Content

What is the Current Metal Stamping Market Size and Share?

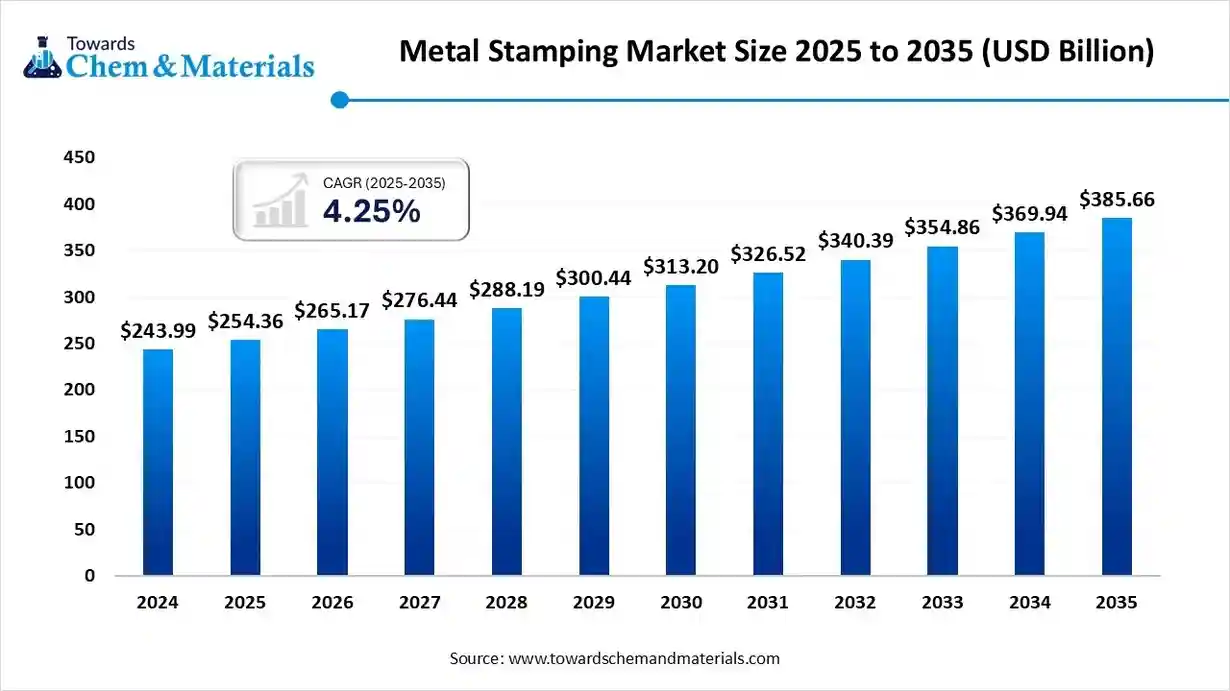

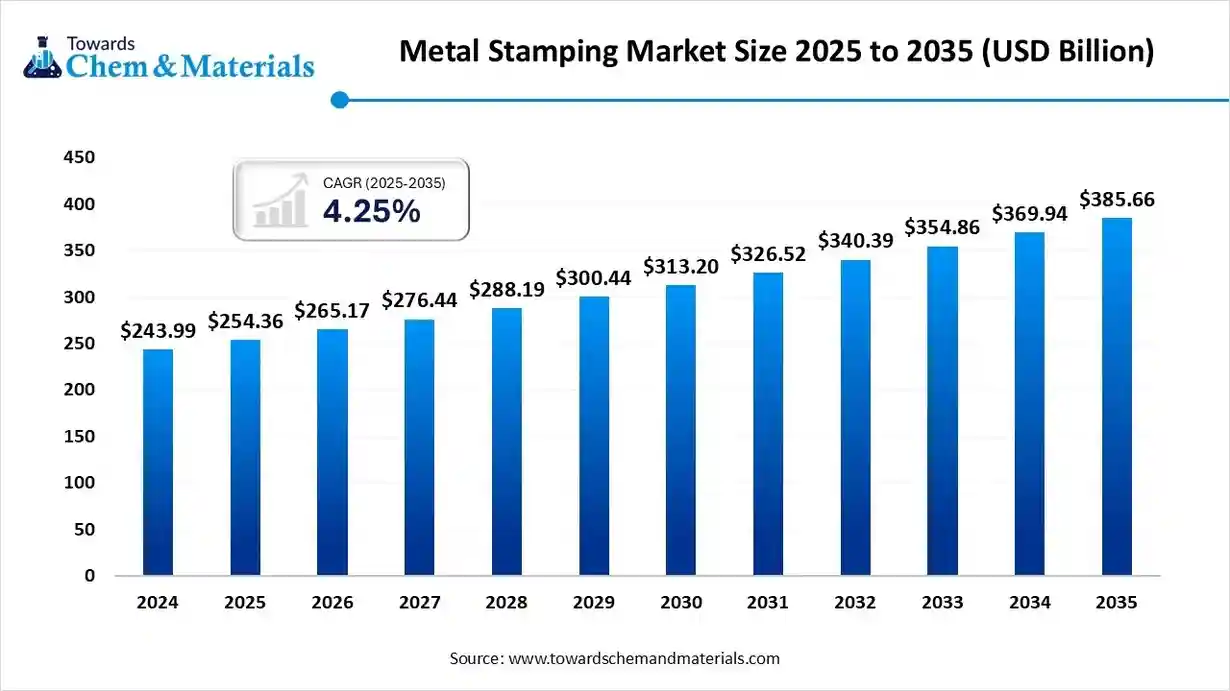

The global metal stamping market size is calculated at USD 254.36 billion in 2025 and is predicted to increase from USD 265.17 billion in 2026 and is projected to reach around USD 385.66 billion by 2035, The market is expanding at a CAGR of 4.25% between 2025 and 2035. Asia Pacific dominated the Metal Stamping market with a market share of 42.20% the global market in 2024.The growing demand for lightweight, high-strength components is driving market growth.

Key Takeaway

- By region, Asia Pacific dominated the market, accounting for 42.2% in 2024.

- By region, North America is expected to grow at a CAGR of 5.2% during the forecast period.

- By process, the banking segment dominated the market, accounting for 35.8% in 2024.

- By process, the bending segment is expected to grow significantly at a 4.6% during the forecast period.

- By material, the steel segment accounted for 50.6% of the metal stamping market in 2024.

- By material, the aluminum segment is expected to grow at a CAGR of 4.8% in the forecast period.

- By application, the automotive segment dominated the market, accounting for 34.5% in 2024.

- By application, the electrical and electronics segment is expected to grow at a 4.6% CAGR in the forecast period.

- By press type, the mechanical press segment accounted for 58.5% of the market in 2024.

- By press type, the servo press segment is expected to grow at a 4.5% CAGR in the forecast period.

Market Overview

What is the significance of the Metal Stamping Market?

The metal stamping market involves forming flat metal sheets into specific shapes through processes such as blanking, punching, bending, embossing, and coining. These techniques are essential for producing components that require high precision, consistency, and structural reliability. Metal stamping is widely used in automotive, aerospace, electrical, and general industrial applications where large production volumes and exact tolerances are required. The process also improves manufacturing efficiency by reducing scrap rates and supporting cost-effective mass customisation.

Growth in automotive production continues to be a major driver for metal stamping. According to the International Organization of Motor Vehicle Manufacturers, global vehicle output increased to more than 90 million units in 2023, which significantly boosts demand for stamped parts used in body panels, structural assemblies, and engine components. The shift toward lightweight and fuel-efficient vehicles has also increased the use of high-strength steel and aluminium stamping.

Current Trends in Metal Stamping Market

- Industry Growth Overview: Between 2025 and 2030, the global metal stamping market is expected to grow steadily due to strong demand from automotive, aerospace, electronics and industrial machinery sectors. Manufacturers increasingly require lightweight, high-precision and durable parts for chassis structures, battery housings, electronic enclosures and mechanical assemblies. Automation in stamping lines and the need for tighter dimensional accuracy are also supporting market expansion, especially as large-scale producers modernise their fabrication systems.

- Sustainability Trends: Sustainability and material efficiency are shaping industry development as manufacturers adopt high-strength alloys, recycled metals and low-energy production equipment. Energy-efficient mechanical and servo presses help reduce electricity consumption while maintaining production speed and accuracy. Companies are also integrating simulation software and digital twin tools to optimise die design, minimise material scrap and reduce reliance on physical prototypes. These improvements support both environmental goals and cost efficiency.

- Global Expansion and Innovation: Leading stamping companies are expanding their global presence by establishing new facilities near automotive, aerospace and electronics hubs to reduce logistics costs and increase supply-chain resilience. Investment in high-speed servo presses, precision tooling and hybrid forming technologies is improving production flexibility and enabling more complex part geometries. Collaboration between OEMs and tier suppliers is accelerating the development of lightweight stamped components, especially for electric vehicle platforms and specialised aerospace structures.

- Major Investors: Large industrial groups and automotive suppliers continue to invest heavily in advanced stamping equipment and digitalised production lines. Companies in Asia, Europe and North America are upgrading their manufacturing assets to keep pace with rising demand for precision metal components. Investments are also being directed toward automation, in-line inspection systems and material-handling technologies that improve throughput and consistency in high-volume stamping operations.

- Startup Ecosystem: Startups in the metal forming and digital manufacturing space are introducing new solutions such as AI-enabled defect detection, cloud-based die design software and modular micro-stamping technologies. Many young companies focus on improving energy efficiency, reducing downtime and enabling small-batch customisation through flexible tooling systems. These innovations are supporting faster prototyping, improved part quality and more sustainable manufacturing practices across the metal stamping value chain.

Report Scope

| Report Attributes | Details |

| Market Size in 2026 | USD 265.17 Billion |

| Expected Size by 2035 | USD 385.66 Billion |

| Growth Rate from 2025 to 2035 | CAGR 4.25% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2026 - 2035 |

| Leading Region | Asia Pacific |

| Fastest Growing Region | North America |

| Segment Covered | By Process, By Material, By Application, By Press Type, By Region |

| Key Companies Profiled | Benteler International AG, Hella KGaA Hueck & Co., Interplex Holdings Pte. Ltd., Trans-Matic Manufacturing Company, Manor Tool & Manufacturing Company, Harsha Engineers International Ltd., Gestamp Automoción S.A, Aisin Seiki Co., Ltd, Magna International Inc., Martinrea International Inc., ThyssenKrupp AG , American Axle & Manufacturing Holdings, Inc. , Shiloh Industries, Inc., Interplex Holdings Pte. Ltd Alcoa Corporation , Kenmode Precision Metal Stamping Clow Stamping Company, Harvey Vogel Manufacturing Co., D&H Industries, Wisconsin Metal Parts, Inc. , Dongguan Fortuna Metal Stamping Co., Ltd. |

Key Technological Shifts In The Metal Stamping Market:

Major technological changes in the metal stamping market involve the growing use of automation and Industry 4.0 systems to improve accuracy, speed, and production consistency. Manufacturers are increasingly adopting robotics, artificial intelligence, and Internet of Things sensors to monitor press performance and reduce downtime. According to data from the International Federation of Robotics, global industrial robot installations reached more than 500,000 units in 2023, and a significant share of these deployments supported metalworking and automotive stamping operations.

There is also a rising focus on advanced materials such as lightweight alloys and high-strength steels, which help reduce vehicle weight and improve fuel efficiency. The United States Department of Energy notes that using lightweight materials in vehicles can improve fuel economy by up to 10 percent for every 10 percent reduction in weight, which has increased demand for precision stamping of specialised metals. These materials require improved tooling and stronger presses, driving investment in hot-stamping and servo-driven equipment.

Trade Analysis Of the Metal Stamping Market: Import & Export Statistics

- According to Volza's Global Export data, the World exported 2,295 shipments of Metal Stamping Press from Oct 2023 to Sep 2024 (TTM). These exports were made by 1,219 Exporters to 1,226 Buyers, marking a growth rate of 20% compared to the preceding twelve months.

- Globally, the top three exporters of Metal Stamping Press are China, Ukraine, and Turkey. China leads the world in Metal Stamping Press exports with 1,808 shipments, followed by Ukraine with 1,392 shipments, and Turkey taking the third spot with 386 shipments.(Source: www.volza.com)

- According to Volza's India Export data, India exported 140 shipments of Metal Stamping Parts from Sep 2023 to Aug 2024 (TTM). These exports were made by 64 Indian Exporters to 57 Buyers, marking a growth rate of -13% compared to the preceding twelve months.

- Globally, the top three exporters of Metal Stamping Parts are China, Vietnam, and Malaysia. China leads the world in Metal Stamping Parts exports with 13,889 shipments, followed by Vietnam with 3,694 shipments, and Malaysia taking the third spot with 3,581 shipments.(Source: www.volza.com)

Metal Stamping Market Value Chain Analysis

- Chemical Synthesis and Processing : This stage involves shaping sheet metals such as steel, aluminum, copper, and titanium into specific components through blanking, bending, punching, embossing, and coining. Hydraulic and mechanical presses are used to ensure precision, high output, and consistency for large production volumes.

- Key players: Gestamp Automoción, AAPICO Hitech Public Company Limited, Magna International Inc., Clow Stamping Company, Interplex Holdings Pte. Ltd.

- Quality Testing and Certification: Stamped metal parts are tested for dimensional accuracy, tensile strength, durability, and surface finish to ensure they meet industry standards such as ISO 9001, IATF 16949, and ASTM A370. This stage helps maintain reliability for sectors that depend on strict quality control, including automotive and aerospace manufacturing.

- Key players: SGS, TÜV SÜD, Intertek, Bureau Veritas.

- Distribution to Industrial Users:Finished stamped components are delivered to automotive, aerospace, electronics, and construction companies through partnerships with original equipment manufacturers and specialized distributors. These channels ensure a steady supply, fast delivery times, and support for large-scale industrial production.

- Key players: Gestamp Automoción, Magna International Inc., Interplex Holdings Pte. Ltd., Clow Stamping Company.

Metal Stamping Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations / Standards | Focus Areas | Notable Notes |

| United States | Occupational Safety and Health Administration (OSHA) Environmental Protection Agency (EPA) Department of Energy (DOE) ASTM / SAE / ISO Standards Bodies |

- OSHA 29 CFR 1910 Subpart O (Machine guarding) - 29 CFR 1910.147 (Lockout/Tagout for presses) - Clean Air Act (CAA) & Clean Water Act (CWA) - Energy Policy Act (Efficiency Programs) - ASTM A series & SAE J standards for metal components |

- Worker safety, press operations, guarding systems - Air and water emissions from stamping lubricants and coatings - Energy-efficient press systems - Material and mechanical quality certification |

OSHA enforces strict machine safety protocols. EPA regulates volatile organic compound (VOC) emissions from degreasers and metal cleaners. DOE promotes high-efficiency servo presses. Automotive OEMs often require IATF 16949 and PPAP certification for suppliers. |

| European Union | European Agency for Safety and Health at Work (EU-OSHA) European Chemicals Agency (ECHA) CEN / ISO / EN Standards |

- EU Machinery Directive (2006/42/EC) - REACH & CLP Regulations - Industrial Emissions Directive (IED) - EN ISO 16092 Series (Safety requirements for presses) |

- Machine conformity (CE marking) - Worker protection & chemical safety - Waste and emission control - Harmonised mechanical standards |

All metal stamping machines require CE marking under the Machinery Directive. REACH restricts hazardous stamping fluids and coatings (e.g., chromium, lead). EU facilities must comply with Best Available Techniques (BAT) for metal forming under the IED. |

| China | Ministry of Ecology and Environment (MEE) State Administration for Market Regulation (SAMR) Standardisation Administration of China (SAC) |

- GB 5226.1–2019 (Machinery electrical safety) - GB 30484–2013 (Metalworking safety) - Cleaner Production Promotion Law - Emission Standards for Industrial VOCs (GB 37822–2019) |

- Workplace safety and mechanical guarding - VOC and metal particulate emission limits - Quality management (CCC certification) |

China enforces strict environmental inspection regimes for stamping workshops, focusing on lubricant fumes and wastewater discharge. National GB standards align with ISO for export-oriented manufacturers. |

| India | Ministry of Environment, Forest and Climate Change (MoEFCC) Directorate General Factory Advice Service & Labour Institutes (DGFASLI) Bureau of Indian Standards (BIS) |

- Factories Act, 1948 and Model Rules - Air (Prevention & Control of Pollution) Act, 1981 - IS 9100 / IS 11363 (Sheet metal quality) - Occupational Safety, Health and Working Conditions Code, 2020 |

- Worker safety and noise/vibration exposure - Emission and waste management - Metal quality standards and conformity |

India’s OSH Code modernises factory safety rules, including press guarding and ergonomics. BIS standards govern sheet thickness tolerance and yield properties. Environmental clearance is needed for large stamping units. |

| Brazil / Latin America | IBAMA ABNT (Brazilian Standards Association) |

- NR-12 (Machine Safety Standard) - ABNT NBR ISO 9001 / 14001 - Environmental licensing norms |

- Machine and operator safety - Emission and waste management - Material quality and conformity |

Brazil’s NR-12 is among the strictest global safety frameworks for machine operations. Environmental licensing and solid waste rules apply to all foundry and metal-forming operations. |

Segmental Insights

Process Insights

Which Process Segment Dominated the Metal Stamping Market in 2024?

The blanking segment dominated the metal stamping market, accounting for 35.8% in 2024. Blanking is one of the most common metal stamping processes, used to cut flat metal sheets into specific shapes before further fabrication. It offers high precision and efficiency, making it suitable for mass production of automotive body parts, electrical connectors, and appliance components. Advancements in die design and high-speed presses have significantly improved productivity and material utilisation.

The bending segment is expected to grow by 4.6% in the metal stamping industry during the forecast period. Bending involves deforming metal sheets along a straight axis to form precise angles or complex shapes. It is widely used in the production of brackets, enclosures, and automotive structures. The process ensures superior strength and dimensional accuracy, supported by modern CNC and servo press technologies that enable flexible operations across varying material thicknesses.

The embossing segment has seen notable growth in the metal stamping market. Embossing creates raised or recessed patterns on metal sheets for both functional and aesthetic purposes. It is used in decorative panels, automotive interiors, and electronic casings. The process enhances rigidity without adding material thickness, making it popular in lightweight design applications where structural integrity and surface finish are critical.

Material Insights

How Did the Steel Segment Dominate the Metal Stamping Market in 2024?

The steel segment dominated the metal stamping market, accounting for 50.6% in 2024. Steel dominates the metal stamping industry due to its strength, versatility, and cost-effectiveness. It is extensively used in automotive components, appliances, and machinery parts. High-strength and galvanised steel variants are preferred for safety-critical applications, offering enhanced corrosion resistance and durability under harsh environmental conditions.

The aluminum segment is expected to grow by 4.8% in the metal stamping sector during the forecast period.

Aluminium is increasingly used in metal stamping because of its lightweight nature, corrosion resistance, and recyclability. It is favoured in the automotive and aerospace sectors to reduce overall vehicle weight and improve fuel efficiency. The rising trend of sustainable manufacturing and electrification is further driving the use of aluminium alloys in precision components.

The copper segment has seen notable growth in the metal stamping market. Copper is primarily utilised for its superior electrical conductivity and malleability, making it essential in electrical and electronic applications. It is commonly used in connectors, terminals, and circuit components. Additionally, copper’s heat-dissipation properties make it valuable in industrial and renewable energy systems, such as transformers and power electronics.

Application Insights

Which Application Segment Dominated the Metal Stamping Sector in 2024?

The automotive segment dominated the metal stamping sector, accounting for 34.5% in 2024. The automotive industry represents the largest application segment for metal stamping, covering body panels, chassis components, and engine systems. Lightweight materials and precision stamping technologies are being adopted to meet emission standards and improve performance. Growth in electric vehicles is also fueling demand for stamped battery housings and motor parts.

The electrical and electronics segment is expected to grow by 4.6% in the metal stamping industry during the forecast period. In the electrical and electronics sector, metal stamping is vital for manufacturing connectors, contact plates, and shielding components. High precision and conductivity are crucial for compact devices and advanced circuits. The rise in consumer electronics, renewable energy systems, and 5G infrastructure is significantly driving demand in this segment.

The industrial machinery segment has seen notable growth in the metal stamping sector. Metal stamping plays a key role in producing structural components, fasteners, and tools for industrial equipment. The process ensures consistency, cost-efficiency, and durability for parts used in manufacturing, construction, and heavy machinery. Automation and digitalisation trends in industrial operations are further increasing the adoption of stamped components for complex assemblies.

Press Type Insights

How Did the Mechanical Segment Dominate the Metal Stamping Market in 2024?

The mechanical press segment dominated the metal stamping market, accounting for 58.5% in 2024. Mechanical presses are widely used due to their speed and efficiency, making them ideal for high-volume production of parts with consistent dimensions. These presses deliver precise strokes and are suitable for applications like automotive and appliance component manufacturing. Continuous advancements in automation enhance their reliability and throughput.

The servo press segment is expected to grow by 4.5% in the metal stamping sector during the forecast period. Servo presses offer greater control and flexibility in the forming process than traditional systems. They offer programmable motion profiles, energy efficiency, and superior precision, making them ideal for complex or high-strength materials. Their adoption is growing rapidly in industries that prioritise precision forming, such as electronics and aerospace.

The hydraulic press segment has seen notable growth in the metal stamping industry. Hydraulic presses provide high force output and are suitable for deep drawing, forming, and embossing thick materials. Their adjustable pressure and stroke make them ideal for low-to-medium production volumes and large parts. These presses are commonly used in heavy industrial applications and specialised component manufacturing.

Regional Analysis

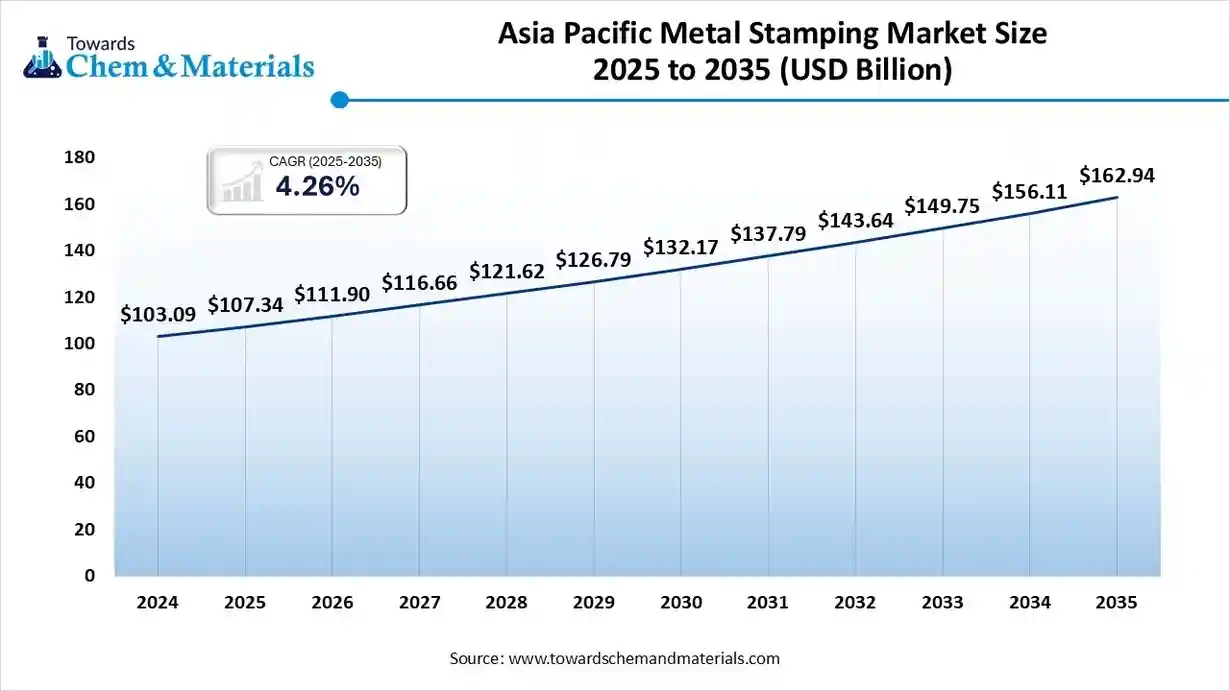

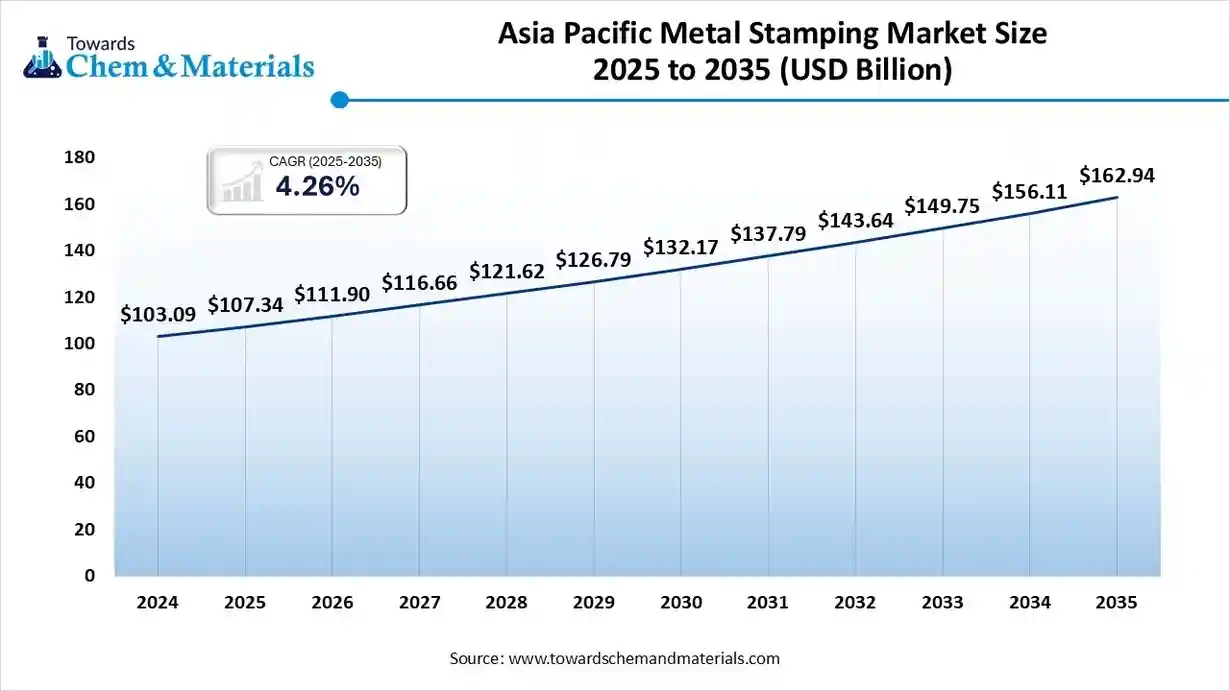

The Asia Pacific metal stamping market size was valued at USD 107.34 billion in 2025 and is expected to reach USD 162.94 billion by 2035, growing at a CAGR of 4.26% from 2025 to 2035. Asia Pacific dominated the metal stamping market in 2024, accounting for 42.2% of global revenue. The region’s leadership is supported by rapid industrialisation, large-scale infrastructure development, and strong manufacturing activity across China, India, Japan, and South Korea. According to the International Organization of Motor Vehicle Manufacturers, Asia continued to produce the highest number of vehicles worldwide in 2023, which significantly increased demand for stamped components used in body structures, engine systems, and electrical assemblies.

Competitive manufacturing costs and a large, skilled labor force further strengthen the region’s position in global supply chains. Many automotive and electronics exporters in the Asia Pacific rely heavily on high-volume stamping operations to maintain production speed and cost efficiency. Government-supported industrial corridors in countries such as China and India have also helped expand metalworking facilities and attract foreign investment.

China: The Metal Stamping Market Growth Trends

China accounts for the largest share of the Asia Pacific metal stamping market due to its massive manufacturing ecosystem and strong government support for industrial modernisation. Data from the National Bureau of Statistics shows that China continues to lead global output in automotive, electronics, and machinery, driving substantial demand for stamped metal components across multiple sectors. These industries rely heavily on large-scale stamping operations to maintain high production volumes and consistent quality.

Growth is further supported by China’s adoption of high-speed stamping presses, robotic handling systems, and precision metal forming technologies. Government initiatives under the Made in China 2025 program have encouraged factories to upgrade equipment and increase automation, improving efficiency and reducing material waste. As manufacturers transition toward high-value and technology-driven production systems, China is expected to remain the dominant market for advanced metal stamping solutions in the region.

North America Has Seen Growth Driven by the Growing Demand From Various Sectors

North America is expected to experience significant growth in the metal stamping sector during the forecast period because of strong demand from the automotive, aerospace, and electronics industries. According to the International Organization of Motor Vehicle Manufacturers, the United States and Canada together produced more than 12 million vehicles in 2023, which continues to create steady demand for stamped body panels, engine components, and electrical assemblies. The aerospace sector also remains a major consumer of precision stamped parts, supported by ongoing aircraft production and maintenance activities.

Advanced manufacturing technologies are widely adopted across the region, including servo-driven presses, automated material handling systems, and digital quality inspection tools. The presence of major original equipment manufacturers in both the United States and Canada encourages continuous innovation in high-strength materials and precision forming processes.

- These capabilities help manufacturers meet the strict performance standards required in transportation and defense industries.

United States (U.S.): The Metal Stamping Market Growth Trends

The United States dominates the North American metal stamping industry because of its strong industrial base and highly developed automotive supply chain. The country remains one of the largest producers of vehicles and industrial machinery, and data from the U.S. Bureau of Economic Analysis shows continued growth in motor vehicle output and parts manufacturing in 2023. This steady production activity increases demand for stamped components used in structural, electrical, and drivetrain applications.

The rapid expansion of electric vehicles, aerospace components, and consumer electronics is also boosting the need for high-precision stamping. The United States is home to major EV manufacturers and leading aerospace companies, which rely on stamped aluminum, high-strength steel, and lightweight alloys to meet performance and safety requirements. These sectors require consistent quality and tight tolerances, which strengthens the demand for advanced stamping solutions.

Europe: The Metal Stamping Sector Growth Is Driven By Government Support

Europe’s metal stamping sector continues to grow because of strict quality standards and the region’s strong base of high-value manufacturing in automotive, aerospace, and industrial machinery. Data from the European Automobile Manufacturers Association shows that Europe produced more than 12 million vehicles in 2023, which drives steady demand for stamped body panels, drivetrain components, and lightweight structural parts. These industries depend on precise and reliable stamping processes to meet safety and performance requirements.

Government support for green mobility and circular manufacturing is also shaping the market. The European Commission’s climate and industrial policies encourage the adoption of energy-efficient production systems, recycling of metals, and reduced material waste. This has led to greater use of advanced forming technologies, such as servo presses, high-strength steel stamping, and precision aluminum forming, helping manufacturers achieve sustainability goals.

Germany: The Metal Stamping Market Growth Trends

Germany serves as the centre of Europe’s metal stamping industry because of its strong automotive, machinery, and engineering capabilities. The country is home to some of the largest vehicle manufacturers and industrial equipment producers in the region, which creates consistent demand for high-precision stamped components. Data from the Federal Statistical Office shows that Germany remains one of Europe’s top producers of passenger cars and industrial machinery, underscoring the need for advanced metal-forming technologies.

The integration of Industry 4.0 practices has further strengthened the sector. German stamping facilities increasingly use robotic automation, digital monitoring systems, and optimised die design software to improve accuracy, reduce downtime, and support high production volumes. These technologies also help maintain the strict quality standards required by the automotive and aerospace industries.

South America Has Seen Growth Driven by the Growing Investments in Production

The South American metal stamping sector is growing steadily as the automotive and construction industries continue to recover and expand. According to data from the Economic Commission for Latin America and the Caribbean, industrial activity in major economies such as Brazil and Argentina showed gradual improvement in 2023, which increased demand for stamped components used in vehicles, building materials, and machinery. These sectors rely on stamping for structural parts, brackets, and precision fittings.

Countries like Brazil are experiencing increased investment in localised component production, especially for automotive systems, appliances, and industrial machinery. Government initiatives that support renewable energy infrastructure, including wind and solar projects, are also boosting demand for stamped metal parts used in turbines, mounting systems, and electrical assemblies. This trend aligns with the region’s broader push toward more resilient and diversified manufacturing capabilities.

Metal Stamping Market Share, By Region, 2024 (%)

| Regional | Revenue Share |

| North America | 22.11% |

| Europe | 19.45% |

| Asia Pacific | 42.20% |

| Latin America | 9.66% |

| Middle East and Africa | 6.66% |

Brazil: The Metal Stamping Market Growth Trends

Brazil is the key contributor to South America’s metal stamping sector because of its strong automotive assembly plants and heavy equipment industries. The country is one of the largest vehicle producers in the region, and data from the National Association of Motor Vehicle Manufacturers shows that Brazil produced more than 2.3 million vehicles in 2023. This scale of production creates consistent demand for stamped metal components used in body structures, powertrain systems, and chassis assemblies. Heavy machinery and agricultural equipment manufacturers also depend on precision stamping for essential structural and functional parts.

The growing focus on domestic sourcing and the modernisation of production facilities is further improving Brazil’s competitiveness. Many manufacturers are upgrading to advanced forming technologies, including servo presses and automated material handling systems, to improve efficiency and reduce operational costs. These improvements align with Brazil’s broader industrial modernisation goals and support higher-quality production across automotive and machinery supply chains.

Middle East & Africa (MEA): Key Players Play a Major Role in the Growth

The Middle East and Africa metal stamping market is emerging as a growing industry, supported by ongoing investments in infrastructure, oil and gas equipment, and renewable energy projects. Data from the African

Development Bank and the Gulf Cooperation Council indicate steady expansion in construction, pipeline systems, and power generation facilities across the region, all of which depend on stamped metal parts for structural supports, brackets, enclosures, and mechanical assemblies. These large-scale projects are creating new opportunities for local manufacturers that supply components to engineering and industrial contractors.

The transition toward industrial diversification in GCC countries is also fostering demand for fabricated metal components and precision tooling. National programs in Saudi Arabia and the United Arab Emirates that focus on manufacturing expansion, such as Vision 2030 and Operation 300bn, encourage companies to develop stronger domestic supply chains. This shift is increasing the need for advanced stamping techniques that can support automotive parts, electrical systems, and industrial machinery.

GCC Countries: The Metal Stamping Market Growth Trends

GCC nations are investing heavily in manufacturing diversification through national programs such as Saudi Vision 2030 and the United Arab Emirates' industrial expansion strategies. These initiatives aim to reduce dependence on oil revenues and strengthen domestic production capacities across key sectors. Government reports from Saudi Arabia and the UAE show rising capital expenditure in engineered products, machinery, and industrial components, which is creating a favorable environment for metal stamping activities.

The metal stamping industry is gaining traction in energy, defence, and the automotive aftermarket, where demand for precision components is increasing. The GCC has been expanding its renewable energy pipelines and defence manufacturing bases, both of which require stamped metal parts for housings, brackets, connectors, and structural assemblies. As local procurement policies strengthen, more regional firms are entering these value chains and upgrading their production capabilities.

Recent Developments

- In September 2025, Wintriss Controls Group introduced the WPC APEX clutch/brake control and the Shadow 10 light curtain at FABTECH. The WPC APEX is designed for mechanical power presses with features like a touchscreen and self-diagnostics, while the Shadow 10 is a CSA-certified safety device meeting ISO 13849 Category 4 standards for metal stamping(Source: www.advancedmanufacturing.org)

- In July 2025, Weiss-Aug has reorganised into two distinct business units, Weiss-Aug and Weiss-Aug MedPharma, to better align its brand and deliver industry-specific expertise. The reorganisation follows strategic investments and includes the addition of two new facilities in New Jersey and Pennsylvania.(Source: www.medicaldesignandoutsourcing.com)

- In April 2025, Dieco, a division of D&H Industries, launched a new e-commerce platform specifically for die springs, accessories, and compression springs, optimised for mobile users in the metal stamping and tooling industries.(Source: www.globenewswire.com)

Top players in the Metal Stamping Market & Their Offerings

- Benteler International AG: Manufactures metal-stamped components and assemblies for automotive and industrial applications. Benteler focuses on structural and crash-relevant components using cold and hot forming technologies.

- Hella KGaA Hueck & Co.: Produces precision metal components for lighting and electronic assemblies, combining stamping and fine blanking for high-volume manufacturing.

- Interplex Holdings Pte. Ltd.: Specialises in precision metal stamping and integrated mechanical solutions for electronics, medical devices, and automotive sectors. Interplex focuses on high-precision micro-stamping and connector manufacturing.

- Trans-Matic Manufacturing Company: A leading supplier of deep-drawn and progressive metal stampings for automotive, appliance, and hardware industries. The company emphasises tight-tolerance stamping and automated production systems.

- Manor Tool & Manufacturing Company: Offers custom metal stamping, deep drawing, and prototyping services for aerospace, medical, and industrial sectors, with an emphasis on small to medium production runs.

- Harsha Engineers International Ltd.: Manufactures precision metal components, stamped parts, and bearing cages for automotive, aerospace, and industrial markets, with integrated design and tooling capabilities.

- Gestamp Automoción S.A.:Gestamp manufactures precision metal components and structural parts for automotive applications, including chassis, body-in-white, and mechanisms. The company specializes in lightweighting, hot stamping, and advanced forming technologies.

- Aisin Seiki Co., Ltd.: Aisin produces high precision metal stamped parts used in automotive drivetrain, engine, and chassis systems. The company integrates stamping with machining, assembly, and advanced materials expertise.

- Magna International Inc.: Magna supplies stamped metal components, body structures, and chassis assemblies for global automakers. Its capabilities include large scale metal forming, lightweight design, and high strength steel processing.

- Martinrea International Inc.:Martinrea manufactures metal stamped parts, assemblies, and fluid management systems for automotive and industrial markets. The company focuses on lightweight materials and complex structural components.

- ThyssenKrupp AG: ThyssenKrupp provides metal stamping services and advanced forming technologies for automotive body and chassis parts. The company leverages high-strength steel solutions and precision engineering.

- American Axle & Manufacturing Holdings, Inc.:AAM produces stamped metal components used in axle, drivetrain, and suspension systems. Its capabilities include heavy-duty stamping and integrated component manufacturing.

- Shiloh Industries, Inc.: Shiloh manufactures lightweight stamped metal components and assemblies using advanced alloys and noise reduction technologies. The company supports automotive OEMs with structural and acoustic solutions.

- Interplex Holdings Pte. Ltd. :Interplex produces precision-stamped metal components for automotive, electronics, and industrial applications. Its expertise includes high-speed stamping, fine blanking, and the production of complex, miniaturized parts.

- Alcoa Corporation:Alcoa supplies aluminum sheet and stamped components used in automotive lightweighting applications. The company focuses on forming high-strength aluminum structures for vehicle bodies and chassis.

- Kenmode Precision Metal Stamping :Kenmode produces high-precision stamped parts for automotive, medical, and electronics customers. The company emphasizes tight tolerance stamping and automated quality control.

Clow Stamping Company :Clow Stamping manufactures custom stamped metal components across a wide range of materials and sizes. The company supports automotive, agricultural, and industrial applications. - Harvey Vogel Manufacturing Co. :Harvey Vogel specializes in precision metal stamping and deep draw forming for complex automotive and industrial components. The company provides rapid tooling and high-volume production.

- D&H Industries :D&H Industries produces custom metal stampings, welded assemblies, and deep-drawn components for automotive and heavy equipment manufacturers. The company focuses on durability and high-strength applications.

- Wisconsin Metal Parts, Inc.:Wisconsin Metal Parts offers metal stamping, fabrication, and machining services for automotive, aerospace, and industrial clients. The company supports prototyping through high-volume production.

- Dongguan Fortuna Metal Stamping Co., Ltd.: Fortuna manufactures precision-stamped components for electronics, automotive, and connector applications. The company specializes in high-speed stamping, micro components, and tight-tolerance production.

Segments Covered:

By Process

- Blanking

- Embossing

- Bending

- Coining

- Flanging

- Others

By Material

- Steel

- Aluminum

- Copper

- Others (Brass, Titanium, Nickel Alloys)

By Application

- Automotive

- Electrical & Electronics

- Industrial Machinery

- Aerospace & Defense

- Consumer Appliances

- Construction

By Press Type

- Mechanical Press

- Hydraulic Press

- Servo Press

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa