Content

Vapor Barrier Market Size and Growth 2025 to 2034

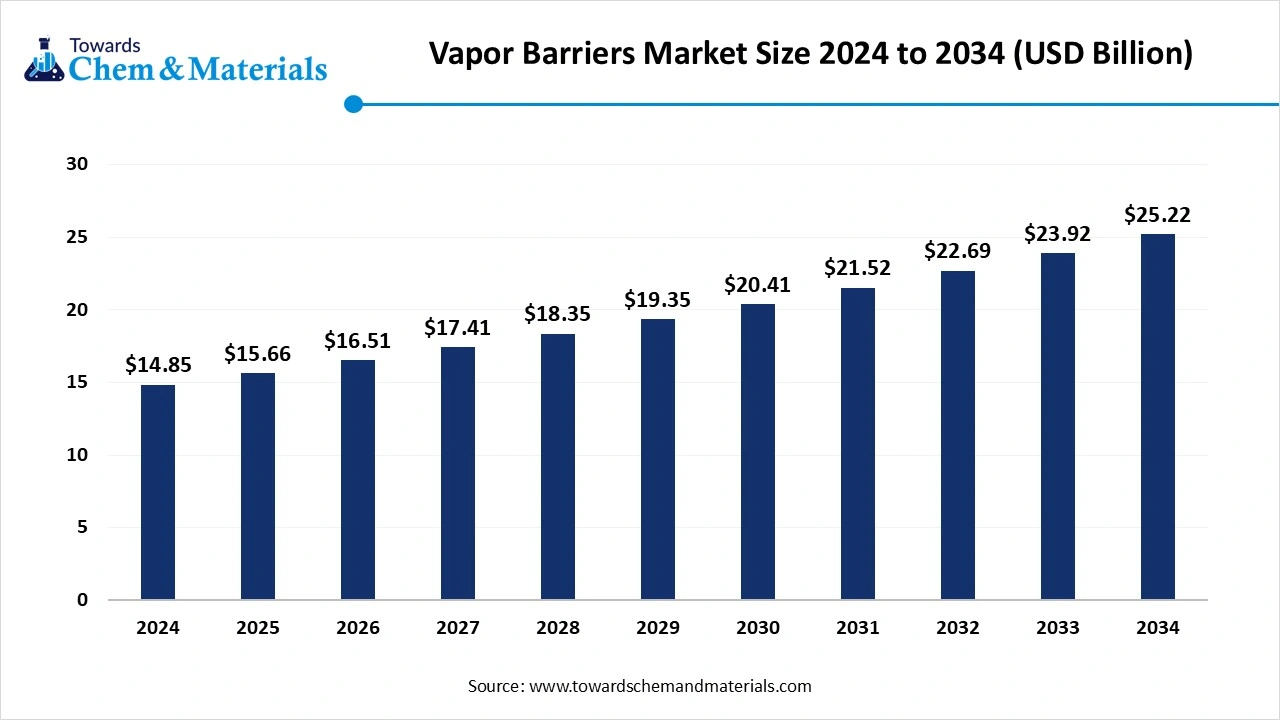

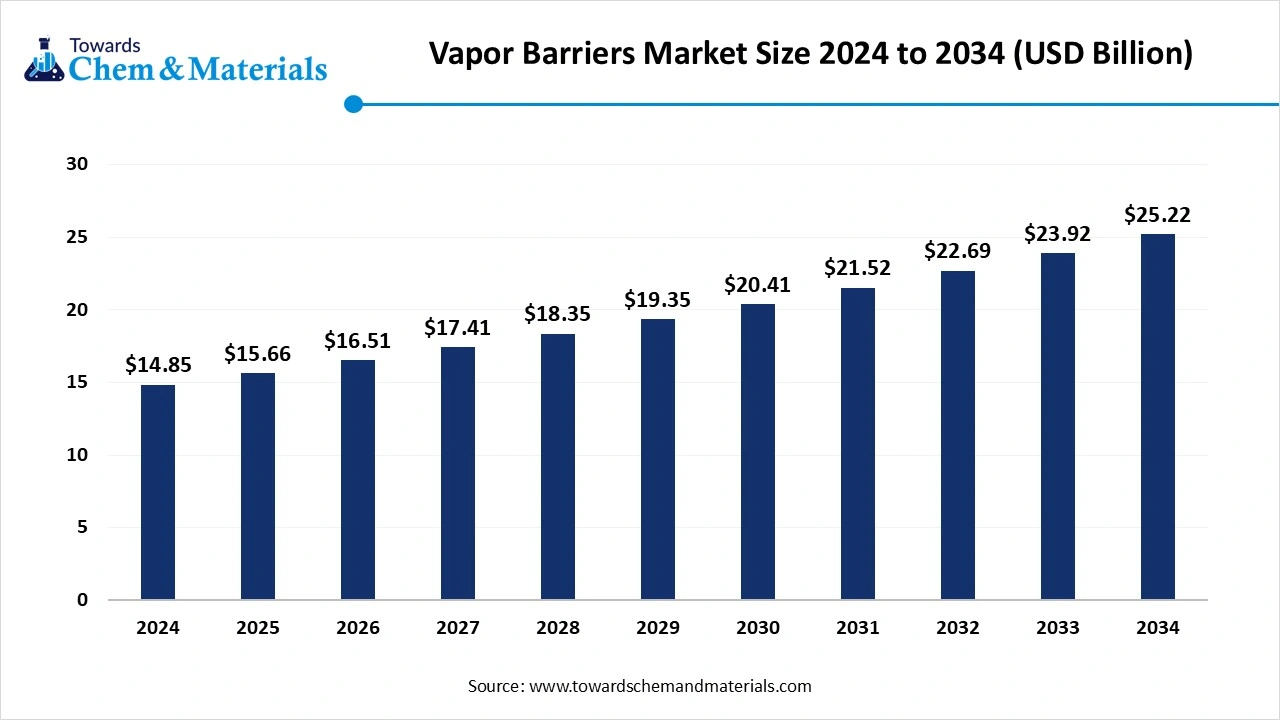

The global vapor barrier market size reached USD 14.85 billion in 2024 and is projected to hit around USD 25.22 billion by 2034, expanding at a CAGR of 5.44% during the forecast period from 2025 to 2034.The increasing demand for energy-efficient buildings, moisture control solutions, and sustainable construction practices drives the growth of the

Vapor Barrier Market Key Takeaways

- By region, North America dominated the vapor barrier market in 2024. The market is driven by strict building regulations, high construction standards, and widespread adoption of energy-efficient and moisture-resistant building practices.

- By region, Asia Pacific is anticipated to have significant growth in the market in the forecast period. The growth is driven by rapid urbanization, rising construction activities, and increasing awareness of building durability and moisture protection, which attracts consumers.

- By material, the polymer segment dominated the market in 2024. versatility, durability, and cost-effectiveness, increases the demand for the market.

- By material, the metal sheet segment is anticipated to grow significantly in the market during the forecast period. market is valued for its high strength, durability, and superior resistance to vapor transmission.

- By application, the insulation segment dominated the market in 2024. is a major application area for vapor barriers, as controlling moisture is essential to maintaining the effectiveness of thermal insulation.

- By application, the waterproofing segment is anticipated to grow in the forecast period. vapor barriers play a vital role in protecting structures from moisture intrusion, especially in basements, foundations, and roofing systems.

- By installation, the membranes segment dominated the market in 2024. The growth is due to its flexibility, ease of application, and reliable performance.

- By installation, the cementitious segment is anticipated to grow in the forecast period. Cementitious vapor barriers are easy to apply and offer excellent resistance to hydrostatic pressure.

- By end use, the construction segment dominated the market in 2024. Demand is driven by stringent building codes, growing emphasis on energy efficiency, and moisture control in new construction and renovation.

- By end use, the automotive segment is anticipated to grow in the forecast period. Growing electric vehicle adoption increases the demand for advanced moisture management to ensure safety.

Rising Demand for Durable Materials: Vapor Barrier Market To Expand

A vapor barrier is a material, or membrane is made for restricting the moisture from entering to the walls, floors, and ceilings by blocking the movement of water vapor. It is commonly used in building construction to protect insulation and structural components from condensation, which generally leads to mold growth, decay, and reduced thermal efficiency. Vapor barriers are specially made from plastic or foil sheets and are installed on the warm side of insulation in climates where indoor heating is common. The key function of this barrier is to maintain the air quality and energy efficiency by controlling the moisture.

The vapor barrier market growth is driven by the growing demand for energy-efficient and moisture-resistant buildings, rising awareness about the harmful effects of mold and dampness on health, and strict building codes and regulations promoting sustainable construction practices. The growing urbanization and infrastructural development are also contributing to the growth of the market, especially in emerging economies are significantly boosting the use of vapor barriers in residential and commercial projects. Along with this advancement in technology of barriers, such as multi-layered films and eco-friendly materials, further increasing market growth by offering improved performance and durability.

The World exported 633 shipments of Vapor Barrier from Oct 2023 to Sep 2024 (TTM). These exports were made by 191 Exporters to 191 Buyers, marking a growth rate of 59% compared to the preceding twelve months. The top three exporters of Vapor Barrier are Russia, United States, and South Korea.

Vapor Barrier Market Trends

- The increasing demand for eco-friendly materials: The growing adoption of sustainable products and growing concerns regarding energy efficiency increase demand for eco-friendly vapor barriers. The eco-friendly vapor barriers are made up of biodegradable & recycled materials. They help in lowering environmental impact and promote sustainable building practices. Manufacturers are focusing on the production of eco-friendly vapor barriers and innovating new materials.

- Growing construction industry in various countries: The growth in the construction industry, like industrial, commercial, residential, and infrastructural projects, increases demand for vapor barrier. Vapor barrier improves energy efficiency, prevents moisture from entering building, protects the structural integrity of the construction, and improves the indoor environment of buildings. Vapor barriers are widely used in various construction applications like roof assemblies, under-slab, and walls.

- Technological advancements: Technological advancements in vapor barriers, like the development of innovative materials, the development of new technologies, the addition of barrier pigments, and improving barrier performance through double coating, help in the growth of the market. The growing advancements like smart vapor barriers, the use of nanotechnology, and aerobic vapor migration barriers, enhance its performance and application in various fields.

Market Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 15.66 Billion |

| Expected Size By 2034 | USD 25.22 Billion |

| Growth Rate from 2025 to 2034 | CAGR 5.44% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025-2034 |

| High Impact Region | North America |

| Segment Covered | By Material, By Application, By Installation, By End Use , By Region |

| Key Companies Profiled | Glenroy Inc., Celplast Metallized Product Ltd., Polifilm Group, ProAmpac Holdings, Optimum Plastics, Inc., 3M Company, Amcor Limited, SAES Getters S.p.A., Kalliomuovi Oy, GLT Products, UFP Industries, Inc., W.R. Meadows, Inc., BMI Icopal, Carlisle Companies Inc. |

Vapor Barrier Market Opportunity

Rapid Expansion of the Construction Industry in Emerging Economies

One of the major opportunities contributing to the growth of the vapor barrier market is the growing and rapid expansion of the construction industry in the emerging economies, where they are experiencing accelerated urbanization and infrastructural development, leading to increased demand for moisture control solutions in residential, commercial, and industrial buildings. The initiatives, such as the smart city mission and substantial investment in infrastructure development, further boost the demand and growth of the market. The regions with humid conditions require and demand efficient moisture management to prevent structural damage and health hazards, which increases demand

Vapor Barrier Market Challenge

Lack Of Awareness and Inconsistent Installation Practices

The vapor barrier market has a key challenge that hinders the growth of the market in the developing region, especially the lack of awareness and inconsistent installation practices. Many builders and contractors overlook the importance of or have poor installation techniques, which leads to reduced effectiveness. Additionally, the selection of inappropriate barrier materials for specific climate conditions results in poor results, and limited availability of skilled labor and lack of training also result in poor performance, which results in less growth and is a challenge to overcome.

Regional Insights

North America dominated the vapor barrier market in 2024. The region's mature and technologically advanced market is driven by strict building regulations, high construction standards, and widespread adoption of energy-efficient and moisture-resistant building practices. The diverse climate conditions in the region increase the demand for reliable vapor barrier solutions to prevent structural damage caused by condensation and moisture. The rising awareness of sustainable construction, increased retrofitting of older buildings, and strong investments in installation technologies help the growth of the market. Additionally, innovation in high-performance materials and emphasis on indoor environmental quality further boost the development of the market across the region.

The United States Has Seen Growth Driven by Widespread Awareness of Moisture-Related Building Issues.

The USA holds a dominant position in the vapor barrier market due to its well-regulated construction industry, which focuses on energy efficiency and widespread awareness of moisture-related building issues. Strict building codes mandate the use of vapor barriers in various applications, which include roofing, wall systems, and flooring, particularly in areas where the climate is fluctuating. The demand is also fueled by the growth of green building initiatives in the region and the retrofitting of older structures to improve energy performance and indoor air quality. Technological advancements and a strong presence of manufacturers continue the demand for innovation and adoption of advanced vapor barrier solutions in the country, which drives the growth.

Asia Pacific is anticipated to grow significantly in the vapor barrier market in the forecast period.

Asia-Pacific is the fastest-growing region in the market, and the growth is driven by rapid urbanization, rising construction activities, and increasing awareness of building durability and moisture protection, which attracts consumers. The region’s hot and humid climate makes effective moisture control essential in residential, commercial, and industrial buildings. Strong infrastructure development, large-scale housing projects, and government investments in smart cities and industrial zones are fueling demand for vapor barriers. Additionally, the availability of cost-effective manufacturing and a growing middle class with higher expectations for building quality are creating new opportunities for market expansion across the region.

India's Market is Seeing Significant Growth Due to Demand for Energy-Efficient and Moisture-Controlled Buildings

India is witnessing a growing demand for vapor barriers, driven by rapid urbanization, increasing construction activities, and a greater emphasis on energy efficiency and moisture control in buildings. The country’s diverse climate, especially in regions with high humidity, necessitates effective moisture protection to prevent structural damage and health hazards like mold.

Government-led infrastructure and affordable housing initiatives are further boosting the adoption of modern construction materials, including vapor barriers. Additionally, rising awareness about sustainable and long-lasting building practices is encouraging both developers and homeowners to incorporate vapor barrier systems, despite ongoing challenges like inconsistent installation practices and limited awareness in rural areas.

Vapor Barrier Market Segmental Insights

Material Insights

The polymer segment dominated the vapor barrier market in 2024. The polymer segment holds a significant share in the market due to its versatility, durability, and cost-effectiveness, which increases the demand for the market. Polymers such as polyethylene, polypropylene, and polyvinyl chloride (PVC) are widely used since they offer excellent moisture resistance and can be easily manufactured into sheets or films. These materials are lightweight, flexible, and suitable for various applications in construction, especially in insulation and under-slab installations, making them a preferred choice for builders and contractors, which increases the demand for the market.

The metal sheet segment expects significant growth in the vapor barrier market during the forecast period. The metal sheet segment in the market is valued for its high strength, durability, and superior resistance to vapor transmission. Typically made from materials like aluminum or galvanized steel, these sheets are used in industrial and commercial buildings where long-term protection and fire resistance are critical. Although heavier and more expensive than polymer options, metal sheets are ideal for harsh environments and are often chosen for roofing and specialized wall applications requiring robust moisture control, which increases the demand and helps in the growth of the market.

Application Insights

The insulation segment dominated the vapor barrier market in 2024. The insulation segment is a major application area for vapor barriers, as controlling moisture is essential to maintaining the effectiveness of thermal insulation. Vapor barriers are typically installed on the warm side of insulation in walls, roofs, and floors to prevent condensation that can degrade insulating materials and lead to mold growth.

This application improves energy efficiency, indoor comfort, and building longevity, making it a critical component in both residential and commercial construction. The waterproofing segment expects significant growth in the vapor barrier market during the forecast period. In the waterproofing segment, vapor barriers play a vital role in protecting structures from moisture intrusion, especially in basements, foundations, and roofing systems.

These barriers act as a seal to prevent water vapor from penetrating building envelopes, which can lead to structural damage, corrosion, and mold formation. Used alongside other waterproofing materials, vapor barriers enhance the overall moisture management system, ensuring building integrity and longevity in both new construction and renovation projects.

Installation Insights

The membranes segment dominated the vapor barrier market in 2024. The membranes segment is a widely used installation type in the market due to its flexibility, ease of application, and reliable performance. These barriers are typically made from polyethylene, bituminous materials, or synthetic polymers and are applied as sheets or rolls.

Membrane vapor barriers are ideal for roofing, walls, and under-slab installations, offering consistent coverage and resistance to moisture penetration. Their adaptability to various surfaces makes them a preferred choice in modern construction practices. The cementitious segment expects significant growth in the vapor barrier market during the forecast period. The cementitious segment includes vapor barriers made from cement-based coatings that are applied to concrete surfaces to block moisture penetration.

These barriers are especially suited for basements, foundations, and water-retaining structures due to their strong adhesion, durability, and compatibility with masonry substrates. Cementitious vapor barriers are easy to apply and offer excellent resistance to hydrostatic pressure, making them a popular choice for both new constructions and repair projects in high-moisture environments.

End Use Insights

The construction segment dominated the vapor barrier market in 2024. The construction sector represents the largest end-use for vapor barriers, encompassing residential, commercial, and industrial building projects. Demand is driven by stringent building codes, growing emphasis on energy efficiency, and moisture control in new construction and renovation. Vapor barriers in walls, roofs, floors, and foundations prevent condensation, protect components, and extend building lifespan. Retrofit projects further boost adoption as older buildings are upgraded for improved thermal performance and indoor air quality.

The automotive segment expects significant growth in the vapor barrier market during the forecast period. In the automotive segment, vapor barriers are used to protect the interior part of the vehicle and components from moisture, particularly in doors, roofs, and electric battery compartments for EVs, which drives the growth. Polymer-based films and adhesives are applied to prevent the vehicle from corrosion, mold, and electrical failures. Precision in thickness and compatibility with paints and trim is critical. Growing electric vehicle adoption increases the demand for advanced moisture management to ensure safety, reliability, and extended component life, which drives the growth of the market.

Vapor Barrier Market Recent Developments

TOPPAN Inc.

- Collaboration: In March 2024, a subsidiary of TOPPAN Holdings Inc., TOPPAN Inc., and TOPPAN Speciality Films Private Limited (TSF) from India partnered for the development of new barrier film called GL-SP.

Delfort

- Innovation: In January 2025, Delfort recently introduced its latest innovation, thin barrier 302, a specialty paper designed to offer superior protection for temperature-sensitive products like ice cream, chocolates, and candies. This new paper boasts excellent barrier properties, guarding against moisture, oxygen, aroma, and fat to ensure freshness and product integrity. As a sustainable alternative to conventional packaging materials, thin barrier 302 aligns with current consumer demands and market trends for eco-friendly and high-performance solutions.

Milliken & Company

- Launch: In November 2024, Milliken & Company, a global manufacturing leader based in Spartanburg, S.C., launched Milliken Assure, first flame-resistant moisture barrier technology in North America that is free from both PFAS and halogenated compounds. This innovative material sets a new standard in firefighter protection by offering safety without relying on harmful chemicals, reflecting a strong commitment to health, performance, and environmental responsibility.

Vapor Barrier Market Top Companies List

- Glenroy Inc.

- Celplast Metallized Product Ltd.

- Polifilm Group

- ProAmpac Holdings

- Optimum Plastics, Inc.

- 3M Company

- Amcor Limited

- SAES Getters S.p.A.

- Kalliomuovi Oy

- GLT Products

- UFP Industries, Inc.

- W.R. Meadows, Inc.

- BMI Icopal

- Carlisle Companies Inc.

Segments Covered in the Report

By Material

- Glass

- Metal Sheet

- Polymers

- Polyethylene

- Polypropylene

- Polyvinyl Chloride

- Others

By Application

- Insulation

- Waterproofing

- Corrosion Resistance

- Others

By Installation

- Membranes

- Coatings

- Cementitious Waterproofing

- Stacking and Filling

By End-Use

- Construction

- Packaging

- Automotive

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait