Content

Pottery Ceramics Market Size and Growth 2025 to 2034

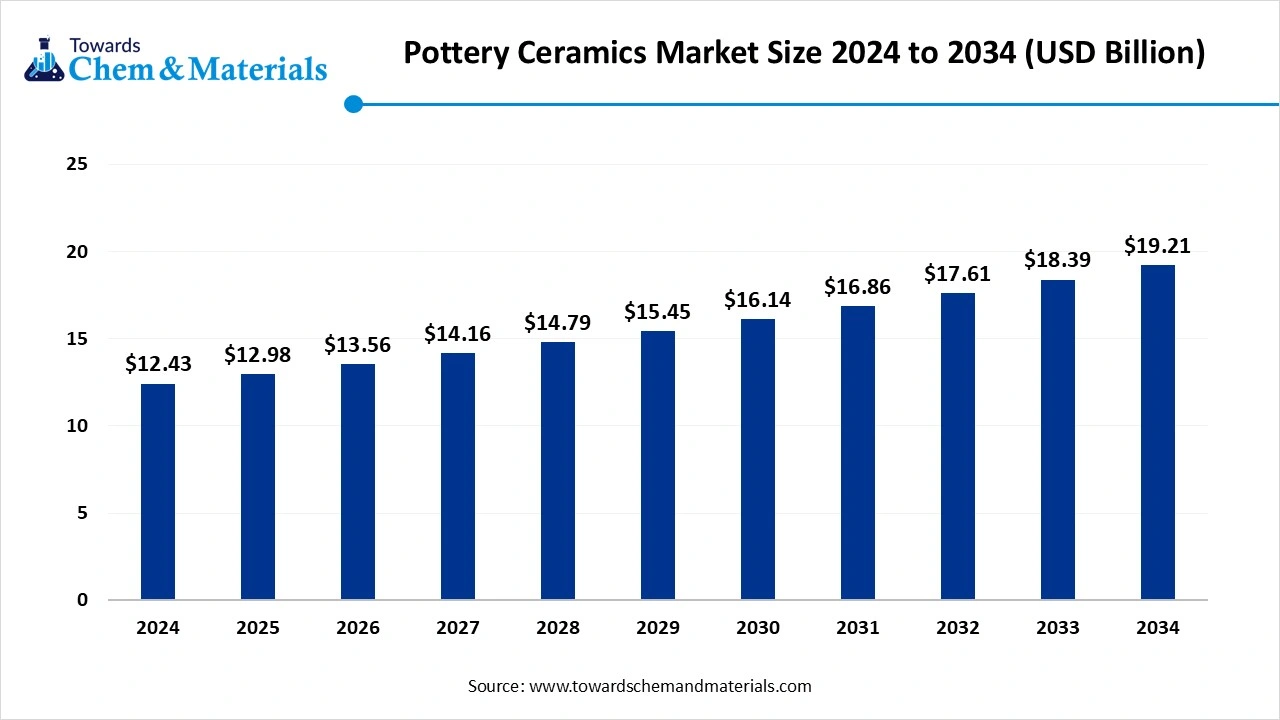

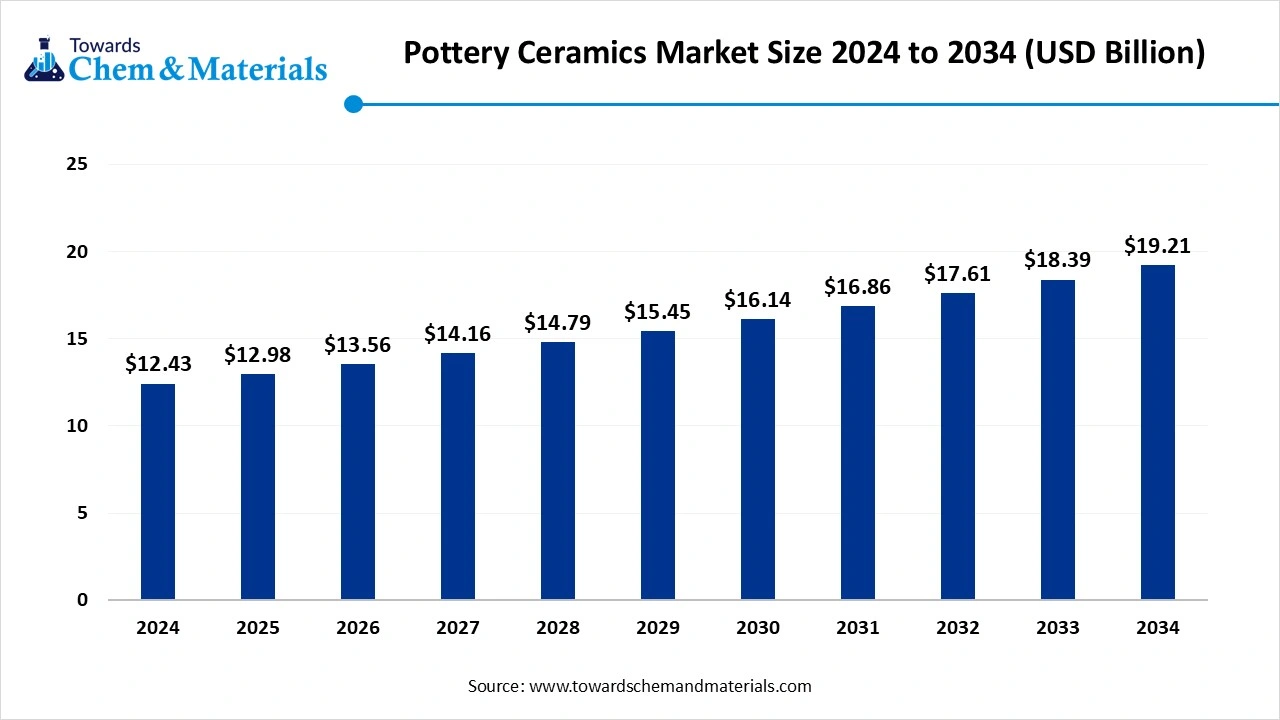

The global pottery ceramics market size was reached at USD 12.43 billion in 2024 and is expected to be worth around USD 19.21 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.45% over the forecast period 2025 to 2034. This market is growing due to rising demand for sustainable, handcrafted, and aesthetically appealing products across households, decor, and hospitality sectors.

Key Takeaways

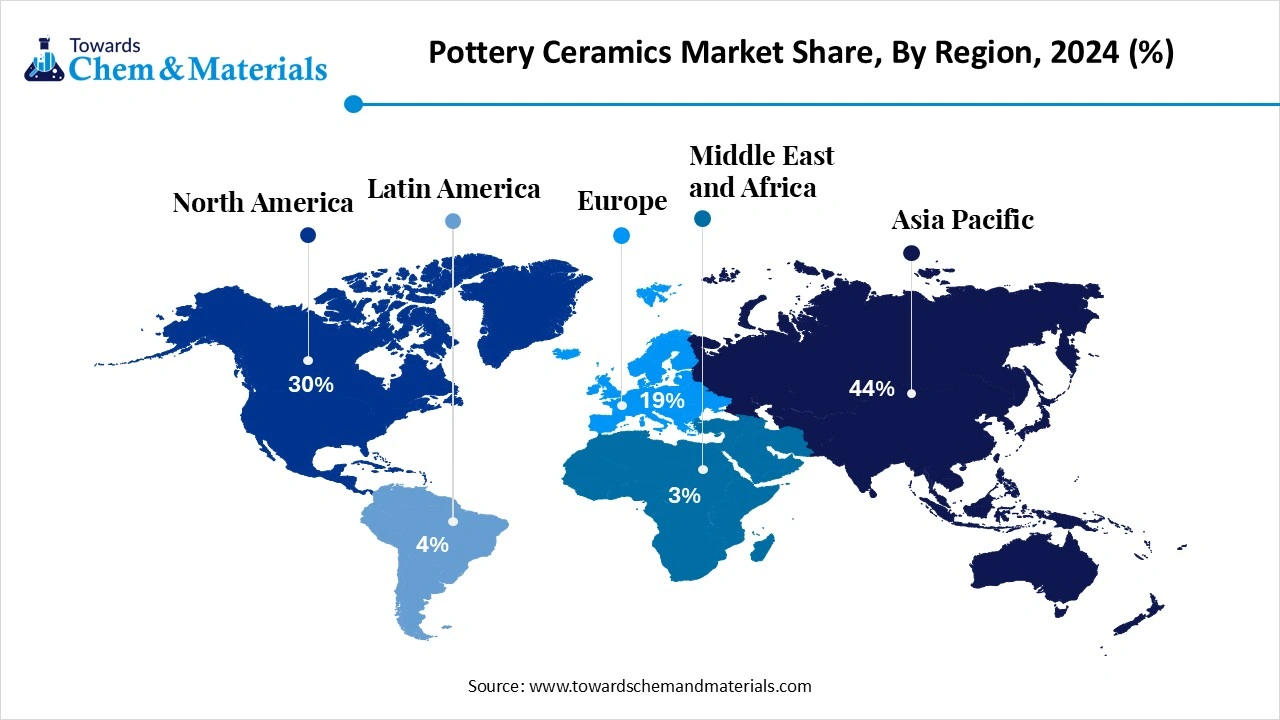

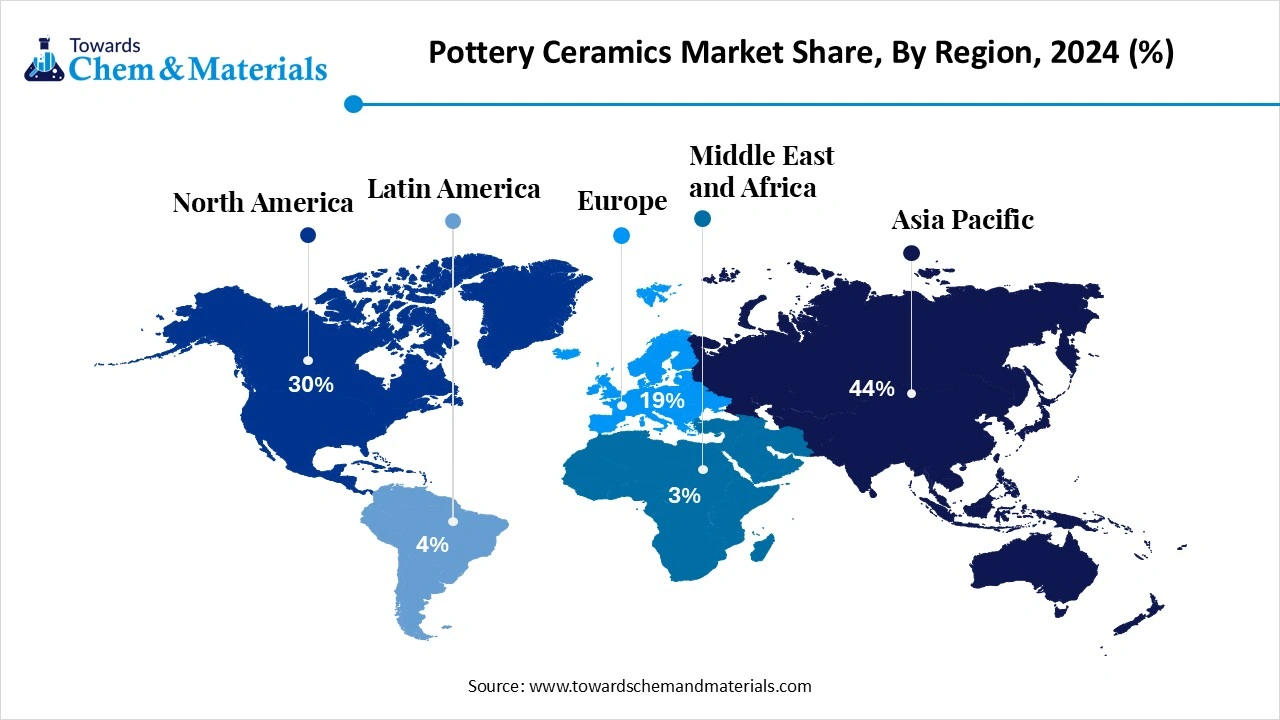

- By region, Asia Pacific dominated the market, holding the largest market share of 44% in 2024, driven by cultural heritage and production hubs.

- By region, North America is expected to grow at the fastest rate during the forecast period, driven by premium lifestyle demand.

- By body type, the stoneware segment held the largest share of the market at 36% in 2024, driven by durability and affordability.

- By body type, the porcelain & bone China segment is expected to grow at the fastest rate during the forecast period, driven by luxury dining trends.

- By forming/process, jiggering/ram pressing segment held the largest share at 42% in 2024, driven by cost-efficient mass production.

- By forming/process, the additive manufacturing (3D) segment is projected to grow at the fastest rate in the pottery ceramics market, driven by customization and innovation.

- By firing/finish, the mid-fire (stoneware) segment held the largest share of 45% in 2024, driven by everyday utility and strength.

- By firing/finish, the high fire (premium porcelain/stoneware) segment is the fastest-growing segment, driven by premiumization and elegance.

- By product/application, the tableware & kitchenware segment held the largest market share of 40% in 2024, driven by household consumption needs.

- By product/application, the home decor & gifting segment is emerging as the fastest growing, driven by aesthetic lifestyle trends.

- By end user, the residential/household segment held the largest share at 55% in 2024, driven by daily utility demand.

- By end user, the HoReCa segment is expected to grow at the fastest rate during the forecast period, driven by hospitality sector growth.

- By distribution channel, the offline retail segment held the largest share at 48% in 2024, driven by traditional buying preferences.

- By distribution channel, online marketplaces & D2C segment are expected to grow at the fastest rate during the forecast period, driven by e-commerce expansion.

Market Dynamics

The pottery ceramics market covers the design, production, and sale of ceramic ware formed from clay bodies (earthenware, stoneware, porcelain) and fired in kilns. Products span tableware & kitchenware, drinkware, cookware, home décor, gifts/collectibles, and select utility items (e.g., planters, vanity basins, architectural accents). Demand is driven by premiumization in home & lifestyle, growth in HoReCa (hotels, restaurants, cafés), e-commerce expansion, and consumer interest in artisanal/handmade and sustainable materials.

The market is driven by the rising demand fueled by the growing market for ornamental and practical goods like art tiles, sanitaryware, and tableware. Growth has been fueled by consumers' growing preference for handcrafted and aesthetically pleasing home decor items. Due to the widespread use of ceramics in wall coverings, flooring, and architectural applications, the demand is also supported by the global expansion of the construction industry. Increasingly popular artisanal crafts and cultural tourism are driving the market's growth.

Market Trends

Rising popularity of handmade and artisanal products

In both developed and developing regions, there is a growing demand for artisanal craftsmanship due to consumers' desire for genuine handcrafted pottery that reflects cultural heritage and individuality. Consumer interest in pottery and ceramics as useful works of art is being further fueled by the growth of slow living and a preference for handcrafted goods. Demand is being further increased by expanding tourism and cultural exchange initiatives that introduce consumers to traditional craft forms. The market value of distinctive artisanal collections is increasing as a result of premium buyers, particularly in North America and Europe, paying more.

- In May 2025, Burleigh Pottery launched its Hal o Collections new prints, offering modern patterns on traditionally crafted earthenware from its historic Stoke-on-Trent workshop.(Source: www.thetimes.co.uk)

Shift Toward Sustainable and Eco-Friendly Materials

Ceramics are favored as a long-lasting, nontoxic, and environmentally responsible substitute for decor made of plastic as sustainability becomes a global concern. Customers are increasingly choosing durable ceramics that biodegrade naturally over time in place of throwaway items as a result of growing environmental consciousness. Incentives are being created by governments to encourage eco-friendly alternatives and encourage ceramic manufacturers to develop sustainable production techniques. Ceramics have evolved from merely decorative objects to lifestyle choices in line with international green initiatives as a result of this ecological shift.

- In March 2025, Earth Tatva commercially launched its recycled clay tableware, using 60% recycled ceramic waste to reduce reliance on virgin clay and promote circular production.(Source: theinterview.world)

Report Scope

| Report Attribute | Details |

| Market Size in 2025 | USD 12.98 Billion |

| Expected Size by 2034 | USD 19.21 Billion |

| Growth Rate from 2025 to 2034 | CAGR 4.45% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Body Type, By Forming/Production Process, By Firing/Finish, By Product/Application, By End-Use, By Distribution Channel, By Region |

| Key Companies Profiled | American Art Clay Co., Inc. (AMACO), Bhoomi Pottery, Bluematchbox Potters Supplies Ltd, CCGNZ Group Limited, Clay-King, Dick Blick Holdings Inc., Laguna Clay Company, Sajo Ceramics, Sheffield Pottery Inc., Sounding Stone |

Market Opportunity

Growing Demand for Sustainable and Eco-Friendly Ceramics

Manufacturers have a great chance to benefit from the increased attention being paid to sustainability on a global scale. Customers are gravitating toward long-lasting biodegradable ceramics as an alternative to plastic and other short-lived materials. Eco-friendly ceramics and pottery not only adapt to changing consumer preferences but also support government programs that promote sustainable goods. This allows manufacturers to emphasize low-energy firing, recycled clay, and green certifications as important differentiators.

Market Challenge

High Production and Energy Costs

The high cost of raw materials and energy-intensive firing processes are two of the largest obstacles in the pottery and ceramics industry. Kilns need a lot of fuel or electricity, which has an immediate effect on production costs. Both large manufacturers and small-scale potters are finding it more and more difficult to maintain profitability as a result of rising global energy prices. Operational pressure is further increased by more stringent environmental regulations on emissions from ceramic kilns. Businesses that don't update their production processes run the risk of becoming less competitive over time.

Regional Insights

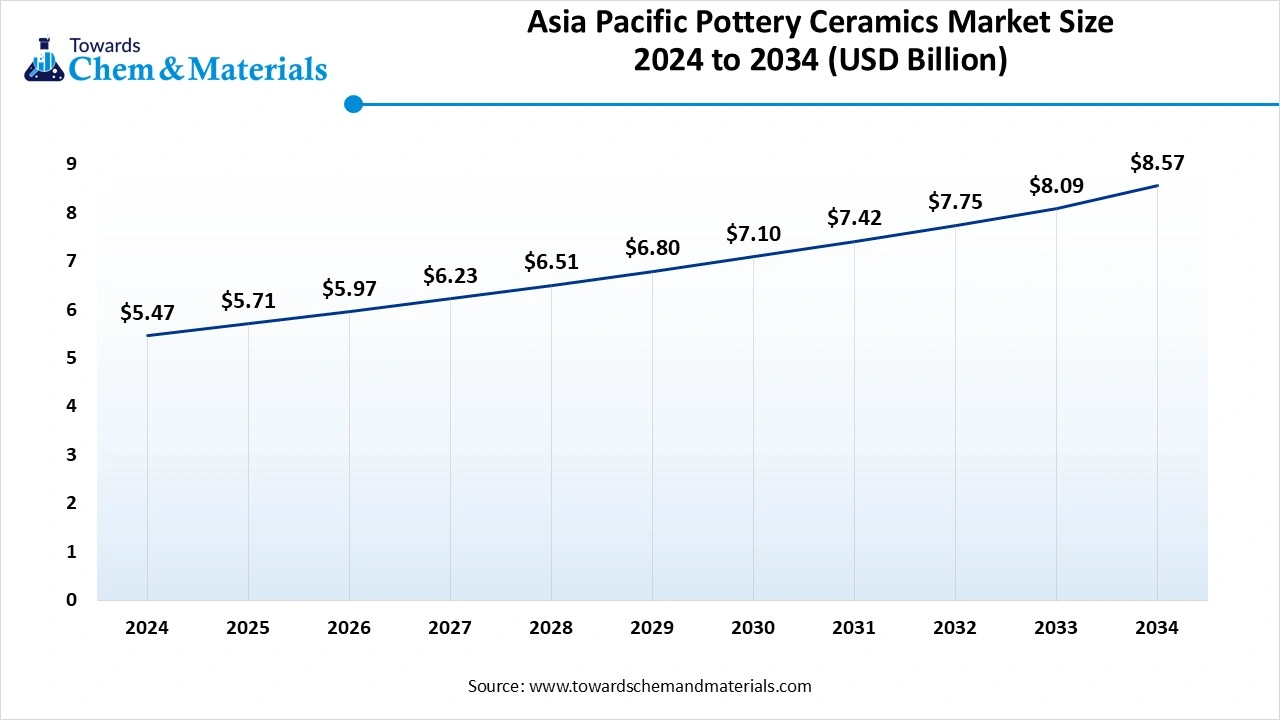

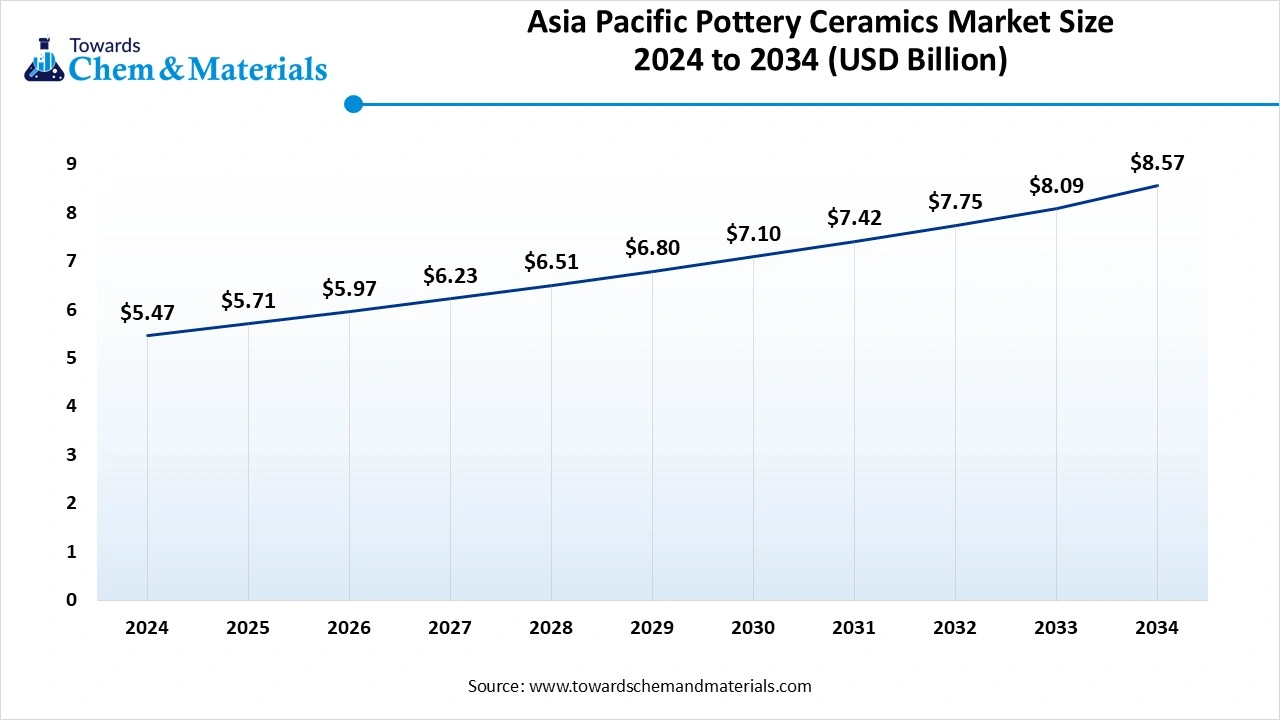

The Asia Pacific pottery ceramics market size was estimated at USD 5.47 billion in 2024 and is anticipated to reach USD 8.57 billion by 2034, growing at a CAGR of 4.59% from 2025 to 2034. Asia Pacific dominated the pottery ceramics market in 2024,

driven by its rich cultural history of ceramics and the robust demand from consumers for both contemporary and traditional pottery products. The region has become the global leader in both volume and value because of the presence of large-scale production hubs, an abundance of raw materials, and skilled artisanal communities. Further solidifying Asia Pacific dominance is the growing use of ceramics in everyday household applications, interior design, and construction.

India Pottery ceramics market Trends

The pottery ceramics market in India is experiencing strong growth, bolstered by its centuries-old craft legacy and a growing consumer demand for conventional yet useful home furnishings. Demand for eco-friendly ceramics, terracotta, and handcrafted pottery is rising, particularly as consumers gravitate toward long-lasting and sustainable lifestyle items. The demand for contemporary ceramic designs in homes and interior décor is also being driven by growing urbanization and rising disposable incomes.

A significant trend influencing the Indian market is the combination of traditional pottery with modern design, which appeals to younger consumers and urban buyers who are concerned about design. E-commerce sites are essential for providing local craftspeople with national and even international exposure, which helps small potters connect with a wider audience. In the HoReCa industry, where restaurants and boutique hotels are increasingly using handcrafted tableware to create upscale dining experiences, pottery and ceramics are also becoming more and more popular. India is becoming a thriving center for the growth of ceramics thanks to this fusion of innovation, cultural heritage, and digital expansion.

North America expects the fastest growth in the pottery ceramics market during the forecast period, driven by rising consumer demand for high-end lifestyle items and artisanal and handcrafted goods. Pottery and ceramics are seeing tremendous growth in both residential and commercial settings because of growing disposable incomes, home decor trends, and the expansion of online retail platforms. Further driving growth in this area are strong demand from the hospitality industry and a growing trend toward eco-friendly, sustainable home furnishings.

Canada Pottery ceramics market Trends

The pottery ceramics market in Canada is witnessing steady growth, driven by growing consumer demand for handmade artisanal and environmentally friendly home goods. Adoption is being fueled by rising demand from households and lifestyle consumers for distinctive tableware, decorative items, and sustainable plastic substitutes. Direct-to-consumer sales are emerging as a powerful growth channel for Canadian artisans and small workshops who are also using online platforms to broaden their reach.

As Canadian consumers place a higher value on individualized and aesthetically pleasing living spaces, pottery and ceramics are becoming increasingly important in interior design and home décor. Through craft fairs, exhibitions, and community marketplaces, the nation supports local artisans and fosters a cultural appreciation of craftsmanship, which benefits the market. There will be a sustained demand for pottery ceramics in Canada because consumers who care about sustainability are choosing long-lasting, robust ceramic products over throwaway ones.

Segmental Insights

Body Type Insights

How Stoneware Segment Dominated the Pottery Ceramics Market In 2024?

Stoneware segment dominated the market in 2024, driven by widespread use in common-place kitchenware and tableware affordability, and durability. Both artisanal makers and mass consumers now favor stoneware because of its exceptional resistance to chipping and capacity to endure regular use. Its dominance is further cemented by its adaptability in both decorative and functional applications.

Porcelain & bone China segment is observed to grow at the fastest rate during the forecast period, stimulated by growing consumer demand for high-end end sophisticated, and exquisite ceramics. Porcelain and bone China are becoming more and more popular in both domestic and international markets because of rising urban lifestyles, a culture of upscale dining, and gift-giving trends. They continue to spur growth because of their association with status and sophistication

Forming/Process Insights

Which Forming/Process Segment Held the Dominating Share of Pottery Ceramics Market In 2024?

Jiggering/Ram pressing segment dominated the pottery ceramics market in 2024, driven by the efficiency with which it produces large quantities of uniform ceramic products. Large factories and mid-sized manufacturers continue to use this process the most because it is economical and has been used for many years to make sanitaryware and tableware.

Additive manufacturing (3D printing) segment is observed to grow at the fastest rate during the forecast period, motivated by its capacity to produce specialized goods and intricate designs with less waste. The growing demand for personalized ceramics and distinctive decor pieces has made 3D printing a popular technique among innovators and boutique manufacturers. It is an innovative trend in contemporary pottery production because of its adaptability and creative freedom.

Firing/Finish Insights

How Mid Fire (Stoneware) Segment Dominated the Pottery Ceramics Market In 2024?

Mid-fire (stoneware) segment dominated the market in 2024, driven by its adaptability to a variety of common household applications, affordability, and durability. Stoneware continues to be the most used body type in kitchenware and tableware because of its strength, ease of production, and widespread acceptance. It has a strong market dominance because of its affordability and quality balance, which makes it the go-to option for both mass consumers and artisanal producers.

High fire (premium porcelain/stoneware) segment is observed to grow at the fastest rate during the forecast period, stimulated by growing consumer demand for high-end, exquisite ceramics for both home decor and fine dining settings. High fire ceramics are being used more and more in the hospitality, luxury interior design, and gifting industries because of their exceptional strength, translucence, and exquisite finish. The market segment is expanding quickly in both domestic and international markets as premiumization, and lifestyle upgrades gain popularity.

Product/Application Insights

What Made Tableware & Kitchenware Segment Dominant Segment In 2024?

Tableware & kitchenware segment dominated the market with the largest share in 2024, driven by the steady demand in households for cooking utensils, bowls, plates, and mugs. Tableware continues to make up most of the pottery and ceramics production worldwide due to its everyday use, affordability, and cultural association with dining customs.

Home decor & gifting segment is expected to grow at the fastest rate in the market during the forecast period, driven by the growing demand for artisanal pottery as upscale presents and decorative items. Pottery ceramics are becoming increasingly prized for their aesthetic appeal and cultural significance because of the global home decor boom, expanding tourism, and rising disposable income.

End User Insights

Why Did the Residential/Household Segment Dominate In 2024?

Residential/household segment held the largest share of the pottery ceramics market in 2024, driven by a robust demand from consumers for pottery ceramics for everyday use in storage, decoration, and dining. Households remain the largest consumer base due to affordability and widespread availability through both offline and online retail.

HoReCa (professional ware) segment is seen to grow at a notable CAGR during the predicted timeframe driven by the hospitality industry's growing need for fashionable long long-lasting, and high-quality ceramics. The professional wear market is growing quickly due to the rise in luxury hotels, fine dining, and international travel. Pottery and ceramics are being used to improve the dining experience of patrons.

Distribution Channel Insights

Why The Offline Retail Segment Dominated The Pottery Ceramics Market In 2024?

Offline retail segment dominated the market in 2024, driven by the desire of customers to make tactile purchases at specialty shops, supermarkets, and neighborhood pottery factories. Offline stores continue to be the biggest distribution channel for pottery and ceramics globally due to the cultural associations and customary purchasing patterns.

Online marketplaces & D2C segment is seen to grow at a notable CAGR during the predicted timeframe, driven by the ease of online shopping and direct access to a worldwide audience for craftspeople. The popularity of social media marketing and e-commerce platforms has led to a rise in online pottery and ceramics sales, which helps small businesses and niche brands.

Recent Developments

- In April 2025, Noritake unveiled the “Rose” porcelain collection by British designer Faye Toogood at Milan Design Week, blending abstract brushwork with heritage forms in a limited-edition series of hand-printed tableware.(Source: www.wallpaper.com)

Pottery Ceramics Market Top Companies

- American Art Clay Co., Inc. (AMACO)

- Bhoomi Pottery

- Bluematchbox Potters Supplies Ltd

- CCGNZ Group Limited

- Clay-King

- Dick Blick Holdings Inc.

- Laguna Clay Company

- Sajo Ceramics

- Sheffield Pottery Inc.

- Sounding Stone

Segments Covered

By Body Type

- Earthenware

- Stoneware

- Porcelain & Bone China

- Terracotta/Redware

- Others (raku, specialty blends)

By Forming/Production Process

- Slip Casting

- Jiggering/Ram Pressing & Isostatic Pressing

- Wheel-Thrown/Hand-Built

- Additive Manufacturing (3D Printing)

- Others (extrusion, press molding)

By Firing/Finish

- Low-Fire (Cone 04–02; typically earthenware)

- Mid-Fire (Cone 5–6; stoneware)

- High-Fire (Cone 9–12; porcelain/stoneware)

- Surface: Glazed (clear, reactive, matte) / Unglazed (bisque, terra, engobe)

By Product/Application

- Tableware & Kitchenware (plates, bowls, serveware)

- Drinkware (mugs, cups, teaware)

- Cookware & Bakeware (casseroles, tagines)

- Home Décor & Gifting (vases, planters, art pieces)

- HoReCa Professional Ware (foodservice-grade)

- Others (vanity basins, architectural accents)

By End-Use

- Residential/Household

- Commercial HoReCa (hospitality & foodservice)

- Corporate/Institutional (gifting, offices, education)

- Art & Collector Markets

By Distribution Channel

- Offline Retail (home & lifestyle, department, specialty stores)

- B2B Sales to HoReCa & Corporate

- Online Marketplaces & D2C Brand Stores

- Craft Fairs/Galleries

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait