Content

What is the Current Paint Protection Film Market Size and Share?

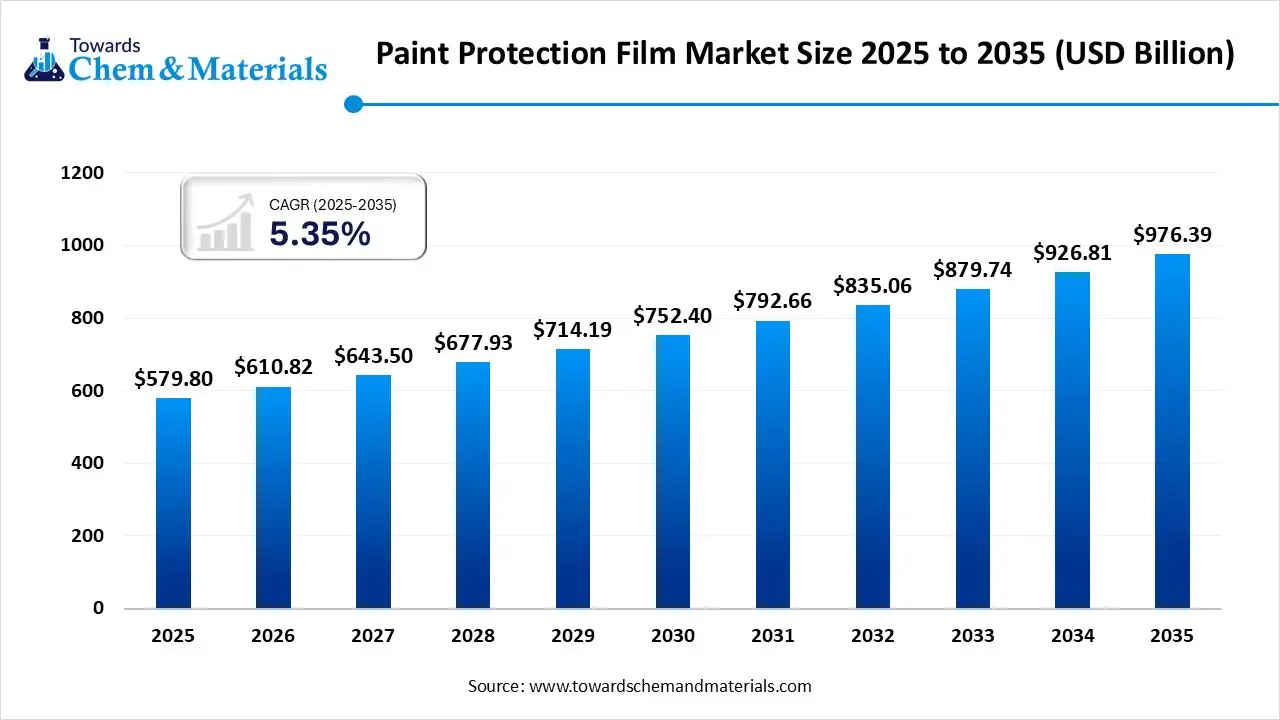

The global paint protection film market size was approximately USD 579.8 million in 2025 and is projected to Reach approximately USD 976.39 million by 2035 growing at a CAGR of 5.35% from 2026 to 2035. Asia Pacific dominated the paint protection film market with the largest volume share of 36.25% in 2025.The rising demand for paint protection film has increased with the awareness among consumer for the protection and maintenance of their automobile, and protection solutions across various industries are fuelling the market growth.

Paint Protection Film Market Key Takeaways

- The Asia Pacific dominated the paint protection film market share of 36.25% in 2025. The rise is seen because of rising luxury car sales in China, India, and Japan.

- By material, the thermoplastic polyurethane segment dominated the market share of 84.67% in 2025. The growth is seen due to its superior durability, self-healing, and flexible properties.

- By material, the polyvinyl chloride segment is anticipated to grow significantly in the market during the forecasted period. The demand increases due to the low cost of production.

- By formulation, the water-based segment dominated the paint protection film market in 2025. The increasing demand for eco-friendly alternatives drives the growth of the segment significantly.

- By end use, the automotive and transportation segment dominated the paint protection film market share of 74.19% in 2025.The growing awareness about paint protection in luxury, sports, and electric vehicles drives the growth of the market.

- By end use, the aerospace & defense industry is expected to grow at a CAGR of 5.16% during the forecast period. Extensively used to prevent the aircraft from UV exposure and harsh weather conditions.

Paint Protection Film Market Overview

The paint protection film is a thermoplastic urethane, a healing film that is applied to the paint surfaces of a car to protect the paint from abrasions. The film is also used by other industries, like electronics, motorcycles, airplanes, defence, etc. The manufacturing process of paint protection film is a complex and precise operation that involves mindful selection of raw materials, meticulous production techniques, and rigorous quality control measures. Ensuring protection of the automobile requires durability, flexibility, and optical clarity, and requires careful selection of raw materials like high-quality polyurethane or polyethylene film.

The increasing demand for luxury cars, sports cars, and premium SUVs is a major driver of the market, as it provides the vehicle with high-end protection and protects it from damage. EV manufacturers are emphasizing durability, which boosts the demand for paint protection film, which helps drive the market. Growing consumer awareness for maintaining the exterior condition and enhancing resale value, and maintaining a scratch-free and glossy appearance, these factors drive the growth of the paint protection film market. New and innovative paint protection films offer better longevity and protection against yellowing, cracks, and environmental damage. Electronics and consumer goods, used to protect smartphones, watches, and screens from scratches and wear. Construction and architecture, applied to glass surfaces, elevators, and home interiors, to protect them from any damage which further contributes in the growth of the market.

Paint Protection Film Market Trends

- Increasing demand for self-healing and advanced paint protection film can repair minor scratches and marks when exposed to heat from sunlight. This is a major growth factor that increases the demand.

- The hydrophobic and stain-resistant coatings offer consumers water and dirt repellence, which again reduces the maintenance cost, and growing consumer interest in non-glossy finish films helps grow the market.

- The shift towards eco-friendly and sustainable films like PVC free and recyclable materials, low-VOC adhesives, which are safe and less toxic, and have biodegradable films, is a major growth factor for the paint protection film market.

- Technological innovation in film material, like nano-ceramic infused films by combining ceramic with paint protection film, will help in the protection of the equipment against UV rays, chemicals, and contaminants; similarly, multi-layered film will help in protection against harsh and rough conditions.

Paint Protection Film Market Report Scope

| Report Attributes | Details |

| Market Size in 2026 | USD 610.82 Million |

| Expected size in 2035 | USD 976.39 Million |

| Growth Rate | CAGR of 5.35% |

| Base Year of estimation | 2025 |

| Forecast Period | 2025-2035 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Material,Fomation,End Use,Region |

| Key Companies Profiled | 3M,XPEL Inc.,Schweitzer-Mauduit International, Inc.,Eastman Chemical Company,Avery Dennison Corporation,Saint-Gobain S.A.,RENOLIT SE,Ziebart International Corporation,Hexis S.A.S,Garware Hi-Tech Films Ltd., |

Paint Protection Film Market Opportunity

The Sustainability and Eco-Friendly Innovations in Paint Protection Film

The rising concerns over the environment, consumers demand eco-friendly and sustainable products. Manufacturers are focusing on sustainable and eco-friendly films to meet consumer demand and the regulatory requirements. Traditional films were made of PVC-based films that contain harsh chemicals, which release volatile organic compounds, which contributed to environmental pollution, and to overcome these, the new and alternative films are being launched in the market by developing PVC-free and biodegradable films using thermoplastic polyurethane, which are more durable, non-toxic, and recyclable.

Water-based adhesives are used for bonding of the films as it is less toxic, and biodegradable as compared to solvent-based adhesives and have stronger bonding ability as well and ensuring easy removal of the film without damaging the vehicle or other equipment. Market demand is increasing for nano ceramic infused films, which enhance the UV resistance and durability without using chemical coating. Using sustainable nanotechnology in filmmaking reduces the need for frequent replacement and minimizes the waste, which creates a great impact on the environment. Advancements in biobased films derived from plant sources are in development, which further reduces the environmental impact.

Paint Protection Film Market Challenge

Durability and Maintenance Issues

The durability and maintenance issues affect the long-term performance of the paint protection. The paint protection film develops yellowing and discoloration when it is exposed to harsh UV rays. Even if the manufacturers have improved UV-resistance coatings, due to low quality and less durability, the films degrade faster. Maintenance challenge also involves stain building from contaminants, using harsh chemicals and abrasive tools can damage the film, shortens the lifespan of the film, these factors hinder the growth of the paint protection film market.

Value Chain Analysis

Research & Development (R&D)

- This focuses on advancing material science to improve self-healing capabilities, hydrophobic properties, UV resistance to prevent yellowing, and increasing the tensile strength of the films.

- Key Players: 3M Company, XPEL Inc., Eastman Chemical Company, Avery Dennison, BASF SE, Covestro AG, and Saint-Gobain Performance Plastics.

Raw Material Sourcing and Intermediate Manufacturing

- This involves production of PPF requires specialized, high-grade polymers. The most dominant material is Thermoplastic Polyurethane.

- Key Players: BASF SE, Covestro AG, Dow, and Argotec.

Manufacturing and Coating

- This is the core, high-value manufacturing step where raw materials are transformed into the final, multi-layered film.

- Key Players: 3M Company, XPEL, Eastman Chemical Company, Garware Hi-Tech Films, Hexis S.A.S., ORAFOL Europe GmbH, Reflek Technologies, and Sangbo Corp.

Distribution, Logistics, and Pattern Creation

- This involves finished, wide-format rolls are shipped to distributors or directly to installers for vehicle-specific, pre-cut kits.

- Key Players: XPEL, 3M, and Eastman.

Application, Installation, and Commercialization

- This involves critical, labor-intensive stage where the film is applied by certified professionals at high-end detailing shops or OEM dealerships.

- Key Players: Elite installers and Ziebart International Corporation.

Paint Protection Film Market Segmental Insights

By Material

The thermoplastic polyurethane segment dominated the paint protection film market in 2025. The thermoplastic polyurethane is the most widely used material in pain protection film, due to its flexibility, durability, and self-healing properties. The thermoplastic polyurethane also provides high impact resistance, which protects the vehicle surfaces from any type of scratches and damage. The traditional PVC-based films used to turn yellow over a while but the advancement in the production techniques ensures long-lasting clarity to the film.

Self-healing capability of the film plays a key role in the market growth as more consumers are attracted and increase the demand for the film as it is a low-maintenance film and offers excellent UV and chemical resistance, preventing discoloration and degradation due to weather conditions. Extensively used in the automobile, electronics, aerospace, and many other sectors, these varied application helps in the growth of the market.

Paint Protection Film Market Share, By Material, 2025 (%)

| By Material | Revenue Share 2025 (%) |

| Thermoplastic Polyurethane (TPU) | 84.67% |

| Polyvinyl chloride (PVC) | 10.23% |

| Others | 5.79% |

The polyvinyl chloride segment expects the significant growth in the paint protection film market during the forecast period. PVC is a cost-effective material used in paint protection, but it is less durable. It protects against minor scratches, dust, and light environmental damage. PVC-based films are popular among the budget-conscious market and are used for temporary protection purposes. It is extensively used for short-term automotive protection, industrial equipment, and architectural applications. These applications drive market expansion in the forecasted period and help the market grow.

By Formulation

The water-based segment dominated the paint protection film market in 2025, This is an eco-friendly alternative to the traditional solvent-based films, offering low VOC emissions, improved safety, and high-performance protection to consumers, which has increased the production of the water-based film due to increasing demand from consumers for eco-friendly options amid rising environmental concerns and impact. As the environmental regulation tightens and demand for sustainable automotive solutions rises, the shift in consumers as well as manufacturers is seen towards water-based oil protection film formulation to reduce the environmental footprint, which attracts more consumers towards the market, which drives the market growth.

The solvent-based segment expects a notable growth in the paint protection film market during the forecast period. Solvent-based formulation of paint protection film has been widely used in automotive, aerospace, and industrial applications due to strong adhesion, durability, and chemical resistance offered by the film, which provides excellent bonding. Solvent-based adhesive creates a strong bond with the surface, ensuring long-term protection against scratches and environmental damage. These films also help protect the vehicle from harsh weather and chemicals, and UV exposure, reducing yellowing and degradation. These applications attract the consumers and help the market expansion in the forecasted period.

By End-Use

The automotive and transportation segment dominated the paint protection film market in 2025. The increasing consumer awareness about the protection of vehicles, rising luxury car sales, and growing demand for long-term protection drive the adoption of the paint protection film in the industry, which drives the film market significantly.

Paint Protection Film Market Share, By End-use, 2025 (%)

| By End Use | Revenue Share 2025 (%) |

| Automotive & Transportation | 74.19% |

| Electrical & Electronics | 6.70% |

| Aerospace & Defense | 14.14% |

| Others | 5.55% |

The aerospace and defence care segment expects a significant growth in the paint protection film market during the forecast period. The aerospace and defence sector are a growing market for paint protection film due to the increasing need for durability, weather resistance, and reduced maintenance costs of the protection film. Aircraft and defence vehicle faces extreme weather and environmental conditions like extreme temperatures and UV exposure, which makes the protection films essential for long-term surface protection of the vehicles. These wide and important applications drive the market growth significantly.

Paint Protection Film Market Regional Insights

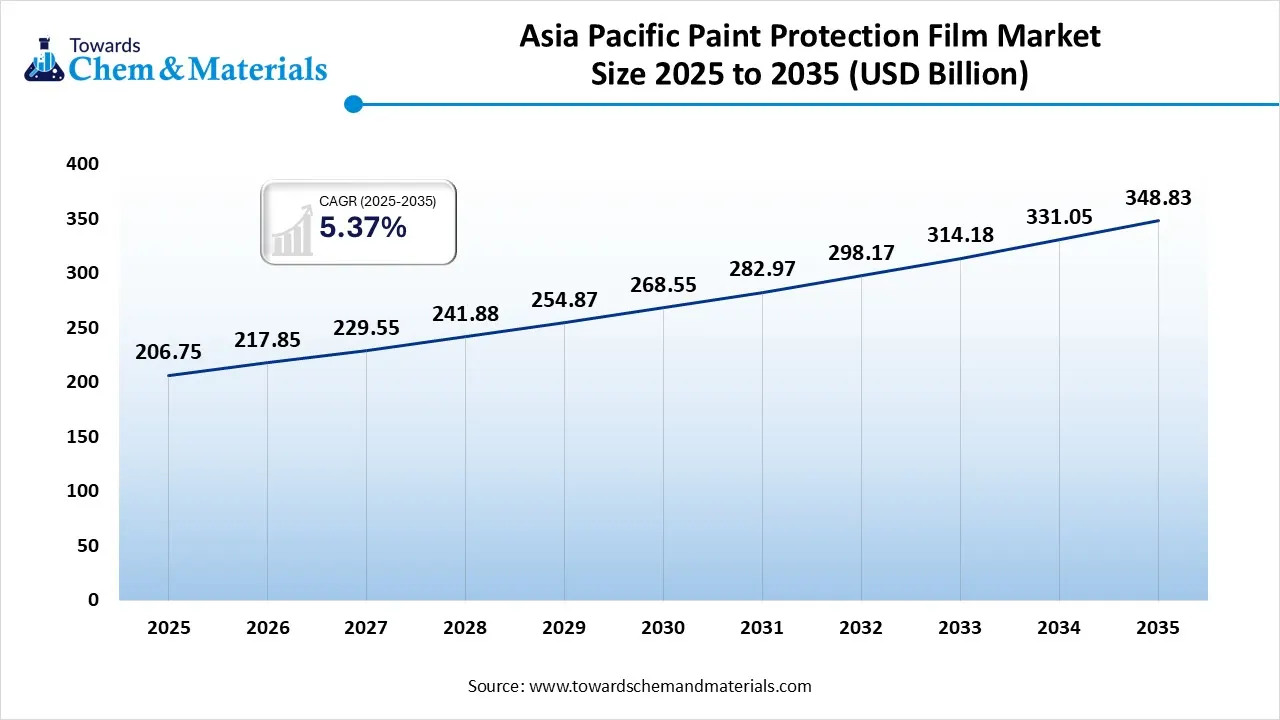

The Asia Pacific paint protection film market size was valued at USD 206.75 million in 2025 and is expected to be worth around USD 348.83 million by 2035, exhibiting at a compound annual growth rate (CAGR) of 5.37% over the forecast period from 2026 to 2035. Asia Pacific dominated the paint protection film market in 2025. The region accounts for the largest share due to rapid urbanization, rising disposable income, and the increasing vehicle sales in the region drive the growth of the market.

The increasing automotive industry, expansion of the aerospace sector, and growing awareness of vehicle protection are the major drivers of the market in the region. Stringent environmental regulations in the region are encouraging consumers to adopt eco-friendly, water-based, and TPU-based PPF over solvent-based alternatives. OEM partnership with luxury car brands offers consumers factory factory-installed option in the region, these innovative factors raise the demand and help in the paint protection film market growth.

Paint Protection Film Market Share, By Region, 2025 (%)

| By Region | Revenue Share 2025 (%) |

| Asia Pacific | 36.25% |

| North America | 24.57% |

| Europe | 20.86% |

| Latin America | 10.12% |

| Middle East and Africa | 8.2% |

China holds the largest film market due to the large number of luxury car brands in the region and a strong ownership and manufacturing base for automotive films, and strong demand for high-performance PPF in vehicles. The sports vehicle market, along with innovation in self-healing and nano-ceramic films in Japan and Korea, drives the growth of the market. India's rapid middle-class consumer base is increasing the adoption of automotive PPF in metro cities, which is a driving factor for the growth of the paint protection film market in the region.

North America is anticipated to have significant growth in the paint protection film market in the forecasted period. North America is the most advanced market in the paint protection film, because of high vehicle ownership, increasing demand for EVs, and due to increasing consumer awareness of vehicle protection. Strong adoption of TPU-based film, self-healing, and eco-friendly film drives the market growth. The strong aftermarket and DIY PPF adoption in the region, like DIY precut PPF kits, is gaining the attention of consumers as it allows consumers to install film at home, a region being most developed with PPF being the most popular upgrade for both new and old vehicles. Strict environmental regulations in the region are shifting consumers towards water-based and low-VOC paint protection film solutions.

Along with the innovation in self-healing, ceramic-infused and hydrophobic paint protection films are gaining popularity. This focus on sustainable and high-performance materials is gaining the interest of consumers, which increases the demand and helps in the growth and expansion of the paint protection film market in the forecasted period.

The United States and Canada hold the largest PPF market due to strong demand from the automotive industry, and aerospace industry, and from luxury car owners. Increasing adoption due to harsh winter conditions, which causes damage and scratches, increases the demand and helps in growth. The US Aerospace and defence industry is a major consumer of paint protection film for aircraft, drones, and military vehicles to protect them from erosion and UV damage. The use of films in commercial aviation is increasing as they are applying them to aircraft exteriors for long-lasting paint protection. These application drives the market and help in the growth throughout the market.

Paint Protection Film Market Recent Developments

XPEL, Inc.

- Collaboration: In November 2024, XPEL, a leading player in protective films and coatings, expanded their collaboration with RIVIAN; through this collaboration, consumers in the US and Canada will get a chance to order XPEL exterior paint protection, window film, and ceramic coating of their choice directly from the source, which will provide consumers with set pricing and ease of installation.

AG Auto

- Announcement: In February 2024, AG Auto, a division of Al Ghurair Investment, one of the leading diversified and prominent UAE family businesses, announced a new partnership with SunTek, a well-known American brand specialized in automotive accessories. Through this collaboration, AG Auto has become the official distributor of SunTek’s paint protection film and window film products in the UAE.

Paint Protection Film Market Top Companies List

- 3M

- XPEL Inc.

- Schweitzer-Mauduit International, Inc.

- Eastman Chemical Company

- Avery Dennison Corporation

- Saint-Gobain S.A.

- RENOLIT SE

- Ziebart International Corporation

- Hexis S.A.S

- Garware Hi-Tech Films Ltd.

Segments Covered in the Report

By Materials

- Thermoplastic Polyurethane

- Polyvinyl Chloride

- Others

By Formulation

- Water-based

- Solvent-based

By End-Use

- Automotive and Transportation

- Electrical and Electronics

- Aerospace and Defence

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- Latin America