.80 | 3.86% | 20.60% |

| Europe | 20.11% | 9.48 | 13.13 | 3.69% | 21.13% |

| Asia Pacific | 48.67% | 22.94 | 29.28 | 2.75% | 47.13% |

| South America | 5.34% | 2.52 | 3.11 | 2.39% | 5.01% |

| Middle East & Africa | 6.56% | 3.09 | 3.81 | 2.34% | 6.13% |

South America Aluminum Flat Products Market Trends

The South America aluminum flat products market volume was estimated at 2.52 million tons in 2025 and is projected to reach 3.11 million tons by 2035, growing at a CAGR of 2.39% from 2026 to 2035. South America’s aluminum flat products market is driven by local demand for construction, packaging, and industrial users. Through accredited testing facilities, both locally and imported processed goods satisfy global standards. The region's industrialization and economic expansion are still driving demand for aluminum flat goods.

Brazil Aluminum Flat Products Market Trends

Brazil’s market is driven by domestic demand in the construction, automotive, and packaging industries. International quality standards are followed when supplying aluminum sheets, plates, and coils through service centers and distributors. Infrastructure and industrial project investments boost market demand even more.

MEA Flat Products Market Trends

The Middle East & Africa aluminum flat products market volume was estimated at 3.09 million tons in 2025 and is projected to reach 3.81 million tons by 2035, growing at a CAGR of 2.34% from 2026 to 2035. MEA aluminum flat products market is driven by growing industrial transportation and construction activity. Shett's plates and coils that are distributed both domestically and internationally satisfy industry specifications, and certified laboratories guarantee dependability and compliance. Infrastructure development and growing urbanization are important factors driving the market.

UAE Aluminum Flat Products Market Trends

The UAE’s aluminum flat products market is driven by robust demand from industrial infrastructure and construction projects. Distribution networks adhere to international certifications and standards while offering premium sheets, plates, and coils. The government's emphasis on contemporary and sustainable building practices is encouraging a rise in the use of aluminum.

Recent Developments

- In December 2025, China Aluminum Downstream Operations environmental protection measures and high aluminum prices have reduced the operating rate of downstream processing enterprises to around 60.8 %, reflecting weaker order books and production pressures.(Source: alcircle.com)

- In January 2025, Press Metal Aluminum Holdings Berhad is set for growth in 2025 due to rising demand recovery from China and eased alumina supply, with plans to expand value‑added aluminum product volumes and secure alumina feedstock through a strategic joint venture.(Source: metal.com)

Market Top Companies

- Novelis Inc.: The world's leading producer of innovative flat-rolled aluminum products and the largest recycler of aluminum globally.

- Alcoa Corporation: A global industry leader in bauxite, alumina, and aluminum production, focusing on sustainable practices and advanced technology.

- Norsk Hydro ASA: A fully integrated aluminum company producing a wide range of solutions from bauxite extraction to finished products, known for its focus on renewable energy.

- Constellium SE: A global manufacturer of high-performance, value-added aluminum products and solutions for the aerospace, automotive, and packaging industries.

- Alcoa Corporation

- Norsk Hydro ASA

- Constellium SE

- Novelis Inc.

- Arconic Corporation

- UACJ Corporation

- United Company RUSAL

- Speira GmbH

Segments Covered in the Report

By Product Type

- Sheets (0.2 mm to 6 mm)

- Plates (Greater than 6 mm)

- Foils (Less than 0.2 mm)

- Foil Stock

- Can Stock

- Circles and Slugs

- Tread and Embossed Plates

By Alloy Series

- 1xxx Series (Pure Aluminium)

- 2xxx Series (Al-Cu Alloys)

- 3xxx Series (Al-Mn Alloys)

- 4xxx Series (Al-Si Alloys)

- 5xxx Series (Al-Mg Alloys)

- 6xxx Series (Al-Mg-Si Alloys)

- 7xxx Series (Al-Zn Alloys)

- 8xxx Series (Al-Li and Other Alloys)

By Processing Technology

- Hot Rolling

- Cold Rolling

- Continuous Casting

By End-Use Industry

- Packaging

- Automotive and Transportation

- Building and Construction

- Aerospace and Defense

- Electrical and Electronics

- Industrial Machinery

- Marine

- Consumer Durables

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa