Content

What is the Current Potassium Chloride Market Size and Volume?

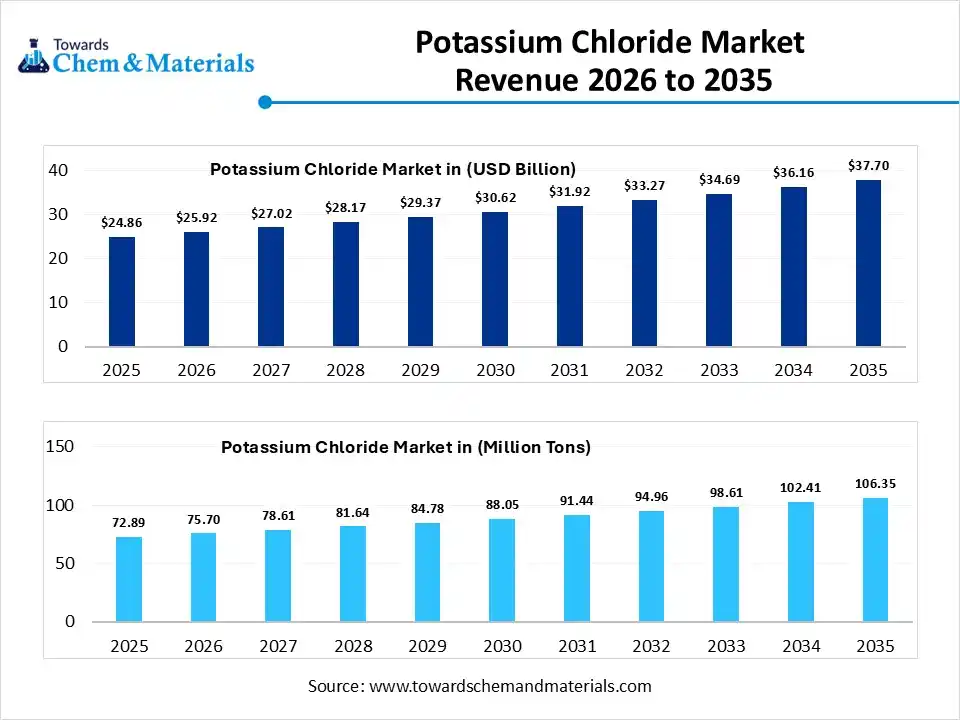

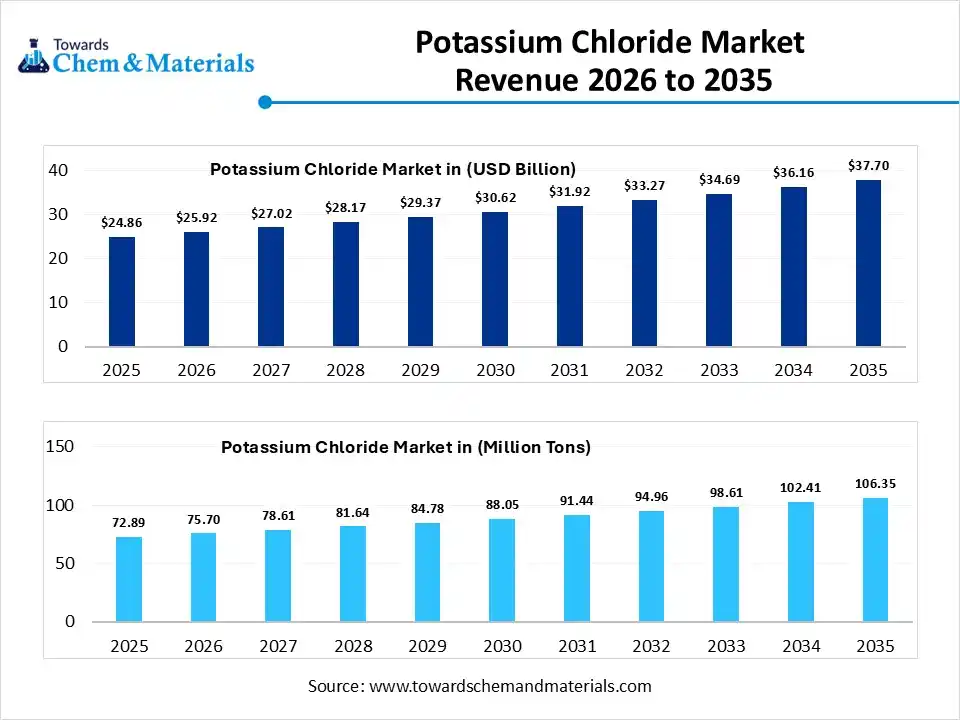

The global potassium chloride market size was estimated at USD 24.86 billion in 2025 and is expected to increase from USD 25.92 billion in 2026 to USD 37.70 billion by 2035, growing at a CAGR of 4.25% from 2026 to 2035. In terms of volume, the market is projected to grow from 72.89 million tons in 2025 to 106.35 million tons by 2035. growing at a CAGR of 3.85% from 2026 to 2035. Asia Pacific dominated the potassium chloride market with the largest volume share of 36.4% in 2025. The market is growing due to rising fertilizer demand to boost crop yields. Increasing industrial and pharmaceutical applications further support growth.

Report Highlights

- The Asia Pacific dominated the potassium chloride market with the largest volume share of 36.4% in 2025.

- The potassium chloride market in Europe is expected to grow at a substantial CAGR of 24.62% from 2026 to 2035.

- By grade, the agriculture grade segment dominated the market and accounted for the largest volume share of 38.4% in 2025.

- By form, the solid (crystalline, granular, powder) segment dominated the market and accounted for the largest volume share of 64.4% in 2025.

- By application, the fertilizers (Muriate of potash) segment led the market with the largest revenue volume share of 33.4% in 2025.

- By end-use, the agricultural segment dominated the market and accounted for the largest volume share of 38.5% in 2025.

Fueling Crops and Industry: The Rising Demand for Potassium Chloride

Potassium chloride is a chemical compound used mainly as a fertilizer and as a potassium supplement in food, medicine, and industry. The potassium chloride market is growing due to increasing global demand for potash fertilizers to enhance crop productivity and ensure food security. Rising population, shrinking arable land, and the need for higher agricultural yields are key drivers. Additionally, expanding use of potassium chloride in pharmaceuticals, food processing, water treatment, and industrial applications is further supporting steady market growth worldwide.

Potassium Chloride Market Trends

- Rising Agricultural Demand: Potassium chloride is increasingly used in fertilizers to improve crop yield and soil nutrition, driven by growing food demand and population growth.

- Expanding Pharmaceutical and Food Applications: Its use as a potassium supplement in medicines and as a food additive is increasing, supporting steady market expansion.

- Growth in Industrial and Water Treatment Uses: Potassium chloride is gaining traction in water softening, chemical manufacturing, and industrial processes.

- Capacity Expansion and Mining Investments: Major producers are investing in mining and production facilities to meet rising global demand.

- Market Price Volatility: Prices are influenced by supply-demand imbalance, geopolitical factors, and fluctuations in raw material availability.

Report Scope

| Report Attribute | Details |

| Market Size and Volume in 2026 | USD 25.92 Billion / 75.70 Million tons |

| Revenue Forecast in 2035 | USD 37.70 Billion / 106.35 Million tons |

| Growth Rate | CAGR 4.25% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Units Considered | Value (Billion / Million), Volume (Million Tons) |

| Dominant Region | Asia Pacific |

| Segment Covered | By Grade, By Form, By Application, By End-Use Industry, By Region |

| Key companies profiled | Mosaic Company, Nutrien Ltd., JSC Acron, Belarusian Potash Company, Uralkali PJSC, SQM (Sociedad Química y Minera de Chile S.A.) |

Technological Developments in the Potassium Chloride Market:

Technological developments in the market focus on advanced mining techniques, improved ore processing, and automation to enhance efficiency and reduce costs. Innovations in flotation and crystallization processes are improving product purity. Additionally, sustainable extraction technologies and energy-efficient production methods are gaining attention to minimize environmental impact.

Trade Analysis of Potassium Chloride Market: Import & Export Statistics

- Canada leads global exports with about $5.59 billion in potassium chloride shipments (approximately 22.9 billion kg).

- Other significant exporters include the United States ($1.25 billion), Germany ($1.06 billion), and the European Union ($803 million).

- Worldwide imports reached 56,279.65 Ktons in 2024, rising by 9.97% versus 2023, that is 51,178.23 Ktons.

- Brazil (25.13%), the China (22.31%), and United States (22.04%) were the top importers, with India (6.62%) also notable.

- India imported potassium chloride worth about US$1,133.28M in 2024 (3,755.33 Ktons), mainly from Canada, Russia, Turkmenistan, Jordan, and Israel.

Potassium Chloride Market Value Chain Analysis

- Manufacturing and Assembly : Potassium chloride (KCl) is mainly produced by extracting it from underground mineral reserves or by evaporating natural brine solutions. The extracted material is refined using techniques such as flotation and crystallization to produce different quality grades suited for fertilizers, industrial chemicals, and pharmaceutical applications.

- Key players: Nutrien, Mosaic, Uralkali, K+S Group, and ICL Group.

- Branding and Packaging : Potassium chloride (KCl) branding is tailored to its end-use across pharmaceutical, food, and industrial sectors. Pharmaceutical products are packaged in small, regulated containers, while industrial and fertilizer grades use large, durable bags. Branding highlights purity levels, grade classifications, safety instructions, and application details.

- Key Players: Arab Potash Company, Belaruskali, Uralkali PJSC, SQM.

- End-of-Life Management : Potassium chloride (KCl) is used in end-of-life procedures under strictly regulated medical and veterinary frameworks, where it is administered only after appropriate anesthesia to safely stop cardiac activity. Its application is governed by legal and ethical standards.

- Key Players: Hikma Pharmaceuticals, Pfizer (hospital injectables), Dechra Pharmaceuticals, Zoetis, and B. Braun, which focus on compliance and safety.

Segmental Insights

Grade Insights

Why Did the Agriculture Grade Segment Dominate in the Potassium Chloride Market in 2025?

The agriculture grade segment held the largest market share of 38.4% in 2025, due to widespread use as a key potash fertilizer to enhance crop yield and soil fertilizer to enhance crop yield and soil fertility. Growing global food demand, expanding commercial farming, and intensive cultivation practices increased fertilizer consumption. Additionally, agriculture-grade potassium chloride is cost-effective, readily available, and suitable for large-scale application, further supporting its dominant market position.

The pharmaceutical (medical) grade segment is expected to grow at the fastest CAGR due to increasing demand for potassium chloride in hospitals and healthcare for treating hypokalemia and other electrolyte disorders. Rising geriatric populations, growing awareness of cardiovascular and kidney-related treatments, and the expansion of healthcare infrastructure globally are driving demand. Strict quality standards and regulatory compliance further boost the adoption of high-purity medical-grade KCl.

Form Type Insights

What made the Solid (crystalline, granular, powder) Segment Dominant in the Potassium Chloride Market in 2025?

The solid (crystalline, granular, powder) segment held the largest market share of 64.4%, due to its versatility and ease of handling across agricultural, industrial, and pharmaceutical applications. Its stability, longer shelf life, and cost-effectiveness make it the preferred choice for large-scale fertilizer use, chemical processing, and medical formulations. High demand in agriculture and widespread industrial adoption contributed to its dominant market position.

The liquid (Solution/brine) segment is expected to grow at the fastest CAGR during the forecast period, due to its increasing use in precision agriculture, fertigation, and industrial processes requiring easy solubility and rapid absorption. Rising adoption in hydroponics, controlled irrigation systems, and chemical manufacturing, along with growing demand for efficient nutrient delivery methods, is driving market growth for liquid potassium chloride formulations.

Application Insights

How will the Fertilizers (Muriate of Potash) Segment dominate the Potassium Chloride Market in 2025?

The fertilizers (Muriate of potash) segment held the highest market share of 33.4% in 2025, due to its extensive use in enhancing soil fertility and boosting crop yields. Growing global food demand, expansion of commercial farming, and intensive agriculture practices increased fertilizer consumption. MOPs are cost-effective, have high potassium content, and wide compatibility with various crops, further reinforced its dominant position in the potassium chloride market.

The pharmaceutical & medical segment is expected to grow at the fastest CAGR, due to the forecast period, due to rising demand for potassium chloride in hospitals and healthcare for treating electrolyte imbalance, particularly hypokalemia. Factors such as an increasing geriatric population, growing prevalence of cardiovascular and kidney-related disorders, and expansion of healthcare infrastructure globally are driving the adoption of high-purity medical-grade potassium chloride in therapeutic and clinical applications.

End-Use Insights

How Does the Agricultural Segment Dominate the Potassium Chloride Market in 2025?

The agricultural segment contributed to the biggest market share of 38.5% in 2025 due to the high demand for potassium chloride as a key nutrient in fertilizers to improve soil fertility and crop yields. The expanding global population, rising food consumption, and intensive farming practices have driven the demand for fertilizers. Additionally, the cost-effectiveness, availability, and versatility of KCl for a wide range of crops reinforced agriculture’s dominance in the market.

The pharmaceutical segment is expected to grow at the fastest CAGR during the forecast period due to increasing demand for potassium chloride in hospitals and healthcare facilities to manage electrolyte imbalance, especially hypokalemia. Factors such as a growing geriatric population, rising prevalence of cardiovascular and kidney-related disorders, and expanding healthcare infrastructure globally are driving the adoption of high-purity, medical-grade KCl in therapeutic and clinical applications.

Regional Insights

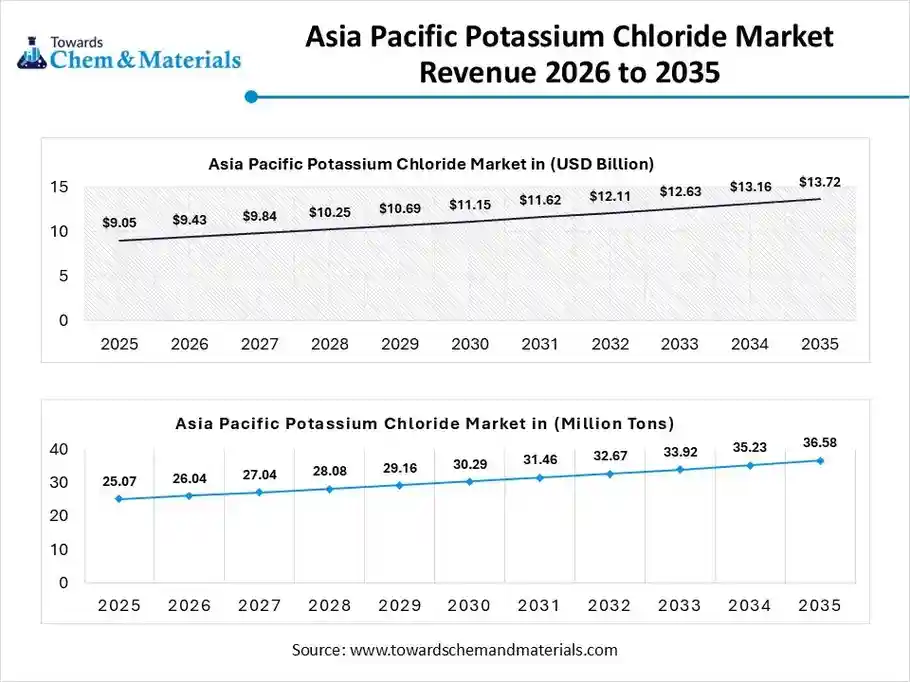

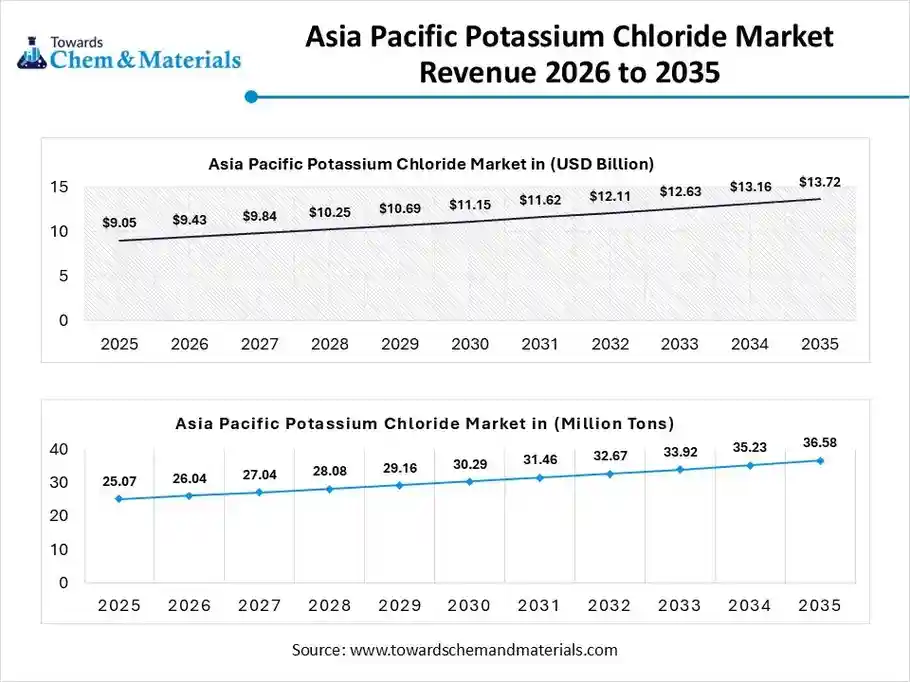

The Asia Pacific potassium chloride market size was valued at USD 9.05 billion in 2025 and is expected to be worth around USD 13.72 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 4.27% over the forecast period from 2026 to 2035.

The Asia Pacific potassium chloride market volume was estimated at 25.07 million tons in 2025 and is projected to reach 36.58 million tons by 2035, growing at a CAGR of 4.11% from 2026 to 2035.

Asia Pacific dominated the potassium chloride market in 2025 with a volume share of 36.4% due to its large agricultural base and high demand for fertilizers to support food production for a growing population. Countries like India, China, and Indonesia drive significant consumption of potash fertilizers. Favorable government policies, expansion of commercial farming, and increasing investments in modern agricultural practices further strengthened the region’s market dominance in terms of revenue share.

India Emerging as a Key Potassium Consumer

India dominated the market in 2025 due to its extensive agricultural sector and high demand for potash fertilizers to enhance crop productivity and ensure food security. Government initiatives promoting fertilizer use, the expansion of commercial farming, and increasing adoption of modern agricultural practices contributed to strong consumption. Additionally, the country’s reliance on imports to meet potassium requirements further reinforced its leading market position in terms of revenue share.

Europe Accelerating Growth Through High-Purity Applications

Europe is anticipated to grow at the fastest CAGR in the potassium chloride market during the forecast period due to increasing demand for high-purity KCl in pharmaceuticals, food processing, and specialty chemicals. Rising focus on sustainable agriculture, advanced farming technologies, and regulatory support for quality fertilizers are driving adoption. Additionally, growing healthcare infrastructure and rising awareness of electrolyte supplementation further contribute to market expansion in the region.

UK Advancing with Smart Agriculture and Healthcare Needs

The UK is anticipated to grow at the fastest CAGR in the market during the forecast period due to rising demand in agriculture, pharmaceuticals, and industrial applications. Increasing adoption of high-efficiency fertilizers, expansion of precision farming, and growing healthcare infrastructure are key drivers. Additionally, government support for sustainable farming practices and the need for potassium supplementation in medical treatments are boosting the consumption of high-purity KCl in the region.

Why is North America significantly growing in the Potassium Chloride Market?

North America is expected to grow at a notable rate in the market during the forecast period due to strong demand from the agricultural sector for high-yield crop production. Expansion of commercial farming, adoption of advanced fertilizer technologies, and increasing use of KCl in industrial and pharmaceutical applications are key growth drivers. Additionally, well-established healthcare infrastructure and focus on sustainable farming practices support market growth in the region.

Why is the U.S. Accelerating Adoption of Potassium Chloride?

The U.S. is expected to grow at a notable rate in the potassium chloride market during the forecast period due to high demand in agriculture for enhancing crop yields and soil fertility. Increased adoption of modern farming techniques, precision agriculture, and efficient fertilizer use are driving growth. Additionally, rising applications in pharmaceuticals, food processing, and industrial sectors, along with strong regulatory support, contribute to the market’s steady expansion in the country.

Middle East and Africa: Strengthening Agriculture Inputs

The Middle East & Africa market is growing significantly due to rising demand for soil nutrients to support agriculture in water-scarce and low-fertility regions. Increasing adoption of modern irrigation systems, expansion of commercial farming, and government-led food security programs are driving fertilizer consumption. Additionally, growing pharmaceutical, food processing, and water treatment industries, along with high reliance on imports, are supporting sustained market growth across the region.

UAE Expanding Through Trade and Sustainable Farming

The UAE potassium chloride market is growing due to increasing focus on food security and the adoption of advanced agricultural practices such as greenhouse farming and hydroponics, which require efficient nutrient inputs. Rising investments in desalination, water treatment, and pharmaceutical manufacturing are also driving demand. Additionally, the UAE’s role as a regional trade and distribution hub supports higher imports and consumption of potassium chloride.

South America Powering Fertilizer-Led Growth

The South America potassium chloride market is growing significantly due to the region’s strong agricultural base and rising demand for potash fertilizers to support large-scale cultivation of crops such as soybeans, corn, and sugarcane. Expanding commercial farming, increasing export-oriented agriculture, and efforts to improve soil productivity are key drivers. Additionally, limited domestic potash reserves increase import reliance, further boosting market growth across South America.

Brazil Fueling Large-Scale Agriculture Expansion

The Brazil market is growing due to the country’s large-scale agricultural sector and strong demand for potash fertilizers to support crops such as soybeans, corn, and sugarcane. Expansion of export-driven farming, increasing use of high-yield fertilizers, and efforts to improve soil fertility are key drivers. Additionally, Brazil’s heavy dependence on potash imports to meet agricultural needs further supports steady market growth.

Recent Developments

- In September 2024, QatarEnergy partnered with Mesaieed Petrochemical Holding Company, QIMC, and Atlas Yatirim Planlama for the establishment of Qatar Salt Products Company (QSalt), a new plant producing industrial and table salt, including potassium chloride, enhancing Qatar’s self-sufficiency and export potential in chemicals and fertilizers.(Source : www.chemanalyst.com)

- In July 2025, Evocus launched Hydration IV Electrolytes Drink in India, a clean-label RTD beverage formulated with important electrolytes like sodium, potassium, and chloride, targeting athletes and wellness-conscious consumers. The launch strengthens Evocus’s presence in India’s growing sports hydration market. Available in four flavors, the drink supports rehydration and recovery after physical activity.(Source: www.financialexpress.com)

Top Companies in the Potassium Chloride Market

- Mosaic Company: Produces potash and potassium chloride fertilizers for conventional and organic farming, focusing on crop yield improvement, soil nutrition, and sustainable agricultural solutions.

- Nutrien Ltd.: Supplies a wide range of KCl and potash products for large-scale agriculture, including granular, soluble, and specialty fertilizers tailored to diverse crop needs.

- JSC Acron: Offers potassium chloride-based fertilizers and mineral nutrients for global agriculture, emphasizing high-efficiency crops and soil productivity enhancement.

- Belarusian Potash Company: Provides KCl fertilizers for international markets, focusing on high-quality potash for staple crops, with reliable bulk export and supply solutions.

- Uralkali PJSC: Manufactures potash and potassium chloride fertilizers, supporting global agriculture with high-purity products for soil enrichment and improved crop output.

- SQM (Sociedad Química y Minera de Chile S.A.): Produces potassium chloride and specialty potash fertilizers for agriculture, including eco-friendly and high-efficiency products for global farming and industrial use.

Segment Covered in the Report

By Grade

- Agriculture Grade

- Industrial Grade

- Pharmaceutical (Medical) Grade

- Food Grade

By Form

- Solid (Crystalline, Granular, Powder)

- Liquid (Solution / Brine)

By Application

- Fertilizers (Muriate of Potash)

- Industrial (Metallurgy, Chemical Manufacturing, De-icing)

- Pharmaceutical & Medical

- Food Processing

- Others (Water Treatment, Laboratory Uses)

By End-Use Industry

- Agricultural

- Chemical Industry

- Pharmaceutical

- Food & Beverage

- Others (De-icing, Water Treatment)

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa