Content

What is the Current Rubber Process Oil Market Size and Volume?

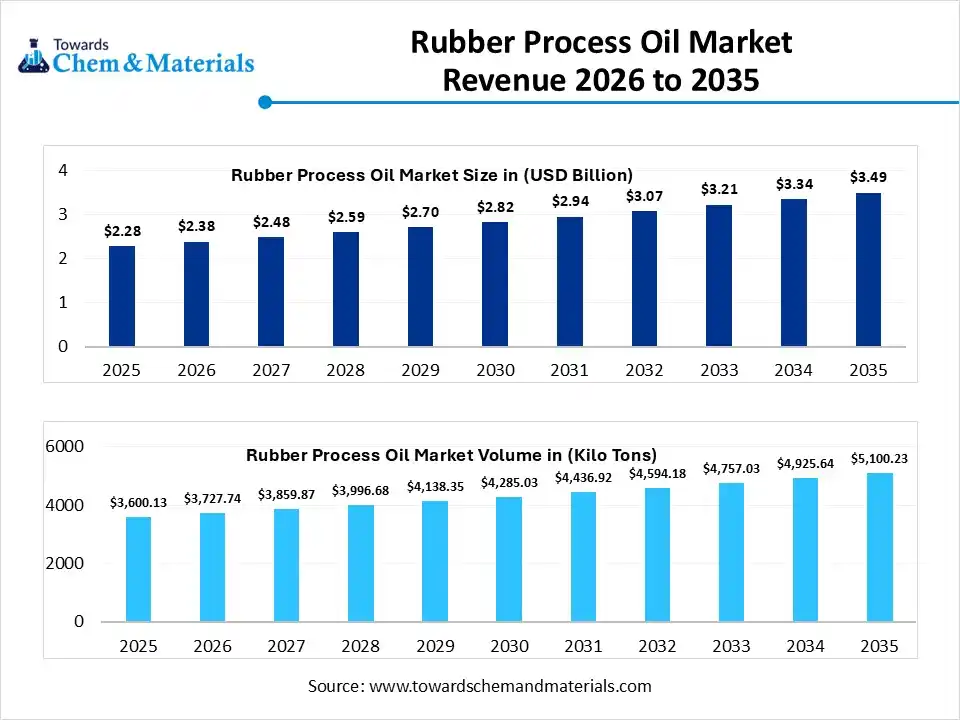

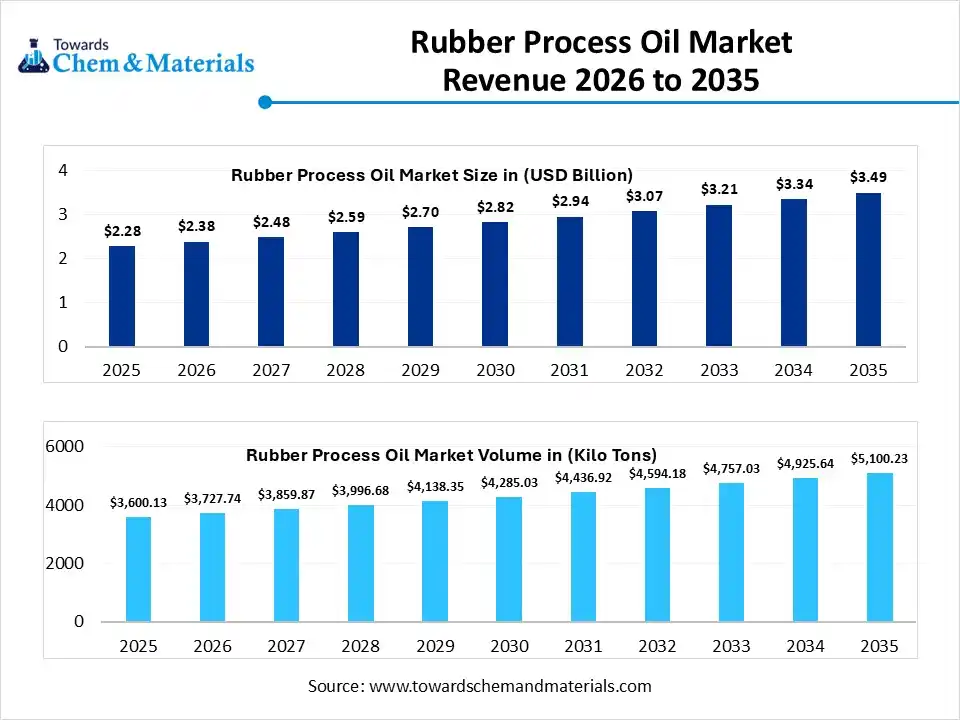

The global rubber process oil market size was estimated at USD 2.28 billion in 2025 and is expected to increase from USD 2.38 billion in 2026 to USD 3.49 billion by 2035, growing at a CAGR of 4.35% from 2026 to 2035. In terms of volume, the market is projected to grow from 3600.13 kilo tons in 2025 to 5100.23 kilo tons by 2035. growing at a CAGR of 3.54% from 2026 to 2035. Asia Pacific dominated the rubber process oil market with the largest volume share of 47% in 2025.The growth of the market is driven by the growing demand from industries and various sectors due to its applications.

Market Highlights

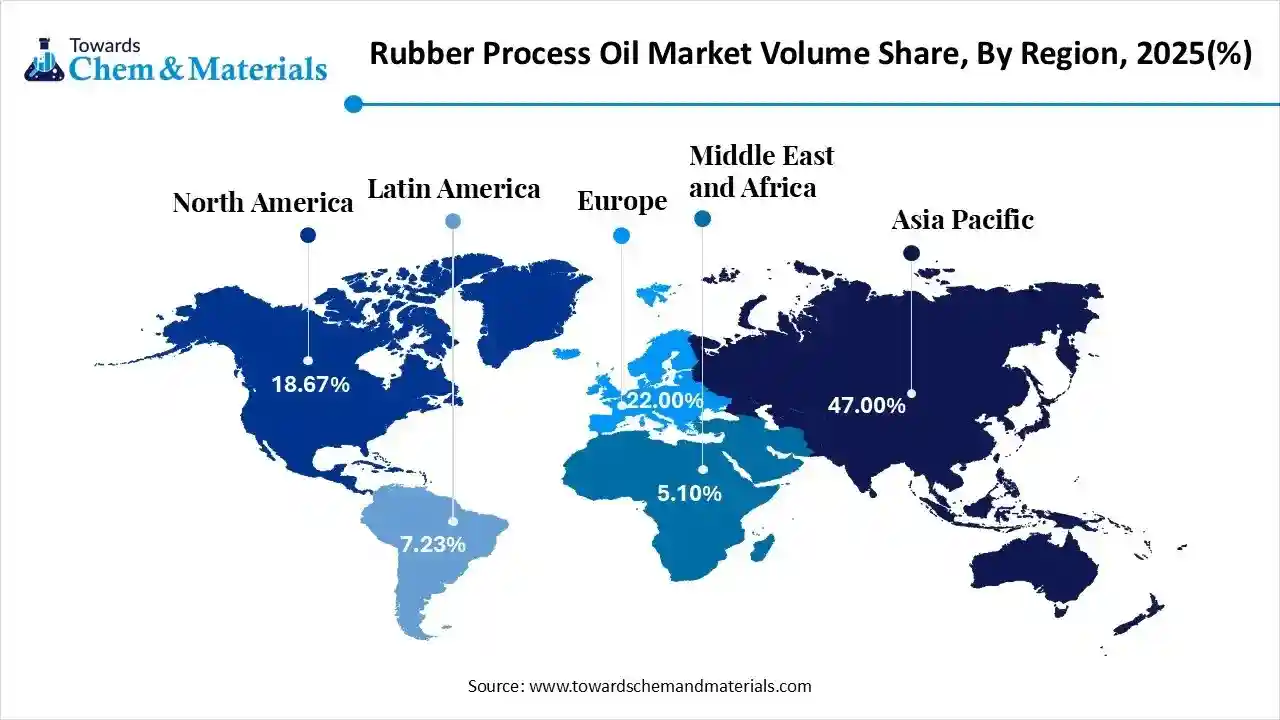

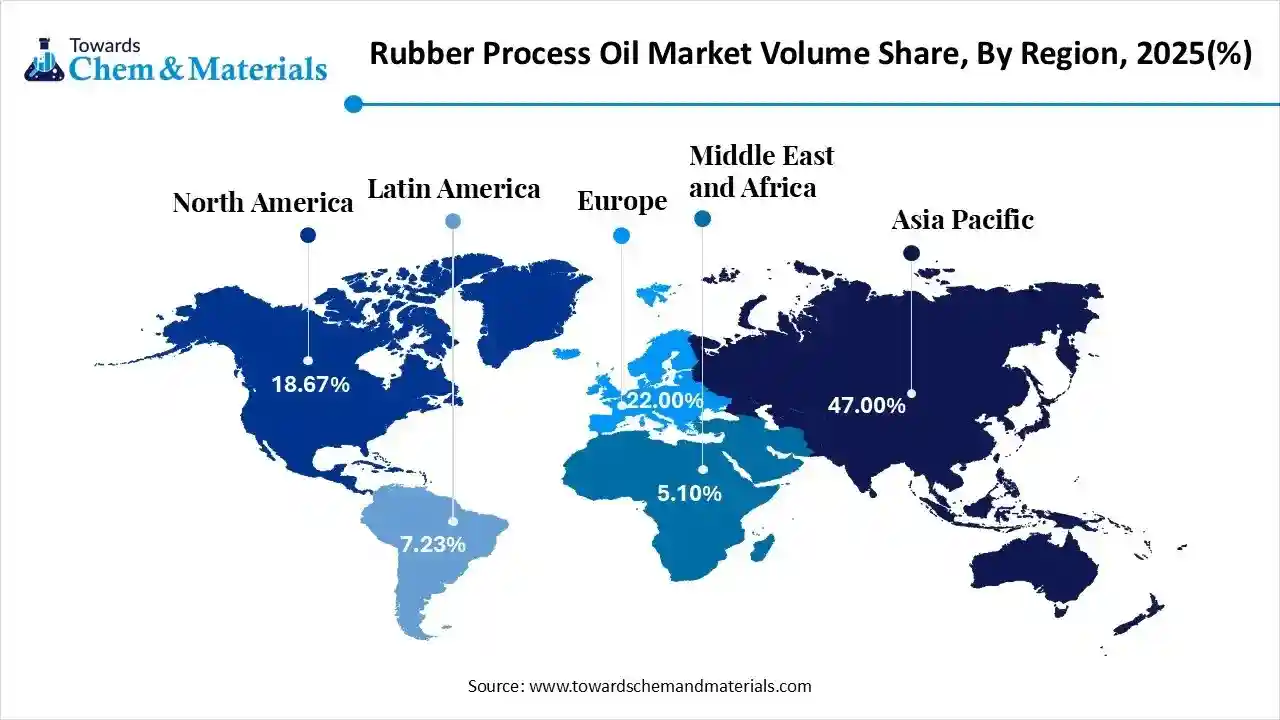

- The Asia Pacific dominated the rubber process oil market with the largest volume share of 47% in 2025.

- The rubber process oil market in Europe is expected to grow at a substantial CAGR of 6.28% from 2026 to 2035.

- The North America rubber process oil market segment accounted for the major volume share of 27.00% in 2025.

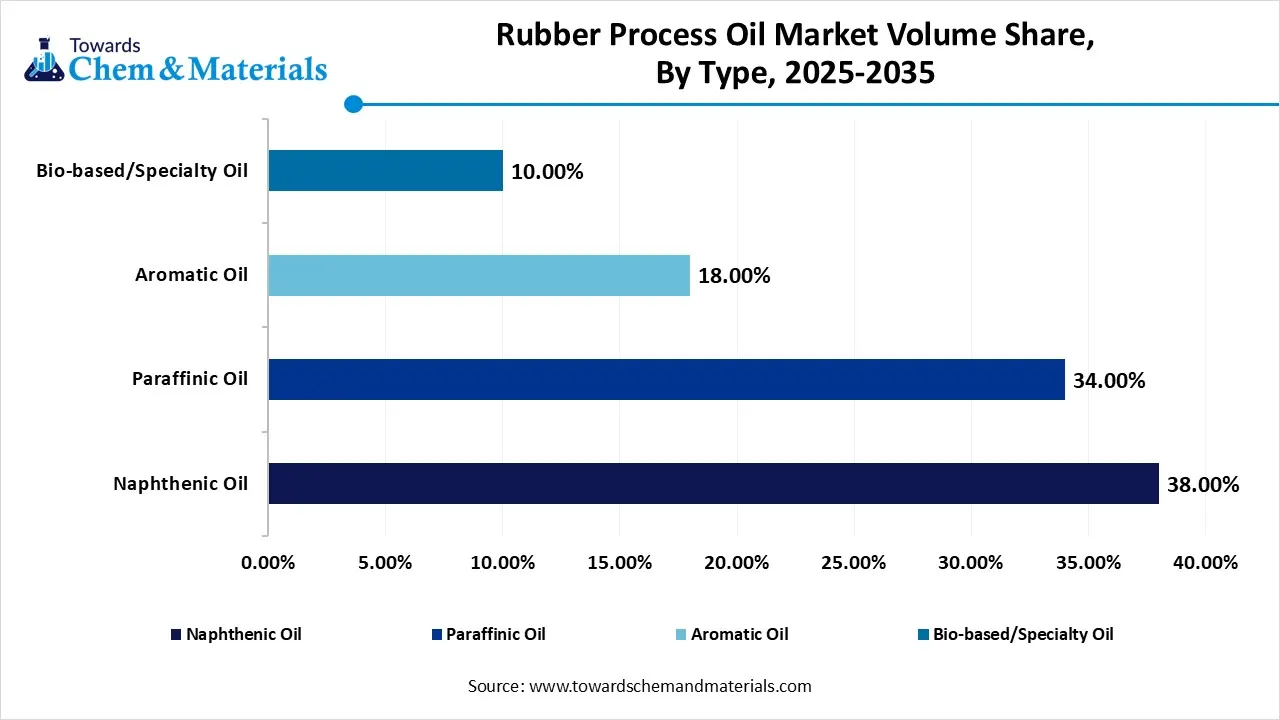

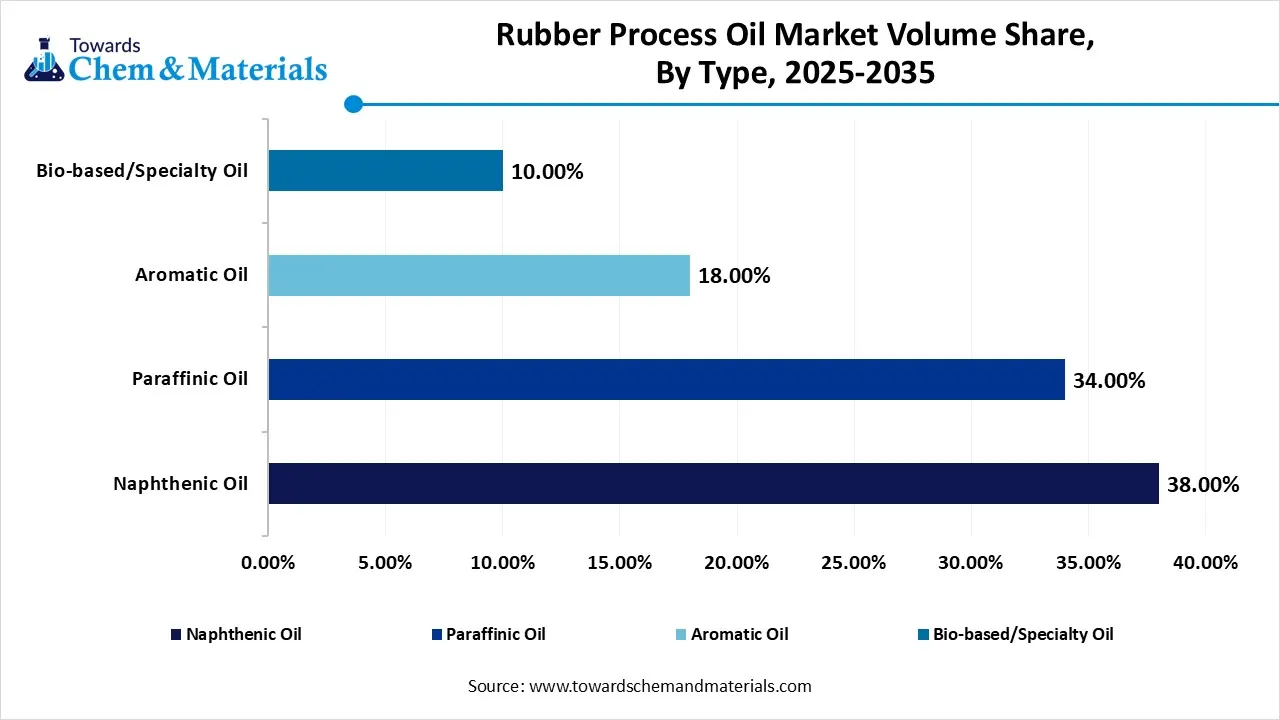

- By type, the naphthenic oil segment dominated the market and accounted for the largest volume share of 38% in 2025.

- By type, the bio-based / specialty oils segment is expected to grow at the fastest CAGR of 7.21% from 2026 to 2035 in terms of volume.

- By rubber type, the synthetic rubber oils segment led the market with the largest revenue volume share of 62% in 2025.

- By application, the tires & tire components segment dominated the market and accounted for the largest volume share of 64% in 2025.

- By sales channel, the direct sales segment led the market with the largest revenue volume share of 70% in 2025.

Market Overview

The rubber process oil (RPO) market encompasses the production and application of petroleum-based and bio-based process oil added during rubber compounding to enhance processing, improve dispersion of fillers, increase flexibility, and optimize finished product performance. Rubber process oils are widely used in tire manufacturing, automotive rubber components, industrial rubber goods, footwear, and general rubber products. Market growth is driven by steady tire demand, the expansion of automotive production, and the replacement of aromatic oils with safer alternatives.

What Is The Significance Of The Rubber Process Oil Market?

The rubber process oil (RPO) market is significant because RPOs are essential processing aids and extenders in manufacturing diverse rubber goods, especially tires, by improving flowability, enhancing mechanical properties (like durability, flexibility, wear resistance), and reducing production costs; its growth is driven by automotive demand, industrial expansion, and strict environmental regulations pushing for safer, greener oil alternatives, with Asia-Pacific leading due to manufacturing.

Rubber Process Oil Market Growth Trends:

- Shift to Green Oils: Strong demand for non-carcinogenic, environmentally friendly oils (like TDAE, MES) over traditional aromatic oils.

- Product Innovation: Development of high-performance oils, including renewable feedstock options, and blends for specific properties (e.g., low heat build-up in tires).

- Regulatory Influence: Stricter environmental rules (like TSCA in the US) are pushing innovation and transparency.

Report Scope

| Report Attribute | Details |

| Market Size and Volume in 2026 | USD 2.38 Billion / 3727.74 Kilo Tons |

| Revenue Forecast in 2035 | USD 3.49 Billion / 5100.23 Kilo Tons |

| Growth Rate | CAGR 4.35% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Units Considered | Value (Billion / Million), Volume (Kilo Tons) |

| Dominant Region | Asia Pacific |

| Segment Covered | By Type, By Rubber Type, By Application, By Sales Channel, By Regions |

| Key companies profiled | Shell plc, Sinopec, ExxonMobil Corporation, Royal Dutch Shell plc, PetroChina Company Limited, Panama Petrochem Ltd.,TotalEnergies SE, BP plc, Chevron Corporation, Nynas AB, H&R Group, Ergon, Inc., Repsol S.A., Calumet Specialty Products Partners, Idemitsu Kosan Co., Ltd., Petronas Lubricants International, Apar Industries Ltd., Raj Petro Specialties Pvt. Ltd., Lukoil, Hindustan Petroleum Corporation Limited, China National Petroleum Corporation (CNPC) |

Key Technological Shifts In The Rubber Process Oil Market :

The key technological shifts in the rubber process oil (RPO) market center on sustainability and regulatory compliance, pushing innovation towards eco-friendly, bio-based oils and low-PAH options like TDAE, while also improving performance through advanced formulations (naphthenic), digital integration (AI, automation), and nanotechnology to meet stringent environmental rules and demands for higher-performing, safer tires and rubber products.

Trade Analysis Of Rubber Process Oil Market: Import & Export Statistics

- According to India Export data, India exported 544 shipments of Rubber Process Oil. These exports were handled by 43 Indian Exporters to 103 Buyers.

- Majority of the Rubber Process Oil exports from India destined to Sri Lanka, Nepal, and the United Arab Emirates.

- Worldwide, the leading three exporters of Rubber Process Oil are India, Iran, and Taiwan. Were India leads with 527 shipments, Iran with 425 shipments, and Taiwan with 401 shipments.

- According to Global Export data, the World exported 3,333 shipments of Rubber Process Oil. These exports were made by 484 Exporters to 512 Buyers.

- Most of the Rubber Process Oil exports from the World go to Vietnam, Pakistan, and Sri Lanka.

Rubber Process Oil Market Value Chain Analysis

- Refining and Processing: Rubber process oils are produced through processes such as crude oil refining, solvent extraction, hydrogenation, distillation, blending, and performance modification to achieve the required viscosity, aromatic content, and compatibility with rubber compounds.

- Key players: Apar Industries, Nynas AB, Chevron Corporation, H&R Group

- Quality Testing and Certification: Rubber process oils require certifications ensuring chemical composition control, low PAH content, performance consistency, and regulatory compliance. Key certifications include ISO 9001 quality standards, REACH compliance, ASTM material specifications, and environmental safety certifications.

- Key players: ISO (International Organization for Standardization), ECHA (REACH), ASTM International, TÜV SÜD.

- Distribution to Industrial Users: Rubber process oils are supplied to tire manufacturers, automotive rubber component producers, industrial rubber goods manufacturers, footwear manufacturers, and polymer compounders.

- Key players: Nynas AB, Apar Industries, H&R Group.

Rubber Process Oil Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas | Notable Notes |

| European Union | European Chemicals Agency (ECHA) | REACH Regulation (EC 1907/2006) CLP Regulation (EC 1272/2008) Industrial Emissions Directive (IED) |

Registration & risk assessment of petroleum derivatives Hazard classification & labeling of oils and additives Emission controls at rubber processing plants |

REACH regulates polycyclic aromatic hydrocarbons (PAHs) content in aromatic oils; CLP mandates proper hazard communication. IED influences emission limits for manufacturing sites. |

| China | Ministry of Ecology and Environment (MEE) | MEE Order No. 12 (New Chemical Substance Registration) Air & Water Pollution Prevention Laws Solid Waste Pollution Prevention Law |

Chemical registration Emission & effluent control Solid waste management |

Rubber process oils and additives require registration and environmental compliance documentation; pollution discharge permits may be mandatory for processing facilities. |

| India | MoEFCC (Ministry of Environment, Forest & Climate Change) CPCB (Central Pollution Control Board) |

Chemicals (Management and Safety) Rules (proposed) Hazardous & Other Wastes (Management & Transboundary Movement) Rules Air/Water Acts |

Chemical hazard communication Solid & hazardous waste handling Emission & effluent discharge control |

India is transitioning toward a more REACH-like regime; aromatic oils high in PAHs are under tighter scrutiny and may face restrictions. |

Segmental Insights

Type Insights

How Did The Naphthenic Oil Segment Dominate The Rubber Process Oil Market In 2025?

The naphthenic oil segment volume was valued at 1368.05 kilo tons in 2025 and is projected to reach 1802.93 kilo tons by 2035, expanding at a CAGR of 3.11% during the forecast period from 2025 to 2035. The naphthenic oil segment dominated the market accounting for approximately 38% share in 2025. Naphthenic rubber process oils are widely used due to their excellent solvency, low pour point, and strong compatibility with a broad range of rubber polymers. They enhance elasticity, processability, and low-temperature performance, making them particularly suitable for tire manufacturing and automotive rubber components that require flexibility and durability.

The bio-based / specialty oils segment volume was valued at 360.01 kilo tons in 2025 and is projected to reach 673.74 kilo tons by 2035, expanding at a CAGR of 7.21% during the forecast period from 2025 to 2035. Bio-based and specialty rubber process oils are gaining traction as sustainable alternatives to conventional petroleum-derived oils. Their adoption is increasing in green tire production, and premium rubber goods are focused on low toxicity and reduced carbon footprint.

Rubber Process Oil Market Volume and Share, By Type, 2025-2035

| By Type | Market Volume Share (%), 2025 | Market Volume (Kilo Tons)2025 | Market Volume (Kilo Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| Naphthenic Oil | 38.00% | 1368.05 | 1802.93 | 3.11% | 35.35% |

| Paraffinic Oil | 34.00% | 1224.04 | 1795.79 | 4.35% | 35.21% |

| Aromatic Oil | 18.00% | 648.02 | 827.77 | 2.76% | 16.23% |

| Bio-based/Specialty Oil | 10.00% | 360.01 | 673.74 | 7.21% | 13.21% |

Rubber Type Insights

Which Rubber Type Segment Dominates The Rubber Process Oil Market In 2025?

The synthetic rubber segment dominated the market accounting for approximately 62% share in 2025. Rubber process oils used with synthetic rubber improve compound dispersion, processing efficiency, and mechanical performance. Rising demand for synthetic rubber in high-performance and specialty applications continues to support steady consumption of compatible process oils.

The natural rubber segment is projected to grow at the fastest CAGR between 2026 and 2035 in the market. In natural rubber applications, process oils enhance plasticity, mixing behavior, and product consistency. Growth in natural rubber-based products, particularly in emerging economies, supports sustained demand for process oils tailored to natural rubber formulations.

Application Insights

How Did Tires And Tire Components Segment Dominate The Rubber Process Oil Market In 2025?

The tires & tire components segment dominated the market accounting for approximately 64% share in 2025. Tires and tire components represent the largest application segment for rubber process oils. Increasing global vehicle production and replacement tire demand continue to drive significant consumption in this application segment.

The automotive rubber parts segment is projected to grow at the fastest CAGR between 2026 and 2035 in the market. Rubber process oils are widely used in automotive rubber parts such as seals, gaskets, hoses, and vibration dampers. Rising automotive production and increasing use of rubber components in vehicles support steady market growth in this segment.

Sales Channel Insights

Which Sales Channel Segment Dominates The Rubber Process Oil Market In 2025?

The direct sales segment dominated the market accounting for approximately 70% share in 2025. Direct sales channels dominate large-volume procurement by tire manufacturers and major rubber processors. Long-term contracts and close supplier-manufacturer collaboration make direct sales the preferred route for high-consumption industrial buyers.

The indirect sales segment is projected to grow at the fastest CAGR between 2026 and 2035 in the market. Indirect sales through distributors and traders cater mainly to small- and medium-scale rubber manufacturers. Growth in decentralized rubber processing units, particularly in developing regions, continues to support the relevance of indirect sales networks.

Regional Insights

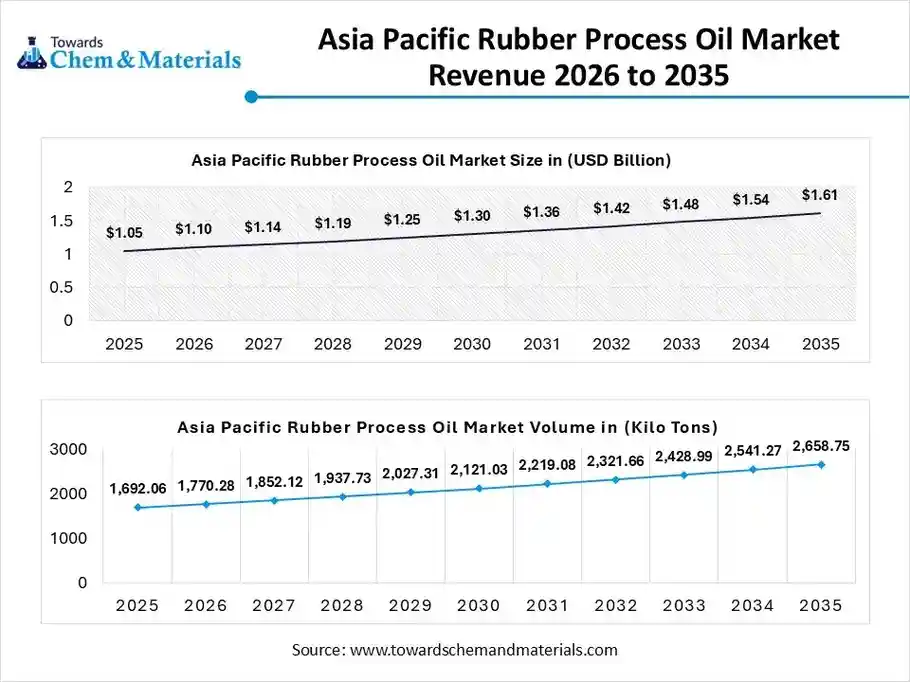

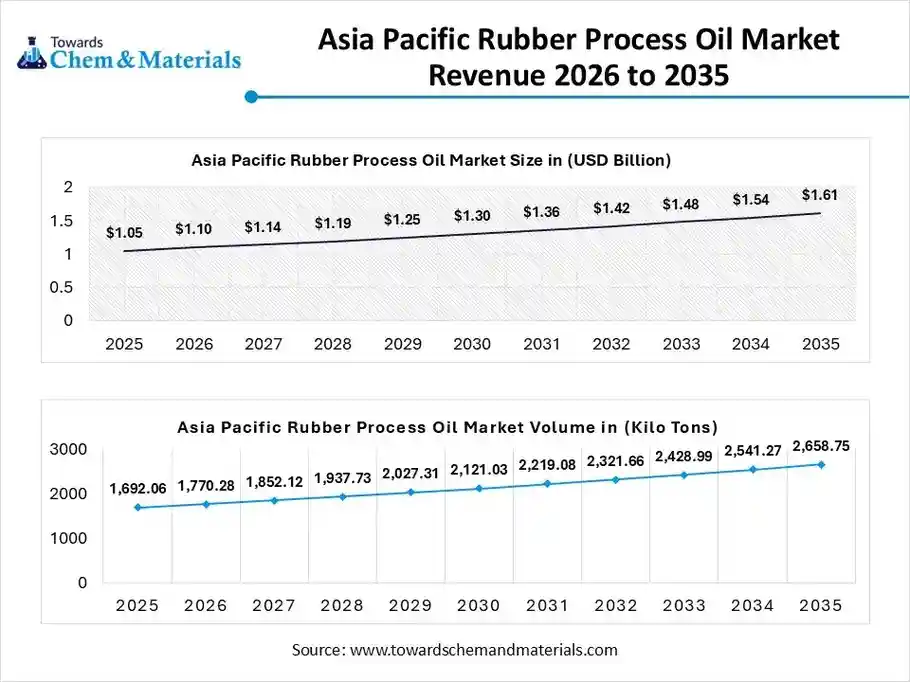

The Asia Pacific rubber process oil market size was valued at USD 1.05 billion in 2025 and is expected to be worth around USD 1.61 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 4.38% over the forecast period from 2026 to 2035.

The Asia Pacific rubber process oil volume was estimated at 1692.06 kilo tons in 2025 and is projected to reach 2658.75 kilo tons by 2035, growing at a CAGR of 5.15% from 2026 to 2035.Asia Pacific dominated the market with a share of approximately 47% in 2025. Asia Pacific represents the largest market for rubber process oils, supported by strong tire manufacturing, automotive production, and industrial rubber goods demand. Rapid urbanization, expanding transportation infrastructure, and cost-competitive manufacturing hubs drive high consumption of aromatic, naphthenic, and paraffinic oils across developing economies.

China: Rubber Process Oil Market Growth Trends

China dominates the Asia Pacific rubber process oil market due to its extensive tire manufacturing base and large-scale automotive production. Strong domestic demand, export-oriented rubber goods manufacturing, and continuous investments in industrial capacity expansion support consistent consumption of process oils, particularly in tire compounding and mechanical rubber goods.

The Europe Rubber Process Oil Market Is Growing Due To String Environmental Regulation

The Europe rubber process oil volume was estimated at 792.03 kilo tons in 2025 and is projected to reach 1026.17 kilo tons by 2035, growing at a CAGR of 2.92% from 2026 to 2035. Europe is expected to have fastest growth in the market in the forecast period between 2026 and 2035. Europe’s rubber process oil market is characterized by strict environmental regulations and high adoption of low-aromatic and sustainable oil grades. Demand is driven by automotive production, specialty rubber goods, and industrial applications, with manufacturers prioritizing compliance, performance efficiency, and long-term material sustainability.

Germany: Rubber Process Oil Market Growth Trends

Germany plays a key role in the European market due to its advanced automotive and industrial manufacturing ecosystem. Strong presence of premium tire manufacturers and rubber component producers drives demand for high-quality, compliant process oils, particularly those meeting REACH and low-PAH regulatory requirements.

Rubber Process Oil Market Volume and Share, By Region, 2025-2035

| By Region | Market Volume Share (%), 2025 | Market Volume (Kilo Tons)2025 | Market Volume (Kilo Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| North America | 18.67% | 672.14 | 870.61 | 2.92% | 17.07% |

| Europe | 22.00% | 792.03 | 1026.17 | 2.92% | 20.12% |

| Asia Pacific | 47.00% | 1692.06 | 2658.75 | 5.15% | 52.13% |

| South America | 7.23% | 260.29 | 317.74 | 2.24% | 6.23% |

| Middle East & Africa | 5.10% | 183.61 | 226.96 | 2.38% | 4.45% |

Recent Developments

- In December 2025, P.S.P. Specialties Public Company Limited (PSP Specialties) is expanding into Vietnam's tire and rubber manufacturing sectors. This move targets the country's booming market for high-performance process oil solutions.(Source: laotiantimes.com)

- In January 2025, Sumitomo Rubber Industries (SRI) and Mitsubishi Chemical Corporation initiated a joint project in January 2025 aimed at the chemical recycling of end-of-life tires.(Source: www.srigroup.co.jp)

Top players in the Rubber Process Oil Market & Their Offerings:

- Shell plc: Shell is a major global supplier of rubber process oils, offering a broad portfolio of aromatic, naphthenic, and paraffinic oils used in tire manufacturing, industrial rubber goods, and elastomer processing.

- Sinopec: Sinopec, one of the largest integrated petrochemical companies, offers rubber process oils, including environmentally compliant extender oils tailored to regulatory requirements (like low PAH content).

- ExxonMobil Corporation

- Royal Dutch Shell plc

- PetroChina Company Limited

- Panama Petrochem Ltd.

- TotalEnergies SE

- BP plc

- Chevron Corporation

- Nynas AB

- H&R Group

- Ergon, Inc.

- Repsol S.A.

- Calumet Specialty Products Partners

- Idemitsu Kosan Co., Ltd.

- Petronas Lubricants International

- Apar Industries Ltd.

- Raj Petro Specialties Pvt. Ltd.

- Lukoil

- Hindustan Petroleum Corporation Limited

- China National Petroleum Corporation (CNPC)

Segments Covered

By Type

- Naphthenic Oil

- Paraffinic Oil

- Aromatic Oil

- Bio-based / Specialty Oils

By Rubber Type

- Synthetic Rubber

- Natural Rubber

By Application

- Tires & Tire Components

- Automotive Rubber Parts

- Industrial Rubber Goods

- Footwear

- Others

By Sales Channel

- Direct Sales

- Indirect Sales

By Regions

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa