Content

Ready-to-Use Pharmaceutical Market Size and Forecast 2025 to 2034

The global ready-to-use pharmaceutical market size was valued at USD 10.47 billion in 2024 and is estimated to reach around USD 21.08 billion by 2034, exhibiting a compound annual growth rate (CAGR) of 7.25% during the forecast period 2025 to 2034.The growing demand for patient safety, product integrity, and technological advancements in packaging drives the market growth.

Key Takeaways

- The U.S. ready-to-use pharmaceutical packaging industry is expected to grow from USD 2.76 billion in 2025 to USD 5.56 billion by 2034, at a CAGR of 8.02%

during this period. - The North America dominated the global ready-to-use pharmaceutical packaging market and accounted for the largest revenue share of 35.11% in 2024.

- The ready-to-use pharmaceutical packaging market in Asia Pacific is expected to grow significantly from 2024 to 2034.

- The Sterile vials segment dominated the market across the container type segmentation in terms of revenue, accounting for a market share of 51.19% in 2024

- The Sterile syringes is emerging as a rapidly growing segment with a CAGR of 7.66% over the forecast period in the market.

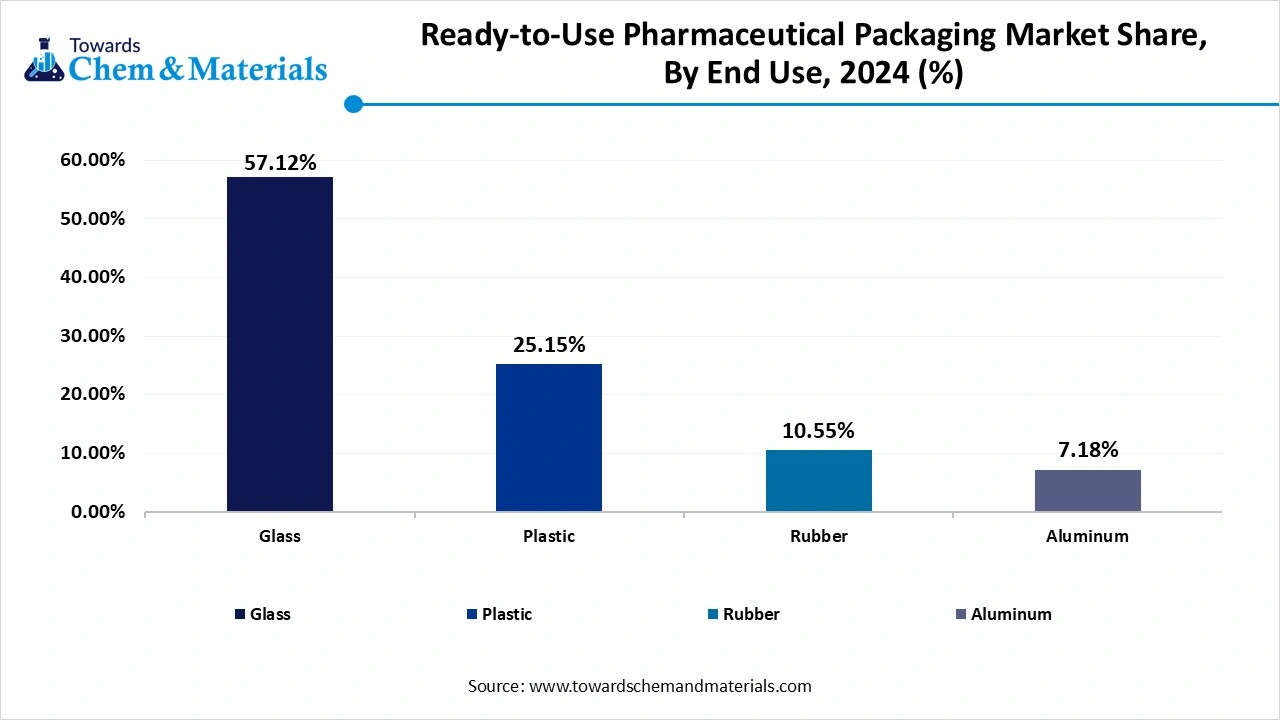

- The Glass dominated the market across the end use segmentation in terms of revenue, accounting for a market share of 57.12% in 2024.

- The plastic segment is projected to witness a substantial CAGR of 7.69% through the forecast period.

Ready-To-Use Pharmaceutical Packaging for Modern Medicine and Healthcare

Ready-to-use (RTU) pharmaceutical packaging is a packaging material that is pre-sterilized and used for pharmaceutical products. It is used for the pharmaceutical fill & finish process and removes the need for multiple sterilizations. It enhances product safety and lowers contamination risk. It eliminates the need for in-house sterilization and accelerates product launch. It offers customized packaging and small-batch production solutions.

The commonly used RTU components are vials, syringes, a container closure system, and Tyvek packaging. Sterile vials are widely used for injectable formulations. Sterile syringes lower the risk of contamination and are widely used for pre-filled injections. Sterile closure provides a sterile seal and secures pharmaceutical products. RTU packaging uses various kinds of materials like glass, plastics, aluminium, rubber, and many more. Increasing demand for advanced therapies like gene therapies & cell therapies fuels demand for RTU packaging for aseptic fill & finish.

Technological advancements in RTU pharmaceutical packaging and technologies like advanced barrier-coated glass & polymer-based syringes help in the market growth. Factors like growing demand for enhancing patient safety, the need for product integrity, streamlining manufacturing processes, demand for cost savings, and regulatory compliance & standards are responsible for the growth of the ready-to-use pharmaceutical packaging market.

- India exported 2.2K shipments of sterile vials. (Source:Volza.com)

- India exported 18697 shipments of glass vials. (Source:Volza.com)

- China exported 25752 shipments of glass vials. (Source: Volza.com)

The Growing Expansion of the Pharmaceutical Industry

The growing expansion of the pharmaceutical industry in various regions increases demand for RTU packaging to maintain the integrity and safety of pharmaceutical products. The growing demand for high-potency drugs and biologics increases demand for RTU packaging. The growing demand for fast delivery of drugs is fueling demand for RTU packaging. The stringent regulations about drug packaging and manufacturing increase demand for RTU to protect the drug. The growing requirement for protecting pharmaceutical products from moisture, damage, light, and other environmental factors increases demand for RTU packaging.

The growing prevalence and awareness of chronic diseases increases demand for pharmaceutical drugs. The growing demand for personalised medicines and precision medicine increases the demand for RTU packaging. The ongoing partnership of pharmaceutical companies and contract packaging organizations helps in the market growth. The growing pharmaceutical industry is a key driver for the growth of the ready-to-use pharmaceutical packaging market.

.webp)

Market Trends

- Increasing demand for biologic & sterile products:- The growing prevalence of chronic diseases like cancer, immune disease, diabetes, and heart diseases increases demand for sterile therapies. The growing demand for sterile syringes and vials increases demand for RTU pharmaceutical packaging.

- Growing focus on patient safety:- The growing demand for enhancing patient safety increases demand for RTU pharmaceutical packaging. RTU packaging helps to streamline the fill & finish process, lowers contamination risk, and ensures sterility. Lowering contamination and maintaining sterility enhances patient safety.

- Growing focus on sustainability:- Growing sustainability focus in the pharmaceutical industry encourages adoption of sustainable materials. The innovations, like the development of recyclable & biodegradable materials, help to enhance the sustainability of the pharmaceutical industry.

- Increasing adoption of glass:- The growing demand for glass in RTU pharmaceutical packaging for complex formulations like mRNA-based drugs and biologics helps market growth. Glass is widely used for RTU packaging due to its stability and chemical resistance.

Report Scope

| Report Attributes | Details |

| Market Volume in 2025 | USD 11.23 Billion |

| Market Volume by 2034 | USD 21.08 Billion |

| Growth Rate from 2025 to 2034 | CAGR 7.25% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| High Impact Region | North America |

| Segment Covered | By Container Type, By End Use, By Region |

| Key Companies Profiled | Gerresheimer AG, Stevanto Group,Nipro Corporation, Berry Global, Schott AG, West Pharmaceutical Services, SGD Pharma, AptarGroup, Datwyler |

Market Opportunity

Technological Advancements Drive RTU Pharmaceutical Packaging

Technological advancements focus on improving traceability, streamlining manufacturing, and enhancing patient safety. Advancements like ready-to-use components, smart packaging, and Automation & AI help the market growth. Smart packaging includes sensors, RFID tags, QR codes, and NFC tags that reduce the risk of counterfeit drugs and maintain integrity during storage & transport. The utilization of ready-to-use components like pre-sterilized containers and blow-fill seal vials ensures product quality. The growing usage of technologies like blockchain provides transparency in supply chains.

Automation & AI optimize the packaging process and enhance the efficiency of packaging lines. Innovations like ready-to-use syringes & vials remove the requirement of in-house sterilization. Advancements like senior-friendly packaging and child-resistant caps help in market growth. Innovations in barrier technology, like nanotechnology, enhance product integrity and extend the shelf life of the product. The focus on sustainability encourages innovations in eco-friendly and biodegradable materials. Technological advancements create opportunities for the ready-to-use pharmaceutical packaging market growth.

Market Challenge

High Initial Cost Limits the Expansion of RTU Pharmaceutical Packaging

Despite several benefits of RTU pharmaceutical packaging, the high initial cost restricts the growth of the ready-to-use pharmaceutical packaging market. Factors like the requirement of specialized manufacturing processes, rigorous quality control needs, and sterilization increase the overall cost. The need for stricter quality control measures and advanced sterilization processes leads to higher costs. The need for certification and validation increases initial costs.

The requirement of specialized facilities and equipment, like sterilization equipment, cleanrooms, and filling lines, leads to higher initial costs. The materials selection for packaging increases the cost. The extensive research & development, and maintaining facilities for RTU packaging require a high investment. The cost of raw materials required for packaging is higher. A need for specialized labor for manufacturing increases the cost. The high initial cost hampers the growth of the ready-to-use pharmaceutical packaging.

Regional Insights

Why Did North America Dominate Ready-To-Use Pharmaceutical Packaging?

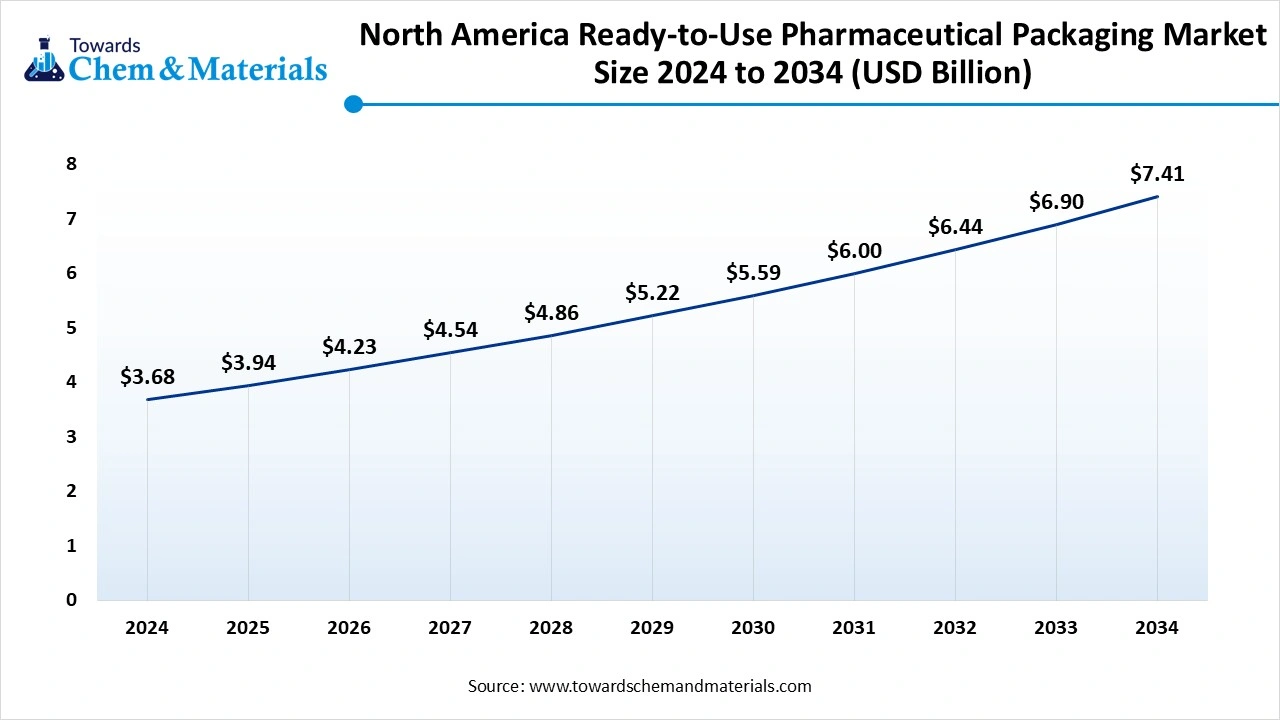

The North America ready-to-use pharmaceutical packaging market size was valued at USD 3.68 billion in 2024 and is expected to be worth around USD 7.41 billion by 2034, exhibiting a compound annual growth rate (CAGR) of 7.26% over the forecast period 2025 to 2034. North America dominated the ready-to-use pharmaceutical packaging market in 2024. The large and well-established pharmaceutical industry in the region increases demand for RTU packaging. The stringent regulations from the U.S. Food and Drug Administration and other regulatory bodies for pharmaceutical packaging help in the market growth.

The growing outsourcing of sterile manufacturing to manufacturing organizations and the growing production of large-scale vaccines increases demand for RTU packaging. The growing demand for cGMP-compliant packaging and advanced development in drug delivery systems like injectables & biologics increases demand for RTU packaging. The strong investment in aseptic fill-finish technologies & pharmaceutical automation, growing healthcare spending, and increasing prevalence of diseases in the region support the overall growth of the market.

United States Ready-To-Use Pharmaceutical Packaging Market Trends

The United States is a major contributor to the ready-to-use pharmaceutical packaging market. The well-established pharmaceutical sector, increasing investment in drug development, and advanced healthcare infrastructure increase demand for RTU packaging. The growing prevalence of chronic diseases and increasing demand for injectables & biologics help in the growth of the market. The growing advancements in drug development and a well-established healthcare system increase demand for RTU packaging. The strict pharmaceutical packaging regulations and the presence of major pharmaceutical packaging companies drive the overall market growth.

The United States exported 11447 shipments of glass vials.(Source: volza.com )

Why is Europe Growing In The Ready-To-Use Pharmaceutical Packaging?

Europe is experiencing the fastest growth in ready-to-use pharmaceutical packaging market during the forecast period. The growing demand for pharmaceuticals in the region increases demand for RTU packaging. The strict regulations about pharmaceutical packaging for sustainability and counterfeit prevention increase demand for RTU solutions, helping in the market growth. The growing focus on automation in pharmaceutical manufacturing and technological advancements for streamlining the packaging process drives the overall growth of the market. The growing pharmaceutical sales in Italy, Germany, and the United Kingdom drive the market growth. Additionally, the presence of major pharmaceutical companies in the region supports the overall market growth.

What are the Germany ready-to-use pharmaceutical packaging market trends?

Germany is a key contributor to the ready-to-use pharmaceutical packaging market. The extensive production of pharmaceuticals and strong research & development help the market growth. The stringent regulations for pharmaceutical products' efficacy, safety, and quality increase demand for RTU packaging. The well-established healthcare system and growing pharmaceutical innovation contribute to the overall market growth.

Germany exported 175 shipments of sterile vials. (Source : Volza)

Segmental Insights

Container Type Insights

The sterile vials segment dominated the ready-to-use pharmaceutical packaging market in 2024. The growing utilization of injectable drugs and the growing prevalence of chronic disease increase demand for sterile vials. Sterile vials lower the risk of contamination during storage & filing and are free from microorganisms. It ensures the drug stays potent & sterile during the overall shelf life. The growing regulatory requirements for pharmaceutical companies increase demand for sterile vials to ensure product integrity and safety. The growing complexity of drug products like gene & cell therapies and innovations in sterilization & manufacturing technologies support the overall growth of the market.

The sterile syringes segment is the fastest growing in the market during the forecast period. The growing demand for patient safety by lowering infection & contamination risk increases demand for sterile syringes. The growing demand from patients and healthcare experts for convenience helps in the market growth. The stricter guidelines & regulations, and growing demand for ensuring the safety of pharmaceutical products, increase demand for sterile syringes. The growing demand for sterile syringes during the aseptic filling process drives the market growth. The growing demand for injectable drugs like biosimilars and biologics increases demand for sterile syringes, contributing to the overall market growth.

End Use Insights

The glass segment dominated the ready-to-use pharmaceutical packaging market in 2024. The growing demand for maintaining the integrity of pharmaceutical formulations and avoiding contamination increases the demand for glass. It ensures the integrity of drugs and does not react with pharmaceutical products. Glass offers a barrier against moisture & air and provides a sterile environment for pharmaceutical products. It provides excellent protection against contamination & degradation and is sterilized through different methods like high-pressure steam sterilization. Glass RTU packaging offers transparency and is fully recyclable. The growing demand for biopharmaceutical packaging, like gene therapies, biologics, and vaccines, supports the overall market growth.

The plastic segment is growing substantially in the market during the forecast period. The wide applications for various pharmaceutical products packaging include biologics, solid, and liquid increase demand for plastics. It can be easily molded into various sizes & shapes and is applicable for injectables, tablets & liquids, helping in the market growth. Plastic has strong barrier properties against oxygen, moisture, and other environmental factors. Plastic is durable, lightweight, and has child-resistant features. The growing demand from the healthcare sector and the expansion of the pharmaceutical industry drive the overall growth of the market.

Recent Developments

- In October 2024, Nipro launched D2F™ (Direct-to-Fill) glass vials. The glass vials were developed using Stevanto Group’s advanced EZ-fill technology and are of high-quality, ready-to-use solutions for the pharmaceutical industry. The features of glass vials are direct-to-fill technology, optimized for fill-finish lines, and increased cost-efficiency & stability. It is efficient, scalable, and reliable RTU packaging for the pharmaceutical industry. (Source:healthcarepackaging.com)

- In March 2025, H&T Presspart launched ready-to-use snap-fit closure solution for advanced therapeutics. Vytal is designed for cell-based therapies, biologics, and mAbs. It is an efficient solution for ensuring the safety & integrity of pharmaceutical products. Vytal consists of the highest quality standards and accelerates pharmaceutical companies' time-to-market. It is compatible with modern filling technology and a reliable packaging solution for the pharmaceutical industry.

(Source:pharmaceuticalmanufacturer.media) - In February 2023, Nexus Pharmaceuticals launched a sterile vial product line. The product trio includes 2 ml amber vials, 20 ml clear vials, and 10 ml clear vials. It consists of 25 vials and is available for purchase in cartons. (Source:businesswire.com)

- In October 2023, SGD Pharma announced the expansion of sterility range RTU Type I molded glass vials. The extension includes 20, 25, 50 ml EasyLyo and 10, 20, 50, 100 ml ISO for various applications like hospitals, pharma, compound pharmacies, veterinary clinics, and biopharma companies. (Source: expresspharma.in)

Top Companies List

- Gerresheimer AG

- Stevanto Group

- Nipro Corporation

- Berry Global

- Schott AG

- West Pharmaceutical Services

- SGD Pharma

- AptarGroup

- Datwyler

Segments Covered in the Report

By Container Type

- Sterile Vials

- Sterile Syringes

- Sterile Cartidge

By End Use

- Glass

- Plastic

- Aluminium

- Rubber

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait