Content

What is the Current Polybutene-1 Market Size and Volume?

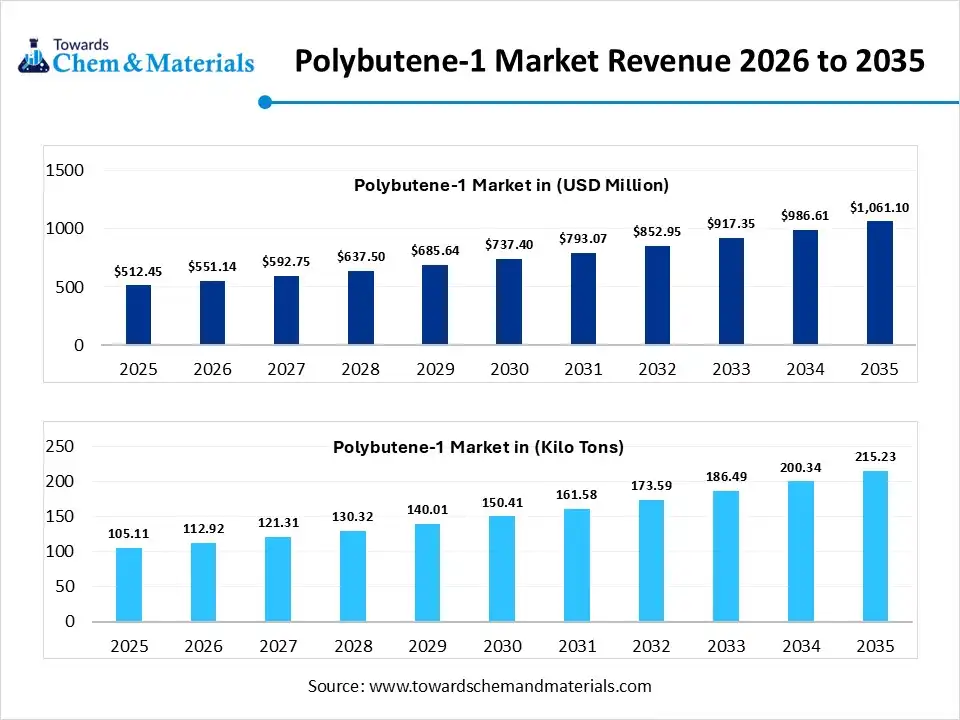

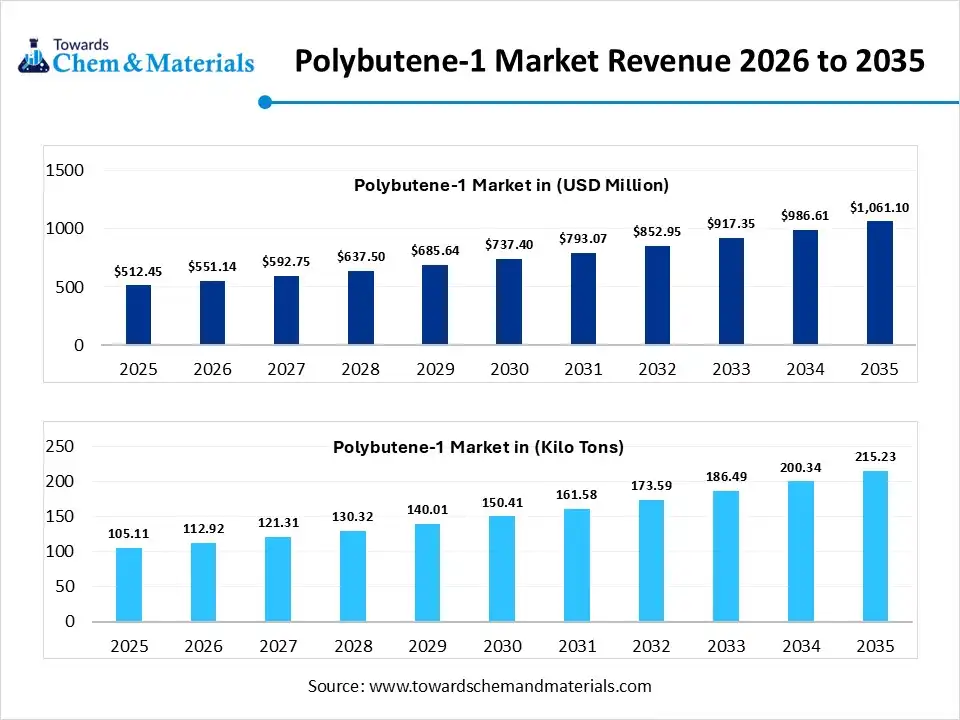

The global polybutene-1 market size was estimated at USD 512.45 million in 2025 and is expected to increase from USD 551.14 million in 2026 to USD 1,061.10 million by 2035, growing at a CAGR of 7.55% from 2026 to 2035. In terms of volume, the market is projected to grow from 105.11 kilo tons in 2025 to 215.23 kilo tons by 2035. growing at a CAGR of 7.43% from 2026 to 2035. Asia Pacific dominated the polybutene-1 market with the largest volume share of 45.00% in 2025.

The sudden surge in infrastructure development and building renovation across the world accelerated industry growth nowadays. The polybutene-1 refers to the type of plastic that is made by joining many 1-butene molecules into long chemical chains. Moreover, by having durability, light weight, and greater resistance to heat and chemicals, the polybutene -1 has offered substantial growth prospects for manufacturing firms in recent years. Also, the ability to handle pressure and temperature changes, polybutene-1 has gained major attention from households and the industrial sector nowadays.

Market Highlights

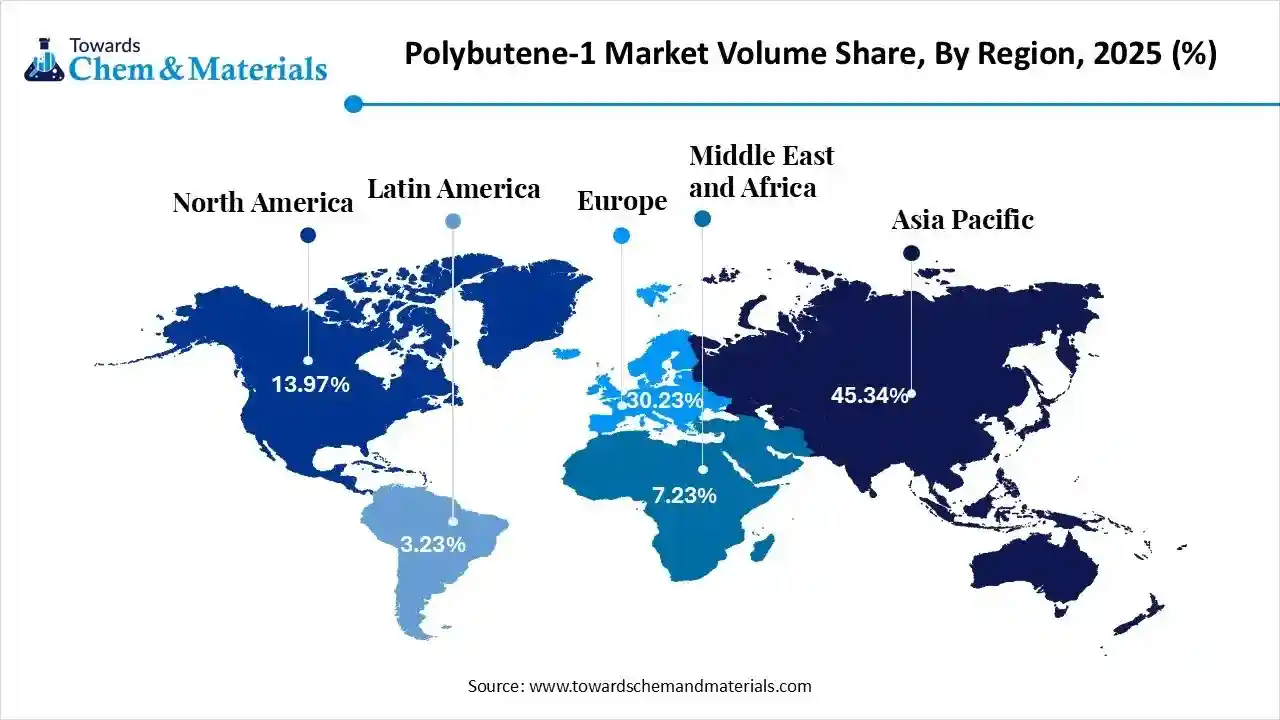

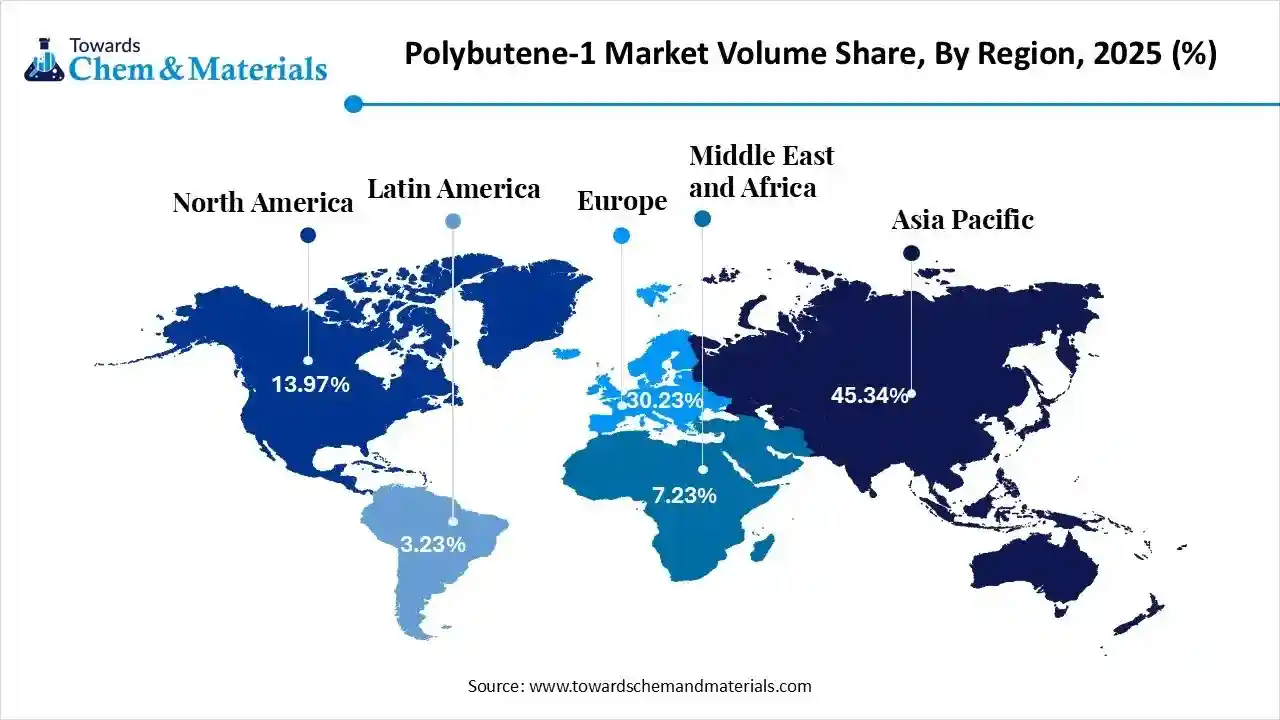

- The Asia Pacific dominated the global polybutene-1 market with the largest volume share of 45.00% in 2025.

- The polybutene-1 market in North America is expected to grow at a substantial CAGR of 7.53% from 2026 to 2035.

- The Europe sustainable polybutene-1 market segment accounted for the major volume share of 30.23% in 2025.

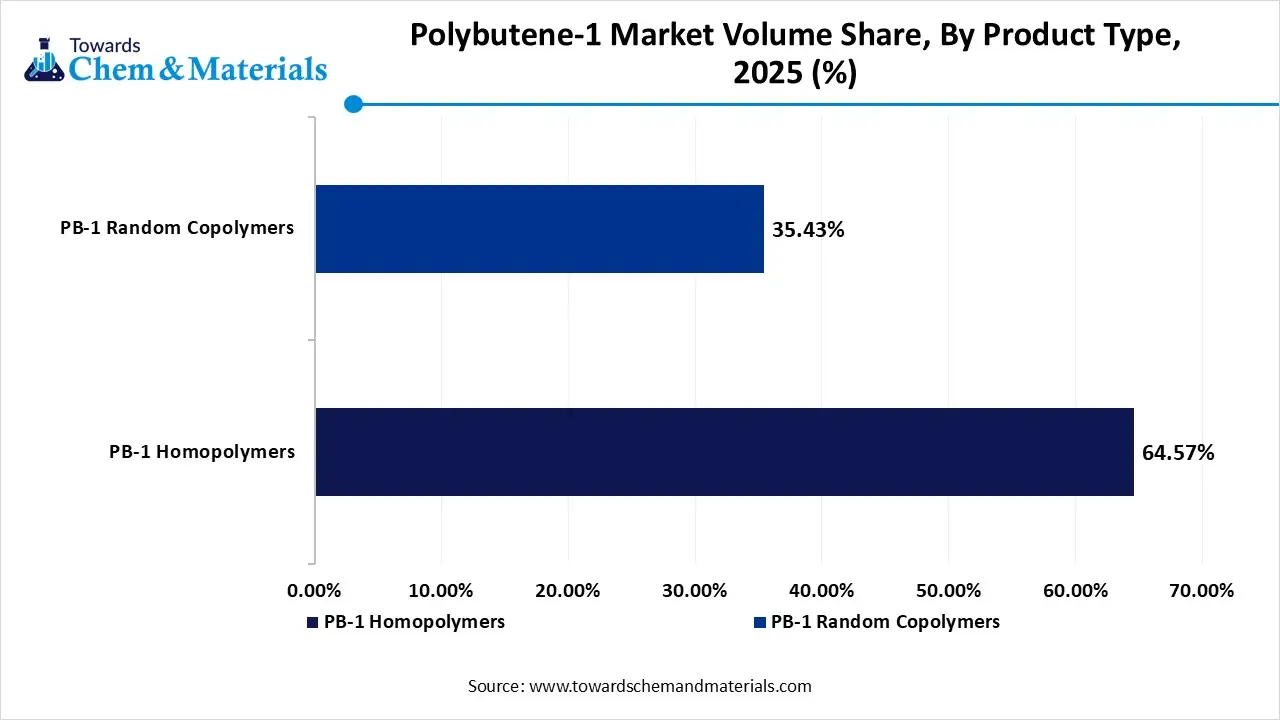

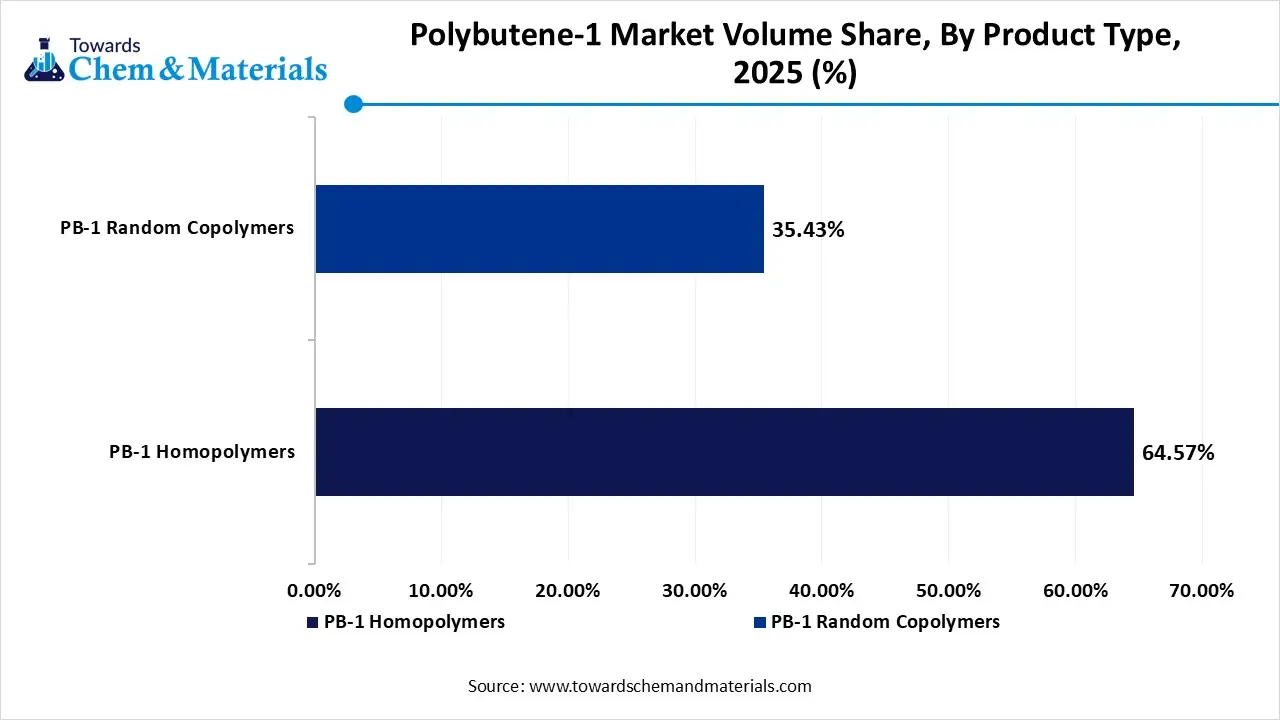

- By product type, the PB-1 homopolymers segment dominated the market and accounted for the largest volume share of 64.57% in 2025.

- By product type, the PB-1 random copolymers segment is expected to grow at the fastest CAGR of 10.39% from 2026 to 2035 in terms of volume.

- By processing grade type, the extrusion grade segment led the market with the largest revenue volume share of 62.00% in 2025.

- By end use, the building and construction segment dominated the market and accounted for the largest volume share of 56.00% in 2025.

Polybutene-1 Market Trends:

- The trend towards sustainable and eco-friendly packaging has enabled high-return ventures for manufacturers in the past few years. Additionally, having greater recyclability, the polybutene is seen as a better choice for this eco-friendly initiative without any complex sorting. Moreover, major brands are actively observed promising ecofriendly product line to customers.

- The sudden growth in infrastructure development, such as construction and plumbing, has boosted the revenue potential across the polybutene-1 manufacturing landscape. The polybutene pipes and materials are known for their strength, heat resistance, and light weight, and are mainly preferred for modern construction development.

- The demand for specialty adhesives and films is expected to enhance market participation for producers. Moreover, polybutene-1 has seen in improving bonding performance where film makers have been using it for clarity and flexibility in the current period.

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | USD 551.14 Million / 112.92 KiloTons |

| Revenue Forecast in 2035 | USD 1,061.10 Million / 215.23 KiloTons |

| Growth Rate | CAGR 7.55% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Units Considered | Value (Billion / Million), Volume (KiloTons) |

| Dominant Region | Asia Pacific |

| Segment Covered | By Product Type, By Processing Grade, By End-Use Industry, By Region |

| Key companies profiled | LyondellBasell Industries N.V., Mitsui Chemicals, Inc, Ylem Technology Co., Ltd, DL Chemical Co., Ltd., Shandong Hongye Chemical Industry Group Co., Ltd., Tengzhou Rida Chemical Co., Ltd. , Shandong Chambroad Petrochemicals Co., Ltd. , Sinopec Zhenhai Refining & Chemical Company , Rida Chem , Shandong Oriental Macro Industry Chemical Co., Ltd. , Hebei Sancun Chemical Co., Ltd. , PetroChina Company Limited, LG Chem, Ltd. , Lotte Chemical Corporation , Formosa Plastics Corporation , SABIC (Saudi Basic Industries Corporation) , Reliance Industries Limited, Borealis AG, Sumitomo Chemical Co., Ltd. , Chevron Phillips Chemical Company |

High Precision Polymers for Next-Era Applications

The market is witnessing a greater technological shift as the adoption of advanced polymerization methods and process optimization aimed at performance differentiation and sustainability. Key industry players are adopting next-generation catalytic systems that deliver precise molecular control, improving product uniformity and application performance.

Trade Analysis of the Polybutene-1 Market:

Import, Export, Consumption, and Production Statistics

- The United States has seen under the heavy butene and isomers export in 2024, and the exported value is approximately around $219,776,89K as per the records.

- World has exported a significant amount of polybutene from June 2024 to May 2025, with approximately 1,035 shipments as per the published report.

Value Chain Analysis of the Polybutene-1 Market:

- Distribution to Industrial Users: The global Polybutene-1 (PB-1) market is a highly specialized sector dominated by a limited number of major manufacturers due to the complex catalytic polymerization processes required for its production.

- Key Players: LyondellBasell (LYB)and Mitsui Chemicals

- Chemical Synthesis and Processing: The chemical synthesis of Polybutene-1 (PB-1) in 2025 is dominated by high-precision catalytic polymerization, primarily utilizing Ziegler-Natta and metallocene technologies to produce high-performance resins. The market is oligopolistic, with a few global leaders controlling most of the production capacity and specialized synthesis processes.

- Key Players: LyondellBasell and Daelim Industrial

- Regulatory Compliance and Safety Monitoring: Regulatory compliance for polybutene-1 (PB-1) is defined by its primary use in high-stakes sectors: potable water infrastructure, food packaging, and healthcare. Manufacturers must adhere to rigorous international and regional standards to ensure material safety and performance longevity.

- Key Agencies: NSF International and WRAS (UK)

Polybutene-1 Market Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas |

| United States | Environmental Protection Agency (EPA) | 21 CFR 176.170 & 177.2600 & 178.3570 | Innovation and demand growth in high-performance materials for automotive and construction |

| European Union | European Food Safety Authority (EFSA) | REACH Regulation (EC) No 1907/2006 | High emphasis on sustainability and the use of PB-1 as a potentially more sustainable alternative to traditional plastics |

| China | National Health Commission (NHC) | GB 4806.7-2023 | Rapid growth driven by industrialization, urbanization, and expanding construction activities. |

Segmental Insights

Product Insights

How did the PB-1 Homopolymers Segment Dominate the Polybutene-1 Market in 2025?

The PB-1 homopolymers segment dominated the market with 64% share in 2025, due to its offerings such as thermal stability, greater strength, and long term pressure resistance. Moreover, the affordability of these homo polymers has made it crucial for industrial components, fittings, and pipes, specifically in the construction and development sector, nowadays.

The PB-1 random copolymers segment is expected to grow with a rapid CAGR, owing to the improved transparency and better sealing performance. Also, by performing better at lower temperatures, the polybutene-1 random co polymers has reflected as an asset for flexible and packaging films applications, allowing thinner metal designs.

Polybutene-1 Market Volume and Share, By Product Type, 2025 (%)

| By Product Type | Market Volume Share (%), 2025 | Market Volume (Kilo Tons)2025 | Market Volume (Kilo Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| PB-1 Homopolymers | 64.57% | 67.87 | 124.55 | 6.98% | 57.87% |

| PB-1 Random Copolymers | 35.43% | 37.24 | 90.68 | 10.39% | 42.13% |

Processing Grade Insights

Why does the Extrusion Grade Segment Dominate the Polybutene-1 Market?

The extrusion grade segment dominated the market with 62% share in 2025, owing to its widespread use in pipe, tubing, and sheet manufacturing. Extrusion processes require materials with stable melt flow, dimensional consistency, and long-term mechanical strength. Extrusion-grade Polybutene-1 meets these requirements effectively, making it a preferred choice for infrastructure and construction applications.

The injection molding grade segment is expected to grow at a rapid CAGR akin to its suitability for producing precise and complex components. This processing grade supports efficient mould filling, consistent part quality, and reduced material waste. Injection moulding allows manufacturers to create fittings, closures, and functional parts with high dimensional accuracy.

End Use Insights

How did the Building & Construction Segment Dominate the Polybutene-1 Market in 2025?

The building & construction segment dominated the market with 56% share in 2025, due to its high resistance and durability to chemical exposure, heat and pressure. Polybutene-1 is widely used in plumbing systems, heating networks, and water distribution applications where long service life is essential. Its lightweight nature and ease of installation provide additional benefits over traditional materials.

The food & beverage packaging segment is expected to grow with a rapid CAGR during the forecast period. The material offers excellent sealing performance, flexibility, and chemical stability, which are essential for maintaining food quality and safety. Polybutene-1 also supports lightweight and efficient packaging designs, contributing to the material reduction initiative.

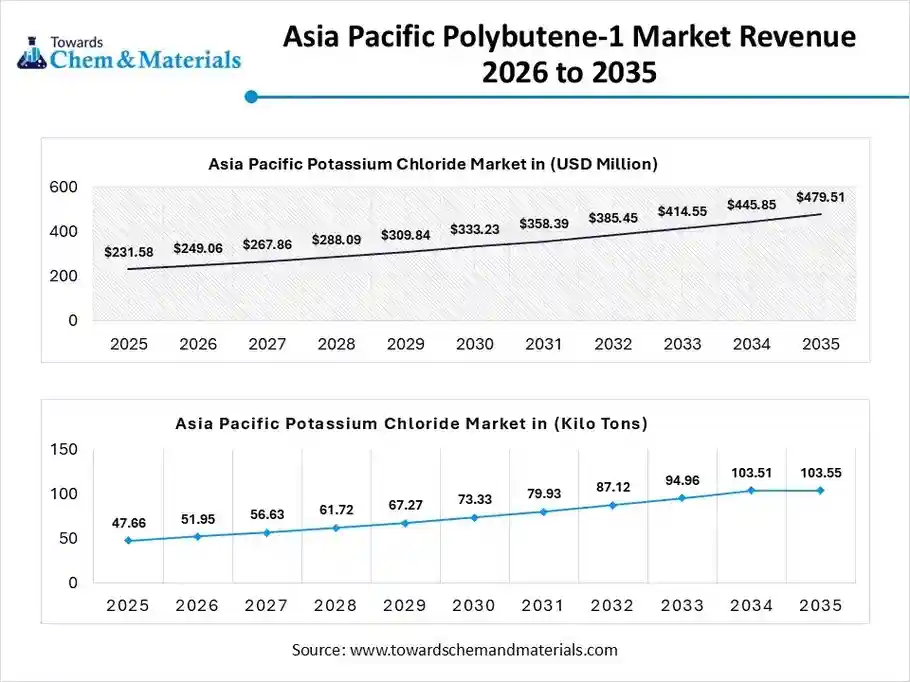

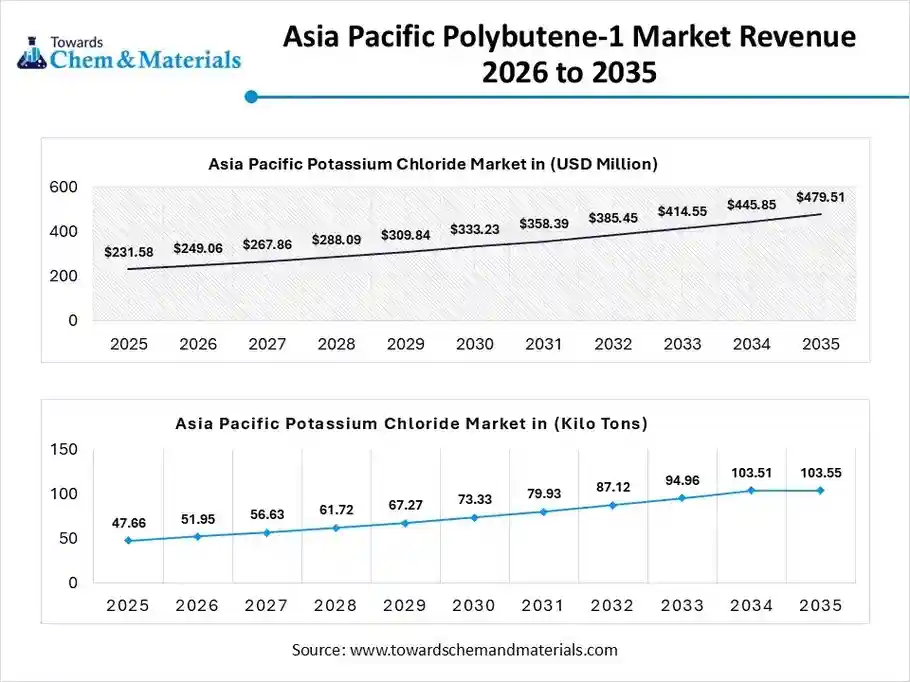

Regional Insights

The Asia Pacific polybutene-1 market size was valued at USD 231.58 million in 2025 and is expected to be worth around USD 479.51 million by 2035, exhibiting at a compound annual growth rate (CAGR) of 7.57% over the forecast period from 2026 to 2035. The Asia Pacific polybutene-1 market volume was estimated at 47.66 kilo tons in 2025 and is projected to reach 103.55 kilo tons by 2035, growing at a CAGR of 9.00% from 2026 to 2035.

Asia Pacific dominated the polybutene-1 market with 45% share in 2025, due to the heavy infrastructure development and rapid urbanization. Moreover, ongoing export focus has leading industry potential for the region in the current period. Also, the regional countries such as China, India, and Japan have seen under the enlarged investment for reliable construction materials.

Water-Efficient Systems Strengthen China’s Demand

China maintained its dominance in the market, owing to the greater expansion of the infrastructure development projects, such as the industrial parks and housing, in the past few years. Furthermore, the country’s ongoing shift towards the water efficient plumbing and green building codes has supported industry expansion in the region.

Polybutene-1 Market Study in North America

The North America Polybutene-1 market volume was estimated at 14.68 Kilo Tons in 2025 and is projected to reach 28.22 Kilo Tons by 2035, growing at a CAGR of 7.53% from 2026 to 2035.North America is expected to capture a notable share of the industry, due to industries seeking alternatives to traditional materials like PVC and PEX. While adoption was slower historically, awareness of polybutene-1's thermal stability and pressure resistance is increasing in building reconstruction projects, advanced packaging, and specialty industrial applications in recent years.

Builders in the United States Evaluate High-Performance Polybutene-1

The United States is expected to emerge as a prominent country, akin to advanced packaging, heat pump systems, and retrofit plumbing. Although historically slower to adopt new polymers due to strong use of established materials, builders and brands in the United States are now evaluating PB-1 for premium performance applications.

Polybutene-1 Market Volume and Share, By Region, 2025 (%)

| By Region | Market Volume Share (%), 2025 | Market Volume (Kilo Tons)2025 | Market Volume (Kilo Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| North America | 13.97% | 14.68 | 28.22 | 7.53% | 13.11% |

| Europe | 30.23% | 31.77 | 60.50 | 7.42% | 28.11% |

| Asia Pacific | 45.34% | 47.66 | 103.55 | 9.00% | 48.11% |

| South America | 3.23% | 3.40 | 5.51 | 5.53% | 2.56% |

| Middle East & Africa | 7.23% | 7.60 | 17.46 | 9.68% | 8.11% |

Europe Polybutene-1 Market Evaluation

The Europe Polybutene-1 market volume was estimated at 31.77 Kilo Tons in 2025 and is projected to reach 60.50 Kilo Tons by 2035, growing at a CAGR of 7.42% from 2026 to 2035.Europe is a notably growing region, owing to the stricter sustainability standards. Moreover, the region's push towards recyclable packaging, energy-efficient buildings, and carbon footprint minimization has created lucrative opportunities for the polybutene-1 market. Furthermore, the region has seen under the heavy development of renewable energy installation, which demand for the polybutene-1 has created its own industry presence in the region nowadays

Advanced Piping Systems Drive Polybutene-1 Growth

Germany is expected to gain a major industry share, akin to countries' focus on the privatization of modern piping systems and the adaptation of advanced polymers. Also, German manufacturers have been seen under the development of the innovative polybutene-1 compounds, which have greater compatibility with modern environmental standards of Germany.

South America Polybutene-1 Market Evaluation

The South America Polybutene-1 market volume was estimated at 3.40 Kilo Tons in 2025 and is projected to reach 5.51 Kilo Tons by 2035, growing at a CAGR of 5.53% from 2026 to 2035. South America is a notably growing region, akin to increased urban development, rising middle-class demand, and the modernization of water systems. Governments across the region are rebuilding infrastructure and expanding housing, which supports PB-1 adoption for plumbing and construction.

Urban Expansion Fuels Polybutene-1 Demand

Brazil is expected to gain a major industry share, akin to strong construction activity and expanded packaging needs. Urban expansion, improved sanitation systems, and a growing consumer goods sector are increasing polybutene-1 demand in the country. Also, the country has experienced the trend, which is the use of PB-1 in flexible refrigeration components for the cold storage and food export industry, where temperature stability and pressure resistance are critical.

Middle East and Africa Polybutene-1 Market Examination

The Middle East & Africa Polybutene-1 market volume was estimated at 7.60 Kilo Tons in 2025 and is projected to reach 17.46 Kilo Tons by 2035, growing at a CAGR of 9.68% from 2026 to 2035. The Middle East and Africa are expected to capture a major share of the Polybutene-1 Market with a rapid CAGR, owing to the heavy pus for initiatives like smart city developments and infrastructure programs. Also, the region has seen under the heavy demand for packaging films and advanced piping, which has been driving the growth of the industry in recent years.

Industrial Expansion Boosts Saudi Arabia’s Industry Potential

Saudi Arabia is expected to emerge as a prominent country for the market in the coming years, akin to the enlarged projects like waterfront development and NEOM nowadays. Also, the increased expansion of the industrial zones and the petrochemicals has generated value-added opportunities for industry participants in the past few years.

Market Top Companies

- LyondellBasell Industries N.V.: A global leader in polyolefin technologies, LyondellBasell produces high-performance Polybutene-1 (PB-1) primarily for specialty applications like easy-open packaging and high-durability plumbing systems.

- Mitsui Chemicals, Inc.: This Japanese chemical giant manufactures PB-1 under the brand name Beaulon, focusing on high-quality resins used for hot-water piping, industrial sheets, and film modifiers.

- Ylem Technology Co., Ltd.: Based in South Korea, Ylem Technology specializes in the production of high-quality Polybutene-1 and related polymer products, often focusing on niche industrial and construction applications.

- DL Chemical Co., Ltd.: Formerly Daelim Industrial, DL Chemical is the world's largest producer of polybutene, operating major plants in South Korea and expanding into Saudi Arabia to supply global markets.

- Shandong Hongye Chemical Industry Group Co., Ltd.

- Tengzhou Rida Chemical Co., Ltd.

- Shandong Chambroad Petrochemicals Co., Ltd.

- Sinopec Zhenhai Refining & Chemical Company

- Rida Chem

- Shandong Oriental Macro Industry Chemical Co., Ltd.

- Hebei Sancun Chemical Co., Ltd.

- PetroChina Company Limited

- LG Chem, Ltd.

- Lotte Chemical Corporation

- Formosa Plastics Corporation

- SABIC (Saudi Basic Industries Corporation)

- Reliance Industries Limited

- Borealis AG

- Sumitomo Chemical Co., Ltd.

- Chevron Phillips Chemical Company

Segments Covered in the Report

By Product Type

- PB-1 Homopolymers

- PB-1 Random Copolymers

By Processing Grade

- Extrusion Grade

- Injection Molding Grade

- Blow Molding Grade

By End-Use Industry

- Building & Construction

- Food & Beverage Packaging

- Electrical & Electronics

- Automotive & Transportation

- Healthcare & Medical Devices

- Industrial Manufacturing

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa