Content

Biodegradable Stretch Film Market Size and Share 2034

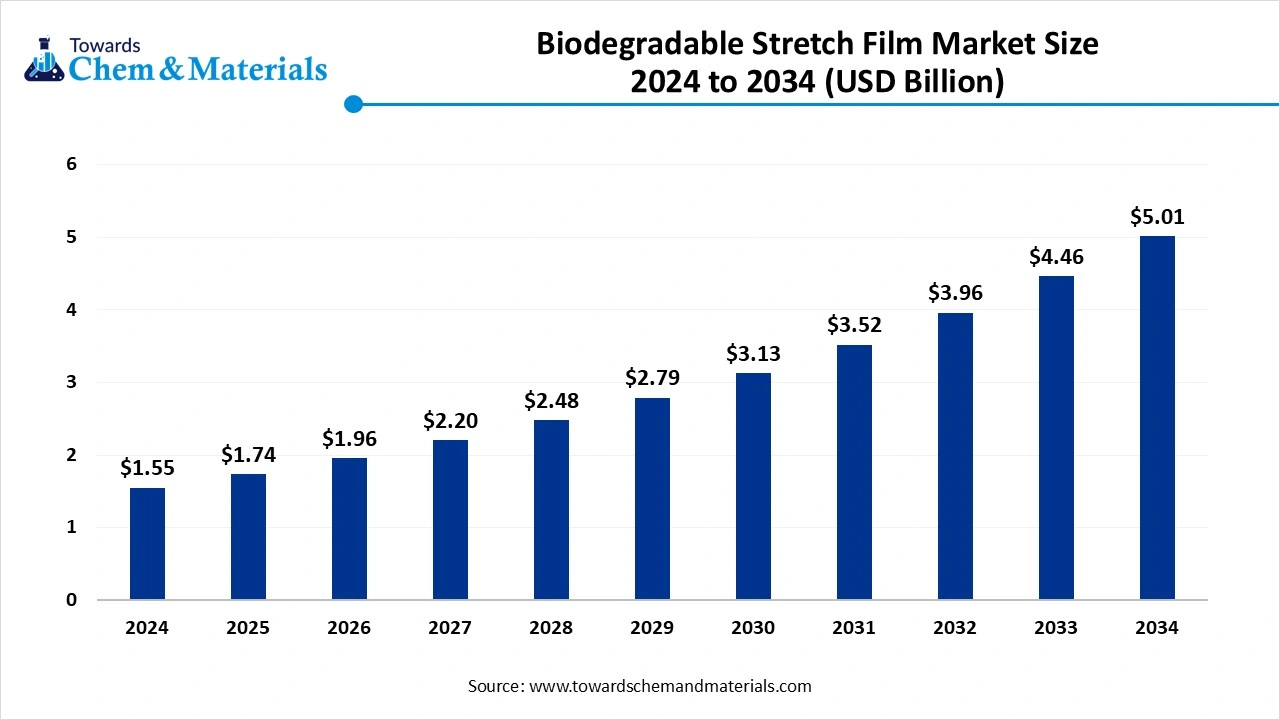

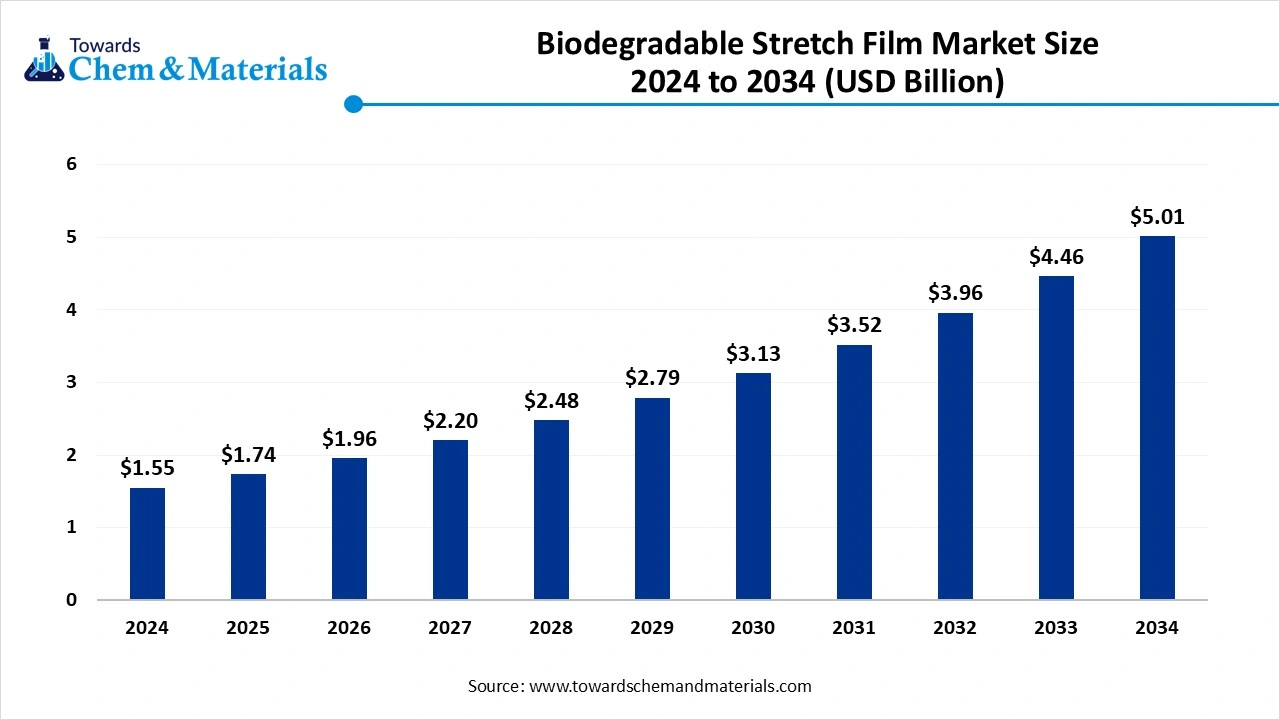

The global biodegradable stretch film market size accounted for USD 1.74 billion in 2025 and is forecasted to hit around USD 5.01 billion by 2034, representing a CAGR of 12.45% from 2025 to 2034. The ongoing expansion and implementation of sustainability standards have accelerated the market potential in recent years.

Key Takeaways

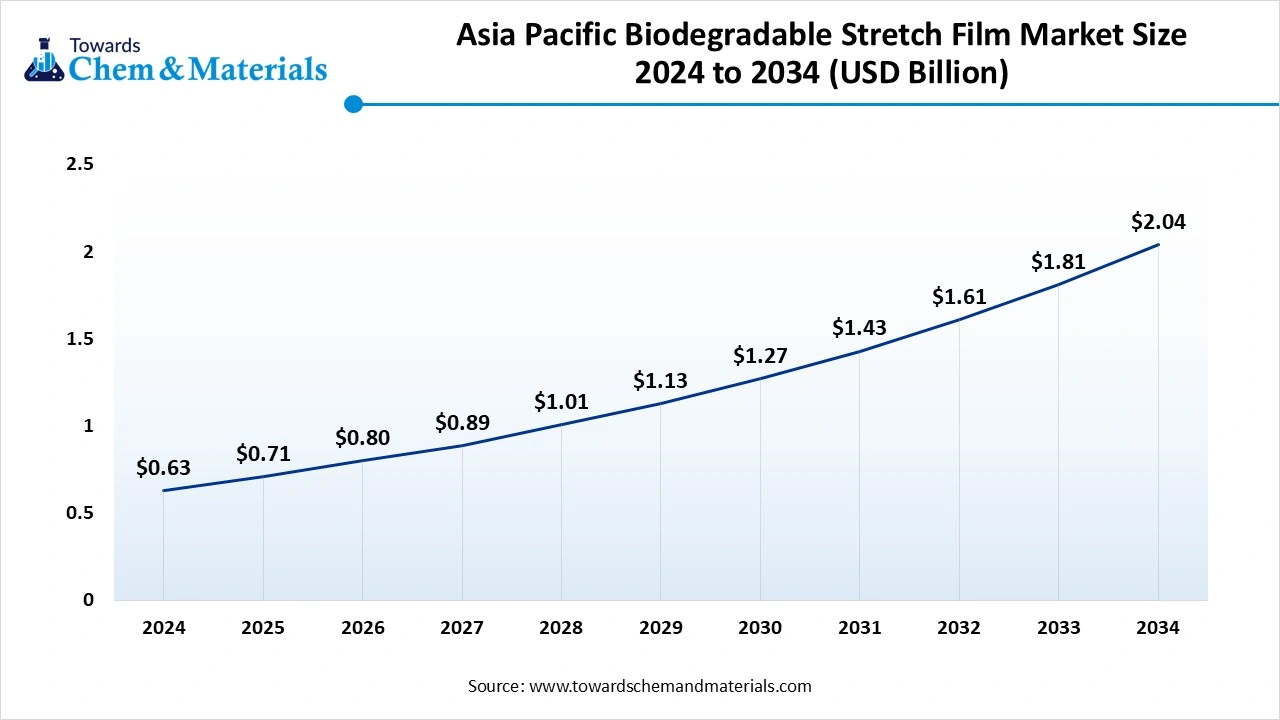

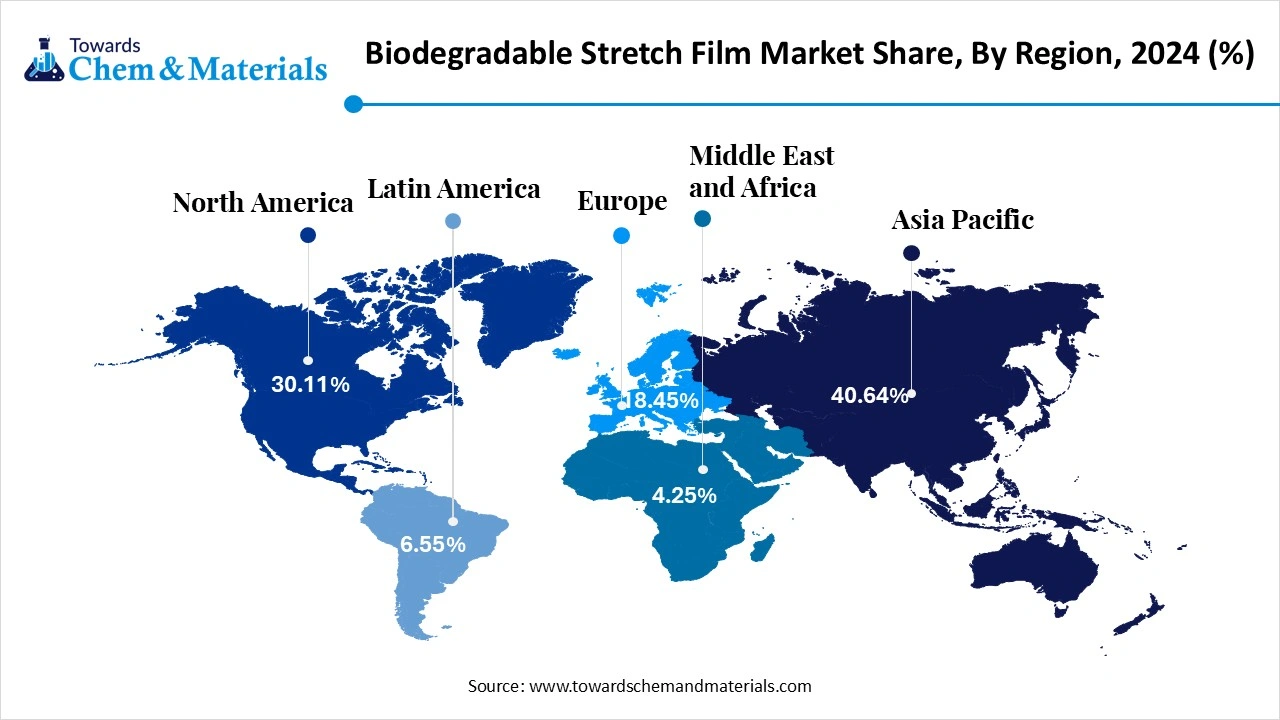

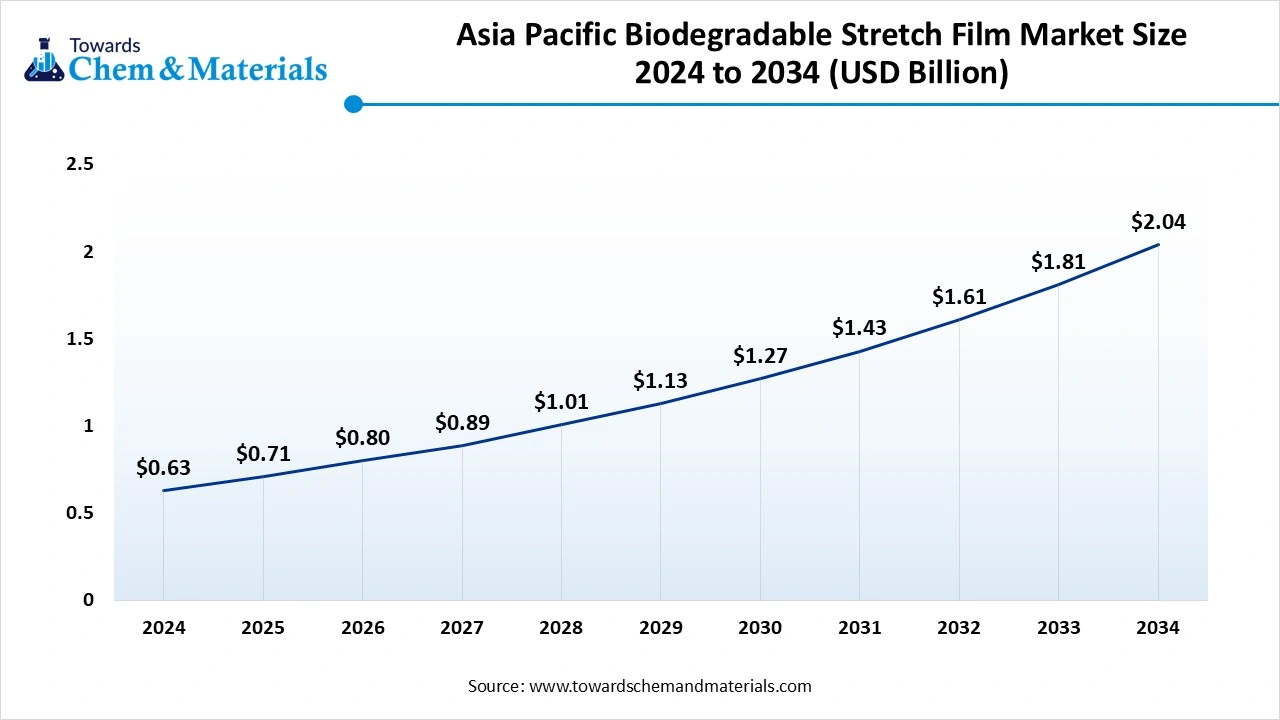

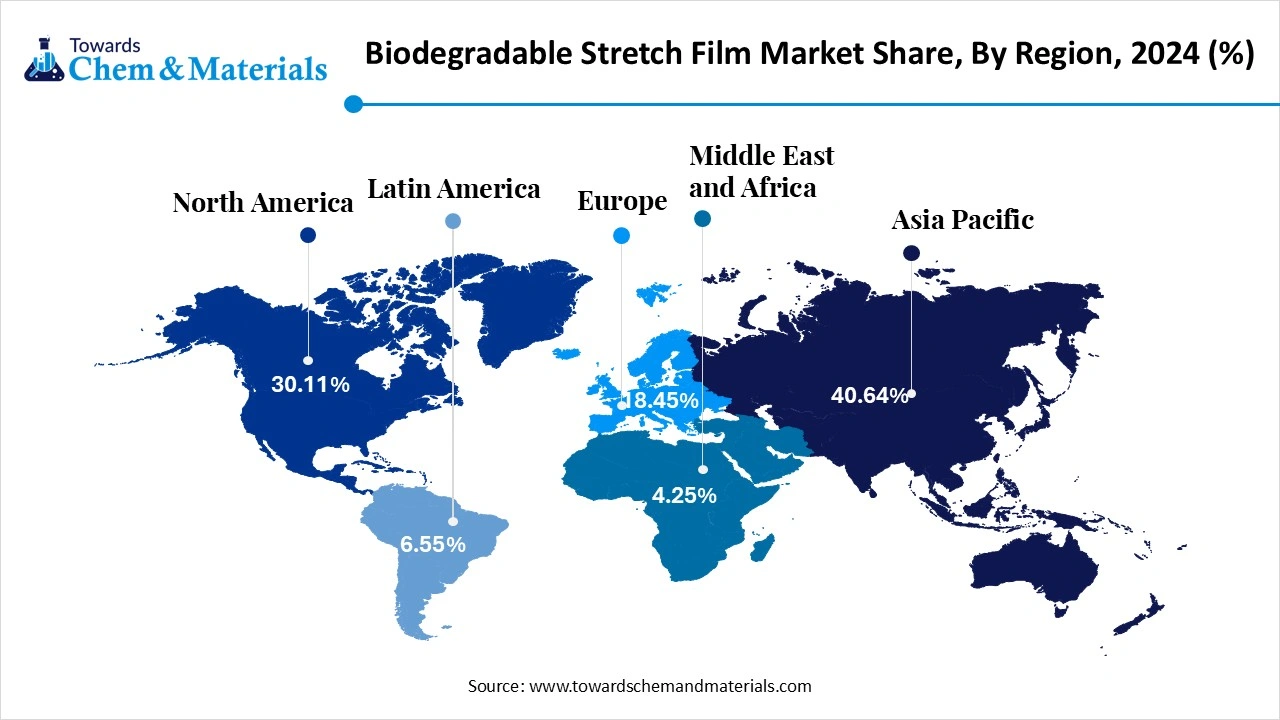

- Asia Pacific biodegradable stretch film market dominated the global market and accounted for the largest revenue share of 40.64% in 2024 and is expected to grow at a rapid CAGR of 13.11% over the forecast period.

- North America biodegradable stretch film market is expected to grow significantly through the forecast period

- By material type, the PHA (Polyhydroxyalkanoates) segment dominated the market accounting for a share of 44.55% in 2024.

- By material type, the starch-based biodegradable is expected to grow at the fastest CAGR of 12.25% through the forecast period.

- By transparency, the Opaque films segment held the largest share of 54.23% in 2024 of the biodegradable stretch film market.

- By transparency, the starch-based biodegradable is expected to grow at a substantial CAGR of 11.89% through the forecast period.

- By thickness type, the Thin films (up to 20 microns) segment dominated the biodegradable stretch film market across the thickness segmentation in terms of revenue, accounting for a market share of 49.11% in 2024.

- By thickness type, the starch-based biodegradable is expected to grow at a significant CAGR of 11.95% through the forecast period.

- By application, the Manual segment led the biodegradable stretch film market across the application method segmentation in terms of revenue, accounting for a market share of 59.48% in 2024.

- By application, the machine segment is expected to grow significantly at a CAGR of 13.11% through the forecast period.

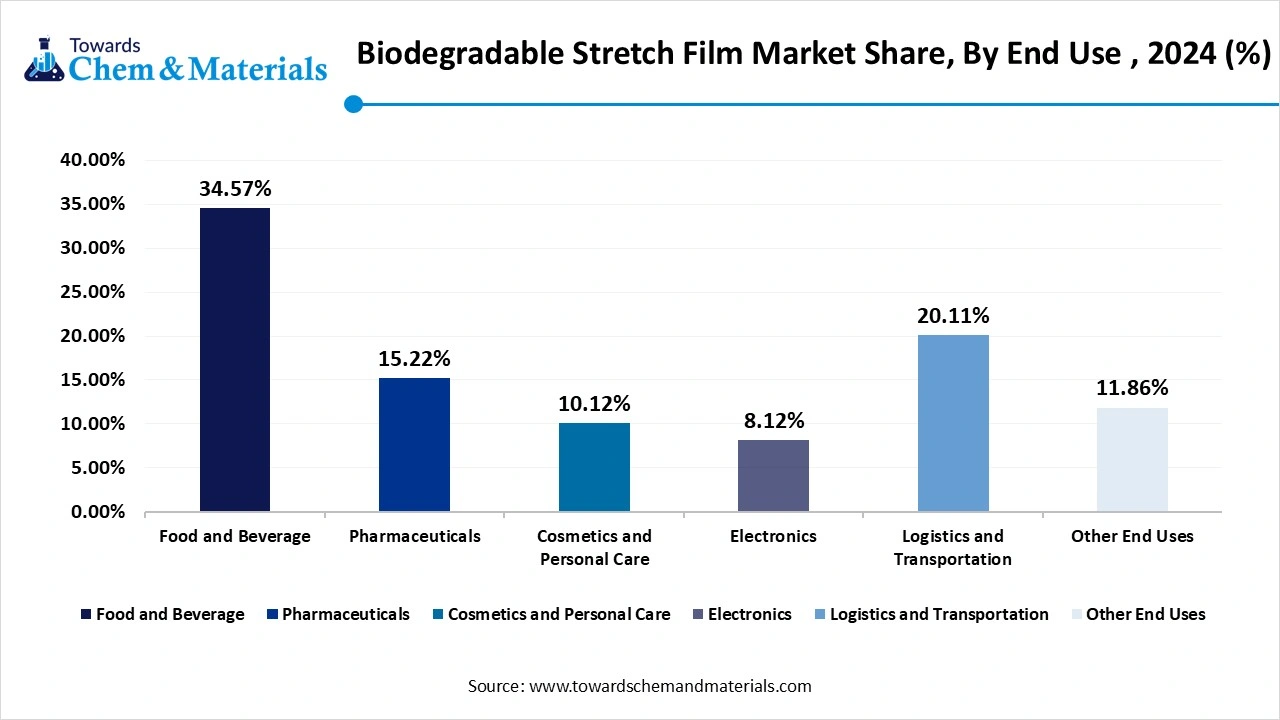

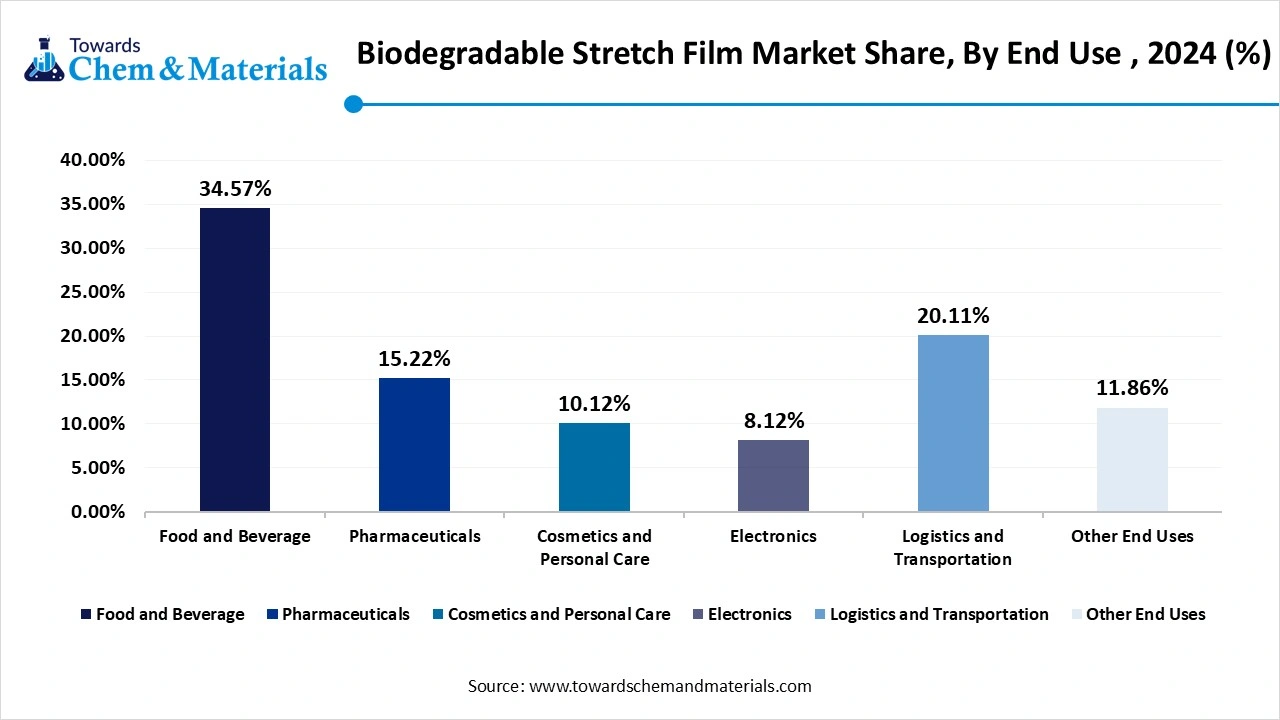

- By end use, the Food and beverage dominated the biodegradable stretch film market across the end use segmentation in terms of revenue, accounting for a market share of 34.57% in 2024.

- By end use, the pharmaceuticals segment is projected to witness a substantial CAGR of 14.85% through the forecast period.

Market Overview

Industry Shifts to Green Alternatives Boost Market Expansion

The biodegradable stretch film market is expected to see steady growth owing to the heavy adoption of eco-friendly packaging initiatives by people and major industries in the current period. As the belonging industries like logistics, food, and retail are seen in seeking eco-friendly stretch film alternatives for their packaging work in recent years. Also, with the implementation of eco-friendly material use and banning single-use plastics from global governments, the manufacturers of biodegradable stretch films have gained substantial industry advantages in recent years. Also, the major brands have been actively engaged in the promotion of their eco-friendly initiatives in the past few years.

Which Factor Is Driving the Growth of the Biodegradable Stretch Film Market?

The ongoing expansion of the e-commerce sector and demand for safe packaging options from several brands are spearheading the industry growth in recent years. Also, stretch films are seen playing an important role in tightly wrapping initiatives where the products are shipping for delivery in recent years. Many e-commerce manufacturers are increasingly preferring the stretch film owing to its durability and safety, as per the recent industry observation. Also, these e-commerce companies are increasingly finding an eco-friendly solution for the packaging, which is likely to fulfill this newly launched bio-degradable stretch film while following the latest government-implemented industry regulation as per the expectation.

Market Trends

- The film manufacturers are increasingly observed using new and improved eco-friendly materials for the making of these biodegradable stretch films in recent years. Additionally, the manufacturers are heavily implementing and integrating technological advances in their manufacturing plants, which are significantly contributing to increased and advanced production in recent times.

- The home-compostable stretch film gained major popularity in the current period. As several individuals are increasingly purchasing products with compostable packaging in developed areas nowadays, according to recent observations.

- The manufacturers are actively promoting their biodegradable stretch films with eco labels and several certificates. Also, the individuals are actively buying these types of films, akin to certificates and good labelling, which builds a greater connection and understanding between the buyer and sellers, as per the recent market environment observation.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 1.74 Billion |

| Expected Size by 2034 | USD 5.01 Billion |

| Growth Rate from 2025 to 2034 | CAGR 12.45% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Material, By Transparency, By Thickness, By Application, By End Use, By Region |

| Key Companies Profiled | TIPA Corp, Futamura, BioBag, Paragon Films, Berry Global, Armando Alvarez, RKW Group, Polystar Plastics |

Market Opportunity

Plastic Restriction in Developing Nations: Unlock Lucrative Opportunities

The ongoing imposition of the plastic bans in developing countries is expected to create lucrative opportunities for biodegradable stretch film market in the coming years, as several developed countries have already implemented the single-use plastic bans b but manufacturers can seize the opportunities in the developing countries. Also, these countries are actively expanding their food, retail shipping needs, which can provide a heavy consumer base to the manufacturers as per future expectations. Furthermore, in the current self-dependency era, several countries are cutting off their imports, where manufacturers can capture the domestic needs while providing a cost-effective and better biodegradable solution without paying the fees like exports, and are likely to gain greater profit margins.

Market Challenge

Expensive Raw Materials Slow Eco-Packaging Expansion

The cost of these biodegradable stretch films is higher than regular plastic is expected to hinder the biodegradable stretch film market growth during the forecast period. Having complex processes and expensive raw materials is making these biodegradable materials costly in the current period. Also, these high-cost initiatives can create growth barriers for small and mid-size businesses, as per industry observation. However, manufacturers can tackle these challenges by using the latest technology, which anticipates providing alternative and beneficial solutions for future growth as per expectations.

Regional Insights

The Asia Pacific biodegradable stretch film market is expected to increase from USD 0.71 billion in 2025 to USD 2.04 billion by 2034, growing at a CAGR of 12.47% throughout the forecast period from 2025 to 2034. Asia Pacific dominated the market in 2024.

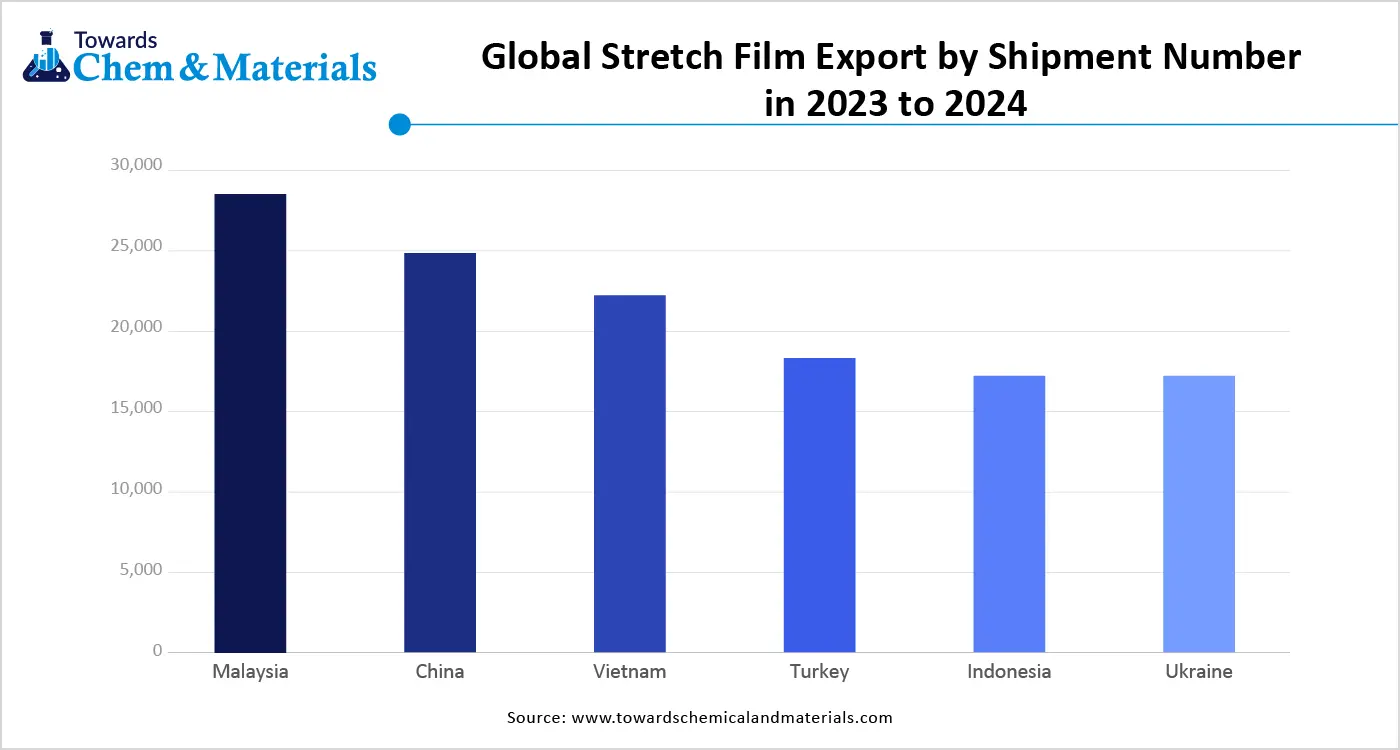

Asia Pacific accounted for the heavy revenue in the current sector, akin to the presence of the enlarged packaging, food, and agriculture industry in the current period. Moreover, countries such as China, India, and South Korea were seen as demanding eco-friendly solutions and implementing sustainability initiatives in the past few years, which contributed to the growth of the industry in recent years. Also, the governments of the regional countries are increasingly supporting the sustainability trends, which are anticipated to create beneficial sales opportunities in the coming years.

China’s Plastic Ban Powers the Rise of Biodegradable Films

China maintained its dominance in the biodegradable stretch film market owing to the stronger implementation of the sustainability regulation by the government in recent years. In recent years, China banned single-use plastics, which has apparently boosted the need for biodegradable material, as per past industry observation. Also, the availability of the local manufacturers of bio-based materials provides various benefits to the market while contributing to the domestic sales of the biodegradable stretch films, according to the recent country survey.

North America is expected to capture a significant share of the market during the forecast period, owing to increasing focus on eco-friendly innovations in recent years. By having advanced technology advantages, the region is ready to dominate the biodegradable film industry. Also, the governments in the region have seen in providing benefits to the eco-friendly manufacturers, like tax reduction and attractive subsidies, in the past few years.

Are United States Brands Shaping the Future of Eco-Friendly Packaging?

The United States is expected to rise as a dominant country in the North American region in the coming years, owing to heavy investment in sustainability in recent years. Also, many major United States brands are considered early adopters of biodegradable materials, which confirms the conscious industry growth. Moreover, several major brands are heavily establishing collaborations and partnerships with research institutes for the innovation of different and cost-effective biodegradable packaging options, which is expected to provide a first mover advantage in the coming years.

Segmental Insights

Material Type Insights

How Polyhydroxyalkanoates Segment Dominated the Biodegradable Stretch Film Market in 2024?

The polyhydroxyalkanoates segment held the largest share of the market in 2024, due to its immense biodegradability and raw material availability. Also, by having greater mixability in soil, the polyhydroxyalkanoates gained immense attention in recent years. Moreover, the flexibility and strength of the segment are considered as the ideal materials for the making of stretch films, as per recent observations.

The starch-based segment expects significant growth in the market during the predicted timeframe, owing to its efficiency in securing products and wrapping tightly. Also, in the current modern era where automation is everywhere, these films provide a fast and smooth operating experience, which is expected to gain significant market share during the forecast period, as per the current industry observation. Also, the economy and shipping boom can provide substantial advantages for the starch-based film as ideal material.

Transparency Type Insights

What Made the Opaque Segment the Dominant Segment in the Degradable Stretch Film Market 2024?

The opaque segment held the dominant share of the biodegradable stretch film market in 2024, akin to the block light, protect products better from UV rays, and offer better privacy. This is especially useful in food and beverage packaging where freshness and appearance matter. Opaque films also hide internal contents, which helps companies with branding and labeling. These benefits make opaque biodegradable films more suitable for industries that care about protection and presentation, keeping them in high demand.

The translucent films segment expects grow at a substantial rate during the predicted timeframe, owing to they offer a balance between visibility and protection. Customers want to see the product without fully opening the packaging, especially in retail settings. These films also allow basic light transmission while maintaining eco-friendly properties. As minimalist packaging trends grow and consumer interest in product visibility increases, translucent films will become more popular across multiple end-use industries like cosmetics, food, and healthcare.

Thickness Insights

Why Did the Thin Films Segment Dominate the Biodegradable Stretch Film Market in 2024?

The thin films segment dominated the market with the largest share in 2024, owing to their cost-effectiveness and requiring fewer raw materials. They are perfect for light and small product packaging, especially in the food and retail industries. Thin films also break down faster, which makes them better fit for short-term packaging needs. Their affordability and easy use make them the most common choice among businesses today looking for budget-friendly, sustainable packaging solutions.

The medium films segment is expected to grow at the fastest rate in the biodegradable stretch film market during the forecast period, as industries seek stronger and more durable packaging. These films offer better tear resistance and are suitable for heavier items or longer transportation times. As biodegradable films move into new applications like industrial packaging or pharmaceuticals, medium films will become more important. They provide both strength and environmental benefits, making them a better choice for long-lasting and reliable green packaging.

Application Method Insights

Why is Manual Wrapping Preferred by Small and Medium-Sized Businesses?

The manual segment held the largest share of the market in 2024 due to its simplicity, doesn't require special machines, and is ideal for small or medium businesses. Workers can easily wrap items by hand, especially in smaller warehouses, local grocery stores, or farms. This method is flexible and affordable, which helps many businesses test biodegradable options without large upfront costs. That's why, for now, manual application remains the preferred choice across various industries.

The machine segment is observed to grow at the fastest rate during the forecast period. As industries automate their packaging processes. Using machines ensures faster, consistent, and more secure wrapping-especially for bulk packaging in large warehouses or e-commerce hubs. Machine use also reduces labor time and waste. As biodegradable films become more machine-friendly and businesses scale up, automated applications will become the standard, helping manufacturers improve productivity while staying eco-conscious

End Use Insights

Why is Sustainable Packaging Important for Food and Beverage Products?

The food and beverage segment led the biodegradable stretch film market in 2024. It has the highest need for safe, protective, and eco-friendly packaging. Moreover, consumers now expect food items to be packed sustainably, and biodegradable films meet those needs while keeping food fresh and secure. The industry also faces strict packaging rules, which biodegradable materials can help follow. Because of daily, high-volume packaging needs, this segment continues to lead the market today.

The pharmaceutical segment is expected to grow at the fastest rate in the market during the forecast period, owing to stricter environmental and safety regulations. Medicines and medical supplies need secure and protective wrapping, and biodegradable films can offer that while reducing plastic waste. As the healthcare sector becomes more environmentally focused and adopts sustainable practices, biodegradable films will gain more Importance. Their ability to maintain hygiene, security, and compliance makes them ideal for future pharmaceutical packaging needs.

Recent Developments

- In January 2024, CAMM Solution introduced its latest sustainable stretch film. Also, the newly launched film is named CAMM stretch film. Moreover, this film is expected to become an alternative to conventional plastic films, as per the report published by the company. (Source: k-online.com)

- In September 2024, Solutum Technologies Ltd introduced their latest biodegradable films. This stretch film is specifically designed for stretch wrapping, as per the company's claim. Also, the newly launched films are likely to pass through the pester stretch wrapping machines, as per the report published by the company.(Source: packagingstrategies.com)

Top Companies List

- TIPA Corp

- Futamura

- BioBag

- Paragon Films

- Berry Global

- Armando Alvarez

- RKW Group

- Polystar Plastics

Segment Covered

By Material

- PLA (Polylactic Acid)

- PHA (Polyhydroxyalkanoates)

- Starch-based Films

- Other Materials

By Transparency

- Opaque Films

- Translucent Films

- Clear Films

By Thickness

- Thin Films (up to 20 microns)

- Medium Films (2150 microns)

- Thick Films (51 microns and above)

By Application

- Manual

- Machine

By End Use

- Food and Beverage

- Pharmaceuticals

- Cosmetics and Personal Care

- Electronics

- Logistics and Transportation

- Other End Uses

By Region

- North America

- U.S.

- Mexico

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Asia Pacific

- China

- India

- Japan

- South Korea

- Central & South America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- UAE