Content

What is the Current Pipe Coatings Market Size and Share?

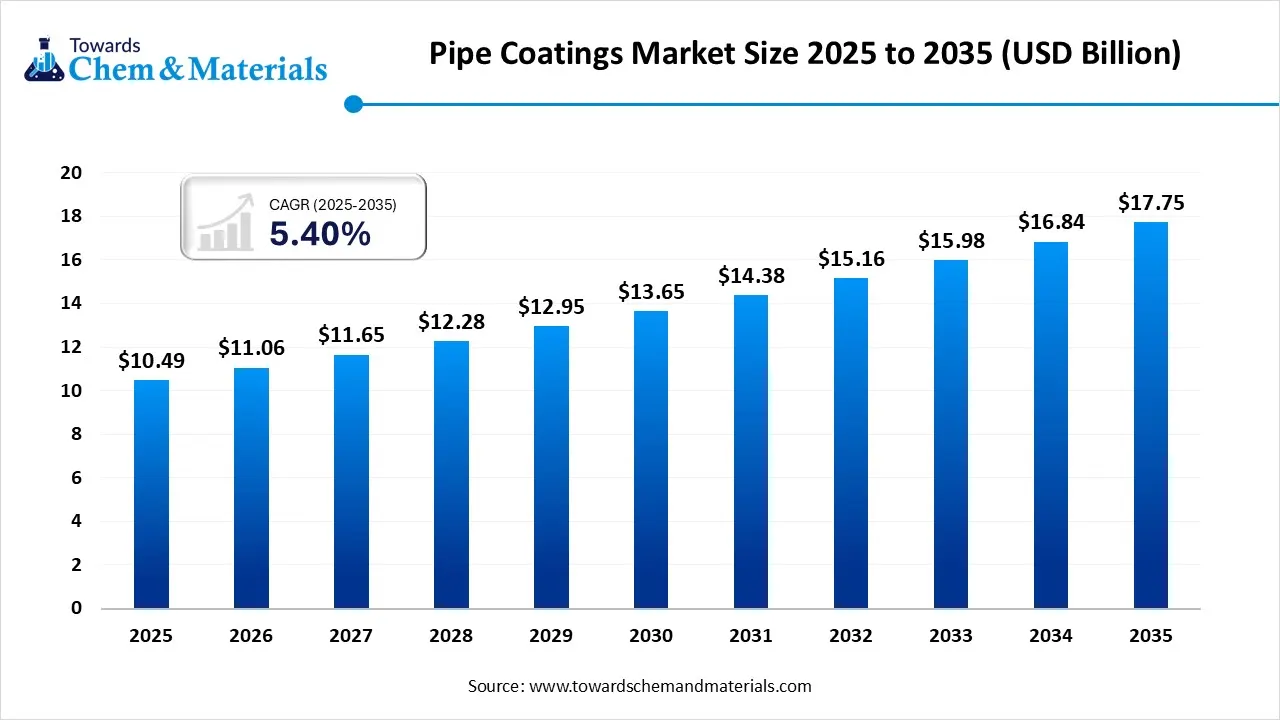

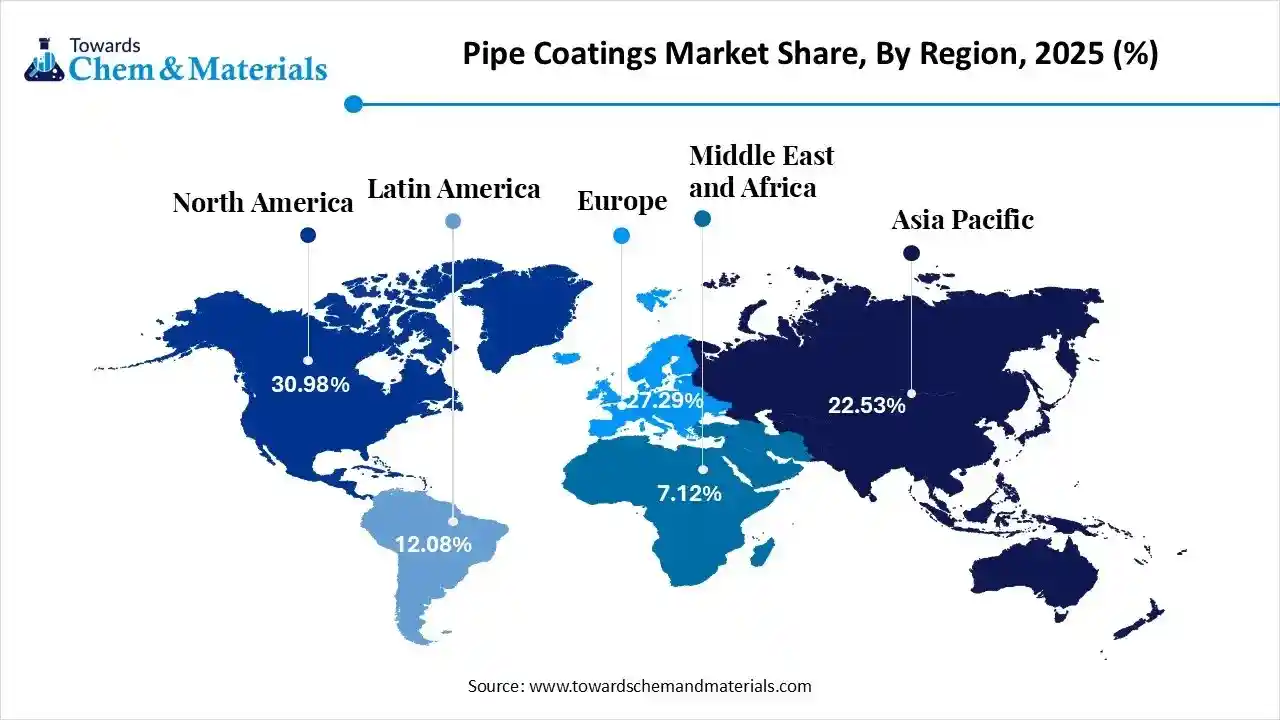

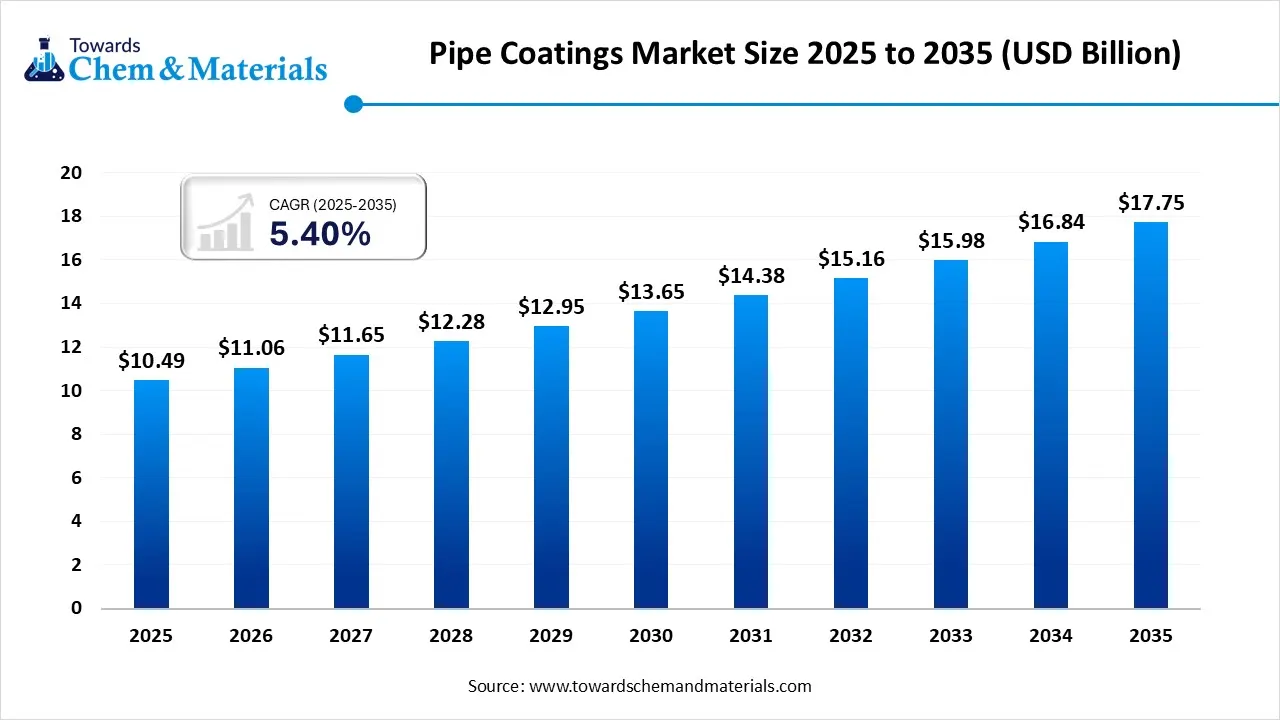

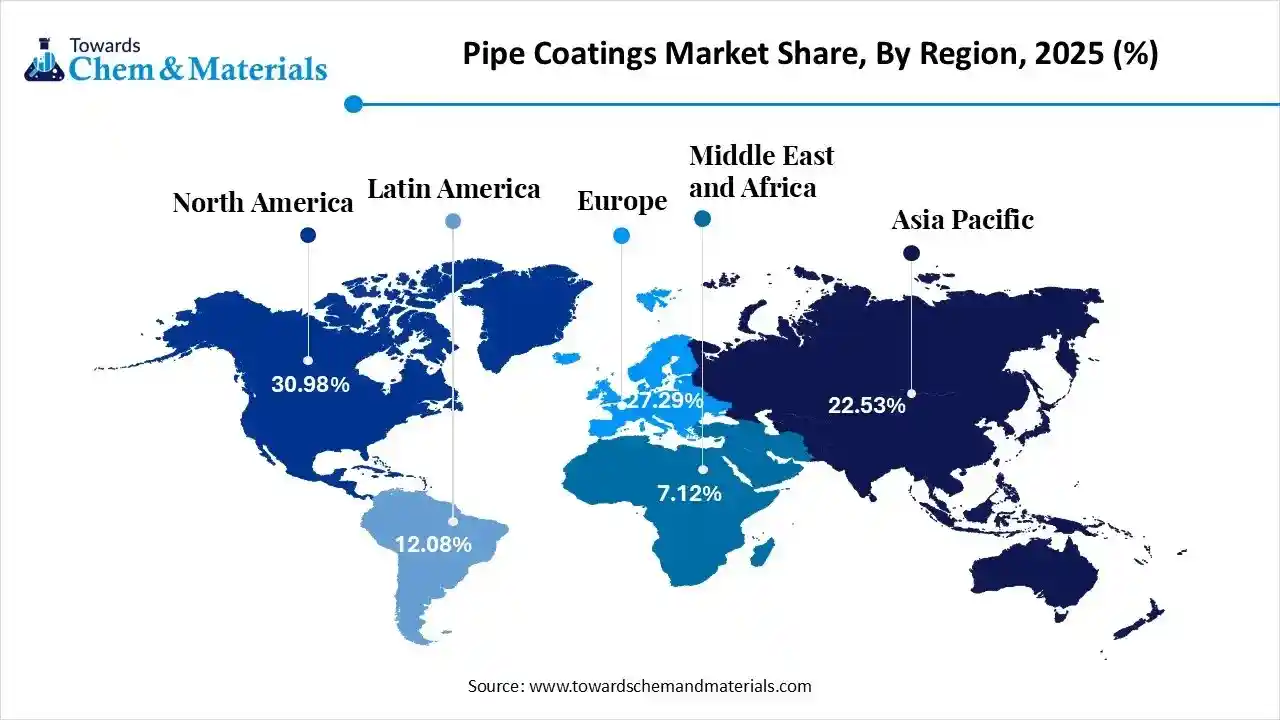

The global pipe coatings market size was USD 10.49 billion in 2025 and is predicted to increase from USD 11.06 billion in 2026 and is expected to be worth around USD 17.75 billion by 2035, growing at a CAGR of 5.40% from 2026 to 2035. North America dominated the pipe coatings market with the largest revenue share of 30.98% in 2025. The ongoing expansion of the oil and gas industry and government regulation toward clean water management is actively stimulating market progression in the current scenario.

Pipe Coatings Market Key Takeaways

- The U.S. pipe coatings market size was estimated at USD 2.59 billion in 2025 and is projected to grow at a CAGR of 6.45% from 2025 to 2034.

- The North America dominated the pipe coatings market with the largest revenue share of 30.98% in 2025.

- The Asia-Pacific has held revenue share of around 27.85% in 2025.

- By type, the Thermoplastic polymer coatings type dominated the market with the highest revenue share of 33.19% in 2025.

- By type, the fusion bonding epoxy segment is expected to grow at a exponential CAGR over the forecast period

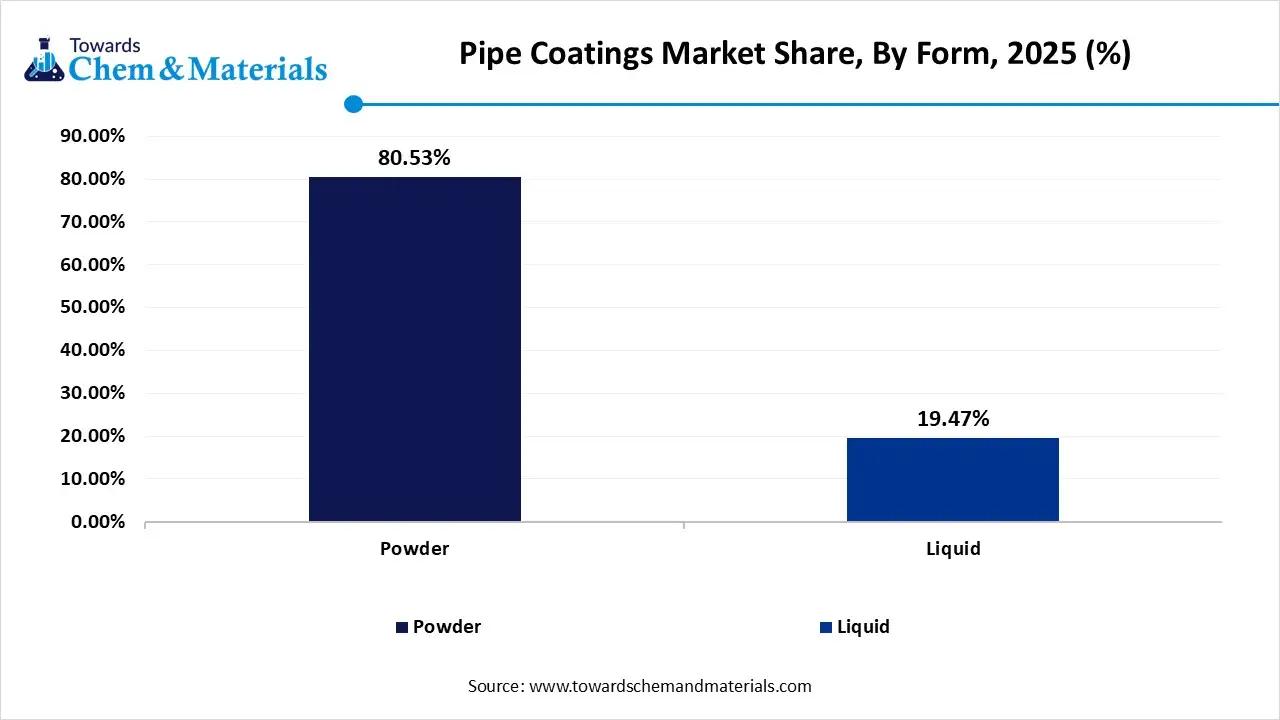

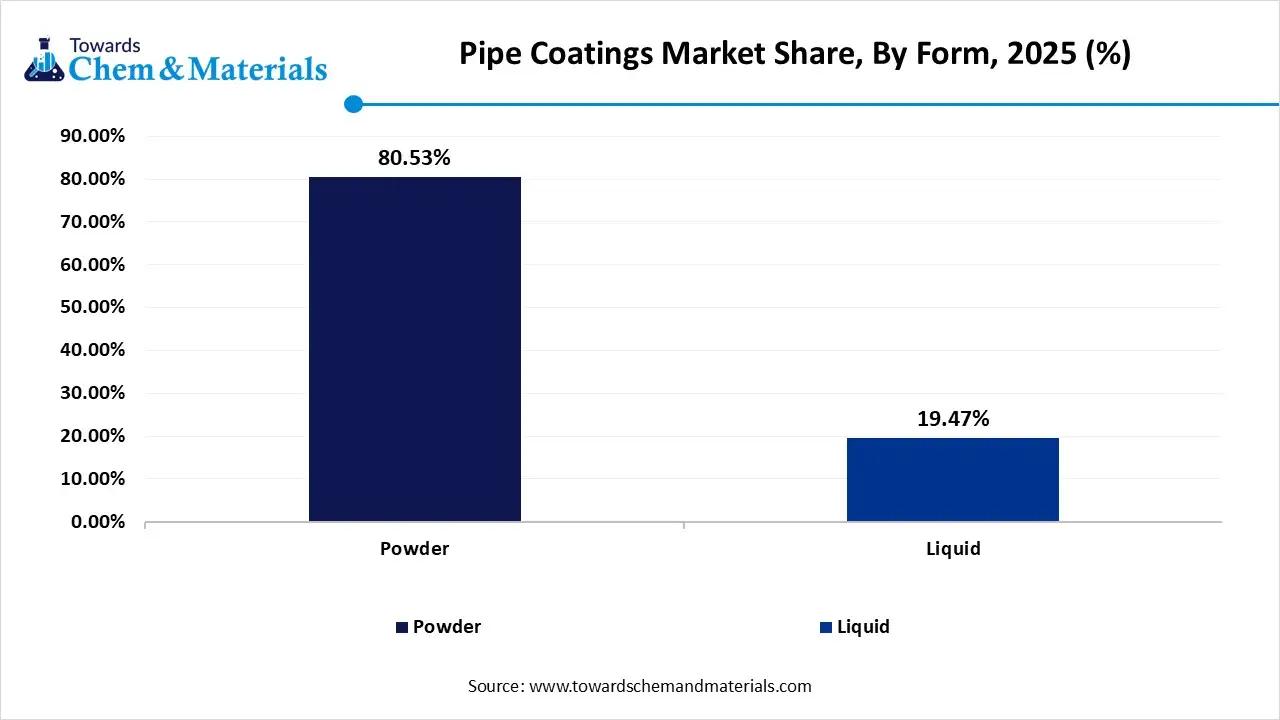

- By form, the powder segment led the market with the largest revenue share of 79.55% in 2025.

- By form, the liquid coating segment is expected to witness at a significant CAGR during the forecast period

- By application, the oil and gas segment accounted for the largest revenue share of 36.33% in 2025

- By application, the water and wastewater segment is expected to witness at a significant CAGR during the forecast period.

Pipe Coatings Market Overview

The pipe coatings market has witnessed fast-paced growth in the recent period. The need for longer life and corrosion protective pipe is majorly contributing to the market growth in recent years. As ongoing expansion of industries such as construction, oil and gas, and water distribution, pipe coating are gaining substantial market attraction in the current period. By maintaining the high quality and long-lasting pipeline infrastructure, the demand for the pipe coating is increased globally. Moreover, the manufacturers are actively investing in research and development of innovative coating combinations that can provide an easier application manual for complex structures of pipes in the coming period.

The rapid expansion of the oil and gas industry has been driving market growth in recent years. The pipelines for oil transportation gained significant attention during the middle years as pipelines are getting rusts and reducing its longer life. Thus, the pipe coating materials are risen as the ideal solution for it. Also, the increasing offshore explorations are increasingly contributing to the pipe coating market potentials in the current period. Moreover, the demand for fusion-bonded epoxy and multi-layer coating is increasing from the oil and gas industries in the current period.

Pipe Coatings Market Recent Trends

- Growing investments in water infrastructures are spearheading the market demand in the current period. Globally governments are actively seen in investing wastewater management programs and leads to the pipe coating demand in recent years. In some regions, there is an increased use of cement mortar coating for municipal water systems.

- Technological advancements in pipes are actively driving the growth of the market recently. The latest coatings are built with durability, sustainability, and improved efficacy, which is becoming an ideal solution for multiple industry uses. The manufacturers are developing are seen in developing smart coating with embedded sensors that can optimize corrosion and leaks in real time.

- Heavy expansion of renewable energy pipelines has gained major market share in the current period. The trend towards sustainability and the need for pipelines that transport biofuels have increased. Thus, the manufacturers are using coating for pipelines actively for preventing pipes from chemical exposures.

Pipe Coating Market Report Scope

| Report Attributes | Details |

| Market size in 2026 | USD 11.06 Billion |

| Expected size in 2035 | USD 17.75 Billion |

| Growth Rate | CAGR of 5.40% |

| Base Year Of Estimation | 2025 |

| Forecast Period | 2025-2035 |

| Dominant Region | North America |

| Segment Covered | By Type, Form, Application, Region |

| Key Companies Profile | PPG Industries, Inc.; Akzo Nobel N.V. The Sherwin-Williams Company; Valspar Industrial. ; Axalta Coating Systems, LLC ; WASCO ENERGY GROUP OF COMPANIES; Arkema Group; 3M; SHAWCOR; Berry Plastics Cpg; Tenaris; Winn & Coales (Denso) Ltd; Aegion Corporation; Dura-Bond Industries; Eupec Pipecoatings France; L.B. Foster Company; Arabian Pipe Coating Company; Perma-Pipe, Inc; Jotun; DuPont |

Hydrogen Pipelines: The Next Big Opportunity Coatings In Pipe Coatings Market

The expansion of the green energy projects is expected to create lucrative opportunities for the pipe coating market during the forecast period. The manufacturers are actively focusing on creating hydrogen transport pipelines as a global shift toward sustainability. Moreover, several companies are trying to get early mover advantages from creating innovative pipes that can provide more benefits than traditional coatings. Also, the coating producers can create partnerships with hydrogen energy firms to gain maximum market attention in the coming years. Also, favorable government laws are likely to support manufacturing in the future

High Cost Barriers Slower Innovation in Pipe Coatings

The higher investment cost of advanced coating technologies is anticipated to impede market growth during the forecast period. These types of technologies require a skilled workforce and specialized equipment, which is expensive sometimes. Moreover, specialized coating demand from industries such as oil and gas and others needs durable coating that provides thermal insulation and chemical protection. The specialized coating needs a professional workforce and expensive raw materials that can hamper manufacturers' productivity of other coating lines. This heavy investment can create significant challenges for new entrants in the coming years.

Value Chain Analysis

Research & Development

- This focuses on creating, testing, and improving coating formulas to enhance corrosion resistance, adhesion, and durability under extreme temperatures and pressures.

- Key Players: 3M, Arkema Group, BASF SE, Covestro AG, Dow Chemical, Axalta Coating Systems, PPG Industries, and AkzoNobel.

Raw Material Supply

- This provides the essential components for coating production, including synthetic resins, pigments, and additives.

- Key Players: Arkema and LyondellBasell Industries.

Manufacturing

- This involves the transformation of raw materials into specialized coating products by mixing, blending, and curing to ensure high-performance standards.

- Key Players: PPG Industries, AkzoNobel, the Sherwin-Williams Company, Axalta Coating Systems, and Jotun.

Application and Coating Operations

- This involves the application of the coating to the pipe, either at a centralized pipe mill or directly on the project site.

- Key Players: Shawcor, Wasco Energy Group of Companies, Dura-Bond Industries, Eupec Pipecoatings, Tenaris, and the Bayou Companies.

Logistics and Distribution

- This involves specialized transportation of coated pipes from coating facilities to end-use sites, requiring careful handling to prevent damage to the coating.

- Key Players: EPC companies and Tenaris logistics.

End-Use and Asset Management

- This involves final installation and utilization of the coated pipes in sectors such as Oil & Gas, Water & Wastewater, and Chemical Processing.

- Key Players: ExxonMobil and Shell

Pipe Coatings Market Segmental Insights

By Type Insights

The thermoplastic polymer coatings segment held the dominating share of the pipe coatings market in 2025. These coatings boast advantages such as adaptability, higher protectiveness, and cost-effectivity is maintaining the segment dominance in the current period. This coating has become an ideal choice for industries such as water treatment, oil and gas, and construction due to its beneficial properties. The thermoplastic polymer coating continuously offers durability, thermal stability, and impressive corrosion resistance to these sectors in the current time period. Also, these coatings protect pipelines against harsh environments like moisture and chemicals. Moreover, the thermoplastic coating sees heavy use in oil and gas industries nowadays, akin to its high underground environment where exposure to corrosive elements is high.

However, the fusion bonding epoxy segment is expected to experience significant market growth in the future. The pipeline protection industry is evolving rapidly where the superior qualities are getting attraction in recent years. Furthermore, the fusion bonding coating segment growth can be attributed to the rising water infrastructure and utility projects in the coming years. This coating has excellent adhesions that ensure metal surfaces are safe from highly humid and submerged conditions. Moreover, the increasing high-temperature application from different industries like power plants, chemical processing, and geothermal energy projects is expected to contribute to the growth of the segment in the coming years.

By Form Insights

The powder segment led the pipe coatings market in 2025. The need for highly protective and long-lasting powder coatings is leading to high powder coating sales in the current market environment. Having greater protection qualities like immense resistance to chemicals and corrosion in any weather conditions makes it a preferred choice for the industries, mainly in water treatment.

Moreover, the unique benefits of powder coatings, such as the ability to create a dense and durable barrier, is leading segment growth, minimizing the cost of multilayer coating in recent years. Also, technical advancement is driving the powder coating segment expansion in similar industries by integrating innovative combinations in coating nowadays. Moreover, the changes in application, such as fluidized bed coating and electrostatic spray coating, can create exceptional opportunities for the segment growth.

The liquid coating segment is expected to grow at the fastest rate during the forecast period. The sudden surge in global infrastructure development and usage of pipelines of energy transportation may drive the segment growth during the anticipated period as the liquid coating is increasingly used in pipelines that transport aggressive substances such as petroleum, chemicals, and raw crude oils in the recent years. Also, having diverse and seamless application in complex pipe structures can increase segment potential in the future period.

By Application Insights

The oil and gas segment held the largest share of the market in 2025. The increased need for the efficient transportation of resources and long-lasting corrosion protection in very weather events is spreading the segment growth in the current days. As the sector is exposed to highly corrosive sites, the individuals are increasingly using pipeline coating in offshore drilling sites in recent years. Also, without the pipeline coating, several companies face metal degradation. Moreover, the rising exploration of unconventional oil and gas resources such as deep-water resources, shell gasses, and oil sands are leading coating sales in the current period. Also, the industrialists are seeking for the coating which is cost effective and durable can gain market attraction in the future.

The water and wastewater segment are seen to grow at a notable rate during the predicted timeframe. The increasing governmental initiatives towards clean water and clean environment will create growth opportunities for the coating in the future. Several coatings are used in waste water pipelines due to their exceptional qualities, such as providing a protective shield to pipelines from any chemicals and rust protection. Furthermore, the wastewater includes the latest chemicals, which can damage the water pipeline in some years; thus, coating manufacturers are actively researching the coating that can protect from this specialized chemical, which is not protected by older coatings.

Regional Insights

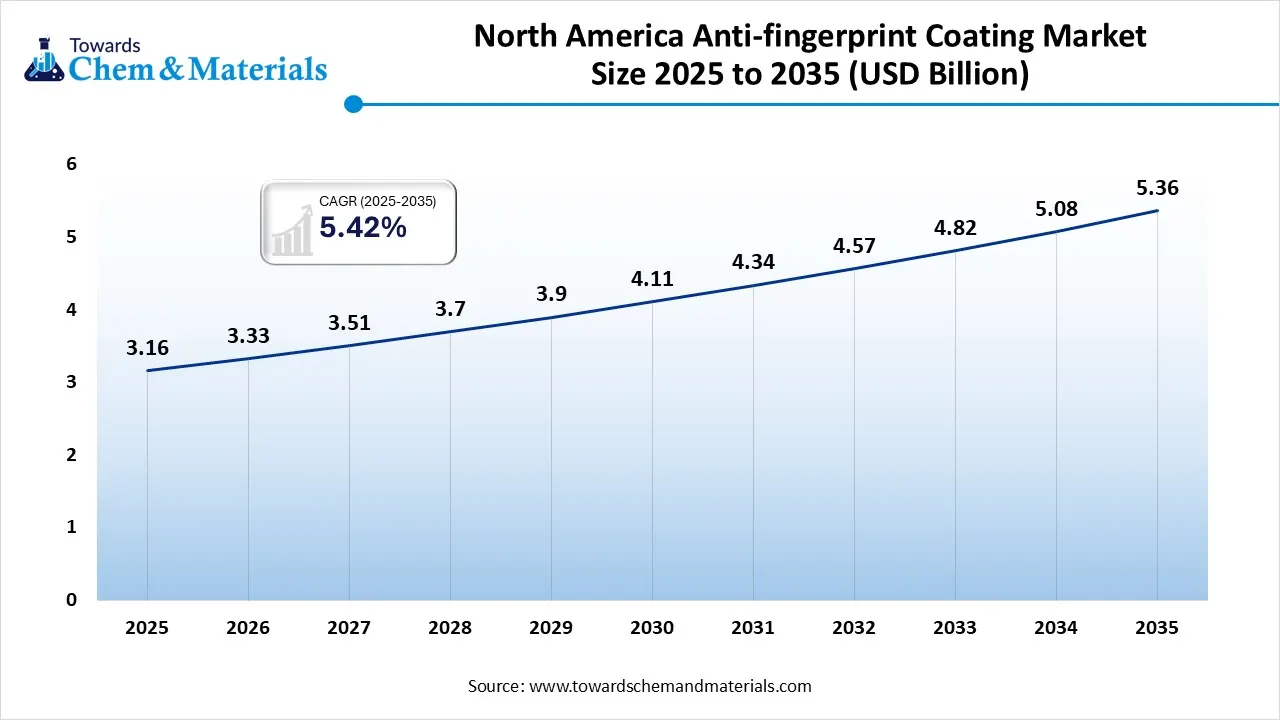

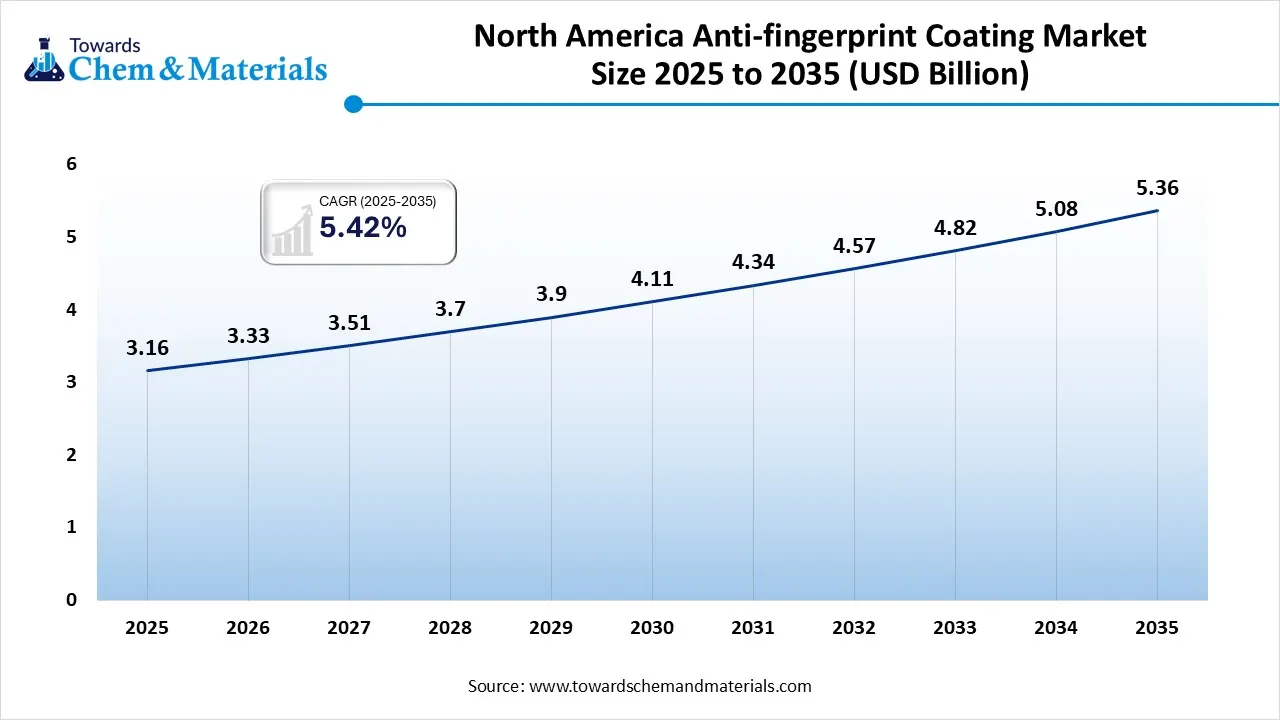

North America

The North America pipe coatings market size was valued at USD 3.16 billion in 2025 and is expected to be worth around USD 5.36 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 5.42% over the forecast period from 2026 to 2035. North America dominated the pipe coatings market in 2025.

The large investment in protective technology is maintaining the market dominance in the region. Having strong industrial bases and modern technological advancements in coating materials is actively contributing to the market potential in recent days. Moreover, countries such as Mexico, Canada, and the United States are seen in launching heavy pipeline projects like the Trans Mountain Expansion Project in Canada and the Permian Highway Pipeline in the United States recently.

Rising Investments in Infrastructure Secure United States Pipe Coating Leadership

United States has had a major market share in pipe coating sales over the years. The United States has the largest pipeline infrastructure for liquid petroleum and natural gas in the current period. The heavier momentum of pipelines from the enlarged manufacturing industries is driving the market growth in the country. The technological advancements and heavy investment in the innovation of cost-effective and long-lasting coating is a substantial market share in the country nowadays. Moreover, the expansion of water waste management industries is heavily consuming stronger pipe coating for the longer protection of pipes.

How will Europe be considered a notable growth in the Pipe Coatings Market?

Europe is experiencing notable growth in the global market, primarily driven by stringent environmental regulations and substantial investments in energy transition projects and infrastructure modernization. There is also a growing demand to rehabilitate and upgrade aging pipeline networks for water, oil, and gas, which necessitates high-performance, durable coatings. The shift toward renewable energy has increased the demand for specialized coatings for hydrogen transport pipelines, alongside new LNG pipeline projects aimed at enhancing energy security. Major coating manufacturers in the region, such as AkzoNobel, BASF, and Jotun, are leading innovation in protective coatings.

Germany Pipe Coatings Market Trends

Germany plays a crucial role in this region due to its emphasis on high-quality, advanced coating materials for the oil, gas, and water sectors. Strict European regulations have heightened the demand for eco-friendly, low-VOC products, prompting the development of sustainable and durable coatings. Additionally, Germany is home to key manufacturers like BASF and Evonik, as well as advanced engineering hubs focused on predictive maintenance and enhanced precision.

Emergence of Latin America in the Pipe Coatings Market

Latin America is an emerging region in the global market, primarily driven by expanding infrastructure, a rise in oil and gas projects, and increased adoption of advanced, eco-friendly corrosion protection solutions. Governments in the region are making substantial investments in new pipelines for water supply, sewage, and hydrocarbon transportation, particularly in Brazil, Mexico, and Argentina. Both Mexico and Brazil are experiencing increased industrialization and near-shoring, which is boosting the demand for industrial pipes. Regulatory pressures are accelerating the adoption of eco-friendly and water-borne coatings.

Brazil Pipe Coatings Market Trends

Brazil stands out as the primary market in Latin America, characterized by the rapid expansion of deepwater and ultra-deepwater projects. This growth fuels high demand for specialized anti-corrosion and concrete weight coatings. Increasing regulatory pressure is driving the adoption of low-VOC and sustainable coatings. Moreover, urban infrastructure development in cities like São Paulo and Rio de Janeiro is also driving demand for potable water and sewage pipe coatings.

How will the Middle East and Africa contribute to the Pipe Coatings Market?

The Middle East and Africa are vital contributors to the global market, fueled by massive energy infrastructure and rapid urbanization. This region holds the world's largest oil reserves, with countries like Saudi Arabia, the UAE, and Qatar investing heavily in expanding their oil transportation networks, which require extensive anti-corrosion coatings. Governments are focusing on diversifying their economies and reducing dependence on imports by encouraging local manufacturing of materials and chemicals. The extreme climate in this region necessitates advanced, specialized coatings to protect pipeline integrity.

The UAE Pipe Coatings Market Trends

The UAE is a prominent market within the region, with significant investments in both upstream oil and gas and public infrastructure. As one of the world’s largest oil producers, Abu Dhabi’s National Oil Company creates substantial demand for anti-corrosion coatings to protect infrastructure against harsh, high-temperature, and corrosive desert conditions. The presence of companies like AkzoNobel, Jotun, and Sherwin-Williams, along with strong regional players like National Paints, is driving market expansion.

Asia Pacific Pipe Coatings Market Trends

Asia Pacific is expected to dominate the pipe coatings market in the forecast period. Factors such as rapid industrialization, heavy infrastructure projects, and increased focus on energy security will drive the market growth in the coming years. the emerging economies such as India, China and Japan is a majorly contributing the market expansion recent years with launching heavier projects for water cleaning and oil industry advancement in the country.

China’s Strategic Investments Drive Pipe Coating Market with Innovations.China is expected to become an emerging country for coating consumption during the forecast period. China has the largest pipeline connection in the Asia region nowadays. Moreover, heavy investment in water projects can lead to market potential in the country for a future period. The strong manufacturing capacity of pipe coating, such as epoxy and polyurethane, is likely to develop a profitable market environment during the anticipated period in China.

Moreover, the favorable government policies and support can create massive opportunities for the manufacturer of pipe coating in the coming years. Also, the modern technological advancement of China can play a major role in the growth of the industry potential during the forecast period. Furthermore, manufacturers are actively collaborating with companies to boost their product portfolio.

- For instance, Evonik Coating Additives and Nippon Paint China recently announced a collaboration with the aim of developing eco-friendly coating solutions for the coming years. The partnership was signed in Shanghai in 2025.

Current Updates In Pipe Coatings Market

- In 2024, Sherwin-Williams introduced the latest category of pipe coating named Frac-Shun ERC. This coating protects pipes from erosion while reducing downtime and maintenance costs. Also, this coating is available in powder form. The coating is suitable for the large and small diameter steel pipes and likely provides greater protection against erosion.

- In 2024, NOV launched the latest tubular internal coating technology for the drilling tools. The technology aims to reduce thermal conductivity while increasing the operational efficacy of the tools. This coating is called TK-Drakon, and it is an insulating coating to maintain drilling tools in a temperature environment.

- In 2024, VALLOUREC acquired a leading thermal insulation pipe coating service provider called Thermotite do Brasil Ltda. This acquisition aims to support Vallourec’s premiumization strategy and establish its presence across the industry value chain for offshore and deep-water markets.

Pipe Coatings Market Key Companies

- PPG Industries, Inc.

- Akzo Nobel N.V.

- The Sherwin-Williams Company

- Valspar Industrial.

- Axalta Coating Systems, LLC

- WASCO ENERGY GROUP OF COMPANIES

- Arkema Group

- 3M

- SHAWCOR

- Berry Plastics Cpg

- Tenaris

- Winn & Coales (Denso) Ltd

- Aegion Corporation

- Dura-Bond Industries

- Eupec Pipecoatings France

- L.B. Foster Company

- Arabian Pipe Coating Company

- Perma-Pipe

- Jotun

- DuPont.

Segments Covered In The Report

By Type

- Thermoplastic Polymer Coatings

- Fusion Bonded Epoxy Coatings

- Bituminous

- Concrete

- Other Types

By Form

- Liquid

- Powder

- Solvent

By Application

- Oil & Gas

- Water & Wastewater

- Chemical Processing

- Mining

- Agriculture

- Other Applications

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- Thailand

- Latin America

- Brazil

- Argentina

- The Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait