Content

What is the Current Insulation Market Size and Share?

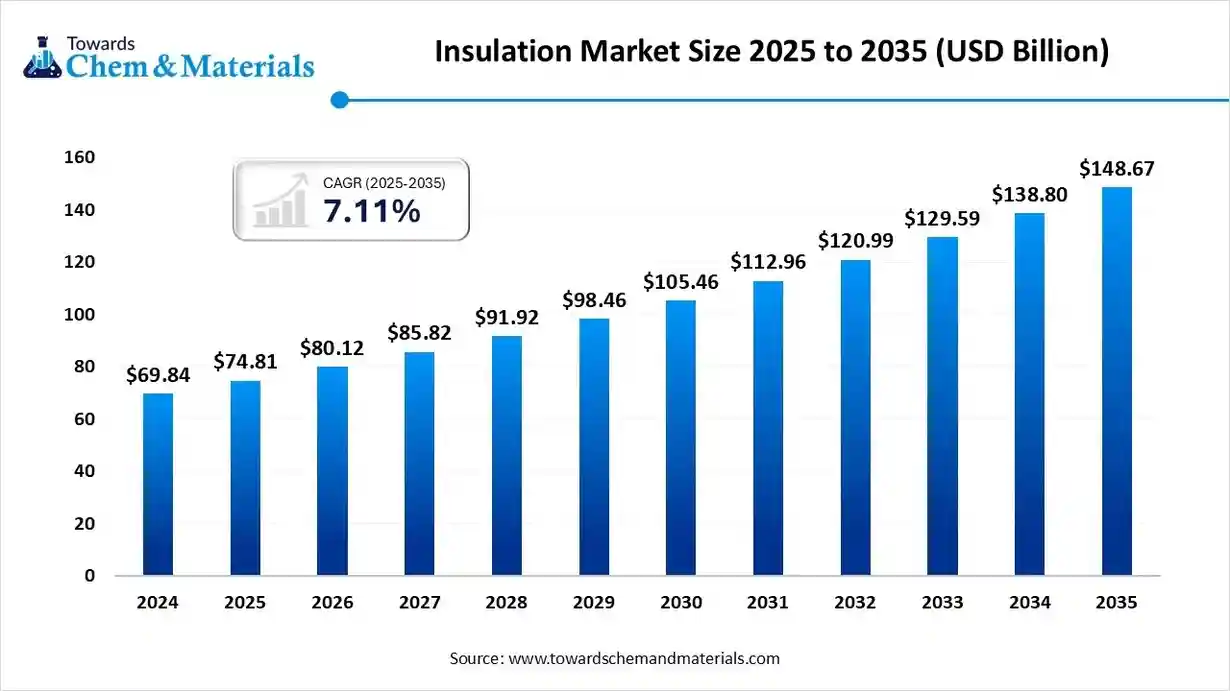

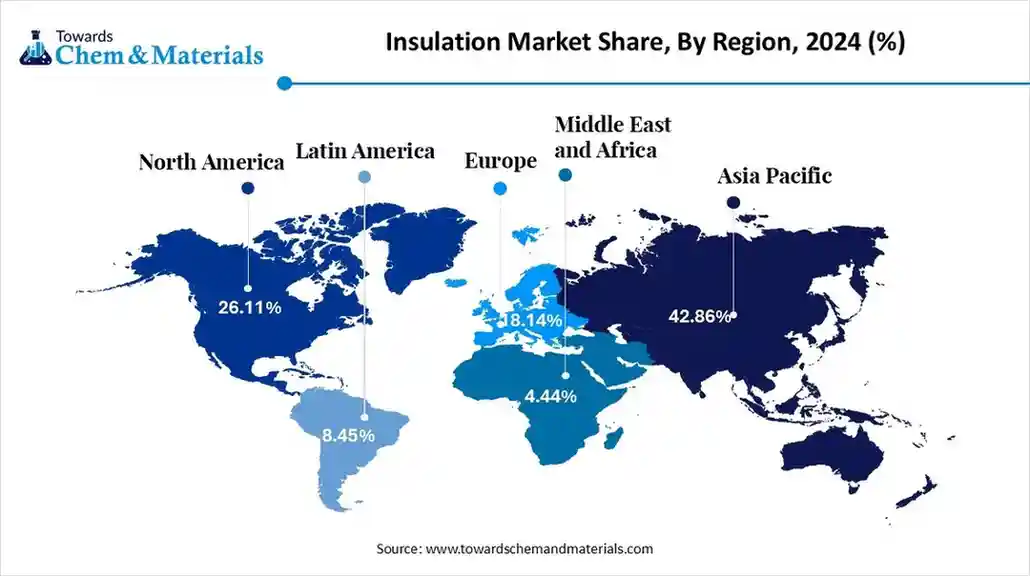

The global Insulation market size is calculated at USD 74.81 billion in 2025 and is predicted to increase from USD 80.12 billion in 2026 and is projected to reach around USD 148.67 billion by 2035, The market is expanding at a CAGR of 7.11% between 2025 and 2035. Asia Pacific dominated the Insulation market with a market share of 42.86% the global market in 2024. Increasing consumer awareness regarding energy conservation across the globe is the key factor driving market growth. Also, favourable rules and regulations in many regions coupled with the raised infrastructure spending in developing countries can fuel market growth further.

Key Takeaways

- By region, Asia Pacific dominated global insulation market with the largest share of 42.86% in 2024. The dominance of the region can be attributed to the surge in oil production in emerging economies like India and China.

- By region, North America is expected to grow at a significant CAGR over the forecast period. The growth of the region can be credited to the growing insulation demand from manufacturing, oil and gas, and power.

- By insulation type, the thermal insulation segment dominated the market in 2024. The dominance of the segment can be attributed to the growing demand for noise reduction, energy efficiency, and strict adherence to energy regulations.

- By insulation type, the acoustic insulation segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the ongoing construction developments, rapid urbanization, and raised awareness regarding noise pollution.

- By material type, the expanded polystyrene (EPS) segment held the largest market share in 2024. The dominance of the segment can be linked to the various benefits of expanded polystyrene across different sectors.

- By material type, the glass wool segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment can be driven by various benefits of glass wool insulation.

- By end use, the building and construction sector segment dominated the insulation market in 2024. The dominance of the segment is owing to the rising number of insulation-intensive buildings in rural and urban areas.

- By end use, the transportation segment is expected to grow at a significant CAGR over the projected period. The growth of the segment is due to the growing need for energy-efficient vehicles, the growth of public transportation, and the surge in electric and hybrid vehicles.

Increasing Consumer Awareness Expanding the Market Growth

The market encompasses the industry that emphasizes on production and supply of materials created to minimize noise, heat transfer, and electrical conductivity. These materials are utilized in different applications such as industrial settings, construction, and HVAC systems. Insulation materials include mineral wool, polyurethane foam, fiberglass, expanded polystyrene, cellulose, and others specific to applications like acoustic, thermal, or electrical insulation. The market is mainly driven by factors such as technological advancements and increasing awareness of sustainable building techniques.

What Are the Key Trends Influencing the Insulation Market?

- The surge in the manufacturing of hybrid and electric vehicles (EVs) has increased the demand for innovative acoustic and thermal insulation solutions to improve performance, energy efficiency, and passenger comfort. This trend is also crucial to create future opportunities in the market. Effective thermal insulation is important to keep optimal battery temperatures, which affects the overall safety, longevity, and performance of the EVs.

- The exponential growth in the construction industry is the latest trend in the market along with the significant surge in infrastructure development, especially in developing countries. Also, government-led programs like urban renewal projects and affordable housing schemes are propelling the demand for high-performance insulation products such as foam and fiberglass.

- New insulation technologies such as vacuum insulation panels, aerogels, and phase-change materials are trending, providing enhanced efficiency and performance. Moreover, individuals and governments are increasingly focusing on energy efficiency, which leads to a greater demand for insulation materials in building and automotive applications.

How is the Government Supporting the Insulation Market?

The Indian government is promoting the market through initiatives such as green buildings, sustainable construction, and energy efficiency, which positively impact the insulation market. The government supports green building initiatives such as the Energy Conservation Building Code (ECBC) and Smart Cities Mission, which necessitates sustainable building materials and designs. Furthermore, the developers of LEED-certified buildings are also eligible for several tax benefits.

The US government is supporting the market through the integration of regulatory frameworks and financial incentives, which are all aimed at optimizing energy efficiency by minimizing carbon emissions. The U.S. Department of Energy (DOE) offers funding for the Weatherization Assistance Program Enhancement and Innovation, which promotes the use of innovative thermal insulation technologies to enhance energy efficiency.

Report Scope

| Report Attributes | Details |

| Market Size in 2026 | USD 80.12 Billion |

| Expected Size by 2035 | USD 148.67 Billion |

| Growth Rate from 2025 to 2034 | CAGR 7.11% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Leading Region | Asia Pacific |

| Fastest Growing Region | North America |

| Segment Covered | By Insulation Type, By Material Type, By End User, By Region , |

| Key Companies Profiled | GAF, Saint Gobain, Recticel , URSA, Rockwool Group, Knauf Insulation, Johns Manville, 3M Company, Owens Corning |

Market Opportunity

Favourable Government Policies

The new policies and laws are increasingly promoting the adoption of modern building methods. The use of these materials has been boosted by the change in building codes to raise the minimum thickness required. Furthermore, the government in various regions is supporting the adoption of sustainable construction and zero-energy buildings which are major factors creating lucrative opportunities in the insulation market. Insulation offers fundamental functionality like raised occupant comfort, high-performance buildings, and fire resistance.

- In April 2025, FOLI AEROGEL, a major insulation company, announced the launch of its latest insulation, designed to offer unprecedented weight and performance for outdoor lifestyle individuals. The new technology provide a range of advantages that set it distant from other insulations in the market.(Source: www.fibre2fashion.com)

Market Challenge

Stricter Energy Efficiency Codes

Many countries are imposing stringent energy efficiency regulations, that require insulation materials to fulfil higher performance standards, which can be sometimes difficult to achieve while maintaining the cost competitive. Moreover, innovative insulation materials, while providing superior performance, come with higher initial costs, which can pose a restriction to price-sensitive businesses and consumers, hampering market expansion soon.

Segmental Insights

Insulation Type Insights

Which Insulation Type Segment Dominated the Insulation Market in 2024?

The thermal insulation segment dominated the market in 2024. The dominance of the segment can be attributed to the growing demand for noise reduction, energy efficiency, and strict adherence to energy regulations. Ongoing construction activities and urbanization particularly in developing economies propel demand for insulation in commercial, residential, and industrial buildings. In addition, thermal insulation materials reduce noise transmission through floors, ceilings, and walls which makes them a key component.

- In June 2025, Kyushu University, announced the launch of its new technology, "Thermal Insulation Retrofit Database, making its entry into the global marketplace for building equipment industry. This technology offers innovative performance and cheapness that sets it apart in the competitive scenario.(Source: www.wane.com)

Acoustic Insulation segment is expected to grow at fastest CAGR over the forecast period. The growth of the segment can be credited to the ongoing construction developments, rapid urbanization, and raised awareness regarding noise pollution. Acoustic insulation is important in commercial spaces, residential buildings, and industrial facilities where noise control is necessary for privacy, comfort, and regulatory compliance. Companies like Saint-Gobain SA, Knauf Insulation, and ROCKWOOL A/S are prominent market players driving the segment's growth.

Material Type Insights

Why Did Expanded Polystyrene (EPS) Segment Dominated The Insulation Market in 2024?

The expanded polystyrene (EPS) segment held the largest insulation market share in 2024. The dominance of the segment can be linked to the various benefits of expanded polystyrene across different sectors such as construction and packaging, because of its thermal insulation properties, lightweight nature, and cost-effectiveness. Moreover, EPS is resistant and durable to chemicals, moisture, and bacteria which makes it a reliable insulation material for long-term use.

The glass wool segment is expected to grow at the fastest CAGR during the forecast period. The growth of the segment can be driven by various benefits of glass wool insulation such as enhanced comfort, improved energy efficiency, sustainability, and fire resistance. Also, glass wool is non-combustible, which makes it a convenient choice for building insulation to help prevent the spread of fires, impacting positive segment growth further.

End-Use Insights

How Did the Building and Construction Sector Segment Hold The Largest Insulation Market Share in 2024?

The building and construction sector segment dominated the insulation market in 2024. The dominance of the segment is owing to the rising number of insulation-intensive buildings in rural and urban areas. Insulation plays a key role in minimizing energy consumption for cooling and heating, which leads to decreased gas emissions and lower operational costs. Insulation also helps maintain indoor temperature and enhances comfort for building occupants.

The transportation segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment is due to the growing need for energy-efficient vehicles, the growth of public transportation, and the surge in electric and hybrid vehicles. Furthermore, the increasing focus on energy efficiency in vehicles, especially with the transition towards hybrid and electric vehicles, is growing the need for insulation to improve overall battery performance.

Regional Insights

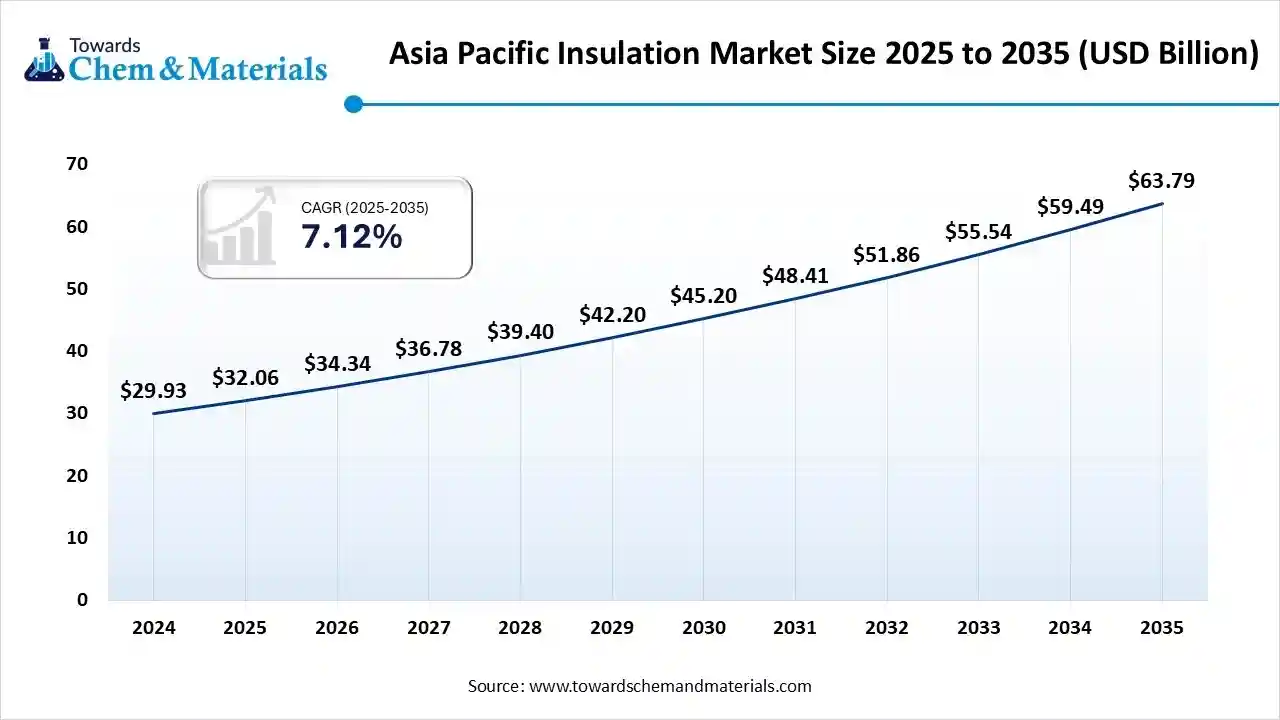

The Asia Pacific insulation market size was valued at USD 32.06 billion in 2025 and is expected to reach USD 63.79 billion by 2035, growing at a CAGR of 7.12%% from 2025 to 2035. Asia Pacific held the largest insulation market share in 2024.

The dominance of the region can be attributed to the surge in oil production in emerging economies like India and China along with the increasing concerns about substantial energy wastage. In addition, major market players in the region are emphasizing more on decreasing losses to enhance their performance by carrying out regular maintenance inspections. The implementation of stringent regulations focusing on minimizing greenhouse gas emissions by different governments in the region is further fuelling market growth.

- In January 2025, V-Marc India Limited, a prominent manufacturer of cables and wires in India, announced its market expansion plan in Kerala. Popular for its adoption of innovation and technology, Kerala is a major market for V-Marc to launch its latest range of innovative wire and cable solutions.(Source: www.apnnews.com)

Insulation Market in China

In Asia Pacific, China dominated the market owing to the growing demand for thermal protection, energy efficiency, and noise reduction in numerous sectors such as industrial facilities, construction, and appliances. Additionally, advancements in insulation technologies and materials are leading to more sustainable and effective solutions, which is strengthening the market reach in the country.

North America is expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to the growing insulation demand from manufacturing, oil and gas, power, metal and mining, and other industries, where operating temperature is relatively high. Furthermore, a stable regional economy promotes significant investment in infrastructure and construction driving regional growth soon.

Insulation Market in the U.S.

In North America, the U.S. led the market due to rising energy efficiency standards coupled with the surge in real estate activity. The increasing property values and rising number of single-family residences, especially in big cities such as New York and Chicago, are contributing to the demand for advanced and re-insulating properties. Companies like Owens Corning, Knauf Insulation, and others are emphasizing collaborations, acquisitions, and strategic partnerships to increase their revenue share.

Who are the Top Electrical Insulators of Glass Exporters in 2023?

| Reporter | Trade Value 1000USD |

| China | 107,414.00K |

| European Union | 97,362.43K |

| Italy | 73,561.41K |

| Spain | 46,746.59K |

| United States | 12,476.65K |

Recent Developments

- In May 2025, SAINT GOBAIN announced to launch a low-carbon stone wool insulation plant in the UK. The plant is anticipated to begin production in 2027.After reaching full capacity, the new factory is anticipated to employ up to 250 workers.(Source: roofingtoday.co.uk)

- In September 2024, Armacell, a leader in equipment insulation industry launched its new ArmaFlex ECO550 adhesives, a solution created to improve the safety, efficiency and sustainability of ArmaFlex applications.(Source: www.armacell.com)

- In November 2024, Aerolam, a manufacturer of insulation products announced the opening of a new production facility in Bhiwandi, Rajasthan, with an investment of Rs 30 crore. The latest facility has an initial manufacturing capacity of 250 tonnes per month.(Source: themachinemaker.com)

Top Companies List

- GAF

- Saint Gobain

- Recticel

- URSA

- Rockwool Group

- Knauf Insulation

- Johns Manville

- 3M Company

- Owens Corning

Segments Covered

By Insulation Type

- Thermal Insulation

- Acoustic Insulation

By Material Type

- Glass Wool

- Mineral Wool

- Expanded polystyrene (EPS)

- Extruded polystyrene foam insulation (XPS)

- Calcium-Magnesium-Silicate (CMS) Fibers

- Calcium Silicate

- Polyurethane

- Aerogel

- Others (Cellulose, Phenolic Foam, etc.)

By End User

- Building and Construction

- HVAC and OEM

- Transportation

- Appliances

- Others (Furniture, Packaging, etc.)

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait