Content

What is the Current Polypropylene Compounds Market Size and Share?

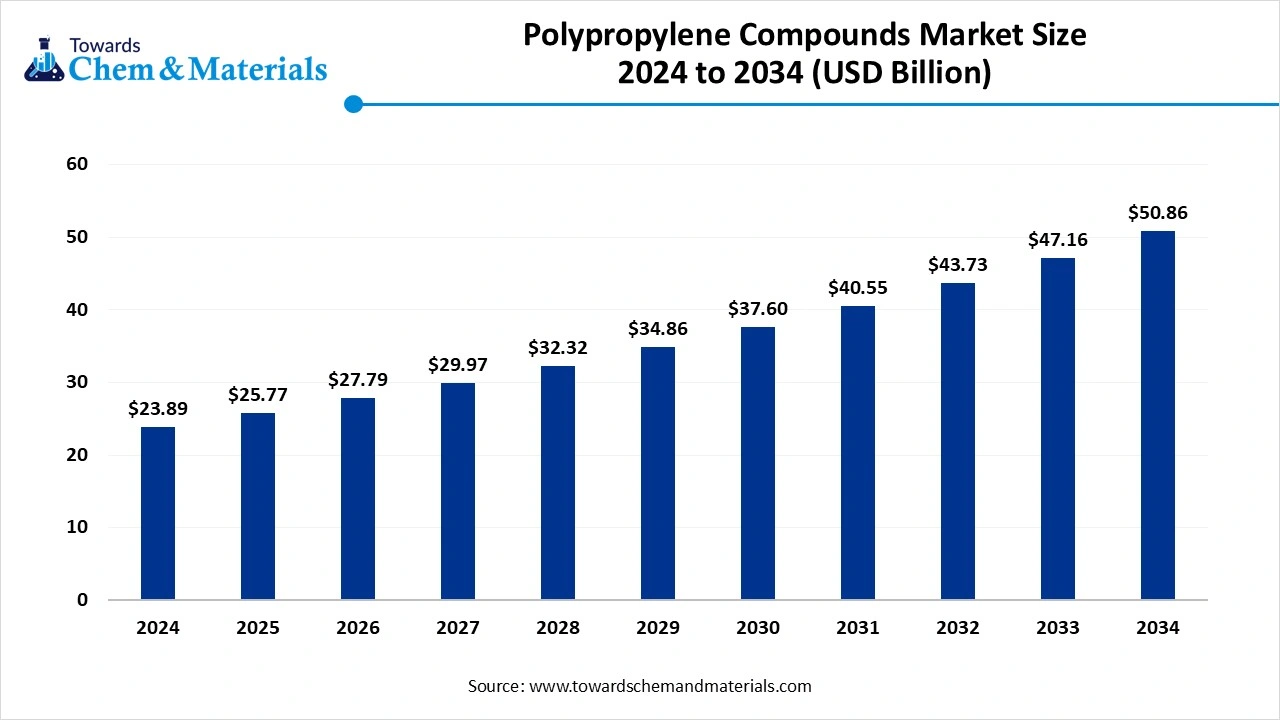

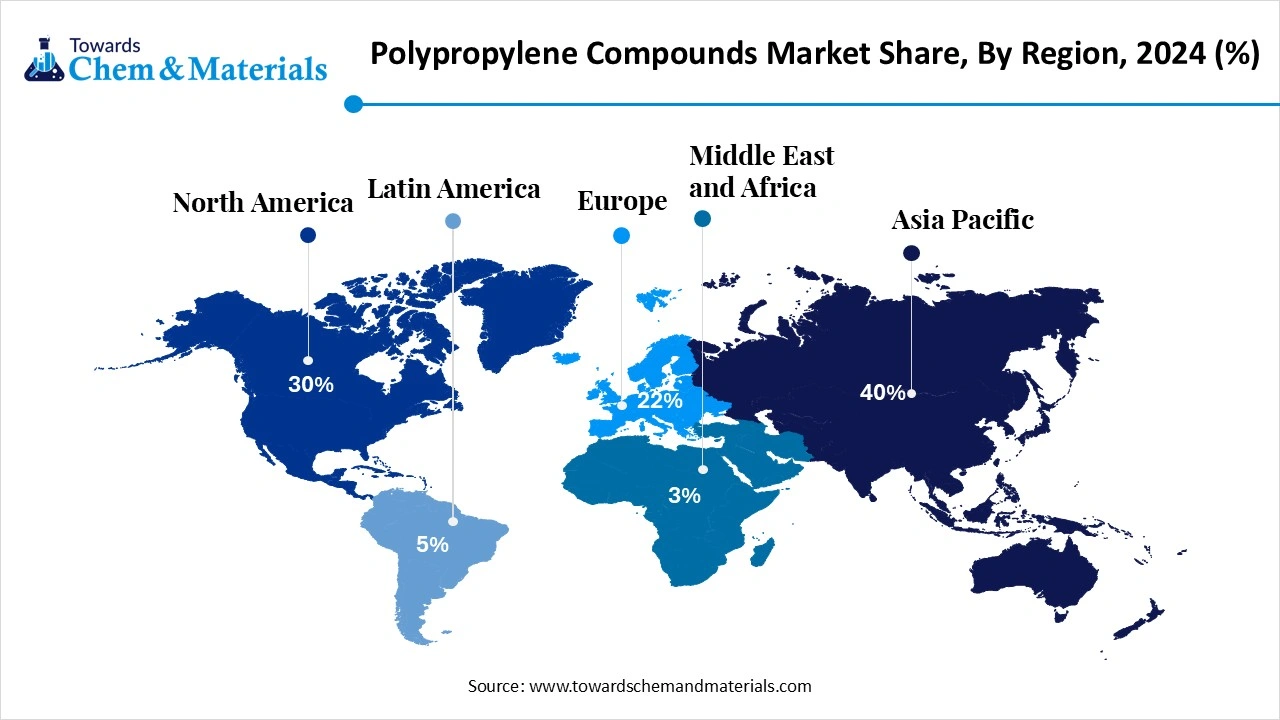

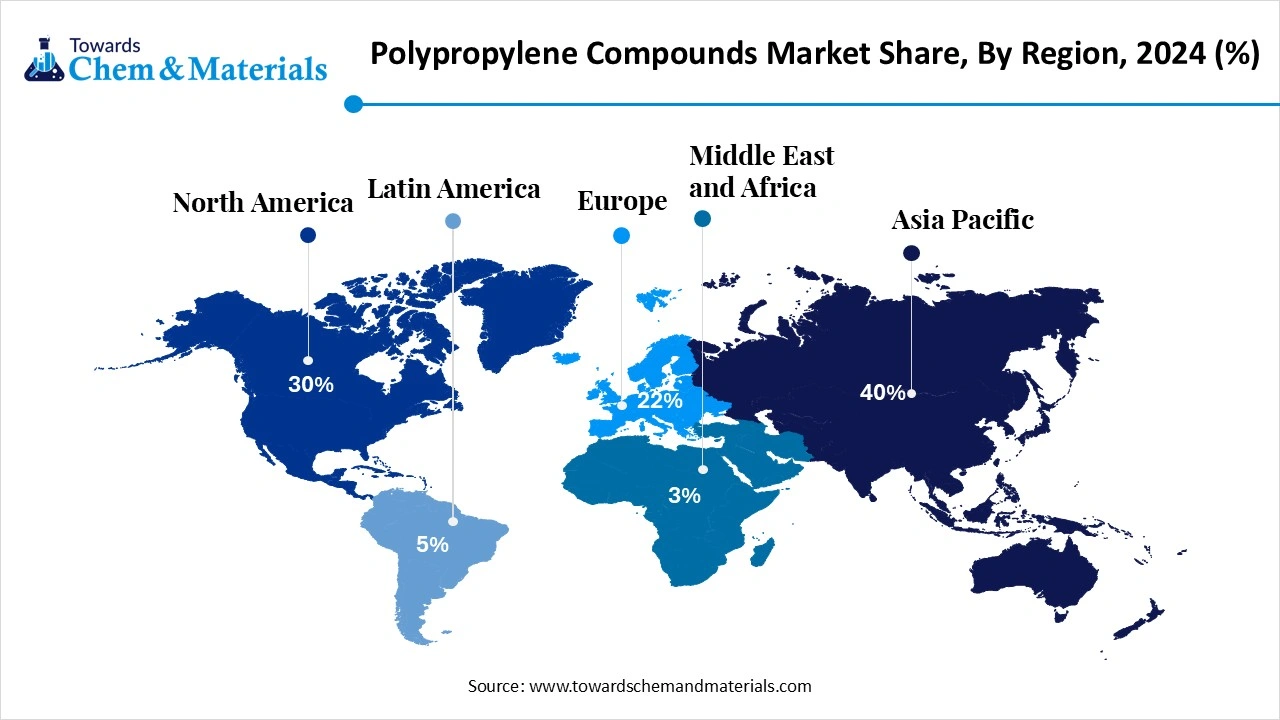

The global polypropylene compounds market size was valued at USD 25.77 billion in 2025 and is expected to hit around USD 54.87 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 7.85% over the forecast period from 2026 to 2035. Asia Pacific dominated the polypropylene compounds market with the largest revenue share of 41.87% in 2025.The increased need for lightweight materials in manufacturing industries has been a key enabler of industry development.

Key Takeaways

- By region, Asia Pacific dominated the market with a 41.87% industry share in 2025.

- By region, North America is expected to grow at a notable rate in the future.

- By propylene type, the homopolymer segment led the market with 66.03% industry share in 2025.

- By propylene type, the copolymer segment is expected to grow at the fastest rate in the market during the forecast period.

- By application type, the automotive segment emerged as the top-performing segment in the market with 35.98% industry share in 2025.

- By application type, the consumer goods segment is expected to lead the market in the coming years.

- By property type, the impact-resistant segment led the market with a 50.61% share in 2025.

- By property type, the UV-resistant segment is expected to capture the biggest portion of the market in the coming years.

- By process technology, the injection molding segment emerged as the top-performing segment in the market with 45.78% industry share in 2025.

- By process technology, the extrusion segment is expected to lead the market in the coming years.

What are Propylene Compounds, and What's the Current Market Condition?

The polypropylene compounds are known as a composite material and are made by the blends of polypropylene with resin plus fillers, and other materials like additives and plasticizers. The polypropylene industry has experienced a greater upward shift in recent years, where the automotive, appliance, and packaging industries have seen under a heavy demand for the polypropylene grades.

Polypropylene Compounds Market Outlook:

- Industry Growth Overview: Between 2025 and 2034, factors like the trend of the lightweight material usage in vehicles, electrification demands, and increased shift towards rigid packaging for the e-commerce sector have allowed key players and distributors to capitalize on growth opportunities in recent years.

- Sustainability Trends: the polypropylene manufacturers are observed in offering certified recycled blends, where the carbon footprint labels and innovative recycling formulation have sparked considerable attention from financial analysts in the past few years.

- Global Expansion: The polypropylene compounds industry is standing on a one-size-fits-all status right now. The global region, like Asia, is considering polypropylene as an ideal material for its enlarged packaging industry, while Europe is using it for the automotive and medical grades. Also, North America has been consuming polypropylene for electric grade compounds immensely in recent years, as per the survey.

Report Scope

| Report Attributes | Details |

| Market Size in 2026 | USD 27.79 Billion |

| Expected Size by 2035 | USD 54.87 Billion |

| Growth Rate from 2025 to 2035 | CAGR 7.85% |

| Base Year of Estimation | 2025 |

| Forecast Period | 2025 - 2035 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Type of Polypropylene, By Application, By Property, By Process Technology, By Region |

| Key Companies Profiled | Braskem , Total Petrochemicals , Reliance Industries , Formosa Plastics Corporation , Chevron Phillips Chemical Company , BASF , LG Chem , China National Petroleum Corporation (CNPC) , DSM Engineering Plastics , Clariant , Arkema Group , Mitsui Chemicals , UBE Industries , Hanwa Chemical Corporation , PolyOne Corporation (Now Avient Corporation) , Polyplastics Co. Ltd. |

Key Technological Shifts in the Polypropylene Compounds Market:

The market has widely accepted the technology integration, where the manufacturer has seen in using the AI-enabled reactive extrusion methods in the current period. furthermore, the major brands are investing in innovative manufacturing technology for initiatives like one-pass reactive blends and others in the coming years. Also, the establishment of the localized small batch production may result in enhanced brand positioning and product offerings during the projected period.

Value Chain Analysis of the Polypropylene Compounds Market:

- Distribution to Industrial Users: The distributors are offering fine solutions to the major sectors like packaging, automotive, and electronics industries.

- Chemical Synthesis and Processing: Chemical synthesis and processing include the primary processes, such as polymerization and others, while using a catalyst like Ziegler-Natta.

- Regulatory Compliance and Safety Monitoring: The safety and regulatory process of the polypropylene compounds can be held under the national and international standards of the respective regions.

Polypropylene Compounds Market’s Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas | Notable Notes |

| United States | U.S. Food and Drug Administration (FDA) and Consumer Product Safety Commission (CPSC) | FDA, 21 CFR 177.1520 | Product safety and food safety | These agencies are ensuring the daily use of plastic safety in food and product usage applications. |

| European Union | European Commission (EC) and European Chemicals Agency (ECHA) | REACH (EC) No 1907/2006 | High level of chemical safety, circular economy, and sustainability | The agencies established to identify and eliminate hazardous substances in propylene compounds |

| China | National Health Commission (NHC) | GB 4806.7-2023 | Mandatory national standards and Food contact safety | These agencies are closely watching imports and exports. |

| India | Bureau of Indian Standards (BIS) and Ministry of Chemicals and Fertilizers | IS 10951:2020 | Standardized product quality | Ensures safety and provides certificates. |

Segmental Insights

Polypropylene Type Insights

How did the Homopolymer Segment Dominate the Polypropylene Compounds Market in 2025?

The homopolymer segment held largest shares of the market in 2025, due to it can offer high stiffness while providing excellent dimensional stability. Moreover, the compound manufacturers are increasingly preferring the homopolymer as baseline resin to blends akin to it can give predictable mechanical behavior across batches.

The copolymer segment is expected to grow at a notable rate during the predicted timeframe, owing to the increased need for clarity, toughness, and low-temperature impact, where the homopolymer has not performed well. Moreover, the better chemical compatibility, improved impact resistance, and superior flexural performance for appliances, the copolymer likely to gain major industry attention in the coming years.

Application Type Insights

Why does the Automotive Segment Dominate the Polypropylene Compounds Market?

The automotive segment held 35.98% of the market in 2025 because cars require lightweight, affordable, and durable materials. PP compounds are used in bumpers, dashboards, door panels, and even electric vehicle parts. They help reduce vehicle weight while keeping strength and safety. Automakers also prefer PP because it is cheaper than metals and can be molded into many shapes quickly.

The consumer goods segment is expected to grow at a notable rate during the forecast period, because everyday products need variety and sustainability. Electronics, appliances, toys, and packaging require attractive finishes, scratch resistance, and recyclable materials. PP compounds can be easily customized for colors, designs, and eco-friendly features.

Property Type Insights

How did the Impact Resistance Segment Dominate the Polypropylene Compounds Market in 2025?

The impact resistance segment dominated the market with a 50% share in 2025, because industries wanted materials that don't break easily. From car bumpers to tool housings, impact resistance is very important for safety and durability. These compounds are specially designed to handle drops, crashes, and rough handling without cracking.

The UV-resistance segment is expected to grow at a significant rate during the forecast period, because more products are used outdoors and in sunlight. Normal PP can fade, crack, or become weak when exposed to the sun for a long time. UV-resistant compounds solve this by keeping color, strength, and flexibility even after years of sun exposure.

Process Technology Insights

How did the Injection Molding Segment Dominate the Polypropylene Compounds Market in 2025?

The injection molding segment dominated the market with a 45.78% share in 2025 because it is fast, efficient, and perfect for making complex shapes. Industries like auto, electronics, and packaging prefer this process since it can produce large quantities in less time. PP compounds work very well with injection machines and can be molded into thin, strong parts.

The extrusion segment is expected to grow at a significant rate during the forecast period, because it is better for making continuous products and recyclable packaging. Unlike injection moulding, extrusion can create films, sheets, pipes, and profiles in large quantities.

Regional Insights

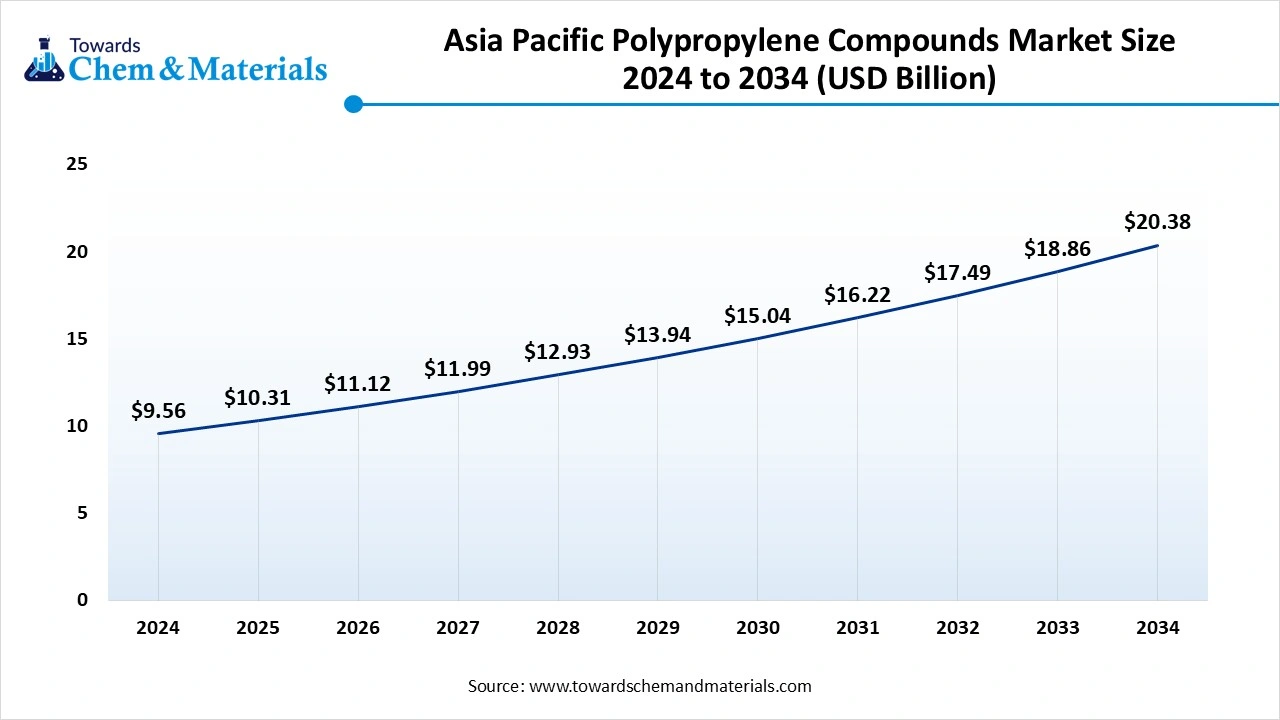

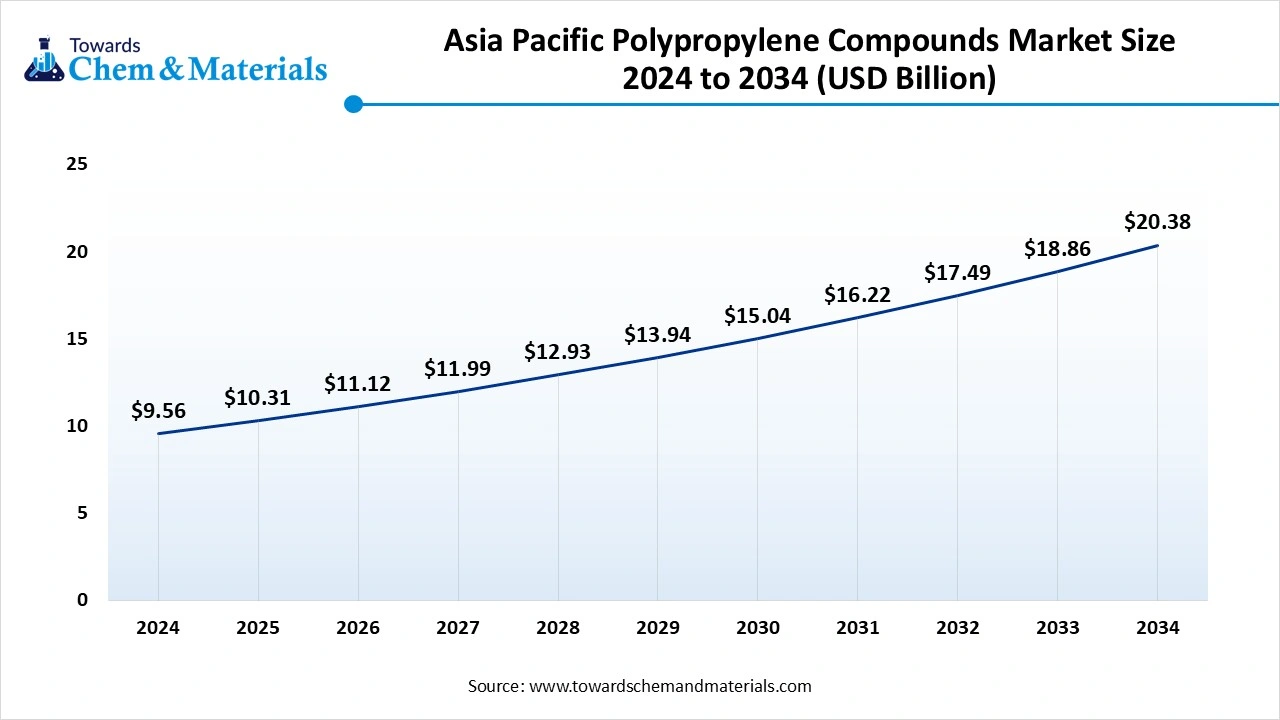

Asia Pacific Polypropylene Compounds Market Size, Industry Report 2035

The polypropylene compounds market size was valued at USD 10.31 billion in 2025 and is expected to be worth around USD 21.97 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 7.86% over the forecast period from 2026 to 2035.

owing to the enlarged and advanced manufacturing infrastructure. Furthermore, the regional countries such as India and China have seen in massive end-market demand within sectors like automotive, packaging, and electronics in the current period. Also, the region has access to advanced refineries, which are contributing to the industry's growth in the current period.

What Drives China’s Supremacy in Propylene Production?

China maintained its dominance in the market, owing to the country’s massive propylene production infrastructure and domestic consumption in recent years. Also, China has seen under a heavy investment in innovative R&D activities for the processing like simplifying extrusion and polymerization in the current period.

North America Polypropylene Compounds Market Trends

North America is expected to capture a major share of the market during the forecast period, akin to the sudden shift towards specialty polypropylene and sustainability. The major sectors in the United States are actively seeking sustainable solutions as a global shift towards eco-friendliness, while the manufacturers in the United States have seen under an innovative and eco-friendly polypropylene development.

How will Europe be considered a Notable Region in the Polypropylene Compounds Market?

Europe is a notable region in the global market, primarily due to its strict environmental regulations within the EU, a high demand for lightweight materials in the automotive sector, and a strong emphasis on circular economy initiatives, especially in Germany, the UK, and France. The rapid transition towards EVs in Europe has led to an increased demand for specialty compounds used in battery housings, trays, and interior components, which necessitate high stiffness and low density. Additionally, the European construction industry is fueling the market by requiring durable, lightweight materials for insulation and piping.

Germany Polypropylene Compounds Market Trends

Germany plays a significant role within the region, driven by its robust automotive industry, which creates a demand for high-performance polypropylene (PP) compounds to replace metal parts, thereby reducing vehicle weight and enhancing fuel efficiency. This growth is also spurred by strict EU regulations concerning recyclable plastics. Germany boasts a high production capacity, with companies like LyondellBasell operating specialized compounding plants in the country.

Emergence of Latin America in the Polypropylene Compounds Market?

Latin America is emerging market within the global market, largely due to rapid industrialization, a flourishing packaging sector, and increased automotive production, particularly in Mexico and Argentina. There is a notable shift toward replacing metal parts with PP compounds to improve fuel efficiency, reduce emissions, and adapt to the rise of EVs. Governments in Latin America are implementing stringent regulations, and consumers are increasingly favoring eco-friendly products.

Brazil Polypropylene Compounds Market Trends

Brazil plays a unique role within the region, mainly because of its urbanization and infrastructure development. Braskem S.A. is the largest producer of thermoplastic resins in the Americas and operates significant facilities in Brazil, including the manufacturing of bio-based plastics. Brazil is committed to green manufacturing, highlighted by collaborations like that of Braskem and Shell, which focus on sustainable feedstock to create higher-performance, eco-friendly PP compounds.

How will the Middle East and Africa contribute to the Polypropylene Compounds Market?

The Middle East and Africa are key contributors to the global market, mainly due to their robust petrochemical base, rapid industrialization, and high demand from end-user industries such as automotive, construction, and packaging. Growing investments in chemical recycling and regulations promoting the use of recycled content in plastic products are driving innovation in sustainable, eco-friendly compounds. Ambitious construction projects in Gulf countries and housing booms in Africa are significantly boosting the demand for PP pipes, sheets, and insulation materials.

The UAE Polypropylene Compounds Market Trends

The UAE stands out as a mature market within the region, primarily stems from its advanced petrochemical infrastructure and sophisticated automated manufacturing plants, such as those operated by Borouge, which serve as distribution centers for the region. The government is heavily investing in recycling initiatives, promoting the production of high-quality, sustainable, and food-safe recycled PP compounds. The region is also a key manufacturer of specialized products, including scratch-resistant polypropylene for automotive interiors.

Country-level Investments & Funding Trends for the Polypropylene Compounds Industry:

- India: The government of India has implemented the quality control completion for the polypropylene imports in 2024.(Source: www.argusmedia.com)

- China: The polypropylene export of China has shifted towards the high-potential region, such as Africa, South Asia, and Southeast Asia, as per the published report.(Source: www.spglobal.com)

Recent Development

- In January 2025, INEOS Olefins and Polymers Europe launched a new Recycl-IN hybrid polymer grade containing 70% recycled material which boost the sustainability of contact-sensitive cosmetics packaging without brands requiring to compromise on quality or performance. This launch deliver the strength, aesthetics, and processing ease customers expect and making it ideal for manufacturing stiff, coloured and translucent components.(Source: www.ineos.com)

Top Vendors in the Polypropylene Compounds Market & Their Offerings:

- LyondellBasell: the company is known as the leading manufacturer of polymers, while specializing in polyolefins and olefins production.

- INEOS Group: the company is focused on specialty chemical manufacturing while aiming to develop products that meet evolving needs.

- SABIC: The major producer and distributor of polyethylene, polypropylene, and polyethylene terephthalate.

- ExxonMobil Chemical: the company is a leading energy and sustainable solution provider, with enlarged ethylene, polymers, and propylene production business.

Other Key Players

- Braskem

- Total Petrochemicals

- Reliance Industries

- Formosa Plastics Corporation

- Chevron Phillips Chemical Company

- BASF

- LG Chem

- China National Petroleum Corporation (CNPC)

- DSM Engineering Plastics

- Clariant

- Arkema Group

- Mitsui Chemicals

- UBE Industries

- Hanwa Chemical Corporation

- PolyOne Corporation (Now Avient Corporation)

- Polyplastics Co. Ltd.

Segments Covered in the Report:

By Type of Polypropylene

- Homopolymer

- Copolymer (Random Copolymer, Block Copolymer)

By Application

- Automotive

- Interior

- Exterior

- Under-the-Hood

- Consumer Goods

- Appliances

- Furniture

- Packaging

- Electrical & Electronics

- Insulation

- Connectors

- Cables

- Medical

- Syringes & Injectables

- Medical Containers

- Diagnostic Devices

- Construction

- Pipes & Fittings

- Flooring

- Insulation

- Packaging

- Rigid Packaging

- Flexible Packaging

- Textiles

- Nonwoven Fabrics

- Carpet Backing

- Apparel

- Others

- Agriculture Films

- Industrial Products

By Property

- Flame Retardant

- Impact Resistant

- UV Resistant

- Antistatic

By Process Technology

- Extrusion

- Injection Molding

- Blow Molding

- Thermoforming

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait