Content

Regenerative Agriculture Market Size | Companies Analysis 2034

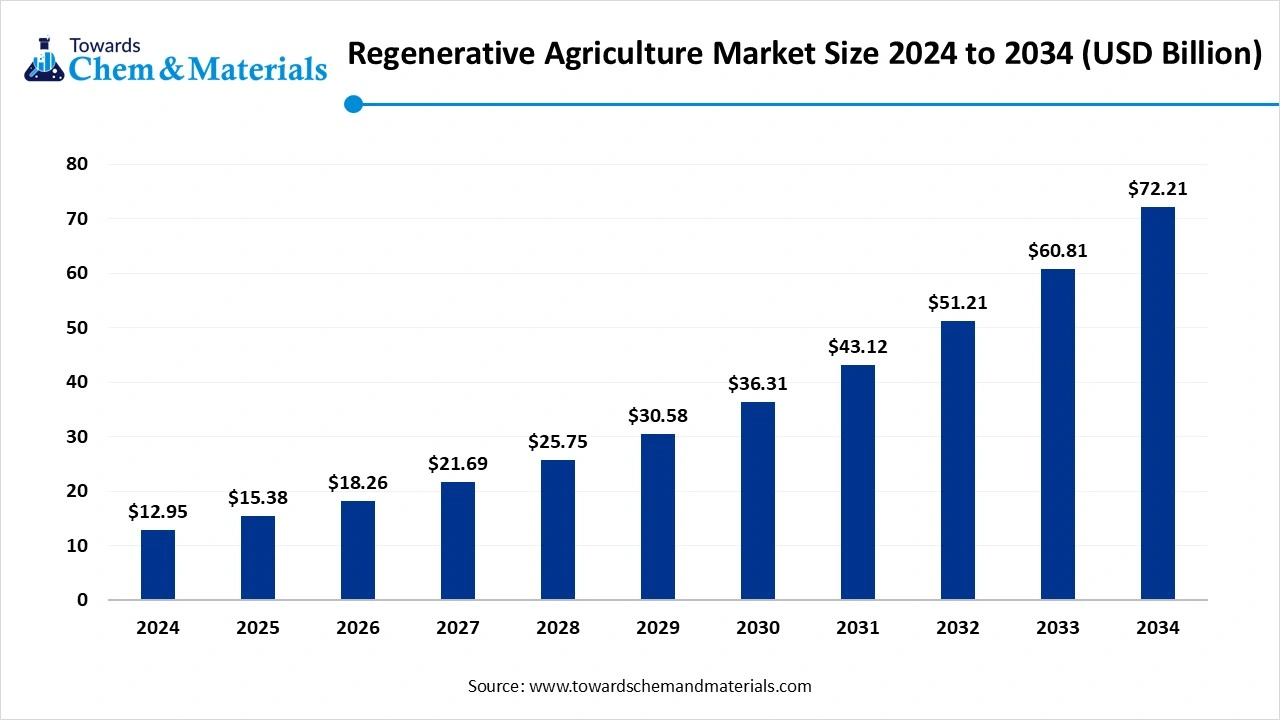

The regenerative agriculture market size accounted for USD 12.95 billion in 2024 and is predicted to increase from USD 15.38 billion in 2025 to approximately USD 72.21 billion by 2034, expanding at a CAGR of 18.75% from 2025 to 2034. The sudden shift towards repression and sustainable agriculture practices has allowed stakeholders to capitalize on growth outputs in recent years.

Key Takeaways

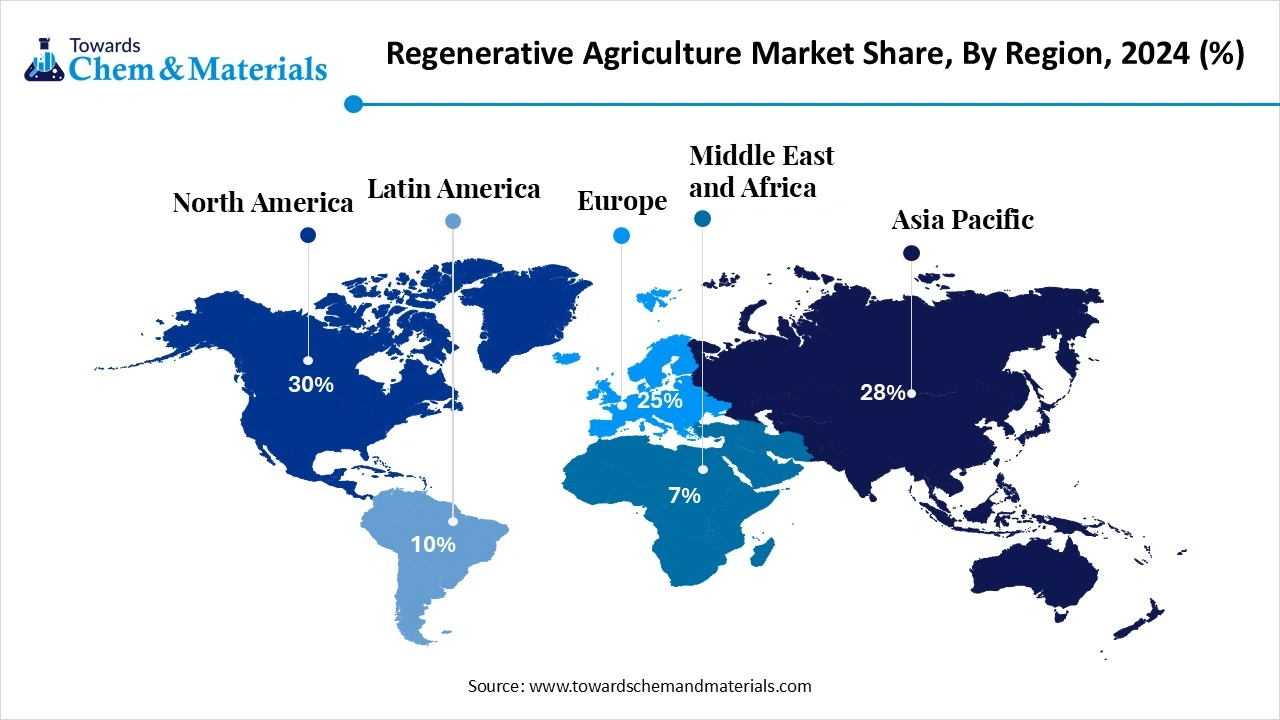

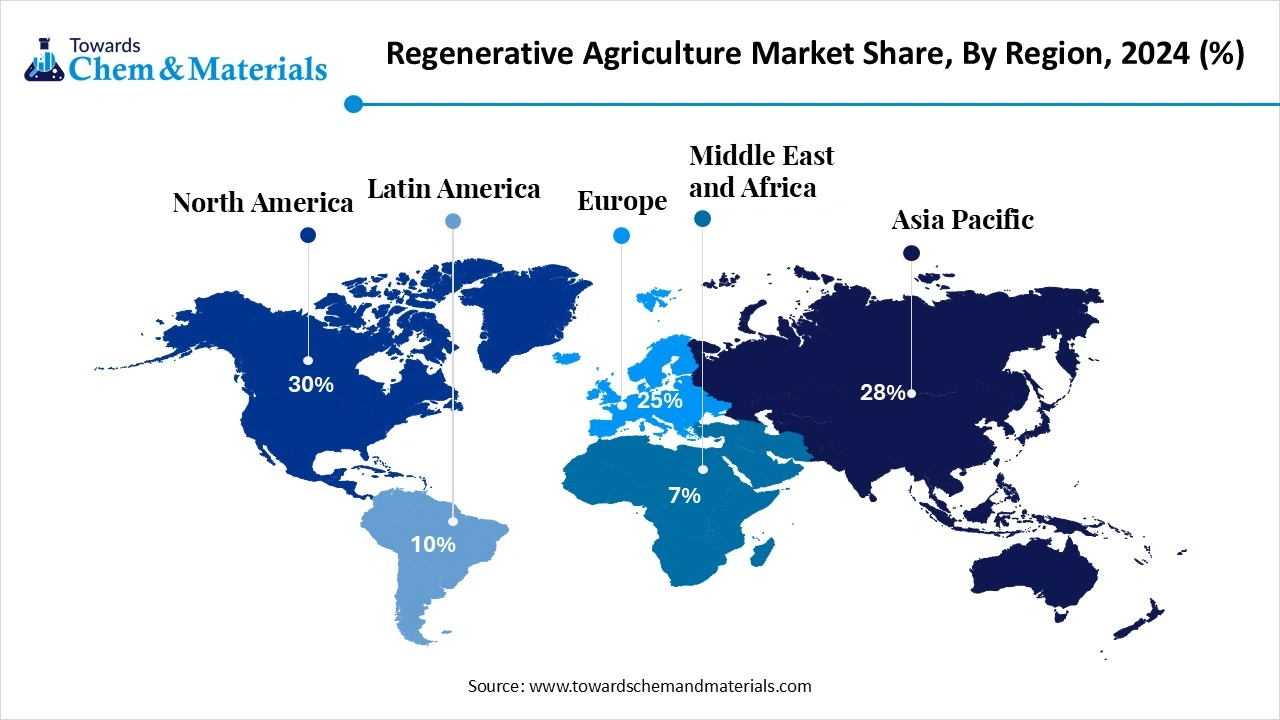

- By region, North America dominated the regenerative agriculture market with approximately 30% industry share in 2024.

- By region, Latin America is expected to grow at a notable rate in the future.

- By practice type, the soil management segment led the market with approximately 35% industry share in 2024.

- By practice type, the pest & disease management segment is expected to grow at the fastest rate in the market during the forecast period.

- By products/ manufactured inputs, the fertilizers & soil amendments segment emerged as the top-performing segment in the market with approximately 30% of the industry share in 2024.

- By products/ manufactured inputs, the biologicals & biostimulants segment is expected to lead the market in the coming years.

- By technology/ tools type, the data platforms & analytics tools segment led the market with approximately 40% share in 2024.

- By technology/ tools type, the precision application hardware segment is expected to capture the biggest portion of the market in the coming years.

- By services and business model, the advisory & agronomic consulting segment led the regenerative agriculture market with approximately 30% industry share in 2024.

- By services and business model, the carbon project development & crediting segment is expected to grow at the fastest rate in the market during the forecast period.

- By crop/ production type, the raw crops segment emerged as the top-performing segment in the market with approximately 40% of the industry share in 2024.

- By crop/ production type, the horticulture & vegetables segment is expected to lead the market in the coming years.

- By end-use industry, the food and beverage segment led the market with approximately 45% share in 2024.

- By end-use industry, the retail & CPG brands segment is expected to capture the biggest portion of the market in the coming years.

What is Regenerative Agriculture?

The term regenerative agriculture refers to the land management that includes the improvement of soil health, ecosystem enhancing resilience with the production of healthy food, and improvisation of biodiversity. Furthermore, the regenerative agriculture industry has gained major attention in recent years as farmers are seen under the heavy soil restoration and boosting biodiversity in recent years.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 15.38 Billion |

| Expected Size by 2034 | USD 72.21 Billion |

| Growth Rate from 2025 to 2034 | CAGR 18.75% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | North America |

| Segment Covered | By Practice Type, By Products / Manufactured Inputs, By Technology & Tools, By Services & Business Models, By Crop / Production Type, By End-Use Industry, By Region |

| Key Companies Profiled | Great Plains Manufacturing, Inc., Kverneland Group AS , Horsch Maschinen GmbH , Amazone GmbH & Co. KG , Vermeer Corporation , Corteva Agriscience , Bayer CropScience , Syngenta Group , BASF Agricultural Solutions, Novozymes A/S , Marrone Bio Innovations, Inc. , Koppert Biological Systems , Verdesian Life Sciences, LLC , The Andersons, Inc. , Pacific Biochar Solutions , Heliae Development, LLC |

Regenerative Agriculture Market Outlook:

- Industry Growth Overview: Between 2025 and 2034, the industry is likely to experience greater growth potential, akin to factors like climate risk, corporate pledges, and consumer preferences. Also, the farmers have been actively adopting modern farming practices in the past few years.

- Sustainability Trends: the farmers are actively seen in shifting focus towards the eco-friendly agriculture practices, including major initiatives such as the minimization of soil carbon, water filtration, yield stability, and biodiversity counts in recent years. Furthermore, the agriculture services brands are offering regenerative premiums for extra verified outcomes to the farmers.

- Global Expansion: The industry is widely discussed in technological forums and whitepapers in certain regions like Latin America, Asia, and Sub-Saharan Africa. The farmers in this region have been involved with different types of regeneration initiatives, like restoration and agroforestry, soil fertility programmes, and paludiculture and rice systems for the past few years

Key Technological Shifts in the Regenerative Agriculture Market:

The regenerative agriculture sector is increasingly shifting towards advanced and modern technology like microbiome-first management and others. These management runs on the ArtificiaI Intelligence, low-cost DNA soil testing, and custom microbial consortia as per the recent observation. Also, the technology enables the drone and satellite mapping of the farm areas, which helps farmers to manage their soil programs or agricultural yield concepts in the coming years.

Value Chain Analysis of the Regenerative Agriculture Market:

- Distribution to Industrial Users: The distributors focused on the improvement of regenerative agriculture products with technology providers.

- Key Players: Bayer and Cargill

- Chemical Synthesis and Processing: Majorly, chemical synthesis and processing are avoided in regenerative agriculture while maintaining a natural growth of soil health and fertility.

- Regulatory Compliance and Safety Monitoring: The safety and regulatory process of regenerative agriculture includes data-driven approaches and soil certifications. Also, the regulatory bodies ensure standardized frameworks and genuine sustainability as per the information.

Regenerative Agriculture Market’s Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas | Notable Notes |

| United States | U.S. Department of Agriculture (USDA) | Farm Bill (e.g., most recent 2018 bill, with the next expected in 2025) | Climate-smart agriculture and soil health | These agencies are actively observing farming practices |

| European Union | Member State Ministries of Agriculture | Common Agricultural Policy | Biodiversity Enhancement | The agency is responsible for the country’s farming. |

| China | Ministry of Agriculture and Rural Affairs (MARA) | 14th Five-Year Plan (FYP) for National Green Development of Agriculture | Green Agricultural Modernization | The agencies sets a broader strategy of "green agriculture" development. |

| India | Ministry of Agriculture and Farmers Welfare and NITI Aayog | India's New Agricultural Policy 2025 | Farmer Empowerment | These agencies are seen in the promotion of natural and regenerative practices, often without heavy reliance on external inputs. |

Segmental Insights

Practice Type Insights

How did the Soil Management Segment Dominate the Regenerative Agriculture Market in 2024?

The soil management segment held approximately 35% share of the market in 2024, due to its reflections as the foundation of resilience and long-term productivity. Furthermore, soil management is the first and most prominent step of agriculture, where farmers cover crops, reduce tillage, and compost. Also, modern farms are seen under the heavy usage of technological advancements for the collection of soil data in recent years.

The pest & disease management segment is expected to grow at a notable rate during the predicted timeframe, owing to ongoing climate change incidents and others. Moreover, farmers have been actively shifting to regenerative methods in recent years, including pest and disease management. Furthermore, the major brands are increasingly offering whole pest and disease management premium packages in recent years.

Products Insights

Why does the Fertilizers and Soil Amendments Segment Dominate the Regenerative Agriculture Market?

The fertilizers and soil amendments segment held approximately 30% of the market in 2024 because they deliver visible, short-term improvements in degraded soils. Farmers shifting to regenerative methods often rely on compost, organic amendments, and low-salt mineral fertilizers to rebuild fertility while reducing synthetic inputs.

The biologics and bio stimulants segment is expected to grow at a notable rate during the predicted timeframe, because they activate soil biology instead of just feeding it. Microbial inoculants, mycorrhizae, and enzyme-based products directly enhance soil microbial networks, making nutrient cycles more self-sustaining.

Technology & Tools Insights

How Did The Data Platforms & Analytics Tools Segment Dominate The Regenerative Agriculture Market In 2024?

The data platforms & analytics tools segment dominated the market with a approximately 40% share in 2024, because they prove and measure impact. Brands, banks, and carbon markets require digital proof of improved soil health and biodiversity. Satellites, soil testing dashboards, and farm management apps provide transparency, making them the most widely adopted tools today.

The precision application hardware segment is expected to grow at a significant rate during the predicted timeframe, because regenerative farming will rely on site-specific, low-disturbance interventions. Drones, variable-rate seeders, and smart sprayers allow targeted cover crop seeding, precise biological applications, and minimal soil disruption. As machinery becomes cheaper and integrated with Al, precision hardware will replace broad-scale equipment.

Services & Business Models Insights

Why does the Advisory & Agronomic Consulting Segment Dominate the Regenerative Agriculture Market?

The advisory & agronomic consulting segment held approximately 30% of the market in 2024 due to regenerative farming requiring knowledge shifts more than product shifts. Farmers transitioning from conventional methods depend on experts for crop rotation design, soil testing interpretation, and financial planning. Unlike traditional input-based models, regenerative systems are highly contextual-what works on one farm may not work on another.

The carbon project development & crediting segment is expected to grow at a notable rate during the predicted timeframe, akin to farmers' need for long-term financial incentives to scale regeneration. Carbon markets and ecosystem service credits turn regenerative outcomes into recurring revenue streams, often exceeding the value of yield premiums.

Production Type Insights

Why does the Raw Crops Segment Dominate the Regenerative Agriculture Market?

The raw crops segment held approximately 40% of the market in 2024 because they cover the largest global acreage-corn, soy, wheat, and rice are grown across millions of hectares. These systems are also the most degraded by monoculture practices, making them the first targets for regenerative transformation.

Cover crops, reduced tillage, and crop rotation deliver clear benefits in these large-scale systems, while corporate buyers prioritize row crop supply chains for regenerative sourcing.

The horticulture & vegetables segment is expected to grow at a notable rate during the predicted timeframe, because consumer demand for clean, chemical-free, nutrient-rich food is highest in this category. Regenerative practices like composting, polycultures, and natural pest control are easier to showcase in fruits and vegetables, giving brands a strong marketing appeal.

End Use Industry Insights

How Did The Food & Beverage Segment Dominate The Regenerative Agriculture Market In 2024?

The food & beverages segment dominated the market with approximately 45% share in 2024, due to brands' need for a secure, sustainable raw material supply. Major global companies like Nestle, PepsiCo, and Danone are embedding regenerative sourcing into their procurement strategies to reduce climate risks and meet net-zero pledges.

The retail and CPG brands segment is expected to grow at a significant rate during the predicted timeframe, because consumer-facing companies need regenerative credibility. Unlike bulk food producers, retailers sell directly to end consumers, who increasingly demand climate-positive labels. CPG brands will integrate regenerative sourcing into product marketing, certifications, and packaging to build brand loyalty.

Regional Insights

North America Regenerative Agriculture Market Size, Industry Report 2034

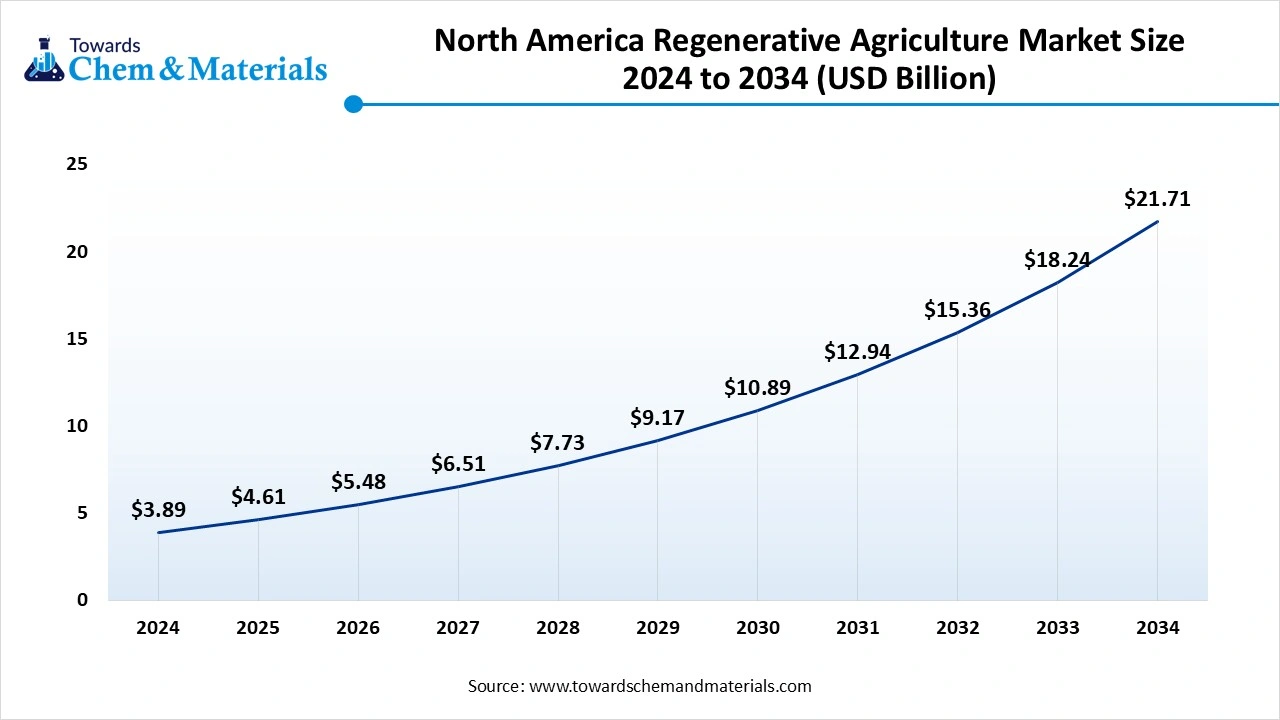

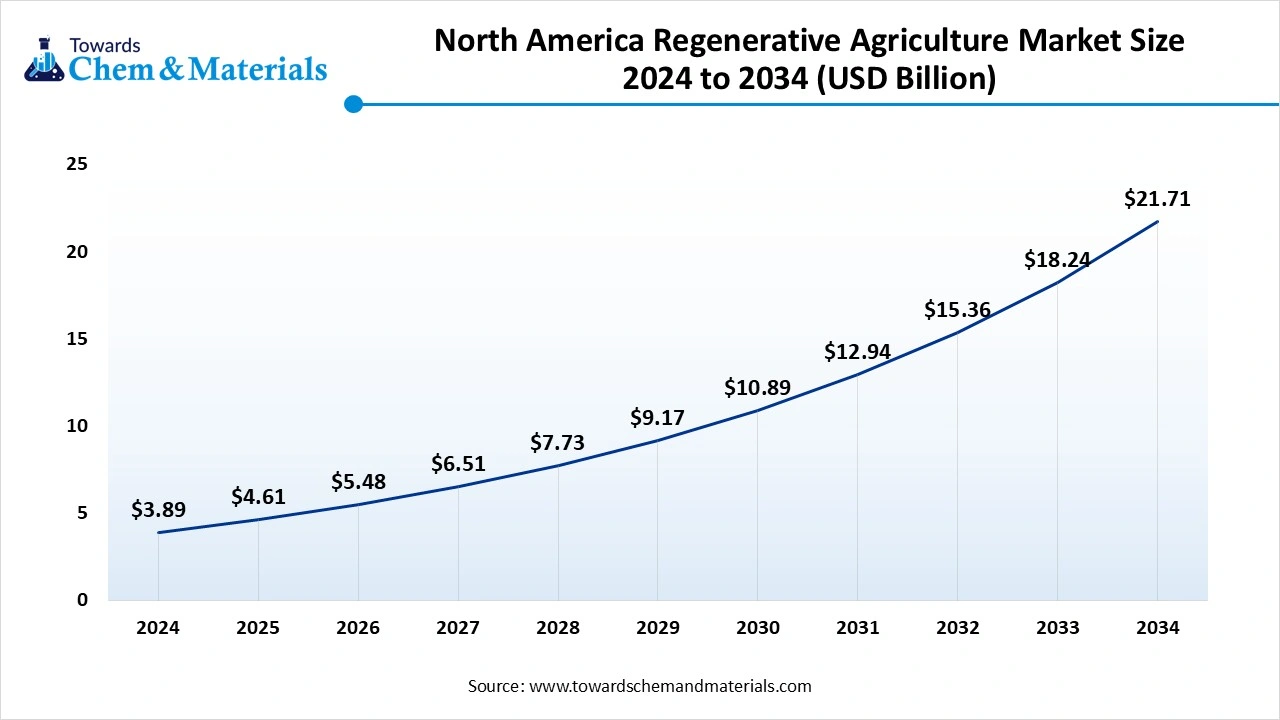

The North America regenerative agriculture market size was estimated at USD 3.89 billion in 2024 and is projected to reach USD 21.71 billion by 2034, growing at a CAGR of 18.76% from 2025 to 2034. North America dominated the regenerative agriculture market in 2024.

owing to enlarged corporate demand and large-scale farming. Also, the region has benefited from access to the latest agricultural technology, which provides confidence to investors in these large-scale sectors nowadays.

What Drives the United States’s Supremacy in Regenerative Agriculture?

The United States maintained its dominance in the market, owing to the country has the most advanced regenerative finance ecosystems in the current period. Also, the country has observed numerous heavy startup programs linked with regenerative agriculture ecosystems, which are likely to create lucrative opportunities for the sector in the coming years.

Latin America Regenerative Agriculture Market Trends

Latin America is expected to capture a major share of the market during the forecast period, akin to the region has vast farmland, diverse climates, and long-standing agricultural traditions that make it suitable for regenerative practices. Countries like Brazil and Argentina are global leaders in soybean, coffee, and beef production, and farmers are adopting regenerative techniques to improve soil health, reduce deforestation impact, and meet export market sustainability demands.

Country-level Investments & Funding Trends for the Regenerative Agriculture Industry:

- India: The country has set a budget of rupees 1,22,528.77 crore for the agriculture sector in 2024 to 2025, as per the published report(Source: www.pib.gov.in)

- China: China invested heavily in the Angolan agriculture recently and invested worth around US$350 million, as per the published report.(Source: www.scmp.com)

Recent Development

- In November 2024, Diageo India introduced the regenerative agriculture program. The aim behind this launch is to minimize the carbon and water footprint in agriculture and its supply chain, as per the published report.(Source: www.diageoindia.com)

Top Vendors in the Regenerative Agriculture Market & Their Offerings:

- Deere & Company (John Deere): the company is considered one of the leading agricultural products and financial services across the globe.

- AGCO Corporation: The company is focused on the design and creation of agricultural machinery with precision technology

- CNH Industrial N.V.: The firm has seen under the development of agricultural construction equipment worldwide.

- Kubota Corporation: the company has a wide range of agricultural products with modern technology integration.

Other Key Players

- Great Plains Manufacturing, Inc.

- Kverneland Group AS

- Horsch Maschinen GmbH

- Amazone GmbH & Co. KG

- Vermeer Corporation

- Corteva Agriscience

- Bayer CropScience

- Syngenta Group

- BASF Agricultural Solutions

- Novozymes A/S

- Marrone Bio Innovations, Inc.

- Koppert Biological Systems

- Verdesian Life Sciences, LLC

- The Andersons, Inc.

- Pacific Biochar Solutions

- Heliae Development, LLC

Segments Covered in the Report

By Practice Type

- Soil Management

- Cover cropping

- No-till / Reduced tillage

- Composting & organic soil amendments

- Biochar application

- Mulching & residue management

- Crop Diversity & Rotation

- Multi-species rotations

- Intercropping

- Relay cropping

- Water Management

- Micro-irrigation / drip systems

- Rainwater harvesting & on-farm storage

- Field-level runoff & infiltration control

- Pest & Disease Management

- Integrated pest management (IPM)

- Habitat/beneficial insect management

- Biological control organism use

- Livestock & Pasture Management

- Managed rotational grazing

- Adaptive multi-paddock grazing

- Silvopasture integration

- Agroforestry & Perennial Integration

- Alley cropping

- Windbreaks & shelterbelts

- Riparian / buffer plantings

- Landscape & Erosion Control

- Contour farming & terracing

- Grassed waterways & permanent groundcovers

- Biodiversity & Habitat Restoration

- Hedgerows & pollinator corridors

- Wetland & riparian restoration

By Products / Manufactured Inputs

- Seeds & Planting Material

- Cover crop seed blends

- Diverse/heritage seed mixes

- Fertilizers & Soil Amendments

- Pelletized compost & organic fertilizers

- Biochar products

- Mineral/rock dust products

- Biologicals & Biostimulants

- Microbial inoculants

- Plant growth promoting formulations

- Seaweed/algal extract products

- Biopesticides & Natural Crop Protection

- Microbial pesticides

- Botanical extracts

- Equipment & Machinery

- No-till planters & seeders

- Interseeders

- Portable grazing infrastructure

- Soil & Crop Diagnostic Kits

By Technology & Tools

- Field Sensing Hardware

- Soil moisture & nutrient sensors

- Weather & microclimate stations

- Remote Sensing & Imagery Analytics

- Drone & satellite imagery platforms

- Data Platforms & Analytics Tools

- Farm data integration & management software

- Carbon MRV tools (software)

- Precision Application Hardware

- Variable-rate controllers & applicators

- Traceability & Recordkeeping Systems

By Services & Business Models

- Advisory & Agronomic Consulting

- Certification & Audit Services

- Carbon Project Development & Crediting

- Training & Extension Programs

- Financing, Insurance & Risk Mitigation Services

- Equipment Leasing / Technology-as-a-Service (TaaS)

- Market Aggregation & Offtake Facilitation

By Crop / Production Type

- Row Crops (cereals, grains, oilseeds)

- Horticulture & Vegetables (annual)

- Orchard & Vineyards (perennial fruit)

- Specialty Crops (coffee, cocoa, spices)

- Pasture & Forage Systems

- Mixed / Diversified Farms

- Forestry & Agroforestry Systems

By End-Use Industry

- Food & Beverage (human consumption)

- Animal Feed & Livestock Industry

- Retail & CPG Brands

- Bioenergy & Biomaterials

- Pharmaceutical / Nutraceutical Raw Materials

- Carbon Credit / Ecosystem Service Buyers

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait