Content

Per- and Polyfluoroalkyl Substances (PFAS) Chemicals Market Market Size and Share 2034

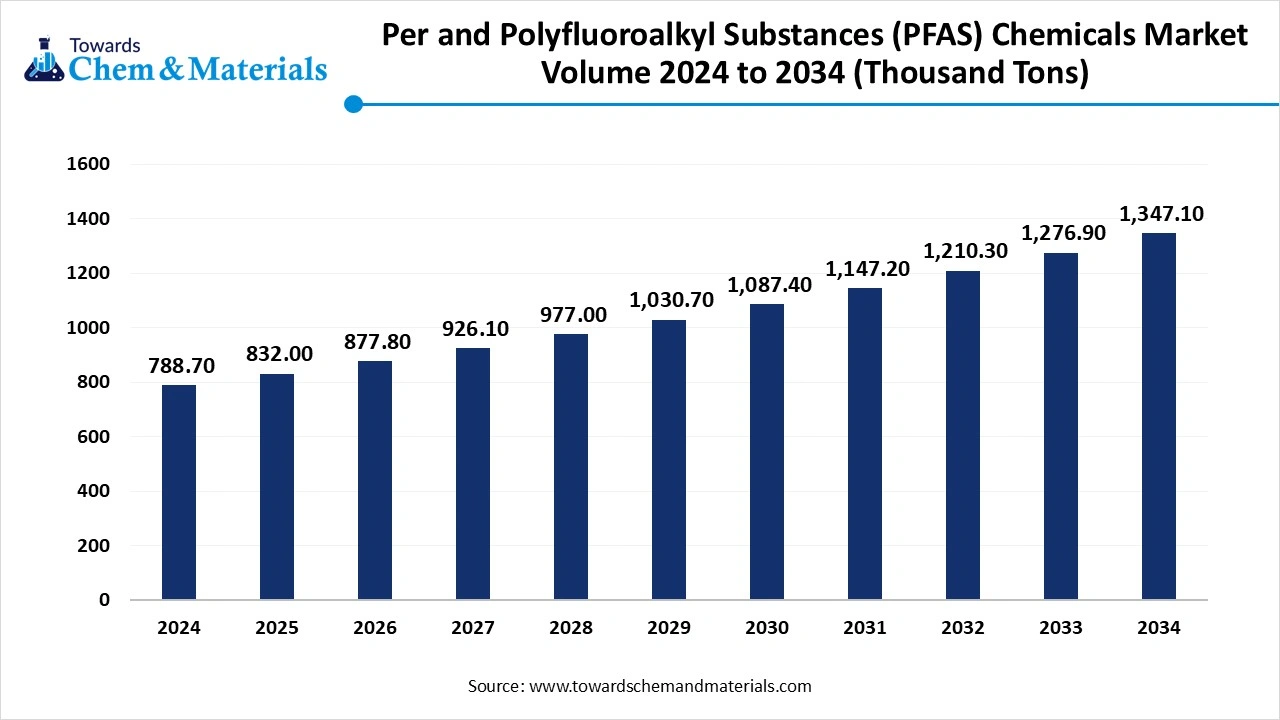

The global per- and polyfluoroalkyl substances (PFAS) chemicals market volume is calculated at 788.70 thousand tons in 2024, grew to 832 thousand ton in 2025, and is projected to reach around 1,347.10 thousand tons by 2034. The market is expanding at a CAGR of 5.50% between 2025 and 2034. The widespread use of PFAS chemicals in the environment and products related to food, commercial, consumer, and industrial purposes is driven by their long-lasting chemical properties that also encourage research and development in the per- and polyfluoroalkyl substances (PFAS) chemicals market.

Per- and Polyfluoroalkyl Substances (PFAS) Chemicals Market Key Takeaways

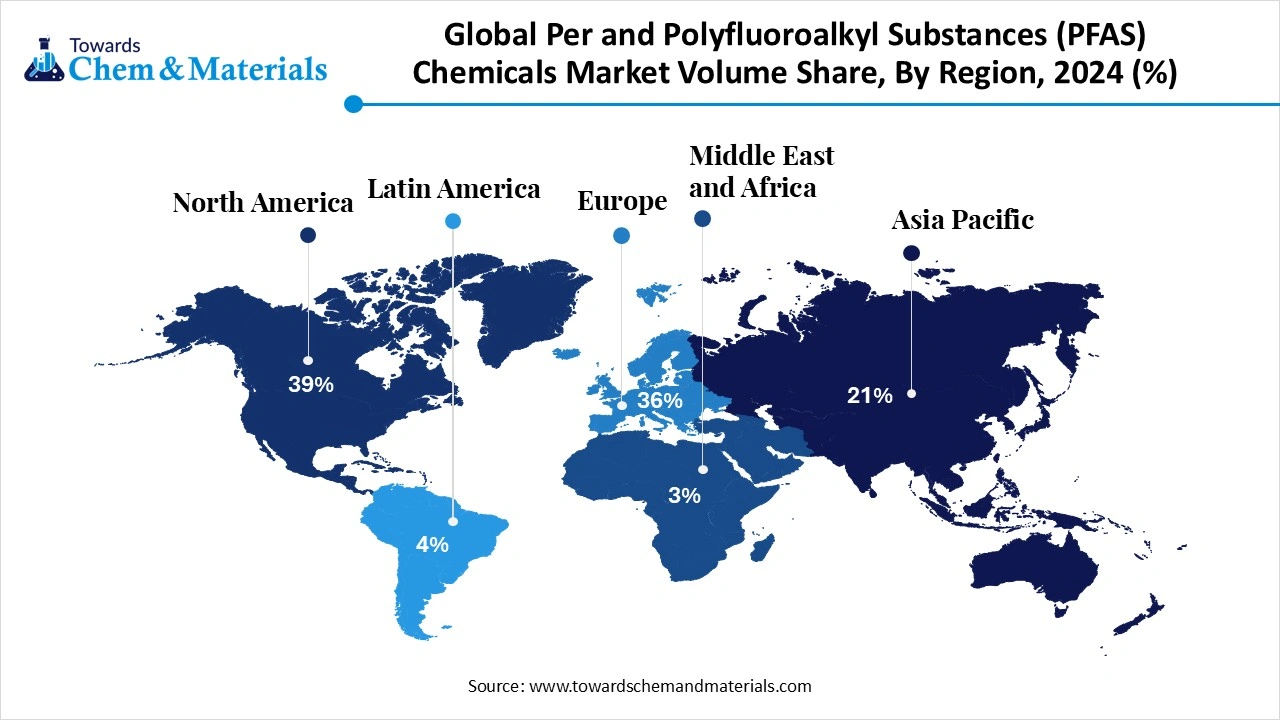

- North America Per and Polyfluoroalkyl Substances (PFAS) Chemicals market dominated the global industry with a Volume Share of 34.1% in 2024.

- Europe is significantly growing area during the forecast period with the rising efforts over PFAS waste management.

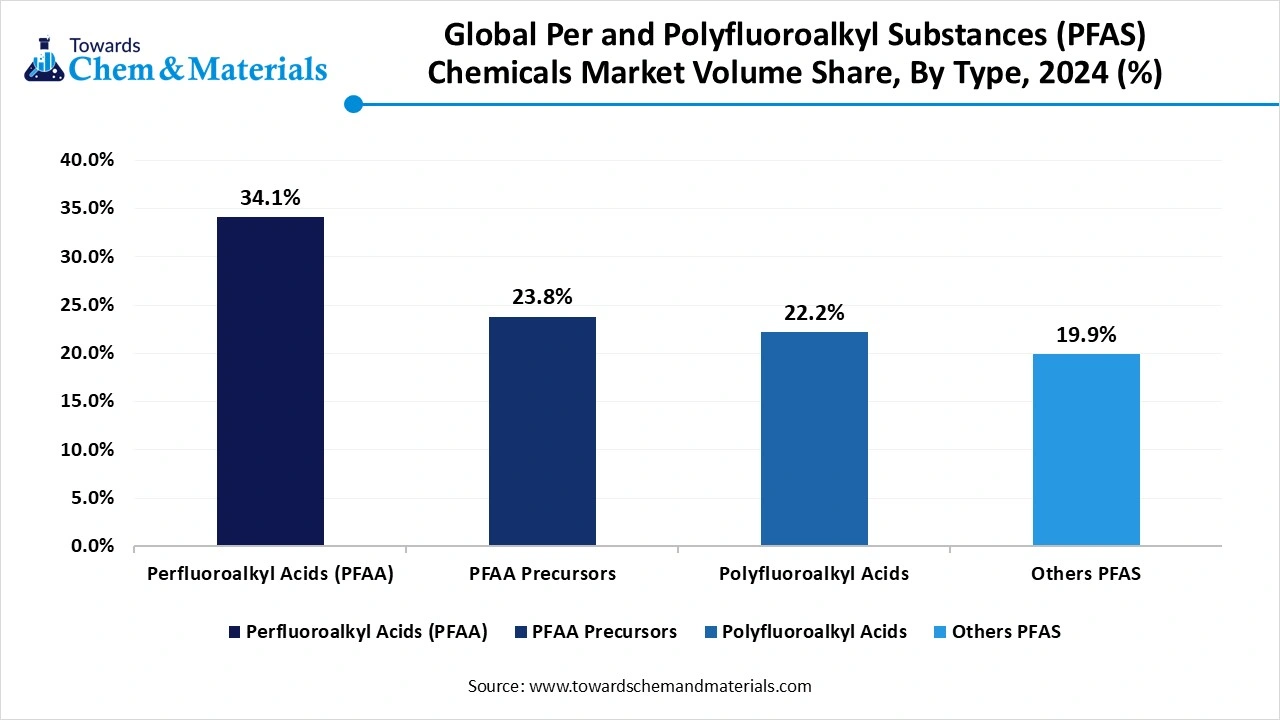

- By type, the perfluoroalkyl acids (PFAA) segment dominated the market in 2024, accounting for the largest Volume Share of 32.63%.

- By type, the PFAA precursors segment is expected to grow at a significant CAGR over the forecast period.

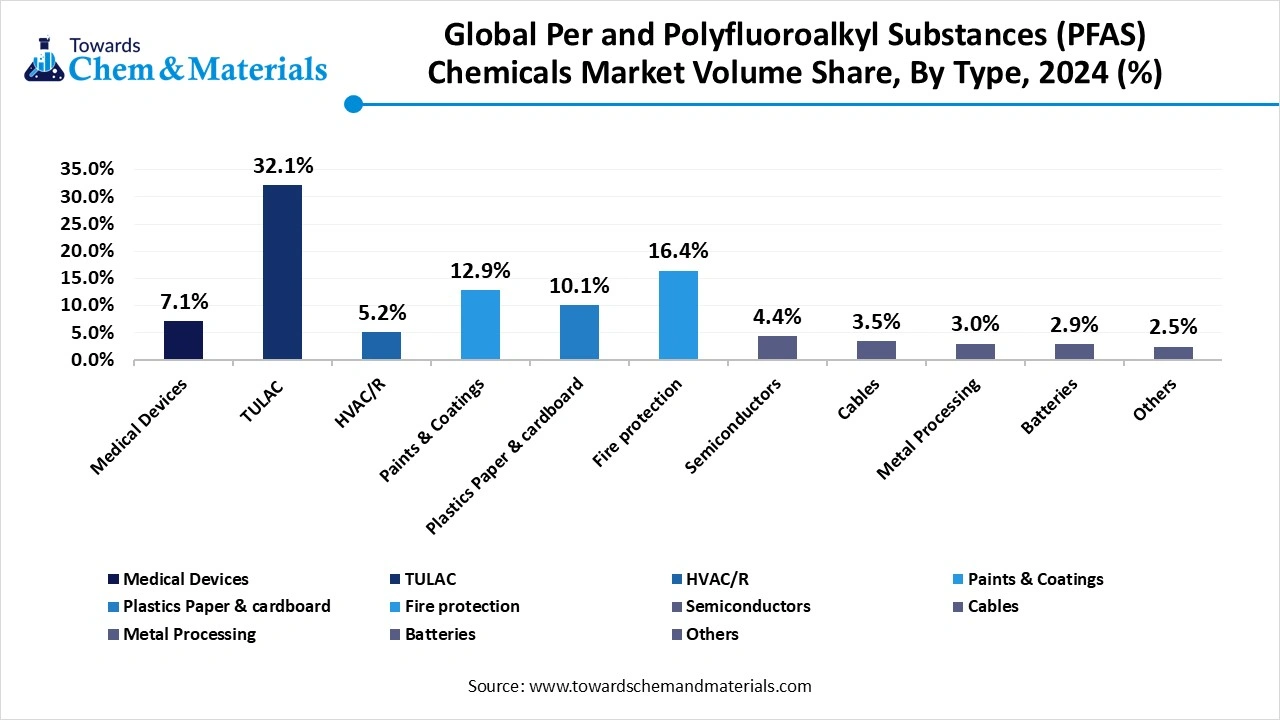

- By application, the TULAC (Textiles, Upholstery, Leather, Apparel, and Carpets) segment dominated the market, with the largest Volume Share of 32.1% in 2024.

- By application, the fire protection segment is projected to grow at the fastest CAGR during the forecast period.

Per- and Polyfluoroalkyl Substances (PFAS) Chemicals Market Overview

The per- and polyfluoroalkyl substances (PFAS) chemicals market revolves around the widespread adoption of PFAS chemical products in various sectors related to aerospace, construction, automotive, and electronics industries. The PFAS chemicals belong to a large group of synthetic chemicals that are largely used in several consumer products. The market is significantly driven by the huge preference for PFAS in everyday products, food packaging, cookware, clothes manufacturing, etc. Moreover, the PFAS became useful in creating firefighting foam that proves to be effective and in making carpets that are resistant to stains.

- According to the National Health and Nutrition Examination Survey (NHANES) and the data provided by the Centres for Disease Control and Prevention (CDC), PFAS was found in the blood of 97% of Americans due to heavy PFAS exposure through PFAS-contaminated water or food. This data showcases the great utilization of PFAS chemicals in every area of the market.

- In September 2024, the American Chemistry Council (ACC) appreciated the Environmental Protection Agency’s (EPA) efforts to collaborate with industries and downstream users of PFAS chemistries to ensure the thorough testing of the Central Data Exchange (CDX) system.

Per- and Polyfluoroalkyl Substances (PFAS) Chemicals Market Trends

- The U.S. Food and Drug Administration (FDA) ensures the authorized use of PFAS chemicals in food products and related applications.

- Artificial intelligence plays an essential role in the automated classification and screening of PFAS. AI can classify the PFAS as miscellaneous or others. AI enables the PFAS screening for persistence, bioaccumulation, and toxicity.

- The U.S. Food and Drug Administration (FDA) makes efforts in R&D, testing, and analysis to better understand the nature of PFAS chemicals, PFAS exposure pathways, and the health effects of these chemicals.

- The research institutes and research organizations provide comprehensive analytical data regarding the safety, efficiency, and impact of chemical compounds for the safe consumption of food and water.

- AI also helps in decision-making to select the next batch of PFAS for testing purposes. AI allows the effective categorization and grouping of PFAS

Per- and Polyfluoroalkyl Substances (PFAS) Chemicals Market Report Scope

| Report Attributes | Details |

| Market volume in 2025 | 832 Thousand Tons |

| Expected volume in 2034 | 1,347.10 Thousand Tons |

| Growth Rate | CAGR of 5.50% from 2025 to 2034 |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025-2034 |

| High Impact Region | North America |

| Segment Covered | By Type, By Application, By Region |

| Key Companies Profiled | BASF SE,BIONA Jersin s.r.o.,3M Company,Bayer AG,AGC Inc.,Daikin Industries Ltd.,Merck KGaA,The Chemours Company,Dongyue Group,Solvay SA |

Per- and Polyfluoroalkyl Substances (PFAS) Chemicals Market Dynamics

Driver

Strategic R&D Goals and Federal Government Decisions

The federal agencies and research teams try to generate information to support the decisions of manufacturers, federal agencies, and consumers related to the products that include PFAS and PFAS alternatives.

These efforts help to reduce the adverse impact of these chemical compounds on human health and the environment. They enable federal data sharing, improved access to data, community engagement, communication, and environmental justice in PFAS R&D.

Restraint

Challenges associated with R&D Initiatives

It becomes challenging for scientists to develop and evaluate technologies for the elimination, destruction, and disposal of PFAS. Researchers and related authorities must provide high-quality and relevant scientific data that will help to understand the PFAS exposure pathways.

Federal decisions are essential in reducing the risks to the environment and humans upon PFAS exposure. The rising need to identify technologies and conduct research to address PFAS contamination raises the efforts to mitigate the adverse impacts on the communities.

Per- and Polyfluoroalkyl Substances (PFAS) Chemicals Market Opportunity

Research and Development Strategies

The Per- and Polyfluoroalkyl Substances (PFAS) Federal Research and Development Strategic Plan introduced by the National Science and Technology Council helps researchers understand PFAS exposure pathways, and address current PFAS measurement challenges.

The R&D plans will contribute to implementing the developed standards, and advanced sampling and analytical methodologies. Researchers are enabled to understand the toxicological mechanisms, risks associated with PFAS exposure, and the health effects of PFAS on humans and the environment. It is possible to identify PFAS alternatives through the evaluation of their health effects on humans and the environment.

Type Insights

By type, the perfluoroalkyl acids (PFAA) segment dominated the per- and polyfluoroalkyl substances (PFAS) chemicals market in 2024. The potential stability of perfluoroalkyl acids (PFAA) in the metabolic and environmental degradation conditions drives their significance in the market. They exhibit strong surfactant properties which make them ideal water and oil repellents and ideal lubricants. The remarkable detection of these compounds in edible plants, wildlife, humans, and environmental media boosts their research significance. These compounds can be exposed to humans through dietary intake, drinking water, food packaging, house dust, and consumer products.

By type, the PFAA precursors segment is expected to witness the fastest rate of growth in the per- and polyfluoroalkyl substances (PFAS) chemicals market during the predicted timeframe. The PFAAs are the stable end products in the environment that are obtained from the degradation of precursors. The PFAA precursors can be potentially treated in sewage sludge to mitigate the adverse impacts of PFAS on humans and environmental health. They exhibit water and oil repellency, and durability, and are resistant to stains. They can be found in textiles, cleaning products, and coatings which raises their expansive reach in the global market.

Application Insights

By application, the TULAC (Textiles, Upholstery, Leather, Apparel, and Carpets) segment dominated the per- and polyfluoroalkyl substances (PFAS) chemicals market in 2024. The upholstery and leather materials showcase superior durability for long-term use along with timeless elegance and versatility. These materials allow easy maintenance and cleaning while offering luxurious comfort over time. The eco-friendly and sustainable choice of these materials raises their adoption among the global population.

By application, the fire protection segment is observed to be the fastest-growing in the per- and polyfluoroalkyl substances (PFAS) chemicals market during the forecast period. The fire protection systems at the workplace and any other settings offer reduced risk of fire and enhanced safety. They protect property and assets while minimizing disruption to business operations. The fire prevention plan assists people through fire safety policies, evacuation procedures, emergency response plans, employee training, maintenance, and inspection.

Per- and Polyfluoroalkyl Substances (PFAS) Chemicals Market Regional Insights

North America dominated the per- and polyfluoroalkyl substances (PFAS) chemicals market in 2024. The Government of Canada introduced the State of Per- and Polyfluoroalkyl Substances (PFAS) Report and presented a Risk Management Approach.

- In August 2024, the National Science and Technology Council introduced the Per- and Polyfluoroalkyl Substances (PFAS) Federal Research and Development Strategic Plan. This strategic plan includes R&D strategies, strategic goals, and cross-cutting themes. The U.S. Food and Drug Administration (FDA) takes regulatory actions on testing and analysis of products related to food, chemicals, drinking water, and the environment.

The National Drinking Water Standards of the United States

The U.S. Environmental Protection Agency (EPA) announced the assistance of $1 billion to the states and territories for implementing PFAS testing and PFAS treatment at public water systems. It has also focused on helping owners of private wells to address PFAS contamination. The efforts made by EPA introduced transparency and accountability to clean up PFAS contamination in communities.

The EPA introduced three methods to test PFAS in the environment including areas of wastewater, surface water, groundwater, soil, etc. The other method provided by EPA can broadly screen for the presence of chemical substances that contain carbon-fluorine bonds, including PFAS, in wastewater. The EPA’s third method can measure 30 volatile fluorinated compounds in air.

Major Initiatives by the U.S. Environmental Protection Agency (EPA):

- In January 2024, the U.S. Environmental Protection Agency (EPA) announced the finalization of a significant new use rule (SNUR) to strengthen the regulation of PFAS.

- In April 2024, the U.S. Environmental Protection Agency (EPA) introduced the first-ever national, legally enforceable drinking water standard to offer exclusive protection to communities from exposure to harmful PFAS. The final rule aimed to reduce PFAS exposure for approximately 100 million people. It has the goal to prevent thousands of deaths and reduce tens of thousands of serious illnesses.

- In July 2024, the U.S. Environmental Protection Agency (EPA) granted a petition from the Center for Environmental Health, Alaska Community Action on Toxics, Clean Water Action, Public Employees for Environmental Responsibility, Clean Cape Fear, and Delaware Riverkeeper and Merrimack Citizens for clean water to address PFAS formed during the fluorination of plastic containers – PFOA, PFNA, and PFDA.

- In September 2024, the U.S. Environmental Protection Agency (EPA) requested public comment on the manufacturing of PFAS including PFOA, perfluorodecanoic acid (PFDA), perfluorononanoic acid (PFNA) during the fluorination of plastic containers and high-density polyethylene (HDPE) to inform regulation under the Toxics Substances Control Act (TSCA).

Europe is a significantly growing area in the per- and polyfluoroalkyl substances (PFAS) chemicals market during the forecast period. In March 2025, the European Chemical Agency (ECA) conducted a meeting of The Committees for Risk Assessment (RAC) and Socio-Economic Analysis (SEAC). These committees also announced the upcoming evaluation of the sectors related to medical devices, lubricants, transport, energy, electronics, and semiconductors.

The European Commission (EU) adopted a strategy for sustainability towards a toxic-free environment. The European Commission believes in the sustainable use and importance of chemicals for the overall well-being, comfort of modern society, and high living standards. The EU accepts the use of chemicals in various sectors including health, energy, housing, and mobility.

The EU proposed that global chemical production will double by 2030. The chemicals strategy for sustainability was proposed by the EU which is a part of the EU’s zero pollution ambition and essential commitment of the European Green Deal.

| By Region | Market Volume Shares (%) | Volume (Thousand Tons)(2024) |

| North America | 39% | 302.9 |

| Europe | 36% | 278.4 |

| Asia Pacific | 21% | 159.1 |

| Latin America | 4% | 25.2 |

| Middle East & Africa | 3% | 23.1 |

The Systematic Regulation of PFAS Chemicals in France

- In February 2025, France was confirmed as the second European country after Denmark to systematically regulate per- and polyfluoroalkyl substances (PFAS) through the French Parliament officially passed Bill No. 2025-188.

There will be a prohibition on PFAS containing cosmetics and ski wax products and their related sales that will be effective from January 2026. France has taken some effective provisions and measures related to product-specific bans, enhanced drinking water monitoring, and corporate emission regulations. The Global PFAS Screening Tool was launched to help businesses in building global compliance defense.

- In February 2025, France announced the adoption of a bill proposed by Green MP Nicolas Thierry to ban PFAS.

Asia Pacific is seen to grow at a notable rate in the per- and polyfluoroalkyl substances (PFAS) chemicals market in the foreseeable future. In March 2025, the Asia Pacific adopted the chemical management frameworks, globally harmonized system (GHS) through achieving control of per- and polyfluoroalkyl substances (PFAS). This region also adopted stringent regulatory models for the evaluation, authorization, and restriction of chemical systems.

Asia Pacific focuses on improving the chemical safety and protecting human health and the environment. The region is leading in the chemical production in the entire world. The countries in the APAC region are shifting towards enhancing chemical safety. These initiatives led the region in the international regulatory landscape.

Key Provisions and Measures of Singapore

Singapore has planned to phase out the import and utilization of fire-fighting foams that contain perfluorooctanoic acid (PFOA) and perfluorooctanesulfonic acid (PFOS), along with their salts and related compounds that will be effective from January 2026. Singapore stands out as an essential part of the Stockholm Convention that makes efforts to remove Persistent Organic Pollutants (POPs) such as PFAS.

- In March 2024, Singapore announced its plans to phase out the use of firefighting foams containing per- and polyfluoroalkyl substances (PFAS) listed under the Stockholm Convention.

Key Players in the Per- and Polyfluoroalkyl Substances (PFAS) Chemicals Market

- BASF SE

- BIONA Jersin s.r.o.

- 3M Company

- Bayer AG

- AGC Inc.

- Daikin Industries Ltd.

- Merck KGaA

- The Chemours Company

- Dongyue Group

- Solvay SA

Per- and Polyfluoroalkyl Substances (PFAS) Chemicals Market Latest Announcements by Leaders

Lummus Technology:

- In July 2024, Leon de Bruyn, President and Chief Executive Officer of Lummus Technology reported about the global challenge related to the destruction and elimination of PFAS from water and announced that the global partnership between Lummus Technology and the Element Six (E6) will embrace it and will make efforts to address it. He said that the various technologies will present scalable, viable, and efficient methods to destroy these chemicals, protect the environment, and safeguard public health for future generations.

Element Six

- In July 2024, Siobhán Duffy, CEO of Element Six (E6) reported that the global partnership between the Lummus Technology and the Element Six (E6) will deliver the pioneering technologies to benefit the various aspects of daily lives. It will focus on safeguarding public health and improving the environment by addressing the global issue of PFAS to ensure the establishment of a better future for everyone. Lummus Technology stands as a global provider of process technologies and value-driven energy solutions while Element Six (E6) stands strong as a pioneer in the development and manufacturing of chemical vapor deposition (CVD) diamond solutions.

BASF Corporation:

- Business Activity: In May 2024, BASF Corporation, the North American affiliate of BASF SE, announced its settlement with the U.S. Public Water Systems that have contributed to the detection of PFAS in their drinking water sources. BASF Corporation signed an agreement to provide $316.5 million along with $312.5 million to resolve the PFAS claims on or about July 2024 and $4 million for settlement administration costs in March 2025.

Baron & Budd

- In May 2024, Baron & Budd announced that it had signed a settlement agreement of $312.5 million with BASF Corporation to resolve PFAS-related drinking water contamination claims. This settlement is a part of the nationwide Aqueous Film-Forming Foam (AF) Products Liability Litigation that will offer critical funding to public water systems throughout the country that have detected PFAS in their water supplies.

Segments Covered in the Report

By Type

- Perfluoroalkyl Acids (PFAA)

- Perfluoroalkyl carboxylic acids (PFCAs)

- Perfluoroalkyl sulfonic acids (PFSAs)

- PFAA Precursors

- Polyfluoroalkyl Acids

- Other PFAS (fluorotelomer alcohols (FTOH), polyfluoroalkyl phosphate esters (PAPs) etc.)

By Application

- Medical Devices

- TULAC (Textiles, Upholstery, Leather, Apparel, and Carpets)

- HVAC/R

- Paints & Coatings

- Plastics Paper & cardboard

- Fire protection

- Semiconductors

- Cables

- Metal Processing

- Batteries

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Asia Pacific

- China

- Singapore

- Japan

- India

- South Korea

- Thailand

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait

- Report Covered: [Revenue + Volume]

- Historical Year: 2021-2023

- Base Year: 2024

- Estimated Years: 2025-2034